TIDMCGH

RNS Number : 1811P

Chaarat Gold Holdings Ltd

30 September 2013

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2013

Road Town, Tortola, British Virgin Islands (30 September

2013)

HIGHLIGHTS

-- Preparation of the Definitive Feasibility Study (DFS) for the Chaarat Project in progress

-- Data collection for the DFS well advanced

-- Infill drilling supports increase in open pit potential and

reduction of upfront project cost

-- Negotiations with parties interested in the Chaarat Project continue

-- Community Consultation Group established

Dekel Golan, Chief Executive Officer of Chaarat, commented:

"I am pleased to report that our strategy to optimise the return

from the Chaarat Project is proceeding to plan. Good progress has

been made in appointing consultants for the Definitive Feasibility

Study and collecting the data they need. We continue to explore all

options at a corporate level with encouraging results. We are fully

funded to complete the DFS and continue our active community

engagement programme to optimise the value of the Chaarat

investment proposition.

Over the coming months we will report on progress and as ever we

are grateful for the continued support of our loyal

shareholders."

Enquiries:

Chaarat Gold Holdings +44 23 800 11747 / +44 20 7499 2612

c/o Central Asia Services Limited info@chaarat.com

Dekel Golan CEO

Linda Naylor FD

Numis Securities Limited +44 (0) 20 7260 1000

John Prior, Stuart Skinner (NOMAD)

James Black (Broker)

Further information is available at www.chaarat.com

Strategic focus

During 2012 all efforts were focused on establishing a small

scale production base for the Tulkubash area within the Chaarat

Project. However, after a thorough review of conditions in the

financial markets, the Board decided not to commit any further

funds to this strategy for the following reasons:

1. The increased volatility of the gold price made it more

difficult to forecast the expected revenue from small scale gold

production. In addition, the cost of borrowing the required $20

million working capital had increased so the Company was unlikely

to generate significant surplus cash flow from such production.

2. It has become clear that a low share price and the absence of

an up-to-date DFS are obstacles in negotiations with potential

strategic investors. A DFS prepared by reputable third parties will

underpin the project layout, its expected production capacity, its

cost and as a consequence its value. Clearly the choice was either

moving to production or preparing a DFS.

3. As reported in May 2013, the Board of Chaarat decided that

the completion of a DFS will substantiate the value and potential

of the Chaarat deposit. It will provide the Board with a stronger

negotiating position with potential strategic investors, who have

already approached Chaarat, as well as increasing the options

available for adding value for shareholders.

Corporate activities

There are two basic options for us to ensure that the value of

the Chaarat Project is optimised. These are either to introduce a

partner (operating or passive) to the Project company and develop

the project as a joint venture, or to sell the Project

altogether.

The Board considers that the sale of the Project may take away

any future "upside" from shareholders and the preference of the

Board is therefore to introduce a significant partner or partners

to the Project company. We are pursuing several avenues to achieve

this outcome.

Negotiations with Shandong Gold

During March we announced that the discussions with Shandong

Gold Mineral Resources Group (SGMR) had been delayed due to a

change in the senior personnel at the holding company level of the

SGMR group. In May we reported that the new management team had

scheduled a site visit for later in the summer. We are pleased to

report that following the site visit the new management team has

reiterated SGMR's interest in the Chaarat Project. A Hong Kong

based investment bank has been appointed by SGMR to oversee the

process of engaging with Chaarat.

Progress on Definitive Feasibility Study

The work on the DFS will be divided into two stages:

1. Between now and the end of 2013, the following activities will be completed:

a. Data collection

i. Exploration and infill drilling of about 11,000 metres including the related road

development

ii. Hydrological and geotechnical drilling of about 4,500

metres

iii. Preparing a number of trade off studies to determine the

best solutions for

different engineering aspects of the Project

b. Scoping the Project - defining the size, set-up and other

general characteristics of the Project (process, capacity, location

of main facilities on site) so as to ensure the scope of work of

the DFS study is clearly defined

c. Selection of Lead Consultant to head the project as well as

the consultants to execute specific sections such as environmental

and social, metallurgy, engineering, resource and reserve

calculation, tailings and waste management etc.

2. The engineering and design work of all the consultants will

be compiled into a single report by the Lead Consultant. The DFS

should then be completed by late 2014.

Mac DeGuire is responsible for coordinating and managing the

DFS. His experience includes the San Cristobal project in Bolivia

which is an $800 million 40,000 tpd open pit silver, zinc lead

deposit and in the top 6 world-wide producers of each metal. He

managed the project development and initial operations of Newmont's

$225 million gold heap leach project in Uzbekistan and the

feasibility study for the Yanacocha gold heap leach project in

Peru.

Exploration

As previously reported, we focused on infill drilling to

increase the open pit potential of the deposit during the period.

We have achieved better results than anticipated as announced on 23

September.

Further drilling as outlined above will be undertaken up to the

end of the season while underground drilling will continue during

the winter. An updated JORC resource will be available in early

2014.

Power

The design of the power line from site to the grid has been

completed. The Company has renewed and extended its agreement with

the national electricity company to allocate and reserve a quota of

25 MW from the Kristal sub-station. This allocation removes the

need to build another substation and will support production of

200,000 ounces of gold per annum.

The Kyrgyz Republic is well endowed with hydropower capacity and

potential and is a net power exporter. The low cost and ready

availability of power in the Kyrgyz Republic is a competitive

advantage to all those involved in the country's mining

industry.

Community relations

During the year the Company continued to engage with the

residents of the Chatkal valley, the adjacent valley to the

deposit. A Community Consultation Group has been established which

includes representatives of all local stakeholders. This group will

be the community representative body to discuss the Project with

Chaarat and the conduit to air the concerns and wishes of the local

population. Chaarat is committed to work according to the IFC and

Equator principles and to ensure its activities in the region are

undertaken in consultation with the local stakeholders.

Chaarat has developed a proactive sensitivity to the concerns

and interests of the local communities and the preparation of the

Definitive Feasibility Study will build on this engagement. We

believe that the long history of cooperation and mutual respect

will result in a fruitful consultation process.

Finance

During the period since the announcement of the change in

strategic focus a review of our staff headcount has been undertaken

and we have reduced our operating team. All costs continue to be

closely scrutinised and overheads cut. During the six month period

we made large payments to the government. We paid $5.77 million to

obtain a mining licence over the whole Chaarat deposit area and we

wrote off $3.3 million of irrecoverable VAT in the six month

period.

We are fully funded to complete the DFS, to continue our active

community engagement programme and cover our reduced overheads

until mid 2015.

Dekel Golan

Chief Executive Officer

About Chaarat Gold

Chaarat Gold is an exploration and development company operating

in the Kyrgyz Republic with a large, high grade resource which is

capable of generating low cost gold production - the Chaarat Gold

Project. Situated in the highly prospective Tien Shan gold belt, a

JORC compliant resource of 5.76Moz at a grade of 4.03g/t has so far

been delineated and recent infill drilling shows the potential to

increase the resource base. The Company's key objective is to

become a low cost gold producer targeting annual production of

200,000 ounces from the development of the Chaarat Gold

Project.

The Pre-feasibility Study published in 2011 indicated that the

Chaarat deposit is capable of supporting gold production of

approximately 200,000 ounces of gold per year, at a cash cost of

production below $600 per ounce. The study also identified areas

which could be improved with further work.

We are fully funded to complete a Definitive Feasibility Study

(DFS) and continue our active community engagement programme to

optimise the value of the Chaarat investment proposition.

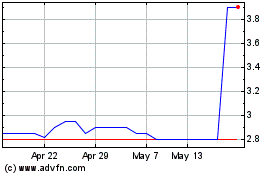

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jul 2023 to Jul 2024