Current Report Filing (8-k)

November 22 2019 - 4:02PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): November 22, 2019

Western

Capital Resources, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

000-52015

|

47-0848102

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer

Identification No.)

|

11550

“I” Street, Suite 150, Omaha, NE 68137

(Address

of principal executive offices) (Zip Code)

(402)

551-8888

(Registrant's

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act 17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§

230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth

company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(A) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

|

|

|

|

|

Item

5.02

|

Departure

of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers;

Compensatory Arrangements of Certain Officers

|

On

November 22, 2019, Western Capital Resources, Inc. entered into an employment agreement (the “Employment Agreement”)

with its Chief Executive Officer, Mr. John Quandahl, effective as of November 1, 2019. Western Capital’s prior employment

agreement with Mr. Quandahl expired as of April 1, 2019. The Employment Agreement has a term of three years from the effective

date and contains other terms and conditions that are substantially the same as those of the prior agreement, except that Mr. Quandahl’s

base salary increased from $300,000 to $330,000.

The

performance-based bonus provisions of the Employment Agreement permit Mr. Quandahl and other members of management to receive

an annual bonus payment based on adjusted EBITDA targets annually established by the Board of Directors. If Western Capital’s

actual adjusted EBITDA performance for a particular annual period ranges from 85-100% of the established adjusted EBITDA target,

management will be entitled to receive a cash bonus consisting of 7.5% of the actual adjusted EBITDA. If Western Capital’s

actual adjusted EBITDA performance for a particular annual period is less than 85% of the established adjusted EBITDA target,

no bonus will be payable, and if such performance exceeds 100% of the established adjusted EBITDA target, the bonus pool will

include 7.5% of the adjusted EBITDA target and 15% of the amount by which such performance exceeds the target. Notwithstanding

the foregoing, the Employment Agreement also provides that the bonuses will not be paid unless, in addition to the adjusted EBITDA

threshold, capital expenditure and working capital thresholds have been achieved. The bonus pool will be payable to other management-level

participants in the bonus pool, if any, selected from time to time by the Board of Directors in its discretion.

The

Employment Agreement also contains customary provisions prohibiting Mr. Quandahl from soliciting customers and employees of Western

Capital for three years after any termination of his employment with the company, and from competing with Western Capital for

either three years (if Mr. Quandahl is terminated for good cause or if he resigns without good reason) or two years (if Western

Capital terminates Mr. Quandahl’s employment for without good cause or if he resigns with good reason). If Mr. Quandahl’s

employment is terminated by Western Capital without “good cause” or if Mr. Quandahl voluntarily resigns with “good

reason,” then Mr. Quandahl will be entitled to (i) severance pay in the form of continuation of his base salary for a period

of 12 months and (ii) reimbursement for health insurance premiums for his family if he elects continued coverage under COBRA.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Western

Capital Resources, Inc.

|

|

|

|

|

|

|

|

Date: November

22, 2019

|

By:

|

/s/

Angel Donchev

|

|

|

|

Angel

Donchev

Chief

Financial Officer

|

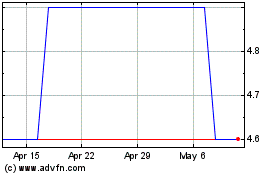

Western Capital Resources (CE) (USOTC:WCRS)

Historical Stock Chart

From Apr 2024 to May 2024

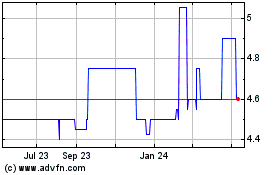

Western Capital Resources (CE) (USOTC:WCRS)

Historical Stock Chart

From May 2023 to May 2024