TIDMHMB

RNS Number : 5688V

Hambledon Mining PLC

16 December 2013

16 December 2013

Hambledon Mining plc

("Hambledon" or the "Company")

Conversion of Convertible Loan Notes and COO Appointment

Hambledon Mining plc (AIM: HMB), the gold mining and development

company, has today issued 583,648,617 new ordinary shares of 0.1

pence each (the "New Ordinary Shares") to African Resources Limited

("African Resources") following the full conversion of the

unsecured convertible loan notes of GBP17.25 million (plus accrued

interest) issued to African Resources as part of the Karasuyskoye

Ore Fields transaction (as announced on 4 October 2013) (the

"Convertible Loan Notes") (the "Conversion").

The Convertible Loan Notes were issued with a five year term,

bore interest at a rate equal to three months LIBOR plus seven per

cent. (which accrued daily and was payable on redemption or, in

shares, on conversion) and were convertible at a conversion price

of 3 pence per share. Accordingly, upon full conversion of the

Convertible Loan Notes, 583,648,617 New Ordinary Shares were issued

by the Company to African Resources to satisfy the outstanding

principle amount of GBP17.25 million and accrued interest (until

midnight on 15 December 2013) of GBP259,459. The conversion price

of 3 pence per share equates to a premium of 31.9 per cent. to the

closing price of 2.275 pence on 13 December 2013.

African Resources' decision to fully convert was based upon,

inter alia, discussions with various stakeholders, including the

EBRD and investors generally. Shareholder approval was granted at

the general meeting of the Company held on 23 October 2013 to

permit the issue of the maximum number of new ordinary shares

required to satisfy full conversion.

Following the issue of the New Ordinary Shares, African

Resources is interested in 1,081,903,593 ordinary shares in the

Company, representing approximately 69.2 per cent. of the Company's

enlarged issued share capital. The New Ordinary Shares will rank

pari passu in all respects with the existing ordinary shares and it

is expected that admission to trading on AIM will occur at 8.00

a.m. on 20 December 2013. Following admission, the total number of

voting rights in the Company's will be 1,563,370,130.

Update on the Karasuyskoye Ore Fields

The Convertible Loan Notes were issued to fund the acquisition

of certain historical geological information pertaining to the

Karasuyskoye Ore Fields, which are located adjacent to the

Company's current operations in Kazakhstan, from Hydrogeology LLP

("Hydrogeology") (the "Acquisition"). The Karasuyskoye Ore Fields

are an advanced exploration project covering an area of

approximately 198 km(2) . Exploration drilling and testing by

Hydrogeology, which has been reviewed by Hambledon's technical

team, indicates estimated resources of approximately 9 million

ounces of gold and in excess of 16 million ounces of silver.

Following completion of the Acquisition, the Company has used

the information to apply for requisite mining licenses covering the

Karasuyskoye Ore Fields, from the Ministry of Industry and New

Technologies ("MINT") and is currently awaiting approval. Assuming

this approval is forthcoming, and following the completion of

limited additional verification work, the Company expects to engage

Venmyn Deloitte to complete an independent JORC-compliant competent

person's report on the Karasuyskoye Ore Fields. Further updates on

the Karasuyskoye Ore Fields will be provided as appropriate.

UK Takeover Code Considerations

As a result of changes in the definition of companies to which

the UK Takeover Code (the "City Code") applies, the Company became

subject to the City Code with effect from 30 September 2013.

Under Rule 9 of the City Code, where any person acquires,

whether by a single transaction or a series of transactions over a

period of time, interests in securities which (taken together with

securities in which persons acting in concert with him are

interested) carry 30 per cent. or more of the voting rights of a

company which is subject to the City Code, that person is normally

required by the Panel on Takeovers and Mergers (the "Panel") to

make a general offer to the shareholders of that company to acquire

their shares. If any person, together with persons acting in

concert with him, is interested in shares which in the aggregate

carry not less than 30 per cent. of the voting rights of a company

but does not hold shares carrying more than 50 per cent. of such

voting rights and such person, or any person acting in concert with

him, acquires an interest in any other shares which increases the

percentage of shares carrying voting rights in which he is

interested, that person is normally required by the Panel to make a

general offer to the shareholders of that company to acquire their

shares.

Further, when any person individually, or a group of persons

acting in concert, already holds shares which carry more than 50

per cent. of the voting rights of a company which is subject to the

City Code, that person, or for so long as the group of persons

presumed to be acting in concert continue to be treated as acting

in concert, may accordingly increase their aggregate shareholding

without incurring an obligation under Rule 9 of the City Code to

make a general offer to the minority shareholders of that company

to acquire their shares. However, individual members of the concert

party will not be able to increase their percentage holdings

through or between a Rule 9 threshold without the consent of the

Panel.

As a result of the recommended cash only partial offer pursuant

to which African Resources offered to acquire up to 60 per cent. of

the existing and to be issued shares of the Company (when

aggregated with the Company shares already held by African

Resources and by persons acting in concert with African Resources)

(the "Partial Offer") which was declared unconditional on 23

November 2012, a concert party (as defined in the partial offer

document dated 2 November 2012) came into existence comprising

African Resources and Blackwill Trade Limited (together the

"Concert Party"). African Resources is a company incorporated in

the British Virgin Islands and is associated with Aidar Assaubayev,

the Company's Chief Executive Officer and an Executive Director of

the Company. Blackwill Trade Limited is a company incorporated in

New Zealand and is connected with African Resources.

African Resources and Blackwill Trade Limited are considered to

be persons acting in concert for the purposes of the City Code in

relation to the Company. Following the Partial Offer, African

Resources and Blackwill Trade Limited held 498,254,976 and

88,448,936 ordinary shares respectively representing approximately

50.9 per cent. and 9.0 per cent. respectively, and 59.9 per cent.

in aggregate, of the share capital of the Company at that time.

Following the issue of the New Ordinary Shares to African

Resources as a result of the Conversion, African Resources and

Blackwill Trade Limited now hold 1,081,903,593 and 88,448,936

ordinary shares in the Company respectively representing

approximately 69.2 per cent and 5.7 per cent respectively, and 74.9

per cent in aggregate, of the enlarged share capital of the

Company.

As a result of the size of its holding in the Company, the

Concert Party will have the ability to exert a significant degree

of control over the future conduct of the Company. Shareholders

should be aware that the members of the Concert Party already hold

shares carrying more than 50 per cent of the Company's voting

rights and for so long as they continue to be treated as acting in

concert may accordingly increase their aggregate shareholding

without incurring an obligation under Rule 9 of the City Code to

make a general offer to all Shareholders, although individual

members of the Concert Party will not be able to increase their

percentage holdings through or between a Rule 9 threshold without

the consent of the Panel.

Corporate Governance

On 23 October 2013, the Company announced the appointment of

Kanat Assaubayev as Hambledon's Chairman. His reputation and

network of contacts in Kazakhstan is viewed as a key driver in the

Company's future growth. Significantly, the Company also announced

the appointment of two independent non-executive directors, a

demonstration of the Board's commitment to its corporate governance

obligations. Further, the Company, together with its advisers, is

reviewing the existing relationship agreement entered into on 2

November 2012 between African Resources and the Company in order to

ensure the agreement continues to reinforce corporate governance

best practice procedures, particularly with regards to minority

shareholder protections.

Chief Operating Officer Appointment

The Company is also pleased to announce the appointment of Maxim

Strelnikov as Chief Operating Officer of Hambledon. Mr. Strelnikov

will be responsible for bringing the underground mine into

production and will be in charge of operations at the mine

thereafter. Mr. Strelnikov has significant experience in the

industry having most recently worked at Satpayevsk Titanium Mines

Limited as General Director of Mining and Processing and prior to

that, Director of Mining Department at Kazakhstan Design and

Engineering Center.

Total Voting Rights

The Company has no ordinary shares held in treasury and

therefore the aforementioned figure of 1,563,370,130 ordinary

shares may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the FCA's

Disclosure and Transparency Rules.

Ashar Qureshi, Non-Executive Director of Hambledon Mining,

commented:

"The Conversion at 3 pence, which is a 31.9 per cent. premium to

the most recent closing price of Hambledon's shares, represents

African Resources' commitment to Hambledon and its belief in the

underlying value within the business. African Resources has made

clear to the Board that it will facilitate future liquidity in the

Company's shares."

Enquiries

Hambledon Mining Plc +44 (0) 207 932

Bogdan Poustovoi, CFA 2455

Strand Hanson (Nomad and Joint Broker)

Andrew Emmott

James Spinney +44 (0) 207 409

Ritchie Balmer 3494

+44 (0) 203 540

1720

Peat & Co. (Joint Broker) +44 (0) 203 540

John Beaumont, COO and Head of Research 1723

+44 (0) 207 138

Blythe Weigh Communications (Financial PR) 3204

Tim Blythe +44 (0) 7816 924626

Halimah Hussain +44 (0) 7725 978141

Camilla Horsfall +44 (0) 7817 841793

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDGBDDUDBBGXU

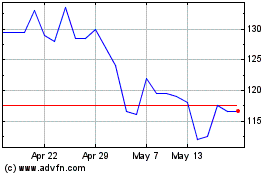

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jul 2024 to Aug 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Aug 2023 to Aug 2024