UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10/A

Amendment No. 1

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

43-2041643

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

26497 Rancho Parkway South

Lake Forest, CA

|

|

92630

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (855) 266-4663

Securities to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

to be so registered

|

|

Name of each exchange on which

each class is to be registered

|

|

None

|

|

None

|

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

þ

|

|

(Do not check if a smaller reporting company)

|

|

|

SearchCore, Inc.

Table of Contents

Form 10

|

Item 1.

|

Business.

|

|

|

3

|

|

|

|

|

|

|

|

|

|

Item 1A.

|

Risk Factors.

|

|

|

19

|

|

|

|

|

|

|

|

|

|

Item 2.

|

Financial Information.

|

|

|

27

|

|

|

|

|

|

|

|

|

|

Item 3.

|

Properties.

|

|

|

49

|

|

|

|

|

|

|

|

|

|

Item 4.

|

Security Ownership of Certain Beneficial Owners and Management.

|

|

|

50

|

|

|

|

|

|

|

|

|

|

Item 5.

|

Directors and Executive Officers.

|

|

|

51

|

|

|

|

|

|

|

|

|

|

Item 6.

|

Executive Compensation.

|

|

|

52

|

|

|

|

|

|

|

|

|

|

Item 7.

|

Certain Relationships and Related Transactions, and Director Independence.

|

|

|

54

|

|

|

|

|

|

|

|

|

|

Item 8.

|

Legal Proceedings.

|

|

|

56

|

|

|

|

|

|

|

|

|

|

Item 9.

|

Market Price of and Dividends on the Registrants Common Equity and Related Stockholder Matters.

|

|

|

56

|

|

|

|

|

|

|

|

|

|

Item 10.

|

Recent Sales of Unregistered Securities.

|

|

|

57

|

|

|

|

|

|

|

|

|

|

Item 11.

|

Description of Registrants Securities to be Registered.

|

|

|

59

|

|

|

|

|

|

|

|

|

|

Item 12.

|

Indemnification of Directors and Officers.

|

|

|

60

|

|

|

|

|

|

|

|

|

|

Item 13.

|

Financial Statements and Supplementary Data.

|

|

|

60

|

|

|

|

|

|

|

|

|

|

Item 14.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

|

|

60

|

|

|

|

|

|

|

|

|

|

Item 15.

|

Financial Statements and Exhibits.

|

|

|

63

|

|

This Registration Statement on Form 10 includes forward-looking statements within the meaning of the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on management’s beliefs and assumptions, and on information currently available to management. Forward-looking statements include the information concerning possible or assumed future results of operations of the Company set forth under the heading “Management Discussion and Analysis.” Forward-looking statements also include statements in which words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “consider,” or similar expressions are used.

Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions. The Company’s future results and shareholder values may differ materially from those expressed in these forward-looking statements. Readers are cautioned not to put undue reliance on any forward-looking statements.

Item 1. Business.

Overview

We, together with our wholly owned subsidiaries, are engaged in developing, operating and monetizing websites that focus on specific niche industries, also known as vertical finder websites or finder sites. We currently are either developing finder sites, or providing marketing services on our existing finder sites, in the recreational sports, prefabricated home, and tattoo industries. We provide finder site services in three different sectors: media, technology, and marketing. All of our operations are conducted through our wholly-owned subsidiaries, each of which is incorporated or qualified to do business in the states in which it does so.

We specialize in connecting consumers with brands, products, and services through highly specific search-driven internet marketing finder sites. We develop and operate vertical finder websites in business-to-business and business-to-consumer markets. Our finder websites include content and resources that are relevant to an internet searcher’s specific query. From local merchants to national brands, we monetize internet search traffic through measurable lead generation, premium listings and highly targeted impression based advertising. Our methodology and technology are geared towards marketing to fragmented, disjointed, niche markets that are largely overlooked by our competitors, and we strive to build the number one or number two vertical finder website as defined by unique monthly visits in a given industry.

Our Technology And Sales Platform

Our business model of creating and monetizing a highly successful finder site was proven with the acquisition, development, and monetization of WeedMaps.com, which we sold in December 2012. WeedMaps grew from zero to $1.5 million in revenues per month and controlled a substantial percentage of its search market. The same technology knowhow, combined with our telemarketing sales platform, are currently being used to grow our new industry verticals.

We have now assembled and are in the processes of executing on a portfolio of domain names in a variety of industry verticals, including tattoos, recreational sports, and prefabricated housing with the goal of creating a large network of finder sites built upon the same technological platform and telemarketing system.

Vertical Finder Sites

The rapid development and evolution of the Internet and Internet search engines and their impact on e-commerce have enabled most businesses to overcome geographical barriers and sell products and services locally, regionally, nationally, and/or worldwide. At the same time, barriers to entry in e-commerce have fallen rapidly. Consequently, businesses have increased their online presence in an effort to more directly market to consumers. The Internet is now widely considered a catalyst for consumers who avail themselves of the abundant amount of products and services information along with consumer reviews. This abundance of products and services creates niche search markets. For example, a consumer may go on to a popular search engine like google.com or bing.com and search for sneakers in their respective neighborhood. The consumer will likely get hundreds of search results with a wide range of relevant and irrelevant options. Our goal is to eliminate the confusion currently in the marketplace as it relates to industries we have identified, and provide the user with more accurate information in a shorter period of time.

Our vertical finder sites act as information marketplaces which provide detailed, focused and relevant information specific to the product or service that a consumer is searching. We focus on becoming a top ranked website on all major search engines within a specific industry. We acquire premium domains in niche verticals, develop relevant content and resources as it relates to that specific industry, and execute campaigns within search engines to capture traffic.

For consumers, our vertical finder sites are designed to provide the technological means necessary to quickly search information in order to get their desired results. Our finder sites aggregate detailed data and information about specific businesses and products, along with reviews by other consumers, all of which when taken together create content in a value-added, engaging experience.

For business owners, our vertical finder sites provide a simple means to outsource their internet traffic aggregation and online marketing advertising. Our finder sites manage various internet marketing tactics on behalf of our clients including Search Engine Optimization (SEO) and Search Engine Management (SEM). This process helps to increase the ranking of the finder site which makes the site easily accessible to prospective consumers. In short, we assist business owners in focusing on their core product or service while alleviating the technological challenges associated with search engine optimization. Our finder sites help to narrow down the target market only to those individuals that are highly targeted for a business owner – the exact person that the business wants to reach.

How We Use Domain Names

We currently own over 150 domains names. Some of our domain names are “Premium Domains” which means that they have a greater value than most domains in that specific industry. A substantial portion of our domain names were purchased in order to drive traffic to the premium domains. We actively pursue and purchase many domain names in a given niche industry which we then use to disseminate into the virtual world. Utilizing a large number of domain names to capture users is similar to utilizing a large internet traffic net. Our goal is to capture only the most relevant consumers and thereby increasing the quality of prospective customer for the business owner.

How We Generate Revenue

We generate revenue through attracting internet and mobile searchers to our internet properties. The users then frequent our clients who pay us a fee to list on our site.

The Internet is a catalyst for consumers who are looking to make a purchase. We are able to attract consumers to our finder sites by becoming a top ranking website on one or more of the major search engine such as Google, Yahoo! or Bing. We charge our clients a fee to market their brands, products or services, place ads, and to create photo and video content, all of which are displayed on our finder sites. Once a client has subscribed, we offer various packages to our clients that serve to increase their exposure and thus increase the likelihood of connecting more consumers with their respective brand, product or service. This continual process makes our finder sites even more compelling to consumers searching on the internet.

Our Revenue Model Remains the Same

Our Internet properties generate revenues from merchants and advertisers within the industry verticals served. This is the revenue model we employed with WeedMaps.com and is the same revenue model we employ with our current finder sites. The revenue model follows a subscription-based approach, generating recurring monthly revenue from a variety of different package listings, lead generation and advertising.

Subscribers

Our clients are businesses and merchants wishing to leverage the power of the Internet to connect their brand, product or service to their customers. One of the primary methods for us to convert clients to a “paying” status, or to become a subscriber, is to allow clients to list and have minimal exposure on our site without paying a fee. Historically, once a client is represented on our site with an icon or listing, then that client begins to experience increase traffic to their brand, product or service. As a result, the client typically desires to convert into a paying customer, increasing their exposure on our site, and increasing the traffic to their location. This model is often referred to as a “freemium” type model which allows our clients to try our services before they subscribe. Businesses can utilize our marketing services for a period of time to gain first-hand exposure to our finder sites’ capabilities. We then create a fee-based monthly subscription agreement with the business. As time goes on, we have the ability to introduce various add-on packages that increase our client’s exposure, driving even more customer traffic to their businesses. In addition to the basic traffic-based programs, ancillary add-on packages and services are also available. These additional services will vary by industry segment, but can be highly valuable to a business. For example, we offer businesses advertising packages that can include banner ads placed on our finder sites, emails, texts, special promotions and events, as well as photo and video production of content such as virtual tours of our client’s establishments and products, which are then displayed on our finder websites.

The terms for advertising on the site are typically month to month. In general, clients begin in a lower advertising tier and then move up advertising tiers as their exposure and associated foot traffic increase.

Regions and Geographic Areas

We typically market our services based on geographic regions. For example, for any given geographic region, we will typically have a listing results page on our finder site that can display up to a certain number of subscriber locations and an unlimited amount of non-paying client listings. Subscribers, in most cases, are provided page one placement, meaning subscribers’ business listings will be among the first listings within the search results on our finder sites. At the end of a given month, if the subscriber count is above a certain number, then the respective regional listing page is typically divided into smaller regions, provided it does not detract from the user experience and in effect creating more revenue generating opportunities for us. In this fashion, the more subscribers we have within a given geographic region, the better and more relevant the information on our finder site becomes, the better value received by visitors to our finder sites, which then generates more page views, and the more sub-regions we create and thus more revenue generating opportunities for us.

Advertising Package Tiers

For our finder sites we typically create advertising package tiers in order to more easily distinguish the different services we offer at different price points. The different advertising package tiers also makes it easy for our clients to distinguish which package tiers are premium and thus likely to generate more traffic to their brand, product or service. The range of prices we charge for each advertising package tier differs per each finder site, per region, and per each tier package. Each region is internally created by us based on geographic location, industry density and demographics.

Listing Revenue

We generate revenues from fees we charge clients to advertise or list their location, products, and services on one or more of our finder websites. We recognize as revenue the fees we charge customers that advertise or list their related company on our websites.

For example, our listing packages typically are made up of two groups, Premium Listings and Standard Listings. The most important distinction between Premium Listings and Standard Listing packages is typically positioning on our finder websites. This distinction is important because the business that appears first in an internet search results list has an increased likelihood of a website visitor clicking on that business and thus “converting” the website visitor to a potential customer for our client. In general, being in the top section of the search results on any of our finder websites for a given geographical region is deemed preferable because of the increased conversion rates (or click-through rates). As a result, we charge a premium dollar amount for a Premium Listing so that the client is placed in the top section of search results for a given region.

Standard Listing Packages are basic packages which typically allow a customer to list their brand, product, or service on one or more of our finder sites with the capability to edit their listing. A Standard Listing also typically allows a customer to add photos, create a menu, and respond to customer reviews, for example.

Advertising Revenue

We generate revenues from fees we charge customers for placing ads for their related companies on our websites (i.e. Advertising Packages). Our Advertising Packages can include banner ads placed on our finder sites, emails, texts, special promotions, and events. All of our Advertising Packages are considered Ad Revenue pursuant to our revenue recognition policy.

Content Production Revenue

We generate revenues from photo and video production of content which is displayed on our finder websites (i.e. Content Production). Typically, Content Production that we create on behalf of our clients is considered an add-on or ancillary service. We typically create video “virtual” tours of our client’s establishments and products, which are then displayed on our finder websites. We recognize as revenue the fees we charge customers for photo and video production services. All of our Content Production services are considered Content Production Revenue pursuant to our revenue recognition policy.

How Our Finder Sites Generate Or Will Generate Revenue

Tattoo.com

The Tattoo.com revenue model follows a subscription-based approach, generating recurring monthly revenue from Standard Listings, lead generation and advertising. We have recently begun offering Premium Listings. In particular, Tattoo.com generates revenues from fees we charge clients in which the clients advertise or list their location, products, and services on tattoo.com. We also expect to generate revenues from advertising and content production in which we charge clients for placing ads for their related companies on our websites, which can include banner ads, emails, texts, special promotions and events, and for photo and video production services in which we charge clients for creating virtual tours of our client’s establishments and products, which are then displayed on Tattoo.com.

ManufacturedHomes.com and ModularHomes.com

ManufacturedHomes.com and ModularHomes.com are currently under development. We anticipate that the ManufacturedHomes.com and ModularHomes.com revenue models will also follow a subscription-based approach, generating recurring monthly revenue for Standard and Premium Listings, lead generation and advertising. In particular, ManufacturedHomes.com and ModularHomes.com will generate revenues from fees we charge clients in which the clients advertise or list their location, products and services on ManufacturedHomes.com and/or ModularHomes.com. We also expect to generate revenues from advertising and content production in which we charge clients for placing ads for their related companies on ManufacturedHomes.com and/or ModularHomes.com, which can include banner ads, emails, texts, special promotions and events, and for photo and video production services in which we charge clients for creating virtual tours of our client’s establishments and products, which are then displayed on ManufacturedHomes.com and/or ModularHomes.com.

Sportify.com

Sportify.com is currently under development. The Sportify.com revenue model will also follow a subscription-based approach, generating recurring monthly revenue from fees we charge our customers for a full feature set of functionality on the website and app. As with our other finder sites, we will offer consumers the ability to utilize it for free with limited functions or pay a subscription fee and gain greater access to a full set of features.

Once Sportify.com attains a certain number of monthly page views, we will then begin approaching sporting goods manufacturers and retailers and offering them advertising packages. We anticipate that Sportify.com will generate revenues from fees we will charge sporting goods manufacturers and retailers to advertise or list their location, products and services on Sportify.com. We intend to also approach corporations, universities and colleges, and introduce Sportify.com as a method to more efficiently schedule, organize and collect fees for respective recreational events at their businesses, facilities or schools.

Karate.com and Rodeo.com

The Karate.com and Rodeo.com websites are currently under development. We expect that their revenue models will also follow a subscription-based approach similar to our other finder sites, generating recurring monthly revenue for premium package listings, lead generation and advertising. We anticipate that Karate.com and Rodeo.com will generate revenues from fees that we will charge clients to advertise or list their location, products and services on Karate.com and/or Rodeo.com. We also expect to generate revenues from advertising and content production in which we will charge clients for placing ads for their related companies on Karate.com and/or Rodeo.com, which can include banner ads, emails, texts, special promotions and events. We will also charge a fee for photo and video production services. Specifically, we will charge clients for creating virtual tours of their respective establishments, and that video will then be displayed on Karate.com and/or Rodeo.com.

WeedMaps Media, Inc.

On November 19, 2010, we acquired WeedMaps, LLC, which was merged with and into WeedMaps Media, Inc., our wholly-owned subsidiary. Prior to the sale of WeedMaps Media, Inc., on December 31, 2012, our first finder site,

www.weedmaps.com

, focused primarily on dispensaries in the medicinal cannabis industry. We were never engaged in the growing, harvesting, cultivation, possession, or distribution of cannabis. Instead, we focused on developing our finder site technology and associated business model which could then be implement in a myriad of industries. We no longer have any clients related to the medicinal cannabis industry and we do not anticipate operating in or returning to the medicinal cannabis industry in the future.

Recent Name Change

Effective on January 6, 2012, we changed our name to SearchCore, Inc. from General Cannabis, Inc. This change was to more accurately reflect the technology aspect of our business and our focus on developing our finder site platform.

Corporate Information

SearchCore, Inc. was formed on July 14, 2003 in the State of Nevada as Tora Technologies, Inc. On November 21, 2006, we changed our name to Makeup.com Limited, on January 29, 1010, we changed our name to LC Luxuries Limited, and on November 5, 2010, we changed our name to General Cannabis, Inc.

On

January 6, 2012, we changed our name to SearchCore, Inc.

Our corporate headquarters are located at 26497 Rancho Parkway South, Lake Forest, California, 92630, and our telephone number is (855) 266-4663. Our website is

www.searchcore.com

. Information contained on our website is not incorporated into, and does not constitute any part of, this registration statement.

Description of Business

Our core service is to connect consumers with brands, products and services via our finder sites. We specialize in creating, operating and monetizing vertical finder sites. We identify niche, fragmented and/or disjoined markets, and attempt to capitalize on those markets by incorporating our existing platform as it relates to technology, marketing, advertising and sales. We only pursue markets in which we anticipate we will be the among the top finder sites in any respective industry. This includes marketing and services in both the business-to-business and the business-to-consumer marketplaces. When a consumer or business utilizes one of our finder sites, they are searching primarily for specific products, related items, social engagement, and/or reviews. Initially, we may waive all or a portion of advertising or marketing fees to clients who subscribe with us and market their brand, product or service on our finder sites. Once a client has subscribed with us then we offer various marketing packages that serve to increase the exposure of their business and thus increase the likelihood of connecting more consumers with their brand, product or service. We charge a fee for these various services. The fee varies depending on the service we provide. We believe that the previous success of our first finder site will enable us to continue and expand into other markets we believe has high growth potential.

Our Principal Services

Our principal services are offered through the following wholly owned subsidiaries:

Sports Asylum, Inc.

VerticalCore Management, Inc.

VerticalCore Solutions, Inc.

VerticalCore Merchant, Inc.

Other Subsidiaries

We have four additional wholly-owned subsidiaries whose operations have been discontinued. These are

General Marketing Solutions, Inc.

,

General Merchant Solutions, Inc.

,

General Processing Corporation

, and

LV Luxuries Incorporated

(which operated as makeup.com). A

s of right now, we have no imminent or specific plans for any of these entities and they are held as corporations in good standing with no operations.

Recent Acquisitions

WeedMaps, LLC

On November 19, 2010, we entered into an Agreement and Plan of Reorganization and Merger pursuant to which we acquired 100% of the membership interests of WeedMaps, LLC, a Nevada limited liability company, which was merged with and into WeedMaps Media, Inc., our wholly-owned subsidiary at the time. Prior to the acquisition of WeedMaps, LLC, SearchCore, Inc. was deemed to be a non-operating public shell corporation with nominal net assets and WeedMaps, LLC was a private operating company

with significant operations. F

or accounting purposes the transaction was considered to be a reverse merger treated as a recapitalization of SearchCore where SearchCore was the surviving legal entity

and the accounting acquiree

, and WeedMaps, LLC was considered to be the accounting acquirer and

the legal acquiree

.

On December 31, 2012, WeedMaps Media, Inc. was sold to a third party.

Synergistic Resources, LLC

On December 3, 2010, we entered into a Reorganization and Asset Acquisition Agreement pursuant to which we acquired substantially all the assets of Synergistic Resources, LLC, a California limited liability company. The assets consisted primarily of the intellectual property and established marketing associated with the name Marijuana Medicine Evaluation Centers, including its website (

www.marijuanamedicine.com

), and the assignment of a Management Services Agreement pursuant to which we ultimately managed fourteen (14) medicinal cannabis medical clinics. This business was operated as General Health Solutions, Inc., and has since been discontinued.

Revyv, LLC

On January 11, 2011, we entered into a Reorganization and Asset Acquisition Agreement pursuant to which we acquired substantially all the assets of Revyv, LLC. The assets consisted primarily of the intellectual property associated with the name CannabisCenters, including its website (

www.cannabiscenters.com

), its related physician software and patient verification system, and numerous existing contracts.

This business was operated as General Marketing Solutions, Inc. and the assets were sold

with WeedMaps Media, Inc.

on December 31, 2012.

Marijuana.com

On November 18, 2011, we entered into a Domain Name Purchase Agreement with an unrelated party for the purchase of the domain name

www.marijuana.com

. On December 31, 2012, the domain name was sold with WeedMaps Media, Inc.

MMJMenu, LLC

On January 5, 2012, WeedMaps Media, Inc. acquired substantially all the assets of MMJMenu, LLC. The assets consist primarily of the intellectual property associated with MMJMENU, including its website (

www.mmjmenu.com

), point-of-sale software, a variety of related websites, and its customers. On December 31, 2012, the assets were sold with WeedMaps Media, Inc.

ManufacturedHome.com, ManufacturedHomes.com and ManufacturedHouse.com

On August 2, 2012, we entered into a Domain Name Purchase Agreement pursuant to which we purchased the domain names known as

www.manufacturedhome.com

and

www.manufacturedhouse.com

, for total consideration of Fifty Thousand Dollars ($50,000), paid at closing.

On August 16, 2012, we entered into a Domain Name Purchase Agreement pursuant to which we purchased the domain name known as

www.manufacturedhomes.com

, for total consideration of One Hundred Thirty Thousand Dollars ($130,000), paid at closing.

Rodeo.com and Karate.com

On August 7, 2012, we entered into a Domain Name Purchase Agreement and a Non-Recourse Secured Promissory Note with Domain Holdings, Inc., an Alberta corporation, pursuant to which we purchased the domain names known as

www.rodeo.com

and

www.karate.com

, for total consideration of Five Hundred Thousand Dollars ($500,000), with the entire purchase price represented by the Note.

On October 25, 2012, we amended the Purchase Agreement and the Note. Pursuant to the terms of the amendments, we agreed to make payments of Fifty Thousand Dollars ($50,000) on each of August 15, 2012 and November 1, 2012, which we did. The balance of $400,000 is to be paid in eighteen (18) equal monthly installments of Twenty Two Thousand Two Hundred Twenty Two Dollars ($22,222) beginning June 1, 2013, and continuing on the first (1st) day of each month thereafter.

Additional Domain

August 24, 2012, we entered into a Domain Names Purchase Agreement with High Level Technologies, Inc. pursuant to which we purchased 57 domain names as set forth in the Agreement, for total consideration of One Hundred Thousand Dollars ($100,000), paid at closing.

On February 22, 2013, we purchased the domain name known as www.traveltrailer.com . The purchase price was $50,000, payable $15,000 at closing and $5,000 per month over seven (7) consecutive months.

On February 27, 2013, we purchased the domain name known as www.toyhaulers.com . The purchase price was $30,000, payable $15,000 at closing and $2,500 per month over six (6) consecutive months.

On December 31, 2012, we entered into a Securities Purchase Agreement by and among us, on the one hand, and Sports Asylum, Inc., a Nevada corporation, and its shareholders, Sabas Carrillo, an individual, and James Pakulis, an individual and one of our officers and directors, on the other hand. Pursuant to the agreement, upon the closing of the transaction, we purchased 100% of the issued and outstanding equity interests of Sports Asylum in exchange for (a) the cancellation of a previous Secured Promissory Note issued to Sports Asylum, entered into on or about August 22, 2012 and with an outstanding principal balance of Two Hundred Eighty Five Thousand Dollars ($285,000) and (b) Two Hundred Fifteen Thousand Dollars ($215,000) represented by promissory notes in the original principal amount of One Hundred Sixty One Thousand Two Hundred Fifty Dollars ($161,250) to Pakulis and Fifty Three Thousand Seven Hundred Fifty ($53,750) to Carrillo. The closing of the purchase took place on December 31, 2012.

Sports Asylum, Inc. owns and operates the intellectual property associated with

www.sportify.com

, and represents our introduction into the recreational sports industry.

Tattoo.com

On January 21, 2013, we entered into a Management Agreement with Tattoo Interactive, LLC pursuant to which we will perform various marketing, promotion, and website management services with respect to the domain name known as

www.tattoo.com

and the commercial website located at that domain. The Agreement has an initial term of twelve (12) months and shall automatically renew for successive one (1) year terms unless terminated in accordance with its terms. In the event we incur at least $25,000 in expenditures relating to the performance of the services in any single month, Tattoo Interactive shall pay us $10,000 as an expense-sharing allotment. Pursuant to the agreement, we will receive twenty percent (20%) of all advertising revenue (as defined therein), and after the payment of the advertising revenue, we will receive sixty five percent (65%) of all remaining designated gross revenue (as defined therein). We have a right of first refusal in the event Tattoo Interactive elects to sell the domain name, and in the event certain revenue goals, as set forth in the agreement, are satisfied, we will be granted certain equity interests in Tattoo Interactive.

Modularhomes.com

On January 25, 2013, we purchased the domain names known as

www.modularhomes.com

for total consideration of One Hundred Forty Thousand Dollars ($140,000), payable in down payment of Fifty Thousand Dollars ($50,000) and the balance over twelve (12) equal monthly payments.

Recent Divestitures

On February 1, 2010, we sold the domain name

www.makeup.com

, its associated domain names and certain intellectual property rights associated with these domain names for $2,000,000, of which we paid $200,000 in fees related to the sale, which resulted in proceeds to us of $1,800,000. We were in the business of selling beauty products, such as makeup and perfume, on the internet through the makeup.com website.

Sale of WeedMaps

On December 11, 2012, we entered into an Agreement and Plan of Reorganization by and among us and our wholly owned subsidiary, WeedMaps Media, Inc., a Nevada corporation, on the one hand, and RJM BV, a Dutch corporation, on the other hand. Pursuant to the Reorganization Agreement, upon the closing of the transaction, we sold WeedMaps to RJM in exchange for (a) Three Million Dollars ($3,000,000), represented by a secured promissory note, (b) the assumption by RJM of all of our various obligations to Douglas Francis, Justin Hartfield, and Keith Hoerling, and the assumption of our office lease in Newport Beach, California, and (c) Seven Hundred Fifty Thousand Dollars ($750,000) in cash (of which we withheld Five Hundred Thousand Dollars ($500,000) from WeedMaps at the closing and Two Hundred Fifty Thousand Dollars ($250,000) of which was to be paid to us on January 15, 2013, before the due date was extended to January 31, 2013). The closing of the sale took place on December 31, 2012.

As partial consideration under the Reorganization Agreement, RJM delivered a Secured Promissory Note in the original principal amount of Three Million Dollars ($3,000,000). The Note is secured by certain assets according to the terms of a Pledge and Security Agreement, which assets include all of the assets of WeedMaps Media, including but not limited to the URL known as

www.weedmaps.com

. Pursuant to the Note RJM will make the following payments: (1) Two Hundred Fifty Thousand Dollars ($250,000) on January 15, 2013 (which payment date was extended to January 31, 2013); One Hundred Thousand Dollars ($100,000) each month beginning February 25, 2013 and continuing on the twenty fifth (25th) of each month thereafter for a total of twenty eight (28) months; and Sixteen Thousand Five Hundred Dollars ($16,500) on July 25, 2015. Interest shall accrue on the outstanding principal amount on an annual basis at a rate of One and One Hundredth Percent (1.01%).

As further consideration under the Reorganization Agreement, RJM delivered documents sufficient (i) to transfer all of the obligations that we owed to Justin Hartfield arising out of the Global Securities Purchase, Consulting, and Resignation Agreement by and between us, WeedMaps, and Hartfield dated as of July 31, 2012, to RJM and to release us from all said obligations thereunder; (ii) to transfer all of the obligations that we owed to Douglas Francis arising out of the Global Securities Purchase and Resignation Agreement by and between us, WeedMaps, and Francis dated as of July 31, 2012, to RJM and to release us from all said obligations thereunder; (iii) to transfer all of the obligations that we owed to Keith Hoerling arising out of the Global Securities Purchase Agreement by and between the Company, WeedMaps, and Hoerling dated August 14, 2012, to RJM and to release us from all said obligations thereunder; (iv) for RJM to assume all of our obligations under that certain Office Lease Agreement by and between us and Redstone Plaza, LLC dated January 17, 2011; and (v) for RJM to assume all of our obligations under certain additional material agreements set forth on Schedule 2.1.16 of the Reorganization Agreement.

As further consideration under the Reorganization Agreement, we, along with our President and Chief Executive Office James Pakulis, and Brad Nelms, an employee of SearchCore, entered into a Non Competition Agreement whereby the bound parties agreed that they (i) will not disclose certain confidential information regarding the Business of WeedMaps; (ii) will not compete with the Business of WeedMaps; (iii) will not solicit, advise, provide or sell, directly or indirectly, any services or products of the same or similar nature to services or products of the Business of WeedMaps, to any client or prospective client of WeedMaps; (iv) will not solicit, request or otherwise attempt to induce or influence, directly or indirectly, any present client, distributor or supplier, or prospective client, distributor or supplier, of WeedMaps, to cancel, limit or postpone their business with WeedMaps, or otherwise take action which might be to the disadvantage of WeedMaps; and (v) will not hire or solicit for employment, directly or indirectly, or induce or actively attempt to influence, any employee, officer, director, agent, contractor or other business associate of WeedMaps (excluding employees prior to December 31, 2012), to terminate his or her employment or discontinue such person’s consultant, contractor or other business association with WeedMaps. The business of WeedMaps is defined in the Non-Competition Agreement as internet search and website operation for the medicinal cannabis industry.

Similarly, RJM, Douglas Francis, Justin Hartfield, and Keith Hoerling entered into a Non-Competition Agreement whereby they agreed not to compete with our business, described in the Non-Competition Agreement as internet search, internet advertising, and website operation for (a) the recreational sports industry, (b) the prefabricated housing industry, (c) the tattoo industry, and (d) other industries in which SearchCore and/or its affiliates operates, at the time of the Agreement or thereafter.

As further consideration under the Reorganization Agreement, we entered into an Assignment of Trademarks and an Assignment of Domain Names whereby we assigned certain trademarks and domain names to WeedMaps.

In the aggregate, the transactions represented by the Reorganization Agreement resulted in a reduction of over $8,000,000 in liabilities.

Sale of Certain Assets

On December 11, 2012, in connection with the transactions contemplated by the sale of WeedMaps Media, Inc., we entered into an Asset Purchase Agreement by and among us and our wholly owned subsidiary, General Marketing Solutions, Inc., a California corporation, on the one hand, and RJM, on the other hand, pursuant to which, upon the closing of the transaction, we sold certain assets (primarily those assets we acquired from Revyv, LLC in January 2011) to RJM for the sum of Ten Dollars ($10.00). The closing of the sale took place on December 31, 2012.

In connection with the Purchase Agreement, GMS entered into an Assignment of Domain Names whereby GMS assigned certain domain names to RJM.

Change in Business of the Company; Shell Status

The sale of WeedMaps resulted in a change in our client base. We continue in the internet search and marketing business. The sale completed our comprehensive exit as a finder and marketing site for our client base in the medicinal cannabis industry. We do not anticipate providing services to clients in the medicinal cannabis industry in the future. Our continued business focus is and will be internet search, advertising, and operating finder sites in the recreational sports, prefabricated housing, tattoo, and other industries identified by our management as having high growth potential.

The sale of WeedMaps will not make us a shell company as defined under Rule 405 of the Exchange Act, as we will continue to operate material business segments currently owned and/or operated by us.

Recent Restructuring

A. On August 9, 2012, we entered into and closed a Global Securities Purchase Agreement and Secured Promissory Note with Keith Hoerling, an individual. Pursuant to the Global Agreement, we acquired Eleven Million Two Hundred Thousand (11,200,000) shares of common stock from Hoerling, in exchange for (A) the Hoerling Note which has a principal balance of One Million Six Hundred and Twenty Five Thousand Dollars ($1,625,000), to be paid in monthly payments beginning September 15, 2012 and ending on January 15, 2015, and (B) an additional amount of up to One Million Six Hundred and Twenty Five Thousand Dollars ($1,625,000), to be paid monthly beginning on September 15, 2012 and ending January 15, 2015, based on the monthly gross revenue of WeedMaps as more fully set forth in the Global Agreements.

Pursuant to the Global Agreement, Hoerling terminated all rights to consideration due from us (including cash and/or stock owed to Hoerling pursuant to agreements whereby we acquired WeedMaps, LLC).

All the Hoerling agreements were terminated in connection with the sale of WeedMaps Media, Inc.

B. On August 16, 2012, we entered into a Stock Purchase Agreement with Revyv, LLC to acquire Five Hundred Thousand (500,000) shares of our common stock for consideration of Sixty Seven Thousand Dollars ($67,000), payable in two installments, the first of which, for Forty Two Thousand Dollars ($42,000) was paid at closing, and the second of which, for Twenty Five Thousand Dollars ($25,000), was paid on January 10, 2013.

C. On August 1, 2012, we closed (A) a Global Securities Purchase, Consulting, and Resignation Agreement, Secured Promissory Note and Consulting Agreement by and among Justin Hartfield, an individual and WeedMaps Media, Inc., a Nevada corporation and our wholly-owned subsidiary, and (B) a Global Securities Purchase and Resignation Agreement and Secured Promissory Note by and among the Company, Douglas Francis, an individual and WeedMaps.

As consideration for the Global Agreements, the Notes were issued to Hartfield and Francis, individually. The Notes were secured by the shares of common stock sold to the Company by the Selling Parties, and each of them, pursuant to the Global Agreements. Pursuant to the Notes, beginning on September 5, 2012, we made monthly payments in the amount of $78,099.38 to each of the Selling Parties.

In addition to the Notes, as consideration for the Global Agreements, we agreed to pay to each of the Selling Parties up to One Million Six Hundred and Twenty Five Thousand Dollars ($1,625,000), to be paid in monthly payments beginning September 15, 2012, and ending January 15, 2015, based on the monthly gross revenue of WeedMaps as more fully set forth in the Global Agreements. We timely made the payments under these agreements until WeedMaps was sold on December 31, 2012.

Pursuant to the Global Agreements, the Selling Parties delivered letters of resignation as our employees, terminated all rights to consideration due from us (including cash and/or stock owed to Hartfield pursuant to agreements whereby we acquired WeedMaps, LLC) and Francis resigned his position as a member of our Board of Directors.

Pursuant to the Global Agreements, we purchased a total of Forty Million Seventy Two Thousand Two Hundred Eighty Nine (40,072,289) shares of our common stock from the Selling Parties, and terminated our obligation at the time to issue over 5 million more shares.

Pursuant to the Consulting Agreement, we were to pay Hartfield Five Thousand Dollars ($5,000) per month for a period of thirty (30) months for the services provided pursuant thereto.

All the Francis and Hartfield agreements were terminated in connection with the sale of WeedMaps Media, Inc.

D. The Global Agreement entered into with Keith Hoerling, taken together with the Global Agreements entered into with Justin Hartfield and Douglas Francis, collectively resulted in the termination of the following agreements:

i. our obligations under the earn-out provisions of that certain Agreement and Plan of Reorganization and Merger, dated November 19, 2010 (the “Reorganization Agreement”) by and among us and WeedMaps Media, Inc., a Nevada corporation (f/k/a Weedmaps, LLC, a Nevada limited liability company) (“WeedMaps”);

ii. Employment Agreement with Hartfield dated November 19, 2010;

iii. Employment Agreement with Hoerling dated November 19, 2010;

iv. Employment Agreement with Francis dated August 1, 2011;

iv. Secured Promissory Note issued to Justin Hartfield in the Principal Amount of $900,000 dated November 19, 2010 and due January 10, 2012;

v. First Amendment to Secured Promissory Note issued to Justin Hartfield dated February 22, 2011;

vi. Secured Promissory Note issued to Justin Hartfield in the Principal Amount of $900,000 dated November 19, 2010 and due January 10, 2013;

vii. Secured Promissory Note issued to Keith Hoerling in the Principal Amount of $900,000 dated November 19, 2010 and due January 10, 2012;

viii. First Amendment to Secured Promissory Note issued to Keith Hoerling dated February 22, 2011;

ix. Secured Promissory Note issued to Keith Hoerling in the Principal Amount of $900,000 dated November 19, 2010 and due January 10, 2013; and

x. Security Agreement dated November 19, 2010.

Intellectual Property

Our intellectual property portfolio is an important part of our business. We currently own over 150 Internet domain names.

We use intellectual property law, that may include a combination of copyright, trade secret and confidentiality agreements to protect our intellectual property. Our employees and independent contractors are required to sign agreements acknowledging that all inventions, trade secrets, works of authorship, developments and other processes generated by them on our behalf are our property, and assigning to us any ownership that they may claim in those works. Despite our precautions, it may be possible for third parties to obtain and use without consent intellectual property that we own. Unauthorized use of our intellectual property by third parties, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business.

From time to time, we may encounter disputes over rights and obligations concerning intellectual property. While we believe that our product and service offerings do not infringe the intellectual property rights of any third party, we cannot assure you that we will prevail in any intellectual property dispute. If we do not prevail in such disputes, we may lose some or all of our intellectual property protection, be enjoined from further sales of the applications determined to infringe the rights of others, and/or be forced to pay substantial royalties to a third party.

Competition

We know that there is intense competition in the internet marketing industry. Our competition includes national search engines such as Google and Yahoo, local search engines, and traditional forms of advertising such as print, radio, and television. We also realize that, in each market we enter, there is a high probability that existing regional marketing companies will be performing similar services as us.

The following is a list of known competitive finder websites for manufactured homes:

Mobile Home Village (http://www.mhvillage.com/)

Manufactured Home Source (http://www.manufacturedhomesource.com/)

Mobile Home Bay (http://www.mhbay.com/)

Mobile Home (http://www.mobilehome.net/)

And also manufacturer websites, such as:

Clayton Homes (http://claytonhomes.com/)

Skyline Homes (http://skylinehomes.com/)

Nationwide Homes (http://nationwide-homes.com/)

Palm Harbor

(

http://www.palmharbor.com/)

Fleetwood Homes (http://www.fleetwoodhomes.com/)

The following is a list of known competitive finder websites for the tattoo industry:

Check Out My Ink (http://www.checkoutmyink.com/)

Yelp (http://www.yelp.com)

Tattoo Finder (http://tattoofinder.com/)

Tattoo Design Shop (http://tattoodesignshop.net/)

Tattoo Road Trip (http://tattooroadtrip.com/)

Tattoo Johnny (http://www.tattoojohnny.com/)

Tattoo Me Now (http://www.tattoomenow.com)

The following is a list of known competitive finder websites for the recreational sports industry:

Bludefields (http://bluefields.com/)

Sportsvite (http://sportsvite.com/)

Teamer (http://teamer.net/)

Team Pages (http://www.teampages.com/)

The following is a list of known competitive finder websites for the karate industry:

Dojo Locator (http://www.dojolocator.com/)

Yelp (http://www.yelp.com)

Martial Info (http://martialinfo.com/)

Inter-Martial Arts (http://www.intermartialarts.com/)

The following is a list of known competitive finder websites for the rodeo industry:

PRCA Pro Rodeo (http://prorodeo.com/)

Rodeo Z (http://www.rodeoz.com/)

US Rodeo Supply (http://www.usrodeosupply.com/)

Ride Right (http://rideright.com/)

Research and Development

Research and development expenses for our most recent fiscal year ended December 31, 2011, consisted mainly of compensation and overhead of research and development activities, namely coders and developers, and third party professional developer services firms performing research and development functions, such as coding.

|

Programmers and testing

|

|

$

|

240,000

|

|

|

Developer firms

|

|

|

105,000

|

|

|

Purchased Software

|

|

|

175,000

|

|

|

|

|

$

|

520,000

|

|

Our Employees

We have 20 full-time employees and/or contractors working in our office, one of which is an officer, 15 of which are engaged in marketing, publishing and development, and 4 of which are engaged in administrative functions.

Organization Within the Last Five Years

SearchCore, Inc. was formed on July 14, 2003 in the State of Nevada as Tora Technologies, Inc. On November 21, 2006, we changed our name to Makeup.com Limited, on January 29, 1010, we changed our name to LC Luxuries Limited, and on November 5, 2010, we changed our name to General Cannabis, Inc. On January 6, 2012, we changed our name to SearchCore, Inc.

Item 1A. Risk Factors.

Any investment in our common stock involves a high degree of risk. You should consider carefully the following information, together with the other information contained in this Registration Statement before you decide to buy our common stock. If one or more of the following events actually occurs, our business will suffer, and as a result our financial condition or results of operations will be adversely affected. In this case, the market price, if any, of our common stock could decline, and you could lose all or part of your investment in our common stock.

We face risks in developing our products and services and eventually bringing them to market. We also face risks that we will lose some, or all of our market share in existing businesses to competition, or we risk that our business model becomes obsolete. The following risks are material risks that we face. If any of these risks occur, our business, our ability to achieve revenues, our operating results and our financial condition could be seriously harmed. We are not and never were engaged in the growing, harvesting, cultivation, possession, or distribution of cannabis. Instead, we focused on developing our finder site technology and associated business model which could then be implement in a myriad of industries.

Risk Factors Related to the Business of the Company

Because the business activities of some of our former customers was illegal under the Federal Controlled Substances Act, we may be deemed to have been aiding and abetting illegal activities through the services that we provided to those customers. As a result, we may be subject to enforcement actions by law enforcement authorities, which would materially and adversely affect our business.

Under United States federal law, and more specifically the Federal Controlled Substances Act, the possession, use, cultivation, and transfer of cannabis is illegal. Our WeedMaps Media, Inc. business provided services to customers that were engaged in the business of possession, use, cultivation, and/or transfer of cannabis. As a result, law enforcement authorities, in their attempt to regulate the illegal use of cannabis, may seek to bring an action or actions against us, including, but not limited, to a claim of aiding and abetting another’s criminal activities. The federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal.” 18 U.S.C. §2(a).

Our prior business, and specifically the advertisements we sold for activities that may be deemed to have been illegal under federal law, may be found to be in violation of this law, and the federal government could decide to bring an action against us. As a result of such an action, we may be forced to cease operations and our investors could lose their entire investment. Such an action would have a material negative effect on our business and operations.

Because we hold a promissory note secured by the domain name

www.weedmaps.com

, if the borrower defaults on the note, and we foreclose on the collateral, we could temporarily hold and operate assets in the medicinal cannabis industry, which may expose us to aiding and abetting risk.

On December 31, 2012, we sold our WeedMaps Media, Inc. subsidiary to a third party, and purchase of the purchase price was a secured promissory note in the principal amount of $3,000,000. That note is secured by the assets of WeedMaps Media, including the domain name and website

www.weedmaps.com

. If the obligated party on the note were to default, and we were to foreclose on the collateral, we would temporarily hold and operate certain assets that may be considered illegal. In such an event, we would continue to operate the assets in order to keep them viable, seek a buyer, and sell the assets. During the time, the assets would be considered held-for-sale by us. In addition, as per the secured promissory note, should the obligated party be forced to cease operations as a direct result of law enforcement actions, then the obligated party will not longer be responsible for the outstanding debt owed on the promissory note to us.

We face various risks related to our restatements

.

On December 19, 2011, we announced in a current report filed with OTC Markets that management believes our acquisition of WeedMaps, LLC in November, 2010 may be more accurately reflected if it was accounted for as a reverse acquisition accompanied by a recapitalization (a capital transaction in substance) with no goodwill being recorded. Likewise, our acquisition of Synergistic Resources, LLC in December, 2010 may be more accurately reflected if it is accounted for as a business combination using the acquisition method (fair value), where the excess of the fair value of consideration transferred is considered to be goodwill. Following consultation with our auditors, on February 28, 2012 we restated our financial statements for the fiscal quarters ended March 31, 2011, June 30, 2011, and September 30, 2011, and for the year ended December 31, 2010. Our restatements included a reduction to the amount allocated to the management contract intangible asset and the amortization period, the reclassification of the earn-out provision from equity to liability, and the expensing of the capitalized software costs.

See Note 25 to our Financial Statements for the years ended December 31, 2011 and 2010.

We cannot assure that there are no significant deficiencies or material weaknesses in our existing controls or that we have effective disclosure controls and procedures and internal controls over financial reporting.

We previously concluded that the net change in the fair value of the earn-out liability was immaterial to our net income and as a result did not record a change in the earn-out liability. However, after further consideration of qualitative as well as quantitative factors, we concluded that the change in the fair value of the earn-out liability was material to our operations and as a result, we recorded a change in the earn-out liability at December 31, 2011. The correction of this error resulted in a change in the fair value of the earn-out liability at December 31, 2011.

See

Note 26 to our Financial Statements for the years ended December 31, 2011 and 2010.

The restatement of these financial statements may lead to legal and regulatory issues. If such issues were to arise, the defense of any such issues may cause the diversion of management’s attention and resources, and may require the payment of damages if any such claims or proceedings are not resolved in our favor. Even if resolved favorably, there could be significant expenses. This may also affect our ability to raise capital or obtain financing. Additionally this may result in the resignation of our auditors which may, among other things, cause a delay in the preparation of future financial statements and increase expenditures related to the retention of new auditors. The process of retaining new auditors may limit our access to the capital markets for an extended period of time. Moreover, the potential negative publicity focusing on the restatement and negative reactions from stockholders, creditors or others with whom business is conducted, in conjunction with or separately from, the occurrence of any of the foregoing, could harm our business and reputation and cause the price of our common stock to decline.

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in their early stages of operations. We may not successfully address all of the risks and uncertainties or successfully implement our existing and new products and services. If we fail to do so, it could materially harm our business and impair the value of our common stock, resulting in a loss to shareholders. Even if we accomplish these objectives, we may not generate the positive cash flows or profits we anticipate. We were incorporated in Nevada in 2003, and the vast majority of the business that we conducted in 2011 and 2012 was started or acquired in 2010. Now, the vast majority of that business has been sold, and our current business generates very little revenue. Unanticipated problems, expenses and delays are frequently encountered in establishing a new business and developing new products and services. These include, but are not limited to, inadequate funding, lack of consumer acceptance, competition, product development, the inability to employ or retain talent, inadequate sales and marketing, and regulatory concerns. The failure by us to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce, curtail, or discontinue operations. No assurance can be given that we can or will ever be successful in our operations and operate profitably.

If we are unable to meet our future capital needs, we may be required to reduce or curtail operations, or shut down completely.

To date we have relied on cash flow from operations and the subsequent sale of our WeedMaps Media subsidiary to fund operations. On December 31, 2012, we sold WeedMaps Media, and we now have limited cash liquidity and capital resources. Our cash on hand as of September 30, 2012 was approximately $812,000. For the year ended December 31, 2011, our total revenue was approximately $11.93 million, our operating income was $1.45 million, and our income from continuing operations was approximately $816,000. However, the business that generated that income has been sold.

Our future capital requirements will depend on many factors, including our ability to market our products successfully, cash flow from operations, locating and retaining talent, and competing market developments. Our business model requires that we spend money (primarily on advertising and marketing) in order to generate revenue. Based on our current financial situation we may have difficulty continuing our operations at their current level, or at all, if we do not raise additional financing in the near future. Additionally, we would like to continue to acquire assets and operating businesses, which will likely require additional cash. Although we currently have no specific plans or arrangements for acquisitions or financing, we intend to raise funds through private placements, public offerings or other financings. Any equity financings would result in dilution to our then-existing stockholders. Sources of debt financing may result in higher interest expense. Any financing, if available, may be on unfavorable terms. If adequate funds are not obtained, we may be required to reduce, curtail, or discontinue operations. There is no assurance that our existing cash flow will be adequate to satisfy our existing operating expenses and capital requirements.

Because we face intense competition, we may not be able to operate profitably in our markets.

The market for the services that we offer is highly competitive. We may not have the resources, expertise or other competitive factors to compete successfully in the future. We expect to face additional competition from existing competitors and new market entrants in the future. Some of our competitors will have greater resources than we do. As a result, these competitors may be able to:

|

|

•

|

develop and expand their product and service offerings more rapidly;

|

|

|

•

|

adapt to new or emerging changes in customer requirements more quickly;

|

|

|

•

|

take advantage of acquisition and other opportunities more readily; and

|

|

|

•

|

devote greater resources to the marketing and sale of their products and adopt more aggressive pricing policies than we can. See “The Company - Competition.”

|

If we are unable to attract and retain key personnel, we may not be able to compete effectively in our market.

Our success will depend, in part, on our ability to attract and retain key management, including our technical experts and sales and marketing personnel. We attempt to enhance our management and technical expertise by recruiting qualified individuals who possess desired skills and experience in certain targeted areas. In the past, we have employed management from companies that we have acquired. Our inability to retain employees and attract and retain sufficient additional employees, and information technology, engineering and technical support resources, could have a material adverse effect on our business, financial condition, results of operations and cash flows. The loss of key personnel could limit our ability to develop and market our products.

Because our officers and directors control a large percentage of our common stock, they have the ability to influence matters affecting our shareholders.

Our officers and directors beneficially own over 75% of our outstanding common stock. As a result, they have the ability to influence matters affecting our shareholders, including the election of our directors, the acquisition or disposition of our assets, and the future issuance of our shares. Because they control such shares, investors may find it difficult to replace our directors and management if they disagree with the way our business is being operated. Because the influence by these insiders could result in management making decisions that are in the best interest of those insiders and not in the best interest of the investors, you may lose some or all of the value of your investment in our common stock. See “Principal Shareholders.”

Because our Chief Financial Officer does not provide his services to us on a full-time basis, he may not be able to devote a sufficient amount of time to our business operations or our reporting obligations pursuant to U.S. securities laws, which may cause our business to fail or cause non-compliance with our reporting obligations.

Munjit Johal, our Chief Financial Officer and a member of our Board of Directors, devotes approximately fifty percent (50%) of his time to our business. The remainder of his time is devoted to unrelated outside employment. Accordingly, he may not be able to devote sufficient time to the management of our business, as and when needed, including time necessary for us to maintain compliance with our reporting obligations once this registration statement becomes effective. While we do not believe there is a present conflict of interest with respect to Mr. Johal’s outside employment or the amount of time that he devotes to our business, it is possible that a conflict of interest could arise in the future. If a conflict of interest were to arise, it would be addressed by the remaining member or members of our Board of Directors.

We may not be able to effectively manage our growth and operations, which could materially and adversely affect our business

.

We have, and may in the future, experience rapid growth and development in a relatively short period of time. The management of this growth will require, among other things, continued development of our financial and management controls and management information systems, stringent control of costs, increased marketing activities, the ability to attract and retain qualified management personnel and the training of new personnel. We may utilize outsourced resources, and hire additional personnel, in order to manage our expected growth and expansion. Failure to successfully manage our possible growth and development could have a material adverse effect on our business and the value of our common stock.

Our industry is experiencing rapid growth and consolidation that may cause us to lose key relationships and intensify competition.

The internet marketing industry is undergoing rapid growth and substantial change. This has resulted in increasing consolidation and formation of strategic relationships. For example, we have recently entered the tattoo industry through a management agreement. A cancellation of our relationship with this group or any group that we form a relationship in the future may have a negative impact on the company because it could limit our advertising exposure or the number of customers that use our websites. We make no assurance that any relationship we have established will continue.

Acquisitions or other consolidating transactions that don’t involve us could nevertheless harm us in a number of ways, including:

|

|

•

|

we could lose strategic relationships if our strategic partners are acquired by or enter into relationships with a competitor (which could cause us to lose access to distribution, content, technology and other resources);

|

|

|

•

|

the relationship between us and the strategic partner may deteriorate and cause an adverse effect on our business;

|

|

|

•

|

we could lose customers if competitors or users of competing technologies consolidate with our current or potential customers; and

|

|

|

•

|

our current competitors could become stronger, or new competitors could form, from consolidations.

|

Any of these events could put us at a competitive disadvantage, which could cause us to lose customers, revenue and market share. Consolidation could also force us to expend greater resources to meet new or additional competitive threats, which could also harm our operating results.

We rely on the continued reliable operation of third parties’ systems and networks and, if these systems and networks fail to operate or operate poorly, our business and operating results will be harmed.

Our operations are in part dependent upon the continued reliable operation of the information systems and networks of third parties. These include a variety of service providers including web browsers sites such as Google or MSN in which the majority of our customers locate us, internet and telephone providers or other communication providers such as for cell phone and texting. If these third parties do not provide reliable operation, our ability to service our customers will be impaired and our business, reputation and operating results could be harmed.

The Internet and our network are subject to security risks that could harm our business and reputation and expose us to litigation or liability.

Online commerce and communications depend on the ability to transmit confidential information and licensed intellectual property securely over private and public networks. Any compromise of our ability to transmit and store such information and data securely, and any costs associated with preventing or eliminating such problems, could damage our business, hurt our ability to distribute products and services and collect revenue, threaten the proprietary or confidential nature of our technology, harm our reputation, and expose us to litigation or liability. We also may be required to expend significant capital or other resources to protect against the threat of security breaches or hacker attacks or to alleviate problems caused by such breaches or attacks. Any successful attack or breach of our security could hurt consumer demand for our products and services, and expose us to consumer class action lawsuits and harm our business.

We may be unable to adequately protect our proprietary rights.

Our ability to compete partly depends on the superiority, uniqueness and value of our intellectual property and technology, including both internally developed technology and technology licensed from third parties. To the extent we are able to do so, in order to protect our proprietary rights, we will rely on a combination of trademark, copyright and trade secret laws, confidentiality agreements with our employees and third parties, and protective contractual provisions. Despite these efforts, any of the following occurrences may reduce the value of our intellectual property:

|

|

•

|

our copyrights relating to our business may be challenged or invalidated;

|

|

|

•

|

registered copyrights may not provide us with any competitive advantages;

|

|

|

•

|

our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our technology;

|

|

|

•

|

our efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those we develop; or

|

|

|

•

|

another party may obtain a blocking patent and we would need to either obtain a license or design around the patent in order to continue to offer the contested feature or service in our products.

|

We may be forced to litigate to defend our intellectual property rights, or to defend against claims by third parties against us relating to intellectual property rights.

We may be forced to litigate to enforce or defend our intellectual property rights, to protect our trade secrets or to determine the validity and scope of other parties’ proprietary rights. Any such litigation could be very costly and could distract our management from focusing on operating our business. The existence and/or outcome of any such litigation could harm our business.

Interpretation of existing laws that did not originally contemplate the Internet could harm our business and operating results.

The application of existing laws governing issues such as property ownership, copyright and other intellectual property issues to the Internet is not clear. Many of these laws were adopted before the advent of the Internet and do not address the unique issues associated with the Internet and related technologies. In many cases, the relationship of these laws to the Internet has not yet been interpreted. New interpretations of existing laws may increase our costs, require us to change business practices or otherwise harm our business.

It is not yet clear how laws designed to protect children that use the Internet may be interpreted, and such laws may apply to our business in ways that may harm our business.

The Child Online Protection Act and the Child Online Privacy Protection Act impose civil and criminal penalties on persons distributing material harmful to minors (e.g., obscene material) over the Internet to persons under the age of 17, or collecting personal information from children under the age of 13. We do not knowingly distribute harmful materials to minors or collect personal information from children under the age of 13. The manner in which these Acts may be interpreted and enforced cannot be fully determined, and future legislation similar to these Acts could subject us to potential liability if we were deemed to be non-compliant with such rules and regulations, which in turn could harm our business.

We may be subject to market risk and legal liability in connection with the data collection capabilities of our products and services.

Many of our products are interactive Internet applications that by their very nature require communication between a client and server to operate. To provide better consumer experiences and to operate effectively, our products send information to our servers. Many of the services we provide also require that a user provide certain information to us. We post an extensive privacy policy concerning the collection, use and disclosure of user data involved in interactions between our client and server products.

Because we were previously service providers to companies in the medicinal cannabis industry, we had and may continue to have a difficult time obtaining the various insurances that are desired to operate our business, which may expose us to additional risk and financial liabilities.

Insurance that is otherwise readily available, such as workers compensation, general liability, and directors and officers insurance, is more difficult for us to find, and more expensive, because we were service providers to companies in the medicinal cannabis industry. Thus far, we have been successful in finding such policies, however it is at a cost that is higher than other businesses. There are no guarantees that we will be able to find such insurances in the future, or that the cost will be affordable to us. If we are forced to go without such insurances, it may prevent us from entering into certain business sectors, may inhibit our growth, and may expose us to additional risk and financial liabilities.

Risks Related To Our Common Stock

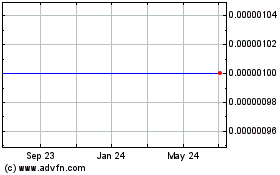

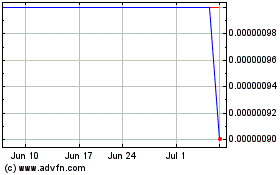

Our common stock is listed for quotation on the OTCQX tier of the marketplace maintained by OTC Markets Group, Inc., which may make it more difficult for investors to resell their shares due to suitability requirements.

Our common stock is currently quoted on the OTCQX tier of the marketplace maintained by OTC Markets Group, Inc. Broker-dealers often decline to trade in over the counter stocks given the market for such securities are often limited, the stocks are more volatile, and the risk to investors is greater. These factors may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of their shares. This could cause our stock price to decline.

If we are unable to pay the costs associated with being a public, reporting company, we may not be able to continue trading on the OTCQX and/or we may be forced to discontinue operations.