TIDMAML

RNS Number : 6919I

Aston Martin Lagonda Global Hld PLC

15 December 2020

15 December 2020

Aston Martin Lagonda Global Holdings plc

Notification of transactions by Directors, Persons Discharging

Managerial Responsibilities ("PDMRs") and persons closely

associated with them

Aston Martin Lagonda Global Holdings plc (the "Company")

announces the following changes in the interests of Directors in

the Ordinary Shares in the Company ("Shares"), which took place on

14 December 2020.

In accordance with the rules of the Aston Martin Lagonda

Long-Term Incentive Plan 2018 ("LTIP"), the Directors named below

were granted nil-cost options over Shares as follows:

-- Tobias Moers (CEO) - 211,618 shares (300% of salary)

-- Kenneth Gregor (CFO) - 70,539 shares (200% of salary)

The LTIP awards are the 2020 grant which was delayed due to the

unprecedented uncertainty and change faced during 2020 (both

specifically for the Company and externally due to Covid-19). The

Remuneration Committee were able to determine the most appropriate

approach and approved the 2020 LTIP grant at its October 2020

meeting, once the new leadership team and an updated business plan

were established. The LTIP awards were granted at the first

opportunity post this approval, following the General Meeting held

on 4 December 2020 and on the first dealing day of the consolidated

shares.

These LTIP awards are subject to the performance conditions,

performance periods, vesting periods and malus and clawback

provisions set out below, in-line with the Remuneration Policy

approved in 2019. The targets related to Adjusted EBITDA

performance remain commercially sensitive at this point and will be

set out in the 2020 Directors' Remuneration Report which is

expected to be published in March 2021, along with full details of

the LTIP awards.

2020 Performance measures

2020 LTIP targets Vesting*

(as a % of maximum)

-------------------- ---------- ------------------------

EBITDA targets remain

commercially sensitive

Adjusted EBITDA and will be disclosed

(80% of award) Threshold in the 2020 DRR 20%

------------------------

Stretch 80%

-------------------

Maximum 100%

------------------------------------ ------------------- --------------------

Relative TSR Threshold Rank 6(th) (median) 20%

(vs. luxury peers)

(20% of award)

Rank 3(rd) or above

Maximum (80(th) percentile) 100%

---------- --------------------------------------------- --------------------

* Vesting will be on a straight-line basis between each of

threshold and stretch, and stretch and maximum for the EBITDA

element and threshold and maximum for the TSR element

-- TSR performance will be measured on a ranked basis against

the following luxury companies: Burberry, Capri Holdings, Compagnie

Financiere Richemont, Ferrari, Hermes International, Kering, LVMH,

Moncler, Prada and Ralph Lauren.

-- The Remuneration Committee retains discretion to adjust the

vesting levels to ensure they reflect underlying business

performance and any other relevant factors to ensure that the value

at vesting is fully reflective of the performance delivered and

executives do not receive unjustified windfall gains.

Performance period

-- The period over which the EBITDA performance condition will

be measured is from 1 January 2020 to 31 December 2022 (three

financial years).

-- The period over which the TSR performance condition will be

measured is from 14 December 2020 to 13 December 2023 (three years

from grant date).

Vesting period

-- Subject to performance, the element of awards subject to

EBITDA performance will vest following the announcement of results

for 2022 (early March 2023).

-- Subject to performance, the element of awards subject to

relative TSR performance will vest three years from grant,

following the Remuneration Committee's determination of the

performance outcome.

-- The CEO and CFO will be required to hold at least 75% of any

shares that vest (net of tax) until they have met their

shareholding guidelines under the shareholding policy.

Malus and Clawback:

-- Malus and clawback provisions will be operated at the

discretion of the Remuneration Committee in respect of awards

granted under the LTIP where it considers that there are

exceptional circumstances. Such exceptional circumstances may

include serious reputational damage, a failure of risk management,

an error in available financial information, which led to the award

being greater than it would otherwise have been or personal

misconduct.

-- Clawback may be applied for a period of up to three years for any LTIP awards.

Enquiries:

Investors and Analysts

Charlotte Cowley, +44 (0)7771 976764

Director of Investor Relations charlotte.cowley@astonmartin.com

Media

Kevin Watters, +44 (0)7764 386683

Director of Communications kevin.watters@astonmartin.com

Grace Barnie, +44 (0)7880 903490

Corporate Communications Manager grace.barnie@astonmartin.com

Tulchan Communications

Harry Cameron and Simon Pilkington +44 (0)20 73534200

Notification of transactions by Directors, Persons Discharging

Managerial Responsibilities ("PDMRs") and persons closely

associated with them

1 Details of the person discharging managerial responsibilities/person closely associated

a) Name Tobias Moers

2 Reason for the notification

a) Position/status Chief Executive Officer

b) Initial notification/Amendment Initial Notification

3 Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

a) Name Aston Martin Lagonda Global Holdings plc

b) LEI 213800167WOVOK5ZC776

4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

a) Description of the financial instrument, type of instrument Ordinary Shares (ISIN: GB00BN7CG237)

Identification code

b) Nature of the transaction Grant of 2020 LTIP awards

c) Price(s) and volume(s) Price(s) Volume(s)

GBP12.05 211,618

d) Aggregated information

- Aggregated volume 211,618

- Price GBP2,549,996.90

e) Date of the transaction 14 December 2020

f) Place of the transaction London

Notification of transactions by Directors, Persons Discharging

Managerial Responsibilities ("PDMRs") and persons closely

associated with them

1 Details of the person discharging managerial responsibilities/person closely associated

a) Name Kenneth Gregor

2 Reason for the notification

a) Position/status Chief Financial Officer

b) Initial notification/Amendment Initial Notification

3 Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

a) Name Aston Martin Lagonda Global Holdings plc

b) LEI 213800167WOVOK5ZC776

4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

a) Description of the financial instrument, type of instrument Ordinary Shares (ISIN: GB00BN7CG237)

Identification code

b) Nature of the transaction Grant of 2020 LTIP awards

c) Price(s) and volume(s) Price(s) Volume(s)

GBP12.05 70,539

d) Aggregated information

- Aggregated volume 70,539

- Price GBP849,994.95

e) Date of the transaction 14 December 2020

f) Place of the transaction London

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHGCBDDGDBDGGU

(END) Dow Jones Newswires

December 15, 2020 04:30 ET (09:30 GMT)

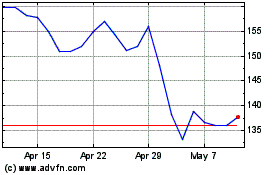

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Jul 2024 to Jul 2024

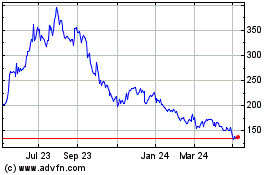

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Jul 2023 to Jul 2024