TIDMCGH

RNS Number : 2976A

Chaarat Gold Holdings Ltd

28 September 2015

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

INTERIM STATEMENT FOR THE SIX MONTHS ENDED 30 JUNE 2015

Road Town, Tortola, British Virgin Islands (28 September

2015)

Chaarat (AIM - CGH), the AIM quoted exploration and development

company with assets in the Kyrgyz Republic, today publishes its

unaudited results for the period ended 30 June 2015. Chaarat is

preparing a Definitive Feasibility Study (DFS) and continuing its

active community engagement programme to optimise the value of the

Chaarat investment proposition.

HIGHLIGHTS

-- Solid progress to production as the DFS edges towards completion

-- Public hearings process successfully completed - local

communities support the Chaarat Project

-- Sterilisation work completed at site

-- Recruitment of production focussed Chaarat team underway

Dekel Golan, Chief Executive Officer of Chaarat, commented:

"The challenges of bringing the Chaarat Project to production

cannot be ignored but I am excited as I see our plans start to

coalesce. I recently had the pleasure of showing the Chaarat site

to our new analyst at Numis. As he reported on his return to the

UK, "the puzzle is coming together ... the project has significant

flexibility and options to ease the development and funding

pathway". With the continued interest of potential joint venture

partners and outright purchasers, pending the delivery of the DFS,

these are indeed exciting times for one of the largest and best

undeveloped deposits in the world."

Enquiries:

Chaarat Gold Holdings

Limited + 44 20 7499 2612

c/o Central Asia Services info@chaarat.com

Limited

Dekel Golan CEO

Linda Naylor FD

Numis Securities Limited +44 (0) 20 7260 1000

John Prior, Paul Gillam

(NOMAD)

James Black (Broker)

Further information is available at www.chaarat.com

Chief Executive Officer's Report

During the first six months of 2015 we continued to build on the

foundations established in 2014 and devoted our efforts principally

to the work on the Definitive Feasibility Study (DFS).

We provided an update last month on the progress of the DFS.

Following a series of review meetings in China we are working with

NERIN and our team of advisers to implement a number of changes

which should have a significant impact on the economics of the

study. Progress continues to be slow and frustrating and the

process of ensuring compliance with Chinese regulatory standards,

required before the DFS can be signed off, is now suspended until

mid-October, after the end of a period of national holidays in

China. Despite these hurdles, the Board remains convinced that the

effort made now will be rewarded. A robust study will assign a

supportable "value" to the Chaarat Project which, together with our

development plans outlined below, will provide a benchmark value

for negotiations with Chinese investors and prospective buyers.

We have had a number of approaches from Chinese companies

interested in either joint venture arrangements or an outright

purchase of the Project. The DFS, already aligned to Chinese

cultural and economic standards, will be more acceptable to

scrutiny by Chinese entities and provide an indispensable input for

their decision making.

Progress to production

We reaped the reward in early July of our active community

engagement programme and the formation of the Community

Consultation Group. The conclusions from a site visit to the Copler

mine in Turkey by 16 community leaders were fed back to their local

communities and (after allaying numerous concerns, answering

questions and providing clarification) representatives from each of

the local villages in the vicinity of the Chaarat Project voted in

favour of its development at a public hearing. This successful

outcome is an essential milestone in achieving full permitting of

the Project.

In tandem with the work on the DFS for the whole Chaarat Project

we are continuing preparations for production and the detailed

planning for the Stage 1 Tulkubash Project. We have decided to

start development of the Chaarat Project by mining the near surface

free milling low sulphur (non-refractory) ore found in the

Tulkubash Zone first, which can be processed in a heap leach

operation which is less capital intensive and has lower operating

costs.

Detailed design work is underway on the heap leach, the mine and

waste dump. The footprint of the Project is being minimised to cut

capital costs of construction. The access road and internal site

roads are being designed and logistics for the site are being

planned to maximise efficiency. The tender process for the contract

to build the plant and associated structures is underway with site

visits arranged before the winter closes the site. We are working

with the communities and the authorities to finalise the land

allocation for the Project and a local Kyrgyz institute is

preparing the necessary environmental reports for submission to

obtain permits. Sterilisation work, to ensure there are no gold

deposits where we plan to build Project infrastructure, has been

completed.

Prior to seeking finance for the Tulkubash Project, we are

planning to recruit an Operations Director to manage the process to

production and beyond. Interviews and visits to site are underway

in what has been a busy September.

Finance matters

As outlined above, we have since the end of 2014 pushed ahead

with the development of the Project with the objective of achieving

production in 2017, subject to financing. Since we decided to

embark on the preparation of a DFS in 2013, conditions for funding

a mining project have remained challenging. We therefore have to

demonstrate that the Chaarat Project merits a share of the limited

funds available, hence our decision to carry on with the

preparatory work, despite incurring additional costs. In mitigation

we have raised more than USD 2 million to date from the sale of

fixed assets and equipment and the site has been sterilised at no

cost to Chaarat. We continue our efforts to reduce discretionary

expenditure and as a result our closing cash balance at 30 June was

USD 5.2 million. As we begin our efforts to seek funding for the

Tulkubash Project we are encouraged by the relationships that the

Kyrgyz Republic enjoys with Turkey, China and Russia which

increases Chaarat's options for engineering and contractors as well

as financing.

In summary we are developing a solid plan to bring the Chaarat

Project to production; the challenges are being addressed. We are

confident that with the continued hard work of our staff and

patient support of our shareholders the remaining hurdles will be

overcome.

Dekel Golan

Chief Executive Officer

About Chaarat Gold

Chaarat Gold is an exploration and development company operating

in the Kyrgyz Republic with a large, high grade resource - the

Chaarat Gold Project. The Company's key objective is to become a

low cost gold producer generating significant production from the

development of the Chaarat Gold Project. Chaarat is preparing a

Definitive Feasibility Study (DFS) and continuing its active

community engagement programme to optimise the value of the Chaarat

investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high quality gold and mineral deposits in the

Kyrgyz Republic by building relationships based on trust and

operating to the best environmental, social and employment

standard.

Consolidated income

statement

For the six months

ended 30 June

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2015 2014 2014

(unaudited) (unaudited) (audited)

USD USD USD

Exploration expenses (787,523) (1,484,299) (4,251,623)

Impairment of assets - - (6,023,622)

Administrative expenses (1,379,582) (1,753,273) (3,868,516)

- Share options expense (45,436) (120,990) (256,613)

- Foreign exchange

gain/(loss) (24,798) 16,826 (45,242)

------------------------------------- ------------ ------------ --------------

Total administrative

expenses (1,449,816) (1,857,437) (4,170,371)

Other operating income/(expense) 65,449 44,052 (81,257)

------------------------------------- ------------ ------------ --------------

Operating loss (2,171,890) (3,297,684) (14,526,873)

Finance income 26,529 31,612 476,536

Taxation - - 486,875

--------------------------------- ------------ --------------

Loss for the period,

attributable to equity

shareholders of the

parent (2,145,361) (3,266,072) (13,563,462)

------------------------------------- ------------ ------------ --------------

Loss per share (basic

and diluted) - USD

cents (0.79) (1.30) (4.97)

------------------------------------- ------------ ------------ --------------

Consolidated statement

of comprehensive income

For the six months

ended 30 June

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2015 2014 2014

(MORE TO FOLLOW) Dow Jones Newswires

September 28, 2015 02:00 ET (06:00 GMT)

(unaudited) (unaudited) (audited)

USD USD USD

Loss for the period,

attributable to equity

shareholders of the

parent (2,145,361) (3,266,072) (13,563,462)

Other comprehensive

income:

Items which may subsequently

be reclassified to

profit and loss

Exchange differences

on translating foreign

operations and investments (1,311,157) (2,752,373) (8,302,919)

Other comprehensive

income for the period,

net of tax (1,311,157) (2,752,373) (8,302,919)

Total comprehensive

loss for the period

attributable to equity

shareholders of the

parent (3,456,518) (6,018,445) (21,866,381)

---------------------------------- ------------ ------------ ---------------

Consolidated balance

sheet

At 30 June

30 June 30 June 31 December

2015 2014 2014

(unaudited) (unaudited) (audited)

USD USD USD

Assets

Non-current assets

Intangible assets 41,399 73,019 50,197

Mining exploration

assets - 6,803,149 -

Mine properties 22,268,925 23,151,084 22,653,950

Property, plant and

equipment 3,129,417 6,450,722 3,622,423

Assets in construction 11,964,950 13,782,021 12,339,224

37,404,691 50,259,995 38,665,794

----------------------------------- ------------------ ------------------ ------------------

Current assets

Inventories 763,523 1,251,030 847,818

Trade and other receivables 728,884 1,085,444 726,386

Cash and cash equivalents 5,156,510 7,122,223 7,608,865

6,648,917 9,458,697 9,183,069

Total assets 44,053,608 59,718,692 47,848,863

------------------------------------ ------------------ ------------------ ------------------

Equity and liabilities

Equity attributable

to shareholders

Share capital 2,729,353 2,504,778 2,729,353

Share premium 132,108,746 128,551,662 132,108,746

Share warrant reserve 1,358,351 - 1,358,351

Other reserves 15,038,993 15,127,145 15,205,510

Translation reserve (12,131,884) (5,270,181) (10,820,727)

Accumulated losses (96,078,216) (83,904,676) (94,144,808)

------------------------------------ ------------------ ------------------ ------------------

43,025,343 57,008,728 46,436,425

----------------------------------- ------------------ ------------------ ------------------

Non- current liabilities

-------------------------------- ------------------ ------------------ ------------------

Deferred tax - 487,000 -

-------------------------------- ------------------ ------------------ ------------------

Current liabilities

Trade payables 386,181 1,442,676 561,916

Accrued liabilities 642,084 780,288 850,522

------------------------------------ ------------------ ------------------ ------------------

1,028,265 2,222,964 1,412,438

----------------------------------- ------------------ ------------------ ------------------

Total liabilities 1,028,265 2,709,964 1,412,438

------------------------------------ ------------------ ------------------ ------------------

Total liabilities

and equity 44,053,608 59,718,692 47,848,863

------------------------------------ ------------------ ------------------ ------------------

Consolidated statement of changes in equity

For the six months ended 30 June

Share Share Share Accumulated Other Translation

capital premium warrant losses reserves reserve Total

USD USD reserve USD USD USD USD

USD

Balance at

31 December

2013 2,504,778 128,551,662 - (80,646,255) 15,013,806 (2,517,808) 62,906,183

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Currency

translation - - - - - (2,752,373) (2,752,373)

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Other

comprehensive

income - - - - - (2,752,373) (2,752,373)

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Loss for the

six months

ended

30 June 2014 - - - (3,266,072) - - (3,266,072)

Total

comprehensive

income for

the six

months

ended

30 June 2014 - - - (3,266,072) - (2,752,373) (6,018,445)

Share options

lapsed - - - 7,651 (7,651) - -

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Share options

expense - - - - 120,990 - 120,990

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Balance at

30 June 2014 2,504,778 128,551,662 - (83,904,676) 15,127,145 (5,270,181) 57,008,728

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Currency

translation - - - - - (5,550,546) (5,550,546)

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Other

(MORE TO FOLLOW) Dow Jones Newswires

September 28, 2015 02:00 ET (06:00 GMT)

comprehensive

income - - - - - (5,550,546) (5,550,546)

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Loss for the

six months

ended

31 December

2014 - - - (10,297,390) - - (10,297,390)

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Total

comprehensive

income for

the six

months

ended

31 December

2014 - - - (10,297,390) - - (10,297,390)

Share options

lapsed - - - 57,258 (57,258) - -

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Share options

expense - - - - 135,623 - 135,623

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Warrant

expense - - 1,358,351 - - - 1,358,351

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Issuance of

shares for

cash 224,575 3,672,495 - - - - 3,897,070

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Share issue

cost - (115,411) - - - - (115,411)

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Balance at

31 December

2014 2,729,353 132,108,746 1,358,351 (94,144,808) 15,205,510 (10,820,727) 46,436,425

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Currency

translation - - - - - (1,311,157) (1,311,157)

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Other

comprehensive

income - - - - - (1,311,157) (1,311,157)

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Loss for the

six months

ended

30 June 2015 - - - (2,145,361) - - (2,145,361)

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Total

comprehensive

income for

the six

months

ended

30 June 2015 - - - (2,145,361) - (1,311,157) (3,456,518)

Share options

lapsed - - - 211,953 (211,953) - -

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Share options

expense - - - - 45,436 - 45,436

Balance at

30 June 2015 2,729,353 132,108,746 1,358,351 (96,078,216) 15,038,993 (12,131,884) 43,025,343

-------------- --------- ----------- ---------- ------------ ---------- ------------ ------------

Consolidated cash

flow statement

For the 6 months ended

30 June

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2015 2014 2014

(unaudited) (unaudited) (audited)

USD USD USD

Operating activities

Loss for the period (2,145,361) (3,266,072) (13,563,462)

Adjustments:

Amortisation expense

- intangible assets 6,953 23,346 45,230

Depreciation expense

- property, plant

and equipment 293,314 445,658 1,622,409

(Profit)/loss on disposal

of property, plant

and equipment 45,227 (520,398) 500,319

Impairment of assets - - 6,023,622

Finance income (26,529) (31,612) (475,536)

Share based payments 45,436 120,990 256,613

Foreign exchange (gains)/losses (24,798) (16,826) 45,242

Decrease in inventories 84,295 502,772 905,984

(Increase)/Decrease

in accounts receivable (2,498) (227,540) 131,517

Increase/(Decrease)in

(MORE TO FOLLOW) Dow Jones Newswires

September 28, 2015 02:00 ET (06:00 GMT)

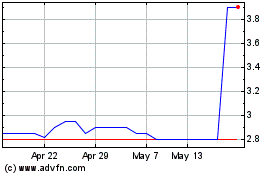

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jul 2023 to Jul 2024