false0000898171NONE00008981712023-11-172023-11-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 17, 2023 |

Uwharrie Capital Corp

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

North Carolina |

000-22062 |

56-1814206 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

132 North First Street |

|

Albemarle, North Carolina |

|

28001 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 704 983-6181 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On November 17, 2023, Uwharrie Capital Corp (the "Registrant") released a quarterly report to its shareholders that included a letter to the shareholders from President and CEO Roger L. Dick and unaudited financial information for the period ended September 30, 2023.

A copy of this report is attached hereto as Exhibit 99.1 and incorporated by reference herein.

This Current Report on Form 8-K (including information included or incorporated by reference herein) may contain, among other things, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, (i) statements regarding certain of the Registrant’s goals and expectations with respect to earnings, income per share, revenue, expenses and the growth rate in such items, as well as other measures of economic performance, including statements relating to estimates of credit quality trends, and (ii) statements preceded by, followed by or that include the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “projects,” “outlook” or similar expressions. These statements are based upon the current belief and expectations of the Registrant’s management and are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond the Registrant’s control).

Item 9.01 Financial Statements and Exhibits

(c) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

UWHARRIE CAPITAL CORP |

|

|

|

|

Date: November 17, 2023 |

|

By: |

/s/ Heather H. Almond |

|

|

|

Heather H. Almond |

|

|

|

Principal Financial Officer |

Exhibit 99.1

November 17, 2023

Dear Shareholder:

As we complete the third quarter of 2023, we are pleased to present you with an update that underscores the strength and stability of our financial position. Your Company has continued to grow in assets and deepen its community ties, reflecting our collective commitment to a prosperous future for all stakeholders.

Over the past year, from September 30, 2022, to September 30, 2023, our assets have increased from $1.04 billion to $1.07 billion. During this period, our loan portfolio has increased by $102 million, which translates to a robust 21% year-over-year growth. This growth has been achieved while steadfastly upholding our strong credit standards. We have not wavered in our commitment to responsible lending, ensuring that the quality of our loan portfolio remains of the highest order.

Our Bank’s capital ratios reflect our strong financial foundation, with a Total Risk Based Capital ratio of 14.23%. This solid capital base positions us well above the regulatory requirements and is indicative of our prudent financial management and forward-looking strategy.

The net income for the first nine months of 2023 is reported at $6.3 million, an increase from the $5.3 million recorded at the same time last year. This equates to $5.9 million in net income available to common shareholders, or $0.82 per share, compared to $4.9 million in net income available to common shareholders, or $0.67 per share, that we reported in 2022 for the same period. This growth in earnings is a clear demonstration of our operational excellence and the effectiveness of our strategic initiatives.

In recognition of our solid performance, the Board of Directors has declared a 2% stock dividend. All shareholders of record on November 7, 2023, will receive the dividend on November 21, 2023. The stock dividend will be paid electronically via book-entry (no stock certificates will be issued). Consistent with prior years, we chose to pay a stock dividend as opposed to cash to provide our shareholders with options to suit their specific financial needs. Shareholders in peak earning years may choose to hold the dividend shares, which defers income, and paying taxes in later years could be at a lower capital gains rate. For our shareholders desiring current income, these new shares can be sold for cash. The stock dividend gives you the flexibility of when to recognize the income and address the tax considerations based on your individual needs.

We move forward with the determination to sustain this momentum, balancing growth with stability and always with an eye on serving the best interests of our communities and stakeholders.

Thank you for your continued trust and partnership. Best wishes to you and your families as we head into the holiday season.

Sincerely,

UWHARRIE CAPITAL CORP

/s/ Roger L. Dick

President and Chief Executive Officer

This Report may contain, among other things, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, (i) statements regarding certain of the Company's goals and expectations with respect to earnings, income per share, revenue, expenses and the growth rate in such items, as well as other measures of economic performance, including statements relating to estimates of credit quality trends, and (ii) statements preceded by, followed by or that include the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “projects,” “outlook,” or similar expressions. These statements are based upon the current belief and expectations of the Company‘s management and are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond the Company’s control).

|

|

|

|

|

|

|

|

|

Uwharrie Capital Corp and Subsidiaries |

|

|

|

|

|

|

Consolidated Balance Sheets (Unaudited) |

|

|

|

|

|

|

|

|

September 30, |

|

|

September 30, |

|

(Amounts in thousands except share and per share data) |

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

Cash and due from banks |

|

$ |

9,463 |

|

|

$ |

5,821 |

|

Interest-earning deposits with banks |

|

|

68,407 |

|

|

|

147,397 |

|

Securities available for sale |

|

|

328,099 |

|

|

|

321,382 |

|

Securities held to maturity (fair value $24,807 and $26,990, respectively) |

|

|

29,146 |

|

|

|

30,343 |

|

Less: allowance for credit losses on securities held to maturity |

|

|

(65 |

) |

|

|

- |

|

Equity securities, at fair value |

|

|

299 |

|

|

|

321 |

|

Loans held for sale |

|

|

4,584 |

|

|

|

4,740 |

|

Loans held for investment |

|

|

578,835 |

|

|

|

477,175 |

|

Less: allowance for credit losses on loans |

|

|

(5,115 |

) |

|

|

(2,661 |

) |

Net loans held for investment |

|

|

573,720 |

|

|

|

474,514 |

|

Premises and equipment, net |

|

|

15,172 |

|

|

|

14,885 |

|

Interest receivable |

|

|

4,313 |

|

|

|

3,203 |

|

Restricted stock |

|

|

1,672 |

|

|

|

1,428 |

|

Bank-owned life insurance |

|

|

7,756 |

|

|

|

9,155 |

|

Deferred income tax benefit |

|

|

12,512 |

|

|

|

11,560 |

|

Loan servicing assets |

|

|

4,431 |

|

|

|

5,149 |

|

Other assets |

|

|

10,293 |

|

|

|

8,783 |

|

Total assets |

|

$ |

1,069,802 |

|

|

$ |

1,038,681 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

Demand, noninterest-bearing |

|

$ |

276,484 |

|

|

$ |

293,112 |

|

Interest checking and money market accounts |

|

|

435,289 |

|

|

|

499,515 |

|

Savings accounts |

|

|

103,953 |

|

|

|

107,088 |

|

Time deposits, $250,000 and over |

|

|

70,026 |

|

|

|

46,422 |

|

Other time deposits |

|

|

104,537 |

|

|

|

17,424 |

|

Total deposits |

|

|

990,289 |

|

|

|

963,561 |

|

Short-term borrowed funds |

|

|

931 |

|

|

|

1,103 |

|

Long-term debt |

|

|

29,085 |

|

|

|

29,588 |

|

Other liabilities |

|

|

12,427 |

|

|

|

11,937 |

|

Total liabilities |

|

|

1,032,732 |

|

|

|

1,006,189 |

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

|

|

Common stock, $1.25 par value: 20,000,000 shares authorized; |

|

|

|

|

|

|

issued and outstanding or in process of issuance |

|

|

|

|

|

|

7,049,510 and 6,928,661 shares, respectively. |

|

|

|

|

|

|

Book value per share $3.67 in 2023 and $3.01 in 2022 (1) |

|

|

8,812 |

|

|

|

8,661 |

|

Common stock dividend distributable |

|

|

176 |

|

|

|

216 |

|

Additional paid-in capital |

|

|

13,331 |

|

|

|

12,886 |

|

Undivided profits |

|

|

39,980 |

|

|

|

34,138 |

|

Accumulated other comprehensive loss |

|

|

(35,884 |

) |

|

|

(34,064 |

) |

Total Uwharrie Capital Corp shareholders' equity |

|

|

26,415 |

|

|

|

21,837 |

|

Noncontrolling interest |

|

|

10,655 |

|

|

|

10,655 |

|

Total shareholders' equity |

|

|

37,070 |

|

|

|

32,492 |

|

Total liabilities and shareholders' equity |

|

$ |

1,069,802 |

|

|

$ |

1,038,681 |

|

|

|

|

|

|

|

|

(1) Net income per share, book value per share and weighted average shares outstanding have been adjusted to reflect the 2% stock dividend in 2023 and the 2.5% stock dividend in 2022. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Uwharrie Capital Corp and Subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Income (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

(Amounts in thousands except share and per share data) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Income |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

7,645 |

|

|

$ |

5,367 |

|

|

$ |

21,001 |

|

|

$ |

15,771 |

|

Interest on investment securities |

|

|

3,086 |

|

|

|

1,973 |

|

|

|

8,904 |

|

|

|

4,954 |

|

Interest-earning deposits with banks and federal funds sold |

|

|

979 |

|

|

|

725 |

|

|

|

3,230 |

|

|

|

1,012 |

|

Total interest income |

|

|

11,710 |

|

|

|

8,065 |

|

|

|

33,135 |

|

|

|

21,737 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

Interest paid on deposits |

|

|

3,188 |

|

|

|

513 |

|

|

|

8,016 |

|

|

|

903 |

|

Interest paid on borrowed funds |

|

|

345 |

|

|

|

340 |

|

|

|

1,030 |

|

|

|

1,014 |

|

Total interest expense |

|

|

3,533 |

|

|

|

853 |

|

|

|

9,046 |

|

|

|

1,917 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Income |

|

|

8,177 |

|

|

|

7,212 |

|

|

|

24,089 |

|

|

|

19,820 |

|

Provision for (recovery of) credit losses |

|

|

599 |

|

|

|

(1,512 |

) |

|

|

985 |

|

|

|

(1,407 |

) |

Net interest income after provision for (recovery of) credit losses |

|

|

7,578 |

|

|

|

8,724 |

|

|

|

23,104 |

|

|

|

21,227 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Income |

|

|

|

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

|

272 |

|

|

|

282 |

|

|

|

785 |

|

|

|

786 |

|

Interchange and card transaction fees |

|

|

291 |

|

|

|

315 |

|

|

|

910 |

|

|

|

856 |

|

Other service fees and commissions |

|

|

875 |

|

|

|

763 |

|

|

|

2,586 |

|

|

|

2,465 |

|

Loss on sale of securities |

|

|

- |

|

|

|

- |

|

|

|

(42 |

) |

|

|

(91 |

) |

Realized/unrealized gain (loss) on equity securities |

|

|

(4 |

) |

|

|

(6 |

) |

|

|

7 |

|

|

|

(71 |

) |

Income from mortgage banking |

|

|

957 |

|

|

|

819 |

|

|

|

2,542 |

|

|

|

3,258 |

|

Other income (loss) |

|

|

128 |

|

|

|

65 |

|

|

|

399 |

|

|

|

(84 |

) |

Total noninterest income |

|

|

2,519 |

|

|

|

2,238 |

|

|

|

7,187 |

|

|

|

7,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

4,822 |

|

|

|

4,868 |

|

|

|

14,498 |

|

|

|

14,796 |

|

Occupancy expense |

|

|

460 |

|

|

|

424 |

|

|

|

1,345 |

|

|

|

1,276 |

|

Equipment expense |

|

|

195 |

|

|

|

199 |

|

|

|

578 |

|

|

|

580 |

|

Data processing |

|

|

103 |

|

|

|

204 |

|

|

|

511 |

|

|

|

610 |

|

Loan costs |

|

|

88 |

|

|

|

92 |

|

|

|

286 |

|

|

|

356 |

|

Professional fees and services |

|

|

268 |

|

|

|

217 |

|

|

|

705 |

|

|

|

633 |

|

Marketing and donations |

|

|

313 |

|

|

|

359 |

|

|

|

1,037 |

|

|

|

898 |

|

Software amortization and maintenance |

|

|

311 |

|

|

|

304 |

|

|

|

914 |

|

|

|

923 |

|

Other operating expenses |

|

|

830 |

|

|

|

733 |

|

|

|

2,483 |

|

|

|

1,751 |

|

Total noninterest expense |

|

|

7,390 |

|

|

|

7,400 |

|

|

|

22,357 |

|

|

|

21,823 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

2,707 |

|

|

|

3,562 |

|

|

|

7,934 |

|

|

|

6,523 |

|

Provision for income taxes |

|

|

558 |

|

|

|

737 |

|

|

|

1,608 |

|

|

|

1,215 |

|

Net Income |

|

$ |

2,149 |

|

|

$ |

2,825 |

|

|

$ |

6,326 |

|

|

$ |

5,308 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated net income |

|

$ |

2,149 |

|

|

$ |

2,825 |

|

|

$ |

6,326 |

|

|

$ |

5,308 |

|

Less: net income attributable to noncontrolling interest |

|

|

(142 |

) |

|

|

(142 |

) |

|

|

(422 |

) |

|

|

(422 |

) |

Net income attributable to Uwharrie Capital Corp and common shareholders |

|

$ |

2,007 |

|

|

$ |

2,683 |

|

|

$ |

5,904 |

|

|

$ |

4,886 |

|

Net Income Per Common Share (1) |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.28 |

|

|

$ |

0.37 |

|

|

$ |

0.82 |

|

|

$ |

0.67 |

|

Assuming dilution |

|

$ |

0.28 |

|

|

$ |

0.37 |

|

|

$ |

0.82 |

|

|

$ |

0.67 |

|

Weighted Average Common Shares Outstanding (1) |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

7,196,706 |

|

|

|

7,245,951 |

|

|

|

7,209,426 |

|

|

|

7,253,349 |

|

Assuming dilution |

|

|

7,196,706 |

|

|

|

7,245,951 |

|

|

|

7,209,426 |

|

|

|

7,253,349 |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

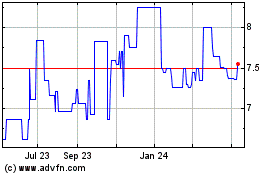

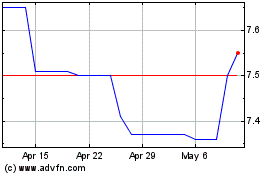

Uwharrie Capital (QX) (USOTC:UWHR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Uwharrie Capital (QX) (USOTC:UWHR)

Historical Stock Chart

From Jul 2023 to Jul 2024