Toshiba Sheds Energy Assets -- WSJ

November 09 2018 - 3:02AM

Dow Jones News

By Kosaku Narioka

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 9, 2018).

TOKYO -- Toshiba Corp. said Thursday it would liquidate its U.K.

nuclear business and sell its U.S. natural-gas business, taking a

combined loss of nearly $1 billion.

The moves are intended to clear away legacy problems after

Toshiba went through waves of restructuring in the past three years

that included the bankruptcy of its former Westinghouse Electric

business in the U.S.

The U.K. business -- NuGeneration Ltd., known as NuGen -- had

sought to build what was planned as Europe's largest new nuclear

project in northwest England. The Moorside project stumbled amid

doubts about the economics of nuclear-power plants.

Toshiba also said it would begin a previously announced share

buyback of Yen700 billion ($6.2 billion) on Friday and complete it

within a year. Investors welcomed the timing of the buyback and

pushed Toshiba shares up 13% in Tokyo trading Thursday.

New York-based King Street Capital Management LP, which held a

6.5% stake as of an Oct. 12 filing, had called on Toshiba in

October to boost the repurchase to Yen1.1 trillion. Non-Japanese

investors held about 72% of shares as of March 31.

Nobuaki Kurumatani, a former banker who took over as Toshiba's

chief executive in April, said he might consider raising the amount

in the future if the company's cash position improves.

Thursday's restructuring moves came after Toshiba sold many of

the businesses that used to be associated with its brand name,

including personal computers, television sets and medical

devices.

Releasing a new business plan, Mr. Kurumatani said Toshiba was

still competitive in many technologies such as batteries and hard

disk drives for data centers.

He set a modest growth target, saying the company wanted revenue

to rise past Yen4 trillion in five years from Yen3.6 trillion

projected for the current year ending in March. He said the company

wouldn't chase big acquisitions.

Toshiba completed a Yen2 trillion ($17.6 billion) sale of its

memory-chip unit in June to a group led by U.S. private-equity firm

Bain Capital LLC, which gave it the leeway to write off troubled

energy investments.

Mr. Kurumatani said Toshiba's spending previously focused on the

memory business and "we failed to invest adequately in the

businesses that will surely yield profits if we invest there."

Toshiba said it would record a loss of Yen93 billion connected

to the planned sale of the U.S. liquefied natural gas business to

China's ENN Ecological Holdings Co. and an additional Yen15 billion

for the NuGen liquidation in the U.K. Together those losses added

up to nearly $1 billion but the company still expects to record a

net profit of around $8 billion this year thanks to gains from the

chip-unit sale.

Toshiba's chief financial officer, Masayoshi Hirata, said the

Chinese company offered by far the best bid for the LNG business,

which involved a 20-year commitment in LNG trading, an area Toshiba

doesn't consider core. Mr. Hirata said he believed the deal was

likely to go through despite higher hurdles recently for Chinese

acquirers in the U.S.

Write to Kosaku Narioka at kosaku.narioka@wsj.com

(END) Dow Jones Newswires

November 09, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

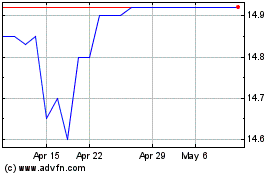

Toshiba (CE) (USOTC:TOSYY)

Historical Stock Chart

From Apr 2024 to May 2024

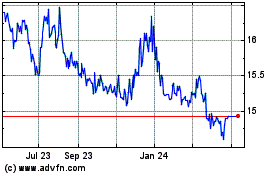

Toshiba (CE) (USOTC:TOSYY)

Historical Stock Chart

From May 2023 to May 2024