TIDMMERI

RNS Number : 7673Q

Merian Chrysalis Investment Co. Ltd

23 October 2019

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, any member state of the European Economic Area

(other than the United Kingdom and the Republic of Ireland),

Canada, Australia, Japan or the Republic of South Africa.

Merian Chrysalis Investment Company Limited

23 October 2019

Merian Chrysalis Investment Company Limited (the "Company")

Portfolio Update

Following the successful Placing under the Company's Placing

Programme in September 2019 in which gross proceeds of GBP175

million were raised (the "Placing"), the Company is today

announcing a number of investments.

Investment in Starling Bank

The Company today announces a follow-on investment of GBP20

million as part of a GBP30 million funding round conducted by

Starling Bank Limited ("Starling").

Richard Watts, co-portfolio manager, comments:

"Starling is already proving to be a disruptive force in the

banking industry, with its efficient, user-friendly platform

gaining popularity among digitally savvy consumers and businesses.

The new capital secured in this funding round will allow its

management team to pursue its ambitious development programme and

we're delighted that we're able to provide additional backing for

this exciting business."

Acquisition of additional shares in existing portfolio

companies

As announced in September 2019 at the time of the Placing, the

Company intends to use approximately 50% of the Placing's proceeds

to scale up its exposure to a number of existing portfolio

holdings. This will be achieved via the acquisition of additional

interests in those investments from the open-ended UK small- and

mid-cap equity funds managed by the Company's Investment Adviser,

Merian Global Investors (UK) Limited (the "Transaction") and the

follow-on investment in Starling.

The Company can now confirm that it has successfully acquired a

further GBP36.3 million holding in TransferWise Limited

("TransferWise"). These shares were acquired at a modest discount

to the latest valuation, as anticipated when the proposed

Transaction was previously announced.

The Company can also confirm that it has signed an agreement to

acquire a further GBP20.7 million holding in The Hut Group Limited

("THG"). Completion of this transaction is subject to certain

consents being obtained by the Company. It is anticipated that

these shares will be acquired at a modest discount to the latest

valuation, as previously announced.

Further details relating to the Transaction will be announced in

due course. Due to the follow-on capital investment in Starling,

the Company does not intend to acquire additional interests in

Starling as part of the Transaction.

Update on portfolio composition

Following the completion of the Starling investment and the

acquisition of additional shares in TransferWise and THG, the

Company will be approximately 65.5% fully invested, with the

impacted holdings adjusted as follows:

Portfolio company Weighting Previously Weighting

as at 30/08/2019 announced as at 22/10/2019(2)

target weighting(1)

TransferWise 13% 14-16% 17%

Starling Bank 11% 12-14% 11%

The Hut Group 5% 8-10% 8%

The investment advisory team continues to work on a pipeline of

compelling investment opportunities.

Corporate update

Further to the announcement made on 20 June 2019, the Board can

today confirm that Nick Williamson, one of the Company's

co-managers, has returned from a period of leave. He has resumed

portfolio management responsibilities.

-ENDS-

(1) Target weighting in accordance with announcement issued on

10 September 2019.

(2) 22 October 2019 weightings are based on current portfolio

company valuations.

For further information, please

contact:

Merian Global Investors:

Will Gold / Amelie Shepherd +44 (0) 20 7332 7500

Liberum:

Gillian Martin / Owen Matthews +44 (0) 20 3100 2000

Maitland Administration (Guernsey)

Limited:

Aimee Gontier / Elaine Smeja +44 (0) 1481 749364

LEI: 213800F9SQ753JQHSW24

A copy of this announcement will be available on the Company's

website at https://www.merian.com/chrysalis/. Neither the content

of the Company's website, nor the content on any website accessible

from hyperlinks on its website for any other website, is

incorporated into, or forms part of, this announcement nor, unless

previously published by means of a recognised information service,

should any such content be relied upon in reaching a decision as to

whether or not to acquire, continue to hold, or dispose of,

securities in the Company.

This announcement may include "forward-looking statements". All

statements other than statements of historical facts included in

this announcement, including, without limitation, those regarding

the Company's financial position, business strategy, plans and

objectives of management for future operations (including

development plans and objectives relating to the Company's products

and services) are forward-looking statements.

Forward-looking statements are subject to risks and

uncertainties and accordingly the Company's actual future financial

results and operational performance may differ materially from the

results and performance expressed in, or implied by, the

statements. These factors include but are not limited to those

described in the formal Prospectus. These forward-looking

statements speak only as at the date of this announcement. The

Company expressly disclaims any obligation or undertaking to update

or revise any forward-looking statements contained herein to

reflect actual results or any change in the assumptions, conditions

or circumstances on which any such statements are based unless

required to do so by the Financial Services and Markets Act 2000,

the Listing Rules or Prospectus Rules of the Financial Conduct

Authority or other applicable laws, regulations or rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PFUBLBDGBGDBGCD

(END) Dow Jones Newswires

October 23, 2019 02:00 ET (06:00 GMT)

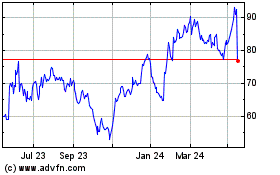

Chrysalis Investments (LSE:CHRY)

Historical Stock Chart

From Jul 2024 to Aug 2024

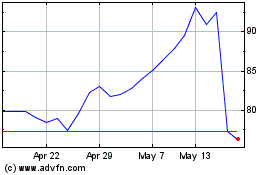

Chrysalis Investments (LSE:CHRY)

Historical Stock Chart

From Aug 2023 to Aug 2024