TIDMBMK

RNS Number : 2677A

Benchmark Holdings PLC

23 May 2023

Information within this announcement is deemed by the Company to

constitute inside information under the Market Abuse Regulations

(EU) No. 596/2014 and Article 7 of the UK version of EU Regulation

596/2014 which forms part of UK law by virtue of the European Union

(Withdrawal) Act 2018.

23 May 2023

Benchmark Holdings plc

("Benchmark", the "Company" or the "Group")

Second Quarter and Interim results for the six months ended 31

March 2023

Strong Q2 and H1 results continuing track record of quarterly

growth and strategic delivery

Benchmark (LSE: BMK), the aquaculture biotechnology company,

announces its unaudited interim results for the six months ended 31

March 2023 (the "Period" or "H1 FY23"). The Company also announces

its unaudited results for the three months ended 31 March 2023 ("Q2

FY23") in compliance with the terms of its unsecured Green

bond.

Financial highlights

-- Excellent H1 FY23 results driven by good performance in all business areas:

o 25% growth in revenues to GBP98.9m (H1 FY22: GBP79.2m)

o 39% increase in Adj. EBITDA to GBP22.1m (H1 FY22:

GBP15.9m)

o 47% increase in Adj. EBITDA excluding fair value ("FV")

movement in biological assets to GBP21.8m (H1 FY22: GBP14.8m):

-- Adj. EBITDA margin excluding FV movement in biological assets

increased to 22% (H1 FY22: 19%)

o 193% increase in Adj. Operating profit excluding FV movement

in biological assets to GBP11.4m (H1 FY22: GBP3.9m)

o Further reduction in loss before tax

o Operating cash inflow GBP9.5m (H1 FY22: cash inflow of

GBP2.0m)

-- Strong Q2 FY23 performance building on track record of continuous quarterly improvement:

o Revenues +13% to GBP44.4m (Q2 FY22: GBP39.2m)

o Adj. EBITDA +32% to GBP11.1m (Q2 FY22: GBP8.4m); Adj. EBITDA

margin of 25% in line with medium term target set in May 2022

o Adj. EBITDA excluding FV movement in biological assets +32% to

GBP9.7m (Q2 FY22: GBP7.3m); Adj. EBITDA margin excluding FV

movement in biological assets of 22% (Q2 2022: 19%)

o Adj. Operating profit excluding fair value movement in

biological assets +244% to GBP4.5m (Q2 FY22: GBP1.3m)

-- Net debt (excluding lease liabilities) continues to reduce to

GBP44.5m (30 September 2022: GBP47.5m; 31 March 2022:

GBP50.6m):

o Cash of GBP41.9m and liquidity (cash and available facility)

of GBP53.9m at 22 May 2023

Business Area highlights

-- Genetics - strong performance in core salmon business and strategic progress in growth areas:

o H1 FY23 Revenues +30% driven by higher salmon sales from

Norway and Iceland; 181m salmon eggs sold (H1 FY22: 134m)

o Continued commercial progress in Chile with new customer

wins

o Obtained "disease free compartment status" from the Chilean

regulator, an important biosecurity endorsement which will enable

the Company to export salmon eggs from Chile

o Completed configuration at Salten, Norway facility to reach

150m salmon eggs production capacity from FY24 (currently 140m),

ahead of plan

o Total salmon egg capacity now 400m eggs, comprising 150m in

Norway, 200m in Iceland and 50m in Chile

o Strengthened scientific team to progress positioning on new

technologies; enhanced genotyping capabilities

-- Advanced Nutrition - strong performance despite soft shrimp

markets demonstrates success of commercial focus and agile

operation:

o Marginally lower revenues in Q2 FY23 albeit 8% higher revenues

for H1 FY23 as a whole

o Strong performance in marine fish species which represent

c.25% of revenues

o Uplift in shrimp market expected as inventory levels normalise

along the global supply chain and consumer confidence improves

-- Health - strong result from combined sea lice product

portfolio and integrated commercial team:

o Continuing adoption of Ectosan(R) Vet and CleanTreat(R)

supported by excellent efficacy resulting in H1 FY23 sales of

GBP12.9m, up 50% on last year

o Progress on development of streamlined integrated

CleanTreat(R) infrastructure with partners MMC and Salt Ship

Design

o Strong sales of Salmosan(R) Vet driven by success of new

marketing label

Current trading and outlook

-- On track to deliver strong growth for the year in line with market expectations:

o Good visibility of salmon egg sales from Norway and

Iceland

o Market conditions in shrimp are expected to remain unchanged

in the short term; well positioned for resilience and market share

wins. Positive backdrop in the Mediterranean marine fish market

o Expect Q3 FY23 sales from Ectosan(R) Vet and CleanTreat(R) to

reflect low sea lice treatment season, thereafter increasing in Q4

FY23

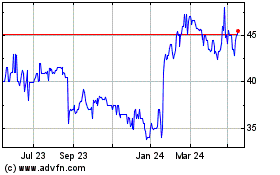

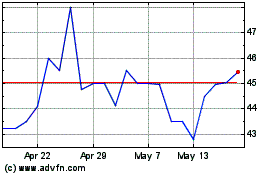

-- Update on Oslo Børs uplisting:

o Consultation with shareholders regarding a potential delisting

from AIM and uplisting to Oslo Børs completed

o Plan to maintain a dual listing on Euronext Growth Oslo and on

AIM for the foreseeable future . Uplisting to Oslo Børs will be

reviewed as part of ongoing strategy to enhance Group positioning

and share performance

GBPm % CER % CER

H1 FY23 H1 FY22 H1 FY23 Q2 FY23 Q2 FY22 Q2 FY23

----------------------------- ---------- ---------- --------- ---------- -------- ---------

98.9 44.4

Revenue +25% 79.2 +19% +13% 39.2 +9%

----------------------------- ---------- ---------- --------- ---------- -------- ---------

Adjusted

----------------------------- ---------- ---------- --------- ---------- -------- ---------

22.1 11.1

Adjusted EBITDA(1) +39% 15.9 +36% +32% 8.4 +28%

----------------------------- ---------- ---------- --------- ---------- -------- ---------

Adj. EBITDA excluding

biological asset fair 21.8 9.7

value movements +47% 14.8 +42% +32% 7.3 +28%

----------------------------- ---------- ---------- --------- ---------- -------- ---------

Adjusted Operating 11.7 5.9

profit(2) +138% 4.9 +130% +145% 2.4 +134%

----------------------------- ---------- ---------- --------- ---------- -------- ---------

Adj. Operating profit

excluding biological 11.4 4.5

asset fair value movements +193% 3.9 180% +244% 1.3 220%

----------------------------- ---------- ---------- --------- ---------- -------- ---------

Statutory

----------------------------- ---------- ---------- --------- ---------- -------- ---------

0.3 0.4

Operating profit/(loss) +114% (2.2) +97% +159% (0.7) +122%

----------------------------- ---------- ---------- --------- ---------- -------- ---------

(1.9) (2.0)

Loss before tax +63% (5.1) +65% - 38% (1.5) -56%

----------------------------- ---------- ---------- --------- ---------- -------- ---------

Basic loss per share

(p) (0.57) (1.32) (0.40) (0.54)

----------------------------- ---------- ---------- --------- ---------- -------- ---------

Net debt(3) (66.3) (81.4) (66.3) (81.4)

----------------------------- ---------- ---------- --------- ---------- -------- ---------

Net debt(3) excluding

lease liabilities (44.5) (50.6) (44.5) (50.6)

----------------------------- ---------- ---------- --------- ---------- -------- ---------

Business Area summary

GBPm %CER* % CER*

H1 FY23 H1 H1 FY23 Q2 Q2 Q2

FY22 FY23 FY22 FY23

Revenue

--------- ------- -------- ------- -------- -----------

45.3 22.6

Advanced Nutrition +8% 42.0 -4% -1% 23.0 -10%

--------- ------- -------- ------- -------- -----------

34.5 13.0

Genetics +30% 26.6 +31% +14% 11.4 +16%

--------- ------- -------- ------- -------- -----------

19.1 8.7

Health +78% 10.7 +79% +77% 4.9 +78%

--------- ------- -------- ------- -------- -----------

Adjusted EBITDA(1)

--------- ------- -------- ------- -------- -----------

Advanced Nutrition 11.5 11.5 -9% 6.2 7.2 -21%

0% -14%

--------- ------- -------- ------- -------- -----------

Genetics 6.0 5.7 +16% 3.4 2.4 +51%

5% +41%

--------- ------- -------- ------- -------- -----------

5.7 2.0

* Net of fair value movements in biological assets +22% 4.7 +32% +52% 1.3 +67%

--------- ------- -------- ------- -------- -----------

6.6 2.6

Health +7,034% 0.1 +6,957% +669% (0.5) +663%

--------- ------- -------- ------- -------- -----------

*Constant exchange rate (CER) figures derived by retranslating

current year figures using previous year's foreign exchange

rates

(1) Adjusted EBITDA is EBITDA (earnings before interest, tax,

depreciation and amortisation and impairment), before exceptional

items including acquisition related expenditure

(2) Adjusted Operating Profit is operating loss before

exceptional items including acquisition related items and

amortisation of intangible assets excluding development costs

(3) Net debt is cash and cash equivalents less loans and

borrowings

Trond Williksen, CEO, commented:

"Benchmark had an excellent first half, delivering double digit

growth. We continue to focus on achieving profitability and cash

generation whilst making good progress towards our medium-term

objectives; we remain on track to deliver strong growth for the

year in line with market expectations .

" Our fundamentals are strong and we have significant

opportunities to continue building our track record of consistent

growth. Aquaculture is a growth industry, supported by robust

megatrends. Benchmark is well positioned to play an important role

in helping the aquaculture industry deliver sustainable growth and

meet the needs of a rising population."

Presentation for analysts and institutional investors at 08.00

UK time (09.00 CET)

Trond Williksen, Chief Executive Officer and Septima Maguire,

Chief Financial Officer will host a presentation for analysts and

institutional investors on the day at 08.00 UK time.

The presentation will be held in person at Pareto Securities

offices in Oslo at Dronning Mauds gate 3, N--0250 Oslo, Norway. If

you would like to attend in person, please contact Thea Naess at

thea.naess@paretosec.com.

A live webcast of the presentation will be available for

analysts and investors to join remotely at the following link:

https://channel.royalcast.com/hegnarmedia/#!/hegnarmedia/20230523_3

A copy of the presentation can be found on the Company's website

https://www.benchmarkplc.com/investors/reports-presentations/

Equity Development webcast at 12.00 UK time

Trond Williksen, Chief Executive Officer and Septima Maguire,

Chief Financial Officer will host a second webcast for retail

investors and wealth managers on the day at 12.00 UK time. The

webcast is open to all existing and potential shareholders.

To register please visit:

https://www.equitydevelopment.co.uk/news-and-events/benchmark-

2qresults-presentation-23may2023

A recording of the presentation will be available after the

event on the Equity Development website .

Enquiries

For further information, please contact:

Benchmark Holdings plc benchmark@mhpgroup.com

Trond Williksen, CEO

Septima Maguire, CFO

Ivonne Cantu, Investor Relations

Numis (Broker and NOMAD) Tel: 020 7260 1000

Freddie Barnfield, Duncan Monteith, Sher

Shah

MHP Tel: 020 3128 899

Katie Hunt, Reg Hoare, Veronica Farah benchmark@mhpgroup.com

About Benchmark

Benchmark is a market leading aquaculture biotechnology company.

Benchmark's mission is to drive sustainability in aquaculture by

delivering products and solutions in genetics, advanced nutrition

and health which improve yield, growth, animal health and

welfare.

Through a global footprint in 26 countries and a broad portfolio

of products and solutions, Benchmark addresses the major

aquaculture species in all the major aquaculture regions around the

world. Find out more at www.benchmarkplc.com

Management Report

Benchmark delivered an excellent performance in the first half

of the year continuing to build on its track record of consistent

quarterly increase in revenues and underlying profitability.

Revenues were up 25% (19% at constant currency) reaching GBP98.9m,

and Adjusted EBITDA excluding fair value movements from biological

assets at GBP21.8m was up 47% (42% at constant currency) against H1

FY22, translating into an Adjusted EBITDA margin excluding fair

value movements of 22% (H1 FY22: 19%) . Adjusted EBITDA increased

by 39% (36% at constant currency) in the six-month period. The

increase in Adjusted EBITDA excluding fair value movements from

biological assets derives primarily from higher revenues, supported

by ongoing cost control and operational leverage.

Higher revenues were reported across all business areas with

Genetics revenues increasing by 30%, Advanced Nutrition 8% and

Health 78%. In Health and Genetics, the impact from foreign

currencies was not material, with revenue growth at constant

currency broadly in line with actual revenue growth. Advanced

Nutrition sales were aided by forex tailwinds, and revenue fell

slightly (-4%) in constant currency terms. Operating costs in H1

FY23 were GBP24.0m, a 21% increase from the prior year. The

increase reflects higher activity levels and inflationary pressure.

R&D expenses at GBP3.0m, were 7% below H1 FY22 and total

R&D investment including capitalised development costs was

GBP3.2m, 30% below the prior year (H1 FY22: GBP4.6m).

Depreciation and amortisation were marginally above the prior

year at GBP19.1m (H1 FY22: GBP18.9m). Together with the increase in

EBITDA, this led to an improvement at Operating Profit level to

GBP0.3m (H1 FY22: -GBP2.2m loss). Adjusted Operating Profit

excluding fair value movements from biological assets increased by

193% to GBP11.4m. Taking into consideration conditions in the end

markets, performance was strong across all business areas.

Net finance costs for H1 FY23 were GBP2.2m (H1 FY22: GBP3.0m).

The reduction arises due to a credit of GBP2.7m arising in H1

relating to the ineffective portion of the movement in the fair

value of derivative financial instruments, offset by higher forex

losses in the period.

Loss before tax in H1 FY23 was GBP1.9m (H1 FY22: GBP5.1m). This

included the impact of significant exceptional costs in the period

of GBP2.7m, largely incurred in legal and professional costs in

relation to the preparations for listing the Group on the Oslo

Børs. The figure contrasted with a GBP0.9m net credit in H1 FY22

which included a credit of GBP1.2m for additional contingent

consideration received from disposals in previous years.

Total tax charge in H1 FY23 was GBP1.5m (H1 FY22: GBP3.6m)

reflecting a change in the mix in the territories in which the

profits have been made, with losses available to shelter profits in

some territories. Loss after tax was GBP3.4m (H1 FY22: GBP8.8m

loss).

The Group reported a net operating cash inflow of GBP9.5m after

an increase in working capital of GBP4.2m (H1 FY22: GBP13.5m) and

tax payments of GBP4.1m (H1 FY22: GBP3.0m). The increase in working

capital is somewhat seasonal, but the much lower increase year on

year, in the context of increased activity, results from our strong

focus on managing our working capital closely towards our goal of

achieving positive cash generation.

Net cash outflow from investing activities was GBP11.5m (H1

FY22: GBP6.6m) of which GBP8.0m related to the acquisition of the

remaining minority stake in Benchmark Genetics Iceland completed in

February 2023. PPE capex was GBP3.3m (H1 FY22: GBP5.1m).

Net cash inflow from financing activities of GBP6.8m (H1 FY22:

GBP10.7m), includes an equity raise of (net) GBP13.0m, net proceeds

from debt refinancing of GBP4.2m, and GBP4.7m of lease payments (H1

FY22: GBP4.8m). Interest charges in the period were GBP4.0m (H1

FY22: GBP3.8m), as the higher cost of borrowing offset the lower

level of borrowings outstanding in the period. Our cash position at

the end of the period was GBP38.6m (H1 FY22: GBP46.3m), and net

debt including lease liabilities was GBP66.3m (H1 FY22:

GBP81.4m).

Advanced Nutrition

Advanced Nutrition delivered a strong result despite soft shrimp

markets in the first half of the year demonstrating the success of

a renewed commercial focus and agile operation. Revenues for the

first half were up 8% at GBP45.3m while Adjusted EBITDA was flat

against the same period in the previous year at GBP11.5m.

Softness in the shrimp markets resulted from subdued demand from

key import markets, inventory levels across the supply chain and

higher input costs, primarily in South East Asia, while Ecuador was

more robust. We expect an uplift in shrimp production as consumer

confidence picks up and inventory levels normalise. Conditions in

the marine fish sector were positive partially offsetting softness

in the shrimp market.

In transactional currency, by product area, Artemia sales were

up 3% and Health sales were up by 22% while Diets saw a 14%

decrease. On the same basis by region, Asia Pacific and South East

Asia were most affected by conditions in the shrimp market leading

to a reduction in sales of 13% and 19% respectively. Conversely,

the Americas reported growth of 8% while sales in Europe increased

6%.

With a leading position in the market, deep customer relations,

operational agility and commercial focus our Advanced Nutrition

business is well placed to mitigate the temporary weakness and take

every opportunity to strengthen our position in the market.

Genetics

Genetics delivered strong performance in the first half of the

year with revenues of GBP34.5m, 30% above the prior year (H1 FY22:

GBP26.6m) driven by higher salmon egg sales and harvest revenues.

Adjusted EBITDA for H1 FY23 excluding fair value movements of

biological assets was GBP5.7m, 22% ahead of the prior year (H1

FY22: GBP4.7m). Including fair value movements Adjusted EBITDA for

the first half was GBP6.0m, 5% ahead of the same period last

year.

Revenues from salmon eggs increased by 45% driven by Norway and

Iceland, while harvest revenues grew by 9%. We made commercial

progress in Chile with new customer wins. In addition, we obtained

"disease free compartment status" from the Chilean regulator,

Senapesca. This is an important biosecurity endorsement which will

enable the Company to export salmon eggs from Chile thereby opening

new avenues to utilise our installed capacity.

In Q2 we completed the configuration of the Salten facility, to

reach 150m salmon egg capacity (currently 140m eggs) which will be

in place from FY24 onwards. This marks the end of an investment

journey where the Company has increased its total salmon egg

capacity to 400m eggs, comprising 150m in Salten, Norway, 200m in

Iceland and 50m in Chile.

In shrimp we continued our efforts to enhance and tailor genetic

traits to local markets and trials in local markets are underway.

We have decreased the intensity of our commercial efforts while the

trials are ongoing. Shrimp sales were GBP0.7m in the period (H1

FY22: GBP0.8m).

Innovation is a core component of our Genetics strategy and we

continue to strengthen our capability in the team. We have also

enhanced our capacity for genotyping, reducing the costs for our

own programmes and enabling us to offer genotyping as part of our

offering in genetics services.

During the period the Company acquired the remaining 10.52%

minority interest in its subsidiary Benchmark Genetics Iceland

ensuring Benchmark receives the full benefit from its successful

salmon genetics business in Iceland. Benchmark Genetics Iceland

represents c.50% of the Group's 400m salmon egg capacity.

Health

Revenues in H1 FY23 increased to GBP19.1m (H1 FY22: GBP10.7m)

with higher sales from both Ectosan(R) Vet and CleanTreat(R) and

Salmosan(R) Vet. Ectosan(R) Vet and CleanTreat(R) sales were

GBP12.9m (H1 FY22: GBP8.6m) of which GBP4.5m (H1 FY22: GBP2.2m)

related to recharging of vessel and fuel costs. There is growing

adoption of our highly efficacious sea lice solution and we

continue to work with our partners MMC and Salt Ship Design to

develop a streamlined infrastructure for CleanTreat(R) which will

further facilitate adoption in the market.

Salmosan(R) Vet sales were GBP6.2m, 192% ahead of the prior year

supported by the success of a new marketing label.

Adjusted EBITDA for the business area was GBP6.6m (H1 FY22:

GBP0.1m).

Q2 FY23 commentary

The Group reported revenue of GBP44.4m, 13% above prior year of

GBP39.2m. This was driven by revenue growth in Health and Genetics

which reported revenue +77% and +14% higher than Q2 FY22

respectively. Revenues in Advanced Nutrition were marginally down

-1% driven by low current demand in the shrimp markets as mentioned

above.

Adjusted EBITDA excluding fair value uplift from biological

assets was GBP9.7m, 32% ahead of the prior year and 28% higher on a

constant currency basis (Q2 FY22: GBP7.3m), reflecting higher

revenues, operational leverage and good cost control. By business

area, Health was up more than sixfold, Genetics was up 52% while

Advanced Nutrition reported a decrease in Adjusted EBITDA of 14%,

despite forex tailwinds mitigating the reduction.

Operating costs of GBP12.3m were 23% above last year (Q2 FY22:

GBP10.0m) driven by increased activity and inflationary pressure.

R&D expenses of GBP1.4m were 10% below the prior year (Q2 FY22:

GBP1.6m) and represented 3% of Group revenues (Q2 FY22: 4%).

Depreciation and amortisation was GBP9.0m (Q2 FY22: GBP10.0m),

leading to a Group operating profit of GBP0.4m (Q2 FY22: GBP0.7m

loss).

Net finance costs of GBP2.4m for the quarter were GBP1.6m higher

than the same period last year (Q2 FY22: GBP0.8m), mainly due to

forex losses of GBP0.7m (Q3 FY22: gain of GBP0.6m) in the

period.

The tax charge of GBP0.7m (Q2 FY22: GBP2.2m) reflects a change

in the mix of territories in which taxable profits were made,

leading loss after tax for the quarter at GBP2.7m (Q2 FY22: loss of

GBP3.7m).

Update on Oslo Børs listing

As previously announced, the Company conducted a consultation

with shareholders regarding a potential delisting from AIM and

uplisting to the Oslo B ø rs. Based on the feedback received the

Board has decided to maintain its current listings on Euronext

Growth Oslo and on AIM for the foreseeable future.

The Board continues to believe that in the medium term the

company could benefit from uplisting to the Oslo Børs as the

leading venue for seafood and aquaculture companies. An uplisting

will be reviewed as part of the Group's ongoing strategy to enhance

the Group's positioning and shareholder value.

Outlook and current trading

The Group had an excellent first half, delivering 25% growth in

revenues and trading in line with market expectations. We continued

to focus on achieving profitability and cash generation whilst

making good progress towards our medium-term objectives.

The Group communicated its medium term (3-5 year) financial

objectives in May 2022 and since then has reported significant

progress as shown in the table below:

Medium term FY21 FY22 H123

objective

Revenue Growth

per annum 15-18% 18% 27% 25%

-------------- ------ ----- -----

Adj. EBITDA

Margin 25-30% 16% 20% 22%

(period end)

-------------- ------ ----- -----

Cashflow conversion

ratio(1) 70-80% 30% 35% 43%

-------------- ------ ----- -----

Free cashflow

as % of sales(2) 10-15% (17%) (8%) 1%

-------------- ------ ----- -----

1. Cash generated from operations after working capital and

taxes as percentage of Adj. EBITDA

2. Free cash flow: Net cash from operating activities less capex

and lease payments (excluding cash interest)

Looking forward to the second half of the year there is good

visibility of salmon egg sales in Genetics and we will continue to

progress our growth vectors of salmon in Chile and shrimp genetics,

which will be key areas of focus in the coming periods. In Advanced

Nutrition we expect conditions in the shrimp market to remain

unchanged in the short term and while this poses a challenge to

growth, we are confident that we have a leading and dynamic

organisation capable of mitigating the impact from market

conditions whilst taking advantage to increase our market share

where possible. In Health, we expect Q3 sales to reflect the

seasonally low sea lice treatment season, thereafter increasing in

Q4.

Our fundamentals are strong and we have significant

opportunities to continue building our track record of consistent

growth. Since completing the Group's restructuring in 2020 we have

delivered a 62% increase in revenue and 117% increase in Adj.

EBITDA, whilst steadily reducing net debt. Aquaculture is a growth

industry, supported by robust megatrends. As a leading aquaculture

biotechnology company, Benchmark is well positioned to play an

important role in helping the aquaculture industry deliver

sustainable growth and meet the needs of a rising population.

Benchmark Holdings plc

Consolidated Income Statement for the period ended 31 March

2023

YTD Q2 YTD Q2

Q2 2023 Q2 2022 2023 2022 FY 2022

All figures in GBP000's Notes (unaudited) (unaudited) (unaudited) (unaudited) (audited)

------------------------------ ------ -------------- -------------- -------------- -------------- ------------

Revenue 4 44,367 39,233 98,862 79,247 158,277

Cost of sales (19,549) (19,210) (49,817) (39,725) (75,149)

------------------------------ ------

Gross profit 24,818 20,023 49,045 39,522 83,128

Research and development

costs (1,435) (1,590) (2,998) (3,237) (6,691)

Other operating costs (12,290) (9,984) (24,043) (19,907) (44,661)

Share of (loss)/profit

of equity-accounted

investees, net of

tax - (24) 56 (528) (595)

------------------------------ ------ -------------- -------------- -------------- -------------- ------------

Adjusted EBITDA(2) 11,093 8,425 22,060 15,850 31,181

Exceptional - restructuring,

disposal and acquisition

related items 5 (1,716) 908 (2,688) 908 16

------------------------------ ------ -------------- -------------- -------------- -------------- ------------

EBITDA(1) 9,377 9,333 19,372 16,758 31,197

Depreciation and impairment (4,551) (5,557) (9,166) (10,052) (19,897)

Amortisation and impairment (4,410) (4,484) (9,912) (8,872) (19,161)

------------------------------ ------ -------------- -------------- -------------- -------------- ------------

Operating profit/(loss) 416 (708) 294 (2,166) (7,861)

Finance cost (3,223) (2,684) (10,353) (4,747) (20,057)

Finance income 791 1,930 8,143 1,769 4,741

------------------------------ ------ -------------- -------------- -------------- -------------- ------------

Loss before taxation (2,016) (1,462) (1,916) (5,144) (23,177)

Tax on loss 6 (704) (2,189) (1,483) (3,616) (7,274)

------------------------------ ------ -------------- --------------

Loss for the period (2,720) (3,651) (3,399) (8,760) (30,451)

------------------------------ ------ -------------- -------------- -------------- -------------- ------------

Loss for the period

attributable to:

- Owners of the parent (2,858) (3,775) (4,141) (9,132) (32,087)

- Non-controlling

interest 138 124 742 372 1,636

------------------------------ ------ --------------

(2,720) (3,651) (3,399) (8,760) (30,451)

------------------------------ ------ -------------- -------------- -------------- -------------- ------------

Earnings per share

Basic loss per share

(pence) 7 (0.40) (0.54) (0.57) (1.32) (4.60)

Diluted loss per share

(pence) 7 (0.40) (0.54) (0.57) (1.32) (4.60)

------------------------------ ------ -------------- -------------- -------------- -------------- ------------

1 EBITDA - Earnings before interest, tax, depreciation,

amortisation, and impairment

2 Adjusted EBITDA - EBITDA before exceptional items including

acquisition related items

Benchmark Holdings plc

Consolidated Statement of Comprehensive Income for the period

ended 31 March 2023

YTD Q2 YTD Q2

Q2 2023 Q2 2022 2023 2022 FY 2022

All figures in GBP000's (unaudited) (unaudited) (unaudited) (unaudited) (audited)

--------------------------------- --- -------------- -------------- -------------- -------------- ------------

Loss for the period (2,720) (3,651) (3,399) (8,760) (30,451)

Other comprehensive income

Items that are or may

be reclassified subsequently

to profit or loss

Foreign exchange translation

differences (5,973) 9,812 (24,013) 7,201 47,606

Cash flow hedges - changes

in fair value 217 3,082 (299) 2,948 2,627

Cash flow hedges - reclassified

to profit or loss (179) 63 (292) 178 2,546

Total comprehensive income

for the period (8,655) 9,306 (28,003) 1,567 22,328

-------------------------------------- -------------- -------------- -------------- -------------- ------------

Total comprehensive income

for the period attributable

to:

- Owners of the parent (8,295) 8,784 (28,046) 836 20,326

- Non-controlling interest (360) 522 43 731 2,002

--------------------------------------

(8,655) 9,306 (28,003) 1,567 22,328

------------------------------------- -------------- -------------- -------------- -------------- ------------

The accompanying notes are an integral part of this consolidated

financial information.

Benchmark Holdings plc

Consolidated Balance Sheet as at 31 March 2023

31 March 31 March 30 September

2023 2022 2022

All figures in GBP000's Notes (unaudited) (unaudited) (audited)

------------------------------------------ ------ ------------ ------------ --------------

Assets

Property, plant and equipment 76,414 81,568 81,900

Right-of-use assets 22,365 31,360 27,034

Intangible assets 215,077 226,912 245,264

Equity-accounted investees 3,136 2,821 3,113

Other investments 14 15 15

Biological and agricultural assets 20,605 17,089 20,878

Non-current assets 337,611 359,765 378,204

------------------------------------------ ------ ------------ ------------ --------------

Inventories 27,129 22,140 29,813

Biological and agricultural assets 22,550 24,294 25,780

Trade and other receivables 48,433 47,275 56,377

Cash and cash equivalents 38,647 46,294 36,399

------------------------------------------ ------ ------------ ------------ --------------

Current assets 136,759 140,003 148,369

------------------------------------------ ------ ------------ --------------

Total assets 474,370 499,768 526,573

------------------------------------------ ------ ------------ ------------ --------------

Liabilities

Trade and other payables (29,723) (33,284) (44,324)

Loans and borrowings 8 (22,115) (13,546) (17,091)

Corporation tax liability (8,413) (7,733) (10,211)

Provisions (1,574) (551) (1,631)

------------------------------------------ ------ ------------ ------------ --------------

Current liabilities (61,825) (55,114) (73,257)

------------------------------------------ ------ ------------ ------------ --------------

Loans and borrowings 8 (82,878) (114,185) (93,045)

Other payables (6,257) (936) (8,996)

Deferred tax (24,293) (27,524) (27,990)

------------

Non-current liabilities (113,428) (142,645) (130,031)

------------------------------------------ ------ ------------ ------------ --------------

Total liabilities (175,253) (197,759) (203,288)

------------------------------------------ ------ ------------ ------------ --------------

Net assets 299,117 302,009 323,285

------------------------------------------ ------ ------------ ------------ --------------

Issued capital and reserves attributable

to owners of the parent

Share capital 9 739 704 704

Additional paid-in share capital 9 37,924 420,824 420,824

Capital redemption reserve 5 5 5

Retained earnings 201,962 (162,696) (185,136)

Hedging reserve (1,294) (2,750) (703)

Foreign exchange reserve 54,391 37,307 77,705

------------

Equity attributable to owners

of the parent 293,727 293,394 313,399

Non-controlling interest 5,390 8,615 9,886

------------------------------------------ ------ ------------

Total equity and reserves 299,117 302,009 323,285

------------------------------------------ ------ ------------ ------------ --------------

The accompanying notes are an integral part of this consolidated

financial information.

Benchmark Holdings plc

Consolidated Statement of Changes in Equity for the period ended

31 March 2023

Total

attributable

Additional to equity

paid-in holders Non-

Share share Other Hedging Retained of controlling Total

capital capital* reserves reserve earnings parent interest equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

As at 1 October

2022

(audited) 704 420,824 77,710 (703) (185,136) 313,399 9,886 323,285

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

Comprehensive

income/(loss)

for the period

Profit/(loss) for

the

period - - - - (4,141) (4,141) 742 (3,399)

Other

comprehensive

income/(loss) - - (23,314) (591) - (23,905) (699) (24,604)

Total

comprehensive

income/(loss)

for the

period - - (23,314) (591) (4,141) (28,046) 43 (28,003)

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

Contributions by

and

distributions to

owners

Share issue 35 12,985 - - - 13,020 - 13,020

Share issue costs

recognised

through equity - (1,650) - - - (1,650) - (1,650)

Cancellation of

part

of share premium

account

(note 9) - (394,235) - - 394,235 - - -

Share-based

payment - - - - 475 475 - 475

Total

contributions

by and

distributions

to owners 35 (382,900) - - 394,710 11,845 - 11,845

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

Changes in

ownership

Acquisition of

NCI - - - - (3,470) (3,470) (4,539) (8,009)

Total changes in

ownership

interests - - - - (3,470) (3,470) (4,539) (8,009)

Total

transactions

with

owners of the

Company 35 (382,900) - - 391,240 8,375 (4,539) 3,836

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

As at 31 March

2023

(unaudited) 739 37,924 54,396 (1,294) 201,963 293,728 5,390 299,118

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

As at 1 October

2021

(audited) 670 400,682 30,470 (5,876) (154,231) 271,715 7,884 279,599

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

Comprehensive

income/(loss)for

the period

Profit/(loss) for

the

period - - - - (9,132) (9,132) 372 (8,760)

Other

comprehensive

income/(loss) - - 6,842 3,126 - 9,968 359 10,327

Total

comprehensive

income/(loss)

for the

period - - 6,842 3,126 (9,132) 836 731 1,567

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

Contributions by

and

distributions to

owners

Share issue 34 20,704 - - - 20,738 - 20,738

Share issue costs

recognised

through equity - (562) - - - (562) - (562)

Share-based

payment - - - - 667 667 - 667

Total

contributions

by and

distributions

to owners 34 20,142 - - 667 20,843 - 20,843

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

Changes in

ownership

Total changes in

ownership

interests - - - - - - - -

Total

transactions

with

owners of the

Company 34 20,142 - - 667 20,843 - 20,843

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

As at 31 March

2022

(unaudited) 704 420,824 37,312 (2,750) (162,696) 293,394 8,615 302,009

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

As at 1 October

2021

(audited) 670 400,682 30,470 (5,876) (154,231) 271,715 7,884 279,599

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

Comprehensive

income/(loss)

for the period

Profit/(loss) for

the

period - - - - (32,087) (32,087) 1,636 (30,451)

Other

comprehensive

income/(loss) - - 47,240 5,173 - 52,413 366 52,779

Total

comprehensive

income/(loss)

for the

period - - 47,240 5,173 (32,087) 20,326 2,002 22,328

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

Contributions by

and

distributions to

owners

Share issue 34 20,704 - - - 20,738 - 20,738

Share issue costs

recognised

through equity - (562) - - - (562) - (562)

Share-based

payment - - - - 1,182 1,182 - 1,182

Total

contributions

by and

distributions

to owners 34 20,142 - - 1,182 21,358 - 21,358

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

Changes in

ownership

Total changes in

ownership

interests - - - - - - - -

Total

transactions

with

owners of the

Company 34 20,142 - - 1,182 21,358 - 21,358

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

As at 30

September 2022

(audited) 704 420,824 77,710 (703) (185,136) 313,399 9,886 323,285

------------------ --------- ------------ ---------- --------- ---------- -------------- ------------- ---------

*Other reserves in this statement is an aggregation of capital

redemption reserve and foreign exchange reserve

Benchmark Holdings plc

Consolidated Statement of Cashflows for the period ended 31

March 2023

31 March 31 March 30 September

2023 2022 2022

Notes (unaudited) (unaudited) (audited)

--------------------------------------------- ------ ------------ ------------ --------------

Cash flows from operating activities

Loss for the period (3,399) (8,760) (30,451)

Adjustments for:

Depreciation and impairment of property,

plant and equipment 4,248 4,187 8,602

Depreciation and impairment of right-of-use

assets 4,918 5,865 11,295

Amortisation and impairment of intangible

fixed assets 9,912 8,872 19,161

Loss on sale of property, plant and

equipment (36) - (43)

Finance income (320) (225) (319)

Finance costs 1,715 3,714 18,437

Increase in fair value of contingent

consideration receivable - (909) (1,203)

Share of profit/(loss) of equity-accounted

investees, net of tax (55) 528 595

Foreign exchange losses (1,104) 841 (3,985)

Share-based payment expense 475 667 1,182

Other adjustments for non-cash items - - (276)

Tax charge 1,482 3,616 7,274

Decrease/(increase) in trade and

other receivables 6,071 108 (8,511)

Decrease/(increase) in inventories 2,517 (1,610) (5,406)

Decrease/(increase) in biological

and agricultural assets 893 (1,635) (6,099)

(Decrease)/increase in trade and

other payables (13,673) (10,317) 6,946

(Decrease)/increase in provisions (13) (12) 1,058

--------------------------------------------- ------ ------------ ------------ --------------

13,631 4,930 18,257

Income taxes paid (4,141) (2,975) (7,447)

--------------------------------------------- ------ ------------ ------------ --------------

Net cash flows generated from operating

activities 9,490 1,955 10,810

--------------------------------------------- ------ ------------ ------------ --------------

Investing activities

Acquisition of minority interests

in subsidiaries, net of cash acquired 12 (8,009) - -

Purchase of investments (307) (48) (378)

Receipts from disposal of investments - - 1,544

Purchases of property, plant and

equipment (3,254) (5,084) (10,808)

Purchase of intangibles (77) (1,523) (205)

Capitalised research and development

costs (197) - (1,708)

Proceeds from sale of fixed assets 77 3 220

Interest received 319 25 119

Net cash flows used in investing

activities (11,448) (6,627) (11,216)

--------------------------------------------- ------ ------------ ------------ --------------

Financing activities

Proceeds of share issues 13,020 20,782 20,737

Share-issue costs recognised through

equity (1,650) (607) (562)

Proceeds from bank or other borrowings 21,393 - 67,939

Repayment of bank or other borrowings (16,560) (939) (74,874)

Capitalised borrowing costs (591) - -

Interest and finance charges paid (4,082) (3,757) (9,629)

Repayments of lease liabilities (4,689) (4,769) (10,533)

--------------------------------------------- ------------ --------------

Net cash inflow/(outflow) from financing

activities 6,841 10,710 (6,922)

--------------------------------------------- ------ ------------ ------------ --------------

Net increase/(decrease) in cash

and cash equivalents 4,883 6,038 (7,328)

Cash and cash equivalents at beginning

of period 36,399 39,460 39,460

Effect of movements in exchange rate (2,634) 796 4,267

--------------------------------------------- ------------ --------------

Cash and cash equivalents at end

of period 38,648 46,294 36,399

--------------------------------------------- ------ ------------ ------------ --------------

Benchmark Holdings plc

Unaudited notes to the quarterly financial statements for the

period ended 31 March 2023

1. Basis of preparation

Benchmark Holdings plc (the 'Company') is a company incorporated

and domiciled in the United Kingdom. These consolidated quarterly

financial statements as at and for the six months ended 31 March

2023 comprises those of the Company and its subsidiaries (together

referred to as the 'Group').

These consolidated quarterly financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006 and are unaudited. These financial

statements do not include all the information required for a

complete set of IFRS financial statements. However, selected

explanatory notes are included to explain events and transactions

that are significant to an understanding of the changes in the

Group's financial position and performance since the last annual

financial statements. The Group's last annual statutory financial

statements as at and for the year ended 30 September 2022 were

prepared in accordance with UK adopted international accounting

standards in conformity with the requirements of the Companies Act

2006 as it applies to companies reporting under those standards

("Adopted IFRS") and are available from the Company's website at

www.benchmarkplc.com .

The prior year comparatives are derived from audited financial

information for Benchmark Holdings PLC Group as set out in the

Annual Report and Accounts for the year ended 30 September 2022 and

the unaudited financial information in the Quarterly Financial

Report for the six months ended 31 March 2022. The comparative

figures for the financial year ended 30 September 2022 are not the

Company's statutory accounts for that financial year. Those

accounts were approved by the Directors on 30 November 2022 and

have been delivered to the Registrar of Companies. The audit report

received on those accounts was (i) unqualified and (ii) did not

include a reference to any matters to which the external auditor

drew attention by way of emphasis without qualifying their report,

and (iii) did not contain a statement under section 498(2) or (3)

of the Companies Act 2006.

Statement of Compliance

These consolidated quarterly financial statements have been

prepared in accordance with UK and EU adopted IAS 34 'Interim

Financial Reporting'. These financial statements do not include all

of the information required for the full annual financial

statements and should be read in conjunction with the Group's last

annual consolidated financial statements as at and for the year

ended 30 September 2022. These consolidated quarterly financial

statements were approved by the Board of Directors on 23 May

2023.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Management Report.

As at 31 March 2023 the Group had net assets of GBP299.1m (30

September 2022: GBP323.3m), including cash of GBP38.6m (30

September 2022: GBP36.4m) as set out in the consolidated balance

sheet. The Group made a loss for the six months of GBP3.4m (year

ended 30 September 2022: loss GBP30.5m).

As noted in the Management Report, the business has continued to

perform well on the back of a good year in FY22. All of the

business areas have performed in line with or ahead of management

expectations. The Directors have reviewed forecasts and cash flow

projections for a period of at least 12 months including downside

sensitivity assumptions in relation to trading performance across

the Group to assess the impact on the Group's trading and cash flow

forecasts and on the forecast compliance with the covenants

included within the Group's financing arrangements.

In the downside analysis performed, the Directors considered

severe but plausible scenarios on the Group's trading and cash flow

forecasts, firstly in relation to continued roll out of the

Ectosan(R)Vet and CleanTreat offering. Sensitivities considered

included modelling slower ramp up of the commercialisation of

Ectosan(R) Vet and CleanTreat(R) through delayed roll-out of the

revised operating model for the service, together with reductions

in expected biomass treated and reduced treatment prices. Key

downside sensitivities modelled in other areas included assumptions

on slower commercialisation of SPR shrimp, slower salmon egg sales

growth both in Chile and to land-based farms in Genetics, along

with sensitivities on sales price increases and demand for artemia

feeds in certain territories. Mitigating measures within the

control of management have been identified should they be required

in response to these sensitivities, including reductions in areas

of discretionary spend, tight control over new hires, and deferral

of capital projects.

The refinancing exercise which commenced in FY22 was completed

in Q1 FY23, so that adequate finance facilities are in place, and

with financial instruments in place to fix interest rates and

opportunities available to mitigate globally high inflation rates,

the Group continues to show resilience against the global economic

pressures, caused mainly by the conflict in Eastern Europe. The

Directors are therefore confident that even under all of the above

sensitivity analysis, the Group has sufficient liquidity and

resources throughout the period under review whilst still

maintaining adequate headroom against the borrowing covenants and

remain confident that the Group has adequate resources to continue

to meet its liabilities as and when they fall due within the period

of 12 months from the date of approval of these financial

statements. Based on their assessment, the Directors believe it

remains appropriate to prepare the financial statements on a going

concern basis.

2. Accounting policies

The accounting policies adopted are consistent with those used

in preparing the consolidated financial statements for the

financial year ended 30 September 2022.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total earnings.

Alternative performance measures ('APMs')

The Directors measure the performance of the Group based on a

range of financial measures, including measures not recognised by

EU or UK-adopted IFRS. These APMs may not be directly comparable

with other companies' APMs, and the Directors do not intend these

as a substitute for, or superior to, IFRS measures.

Directors have presented the performance measures Adjusted

EBITDA, Adjusted Operating Profit, Adjusted Profit Before Tax and

Adjusted EBITDA excluding fair value movement on biological assets

because they monitor performance at a consolidated level using

these and believe that these measures are relevant to an

understanding of the Group's financial performance (see note 10).

Furthermore, the Directors also refer to current period results

using constant currency, which are derived by retranslating current

period results using the prior year's foreign exchange rates.

Use of estimates and judgements

The preparation of quarterly financial information requires

management to make certain judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

amounts may differ from these estimates.

In preparing these quarterly financial statements the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those applied to the consolidated financial

statements for the year ended 30 September 2022.

3. Segment information

Operating segments are reported in a manner consistent with the

reports made to the chief operating decision maker. It is

considered that the role of chief operating decision maker is

performed by the Board of Directors.

The Group operates globally and for management purposes is

organised into reportable segments based on the following business

areas:

-- Genetics - harnesses industry leading salmon breeding

technologies combined with state-of-the-art production facilities

to provide a range of year-round high genetic merit ova.

-- Advanced Nutrition - manufactures and provides technically

advanced nutrition and health products to the global aquaculture

industry.

-- Health - the segment provides health products and services to

the global aquaculture market.

3. Segment information (continued)

In order to reconcile the segmental analysis to the consolidated

income statement, corporate and inter-segment sales are also shown.

Corporate sales represent revenues earned from recharging certain

central costs to the operating business areas, together with

unallocated central costs.

Measurement of operating segment profit or loss

Inter-segment sales are priced along the same lines as sales to

external customers, with an appropriate discount being applied to

encourage use of Group resources at a rate acceptable to local tax

authorities. This policy was applied consistently throughout the

current and prior period.

Segmental Revenue

--------------- --------------- -------------- --------------- -------------

YTD Q2 YTD Q2

Q2 2023 Q2 2022 2023 2022 FY 2022

All figures in GBP000's (unaudited) (unaudited) (unaudited) (unaudited) (audited)

---------------------------- --------------- --------------- -------------- --------------- -------------

Genetics 13,042 11,408 34,481 26,603 58,008

Advanced Nutrition 22,644 22,974 45,324 42,033 80,286

Health 8,692 4,916 19,077 10,693 20,135

Corporate 1,436 1,406 2,873 2,812 5,120

Inter-segment sales (1,447) (1,471) (2,893) (2,894) (5,272)

Total 44,367 39,233 98,862 79,247 158,277

---------------------------- --------------- --------------- -------------- --------------- -------------

Segmental Adjusted EBITDA

--------------

YTD Q2 YTD Q2

Q2 2023 Q2 2022 2023 2022 FY 2022

All figures in GBP000's (unaudited) (unaudited) (unaudited) (unaudited) (audited)

---------------------------- --------------- --------------- -------------- --------------- -------------

Genetics 3,420 2,428 5,983 5,691 15,980

Advanced Nutrition 6,169 7,154 11,466 11,474 19,017

Health 2,583 (454) 6,650 93 108

Corporate (1,079) (703) (2,039) (1,408) (3,924)

Total 11,093 8,425 22,060 15,850 31,181

---------------------------- --------------- --------------- -------------- --------------- -------------

Reconciliations of segmental information to IFRS measures

Reconciliation of Reportable Segments Adjusted EBITDA to Loss before

taxation

-----------------------------------------------------------------------------------------------------------------

YTD Q2 YTD Q2

Q2 2023 Q2 2022 2023 2022 FY 2022

All figures in GBP000's (unaudited) (unaudited) (unaudited) (unaudited) (audited)

------------------------------- --------------- --------------- -------------- --------------- -------------

Total reportable segment

Adjusted EBITDA 12,172 9,128 24,099 17,258 35,105

Corporate Adjusted EBITDA (1,079) (703) (2,039) (1,408) (3,924)

------------------------------- --------------- --------------- -------------- --------------- -------------

Adjusted EBITDA 11,093 8,425 22,060 15,850 31,181

Exceptional - restructuring,

disposal and acquisition

related items (1,716) 908 (2,688) 908 16

Depreciation and impairment (4,551) (5,557) (9,166) (10,052) (19,897)

Amortisation and impairment (4,410) (4,484) (9,912) (8,872) (19,161)

Net finance costs (2,432) (754) (2,210) (2,978) (15,316)

Loss before taxation (2,016) (1,462) (1,916) (5,144) (23,177)

------------------------------- --------------- --------------- -------------- --------------- -------------

4. Revenue

The Group's operations and main revenue streams are those

described in its financial statements to 30 September 2022. The

Group's revenue is derived from contracts with customers.

Disaggregation of revenue

In the following tables, revenue is disaggregated by primary

geographical market and by sales of goods and services. The table

includes a reconciliation of the disaggregated revenue with the

Group's reportable segments (see note 3).

Sale of goods and provision of services

3 months ended 31 March 2023 (unaudited)

------------------------- ---------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- -------

Sale of goods 11,083 22,635 6,115 - - 39,833

Provision of services 1,957 - 2,577 - - 4,534

Inter-segment sales 2 9 - 1,436 (1,447) -

13,042 22,644 8,692 1,436 (1,447) 44,367

------------------------- ---------- ------------ -------- ----------- --------------- -------

3 months ended 31 March 2022 (unaudited)

------------------------- ---------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- -------

Sale of goods 9,872 22,945 2,594 - - 35,411

Provision of services 1,500 - 2,322 - - 3,822

Inter-segment sales 36 29 - 1,406 (1,471) -

------------------------- ---------- ------------ -------- ----------- --------------- -------

11,408 22,974 4,916 1,406 (1,471) 39,233

------------------------- ---------- ------------ -------- ----------- --------------- -------

6 months ended 31 March 2023 (unaudited)

------------------------- ---------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- -------

Sale of goods 32,204 45,307 13,564 - - 91,075

Provision of services 2,274 - 5,513 - - 7,787

Inter-segment sales 3 17 - 2,873 (2,893) -

34,481 45,324 19,077 2,873 (2,893) 98,862

------------------------- ---------- ------------ -------- ----------- --------------- -------

6 months ended 31 March 2022 (unaudited)

------------------------- ---------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- -------

Sale of goods 24,381 41,993 5,845 - - 72,219

Provision of services 2,180 - 4,848 - - 7,028

Inter-segment sales 42 40 - 2,812 (2,894) -

------------------------- ---------- ------------ -------- ----------- --------------- -------

26,603 42,033 10,693 2,812 (2,894) 79,247

------------------------- ---------- ------------ -------- ----------- --------------- -------

4. Revenue (continued)

Sale of goods and provision of services (continued)

12 months ended 30 September 2022 (audited)

------------------------- ------------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- --------------

Sale of goods 53,978 80,191 13,528 - - 147,697

Provision of services 3,973 - 6,607 - - 10,580

Inter-segment sales 57 95 - 5,120 (5,272) -

------------------------- ---------- ------------ -------- ----------- --------------- --------------

58,008 80,286 20,135 5,120 (5,272) 158,277

------------------------- ---------- ------------ -------- ----------- --------------- --------------

Primary geographical markets

3 months ended 31 March 2023 (unaudited)

------------------------- -------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- -------

Norway 6,177 252 6,157 - - 12,586

India - 2,822 - - - 2,822

Turkey - 2,528 - - - 2,528

Greece - 2,002 - - - 2,002

Faroe Islands 2,224 - 119 - - 2,343

Ecuador 9 1,832 - - - 1,841

United Kingdom 814 8 - - - 822

Chile 1,121 9 88 - - 1,218

Vietnam - 2,330 - - - 2,330

Rest of Europe 1,680 1,716 - - - 3,396

Rest of World 1,015 9,136 2,328 - - 12,479

Inter-segment sales 2 9 - 1,436 (1,447) -

13,042 22,644 8,692 1,436 (1,447) 44,367

------------------------- ---------- ------------ -------- ----------- --------------- -------

3 months ended 31 March 2022 (unaudited)

------------------------- -------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- -------

Norway 6,115 211 4,288 - - 10,614

India 260 3,711 - - - 3,971

Turkey - 2,238 - - - 2,238

Greece - 1,832 - - - 1,832

Faroe Islands 1,709 5 147 - - 1,861

Ecuador - 1,227 - - - 1,227

United Kingdom 899 14 30 - - 943

Chile 224 5 150 - - 379

Vietnam - 3,014 - - - 3,014

Rest of Europe 1,590 1,278 - - - 2,868

Rest of World 575 9,410 301 - - 10,286

Inter-segment sales 36 29 - 1,406 (1,471) -

11,408 22,974 4,916 1,406 (1,471) 39,233

------------------------- ---------- ------------ -------- ----------- --------------- -------

4. Revenue (continued)

Primary geographical markets (continued)

6 months ended 31 March 2023 (unaudited)

------------------------- ------------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- --------------

Norway 23,061 342 14,452 - - 37,855

India - 7,025 - - - 7,025

Turkey 2 4,732 - - - 4,734

Greece - 4,271 - - - 4,271

Faroe Islands 3,319 - 348 - - 3,667

Ecuador 29 3,572 - - - 3,601

United Kingdom 1,551 27 42 - - 1,620

Chile 1,133 11 342 - - 1,486

Vietnam - 5,025 - - - 5,025

Rest of Europe 3,742 3,338 - - - 7,080

Rest of World 1,641 16,964 3,893 - - 22,498

Inter-segment sales 3 17 - 2,873 (2,893) -

34,481 45,324 19,077 2,873 (2,893) 98,862

------------------------- ---------- ------------ -------- ----------- --------------- --------------

6 months ended 31 March 2022 (unaudited)

------------------------- ------------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- --------------

Norway 15,794 323 8,956 - - 25,073

India 400 7,719 - - - 8,119

Turkey - 3,932 - - - 3,932

Greece - 3,471 - - - 3,471

Faroe Islands 2,856 28 118 - - 3,002

Ecuador - 2,291 - - - 2,291

United Kingdom 2,601 6 277 - - 2,884

Chile 340 5 553 - - 898

Vietnam - 6,009 - - - 6,009

Rest of Europe 3,361 2,581 - - - 5,942

Rest of World 1,209 15,628 789 - - 17,626

Inter-segment sales 42 40 - 2,812 (2,894) -

26,603 42,033 10,693 2,812 (2,894) 79,247

------------------------- ---------- ------------ -------- ----------- --------------- --------------

4. Revenue (continued)

Primary geographical markets (continued)

12 months ended 30 September 2022 (audited)

------------------------- --------------------------------------------------------------------------

Advanced Inter-segment

All figures in GBP000's Genetics Nutrition Health Corporate sales Total

------------------------- ---------- ------------ -------- ----------- --------------- --------

Norway 34,666 965 15,571 - - 51,202

India 619 12,001 - - - 12,620

Turkey - 6,419 - - - 6,419

Greece 2 6,197 - - - 6,199

Faroe Islands 5,465 9 587 - - 6,061

Ecuador 18 6,472 - - - 6,490

United Kingdom 4,318 93 199 - - 4,610

Chile 1,006 15 871 - - 1,892

Vietnam - 10,512 - - - 10,512

Rest of Europe 7,110 4,056 - - - 11,166

Rest of World 4,747 33,452 2,907 - - 41,106

Inter-segment sales 57 95 (0) 5,120 (5,272) (0)

58,008 80,286 20,135 5,120 (5,272) 158,277

------------------------- ---------- ------------ -------- ----------- --------------- --------

5. Exceptional - restructuring, disposal, and acquisition related items

Items that are material because of their size or nature,

non-recurring and whose significance is sufficient to warrant

separate disclosure and identification within the consolidated

financial statements are referred to as exceptional items. The

separate reporting of exceptional items helps to provide an

understanding of the Group's underlying performance.

All figures in GBP000's Q2 2023 Q2 2022 YTD YTD FY 2022

Q2 2023 Q2 2022

(unaudited) (unaudited) (unaudited) (unaudited) (audited)

------------------------- --- -------------- --------------------- -------------- --------------------- ------------

Exceptional restructuring

costs 1,716 - 2,688 - 1,229

Income in relation to

disposals - (908) - (908) (1,245)

Total exceptional items 1,716 (908) 2,688 (908) (16)

------------------------------ -------------- --------------------- -------------- --------------------- ------------

Exceptional restructuring costs for the quarter include

GBP1,666,000 (YTD 2023: GBP2,553,000; FY 2022: GBP843,000) of legal

and professional costs in relation to preparing for listing the

Group on the Oslo stock exchange, and GBP50,000 (YTD 2023:

GBP135,000; FY 2022: GBP276,000) relating to other restructuring

costs.

Income in relation to disposals for Q2 2022 and YTD Q2 2022 of

GBP908,000 relate to an increase in the fair value of contingent

consideration receivable following the disposal of Improve

International Limited in 2020. Further to this, the balance in FY

2022 includes GBP294,000 of additional contingent consideration

received relating to the disposal of Aquaculture UK in 2020.

6. Taxation

YTD Q2 YTD Q2

Q2 2023 Q2 2022 2023 2022 FY 2022

All figures in GBP000's (unaudited) (unaudited) (unaudited) (unaudited) (audited)

-------------------------------- --- -------------- -------------- -------------- -------------- ------------

Analysis of charge in period

Current tax:

Current income tax expense

on profits for the period 997 2,642 2,835 5,007 11,727

Adjustment in respect of prior

periods - - - - (39)

------------------------------------- -------------- -------------- -------------- -------------- ------------

Total current tax charge 997 2,642 2,835 5,007 11,688

Deferred tax:

Origination and reversal of

temporary differences (293) (453) (1,352) (1,391) (4,414)

Deferred tax movements in

respect of prior periods - - - - -

-------------------------------- --- -------------- -------------- -------------- -------------- ------------

Total deferred tax credit (293) (453) (1,352) (1,391) (4,414)

- -

-------------------------------- --- -------------- -------------- -------------- -------------- ------------

Total tax charge 704 2,189 1,483 3,616 7,274

------------------------------------- -------------- -------------- -------------- -------------- ------------

7. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary equity holders of the Company by the

weighted average number of ordinary shares in issue during the

period.

YTD YTD

Q2 2023 Q2 2022 Q2 2023 Q2 2022 FY 2022

(unaudited) (unaudited) (unaudited) (unaudited) (audited)

----------------------------------- -------------- -------------- -------------- -------------- ------------

Loss attributable to equity

holders of the parent (GBP000) (2,858) (3,775) (4,141) (9,132) (32,087)

Weighted average number of shares

in issue (thousands) 723,173 703,926 724,505 692,474 698,233

Basic loss per share (pence) (0.40) (0.54) (0.57) (1.32) (4.60)

----------------------------------- -------------- -------------- -------------- -------------- ------------

Diluted loss per share is calculated by adjusting the weighted

average number of ordinary shares outstanding to assume conversion

of all dilutive potential ordinary shares. This is done by

calculating the number of shares that could have been acquired at

fair value (determined as the average market price of the Company's

shares for the period) based on the monetary value of the

subscription rights attached to outstanding share options and

warrants. The number of shares calculated above is compared with

the number of shares that would have been issued assuming the

exercise of the share options and warrants.

Therefore, the Company is required to adjust the earnings per

share calculation in relation to the share options that are in

issue under the Company's share-based incentive schemes, and

outstanding warrants. However, as any potential ordinary shares

would be anti-dilutive due to losses being made there is no

difference between Basic loss per share and Diluted loss per share

for any of the periods being reported.

A total of 4,312,880 potential ordinary shares have not been

included within the calculation of statutory diluted loss per share

for the year (30 September 2022: 6,240,304 and 31 March 2022:

5,184,054). These potential ordinary shares could dilute

earnings/loss per share in the future.

8. Loans and borrowings

YTD YTD

Q2 2023 Q2 2022 FY 2022

All figures in GBP000's (unaudited) (unaudited) (audited)

---------------------------- ------------ ------------ ----------

Non-Current

2025 750m NOK Loan notes 56,756 - 61,054

2023 850m NOK Loan notes - 76,353 -

Bank borrowings 16,974 18,917 17,226

Lease liabilities 9,148 18,915 14,765

---------------------------- ----------

82,878 114,185 93,045

---------------------------- ------------ ------------ ----------

Current

Bank borrowings 9,421 1,648 5,569

Lease liabilities 12,694 11,899 11,522

---------------------------- ----------

22,115 13,546 17,091

---------------------------- ------------ ------------ ----------

Total loans and borrowings 104,993 127,732 110,136

---------------------------- ------------ ------------ ----------

On 27 September 2022, the Group successfully issued a new

unsecured floating rate listed green bond of NOK 750m. The bond

which matures in September 2025, has a coupon of three-month NIBOR

+ 6.50% p.a. with quarterly interest payments. The proceeds were

used to repay its existing NOK 850m floating rate listed bond,

originally raised in June 2019. The bond was listed on the Oslo

Stock Exchange during the current period on 12 April 2023.

On 21 November 2022, the Group refinanced its USD15m RCF, which

was provided by DNB Bank ASA (50%) and HSBC UK Bank PLC (50%), with

a secured GBP20m RCF provided by DNB Bank ASA, maturing on 27 June

2025. The margin on this facility is a minimum of 2.75% and a

maximum of 3.25%, dependent upon the leverage of the Group above

the relevant risk-free reference or IBOR rates depending on which

currency is drawn.

On 15 February 2023, the Group drew down EUR9,000,000 on the

GBP20,000 RCF leaving GBP12,110,000 undrawn as at 31 March

2023.

Additionally, during the period, on 1 November 2022, the Group's

Nordea Bank term loan of NOK 165.6m, which had a term loan of five

years ending in November 2023 and interest rate of 2.5% above three

month NIBOR, was refinanced together with an existing undrawn

overdraft facility into a new loan facility of NOK 179.5m with a

new maturity date in a further five years no later than 15 January

2028. Other terms of this facility remain the same.

9. Share capital and additional paid-in share capital

Additional

paid-in

Share share

Number Capital capital

Allotted, called up and fully paid GBP000 GBP000

---------------------------------------------- ------------ --------- -----------

Ordinary shares of 0.1 pence each

Balance at 30 September 2022 703,960,798 704 420,824

Shares issued through placing and open offer 35,189,350 35 11,335

Cancellation of part of the share premium

account - - (394,235)

Exercise of share options 127,321 - -

Balance at 31 March 2023 739,277,469 739 37,924

---------------------------------------------- ------------ --------- -----------

On 15 December 2022, the Company issued 35,189,350 new ordinary

shares of 0.1 pence each by way of a placing and subscriptions at

an issue price of 37.0 pence per share. Gross proceeds of GBP13.0m

were received for the placing and subscription shares.

Non-recurring costs of GBP1.7m were in relation to the share issues

and this has been charged to the share premium account (presented

within additional paid-in share capital).

The share premium account is used to record the aggregate amount

of value of the premiums paid when the Company's shares are

issued/redeemed at a premium. On 20 March 2023, part of the

Company's share premium account was cancelled following the

confirmation of the capital reduction by the High Court of England

and Wales on 14 March 2023 and the subsequent registration of the

court order with the Registrar of Companies. The capital reduction

created additional distributable reserves to the value of

GBP394,235,072.

10. Alternative performance measures and other metrics

Management has presented the performance measures EBITDA,

Adjusted EBITDA, Adjusted EBITDA before fair value movement in

biological assets, Adjusted Operating Profit and Adjusted Profit

Before Tax because it monitors performance at a consolidated level

using these and believes that these measures are relevant to an

understanding of the Group's financial performance.

Adjusted EBITDA which reflects underlying profitability, is

earnings before interest, tax, depreciation, amortisation,

impairment, and exceptional items and is shown on the Income

Statement.

Adjusted EBITDA before fair value movements in biological

assets, which is Adjusted EBITDA before the non-cash fair value

movements in biological assets arising from their revaluation in

line with International Accounting Standards.

Adjusted Operating Profit is operating profit/loss before

exceptional items and amortisation and impairment of intangible

assets excluding development costs as reconciled below.

Adjusted Profit Before Tax is earnings before tax, amortisation

and impairment of intangibles assets excluding development costs,

and exceptional items as reconciled below. These measures are not

defined performance measures in IFRS. The Group's definition of

these measures may not be comparable with similarly titled

performance measures and disclosures by other entities.

10. Alternative performance measures and other metrics

(continued)

Reconciliation of Adjusted Operating Profit to Operating

Loss

YTD Q2 YTD Q2

Q2 2023 Q2 2022 2023 2022 FY 2022

All figures in GBP000's (unaudited) (unaudited) (unaudited) (unaudited) (audited)

----------------------------------- --- -------------- -------------- -------------- -------------- ------------

Revenue 44,367 39,233 98,862 79,247 158,277

Cost of sales (19,549) (19,210) (49,817) (39,725) (75,149)

---------------------------------------- -------------- -------------- -------------- -------------- ------------

Gross profit 24,818 20,023 49,045 39,522 83,128

Research and development costs (1,435) (1,590) (2,998) (3,237) (6,691)

Other operating costs (12,290) (9,984) (24,043) (19,907) (44,661)

Depreciation and impairment (4,551) (5,557) (9,166) (10,052) (19,897)

Amortisation of capitalised