UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý

Annual report under Section 13 or 15(d) of the Securities Exchange Act of 1934

For fiscal year ended

December 31, 2008

¨

Transition report under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ______________to _______________

Commission file number ___________

|

|

|

|

|

|

|

|

WOODSTOCK FINANCIAL GROUP, INC

|

|

|

|

(Name of small business issuer in its charter)

|

|

|

Georgia

|

|

58-2161804

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

|

117 Towne Lake Parkway, Suite 200, Woodstock, GA

|

|

30188

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (770) 516-6996.

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of Securities Act. Yes

¨

No

ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes

¨

No

ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for past 90 days.

Yes

ý

No

¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in this herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

ý

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or small reporting company in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

ý

|

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes

¨

No

ý

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Average Bid $0.07 and Average Ask $0.09 as of June 30, 2008.

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date.

17,619,028 as of March 4, 2009

DOCUMENTS INCORPORATED BY REFERENCE – N/A

-1-

TABLE OF CONTENTS

-2-

PART I

ITEM 1.

DESCRIPTION OF BUSINESS

Special Cautionary Notice Regarding Forward-Looking Statements

Various matters discussed in this document and in documents incorporated by reference herein, including matters discussed under the caption “Management’s Discussion and Analysis or Plan of Operation,” may constitute forward-looking statements for purposes of the Securities Act and the Securities Exchange Act. These forward-looking statements may involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Woodstock Financial Group, Inc. (the “Company”) to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. The words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” and similar expressions are intended to identify such forward-looking statements. The Company’s actual results may differ materially from the results anticipated in these forward-looking statements due to a variety of factors, including, without limitation:

·

The effects of future economic conditions;

·

Governmental monetary and fiscal policies, as well as legislative and regulatory changes;

·

The risks of changes in interest rates on the level and composition of deposits, loan demand, and the values of loan collateral, securities and interest rate protection agreements, as well as interest rate risks; and

·

The effects of competition from other financial institutions and financial service providers operating in the Company’s market area and elsewhere, including institutions operating locally, regionally, nationally and internationally, together with such competitors offering products and services by mail, telephone, and computer and the Internet.

All written or oral forward-looking statements attributable to the Company are expressly qualified in their entirety by these cautionary statements.

ITEM 1A.

RISK FACTORS

This item is not required.

-3-

Woodstock Financial Group, Inc.

General

The Company is a full service securities brokerage and investment banking firm, in business since 1995. We are registered as a broker/dealer with the Financial Industry Regulatory Authority (“FINRA”) and 50 states, Puerto Rico, Washington D.C. and also as a municipal securities dealer with the Municipal Securities Regulation Board (“MSRB”). We are subject to net capital and other regulations of the U.S. Securities and Exchange Commission (“SEC”). We offer full service commission and fee based money management services to individual and institutional investors. We maintain a custody-clearing relationship with Southwest Securities, Inc. in Dallas, Texas, one of the largest publicly held custodians of brokerage firm securities in the United States.

We trade securities as an agent and a principal on exchanges such as the NYSE, AMEX and NASDAQ. We maintain selling agreements with mutual fund families and insurance companies offering load and no load funds, annuities and insurance products.

Our Company headquarters is at 117 Towne Lake Parkway Suite 200, Woodstock, GA 30188, and our telephone number is (770) 516-6996. We maintain branch and other offices in a number of other jurisdictions and a complement of approximately 110 independent retail brokers. Our SEC net capital position as of December 31, 2008 and 2007 was $1,154,757

and $1,242,409 respectively.

From our beginnings in May of 1995, our annual revenues are as follows:

|

|

|

|

|

|

|

Year

|

|

Revenues

|

|

No. of Reps.

|

|

1995

|

|

$ 221,476

|

|

19

|

|

1996

|

|

$ 793,309

|

|

19

|

|

1997

|

|

$1,907,486

|

|

50

|

|

1998

|

|

$3,507,000

|

|

75

|

|

1999

|

|

$5,987,067

|

|

100

|

|

2000

|

|

$9,741,567

|

|

90

|

|

2001

|

|

$5,959,712

|

|

77

|

|

2002

|

|

$5,787,621

|

|

74

|

|

2003

|

|

$8,341,118

|

|

69

|

|

2004

|

|

$8,071,847

|

|

68

|

|

2005

|

|

$8,022,361

|

|

71

|

|

2006

|

|

$9,264,261

|

|

70

|

|

2007

|

|

$8,067,137

|

|

74

|

|

2008

|

|

$8,056,893

|

|

110

|

Thus far, all expansion and growth has been funded from cash flows from operations and private sales of our securities. Our plans are to invest in advertising and recruiting efforts to continue our growth and profitability. We expand through recruiting additional registered representatives, establishing new branch offices, broadening our institutional services and creating new financial products and service offerings.

The Company’s website address is

www.woodstockfg.com

-4-

BUSINESS

Our primary sources of revenue are derived from brokerage services and related financial activities.

SECURITIES SALES SERVICES

We are a FINRA member broker-dealer providing securities sales services through a network of "independent contractor" registered representatives to several thousand retail clients. These representatives primarily retail stocks, mutual funds, variable annuities and variable life insurance products, managed account and other investment advisory and financial planning products and services. Commissions are charged on the sale of securities products, of which a percentage is shared with the representatives. Over 85% of our revenue during 2008 and 2007 has been derived from these securities sales services.

The Company’s independent contractors receive a commission payout of between 80% and 90% on average.

INSURANCE PRODUCT SALES

Through several selling agreements with larger insurance companies, we offer a variety of insurance products, which are sold by our independent broker network. Variable annuity and variable life products from over 10 carriers are also offered, providing a large variety for consumers from which to choose. While this business is not significant to date, in terms of dollar revenues, we regard it as an important part of the services provided.

ADVISORY AND PLANNING

We are also registered as an Investment Advisor with the SEC and provide investment supervisory services. In addition, our independent representatives are able to provide planning and consulting services in a variety of financial services areas such as financial planning, tax planning, benefits consulting, corporate 401(k)s and other types of financial structures. Fees are billed quarterly for these services and shared between the firm and the Investment Advisor Representatives on a fully disclosed basis. No significant amount of business has been derived from advisory and planning activities to date.

INTERNET TRADING

Trading investments on the Internet has become a standard among many investors. We believe that this method of trading will grow. We created our Woodstock Discount Brokerage Division (“Woodstock”) in early 1998 to participate in this growth area as well as to diversify the firm’s operations and assets. This capacity to offer Internet trading complements our full service business by attracting cost conscious investors who normally would not have been interested in the firm. This in turn enhances our ability to “cross market” other products and services specifically tailored to meet the Internet needs of our clients. As the information age continues to integrate our lives, new Internet business opportunities will arise and we hope to make these opportunities a large part of our growth. In doing so, Internet trading will give clients more opportunity to trade directly as well as allow for the electronic delivery of documents and information.

Through the Woodstock site, investors have the opportunity to execute a trade at a cost which is competitive with the deep discount on-line brokerage firms. Since as a broker-dealer we already have the facilities in place to do this, this does not add a great deal of expense. All clearing services are provided by the firm’s clearing agent and total cost of operations is minimal. The firm plans to enhance the site and provide several more products and services.

EXPANSION OF EXISTING BUSINESS

We believe that our business has been limited by our capital position. Increased capital will allow us to expand our existing business as set forth below:

We intend to intensify our efforts to attract higher producing independent registered representatives by offering them a higher quality of service and a larger variety of financial products and service options to provide to their clients.

-5-

The expanded services include:

·

Improved sales and business development education and support services

·

Better continuing education programs

·

Enhanced electronic order processing, communications and record keeping

·

Improved compliance support and communications

·

Better contact with product and service suppliers

We also intend to expand our investment banking activities, hiring additional brokers and marketing specialized products to retail and institutional clients.

CLEARING AGENT AND CUSTOMER CREDIT

We currently use Southwest Securities, Inc. as our clearing agent on a fully disclosed basis (the "Clearing Agent"). The Clearing Agent processes all securities transactions and maintains the accounts of customers. Customer accounts are protected through the Securities Investor Protection Corporation (“SIPC”) for up to $500,000, with coverage of cash balances limited to $100,000

.

The Clearing Agent provides through an Excess Securities Bond an additional aggregate protection of $19.5 million per account above the SIPC coverage.

The services of the Clearing Agent include billing, credit control and receipt, and custody and delivery of securities. The Clearing Agent provides the operational support necessary to process, record and maintain securities transactions for our brokerage and distribution activities. The total cost of the Clearing Agent's services is closely monitored to determine the feasibility of our providing these services ourselves.

The Clearing Agent lends funds to our customers through the use of margin credit. These loans are made to customers on a secured basis, with the Clearing Agent maintaining collateral in the form of saleable securities, cash or cash equivalents. Under the terms of our clearing agreement, we indemnify the Clearing Agent for any loss on these credit arrangements. We have implemented policies to avoid possible defaults on margin loans in the increased supervision of customers with margin loans. Margin interest for the years ending December 31, 2008 and 2007 was approximately 1.6% and 3.6%, respectively, of revenues.

REGULATION

The securities business is subject to extensive and frequently changing federal and state laws and substantial regulation under such laws by the SEC and various state agencies and self-regulatory organizations, such as FINRA. Much of the regulation of broker-dealers has been delegated to self-regulatory organizations, principally FINRA, which has been designated by the SEC as the Company's primary regulator. FINRA adopts rules (which are subject to approval by the SEC) that govern FINRA members and conducts periodic examinations of member firms' operations. We are also subject to regulation as a broker-dealer and investment advisor by state securities administrators in those states in which we conduct business.

Broker-dealers are subject to regulations which cover all aspects of the securities business, including sales methods and supervision, trading practices, use and safekeeping of customers' funds and securities, capital structure of securities firms, record keeping and reporting, continuing education and the conduct of directors, officers and employees. Additional legislation, changes in rules promulgated by the SEC and self-regulatory organizations, or changes in the interpretation or enforcement of existing laws and rules, may directly affect the mode of operation and profitability of broker-dealers.

The SEC, self-regulatory organizations and state securities commissions may conduct administrative proceedings which can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of a broker-dealer, its officers or employees. The principal purpose of regulation and discipline of broker-dealers is the protection of customers and the integrity of the securities markets.

Our mutual fund distribution business is subject to extensive regulation as to duties, affiliations, conduct and limitations on fees under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), the Investment Company Act of 1940, as amended (the "1940 Act"), and the regulations of FINRA. As discussed above, the Company is a FINRA member. FINRA has prescribed rules with respect to maximum commissions, charges and fees related to investment in any open-end investment company registered under the 1940 Act.

-6-

NET CAPITAL REQUIREMENTS

As a registered broker-dealer and a member firm of FINRA, we are subject to the net capital rule of the SEC. The net capital rule, which specifies minimum net capital requirements for registered brokers and dealers, is designed to measure the general financial integrity and liquidity of a broker-dealer and requires that at least a minimum part of its assets be kept in relatively liquid form. Net capital is essentially defined as net worth (assets minus liabilities), plus qualifying subordinated borrowings and less certain mandatory deductions that result from excluding assets not readily convertible into cash and from valuing certain other assets, such as a firm's positions in securities, conservatively.

Among these deductions are adjustments in the market value of securities to reflect the possibility of a market decline prior to disposition. We have elected to compute our net capital under the standard aggregate indebtedness method permitted by the net capital rule, which requires that the ratio of aggregate indebtedness to net capital, both as defined, shall not exceed a 15-to-1 ratio. Our required minimum net capital is $100,000. As of December 31, 2008, we had FINRA reported net capital of $1,154,757 and our ratio of aggregate indebtedness to net capital was .44 to 1.

Failure to maintain the required net capital may subject a firm to suspension or expulsion by FINRA, the SEC and other regulatory bodies and ultimately may require its liquidation. We have met or exceeded all net capital requirements since the Company’s inception. The net capital rule also prohibits payments of dividends, redemption of stock and the prepayment or payment in respect of principal of subordinated indebtedness if net capital, after giving effect to the payment, redemption or repayment, would be less than a specified percentage of the minimum net capital requirement. Compliance with the net capital rule could limit those operations that require the intensive use of capital, such as underwriting and trading activities, and also could restrict our ability to withdraw capital, which in turn, could limit our ability to pay dividends, repay debt and redeem or purchase shares of our outstanding capital stock.

COMPETITION

We encounter intense competition in all aspects of our securities business and compete directly with other securities firms, a significant number of which have greater capital and other resources. In addition to competition from firms currently in the securities business, there has recently been increasing competition from other sources, such as commercial banks and insurance companies offering financial services, and from other investment alternatives. We believe that the principal factors affecting competition in the securities industry are the quality and abilities of professional personnel, including their ability to effectuate a firm's commitments, and the quality, range and relative prices of services and products offered.

Although we may expand the financial services we can render to our customers, we do not now offer as broad a range of financial services as national stock exchange member firms, commercial banks, insurance companies and others.

PERSONNEL

At December 31, 2008, we had 15 full-time employees in addition to approximately 110 registered representatives. None of our personnel is covered by a collective bargaining agreement. We consider our relationships with our employees to be good.

ITEM 2.

DESCRIPTION OF PROPERTY

Our principal executive offices are located at 117 Towne Lake Parkway, Suite 200, Woodstock, Georgia 30188 where the Company purchased 7,200 square feet of office space for approximately $1.2 million. The Company closed on this purchase on May 25, 2006.

ITEM 3.

LEGAL PROCEEDINGS

Currently, the Company has no pending claims by retail customers. We are the subject of routine examinations by self regulatory organizations including the SEC, FINRA and individual states and are not aware of any regulatory examinations at this time that would have a material impact on the company’s financial position.

ITEM 4.

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

-7-

PART II

ITEM 5.

MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

(a)

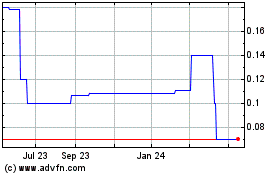

The Company’s Common Stock is traded on the NASDAQ OTC Bulletin Board under the symbol “WSFL.OB”

.

(b)

Not applicable.

(c)

Not applicable.

ITEM 6.

SELECTED FINANCIAL DATA

Not applicable.

ITEM 7.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

The following discussion should be read in conjunction with the financial statements of the Company and the notes thereto appearing elsewhere herein.

OVERVIEW AND GENERAL INDUSTRY CONDITIONS

Our primary sources of revenue are commissions earned from brokerage services. Our principal business activities are, by their nature, affected by many factors, including general economic and financial conditions, movement of interest rates, security valuations in the marketplace, regulatory changes, competitive conditions, transaction volume and market liquidity. Consequently, brokerage commission revenue and investment banking fees can be volatile. While we seek to maintain cost controls, a significant portion of our expenses is fixed and does not vary with market activity. As a result, substantial fluctuations can occur in our revenue and net income from period to period. Unless otherwise indicated, in this section, references to years are to fiscal years.

The Company is a licensed insurance broker and we receive commission revenue as a result of our insurance operations. The Company does not regard insurance commission revenue as material at this time.

RESULTS OF OPERATIONS – YEARS ENDED DECEMBER 31, 2008 and 2007

Total revenue for the year ended December 31, 2008 decreased by $10,244 to $8,056,893 from $8,067,137 for the comparable period in 2007.

Commission revenue increased by $83,407or 1% to $7,028,739 from $6,945,332 for the comparable period in 2007. The increase was due to a slight increase in managed accounts and insurance revenue.

Interest income decreased by $168,195 or 50% to 170,972 for the year ended December 31, 2008 from $339,167 compared to the same period in 2007. This decrease is due to the decrease in interest from margin accounts and customer accounts held by our clearing agent, due primarily to a decrease in the Company’s marginal rate received on these accounts.

Fees from clearing transaction charges and other income increased by $74,544, or 10% to $857,182 for the year ended December 31, 2008 from $782,638 for the same period in 2007. This increase is due primarily to an increase in transactional fees.

Total operating expenses for the year ended December 31, 2008 decreased by $374,031 to $8,055,932 from $8,429,963 for the same period in 2007. Total expenses decreased due primarily to an expense of $338,550 related to the recognition of stock based compensation expense taken in July 2007.

Commissions to brokers decreased by $91,611 to $5,846,564 for the year ended December 31, 2008 from $5,938,175 in the prior year. This decrease is driven by the decrease in commission revenues of transactional business.

Clearing costs decreased by $4,421 or 3% to $146,974 for the year ended December 31, 2008 from $151,395 in the prior year. As a percentage of commission income clearing costs were 2.1% in 2008 compared to 2.2% in 2007.

-8-

Selling, general and administrative expense decreased $249,793 or 11% to $1,976,351 for the year ended December 31, 2008 compared to $2,226,144 in the prior year. This decrease was due primarily to the expense of $338,550 related to the recognition of stock compensation expense taken in July 2007, offset by a slight increase in consulting, error and omissions insurance, marketing and salaries.

The Company recorded no income tax expense or benefit for the years ended December 31, 2008 and 2007. We have a net operating loss carryforward as of December 31, 2008, the utilization of which is dependent upon future taxable income.

Net profit was $961 for the year ended December 31, 2008 compared to net loss of $362,826 for the same period in 2007.

LIQUIDITY AND CAPITAL RESOURCES

Our assets are reasonably liquid with a substantial majority consisting of cash and cash equivalents, and receivables from other broker-dealers and our clearing agent, all of which fluctuate depending upon the levels of customer business and trading activity. Receivables from broker-dealers and our clearing agent turn over rapidly. Both our total assets as well as the individual components as a percentage of total assets may vary significantly from period to period because of changes relating to customer demand, economic, market conditions and proprietary trading strategies. Our total net assets at December 31, 2008 were $1,464,999 of which $976,450 is cash and cash equivalents.

As a broker-dealer, we are subject to the Securities and Exchange Commission Uniform Net Capital Rule (Rule15c3-1). The Rule requires maintenance of minimum net capital and that we maintain a ratio of aggregate indebtedness (as defined) to net capital (as defined) not exceed 15 to 1. Our minimum net capital requirement is $100,000. Under the Rule we are subject to certain restrictions on the use of capital and its related liquidity. Our net capital position at December 31, 2008 was $1,154,757 and our ratio of aggregate indebtedness to net capital was .44 to 1.

Historically, we have financed our operations through cash flow from operations and the private placement of equity securities. We have not employed any significant leverage or debt.

We believe that our capital structure is adequate for our current operations. We continually review our overall capital and funding needs to ensure that our capital base can support the estimated needs of the business. These reviews take into account business needs as well as the Company's regulatory capital requirements. Based upon these reviews, to take advantage of strong market conditions and to fully implement our expansion strategy, we will continue to pursue avenues to decrease costs and increase our capital position.

The Company's cash and cash equivalents decreased by $142,092 to $976,450 as of December 31, 2008, from $1,118,542 as of December 31, 2007. This decrease was due to cash used by operating activities of $64,088, cash used in investing activities of $4,016, and cash used in financing activities of $73,998. For more information on the cash flows of the Company, please see the statement of cash flows included in the Company’s financial statements appearing elsewhere herein.

EFFECTS OF INFLATION AND OTHER ECONOMIC FACTORS

Market prices of securities are generally influenced by changes in rates of inflation, changes in interest rates and economic activity generally. Our revenues and net income are, in turn, principally affected by changes in market prices and levels of market activity. Moreover, the rate of inflation affects our expenses, such as employee compensation, occupancy expenses and communications costs, which may not be readily recoverable in the prices of services offered to our customers. To the extent inflation, interest rates or levels of economic activity adversely affect market prices of securities, our financial condition and results of operations will also be adversely affected.

ITEM 7A.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company does not invest or trade in market sensitive investments.

-9-

ITEM 8.

FINANCIAL STATEMENTS

The following financial statements are included herein:

Report of Independent Registered Public Accounting Firm

Balance Sheets as of December 31, 2008 and 2007

Statements of Earnings for the years ended December 31, 2008 and 2007

Statements of Shareholders’ Equity for the years ended December 31, 2008 and 2007

Statements of Cash Flows for the years ended December 31, 2008 and 2007

Notes to Financial Statements

Supplemental Schedule – Computation of Net Capital Under Rule 15c3-1 of the Securities and Exchange Commission

-10-

![[WDSTFG_10K002.GIF]](http://content.edgar-online.com/edgar_conv_img/2009/03/23/0000943440-09-000246_WDSTFG_10K002.GIF)

Report of Independent Registered Public Accounting Firm

To the Shareholders

Woodstock Financial Group, Inc.

We have audited the balance sheets of Woodstock Financial Group, Inc. as of December 31, 2008 and 2007 and the related statements of operations, shareholders’ equity and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Woodstock Financial Group, Inc. as of December 31, 2008 and 2007, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Our audits were conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States) and were made for the purpose of forming an opinion on the basic financial statements taken as a whole. The information contained in the Supplemental Schedule is presented for purposes of additional analysis and is not a required part of the basic financial statements, but is supplementary information required by Rule 17a-5 of the Securities Exchange Act of 1934. Such information has been subjected to the auditing procedures applied in the audit of the basic financial statements and, in our opinion, is fairly presented in all material respects in relation to the basic financial statements taken as a whole.

![[WDSTFG_10K003.JPG]](http://content.edgar-online.com/edgar_conv_img/2009/03/23/0000943440-09-000246_WDSTFG_10K003.JPG)

Atlanta, Georgia

February 24, 2009

|

|

|

Certified Public Accountants

|

|

Suite 1800

Ÿ

235 Peachtree Street NE

Ÿ

Atlanta, Georgia 30303

Ÿ

Phone 404-588-4200

Ÿ

Fax 404-588-4222

Ÿ

www.pkm.com

|

-11-

WOODSTOCK FINANCIAL GROUP, INC.

Balance Sheets

December 31, 2008 and 2007

|

|

|

|

|

|

|

|

|

|

2008

|

|

2007

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

976,450

|

|

$

|

1,118,542

|

|

|

Clearing deposit

|

|

130,887

|

|

|

128,968

|

|

|

Furniture, fixtures, and equipment, at cost, net of accumulated

depreciation of $157,892 and $139,980, respectively

|

|

25,786

|

|

|

38,909

|

|

|

Building, net of accumulated depreciation of $104,253 and $67,813, respectively

|

|

1,173,035

|

|

|

1,209,479

|

|

|

Commissions receivable

|

|

555,309

|

|

|

522,658

|

|

|

Other assets

|

|

78,829

|

|

|

12,604

|

|

|

|

|

|

|

|

|

|

|

|

$

|

2,940,296

|

|

$

|

3,031,160

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

Accounts payable

|

$

|

46,710

|

|

$

|

40,958

|

|

|

Commissions payable

|

|

427,426

|

|

|

450,930

|

|

|

Mortgage note

|

|

967,408

|

|

|

980,848

|

|

|

Preferred dividends payable

|

|

30,274

|

|

|

30,274

|

|

|

Other liabilities

|

|

3,479

|

|

|

3,564

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

1,475,297

|

|

|

1,506,574

|

|

|

|

|

|

|

|

|

|

|

Commitments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

Series A preferred stock of $.01 par value; 5,000,000 shares authorized,

86,500 shares issued and outstanding (liquidation value of $865,000)

|

|

865

|

|

|

865

|

|

|

Common stock of $.01 par value; 50,000,000 shares authorized;

17,941,772 shares issued

|

|

179,418

|

|

|

179,418

|

|

|

Additional paid-in capital

|

|

3,689,778

|

|

|

3,689,778

|

|

|

Accumulated deficit

|

|

(2,249,107

|

)

|

|

(2,189,520

|

)

|

|

Treasury stock; 322,744 shares, carried at cost, respectively

|

|

(155,955

|

)

|

|

(155,955

|

)

|

|

|

|

|

|

|

|

|

|

Total shareholders’ equity

|

|

1,464,999

|

|

|

1,524,586

|

|

|

|

|

|

|

|

|

|

|

|

$

|

2,940,296

|

|

$

|

3,031,160

|

|

See accompanying notes to financial statements.

-12-

WOODSTOCK FINANCIAL GROUP, INC.

Statements of Operations

For the Years Ended December 31, 2008 and 2007

|

|

|

|

|

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

|

|

|

|

|

|

Operating income:

|

|

|

|

|

|

|

|

Commissions

|

$

|

7,028,739

|

|

$

|

6,945,332

|

|

|

Interest and dividends

|

|

170,972

|

|

|

339,167

|

|

|

Other fees and income

|

|

857,182

|

|

|

782,638

|

|

|

|

|

|

|

|

|

|

|

Total operating income

|

|

8,056,893

|

|

|

8,067,137

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

Commissions to brokers

|

|

5,846,564

|

|

|

5,938,175

|

|

|

Clearing costs

|

|

146,974

|

|

|

151,395

|

|

|

Selling, general and administrative expenses

|

|

1,976,351

|

|

|

2,226,144

|

|

|

Interest expense

|

|

83,778

|

|

|

85,211

|

|

|

Other expense

|

|

2,265

|

|

|

29,038

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

8,055,932

|

|

|

8,429,963

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss)

|

$

|

961

|

|

$

|

(362,826

|

)

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) per share, based on weighted average shares outstanding

of 17,619,028 for the periods ended December 31, 2008 and 2007

|

$

|

0.00

|

|

$

|

(0.02

|

)

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

-13-

WOODSTOCK FINANCIAL GROUP, INC.

Statements of Shareholders’ Equity

For the Years Ended December 31, 2008 and 2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock

|

|

Common Stock

|

|

Additional

Paid-in

Capital

|

|

Accumulated

Deficit

|

|

Treasury

Stock

|

|

Total

Shareholders’

Equity

|

|

|

Balance at December 31, 2006

|

|

$

|

865

|

|

$

|

179,418

|

|

$

|

3,351,228

|

|

$

|

(1,766,146

|

)

|

$

|

(155,955

|

)

|

$

|

1,609,410

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred dividends

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(60,548

|

)

|

|

-

|

|

|

(60,548

|

)

|

|

Stock based compensation

|

|

|

-

|

|

|

-

|

|

|

338,550

|

|

|

-

|

|

|

-

|

|

|

338,550

|

|

|

Net loss

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(362,826

|

)

|

|

-

|

|

|

(362,826

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2007

|

|

|

865

|

|

|

179,418

|

|

|

3,689,778

|

|

|

(2,189,520

|

)

|

|

(155,955

|

)

|

|

1,524,586

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred dividends

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(60,548

|

)

|

|

-

|

|

|

(60,548

|

)

|

|

Net earnings

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

961

|

|

|

-

|

|

|

961

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2008

|

|

$

|

865

|

|

$

|

179,418

|

|

$

|

3,689,778

|

|

$

|

(2,249,107

|

)

|

$

|

(155,955

|

)

|

$

|

1,464,999

|

|

See accompanying notes to financial statements.

-14-

WOODSTOCK FINANCIAL GROUP, INC.

Statements of Cash Flows

For the Years Ended December 31, 2008 and 2007

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

Net earnings (loss)

|

|

$

|

961

|

|

$

|

(362,826

|

)

|

|

Adjustments to reconcile net earnings (loss) to net cash provided by

operating activities:

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

53,583

|

|

|

64,665

|

|

|

Compensation expense related to stock options

|

|

|

-

|

|

|

338,550

|

|

|

Change in clearing deposit

|

|

|

(1,919

|

)

|

|

(3,968

|

)

|

|

Change in commissions receivable

|

|

|

(32,651

|

)

|

|

62,545

|

|

|

Change in due from brokers

|

|

|

(11,107

|

)

|

|

26,321

|

|

|

Change in other assets

|

|

|

(55,118

|

)

|

|

(11,048

|

)

|

|

Change in accounts payable

|

|

|

5,752

|

|

|

8,442

|

|

|

Change in commissions payable

|

|

|

(23,504

|

)

|

|

23,373

|

|

|

Change in other liabilities

|

|

|

(85

|

)

|

|

397

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided (used) by operating activities

|

|

|

(64,088

|

)

|

|

146,451

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities consisting of purchases of

furniture, fixtures and equipment

|

|

|

(4,016

|

)

|

|

(3,749

|

)

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

Principal payments on mortgage note

|

|

|

(13,440

|

)

|

|

(12,564

|

)

|

|

Cash dividends paid on preferred stock

|

|

|

(60,548

|

)

|

|

(60,548

|

)

|

|

|

|

|

|

|

|

|

|

|

Net cash used by financing activities

|

|

|

(73,988

|

)

|

|

(73,112

|

)

|

|

|

|

|

|

|

|

|

|

|

Net change in cash

|

|

|

(142,092

|

)

|

|

69,590

|

|

|

|

|

|

|

|

|

|

|

|

Cash at beginning of year

|

|

|

1,118,542

|

|

|

1,048,952

|

|

|

|

|

|

|

|

|

|

|

|

Cash at end of year

|

|

$

|

976,450

|

|

$

|

1,118,542

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash paid for interest

|

|

$

|

83,778

|

|

$

|

85,211

|

|

See accompanying notes to financial statements.

-15-

WOODSTOCK FINANCIAL GROUP, INC.

Notes to Financial Statements

(1)

Description of Business and Summary of Significant Accounting Policies

Business

Woodstock Financial Group, Inc. (the “Company”) is a full service securities brokerage firm, which has been in business since 1995. The Company is registered as a broker-dealer with the Financial Regulatory Authority (“FINRA”) in 50 states, Puerto Rico, Washington D.C. and also as a municipal securities dealer with the Municipal Securities Regulation Board (“MSRB”). The Company is subject to net capital and other regulations of the U.S. Securities and Exchange Commission (“SEC”). The Company offers full service commission and fee-based money management services to individual and institutional investors. The Company maintains a custody-clearing relationship with Southwest Securities, Inc. In 2005, the Company, as a registered investment advisor, created a managed account program named “RFG Stars”. Through the RFG Stars Program, the Company provides investment advisory services to clients. RFG Stars Program client accounts are maintained with Fidelity Registered Investment Advisor Group (“FRIAG”), an arm of Fidelity Investments. FRIAG provides brokerage, custody, and clearing services to RFG Stars Program clients and Southwest Securities.

Basis of Presentation

The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America (“GAAP”) and to general practices within the broker-dealer industry. The preparation of financial statements in conformity with GAAP requires the Company’s management to make estimates and assumptions that affect the amounts reported in the financial statements. Actual results could differ from these estimates.

Revenue Recognition and Commissions Receivable

Commissions represent transactions processed and net fees charged to customers per transaction for buy and sell transactions processed. Commissions are recorded on a settlement date basis, which does not differ materially from trade date basis.

Building and Furniture, Fixtures and Equipment

Building, furniture, fixtures and equipment are reported at cost less accumulated depreciation. Depreciation is computed primarily by the straight-line method over the estimated useful lives of the assets as shown below:

|

|

|

|

Furniture

|

5 – 7 years

|

|

Equipment

|

3 years

|

|

Building

|

39 years

|

The cost of maintenance and repairs which do not improve or extend the useful life of the respective asset is charged to earnings as incurred, whereas significant renewals and improvements are capitalized.

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Additionally, the recognition of future tax benefits, such as net operating loss carryforwards, is required to the extent that realization of such benefits is more likely than not. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which the assets and liabilities are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income tax expense in the period that includes the enactment date.

In the event the future tax consequences of differences between the financial reporting bases and the tax bases of the Company’s assets and liabilities results in deferred tax assets, an evaluation of the probability of being able to realize the future benefits indicated by such asset is required. A valuation allowance is provided for the portion of the deferred tax asset when it is more likely than not that some portion or all of the deferred tax asset will not be realized. In assessing the realizability of the deferred tax assets, management considers the scheduled reversals of deferred tax liabilities, projected future taxable income, and tax planning strategies.

-16-

WOODSTOCK FINANCIAL GROUP, INC.

Notes to Financial Statements, continued

(1)

Description of Business and Summary of Significant Accounting Policies, continued

Treasury Stock

Treasury stock is accounted for by the cost method. Subsequent reissuances are accounted for at average cost.

Net Earnings Per Share

During the years ended December 31, 2008 and 2007, the Company had potential common stock issuances outstanding totaling 865,000 shares related to preferred stock and warrants. As of December 31, 2008, all warrants had expired. The effect of the remaining convertible preferred stock issuances would be antidilutive because the exercise price is more than the fair value of the stock. The effect of these potential common stock issuances has been excluded from the computation of net earnings per share for each year. Additionally, as of December 31, 2008, the Company had options outstanding. The effect of these options was not considered due to their antidilutive effect. Presented below is a summary of earnings per share for the years ended December 31, 2008 and 2007:

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

|

2007

|

|

|

Weighted average common shares outstanding

|

|

|

17,619,028

|

|

|

17,619,028

|

|

|

Net earnings (loss)

|

|

$

|

961

|

|

$

|

(362,826

|

)

|

|

Preferred stock dividend

|

|

|

(60,548

|

)

|

|

(60,548

|

)

|

|

Net loss attributable to common shareholders

|

|

$

|

(59,587

|

)

|

$

|

(423,374

|

)

|

|

Net loss per common share

|

|

$

|

(.00

|

)

|

$

|

(.02

|

)

|

Stock-Based Compensation

The Company sponsors a stock-based incentive compensation plan for the benefit of certain employees. The Company accounts for this plan under the recognition and measurement principles of Statement of Financial Accounting Standard No. 123 “Share-Based Payment” (SFAS No. 123(R)).

Recent Accounting Pronouncements

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles” (SFAS 162). This standard identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with GAAP. SFAS 162 is effective as of November 15, 2008. The adoption of this standard did not have an effect on our financial position or results of operations.

The following accounting standards that have been issued or proposed by the Financial Accounting Standards Board and other standard setting entities that do not require adoption until a future date are not expected to have a material impact on the Company’s financial statements upon adoption.

In December 2007, the FASB issued SFAS No. 141(R) “Business Combinations.” This Statement replaces the original SFAS No. 141. This Statement retains the fundamental requirements in SFAS No. 141 that the acquisition method of accounting (which SFAS No. 141 called the

purchase method

) be used for all business combinations and for an acquirer to be identified for each business combination. The objective of SFAS No. 141(R) is to improve the relevance, and comparability of the information that a reporting entity provides in its financial reports about a business combination and its effects. To accomplish that, SFAS No. 141(R) establishes principles and requirements for how the acquirer:

a. Recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree.

b. Recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase.

c. Determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination.

-17-

WOODSTOCK FINANCIAL GROUP, INC.

Notes to Financial Statements, continued

(1)

Description of Business and Summary of Significant Accounting Policies, continued

Recent Accounting Pronouncements, continued

This Statement applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008 and may not be applied before that date. The Company does not expect that its adoption of SFAS No. 141(R) will have a material effect on the results of operations and financial condition.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements — an amendment of ARB No. 51” (SFAS 160). The purpose of SFAS 160 is to improve relevance, comparability, and transparency of the financial information that a reporting entity provides in its consolidated financial statements by establishing accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS 160 is effective for fiscal years beginning on or after December 15, 2008, with earlier adoption prohibited. The Company does not expect the adoption of this standard to have an effect on its financial position or results of operations.

(2)

Related Party Transactions

The majority shareholder receives consulting fees in the amount of $130,000 annually. In addition, the Company pays a bonus equal to 2.5% of revenues to the majority shareholder. The majority shareholder’s spouse also receives consulting fees of $120,000 annually. During the year ended December 31, 2008 and 2007, the majority shareholder earned a bonus of $201,040 and $202,919, respectively.

In 2004, the Company entered into an agreement with Pea Pod Consulting, Inc., which is owned by a former member of the Company’s Board of Directors. This agreement called for annual consulting fees for services related to regulatory compliance and other operational issues totaling $84,000, of which a total of $35,538 was paid during 2007. The agreement with Pea Pod Consulting, Inc. was terminated voluntarily effective April 20, 2007.

(3)

Net Capital Requirements

The Company is subject to the SEC Uniform Net Capital Rule (SEC Rule 15c3-1), which requires the maintenance of minimum net capital and requires that the ratio of aggregate indebtedness to net capital, both as defined, shall not exceed 15 to 1 (and the rule of the “applicable” exchange also provides that equity capital may not be withdrawn or cash dividends paid if the resulting net capital ratio would exceed 10 to 1). At December 31, 2008, the Company had net capital of $1,154,756, which was $1,054,756 in excess of its required net capital of $100,000. The Company’s net capital ratio was 0.44 to 1.

(4)

Income Taxes

The components of income tax expense for the years ended December 31, 2008 and 2007 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

|

2007

|

|

|

Current

|

|

$

|

-

|

|

$

|

-

|

|

|

Deferred

|

|

|

(2,525

|

)

|

|

(134,027

|

)

|

|

Change in valuation allowance

|

|

|

2,525

|

|

|

134,027

|

|

|

|

|

$

|

-

|

|

$

|

-

|

|

-18-

WOODSTOCK FINANCIAL GROUP, INC.

Notes to Financial Statements, continued

(4)

Income Taxes, continued

The difference between income tax expense computed by applying the statutory federal income tax rate to earnings before taxes for the years ended December 31, 2008 and 2007 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

|

2007

|

|

|

Pretax income (loss) at statutory rate

|

|

$

|

327

|

|

$

|

(123,361

|

)

|

|

State income tax, net of federal benefit

|

|

|

38

|

|

|

(14,512

|

)

|

|

Other

|

|

|

(2,890

|

)

|

|

3,846

|

|

|

Change in valuation allowance

|

|

|

2,525

|

|

|

134,027

|

|

|

|

|

$

|

-

|

|

$

|

-

|

|

The following summarizes the components of deferred taxes at December 31, 2008 and 2007.

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

|

2007

|

|

|

Deferred income tax assets:

|

|

|

|

|

|

|

|

|

Operating loss carryforwards

|

|

$

|

325,403

|

|

$

|

327,928

|

|

|

Stock based compensation expense

|

|

|

128,649

|

|

|

128,649

|

|

|

Total gross deferred income tax assets

|

|

|

454,052

|

|

|

456,577

|

|

|

Less valuation allowance

|

|

|

(454,052

|

)

|

|

(456,577

|

)

|

|

Net deferred tax asset

|

|

$

|

-

|

|

$

|

-

|

|

During 2008 and 2007, a valuation allowance was established for the entire amount of the net deferred tax asset, as the realization of the deferred tax asset is dependent on future taxable income.

At December 31, 2008, the Company had net operating loss carryforwards for tax purposes of approximately $862,000 which will expire beginning in 2016 if not previously utilized.

(5)

Long Term Debt

The Company closed on the purchase of its office building on May 25, 2006 for a total cost of $1,273,455, financing it with a $1,000,000 loan with a 5-year balloon amortized on a 25-year basis, at a fixed rate interest rate of 8.610%.

Subsequent to the closing of this commercial property purchase the Company pays a monthly condo association fee. Total fees paid during each of 2008 and 2007 totaled $50,400.

Scheduled principal payments due on debt outstanding as of December 31 are as follows:

|

|

|

|

|

|

|

2009

|

|

$

|

14,872

|

|

|

2010

|

|

|

16,205

|

|

|

2011

|

|

|

936,331

|

|

|

|

|

$

|

967,408

|

|

(6)

Selling, General and Administrative Expenses

Components of selling, general and administrative expenses, which are greater than 1% of total revenues for the years ended December 31, 2008 and 2007, are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

|

2007

|

|

|

Consultant fees

|

|

$

|

629,619

|

|

$

|

604,406

|

|

|

Compensation

|

|

|

460,513

|

|

|

411,212

|

|

|

Compensation expense related to stock options

|

|

|

-

|

|

|

338,550

|

|

|

Errors & omissions insurance

|

|

|

136,435

|

|

|

116,257

|

|

|

Legal and professional fees

|

|

|

125,153

|

|

|

133,386

|

|

-19-

WOODSTOCK FINANCIAL GROUP, INC.

Notes to Financial Statements, continued

(7)

Shareholders’ Equity

Stock Option Plan

The Company sponsors an incentive stock option plan for the benefit of certain employees in order that they might purchase Company stock at a certain price. Initially, a total of 800,000 shares of the Company’s common stock were reserved for possible issuance under this plan. In May 2007, the Board of Directors approved increasing the total shares available for potential future option grants to approximately 6.9 million shares, from which 2,257,000 options were granted in 2007. There were no stock options granted during 2008.

Stock Option Plan, continued

During July 2007, the Company granted a total of 2,257,000 options to certain brokers with a strike price of $.01 where the market value of the Company’s stock was $.15 per share at the time of grant. These options vested immediately, and the Company recognized expense related to these options of $338,550. The fair value of these options, using the Black-Scholes pricing model was $.15 per share.

A summary of activity in the stock option plan is presented below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

|

Weighted

|

|

|

|

Weighted

|

|

|

|

|

|

Average

|

|

|

|

Average

|

|

|

|

|

|

Price

|

|

|

|

Price

|

|

|

|

Shares

|

|

Per Share

|

|

Shares

|

|

Per Share

|

|

Outstanding, beginning of year

|

|

2,257,000

|

|

|

$ .01

|

|

|

-

|

|

|

$ -

|

|

|

Granted during the year

|

|

-

|

|

|

-

|

|

|

2,257,000

|

|

|

.01

|

|

|

Cancelled during the year

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

Exercised during the year

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding and exercisable, end of year

|

|

2,257,000

|

|

|

$ .01

|

|

|

2,257,000

|

|

|

$ .01

|

|

The total intrinsic value of options outstanding and exercisable as of December 31, 2008 and 2007 was $4,502 and $315,980, respectively.

The Company used the following assumptions in estimating the fair value of the option awards:

|

|

|

|

|

|

|

Expected volatility

|

|

|

.5%

|

|

|

Risk-free interest rate

|

|

|

4.99%

|

|

|

Expected life

|

|

|

10 years

|

|

|

Dividend yield

|

|

|

0%

|

|

Perpetual Preferred Stock

The Preferred Stock pays a cumulative annual dividend of $.70 per share. Each share of Preferred Stock is convertible into five shares of common stock at the option of the holder. Each share of Preferred Stock is mandatorily convertible into five shares of common stock upon the filing of a public offering registration statement or a change in control (as defined). The Company may redeem the Preferred Stock by giving 30-day’s notice to the preferred stockholders for a redemption price of $10.00 per share, plus unpaid dividends through the redemption date. Upon voluntary or involuntary dissolution of the Company, the preferred stockholders will receive $10.00 per share prior to the distribution of any amounts to common shareholders. The Preferred Stock has no voting rights. As of December 31, 2008 and 2007, there were no preferred dividends in arrears.

(8)

Employee Retirement Plan

The Company has established a Savings Incentive Match Plan for Employees of Small Employers (SIMPLE IRA). Employees who receive at least $5,000 of compensation for the calendar year are eligible to participate. The Company matches employee contributions dollar for dollar up to three percent of the employee’s compensation. Total contributions for any employee are limited by certain regulations. During 2008 and 2007, the Company contributed approximately $9,500 and $9,900, respectively, to the plan.

-20-

SUPPLEMENTAL

SCHEDULE

-21-

WOODSTOCK FINANCIAL GROUP, INC.

(formerly Raike Financial Group, Inc.)

Supplemental Schedule

Computation of Net Capital Under Rule 15c3-1 of

the Securities and Exchange Commission

December 31, 2008

|

|

|

|

|

|

|

|

|

|

|

Computation of Net Capital:

|

|

|

|

|

|

|

|

|

|

Total shareholders’ equity

|

$

|

1,464,999

|

|

|

Non-allowable assets

|

|

(310,242

|

)

|

|

|

|

|

|

|

Tentative net capital

|

|

1,154,757

|

|

|

Unsecured debits

|

|

-

|

|

|

|

|

|

|

|

Net capital

|

|

1,154,757

|

|

|

|

|

|

|

|

Minimum net capital

|

|

100,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Excess net capital

|

$

|

1,054,757

|

|

|

|

|

|

|

|

Aggregate Indebtedness to Net Capital Ratio:

|

|

|

|

|

Aggregate indebtedness

|

$

|

507,890

|

|

|

|

|

|

|

|

Net capital

|

$

|

1,154,757

|

|

|

|

|

|

|

|

Ratio

|

|

0.44 to 1

|

|

|

|

|

|

|

|

There was no significant difference between net capital as computed by the Company

|

|

|

|

|

(included in Part II of its FOCUS report as of December 31, 2008) and the amount

|

|

|

|

|

computed above.

|

|

|

|

-22-

ITEM 9.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A.

CONTROLS AND PROCEDURES

As of the end of the period covered by this report, our management, including our Chief Executive Officer and Chief Financial Officer, reviewed and evaluated the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Exchange Act Rule 15d-15. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures are effective in timely alerting them to material information relating to the Company that is required to be included in our periodic filings with the Securities and Exchange Commission. There have been no significant changes in our internal controls or, to management’s knowledge, in other factors that could significantly affect those internal controls subsequent to the date we carried out our evaluation, and there has been no corrective actions with respect to significant deficiencies or material weaknesses.

Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-5(f) under the Exchange Act). Our management assessed the effectiveness of our internal control over financial reporting as of December 31, 2008. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control-Integrated Framework. Our management has concluded that, as of December 31, 2008, our internal control over financial reporting is effective based on these criteria. This annual report does not include an attestation report of Woodstock Financial Group, Inc.’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by Woodstock Financial Group, Inc.’s independent registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit Woodstock Financial Group, Inc. to provide only management’s report in this annual report.

Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that our internal control over financial reporting will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within Woodstock Financial Group, Inc. have been detected Woodstock Financial Group, Inc.’s internal control over financial reporting, however, are designed to provide reasonable assurance that the objectives of internal control over financial reporting are met.

ITEM 9B.

OTHER INFORMATION

None.

-23-

PART III

ITEM 10.

DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

Set forth below is information regarding our directors and executive officers. We have no other management employees besides those described below, and there are currently no other persons under consideration to become directors or executive officers.

|

|

|

|

|

|

|

NAME

|

|

AGE

|

|

POSITION

|

|

William J. Raike, III

|

|

50

|

|

Chairman, President and CEO

|

|

Melissa L. Whitley

|

|

32

|

|

Treasurer, CFO and Director

|

|

Morris L. Brunson

|

|

69

|

|

Director

|

|

William D. Bertsche

|

|

64

|

|

Director

|

|

Geoffrey T. Chalmers

|

|

73

|

|

Director

|

The Board of Directors has designated an Audit Committee of the Board of Directors consisting of one member, that will review the scope of accounting audits, review with the independent auditors the corporate accounting practices and policies and recommend to whom reports should be submitted within the Company, review with the independent auditors their final report, review with independent auditors overall accounting and financial controls, and be available to the independent auditors during the year for consultation purposes. The Board of Directors has also designated a Compensation Committee of the Board of Directors consisting of three Directors, which will review the performance of senior management, recommend appropriate compensation levels and approve the issuance of stock options pursuant to the Company's stock option plan. All Directors and officers of the Company serve until their successors are duly elected and qualify.

The Audit Committee consists of Morris Brunson.

The Compensation Committee consists of Morris Brunson, William Raike, and William Bertsche.

William J. Raike, III, Chairman, President and CEO