TIDMCGH

RNS Number : 1148E

Chaarat Gold Holdings Ltd

16 October 2018

Correction: The 'Closing of first phase fundraise of up to

US$100 million' announcement released on 13 September 2018 at

7.00am (UK time) under RNS No 6192A is amended and restated as

below. There was an error in the value of Existing Notes and

interest to be converted into equity or reinvested into new 2021

Notes. There are a number of consequential changes to the

announcement, as described in the amended text below, including a

reduction in the Company's issued share capital.

The full amended text is below.

16 October 2018

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

Not for release, publication or distribution to United States

newswire services or for release, publication or dissemination in

the United States and does not constitute an offer of the

securities herein.

This press release does not constitute an offer to sell, or a

solicitation of an offer to buy, securities in the United States or

any other jurisdiction. Any securities described in this press

release have not been, and will not be, registered under the US

Securities Act of 1933, as amended, and may not be offered or sold

in the United States absent registration except in transactions

exempt from, or not subject to, registration under the US

Securities Act and applicable US state securities laws. There is no

public offering of the securities in the United States expected.

Any public offering of securities to be made in the United States

will be made by means of a prospectus that may be obtained from

Chaarat and that will contain detailed information about Chaarat

and management, as well as financial statements.

Chaarat Gold Holdings Limited

("Chaarat" or the "Company")

Closing of first phase of fundraise of up to US$100 million

On 28 August 2018 (and as corrected by an announcement on 6

September 2018), Chaarat (AIM: CGH) announced that it had received

commitments for approximately US$17 million in the first phase of

up to US$100 million of a convertible debt placement (the

"Fundraise") with existing convertible investors, as well as select

new investors. Chaarat is pleased to announce that this first phase

of the Fundraise has now successfully closed as anticipated.

The second phase of the Fundraise, as also announced on 28

August 2018, is ongoing and is expected to close by the end of

September/early October 2018. Following positive feedback from

potential investors, Chaarat will amend the terms of the up to

US$100 million Convertible Notes (the "2021 Notes"). Under the

previous terms, interest would accrue at 10% per year for the first

18 months and then at 12% per year thereafter and be in

Payment-In-Kind ("PIK") form, where a single interest payment is

due on the final repayment date (31 October 2021) provided that no

conversion has occurred. This shall be replaced with a combined

interest rate made up of a cash coupon of 6% payable semi annually

and a 4% interest rate per year PIK which increases to 6% per year

for the last 18 months of the term of the 2021 Notes, again

provided that no conversion has occurred. The revised terms will

apply to the whole Fundraise pursuant to "most favoured nation"

provisions benefitting first phase investors in the Fundraise.

In addition, post closing of phase two of the Fundraise, Chaarat

will apply for a listing of the 2021 Notes, anticipated to be on

the Frankfurt Open Market (Freiverkehr). It is also now anticipated

that the 2021 Notes will be cleared and settled through Euroclear

and Clearstream, the international clearing and settlement

systems.

The previously announced acquisition is progressing towards the

signing of definitive documentation. The transaction remains

subject to final and confirmatory due diligence. However,

substantial due diligence work has already taken place and the

transaction is at an advanced stage, with the signature of

definitive documents expected by the end of September/early October

2018 and completion in early/mid-November 2018.

The First Phase Closing

The first phase of the Fundraise comprised the issue on 11

September 2018 of a total of US$17,580,000 of 2021 Notes with a

conversion price of GBP0.37 / share and a 10% interest rate per

year which increases to 12% per year for the last 18 months (prior

to the anticipated amendments referred to above).

Investors in the 2021 Notes consisted of both holders of

existing convertible notes maturing in 2018 and 2019 ("Existing

Notes") ("Existing Noteholders") and new investors.

-- Existing Noteholders invested a total of US$14,230,000 in the 2021 notes, comprising:

- Reinvestment of US$8,805,000 of their Existing Note redemption

proceeds into the 2021 Notes (of which US$1,055,000 represents the

interest accrued on the Existing Notes and the balance represents

principal on the Existing Notes); and

- Investment of a further US$5,425,000.

-- New investors subscribed for US$3,350,000 of the 2021 Notes

(which, together with the investment of a further US$5,425,000 by

Existing Noteholders mentioned above, represents a total additional

cash investment of US$8,775,000).

Existing Noteholders converted US$9,088,369.86 (rather than

US$9,486,602 as previously announced) (comprising principal of

US$8,150,000 (rather than US$8,400,000 as previously announced) and

interest of US$938,369.86 (rather than US$1,086,603 as previously

announced)) of their holdings into (after rounding) 22,991,251 new

ordinary shares (rather than 24,067,806 as previously announced) in

the Company ("Ordinary Shares") at conversion prices of:

-- 675,833 Ordinary Shares for each US$250,000 (and pro rata for

any amounts less than US$250,000) of Existing Notes (as to

14,917,982 Ordinary Shares (rather than 15,994,537 as previously

announced)); and

-- 565,355 Ordinary Shares for each US$250,000 (and pro rata for

any amounts less than US$250,000) of Existing Notes (as to

8,073,269 Ordinary Shares).

A total of US$4,323,671 was redeemed in cash to one Existing

Noteholder, pending the outcome of ongoing discussions as to this

investor's potential re-investment. Other Existing Noteholders have

been paid balancing interest payments totaling US$20,082.20 (rather

than US$16,849 as previously announced).

Following the closing of the first phase of the Fundraise, and

the conversion of US$9,088,309.86 (rather than US$9,486,602 as

previously announced) of Existing Notes into 22,991,251 Ordinary

Shares (rather than 24,067,806 as previously announced), the

Company's existing issued share capital has increased to

394,623,127 Ordinary Shares (rather than 395,699,682 as previously

announced) and the total number of voting rights, on the basis of

one vote per Ordinary Share, is therefore 394,623,127 (rather than

395,699,682 as previously announced). The Ordinary Shares were

issued on 11 September 2018 and application for these Ordinary

Shares to admission on AIM is expected to be made in due course

upon restoration of trading of the Company's Ordinary Shares on

AIM.

The Company intends to raise additional growth capital in a

second fundraising round and is targeting a further closing in late

September 2018.

Enquiries

Chaarat Gold Holdings Limited

Martin Andersson (Chairman) +44 (0)20 7499 2612

Artem Volynets (CEO) info@Chaarat.com

Numis Securities Limited

John Prior, Paul Gillam (NOMAD) +44 (0) 20 7260 1000

James Black (Corporate Broking)

BMO Capital Markets Limited

Jeffrey Couch, Thomas Rider (Joint

Broker) +44 (0) 20 7236 1010

Powerscourt

Conal Walsh +44 (0)20 7250 1446

Matthew Attwood Chaarat@powerscourt-group.com

Isabelle Saber

About Chaarat Gold

Chaarat Gold is an exploration and development company operating

in the Kyrgyz Republic with a large, high grade resource - the

Chaarat Gold Project. The Company's key objective is to become a

low-cost gold producer generating significant production from the

development of the Chaarat Gold Project. Chaarat is engaged in an

active community engagement programme to optimise the value of the

Chaarat investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high-quality gold and mineral deposits in the

Kyrgyz Republic by building relationships based on trust and

operating to the best environmental, social and employment

standards.

Further information is available at www.chaarat.com

China Nonferrous Metals International Mining Co Ltd

("CNMIM")

Chaarat is required to give notice to CNMIM if it intends to

issue any Ordinary Shares for cash or non-cash consideration. CNMIM

may, within 15 business days of receipt of such notice being issued

in connection with any conversion of Notes into Ordinary Shares,

give written notice to require Chaarat to issue such number of

Ordinary Shares to CNMIM, on the same terms as the issue of such

Ordinary Shares, as is necessary to maintain the percentage

shareholding of CNMIM in the Company prior to conversion. Once the

Existing Notes are converted, and if and when any 2021 Notes are

converted, the required notice in respect of the issue of Ordinary

Shares on conversion will be sent to CNMIM and a further

announcement made, if appropriate. CNMIM currently holds 22,469,289

Ordinary Shares representing 6.05% of the issued share capital of

Chaarat.

Subscription for 2021 Notes by Labro and a Director and concert

party arrangements

Labro Investments Limited ("Labro") has subscribed for

US$1,000,000 of 2021 Notes (by way of reinvesting US$375,000 of

Existing Notes being redeemed, including interest of US$50,000,

plus an additional US$575,000). As announced previously, Martin

Andersson is indirectly beneficially interested in the majority of

the shares in Labro. Following the Fundraise, including the

conversion of Existing Notes by other noteholders into Ordinary

Shares, Labro will continue to hold 131,878,037 Ordinary Shares

representing approximately 33.42% (rather than 33.33%, as

previously announced) of the Company's share capital and 21,367,521

warrants to subscribe for Ordinary Shares ("Labro Warrants") and,

in addition, US$1,000,000 of 2021 Notes (which are convertible into

2,111,484 Ordinary Shares in respect of principal on the 2021 Notes

and up to around 696,789 Ordinary Shares in respect of interest on

the 2021 Notes assuming interest is converted into Ordinary Shares

and that the 2021 Notes are converted at the final maturity date of

31 October 2021).

Martin Wiwen-Nilsson has subscribed for US$425,000 of 2021 Notes

(by way of reinvesting US$375,000 of Existing Notes being redeemed,

including interest of US$50,000). Following the Fundraise,

including the conversion of Existing Notes by other noteholders

into Ordinary Shares, he will continue to hold 9,998,237 Ordinary

Shares representing 2.53% of the Company's share capital and

200,000 options to subscribe for Ordinary Shares ("MWN Options")

and, in addition, US$425,000 of 2021 Notes (which are convertible

into 897,380 Ordinary Shares in respect of principal on the 2021

Notes and up to around 296,135 Ordinary Shares in respect of

interest on the 2021 Notes assuming interest is converted into

Ordinary Shares and that the 2021 Notes are converted at the final

maturity date of 31 October 2021).

Labro and Martin Wiwen-Nilsson are members of the Concert Party

(as referred to and defined in the Company's announcement on 27

October 2017) (the "Concert Party"). The Board (excluding Martin

Andersson and Martin Wiwen-Nilsson) has therefore agreed that their

participation in the issue of 2021 Notes will not trigger a

requirement to make a mandatory offer under the Articles (see

"Further information relating to the Issue" below). If all Labro

Warrants and MWN Options were exercised and all 2021 Notes issued

to Labro and Martin Wiwen-Nilsson were converted (but no other

warrants or options to subscribe for Ordinary Shares were

exercised, no other 2021 Notes were converted and no other Ordinary

Shares were issued), the Concert Party would hold 192,405,615

Ordinary Shares representing 45.79% (rather than 45.67%, as

previously announced) of the resulting enlarged share capital.

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Labro Investments Limited

------------------------- ----------------------------------------------------------------------

2. Reason for the notification

-------------------------------------------------------------------------------------------------

a) Position Person closely associated with the Chairman

/ status

------------------------- ----------------------------------------------------------------------

b) Initial Initial notification

notification

/ amendment

------------------------- ----------------------------------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------------------

a) Name Chaarat Gold Holdings Limited

------------------------- ----------------------------------------------------------------------

b) Legal entity 213800T2A5CV84VTFJ70

identifier

------------------------- ----------------------------------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------------------------------------

a) Description of 10% Secured Convertible Loan Notes 2021

the financial 10% Secured Convertible Loan Notes 2018

instrument, type

of instrument

Identification VGG203461055 (this relates to the Ordinary

code shares of US$0.01 each in the Company into

which the 10% Secured Convertible Loan

Notes 2021 and the 10% Secured Convertible

Loan Notes 2018 may become convertible)

-------------------------- ---------------------------------------------------------------------

b) Nature of the Purchase of 10% Secured Convertible Loan

transaction Notes 2021

Redemption of 10% Secured Convertible Loan

Notes 2018

-------------------------- ---------------------------------------------------------------------

c) Currency USD

-------------------------- ---------------------------------------------------------------------

d) Price(s) and Price(s) Volume(s)

volume(s)

-------------------------- ------------------------------------ ------------- -------------

Purchase of 10% Secured

Convertible Loan

Notes 2021 US$1.00 1,000,000

------------------------------------ ------------------------------------------------------ -------------

Redemption of 10%

Secured Convertible

Loan Notes 2018 US$1.00 375,000

------------------------------------ ------------------------------------------------------ -------------

e) Aggregated information Aggregated Aggregated Aggregated

volume price total

Purchase of 1,000,000 US$1.00 US$1,000,000

10% Secured

Convertible

Loan Notes

2021

----------- ----------- -------------

Redemption 375,000 US$1.00 US$375,000*

of 10% Secured

Convertible

Loan Notes

2018

----------- ----------- -------------

* US$426,678.08, including accrued interest.

-------------------------- ---------------------------------------------------------------------

f) Date of the transaction 11 September 2018

-------------------------- ---------------------------------------------------------------------

g) Place of the Off market

transaction

-------------------------- ---------------------------------------------------------------------

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Martin Wiwen-Nilsson

------------------------- -----------------------------------------------------------

2. Reason for the notification

--------------------------------------------------------------------------------------

a) Position / status Director

------------------------- -----------------------------------------------------------

b) Initial notification Initial notification

/ amendment

------------------------- -----------------------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------------------

a) Name Chaarat Gold Holdings Limited

------------------------- -----------------------------------------------------------

b) Legal entity identifier 213800T2A5CV84VTFJ70

------------------------- -----------------------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

a) Description of 10% Secured Convertible Loan Notes 2021

the financial 10% Secured Convertible Loan Notes 2018

instrument, type

of instrument

Identification VGG203461055 (this relates to the Ordinary

code shares of US$0.01 each in the Company

into which the 10% Secured Convertible

Loan Notes 2021 and the 10% Secured Convertible

Loan Notes 2018 may become convertible)

------------------------- -----------------------------------------------------------

b) Nature of the Purchase of 10% Secured Convertible Loan

transaction Notes 2021

Redemption of 10% Secured Convertible

Loan Notes 2018

------------------------- -----------------------------------------------------------

c) Currency US$

------------------------- -----------------------------------------------------------

d) Price(s) and volume(s) Price(s) Volume(s)

Purchase of 10% Secured

Convertible Loan Notes

2021 US$1.00 425,000

---------- ----------

Redemption of 10%

Secured Convertible

Loan Notes 2018 US$1.00 375,000

---------- ----------

------------------------- -----------------------------------------------------------

e) Aggregated information Aggregated Aggregated Aggregated

* Aggregated volume volume price total

Purchase 425,000 US$1.00 US$425,000

of 10% Secured

* Aggregated price Convertible

Loan Notes

2021

* Aggregated total ----------- ----------- ------------

Redemption 375,000 US$1.00 US$375,000*

of 10% Secured

Convertible

Loan Notes

2018

----------- ----------- ------------

* US$426,678.08, including accrued interest.

------------------------- -----------------------------------------------------------

f) Date of the transaction 11 September 2018

------------------------- -----------------------------------------------------------

g) Place of the transaction Off market

------------------------- -----------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCDELFFVBFEFBK

(END) Dow Jones Newswires

October 16, 2018 02:00 ET (06:00 GMT)

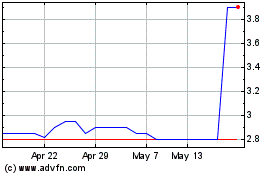

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jul 2023 to Jul 2024