TIDMALGW

RNS Number : 3897A

Alpha Growth PLC

02 February 2022

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulation (EU) No. 596/2014 (as in force in the United

Kingdom pursuant to the European Union (Withdrawal) Act 2018). Upon

the publication of this announcement, this inside information is

now considered to be in the public domain

Alpha Growth Plc

("Alpha", or the "Company")

BlackOak Alpha Growth Fund managed by the Group continues its

Growth and Performance

Alpha Growth Plc (LSE: ALGW and OTCQB: ALPGF), a leading

financial services specialist in the growing longevity asset class,

is pleased to announce the results for the year-ended 31 December

2021 for its BlackOak Alpha Growth Fund (the "Fund") investing in

Senior Life Settlements ("SLS").

The Fund in 2021, has seen significant positive inflows of

investment, doubling its assets under management to $45 million and

achieving a compounded annual growth rate (CAGR) of 112% since

January 2020.

BOAGF AUM January 2020: $10m

BOAGF AUM January 2021: $22m

BOAGF AUM January 2022: $45m

On a net basis, the Fund produced a total return of 18.9%,

annualized 7.7% since inception in September 2019, and monthly

returns of 0.6%. The Fund has achieved positive returns in 27 out

of the 28 months it has been operational.

At 2021 year end the Fund owned 96 SLS with a total face value

of $79,626,819.83 and average life expectancy of 73 months. The

minimum is $100,000 and maximum face value is $5,000,000 with an

average face value of $829,446.04.

The Company continues to actively market the Fund to registered

investment advisors in the US and supplements this direct outreach

by showcasing the Fund at virtual events.

Danny Swick, COO and co-GP of the Fund stated "We continue to go

from strength to strength and have received a very positive

reception by investors that look for consistent and uncorrelated

returns and yield over multi-year periods. We continue to build our

portfolio of SLS into a well-diversified pool of policies and

remain focused on investing in quality SLS to meet our investment

objectives on behalf of our investors."

Gobind Sahney, Executive Chairman, added "The Alpha Growth team

continues to perform exceptionally well and have once again more

than doubled the size of the Fund over a 12 month period. During

this period, the Fund held 25% of its assets in cash, however as

the fund continues to grow and mature, we would expect this figure

to reduce to circa 15% - this will have a net positive impact on

future reported returns."

Gobind continued "Alpha continues to build on its business plan

of accreting assets under management and growing long term revenue

through its steady focus on the fund and insurance business

segments. Providence Life Assurance Company (Bermuda) Ltd continues

to perform well and is increasing its balance sheet assets. We have

successfully made a number of strategic advances in both business

segments recently and I look forward to updating our shareholders

when appropriate."

For more information, please visit www.algwplc.com or contact

the following:

Alpha Growth Plc +44 (0) 20 3959 8600

Gobind Sahney, Executive Chairman info@algwplc.com

BlackOak Alpha Growth Funds +1 949-326-9799

www.boagf.com

Arden Partners plc +44 (0) 20 7614 5900

Ruari McGirr / Alexandra Campbell-Harris

(Corporate Finance)

UK Investor Relations - Mark Treharne ir@algwplc.com

About Alpha Growth plc

Specialist in Longevity Assets

Alpha Growth plc is a financial advisory business providing

specialist consultancy, advisory, and supplementary services to

institutional and qualified investors globally in the multi-billion

dollar market of longevity assets. Building on its well-established

network, the Alpha Growth Group has a unique position in the

longevity asset services and investment business, as a listed

entity with global reach. The Group's strategy is to expand its

advisory and business services via acquisitions and joint ventures

in the UK and the US to attain commercial scale and provide

holistic solutions to alternative institutional investors who are

in need of specialised skills and unique access to deploy their

financial resource in longevity assets.

Longevity Assets and Non-correlation

As a longevity asset, it is non-correlated to the real estate,

equity capital and commodity markets. Its value is a function of

time because as time passes the value gets closer to the face value

of the policy. Hence creating a steady increase in the net asset

value of the investment. This makes it highly attractive to

investors wishing to counteract volatility within an investment

portfolio and add yield.

Note: The Company only advises on and manages Longevity Assets

that originate in the USA where the structured and life settlement

market is highly regulated.

Forward Looking Statements Disclaimer

Certain statements, beliefs and opinions in this document are

forward-looking, which reflect the Company's or, as appropriate,

the Company's directors' current expectations and projections about

future events. By their nature, forward-looking statements involve

a number of risks, uncertainties and assumptions that could cause

actual results or events to differ materially from those expressed

or implied by the forward-looking statements. These risks,

uncertainties and assumptions could adversely affect the outcome

and financial effects of the plans and events described herein.

Forward-looking statements contained in this document regarding

past trends or activities should not be taken as a representation

that such trends or activities will continue in the future. The

Company does not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. You should not place undue reliance on

forward- looking statements, which speak only as of the date of

this document. Readers should not treat the contents of this

document as advice relating to legal, taxation or investment

matters, and are to make their own assessments concerning these and

other consequences, including the merits of information and the

risks. Readers of this announcement are advised to conduct their

own due diligence and agree to be bound by the limitations of this

disclaimer.

Important Notice

The content of this announcement has not been approved by an

authorised person within the meaning of the Financial Services and

Markets Act 2000 (FSMA). This announcement has been issued by and

is the sole responsibility of the Company. The information in this

announcement is subject to change.

This announcement is not an offer of securities for sale into

the United States. The securities referred to herein have not been

and will not be registered under the U.S. Securities Act of 1933,

as amended (the Securities Act), and may not be offered or sold,

directly or indirectly, in or into the United States, except

pursuant to an applicable exemption from registration. No public

offering of securities is being made in the United States. This

announcement is not for release, publication or distribution,

directly or indirectly, in or into the United States, Australia,

Canada, the Republic of South Africa, Japan or any jurisdiction

where to do so might constitute a violation of local securities

laws or regulations (a Prohibited Jurisdiction). This announcement

and the information contained herein are not for release,

publication or distribution, directly or indirectly, to persons in

a Prohibited Jurisdiction unless permitted pursuant to an exemption

under the relevant local law or regulation in any such

jurisdiction.

About BlackOak Alpha Growth Fund

The Fund was established by two highly experienced longevity

asset management companies. The Fund invests in life settlements,

is a Cayman LP with a tax efficient Master/Feeder structure in an

open-ended format with quarterly redemptions. The Fund seeks to

provide well-diversified, non-correlated returns. The Fund aims to

achieve this objective through the acquisition of secondary and

tertiary Life Settlement policies that will be structured and

purchased to mitigate longevity risk and other investment and

business risks and where the Company's expertise can add value.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFFLIFDILIIF

(END) Dow Jones Newswires

February 02, 2022 01:59 ET (06:59 GMT)

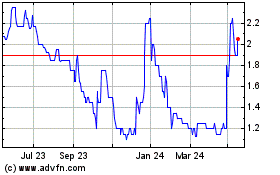

Alpha Growth (LSE:ALGW)

Historical Stock Chart

From Jun 2024 to Jul 2024

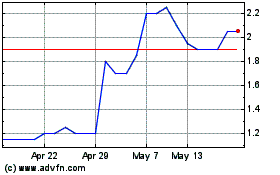

Alpha Growth (LSE:ALGW)

Historical Stock Chart

From Jul 2023 to Jul 2024