Doc re. Operations update

May 17 2010 - 2:00AM

UK Regulatory

TIDMCGH

Chaarat Gold Holdings Ltd

("Chaarat" or "the Company")

Operations update

Road Town, Tortola, British Virgin Islands (17 May 2010).

Chaarat (AIM: CGH), the gold exploration and development company operating in

the Kyrgyz Republic, is pleased to announce an update on recent developments in

the Pre Feasibility Study (PFS) at its 100% owned Chaarat project, on which a

4.009 million ounce JORC compliant gold resource has been reported.

Highlights

* The PFS findings indicate the potential of implementing an initial high

grade, low-cost, open pit mine within the T0700 project area

* The PFS is on track for completion in Q3 2010

T0700 Project Area

Strong progress has been made in determining the development strategy and

economic parameters of the Chaarat project.

A significant development, which is being explored in more detail, is the

potential of implementing an initial, high grade, low-cost open pit mine within

the T0700 project area in the Tulkubash zone. This area currently has a JORC

compliant resource of 336,000 oz at a grade of 4.18 g/t Au. The development of

such a mine would require a comparatively small capital investment and provide a

much shorter time frame to production than originally envisaged.

Recent work has shown that a significant proportion of the mineralisation in the

T0700 project area is not sulphidic and that consequently gold can be extracted

by direct and simple cyanidation. This option would not require the costly

pressure oxidation unit which is part of the larger scale project. It has also

been confirmed that almost all of the resource in the T0700 project can be mined

by an open pit method. Open pit is a significantly cheaper mining method than

underground mining and could allow a rapid increase in the mining rate.

The benefits of developing an early stage open pit operation within the T0700

project area will need to be considered against its inclusion within the

construction of the full scale plant which will take place later and require

much larger investment. The economic analysis of the relative merits of the two

options will be dependent on the fund raising options available to the Company.

Chaarat is in the process of assessing the best development strategy for its

shareholders.

The Company believes that the Tulkubash zone, which has not been extensively

drilled to date, is very prospective and significant exploration attention will

be directed towards it. The Company is pleased to report that drilling will

recommence this week in the Tulkubash zone and preliminary studies indicate the

potential for the resource to be increased considerably.

Update on PFS

During the last few months, Chaarat has been coordinating a team of consultants

and consulting companies to generate the information and analysis for a PFS.

SRK (Johannesburg) has been selected to manage the PFS as well as to prepare

the mine design and mine-scheduling work. SNC Lavalin, a world leader in

process engineering and pressure oxidation plant designs, has been commissioned

to undertake the process plant engineering and design. RDI, a leading Denver

based metallurgical laboratory, has developed the process package and

Eco-Services, a Kyrgyz company, is preparing the tail dam design and the general

arrangement of the site in order to ensure compliance with both Kyrgyz and

"western" standards and legal requirements.

Mining

Following a thorough geo-technical study, a pit design and pit optimisation plan

have been completed for the open pit areas within the project. A mining method

has been selected for the underground operation and scheduling of the mining

activities is being undertaken to determine mining rate. The work is attempting

to balance production from open pit and underground activities in order to

optimise the capital investment and the utilisation of equipment.

Once the mine design has been completed, the ventilation and other facilities

will be designed and included in the operational and economic models.

Process

The optimal process, developed by RDI, has been selected. The process will

involve flotation of the ore and pressure oxidation of the float concentrate,

instead of the previously considered option of whole ore pressure oxidation.

Following oxidation, the concentrate, together with the tailings from the

flotation circuit, will be sent to a CIL circuit for gold extraction. The

process will provide a significant reduction in both capital and operating

costs, as well as technical complexity, whilst still subjecting the whole ore to

CIL high gold recovery. Bench scale trials are in process in order to further

optimise the gold recovery parameters. The Company believes that recovery of

around 88%-90% of contained gold is feasible.

An added benefit of this process is a much reduced environmental impact due to

the fact that most, if not all, the arsenic is expected to be locked in

non-soluble, non-hazardous compounds following the high pressure oxidation

process.

Road and Transport

A number of trade-off studies have shown that the optimal way to site is a route

of 190 km from the nearest rail head. The majority of the route is on public

roads and only the last 40 km are on a private road. Another option being

investigated is to avoid a mountain pass by taking a detour of 80 km. The

decision is not purely economic as the needs of the local population and the

impact traffic will have on their lives must be considered. It does seem

however, at this stage, that the shorter road is also the one which has the

least negative impact on society and the environment.

Additional resource and exploration

With the progress on the mine planning and the mining scheduling, it has become

clear where further drilling will have the most significant impact, not only on

the resource, but also on the quantity of reserves to be determined at the end

of the PFS. The Company plans to target those areas in the current season.

Dekel Golan, CEO of Chaarat, comments: "I am delighted to report such pleasing

progress on the project and look forward to updating the market as we proceed to

completion of the PFS later this year."

Enquiries:

Chaarat Gold Holdings Ltd

c/o Central Asia Services Ltd +44 (0) 20 7499 2612

Dekel Golan dekel@chaarat.com <mailto:dekel@chaarat.com>

Linda Naylor linda.naylor@chaarat.com

<mailto:linda.naylor@chaarat.com>

Westhouse Securities Limited +44 (0) 20 7601 6100

Tim Feather tim.feather@westhousesecurities.com

<mailto:tim.feather@westhousesecurities.com>

Richard Baty richard.baty@westhousesecurities.com

<mailto:richard.baty@westhousesecurities.com>

Mirabaud Securities LLP +44 (0) 20 7321 2508

Rory Scott rory.scott@mirabaud.com

<mailto:rory.scott@mirabaud.com>

Smith's Corporate Advisory +44 (0) 20 7239 0140

Dominic Palmer-Tomkinson tomkinson@smiths-ca.com

<mailto:tomkinson@smiths-ca.com>

Conduit PR +44 (0) 20 7429 6603

Jos Simson jos@conduitpr.com <mailto:jos@conduitpr.com>

Emily Fenton emily@conduitpr.com

Chaarat

Chaarat is an exploration and development company operating in the Kyrgyz

Republic with its current main activity being the development of the Chaarat

Gold Project. The Chaarat Gold Project is situated within the Middle Tien Shan

Mountains of Kyrgyzstan which form part of the Tien Shan gold belt. The Company

has thus far delineated a JORC compliant mineral resource of 4.009 Moz at a

grade of 4.14 g/t gold. A scoping study demonstrating the economic viability of

the Chaarat Gold Project was completed at the end of 2008. The Company is

currently in the process of compiling a pre-feasibility study. Chaarat's

objective is to become a low cost gold producer targeting an initial production

of over 200,000 ounces per annum by early 2013.

Disclaimer

This press release includes forward-looking statements. Such forward-looking

statements involve known and unknown risks, uncertainties and other important

factors beyond Chaarat's control that would cause the actual results,

performance or achievements of Chaarat to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are based on

numerous assumptions regarding Chaarat's present and future business strategies

and the environment in which Chaarat will operate in the future. Any

forward-looking statements speak only as at the date of this document. Chaarat

expressly disclaims any obligation or undertaking to disseminate any updates or

revisions to any forward-looking statements contained in this document to

reflect any change in Chaarat's expectations with regard to these or any change

in events, conditions or circumstances on which any such statements are based.

As a result of these factors, the events described in the forward-looking

statements in this press release may not occur either partially or at all.

[HUG#1415999]

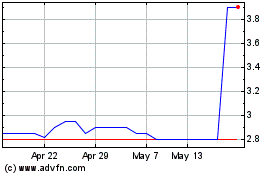

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jul 2023 to Jul 2024