Current Report Filing (8-k)

October 20 2022 - 5:17PM

Edgar (US Regulatory)

0001516887

false

0001516887

2022-10-15

2022-10-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October 15, 2022

WELLNESS

CENTER USA, INC.

(Exact

name of registrant as specified in its charter)

| nevada |

|

333-173216 |

|

27-2980395

|

(State or other jurisdiction

of

incorporation or organization) |

|

Commission

File Number |

|

(IRS Employee

Identification No.) |

145

E. University Boulevard, Tucson, AZ 85705

(Address

of Principal Executive Offices)

(847)

925-1885

(Issuer

Telephone number)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common stock, par value $0.001 per share |

|

WCUI |

|

OTC Markets |

Item

1.01 Entry into a Material Definitive Agreement.

On

October 15, 2022, the Company received 52% majority shareholder approval of the execution and delivery of a proposed Share Exchange Agreement

(“Agreement”) relating to the share exchange and transfer of certain assets of the Company’s wholly-owned subsidiary, StealthCo

Inc. (“SCI”) d/b/a Stealth Mark, Inc., to Quantum Age Corporation, pursuant to the terms and conditions of the Agreement in

substantially the form of the copy presented to the Board. The Agreement provides, among other things, as follows:

| ● | Quantum

Age will pay $10,000 to the Company’s wholly-owned subsidiary, SMI-DTI Holdings, LLC

(“SMI-DTI”), upon execution of the Agreement. |

| ● | Quantum

Age will pay $90,000 to the Company’s wholly-owned subsidiary, SMI-DTI Holdings, LLC

(“SMI-DTI”), upon Closing. |

| ● | Quantum

Age will issue 5,500,000 shares of Class A common stock of Quantum Age Corporation to SMI-DTI

at Closing. |

| ● | Quantum

Age will assign the assets transferred by SCI, including trademarks, intellectual properties,

and patents, to its subsidiary, Femtobitz, Inc., a Delaware corporation. |

| ● | Upon

Closing of the share exchange, the Company’s Chairman will be appointed an advisory board

member of Quantum Age and a board member of Femtobitz, Inc. |

The

5,500,000 shares of Class A common shares of Quantum Age Corporation to be issued in exchange for all of the outstanding shares of SCI

common stock will represent a minority of the issued and outstanding shares of Quantum Age common stock as of the date of issuance. The

Quantum Age shares will be issued in reliance upon the exemption from registration requirements under the Securities Act of 1933, as

amended (the “Securities Act”), pursuant to Section 4(2) thereof and Regulation D thereunder. As such, such shares may not

be offered or sold by us unless they are registered under the Securities Act or qualify for an exemption from the registration requirements

under the Securities Act.

The

Agreement is included as an Exhibit to this Report and is the legal document that governs the terms of the share exchange described therein

and the other actions contemplated thereby. The discussion of the Agreement, and the proposed Share Exchange Agreement, as set forth

herein is qualified in its entirety by reference thereto.

Item

9.01 Financial Statements and Exhibits.

(a)

Financial Statements of business acquired. None.

(b)

Pro forma financial information. None.

(c)

Shell Company Transaction. Not applicable.

(d)

Exhibits.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

WELLNESS CENTER USA, INC. |

| |

|

| Date: October 19, 2022 |

By: |

/s/

Calvin R. O’Harrow |

| |

|

Calvin R. O’Harrow |

| |

|

President, CEO |

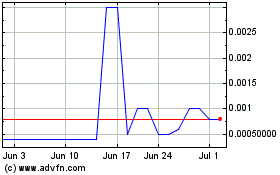

Wellness Center USA (PK) (USOTC:WCUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

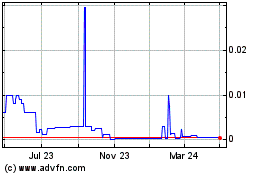

Wellness Center USA (PK) (USOTC:WCUI)

Historical Stock Chart

From Jul 2023 to Jul 2024