TIDMCLIG

RNS Number : 9260V

City of London Investment Group PLC

21 January 2013

21(st) January 2013

CITY OF LONDON INVESTMENT GROUP PLC

("City of London" or "the Group")

HALF YEAR RESULTS TO 30(th) NOVEMBER 2012

City of London (LSE: CLIG) announces half year results for the

six months to 30(th) November 2012.

SUMMARY

-- Funds under Management ("FuM") of US$3.9 billion (GBP2.4

billion) at 30(th) November 2012. This compares to US$4.5 billion

(GBP2.9 billion) at the beginning of this financial year on 1(st)

June 2012 and US$4.8 billion (GBP3.0 billion) at 30th November

2011.

-- FuM at 31(st) December 2012 of US$4.1 billion (GBP2.5 billion)

-- Revenues, representing the Group's management charges on FuM,

were GBP15.1 million (2011: GBP17.2 million)

-- Profit before tax of GBP4.7 million (2011: GBP5.7 million,

excluding a one-off gain on the sale of an investment)

-- Maintained interim dividend of 8p per share paid on 28(th)

December 2012 to shareholders on the register on 14(th) December

2012

-- Cash and cash equivalents at the period end of GBP5.8 million (2011: GBP5.9 million)

David Cardale, Chairman, said, "We anticipate that global

investors will re-commit to our core emerging and frontier

investment markets - the MXEF has increased by about 7% from 30(th)

November 2012 to date. If we can benefit from a continuation of

this trend, then the operational gearing inherent in City of

London's business model, together with the reduced costs and

commissions, will produce a welcome uplift in revenues,

profitability, dividend cover and ultimately, dividends

themselves."

For further information, please visit www.citlon.co.uk or

contact:

Doug Allison (CEO) Simon Hudson / Kelsey Traynor

City of London Investment Group Tavistock Communications

PLC

Tel: +44 (0) 20 7860 8347 Tel: +44 (0)20 7920 3150

Martin Green

Canaccord Genuity Limited

Financial Adviser & Broker

Tel: +44 (0)20 7050 6500

Chairman's statement

This is my first statement to shareholders since becoming

Chairman on Andrew Davison's retirement at the conclusion of the

Annual General Meeting in October 2012. I have been a non-executive

director of the Company since the IPO in 2006 and was the Senior

Independent Non-executive Director from 2008 until my appointment

as Chairman.

The six month period to 30(th) November 2012 was not an easy one

for City of London. Global investors remained nervous of prospects

for both developed and emerging economies, and this resulted in an

environment in which there was little or no interest from investors

in taking up any new strategies or products, including our own. We

have taken the opportunity to rationalise our portfolio of equity

products and this is discussed in more detail in the Chief

Executive Officer's (CEO) review below.

On top of these challenges, the Group has also had to deal with

the very large redemption from a single client that took the

management of its emerging market exposure in-house, having been a

client of ours for nearly five years. The decision was based on a

change in the client's strategic objectives.

Total funds under management ("FuM") at the Company's half-year

end on 30(th) November 2012 were US$3.9 billion (GBP2.4 billion), a

decline of 13% in US$ terms, compared to the US$4.5 billion (GBP2.9

billion) at 31(st) May 2012. The decrease of US$0.6 billion over

the period reflected almost entirely the client redemption

mentioned above, which totalled US$0.5 billion.

Results - unaudited

As a result of the decline in FuM, revenues for the half-year

were 12% lower at GBP15.1 million (2011: GBP17.2 million). Our

practice of keeping our ratio of fixed costs to variable costs to a

minimum meant that overall costs declined with revenues, producing

a 9% reduction in administrative expenses to GBP10.5 million for

the period (2011: GBP11.6 million). Profit before tax was GBP4.7

million compared to GBP5.7 million for the six months to 30(th)

November 2011 (excluding a gain of GBP0.4 million on the sale of an

investment in options on unquoted equity), representing a decline

of 18%.

Variable costs within administrative expenses represented

approximately 49% of the total (2011: 53%). The principal

components are profit-share of GBP2.3 million (2011: GBP2.8

million), and the commission payable to our ex-third party

marketing consultant of GBP2.2 million (2011: GBP2.7 million).

Basic earnings per share, after a 29% tax charge of GBP1.4

million (2011: GBP2.0 million representing 33% of profit before

tax), were 13.1p (2011: 16.2p). Diluted earnings per share were

12.9p (2011: 15.7p).

Dividends

We stated in an update announced on 15(th) November 2012, that

it was the Board's intention to maintain the interim dividend at

last year's level of 8p per share, albeit with a reduced (and we

hope temporary) level of cover. The Board has subsequently

confirmed the payment of a maintained interim dividend of 8p per

share. The dividend was paid on 28(th) December 2012 to

shareholders on the register on 14(th) December 2012. That we can

do this is a reflection of the Group's conservative financial

management philosophy and careful management of the balance between

fixed and variable costs. Our dividend payment policy has normally

been based on a split of one third/two thirds between the interim

and the final, and currently there are no plans for this to

change.

Board

Andrew Davison stepped down as Chairman and retired from the

Board at the beginning of October 2012. Andrew had been Chairman

since 1999 and for over thirteen years provided wise and valued

counsel to the Board and the Group. On behalf of the Directors,

staff and shareholders, I thank him for his contribution and wish

him a long and happy retirement.

In line with our policy of putting in place long term succession

planning, there have been two other changes to the Board since the

period end. As we advised shareholders over a year ago, City of

London's founder, Barry Olliff, planned to relinquish his role as

Chief Executive in favour of Doug Allison, our Finance Director

since 1998, but would retain his role as Chief Investment Officer.

These changes were duly announced on 31(st) December 2012, along

with the appointment of Valerie Tannahill as Finance Director to

replace Doug. Valerie joined City of London in 1997 as Finance

Manager, and is a director of The World Markets Umbrella Fund plc,

City of London's Dublin listed UCITS product. I congratulate both

Doug and Valerie on their appointments and welcome Valerie to the

Board.

Outlook

The Group's business model is built to withstand shocks and to

cope with volatility, nevertheless we constantly strive both to

improve efficiencies and to cut fixed and variable costs. The Board

and management have recently instituted a review focusing on

product restructuring and process improvement including technology

driven efficiencies in order to enhance the core investment

management function; we are currently in the process of

implementing the improvements identified. We expect this programme

to result in annualised cost savings of at least GBP1 million, to

be reflected fully in our 2013/14 financial year. In addition, next

year will see the first of the significant reductions in run-off

commissions payable to our previous third party marketing

consultants, as further detailed in the CEO review. Both of these

factors can be expected to have a positive impact on Group

profitability.

We anticipate that global investors will re-commit to our core

emerging and frontier investment markets - the MXEF has increased

by about 7% from 30(th) November 2012 to date. If we can benefit

from a continuation of this trend, then the operational gearing

inherent in City of London's business model, together with the

reduced costs and commissions, will produce a welcome uplift in

revenues, profitability, dividend cover and ultimately, dividends

themselves.

David Cardale

Chairman

16(th) January 2013

Chief Executive Officer's review

This will be my last Review for shareholders as Chief Executive

Officer of City of London. As previously advised, I stood down as

CEO at the end of 2012 but will continue in my role as Chief

Investment Officer.

Funds under Management ("FuM") at the Group's half year end,

30(th) November 2012 were US$3.9bn (GBP2.4bn). This should be

compared with US$4.8bn (GBP3.0bn) at 30(th) November 2011 and

US$4.5bn ($2.9bn) as at May 31(st) 2012. As an update, FuM at the

end of December were US$4.1bn (GBP2.5bn).

MXEF, (which we use as a proxy via which our FuM can be measured

and compared), was 1007 at the end of November 2012, 928 at the end

of November 2011 and 906 at the end of May 2012. MXEF at the end of

December 2012 was 1055. These price index levels should be compared

with the all-time high in MXEF of 1340 at the end of October 2007

and our all-time high assets under management of US$6.2bn at the

end of April 2011.

Results - unaudited

Our pretax profits for the half year were GBP4.7 million

compared with GBP5.7 million for the equivalent period to 30(th)

November 2011 (excluding a gain in the prior period of GBP0.4

million on the sale of an investment in options on an unlisted

investment). At the same time an interim dividend of 8p was

announced for Y/E 2013 (2012: 8p).

Investment performance

I thought that it would be helpful for shareholders if I was to

drill down into certain aspects of our investment performance.

The Size Weighted Average Discount (SWAD) of our largest

commingled fund has increased from 7.7% to 13.4% over the past five

years. This significant head wind has adversely, particularly over

the last two years affected the investment performance of our

Emerging Markets closed-end fund business. While significant moves

over long periods can be countered via good country allocation

relative to the funds' benchmark, and opportunities to trade

discount volatility, moves in the SWAD of the order of magnitude,

between October 2010 (8.7%) and end September 2012 (13.4%) are

virtually impossible to counter. As of the end of December the SWAD

was 13.1%.

The SWAD, particularly when it increases or decreases

significantly in a short period of time, is therefore a headwind or

a tailwind in terms of our investment performance. However, by far

and away the greater contribution to investment performance through

extended cycles is trading the various securities that we consider

to be within our investible universe, taking advantage of discount

volatility, country allocation and also corporate actions. These

parts of our process have continued to do very well through this

period of underperformance.

The recent narrowing of the SWAD from 13.4% to 13.1% referenced

earlier has provided us with some modest outperformance, and in

addition is beginning to reflect a significant number of

transactions that had been announced by CEF's over the recent

period. With discounts remaining so wide for so long it would seem

likely that there will continue to be buy- backs, tender offers, in

specie distributions along with the odd liquidation and open

ending. Thus we believe that our investment performance will

continue to improve.

As was referenced in previous CEO Reports (both the Half Year

report for 2012 and the Report and Accounts for 2012), in our

opinion, a wide discount to NAV reflects either over supply or a

poorly performing or constructed product. To the extent that supply

is reduced as has been happening recently, not only will discounts

narrow, but our performance will improve. I would make the point

that we have gone through many such cycles and this one seems to be

no different from those that have gone before.

Diversification

Fortunately we are well advanced in our diversification plans

which have recently started to generate significant interest.

Emerging Asia Small Cap, Global Absolute Return Fund (GARF) and

GARF Plus, Frontier and Global Developed all outperformed their

relevant benchmarks last year and are now being actively marketed.

In many instances we have provided additional infrastructure or

personnel to these areas of our business to ensure that as they

develop they are adequately resourced.

We decided to rationalise our Equity products. Brazil, Chile and

Mexico plus EM Value and Growth have been liquidated. We have

started a new Emerging Markets Equities Small Cap fund based upon

the process developed within our Asia Small Cap Fund.

Cost controls

As referenced in the announcement on 15(th) November we have

continued to focus on cost controls. We consider that we are pretty

lean to start with but we have taken a look at many of our support

functions and where it has been possible we have reduced costs,

significantly in aggregate. In many instances we have taken

advantage of advances in technology that we have recently

introduced. This has enabled us to reduce our headcount. Total

savings as a result of our reductions in expenses on an annual

basis are expected to exceed GBP1 million.

Our Operating Margin has increased from 0.85% in December 2010

to 0.91% as of December 2012, based on monthly data which includes

estimated accruals.

One of the contributing factors leading to this increase in

margin was that after our third party marketing agreement ended,

all new business was written at our full fee (without 20% being

paid out as commission).

The large majority of departing clients therefore had

effectively been paying us 80% of our fee with the other 20% going

to the marketing agent. The effect of this on our present margin,

our ongoing commission liabilities, and the potential for retained

earnings is shown in the table following.

This reduction in commission payments is very noticeable in the

higher margin referenced above. The most recent uptick reflects the

loss of our largest client who was paying us a lower fee as a

result of their size.

All data in the following table, with the exception of the last

column, is from previous Report and Accounts. The table estimates

the commission payable annually through to final run-off, using the

level of FuM and US$/GBP rate at each data point, most recently

31(st) December 2012.

December

As of: July 2010 July 2011 July 2012 2012

MXEF 991 1138 952 1055

GBP/$ 1.55 1.60 1.55 1.60

GBPm.

2012-13 5.2 5.8 4.4 4.1

2013-14 5.0 5.5 4.2 3.7

2014-15 4.4 4.8 3.7 3.2

2015-16 3.3 3.6 2.9 2.4

2016-17 2.7 3.0 2.5 2.0

2017-18 2.2 2.4 2.0 1.7

2018-19 1.2 1.3 1.1 1.0

2019-20 0.4 0.3 0.3 0.3

2020-21 0 0.1 0.1 0.1

Responsibilities

Having worked in the City for 50 years, it's been 25 years since

I started a new business, Olliff and Partners (O&P), back in

1987. City of London Investment Group which was an outgrowth of

O&P has been developed over the past 21 years and I would like

to thank all present and past employees for the assistance that

they have provided in the growth of that business.

As referenced in the announcement on 31(st) December, from 1(st)

January 2013 Doug Allison became CEO. I continue in the role of

Chief Investment Officer. I would like to wish Doug all the best

with his new responsibilities.

Barry Olliff

Chief Investment Officer

16(th) January 2012

For further information please see the most recent presentation

to CLIG shareholders released today. This is on our website

www.citlon.co.uk

Consolidated income statement

For the six months ended 30(th) November 2012

Six months Six months

ended ended Year ended

------------------------------- ----- -------------- -------------- -------------

30(th) Nov 30(th) Nov 31(st) May

2012 2011 2012

------------------------------- ----- -------------- -------------- -------------

(unaudited) (unaudited) (audited)

------------------------------- ----- -------------- -------------- -------------

Note GBP GBP GBP

------------------------------- ----- -------------- -------------- -------------

Revenue 2 15,135,250 17,232,079 34,142,706

------------------------------- ----- -------------- -------------- -------------

Administrative expenses

------------------------------- ----- -------------- -------------- -------------

Staff costs 5,696,604 5,991,205 12,177,561

------------------------------- ----- -------------- -------------- -------------

Commissions payable 2,227,843 2,663,695 5,194,630

------------------------------- ----- -------------- -------------- -------------

Custody fees payable 643,855 706,410 1,433,342

------------------------------- ----- -------------- -------------- -------------

Other administrative expenses 1,824,386 2,087,507 3,955,738

------------------------------- ----- -------------- -------------- -------------

Depreciation and amortisation 111,830 147,754 347,591

------------------------------- ----- -------------- -------------- -------------

(10,504,518) (11,596,571) (23,108,862)

------------------------------- ----- -------------- -------------- -------------

Operating profit 4,630,732 5,635,508 11,033,844

------------------------------- ----- -------------- -------------- -------------

Interest receivable and

similar income 3 34,097 468,786 427,670

------------------------------- ----- -------------- -------------- -------------

Profit before tax 4,664,829 6,104,294 11,461,514

------------------------------- ----- -------------- -------------- -------------

Income tax expense (1,355,279) (2,022,156) (2,963,660)

------------------------------- ----- -------------- -------------- -------------

Profit for the period 3,309,550 4,082,138 8,497,854

------------------------------- ----- -------------- -------------- -------------

Basic earnings per share 4 13.1p 16.2p 33.8p

------------------------------- ----- -------------- -------------- -------------

Diluted earnings per share 4 12.9p 15.7p 32.8p

------------------------------- ----- -------------- -------------- -------------

Consolidated statement of comprehensive income

For the six months ended 30(th) November 2012

Six months Six months

ended ended Year ended

---------------------------------- ----------------- --------------- --------------

30(th) Nov 30(th) Nov 31(st) May

2012 2011 2012

---------------------------------- ----------------- --------------- --------------

(unaudited) (unaudited) (audited)

---------------------------------- ----------------- --------------- --------------

GBP GBP GBP

---------------------------------- ----------------- --------------- --------------

Profit for the period 3,309,550 4,082,138 8,497,854

---------------------------------- ----------------- --------------- --------------

Fair value gains/(losses)

on

available-for-sale investments* 379,361 (704,442) (720,952)

---------------------------------- ----------------- --------------- --------------

Release of fair value (gains)

on

disposal of available-for-sale

investments* - - (14,128)

---------------------------------- ----------------- --------------- --------------

Other comprehensive income 379,361 (704,442) (735,080)

---------------------------------- ----------------- --------------- --------------

Total comprehensive income

for the period

attributable to equity holders

of the company 3,688,911 3,377,696 7,762,774

---------------------------------- ----------------- --------------- --------------

*Net of deferred tax

Consolidated statement of financial position

30(th) November 2012

30(th) Nov 30(th) Nov 31(st) May

2012 2011 2012

------------------------------ ----- -------------- ------------- -------------

(unaudited) (unaudited) (audited)

------------------------------ ----- -------------- ------------- -------------

Note GBP GBP GBP

------------------------------ ----- -------------- ------------- -------------

Non-current assets

------------------------------ ----- -------------- ------------- -------------

Property and equipment 559,272 719,347 607,437

------------------------------ ----- -------------- ------------- -------------

Intangible assets 329,589 375,049 352,319

------------------------------ ----- -------------- ------------- -------------

Other financial assets 31,486 24,676 31,354

------------------------------ ----- -------------- ------------- -------------

Deferred tax asset 337,191 858,716 929,692

------------------------------ ----- -------------- ------------- -------------

1,257,538 1,977,788 1,920,802

------------------------------ ----- -------------- ------------- -------------

Current assets

------------------------------ ----- -------------- ------------- -------------

Trade and other receivables 3,693,521 4,395,060 5,345,334

------------------------------ ----- -------------- ------------- -------------

Available-for-sale financial

assets 7,526,393 5,017,689 6,924,552

------------------------------ ----- -------------- ------------- -------------

Cash and cash equivalents 5,791,168 5,878,235 5,399,869

------------------------------ ----- -------------- ------------- -------------

17,011,082 15,290,984 17,669,755

------------------------------ ----- -------------- ------------- -------------

Current liabilities

------------------------------ ----- -------------- ------------- -------------

Trade and other payables (4,092,094) (3,589,344) (3,891,267)

------------------------------ ----- -------------- ------------- -------------

Current tax payable (441,180) (979,787) (410,705)

------------------------------ ----- -------------- ------------- -------------

Creditors, amounts falling

due within one year (4,533,274) (4,569,131) (4,301,972)

------------------------------ ----- -------------- ------------- -------------

Net current assets 12,477,808 10,721,853 13,367,783

------------------------------ ----- -------------- ------------- -------------

Total assets less current

liabilities 13,735,346 12,699,641 15,288,585

------------------------------ ----- -------------- ------------- -------------

Non-current liabilities

------------------------------ ----- -------------- ------------- -------------

Deferred tax liability (98,997) - -

------------------------------ ----- -------------- ------------- -------------

Net assets 13,636,349 12,699,641 15,288,585

------------------------------ ----- -------------- ------------- -------------

Capital and reserves

------------------------------ ----- -------------- ------------- -------------

Share capital 268,327 268,684 268,784

------------------------------ ----- -------------- ------------- -------------

Share premium account 2,019,159 1,977,584 1,980,084

------------------------------ ----- -------------- ------------- -------------

Investment in own shares 5 (4,984,300) (4,637,273) (4,560,603)

------------------------------ ----- -------------- ------------- -------------

Fair value reserve 313,492 (35,231) (65,869)

------------------------------ ----- -------------- ------------- -------------

Share option reserve 786,162 1,146,553 1,267,553

------------------------------ ----- -------------- ------------- -------------

Capital redemption reserve 20,582 18,562 18,562

------------------------------ ----- -------------- ------------- -------------

Retained earnings 15,212,927 13,960,762 16,380,074

------------------------------ ----- -------------- ------------- -------------

Total equity 13,636,349 12,699,641 15,288,585

------------------------------ ----- -------------- ------------- -------------

Consolidated statement of changes in equity

For the six months ended 30(th) November 2012

Share Investment Share Capital

Fair redemption

Share premium in own value option Retained

capital account shares reserve reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP GBP GBP

---------------- -------- ---------- ------------ --------- ---------- ----------- ------------- -------------

At

1(st) June

2012 268,784 1,980,084 (4,560,603) (65,869) 1,267,553 18,562 16,380,074 15,288,585

Profit

for the

period - - - - - - 3,309,550 3,309,550

Comprehensive

income - - - 379,361 - - - 379,361

---------------- -------- ---------- ------------ --------- ---------- ----------- ------------- -------------

Total

comprehensive

income - - - 379,361 - 3,309,550 3,688,911

Transactions

with owners

Share option

exercise 1,563 39,075 95,125 - (20,443) - 20,443 135,763

Share

cancellation (2,020) - - - - 2,020 (516,241) (516,241)

Purchase

of own

shares - - (518,822) - - - - (518,822)

Share-based

payment - - - - 86,195 - - 86,195

Deferred

tax - - - - (547,143) - (49,970) (597,113)

Current

tax on

share options - - - - - - 119,389 119,389

Dividends

paid - - - - - - (4,050,318) (4,050,318)

---------------- -------- ---------- ------------ --------- ---------- ----------- ------------- -------------

Total

transactions

with owners (457) 39,075 (423,697) - (481,391) 2,020 (4,476,697) (5,341,147))

---------------- -------- ---------- ------------ --------- ---------- ----------- ------------- -------------

As at

30(th)

November

2012 268,327 2,019,159 (4,984,300) 313,492 786,162 20,582 15,212,927 13,636,349

---------------- -------- ---------- ------------ --------- ---------- ----------- ------------- -------------

Share Investment Share Capital

Fair redemption

Share premium in own value option Retained

capital account shares reserve reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP GBP GBP

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

At

1(st) June

2011 268,584 1,975,084 (4,183,659) 669,211 1,621,936 18,562 13,890,478 14,260,196

Profit

for the

period - - - - - - 4,082,138 4,082,138

Comprehensive

income - - - (704,442) - - - (704,442)

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

Total

comprehensive

income - - - (704,442) - - 4,082,138 3,377,696

Transactions

with owners

Share option

exercise 100 2,500 59,962 - (6,052) - 6,052 62,562

Purchase

of own

shares - - (513,576) - - - - (513,576)

Share-based

payment - - - - 96,175 - - 96,175

Deferred

tax - - - - (565,506) - (2,261) (567,767)

Current

tax on

share options - - - - - - 25,817 25,817

Dividends

paid - - - - - - (4,041,462) (4,041,462)

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

Total

transactions

with owners 100 2,500 (453,614) - (475,383) - (4,011,854) (4,938,251)

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

As at

30(th)

November

2011 268,684 1,977,584 (4,637,273) (35,231) 1,146,553 18,562 13,960,762 12,699,641

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

Share Investment Share Capital

Fair redemption

Share premium in own value option Retained

capital account shares reserve reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP GBP GBP

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

At

1(st) June

2011 268,584 1,975,084 (4,183,659) 669,211 1,621,936 18,562 13,890,478 14,260,196

Profit

for the

year - - - - - - 8,497,854 8,497,854

Comprehensive

income - - - (735,080) - - - (735,080)

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

Total

comprehensive

income - - - (735,080) - - 8,497,854 7,762,774

Transactions

with owners

Share option

exercise 200 5,000 136,632 - (18,685) - 18,685 141,832

Purchase

of own

shares - - (513,576) - - - - (513,576)

Share-based

payment - - - - 195,940 - - 195,940

Deferred

tax - - - - (531,638) - (8,267) (539,905)

Current

tax on

share options - - - - - - 33,392 33,392

Dividends

paid - - - - - - (6,052,068) (6,052,068)

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

Total

transactions

with owners 200 5,000 (376,944) - (354,383) - (6,008,258) (6,734,385)

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

As at

31(st)

May

2012 268,784 1,980,084 (4,560,603) (65,869) 1,267,553 18,562 16,380,074 15,288,585

----------------- -------- ---------- ------------ ---------- ---------- ----------- ------------ ------------

Consolidated cash flow statement

For the six months ended 30(th) November 2012

Six months Six months

ended ended Year ended

------------------------------------- ------------------- --------------- --------------

30(th) Nov 30(th) Nov 31(st)

2012 2011 May 2012

------------------------------------- ------------------- --------------- --------------

(unaudited) (unaudited) (audited)

------------------------------------- ------------------- --------------- --------------

GBP GBP GBP

------------------------------------- ------------------- --------------- --------------

Cash flow from operating activities

------------------------------------- ------------------- --------------- --------------

Operating profit 4,630,732 5,635,508 11,033,844

------------------------------------- ------------------- --------------- --------------

Adjustments for:

------------------------------------- ------------------- --------------- --------------

Depreciation charges 89,100 159,119 336,226

------------------------------------- ------------------- --------------- --------------

Amortisation of intangible

assets 22,730 (11,365) 11,365

------------------------------------- ------------------- --------------- --------------

Share based payment charge 86,196 96,175 195,941

------------------------------------- ------------------- --------------- --------------

Translation adjustments 162,539 (23,622) (108,680)

------------------------------------- ------------------- --------------- --------------

Profit on disposal of fixed

assets - (72) (72)

------------------------------------- ------------------- --------------- --------------

Cash generated from operations

before changes in working

capital 4,991,297 5,855,743 11,468,624

------------------------------------- ------------------- --------------- --------------

Decrease in trade and other

receivables 1,651,813 1,342,096 230,677

------------------------------------- ------------------- --------------- --------------

Decrease in trade and other

payables (834,236) (424,075) (122,152)

------------------------------------- ------------------- --------------- --------------

Cash generated from operations 5,808,874 6,773,764 11,577,149

------------------------------------- ------------------- --------------- --------------

Interest received 34,097 33,695 62,875

------------------------------------- ------------------- --------------- --------------

Taxation paid (1,230,826) (2,391,025) (3,928,729)

------------------------------------- ------------------- --------------- --------------

Net cash generated from operating

activities 4,612,145 4,416,434 7,711,295

------------------------------------- ------------------- --------------- --------------

Cash flow from investing activities

------------------------------------- ------------------- --------------- --------------

Purchase of property and equipment (40,935) (334,966) (400,163)

------------------------------------- ------------------- --------------- --------------

Proceeds from sale of property

and equipment - 320 320

------------------------------------- ------------------- --------------- --------------

Purchase of non-current financial

assets - - (6,491)

------------------------------------- ------------------- --------------- --------------

Proceeds from sale of non-current

financial assets - 322,289 483,434

------------------------------------- ------------------- --------------- --------------

Purchase of current financial

assets (312,246) - (2,132,613)

------------------------------------- ------------------- --------------- --------------

Proceeds from sale of current

financial assets - - 178,438

------------------------------------- ------------------- --------------- --------------

Net cash used investing activities (353,181) (12,357) (1,877,075)

------------------------------------- ------------------- --------------- --------------

Cash flow from financing activities

------------------------------------- ------------------- --------------- --------------

Proceeds from issue of ordinary

shares 40,638 2,600 5,200

------------------------------------- ------------------- --------------- --------------

Ordinary dividends paid (4,050,318) (4,041,462) (6,052,068)

------------------------------------- ------------------- --------------- --------------

Purchase of own shares by

employee share option trust - (513,576) (513,576)

------------------------------------- ------------------- --------------- --------------

Proceeds from sale of own

shares by employee share option

trust 95,125 59,962 136,632

------------------------------------- ------------------- --------------- --------------

Net cash used in financing

activities (3,914,555) (4,492,476) (6,423,812)

------------------------------------- ------------------- --------------- --------------

Net increase/(decrease) in

cash and

cash equivalents 344,409 (88,399) (589,592)

------------------------------------- ------------------- --------------- --------------

Cash and cash equivalents

at start of period 5,399,869 6,104,673 6,104,673

------------------------------------- ------------------- --------------- --------------

Effect of exchange rate changes 46,890 (138,039) (115,212)

------------------------------------- ------------------- --------------- --------------

Cash and cash equivalents

at end of period 5,791,168 5,878,235 5,399,869

------------------------------------- ------------------- --------------- --------------

Notes

1. Basis of preparation and significant accounting policies

The financial information contained herein is unaudited and does

not comprise statutory financial information within the meaning of

section 434 of the Companies Act 2006. The information for the year

ended 31st May 2012 has been extracted from the latest published

audited accounts. The report of the independent auditor on those

financial statements contained no qualification or statement under

s498(2) or (3) of the Companies Act 2006.

These interim financial statements have been prepared in

accordance with the Disclosure and Transparency Rules of the

Financial Services Authority and IAS 34 "Interim Financial

Reporting" as adopted by the European Union. The accounting

policies are consistent with those set out and applied in the

statutory accounts of the Group for the period ended 31st May

2012.

2. Segmental analysis

The directors consider that the Group has only one reportable

segment, namely asset management, and hence only analysis by

geographical location is given.

USA Canada UK Europe Other Total

GBP GBP GBP ex UK GBP GBP

GBP

------------------- ------------- --------- ---------- ---------- -------- -----------

Six months to

30(th) Nov 2012

------------------- ------------- --------- ---------- ---------- -------- -----------

Revenue 12,721,460 332,248 1,227,868 853,674 - 15,135,250

------------------- ------------- --------- ---------- ---------- -------- -----------

Non-current

assets:

------------------- ------------- --------- ---------- ---------- -------- -----------

Property and

equipment 362,049 - 178,480 - 18,743 559,272

------------------- ------------- --------- ---------- ---------- -------- -----------

Intangible assets 329,589 - - - - 329,589

------------------- ------------- --------- ---------- ---------- -------- -----------

Six months to

30(th) Nov 2011

------------------- ------------- --------- ---------- ---------- -------- -----------

Revenue 14,754,905 324,215 1,279,471 873,488 - 17,232,079

------------------- ------------- --------- ---------- ---------- -------- -----------

Non-current

assets:

------------------- ------------- --------- ---------- ---------- -------- -----------

Property and

equipment 454,453 - 206,827 - 58,067 719,347

------------------- ------------- --------- ---------- ---------- -------- -----------

Intangible assets 375,049 - - - - 375,049

------------------- ------------- --------- ---------- ---------- -------- -----------

Year to 31(st)

May 2012

------------------- ------------- --------- ---------- ---------- -------- -----------

Revenue 29,050,781 654,182 2,680,574 1,757,169 - 34,142,706

------------------- ------------- --------- ---------- ---------- -------- -----------

Non-current

assets:

------------------- ------------- --------- ---------- ---------- -------- -----------

Property and

equipment 389,771 - 191,794 - 25,872 607,437

------------------- ------------- --------- ---------- ---------- -------- -----------

Intangible assets 352,319 - - - - 352,319

------------------- ------------- --------- ---------- ---------- -------- -----------

The Group has classified revenue based on the domicile of its

clients and non-current assets based on where the assets are held.

Any individual client generating revenue of 10% or more would be

disclosed separately, as would assets in a foreign country if they

are material.

3. Interest receivable and similar income

30(th) Nov 30(th) Nov 31(st) May

2012 2011 2012

GBP GBP GBP

----------------------------- ----------- ----------- -----------

Interest 34,097 33,695 62,875

----------------------------- ----------- ----------- -----------

Gain on sale of investments - 435,091 364,795

----------------------------- ----------- ----------- -----------

34,097 468,786 427,670

----------------------------- ----------- ----------- -----------

Last year's interim figure includes a gain of US$675,000

(GBP435,091) on the sale of an investment in options on unquoted

equity.

4. Earnings per share

The calculation of earnings per share is based on the profit for

the period of GBP3,309,550 (31st May 2012- GBP8,497,854; 30th

November 2011 - GBP4,082,138) divided by the weighted average

number of ordinary shares in issue for the six months ended 30th

November 2012 of 25,254,902 (31st May 2012 -25,171,389; 30th

November 2011 - 25,203,351).

As set out in note 5 the Employee Benefit Trust held 1,877,783

ordinary shares in the company as at 30th November 2012. The

Trustees of the Trust have waived all rights to dividends

associated with these shares. In accordance with IAS33 "Earnings

per share", the ordinary shares held by the Employee Benefit Trust

have been excluded from the calculation of the weighted average

number of ordinary shares in issue.

The calculation of diluted earnings per share is based on the

profit for the period of GBP3,309,550 (31st May 2012 -

GBP8,497,854; 30th November 2011 - GBP4,082,138) divided by the

diluted weighted average number of ordinary shares in issue for the

six months ended 30th November 2012 of 25,697,187 (31st May 2012 -

25,917,327; 30th November 2011 - 26,018,983).

5. Investment in own shares

Investment in own shares relates to City of London Investment

Group PLC shares held by an Employee Benefit Trust on behalf of

City of London Investment Group PLC.

At 30th November 2012 the Trust held 1,877,783 ordinary 1p

shares (31st May 2012 - 1,711,867; 30th November 2011 - 1,746,117),

of which 1,585,115 ordinary 1p shares (31st May 2012 - 1,654,242;

30th November 2011 - 1,667,492) were subject to options in

issue.

6. Dividends

A final dividend of 16p per share in respect of the year ended

31st May 2012 was paid on 19th October 2012.

An interim dividend of 8p per share (2012 - 8p) in respect of

the year ended 31st May 2013 was paid on 28th December 2012 to

members registered at the close of business on 14th December 2012.

This interim dividend was paid earlier than usual to accommodate US

resident shareholders.

7. General

The interim financial statements for the six months to 30th

November 2012 were approved by the Board on 16th January 2013.

These financial statements are unaudited, but they have been

reviewed by the auditors, having regard to the bulletin "Review of

Interim Financial Information" issued by the Auditing Practices

Board.

Copies of this statement are available on our website,

www.citlon.co.uk

- ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KMGMMDRLGFZM

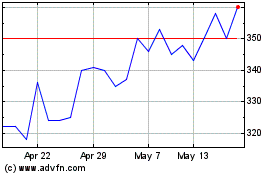

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Jul 2024 to Aug 2024

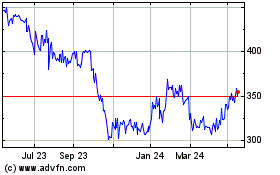

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Aug 2023 to Aug 2024