TIDMCRPR

RNS Number : 7378E

Cropper(James) PLC

10 November 2020

The advanced materials and paper products group, is pleased to

announce its

Half year results to 26 September 2020

Half year Half year Full year

to 26 September to 28 September to

2020 2019 28 March

2020

GBPm GBPm GBPm

Revenue 34.0 52.8 104.7

Adjusted operating (loss) / profit

* (1.2) 2.8 7.2

Operating profit 0.4 2.6 6.6

Adjusted (loss) / profit before

tax * (1.4) 2.6 6.7

Impact of IAS 19 (0.3) (0.6) (1.2)

Impact of exceptional items 1.7 - -

Profit before tax 0.0 2.0 5.5

Earnings per share - basic and

diluted (0.2p) 17.0p 50.6p

Dividend per share declared nil 2.5p 2.5p

Net borrowings (5.2) (15.3) (11.1)

Equity shareholders' funds 27.3 21.9 34.4

Gearing % - before IAS 19 deficit 12% 38% 26%

Gearing % - after IAS 19 deficit 19% 70% 32%

Capital expenditure 1.4 3.3 9.2

* excludes the impact of IAS 19 and exceptional items (per note

9)

Highlights

-- The key priority remains the safety and wellbeing of employees

-- Rapid response to Covid 19 to reduce costs, optimise cash flow and protect liquidity

-- Group revenues down 36% on prior year mainly within the Paper division

-- Colourform revenues up 17% on prior year

-- The downturn in TFP sales, particularly in the aerospace

sector mitigated by growth in medical and renewable energy

sectors

-- Restructuring costs nearing completion with a net cost of

GBP0.2m projected for the year and GBP2m savings pa thereafter.

-- Company has liquidity of over GBP14m including cash and available overdraft facilities.

-- Capital investments for future growth to restart in the second half

-- To protect liquidity, no interim dividend declared.

Mark Cropper, Chairman, commented:

"Our immediate key priority is to maintain the safety and

wellbeing of our employees and customers. Each division is seeing

signs of recovery with most markets trending back to normality. The

restructuring plans are nearing completion with a small net cost

anticipated for the year but anticipated savings of GBP2m p.a. in

future years. The restructuring has affected less than 10% of the

workforce but will result in a leaner, stronger Group. Capital

investment was suspended during the first half of the year and is

planned to resume in the second half."

"The Group has weathered a major challenge during the period.

The actions of our employees to meet and overcome the challenge has

been exceptional across the Group. I am proud of their actions and

commitment as ever and would like to thank them all for their

continued efforts to protect themselves, their fellow employees and

the business as we plan to come out of this pandemic a stronger,

fitter Group and continue our plans for growth."

Enquiries:

Isabelle Maddock, Chief Robert Finlay, Henry Willcocks,

Financial Officer John More

James Cropper PLC (AIM:CRPR.L) Shore Capital

Telephone: +44 (0) 1539 Telephone: +44 (0) 20 7408 4090

722002

www.jamescropper.com

Half year Half year Full year

to 26 September to 28 September to 28 March

2020 2019 2020

Summary of results GBP '000 GBP'000 GBP'000

Revenue 34,004 52,792 104,667

Adjusted operating loss / (profit)* (1,196) 2,826 7,240

Operating profit 352 2,554 6,569

Adjusted (loss) / profit before

tax * (1,445) 2,557 6,674

Impact of IAS19 (293) (548) (1,215)

Exceptional items (note 8) 1,722 - -

Loss / profit before tax (16) 2,009 5,459

------------------------------------- ----------------- ----------------- -------------

* excludes the impact of IAS 19 and exceptional items (per note

9)

Half year Half year Full year

to 26 September to 28 September to 28 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

Revenue

Paper division 20,856 37,992 75,545

Colourform division 1,414 1,211 2,586

Technical Fibre Products division 11,734 13,589 26,536

---------------------------------------- ----------------- ----------------- -------------

34,004 52,792 104,667

Adjusted operating (loss) / profit

* (1,196) 2,826 7,240

Adjusted net interest (249) (269) (566)

---------------------------------------- ----------------- ----------------- -------------

Adjusted (loss) / profit before

tax * (1,445) 2,557 6,674

IAS19 pension adjustments

Net current service charge against

operating profits (174) (273) (671)

Finance costs charged against interest (119) (275) (544)

---------------------------------------- ----------------- ----------------- -------------

(293) (548) (1,215)

Exceptional items (note 8) 1,722 - -

---------------------------------------- ----------------- ----------------- -------------

Loss / profit before tax (16) 2,009 5,459

---------------------------------------- ----------------- ----------------- -------------

* excludes the impact of IAS 19 and exceptional items (per note

9)

Balance sheet summary Half year Half year Full year

to 26 September to 28 September to 28 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

Non-pension assets - excluding

cash 69,854 71,320 72,084

Non-pension liabilities - excluding

borrowings (22,517) (15,704) (19,032)

47,337 55,616 53,052

Net IAS19 pension deficit (after

deferred tax) (14,791) (18,351) (7,600)

------------------------------------- ----------------- ----------------- -------------

32,546 37,265 45,452

Net borrowings (5,220) (15,323) (11,055)

------------------------------------- ----------------- ----------------- -------------

Equity shareholders' funds 27,326 21,942 34,397

------------------------------------- ----------------- ----------------- -------------

Gearing % - before IAS19 deficit 12% 38% 26%

Gearing % - after IAS19 deficit 19% 70% 32%

Capital expenditure 1,367 3,284 9,195

Dear Shareholders

The last six months have been a challenging period for the

Group, particularly for our employees, customers, suppliers, local

communities and shareholders. The impact of the pandemic has been

significant, but due to the actions taken at the onset, the Group

remains in a strong position.

The Group responded quickly to the challenges. Throughout the

crisis we have managed our response under three headings: the

health and wellbeing of our employees, supporting customers and

reducing costs. The overall objective has been to emerge from the

pandemic a stronger Group. The commitment, support and engagement

of our employees in such an adverse time has been truly remarkable:

everyone has excelled in protecting the business and each other.

Immediate actions included working from home where possible whilst

continuing to support our customer needs and cutting non-essential

expenditure to reduce costs. Employee safety was a primary focus

with enhanced safety measures introduced to provide a Covid-19

secure environment in line with government and NHS guidelines.

The Group took swift action to reduce costs and protect

liquidity. This included the deferral of all discretionary

spending, suspension of major capital expenditure, suspension of

dividend payments, and seeking support from local authorities,

government agencies and the banks. During the period, our

customers, particularly in the Paper division were globally

impacted by Covid-19, leading to reduced demand and periods of

inefficient or no production. This resulted in many employees being

placed on furlough. In addition, payment of the bonuses earned from

our record results last year have been deferred until the second

half of the year. No bonuses or annual incremental pay increases

will be implemented in the current year.

The Group has weathered the initial impact of the pandemic. All

divisions in the business have been impacted to varying degrees

with Paper affected the most, TFP more resilient and Colourform

continuing to grow. Markets are improving but it is too early to

say whether the Group may be affected by further lockdowns. With

this in mind, the Group has prepared projections and continues to

protect liquidity. With this backdrop the Board has decided not to

declare an interim dividend.

As reported in our trading update at the AGM, the Group has been

developing restructuring plans for some time in order to drive

growth and competitiveness. The impact of the pandemic has required

us to accelerate the implementation of these plans, which affect

our Paper and Group operations divisions. Most of the restructuring

has now been completed and has impacted less than 10% of our

employees.

Financial Performance

Revenue in the period was 36% lower than the prior comparative

period at GBP34.0m (2019: GBP52.8m). Operating profit in the period

was 86% lower than the prior period at GBP0.4m (2019: GBP2.6m).

Provisions for exceptional costs relating to the restructuring

plans are expected to be GBP1m. The net impact to the Group for the

year is expected to be (GBP0.2m) with savings in future years of

GBP2m p.a.

Statutory operating profit for the period was GBP0.4m after

exceptional items for the restructuring costs and grant income from

governmental authorities in the UK and USA. This compares to the

prior year comparative of GBP2.6m. The Group had a loss before

taxation of GBP16,000 compared to a profit of GBP2.0m in the prior

year comparative period.

The business is in an 18-24 month recovery period. The Company

has experienced a trading hit in the first half of 2020-2021 and

expects cash generated to be down during the period of the pandemic

until we return to more normal trading conditions. We have acted

promptly to conserve cash and to implement immediate savings to

shore up reserves, in order to continue to protect cash flows and

liquidity, the Board has not declared an interim dividend. The

Company presently has liquidity of over GBP14 million including

cash and available overdraft facilities thanks to the cash

management actions implemented. This is expected to be sufficient

to weather further lockdowns, the return to more normal trading

conditions and a re-instatement of investment plans to support

future growth. Since the period end a GBP4m CLBIL has been secured

which brings additional cash security should it be required as we

face continued uncertainty due to Covid-19.

James Cropper Paper ("Paper")

The Paper division has been adversely impacted by Covid-19 with

revenues down by 45% compared to the comparable period last year,

as a result of global lockdowns affecting demand for luxury

packaging, education and event collateral. Whilst the division did

not have to close completely at any time, a large number of

employees were placed on furlough for some time over the period.

The Group decided to accelerate restructuring plans during the

period, the implementation of which is nearing completion. Whilst

there is expected to be a small net cost during the current year,

the restructuring will generate significant annual savings. Towards

the end of the period positive signs of normality were experienced

as markets opened up following the easing of lockdown rules

globally.

Colourform(TM) ("Colourform")

Revenues in the Colourform division grew by 17% in the period;

however the rate of growth was impacted by Covid-19. In the period,

the division's leadership and growth plans were boosted by the

appointment of Patrick Willink as Managing Director. Colourform has

reduced production for short periods and placed some employees on

furlough during the period.

Technical Fibre Products ("TFP")

Revenues in the TFP division were down by 14% mainly from

reduced demand within the aerospace market as a direct result of

Covid-19. The drop in the aerospace sector was mitigated by good

growth in the medical and green energy sectors, such as hydrogen

fuel cells and wind. The division has utilised the furlough scheme

for short periods.

Pension

The IAS19 valuations, for the two defined benefit schemes as at

26 September 2020, revealed a combined deficit of GBP18.3m,

compared with GBP9.4m as at 28 March 2020. This change was driven

primarily by a large fall in corporate bond yields and a rise in

inflation expectations. After deferred taxation the net deficit

stands at GBP14.8m.

Earnings per share and dividend

Basic and fully diluted earnings per share decreased to (0.2)

pence, compared to 17.0 pence in the prior year comparative

period.

In order to continue to protect cash flows and liquidity, the

Board has not declared an interim dividend.

Outlook

Our immediate key priority is to maintain the safety and

wellbeing of our employees and customers. Each division is seeing

signs of recovery with sectors moving towards normality. The

restructuring plans are nearing completion with a small net cost

anticipated for the year but anticipated savings of GBP2m pa in

future years. The restructuring has affected less than 10% of the

workforce but will result in a leaner, stronger Group. Capital

investment was suspended during the first half of the year and is

planned to resume in the second half.

The Group has weathered a major challenge during the period. The

actions of our employees to meet and overcome the challenge has

been exceptional across the Group. I am proud of their actions and

commitment as ever and would like to thank them all for their

continued efforts to protect themselves, their fellow employees and

the business as we plan to come out of this pandemic a stronger,

fitter Group and continue our plans for growth.

Mark Cropper

Chairman

UN-AUDITED CONSOLIDATED INCOME STATEMENT

26 week period 26 week period 52 week period

to 26 September to 28 September to 28 March

2020 2019 2020

------------------------------------------ ---------------- ---------------- --------------

GBP'000 GBP'000 GBP'000

Revenue 34,004 52,782 104,667

Provision for impairment - - (308)

Other income 25 32 486

Changes in inventories (1,383) 205 (1,330)

Raw materials and consumables used (10,416) (20,391) (38,200)

Energy costs (1,034) (2,152) (4,539)

Employee benefit costs (11,934) (15,483) (30,388)

Depreciation and amortisation (2,158) (1,911) (3,950)

Other expenses (6,752) (10,538) (19,869)

Operating profit 352 2,554 6,569

Interest payable and similar charges (370) (567) (1,136)

Interest receivable and similar

income 2 22 26

(Loss)/profit before taxation (16) 2,009 5,459

Taxation 3 (382) (630)

------------------------------------------ ---------------- ---------------- --------------

(Loss)/profit for the period (13) 1,627 4,829

Earnings per share - basic and diluted (0.2p) 17.0p 50.6p

UN-AUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME COMPREHENSIVE

INCOME

(Loss)/profit for the period (13) 1,627 4,829

------------------------------------------ ---------------- ---------------- --------------

Items that are or may be reclassified

to profit or loss

Foreign currency translation (80) 96 181

Cash flow hedges - effective portion

of changes in fair value 53 (32) (295)

Items that will never be reclassified

to profit or loss

Retirement benefit liabilities -

actuarial (loss)/ gain (8,788) 352 13,057

Deferred tax on actuarial loss /

(gain) on retirement benefit liabilities 1,670 (60) (2,481)

Other comprehensive (expense) /

income for the period (7,145) 356 10,462

------------------------------------------ ---------------- ---------------- --------------

Total comprehensive (expense) /

income for the period attributable

to equity holders of the Company (7,158) 1,983 15,291

------------------------------------------ ---------------- ---------------- --------------

UN-AUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

26 September 28 September 28 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

------------------------------- ------------ --------------- ----------------

Assets

Intangible assets 421 320 495

Property, plant and equipment 32,438 29,521 31,882

Right of use assets 3,468 4,016 4,907

Deferred tax assets 3,471 3,759 1,921

------------------------------- ------------ --------------- ----------------

Total non-current assets 39,798 37,616 39,205

------------------------------- ------------ --------------- ----------------

Inventories 13,550 16,875 13,956

Trade and other receivables 18,656 19,337 19,363

Provision for impairment (536) - (530)

Cash and cash equivalents 11,064 435 8,964

Current tax assets 1,857 1,251 1,872

Total current assets 44,591 37,898 43,625

------------------------------- ------------ --------------- ----------------

Total assets 84,389 75,514 82,830

------------------------------- ------------ --------------- ----------------

Liabilities

Trade and other payables 20,219 14,075 16,544

Other financial liabilities 222 12 275

Loans and borrowings 4,774 1,912 3,756

Total current liabilities 25,215 15,999 20,575

Long-term borrowings 11,510 13,846 16,263

Retirement benefit liabilities 18,262 22,110 9,382

Deferred tax liabilities 2,076 1,617 2,213

Total non-current liabilities 31,848 37,573 27,858

------------------------------- ------------ --------------- ----------------

Total liabilities 57,063 53,572 48,433

------------------------------- ------------ --------------- ----------------

Equity

------------------------------- ------------ --------------- ----------------

Share capital 2,389 2,389 2,389

Share premium 1,588 1,588 1,588

Translation reserve 504 499 584

Reserve for own shares (1,251) (1,251) (1,251)

Retained earnings 24,096 18,717 31,087

------------------------------- ------------ --------------- ----------------

Total shareholders' equity 27,326 21,942 34,397

------------------------------- ------------ --------------- ----------------

Total equity and liabilities 84,389 75,514 82,830

------------------------------- ------------ --------------- ----------------

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

26 week period 26 week period 52 week period

to 26 September to 28 September to 28 March

2020 2019 2020

--------------------------------------------- ---------------- --------------------- ---------------------

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Net (loss) / profit (13) 1,627 4,829

Adjustments for:

Tax (3) 382 630

Depreciation and amortisation 2,158 1,911 3,950

Net IAS 19 pension adjustments within

Statement of comprehensive income 293 548 1,215

Past service pension deficit payments (201) (734) (1,424)

Foreign exchange differences 112 (77) (74)

Loss on disposal of property, plant

and equipment 2 - 23

Net bank interest expense 249 269 566

Share based payments 87 188 (252)

Changes in working capital:

Decrease / (increase) in inventories 386 (454) 2,475

Decrease in trade and other receivables 537 1,644 149

Increase / (decrease) in trade and other

payables 3,663 (2,331) 1,719

Tax paid - (177) (741)

--------------------------------------------- ---------------- --------------------- ---------------------

Net cash generated from operating activities 7,270 2,796 13,065

Cash flows from investing activities

Purchase of intangible assets (29) (34) (190)

Purchases of property, plant and equipment (1,338) (3,250) (9,005)

Net cash used in investing activities (1,367) (3,284) (9,195 )

Cash flows from financing activities

Proceeds from issue of new loans 5,402 913 9,121

Repayment of borrowings (9,066) (1,222) (4,789)

Interest received 2 22 26

Interest paid (160) (212) (434)

Dividends paid to shareholders - (1,038) (1,275)

--------------------------------------------- ---------------- --------------------- ---------------------

Net cash (used) / generated in financing

activities financingactactivitiesactivities (3,822) (1,537) 2,649

Net increase / ( decrease) in cash

and cash equivalents 2,081 (2,025) 6,519

Effect of exchange rate fluctuations

on cash held 19 108 93

--------------------------------------------- ---------------- --------------------- ---------------------

Net increase / ( decrease) in cash

and cash equivalents 2,100 (1,917) 6,612

Cash and cash equivalents at the start

of the period 8,964 2,352 2,352

Cash and cash equivalents at the end

of the period 11,064 435 8,964

Cash and cash equivalents consists

of:

Cash at bank and in hand 11,064 435 8,964

--------------------------------------------- ---------------- --------------------- ---------------------

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

Share Translation Retained

capital Share premium reserve Own shares earnings Total

-------------------------------- --------- ------------- ---------------- ---------- -------------- ------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 28 March 2020 2,389 1,588 584 (1,251) 31,087 34,397

Comprehensive (expense) for

the period - - - - (13) (13)

Total other comprehensive

expense - - (80) - (7,065) (7,145)

Share based payment charge - - - - 87 87

Total contributions by and

distributions to owners of

the Group - - - - 87 87

-------------------------------- --------- ------------- ---------------- ---------- -------------- ------------

At 26 September 2020 2,389 1,588 504 (1,251) 24,096 27,326

-------------------------------- --------- ------------- ---------------- ---------- -------------- ------------

At 30 March 2019 2,389 1,588 403 (1,251) 18,147 21,276

Adjustment on initial

application

of IFRS 16 - - - - (467) (467)

-------------------------------- --------- ------------- ---------------- ---------- -------------- ------------

At 31 March 2019 2,389 1,588 403 (1,251) 17,680 20,809

Comprehensive income for the

period - - - - 1,627 1,627

Total other comprehensive income - - 96 - 260 356

Dividends paid - - - - (1,038) (1,038)

Share based payment charge - - - - 188 188

Total contributions by and

distributions to owners of

the Group - - - - (850) (850)

-------------------------------- --------- ------------- ---------------- ---------- -------------- ------------

At 28 September 2019 2,389 1,588 499 (1,251) 18,717 21,942

-------------------------------- --------- ------------- ---------------- ---------- -------------- ------------

NOTES TO THE CONDENSED CONSOLIDATED HALF YEAR STATEMENTS

1 BASIS OF PREPARATION

James Cropper Plc (the Company) is a public limited company

incorporated and domiciled in the United Kingdom and listed on the

Alternative Investment Market (AIM). The condensed consolidated

half year financial statements of the Company for the twenty six

weeks ended 26 September 2020, which have not been audited or

reviewed, comprise the Company and its subsidiaries (together

referred to as the Group).

Basis of preparation

The condensed consolidated financial statements for the 26 week

periods ending 26 September 2020 and 28 September 2019 are

unaudited and were approved by the Directors on 9 November 2020.

They do not constitute statutory accounts as defined in s434 of the

Companies Act 2006. The financial statements for the year ended 28

March 2020 were prepared in accordance with International Financial

Reporting Standards (IFRS) and have been delivered to the Registrar

of Companies. The report of the auditor on those financial

statements was unqualified and did not draw attention to any

matters by way of emphasis of matter. The Group's financial

statements consolidate the financial statements of James cropper

Plc and its subsidiaries.

Applicable standards

These unaudited consolidated interim financial statements have

been prepared in accordance with International Financial Reporting

Standards as adopted by the European Union, under the historical

cost convention. They have not been prepared in accordance with IAs

34, the application of which is not required to the interim

financial statements of companies trading on the Alternative

Investment Market (AIM companies). The interim financial statements

have been prepared in accordance with the accounting policies

applied in the preparation of the Group's published consolidated

financial statements for the 52 week period ended 28 March

2020.

The consolidated financial statements of the Group for the 52

week period ended 28 March 2020 are available upon request from the

Company's registered office Burneside Mills, Kendal, Cumbria, LA9

6PZ or at www.jamescropper.com .

The half year financial information is presented in Sterling and

all values are rounded to the nearest thousand pounds (GBP'000)

except where otherwise indicated.

Going concern

The Directors, at the time of approving these interim

statements, have a reasonable expectation that the Group has

adequate resources to continue in operational existence for at

least 12 months from this reporting date.

In light of the Covid-19 pandemic and subsequent uncertainty,

the Group has undertaken a detailed review and taken appropriate

mitigating actions to protect the business and liquidity.

A robust assessment modelling the most severe impact of the

Covid-19 pandemic was carried out in April 2020 and the Company is

trading significantly ahead of the most severe forecasts at both

sales and profit level. The Group's quick response to Covid-19 has

provided financial resilience during this particularly challenging

period. Nonetheless the potential of demand decline resulting from

Covid-19 establishes an ongoing risk to future financial

performance. For the interim going concern review the Group has a

base case forecast for the next 30 months to assess the latest

position and potential associated ongoing impacts of Covid-19. A

number of scenarios assess headroom against facilities and impacts

on bank covenants, which showed adequate headroom and no covenant

breaches. No revolving credit facilities are due for renewal within

the next 12 months. On 27 October 2020, the Company secured a

Coronavirus Large Business Interruption Loan ("CLBIL") for a three

year duration under which the Group can draw up to GBP4m. The

interim going concern review assumes that this facility remains

undrawn.

Following this review the Directors are satisfied that the

Company and the Group have adequate resources to continue in

operational existence for the foreseeable future. Accordingly, they

continue to adopt the going concern basis in preparing the

condensed consolidated financial statements.

Significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated financial statements are the same as those applied by

the Group in its consolidated financial statements as at and for

the 52 week period ended 28 March 2020.

During the period, some employees across the Group were placed

on furlough under the Coronavirus Job Retention Scheme ("JRS"). In

addition, in the USA, the subsidiaries of Technical Fibre Products

took part in the Paycheck Protection Program ("PPP"). Income from

the JRS Scheme and the PPP program of GBP2.8m has been recognised

in the six months ended 26 September 2020. The grants have been

recognised as income and matched with associated payroll costs over

the same period. These grants have been treated as exceptional in

the financial statements for the period ended 28 September 2020.

This income has been treated as exceptional in the exceptional

items note 8.

2 Accounting estimates and judgements

The preparation of half year financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. Actual

results may differ from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the 52 week period ended 28

March 2020.

As mentioned in the trading update announcement at the AGM, the

Group has accelerated the implementation of a restructuring plan.

The plan is still ongoing with costs to date of GBP495,000.

Included in the financial statements for the period ended 26

September 2020 are additional provisions for completion of the plan

amounting to a further GBP562,000. The net impact at the year ended

26 March 2020 is expected to be around GBP183,000 and generate an

annual saving of circa GBP2m per year. The costs to date and

provisions to completion have been recognised in the employee

benefits figure of the income statement. The costs have been

treated as exceptional and included in the exceptional items note

8.

3 Risks and uncertainties

The principal risks and uncertainties which may have the largest

impact on performance in the second half of the year are the same

as disclosed in the 2020 Annual Report on pages 21-25. The

principal risks set out in the 2020 Annual Report were:

Covid-19 pandemic risk; employee health & safety; energy

price volatility; pulp price volatility and sustainability;

exchange rate volatility; Brexit; pension and information security

and cyber risk.

The Board considers that the principal risks and uncertainties

set out in the 2020 annual report have not changed and remain

relevant for the second half of the financial year.

4 Alternative performance measures

The Company uses alternative performance measures to allow users

of the financial statements to gain a clearer understanding of the

underlying performance of the business.

Profit before tax represents the Group's overall performance and

financial position, however it contains significant non-operational

items relating to IAS 19 that the directors believe obscure an

understanding of the key performance trend.

Measures used to evaluate business performance are 'Adjusted

operating profit' (operating profit excluding the impact of IAS 19

and exceptional items), and 'Adjusted profit before tax' (profit

before tax excluding the impact of IAS 19 and exceptional items).

The alternative performance measures are reconciled in note 9.

The adjustment, which we refer to in these accounts as the "IAS

19 impact" represents the difference between the pension charge as

calculated under IAS 19 and the cash contributions for the current

service cost only as determined by the latest triennial valuation.

The Directors consider that the adjusted pension charge better

reflects the actual pension costs for ongoing service compared to

the IAS 19 charge. This adjustment is made internally when we

assess performance and is also used in the EBITDA and EPS targets

used in management incentive schemes.

5 Earnings per share

Six months Six months Year ended

ended 26 September ended 28 September 28 March

2020 2019 2020

----------------------------------- -------------------- -------------------- ------------

Earnings per share - basic

and diluted (0.2p) 17.0p 50.6p

(Loss) / Profit for the financial

period (GBP'000) (16) 1,627 4,829

----------------------------------- -------------------- -------------------- ------------

Weighted average number of

shares -

basic and diluted 9,554,803 9,554,803 9,554,803

6 Dividends

The group has weathered the initial storm of Covid-19. The Group

operates in diverse sectors and in wide geographical markets, so

whilst certain parts of the business have been impacted by

Covid-19, other parts of the business have demonstrated greater

resilience.

With this balance, and the likelihood of a slower recovery, the

Board has not declared an interim dividend as it continues to

protect the liquidity of the Group.

7 Retirement benefit obligations

Movements during the period in the Group's defined benefit

pension schemes are set out below:

26 week period 26 week period 52 week period

ended 26 September ended 28 September ended 28 March

2020 2019 2020

--------------------------------------- ----------------------- ----------------------- -------------------

GBP'000 GBP'000 GBP'000

Obligation brought forward (9,382) (22,648) (22,648)

Expense recognised in the

income statement (528) (806) (1,732)

Contributions paid to the

schemes 437 992 1,941

Actuarial (losses) and gains

recognised in Other Comprehensive

Income (8,788) 352 13,057

--------------------------------------- ----------------------- ----------------------- -------------------

Obligation carried forward (18,261) (22,110) (9,382)

--------------------------------------- ----------------------- ----------------------- -------------------

8 Exceptional items

26 week period 26 week period 52 week period

ended 26 September ended 28 September ended 28 March

2020 2019 2020

------------------------------- ----------------------- ----------------------- -------------------

GBP'000 GBP'000 GBP'000

Income from the JRS scheme 2,521 - -

Income from the PPP program

(USA) 258 - -

Restructuring costs (1,057) - -

------------------------------- ----------------------- ----------------------- -------------------

Exceptional items 1,722 - -

------------------------------- ----------------------- ----------------------- -------------------

9 Alternative performance measures

26 week period 26 week period 52 week period

ended 26 September ended 28 September ended 28 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

Adjusted operating (loss)

/ profit (1,196) 2,826 7,240

Net IAS 19 pension adjustments

- current service costs (174) (272) (671)

Grants received JRS scheme 2,521 - -

PPP program (USA) 258 - -

Restructuring costs (1,057) - -

----------------------------------- ----------------------- ----------------------- -------------------

Operating profit 352 2,554 6,569

----------------------------------- ----------------------- ----------------------- -------------------

26 week period 26 week period 52 week period

ended 26 September ended 28 September ended 28 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

Adjusted (loss) / profit

before tax (1,445) 2,557 6,674

Net IAS 19 pension adjustments

- current service

costs (409) (531) (1,188)

- future service

contributions

paid 235 258 517

- finance costs (119) (275) (544)

Grants received - JRS scheme 2,521 - -

PPP program (USA) 258 - -

Restructuring costs (1,057) - -

----------------------------------------------- ----------------------- ----------------------- -------------------

(Loss) / profit before tax (16) 2,009 5,459

----------------------------------------------- ----------------------- ----------------------- -------------------

10 Related parties

There have been no significant changes in the nature of related

party transactions in the period ended 26 September 2020 from that

disclosed in the 2020 annual report.

Statement of Directors' responsibilities

The Directors confirm that these condensed consolidated interim

financial statements have been prepared in accordance with IAS 34

as adopted by the European Union and that the interim management

report includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

(i) An indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

(ii) Material related party transactions in the first six months

and any material changes in the related party transactions

described in the last Annual report.

During the period since approval of the annual report for the 52

weeks ended 28 March 2020, Dave Watson resigned as a director on 1

August 2020.

The Directors of James Cropper Plc are detailed on our Group

website www.jamescropper.com

Forward-looking statements

Sections of this half-yearly financial report may contain

forward-looking statements with respect to the Group's plans and

expectations relating to its future performance, results, strategic

initiatives, objectives and financial position, including liquidity

and capital resources. These forward-looking statements are not

guarantees of future performance. By their very nature, all

forward-looking statements involve risks and uncertainties because

they relate to events that may or may not occur in the future and

are or may be beyond the Group's control. Accordingly, the Group's

actual results and financial condition may differ materially from

those expressed or implied in any forward-looking statements.

Forward-looking statements in this half-yearly financial report are

current only as of the date on which such statements are made. The

Group undertakes no obligation to update any forward-looking

statements, save in respect of any requirement under applicable law

or regulation. Nothing in this announcement shall be construed as a

profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDLDLAIII

(END) Dow Jones Newswires

November 10, 2020 02:00 ET (07:00 GMT)

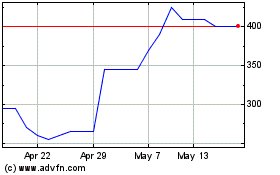

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Jul 2023 to Jul 2024