UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

|

|

|

þ

|

|

QUARTERLY REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Quarterly Period Ended October 31, 2009

OR

|

|

|

|

|

o

|

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from

to

Commission file number 333-157360

WELLTEK INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Nevada

|

|

5912

|

|

98-0610431

|

|

(State or other jurisdiction of

|

|

(Primary Standard Industrial

|

|

(IRS Employer Identification #)

|

|

organization)

|

|

Classification Code)

|

|

|

1030 N Orange Ave, Ste 105

Orlando, FL 32801

(Address of Issuer’s principal executive offices)

Tel. (407) 704-8950

(Issuer’s telephone number)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the

Exchange Act during the past 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for the last 90 days.

YES

þ

NO

o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate

Web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to

submit and post such files). YES

o

NO

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer, “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act).

YES

þ

NO

o

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the

latest practicable date: 96,160,000 as of October 31, 2009.

WELLTEK INCORPORATED

INDEX

2

PART I. FINANCIAL INFORMATION

|

|

|

|

|

Item 1.

|

|

Financial Statements

|

Welltek Incorporated

(A Development Stage Company)

Balance Sheet

As of October 31, 2009 and January 31, 2009

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

October 31,

|

|

|

January 31,

|

|

|

|

|

2009

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

19,212

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

19,212

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

275

|

|

|

$

|

275

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

$

|

275

|

|

|

$

|

275

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity (Deficit)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, $0.00001 par value, 200,000,000 and

75,000,000 authorized at 10/31/09 and 1/31/09

respectively, 96,160,000 and 2,000,000 shares

issued and outstanding at 10/31/09 and 1/31/09

respectively

|

|

|

24

|

|

|

|

20

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

24,376

|

|

|

|

580

|

|

|

|

|

|

|

|

|

|

|

|

|

Deficit accumulated during the development stage

|

|

|

(5,463

|

)

|

|

|

(875

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders’ Equity (Deficit)

|

|

|

18,937

|

|

|

|

(275

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Equity (Deficit)

|

|

$

|

19,212

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

See the accompanying summary of accounting policies and notes to the financial statements

3

Welltek Incorporated

(A Development Stage Company)

Statements of Operations

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three

|

|

|

For the nine

|

|

|

For the period from

|

|

|

|

|

months ended

|

|

|

months ended

|

|

|

January 23, 2009

|

|

|

|

|

October 31,

|

|

|

October 31,

|

|

|

(Inception) through

|

|

|

|

|

2009

|

|

|

2009

|

|

|

October 31, 2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consulting services

|

|

$

|

—

|

|

|

$

|

1,800

|

|

|

$

|

2,100

|

|

|

General and administrative

|

|

|

—

|

|

|

|

988

|

|

|

|

988

|

|

|

Rent

|

|

|

—

|

|

|

|

1,800

|

|

|

|

2,100

|

|

|

Legal and accounting

|

|

|

—

|

|

|

|

—

|

|

|

|

275

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Expenses

|

|

|

—

|

|

|

|

4,588

|

|

|

|

5,463

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

—

|

|

|

$

|

(4,588

|

)

|

|

$

|

(5,463

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Per Common

Share — Basic and Diluted

|

|

$

|

—

|

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average

Number of Common Shares

Outstanding

|

|

|

2,404,000

|

|

|

|

2,335,927

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See the accompanying summary of accounting policies and notes to the financial statements

4

Welltek Incorporated

(A Development Stage Company)

Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine

|

|

|

January 23, 2009

|

|

|

|

|

months ended

|

|

|

(inception) through

|

|

|

|

|

October 31, 2009

|

|

|

October 31, 2009

|

|

|

Cash Flows from Operating Activities

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(4,588

|

)

|

|

$

|

(5,463

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net

cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Donated consulting services and expenses

|

|

|

3,600

|

|

|

|

4,200

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in accounts payable

|

|

|

—

|

|

|

|

275

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Used in Operating Activities

|

|

|

(988

|

)

|

|

|

(988

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from the sale of common stock

|

|

|

20,200

|

|

|

|

20,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided by Financing Activities

|

|

|

20,200

|

|

|

|

20,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in Cash

|

|

|

19,212

|

|

|

|

19,212

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash — Beginning of Period

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash — End of Period

|

|

$

|

19,212

|

|

|

$

|

19,212

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosures:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

|

—

|

|

|

|

—

|

|

|

Income taxes paid

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

See the accompanying summary of accounting policies and notes to the financial statements

5

Welltek Incorporated

Notes to the Financial Statements

(Unaudited)

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited interim financial statements of Welltek Incorporated have been prepared

in accordance with accounting principles generally accepted in the United States of America and the

rules of the Securities and Exchange Commission, and should be read in conjunction with Welltek’s

audited 2009 annual financial statements and notes thereto filed with the SEC on form 10-K. In the

opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a

fair presentation of financial position and the result of operations for the interim periods

presented have been reflected herein. The results of operations for interim periods are not

necessarily indicative of the results to be expected for the full year. Notes to the financial

statements, which would substantially duplicate the disclosure required in Welltek’s 2009 annual

financial statements have been omitted.

NOTE 2 — GOING CONCERN

These financial statements are presented on the basis that the company is a going concern, which

contemplates the realization of assets and satisfaction of liabilities in the normal course of

business over a reasonable length of time. Realization value may be substantially different from

carrying values as shown and these financial statements do not include any adjustments to the

recoverability and classification of recorded asset amounts and classification of liabilities that

might be necessary should Welltek Incorporated be unable to continue as a going concern. As of

October 31, 2009 Welltek Incorporated has not generated revenues and has accumulated losses of

$5,463 since inception. The continuation of Welltek Incorporated as a going concern is dependent

upon the continued financial support from its shareholders, the ability of Welltek Incorporated to

obtain necessary financing to continue operations, and the attainment of profitable operations.

These factors raise substantial doubt regarding Welltek Incorporated’s ability to continue as a

going concern.

NOTE 3 — RELATED PARTY TRANSACTIONS

During the nine months ended October 31, 2009 the Company paid a total of $3,600 to related

parties. A total of $1,800 was paid to directors for rent ($300 per month) and $1,800 was paid in

exchange for consulting services ($300 per month) provided by the President and Director of the

Company. These transactions are recorded at the exchange amount which is the amount agreed to by

the transacting parties.

NOTE 4 — COMMON STOCK

For the nine months ended October 31, 2009, Welltek Incorporated sold 404,000 common shares at

$0.05 per share, for proceeds of $20,200. On September 25, 2009, the Company filed a Certificate

of Amendment with the Nevada Secretary of State changing its name from Pharmacity Corporation to

Welltek Incorporated, increasing its authorized common stock from 75 million shares to 200 million

shares, and effecting a 40-1 forward split of its common stock.

NOTE 5 — SUBSEQUENT EVENTS

Effective on November 12, 2009, pursuant to an Agreement and Plan of Merger dated September 1, 2009

(the “Merger Agreement”), the Company, WI Acquisition, Inc., a Florida corporation and wholly-owned

subsidiary of the Company, and MedX Systems, Inc., a Florida corporation (“MedX Systems”), MedX

Systems merged with and into WI Acquisition, with WI Acquisition surviving the merger, and became a

wholly-owned subsidiary of the Company (the “Merger”). At the time of the Merger, the Company was a

shell corporation and was not engaged in any active business. The acquisition of MedX Systems

through the Merger is treated as a

reverse acquisition for accounting purposes, and the business of MedX Systems became the business

of the Company as a result thereof. MedX Systems conducts its business operations through the

following three operating subsidiaries: MedX Limited, an English and Wales corporation, Pure

Healthy Back, Inc., a Florida corporation, and Lime Fitness, Inc., a Florida corporation.

6

|

|

|

|

|

Item 2.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

Special Note Regarding Forward-Looking Statements

Certain statements in this Form 10-Q under “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” constitute “forward-looking” statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known

and unknown risks, uncertainties and other factors which may cause the actual results, performance

or achievements of the Company to be materially different from any future results, performance or

achievements expressed or implied by such forward-looking statements. Such statements are indicated

by words or phrases such as “anticipates,” “projects,” “management believes,” “believes,”

“intends,” “expects,” and similar words or phrases. Such factors include, among others, the

following: competition; seasonality; success of operating initiatives; new product development and

introduction schedules; acceptance of new product offerings; advertising and promotional efforts;

adverse publicity; changes in business strategy or development plans; availability and terms of

capital; labor and employee benefit costs; changes in government regulations; and other factors

particular to the Company.

Should one or more of these risks, uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results, performance, or achievements of Welltek may vary

materially from any future results, performance or achievements expressed or implied by such

forward-looking statements. All subsequent written and oral forward-looking statements attributable

to Welltek or persons acting on our behalf are expressly qualified in their entirety by the

cautionary statements in this paragraph. Welltek disclaims any obligation to publicly announce the

results of any revisions to any of the forward-looking statements contained herein to reflect

future events or developments.

Results of Operations

From Inception on January 23, 2009 to October 31, 2009

We were organized on January 23, 2009, with a business plan that focused on the establishment of

retail pharmacies overseas.

On March 18, 2009, we sold 404,000 shares of common stock (pre forward split) at a price of $0.05

per share for cash proceeds of $20,200.

On September 1, 2009, we entered into an Agreement and Plan of Merger with MedX Systems, Inc.

(“MedX”), pursuant to which MedX is to merge with and into a newly formed, wholly owned subsidiary

of ours named WI Acquisition, Inc. (“Acquisition Sub”).

As of October 31, 2009, the merger transaction had yet to close, and we remained a start-up

corporation that had not yet generated or realized any revenues.

Our loss since inception is $5,463 of which $275 is for legal and accounting fees, $2,100 is for

rent, $2,100 is for consulting services, and $988 is for filing fees and general office expenses.

7

Liquidity and Capital Resources

Since

inception, we have issued 2,404,000 shares of our common stock (pre

forward split) and received $20,200.

We issued 2,000,000 shares of common stock (pre forward split) to our sole officer and director

pursuant to the exemption from registration contained in Regulation S of the Securities Act of

1993. This was accounted for as an issuance of founder’s shares.

On March 18, 2009, we sold 404,000 shares of common stock (pre forward split) at a price of $0.05

per share for cash proceeds of $20,200.

As of October 31, 2009, our total assets were $19,212 and our total liabilities were $275.

Off Balance Sheet Arrangements

None.

|

|

|

|

|

Item 3.

|

|

Quantitative and Qualitative Disclosures About Market Risk

|

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934

and are not required to provide the information under this item.

|

|

|

|

|

Item 4.

|

|

Controls and Procedures

|

Disclosure Controls and Procedures

The Company’s management, with the participation of the Company’s Chief Executive Officer (CEO) and

Chief Financial Officer (CFO), has evaluated the effectiveness of the Company’s disclosure controls

and procedures, as such term is defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange

Act of 1934 (Exchange Act) as of the end of the period covered by the report.

Based upon that evaluation, the Company’s CEO and CFO concluded that as of October 31, 2009 the

Company’s disclosure controls and procedures were not effective to provide reasonable assurance

that (i) the information required to be disclosed by the Company in the Report that it files or

submits under the Exchange Act is recorded, processed, summarized and reported within the time

periods specified in the SEC’s rules and forms, and (ii) information required to be disclosed by

the Company in the reports that its files or submits under the Exchange Act is accumulated and

communicated to its management, including its CEO and CFO, or persons performing similar functions,

as appropriate to allow timely decisions regarding required disclosure.

Internal Control over Financial Reporting

During the quarter ended October 31, 2009, there have been no changes in our internal control over

financial reporting (as defined in Rule 13a-15(f) of the Exchange Act) that have materially

affected, or are reasonably likely to materially affect, our internal control over financial

reporting.

8

PART II. OTHER INFORMATION

|

|

|

|

|

Item 1.

|

|

Legal Proceedings

|

None.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934

and are not required to provide the information under this item.

|

|

|

|

|

Item 2.

|

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

On March 05, 2009, the Securities and Exchange Commission declared our Form S-1 Registration

Statement effective, file number 333-157360, permitting us to offer up to 2,000,000 shares of

common stock (pre forward split) at $0.05 per share. There was no underwriter involved in our

public offering. On March 18, 2009 we completed our public offering and raised $20,200 by selling

404,000 shares of common stock (pre forward split). Since then we have used the proceeds as

follows:

|

|

|

|

|

|

|

General & Administrative

|

|

$

|

988

|

|

|

Bank balance as of October 31, 2009

|

|

|

19,212

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL:

|

|

$

|

20,200

|

|

|

|

|

|

|

Item 3.

|

|

Defaults Upon Senior Securities

|

None.

|

|

|

|

|

Item 4.

|

|

Submission of Matters to a Vote of Security Holders

|

On September 1, 2009, we received a written consent resolution signed by the holders of a majority

of our issued and outstanding shares of common stock, with respect to the following matters:

|

|

•

|

|

Approval of the terms and conditions set forth in the Agreement and Plan of Merger

between the Company, MedX, and Acquisition Sub, and directing that a number of steps

required to effectuate the closing of the transaction be taken by the Company; and

|

|

|

|

|

•

|

|

Approving an amendment of the Company’s articles of incorporation changing its name

from Pharmacity Corporation to Welltek Incorporated, increasing its authorized common

stock from 75 million shares to 200 million shares, and effecting a 40-1 forward split

of its common stock;

|

|

|

|

|

|

Item 5.

|

|

Other Information

|

None.

9

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

|

3.1

|

(i)

|

|

Articles of Incorporation (2)

|

|

|

|

|

|

|

|

|

3.1

|

(ii)

|

|

Certificate of Amendment to Articles of Incorporation, filed September 25, 2009 (1)

|

|

|

|

|

|

|

|

|

3.2

|

|

|

Bylaws (2)

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Agreement and Plan of Merger, dated September 1, 2009 (3)

|

|

|

|

|

|

|

|

|

21

|

|

|

Subsidiaries (1)

|

|

|

|

|

|

|

|

|

31.1

|

|

|

Certification of the PEO Pursuant to Section 302 of Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

|

|

|

31.2

|

|

|

Certification of the PFO Pursuant to Section 302 of Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

|

|

|

32.1

|

|

|

Certification of the CEO Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

|

|

|

32.2

|

|

|

Certification of the CFO Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

(1)

|

|

Incorporated by reference from the Form 8-K filed by the Company on November 18, 2009

|

|

|

|

(2)

|

|

Incorporated by reference from the Form S-1 filed by the Company on February 17, 2009

|

|

|

|

(3)

|

|

Incorporated by reference from the Form 8-K filed by the Company on September 15, 2009

|

10

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed

below by the following person on behalf of the Registrant and in the capacities on this December

14, 2009.

|

|

|

|

|

|

|

|

WELLTEK INCORPORATED

|

|

|

|

By:

|

/s/ Randy Lubinsky

|

|

|

|

|

Randy Lubinsky

|

|

|

|

|

Chief Executive Officer

Principal Executive Officer

|

|

11

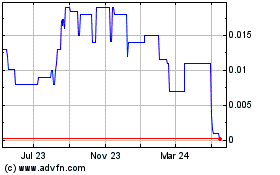

WellTek (CE) (USOTC:WTKN)

Historical Stock Chart

From Jun 2024 to Jul 2024

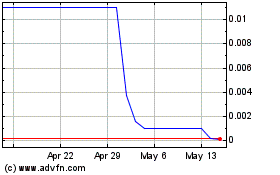

WellTek (CE) (USOTC:WTKN)

Historical Stock Chart

From Jul 2023 to Jul 2024