Interim Management Statement

November 18 2009 - 2:00AM

UK Regulatory

TIDMCLI

18 November 2009

CLS Holdings plc

("CLS", the "Company" or the "Group")

Interim Management Statement for the period 1 July 2009 to 18 November 2009

The Company today announces its Interim Management Statement for the period 1

July 2009 to 18 November 2009.

HIGHLIGHTS

* Lease renewals and extensions completed on 10,738 sq m (115,573 sq ft)

* New leases signed on 10,492 sq m (112,925 sq ft)

* Vacancy rate down to 4.5% by rental value (30 June 2009: 5.4%)

* Voids at Vänerparken down to 1.1% by rental value (30 June 2009: 8.3%)

* Sale of 2 Deanery Street, W1 at 17.4% above 31 December 2008 valuation

* Over GBP160 million of internal resources available for investment

PROPERTY REVIEW

UK - Since 1 July 2009, sentiment in the investment market in central London

has improved, although bank financing remains relatively expensive compared to

elsewhere in Europe. The occupational market in central London has also seen a

positive shift, but competition between landlords remains challenging.

Lease renewals were completed on 1,900 sq m (20,450 sq ft), new lettings were

achieved on 838 sq m (9,030 sq ft) and one tenant vacated from 288 sq m (3,100

sq ft), resulting in a net reduction of the vacancy rate by rental value from

5.0% at 30 June 2009 to 4.5%.

In August, 2 Deanery Street, W1 was sold for GBP2.2 million, 17.4% above its

valuation at 31 December 2008.

FRANCE - The French investment market saw yields stabilise after a period of

increases, and rents fall marginally for new and redeveloped space in central

Paris. Credit conditions have begun to relax, significantly more so than in the

UK, and we are looking closely at a number of investment opportunities in the

Paris market.

Since 1 July 2009, new leases, rent reviews and lease extensions have been

agreed on 8,078 sq m (86,950 sq ft) of space in the French portfolio,

contributing to a fall in the vacancy rate from 6.1% to 5.9% by rental value.

GERMANY - There has been a 70% increase in investment market activity in

Germany between the second and third quarters of 2009. Prime yields have

stabilised, but vacancy rates are rising towards 10%, and unemployment is at

7.7%.

Intensive asset management of our German portfolio has maintained the vacancy

rate at 4.1% (30 June 2009: 4.3%), and tenant discussions are ongoing in

respect of a number of buildings. We expect the occupational markets to remain

challenging for some time.

The development of the Rathaus Centre in Bochum is on time and on budget with

final fit-out works now under way. The tenant is already in occupation and

paying rent on a 30 year index-linked lease.

SWEDEN - 2,525 sq m (27,180 sq ft) of space became vacant and was relet in our

real estate investment in Sweden, the Vänerparken portfolio, and an additional

letting to the City of Vänersborg of 4,135 sq m (44,510 sq ft) reduced the void

rate by rental value from 8.3% at 30 June to 1.1%. Refurbishment of this space

will take six months prior to the tenant's occupation.

FINANCIAL UPDATE

At 30 September 2009 borrowings were GBP576.6 million (30 June 2009: GBP562.1

million) and the weighted average cost of debt was 4.1%. Cash and undrawn

facilities stood at GBP103.0 million (30 June 2009: GBP111.2 million), and the

Group held corporate bonds with a value of GBP58.4 million (30 June 2009: GBP31.0

million).

At 30 September 2009 the Group had 55 bank loans from 18 banks; none of the

bank loan covenants was in breach.

Underlying profit continues to be resilient, with stable net rental income,

high debt collection rates, and tightly controlled costs.

Executive Chairman of CLS, Sten Mortstedt, commented:

"We have begun to see a degree of improvement in sentiment in the markets in

which we operate, but conditions remain challenging. Notwithstanding this, our

focus on active portfolio management has delivered a fall in vacancy rates

across the portfolio, and we anticipate a strong performance from our core

business for the full year. Further, with significant resources at its disposal

the Company is well placed to take advantage of investment opportunities as

they arise."

For further information, please contact:

Sten Mortstedt, Executive Chairman, CLS Holdings plc +44 (0)20 7582 7766

Henry Klotz, Chief Executive Officer, CLS Holdings plc +44 (0)20 7582 7766

John Whiteley, Chief Financial Officer, CLS Holdings plc +44 (0)20 7582 7766

Jonathan Gray, Kinmont Advisory Limited +44 (0)20 7087 9100

Adam Reynolds, Hansard Group +44 (0)20 7245 1100

END

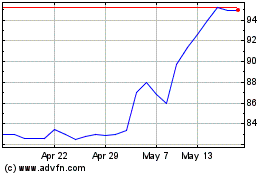

Cls (LSE:CLI)

Historical Stock Chart

From Jun 2024 to Jul 2024

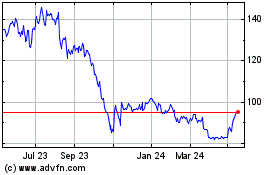

Cls (LSE:CLI)

Historical Stock Chart

From Jul 2023 to Jul 2024