Current Report Filing (8-k)

August 24 2022 - 4:01PM

Edgar (US Regulatory)

0001648365

false

0001648365

2022-08-24

2022-08-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 24, 2022

| TINGO, INC. |

| (Exact Name of Registrant as Specified in its Charter) |

| Nevada |

333-205835 |

83-0549737 |

| (State or Other Jurisdiction |

(Commission File |

(IRS Employer |

| Of Incorporation) |

Number) |

Identification No.) |

|

43

West 23rd Street

New York, NY |

10010 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone

number, including area code: (646) 847-0144

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-k filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2). ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

|

Item 4.02(a) | Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. |

On October 12, 2021, the shareholders of Tingo,

Inc. (the “Company”) adopted the Company’s 2021 Equity Incentive Plan (“Incentive Plan”) which provides

for awards of restricted stock to Incentive Plan participants (“Stock Awards”), most of which are subject to time-based vesting

requirements of up to two years. During the fourth quarter of 2021 and the first quarter of 2022, the Company issued Stock Awards for

118,870,000 shares of the Company’s class A common stock and, accordingly, expensed the value of the Stock Awards in the Company’s

Consolidated Statements of Operations for these periods. The allocation of non-cash expenses relating to the Stock Awards resulted in

a net loss for the year ended December 31, 2021 and substantially reduced the Company’s net income for the quarter ended March 31,

2022. In addition, Stock Awards to non-employees were fully-expensed in the period in which the Stock Awards were granted, even though

certain of these Stock Awards were subject to time-based vesting requirements as noted above.

In examining the guidance of Accounting Standards

Codification 718 – Compensation-Stock Compensation (“ASC 718”), Company management determined that all Stock

Awards that were subject to time-based vesting requirements should have been ratably expensed over the vesting period based on the fair

value of the Stock Award on the grant date, instead of being fully expensed, regardless of whether the recipient was an employee, director,

or contractor of the Company. As a result, stock-based expenses for the Company were overstated for the year 2021 and the first quarter

of 2022. The proper allocation of non-cash expenses over the applicable vesting period relating to Stock Awards in accordance with ASC

718 is, therefore, expected to result in a smaller net loss for the year ended December 31, 2021 and higher net income for the quarter

ended March 31, 2022.

The decision of the Company to revise its treatment

of the Stock Awards was made following consultation of Company management with the Audit Committee of its Board of Directors. Consequently,

the Company is proceeding, as promptly as possible, to file amendments to its quarterly report on Form 10-Q for the quarter ended March

31, 2022, as well as its annual report for the year ended December 31, 2021 (collectively, the “Amended Reports”). The Amended

Reports will replace and supersede the respective previously filed reports and financial statements included therein.

Of significance, however, is that the revised treatment

of Stock Awards is expected to leave unaffected the unconsolidated operational results of Tingo Mobile PLC, the Company’s sole operating

subsidiary, for the full year 2021 and the first quarter of 2022.

In addition, although the Amended Reports will

restate the consolidated operating results of the Company for the first quarter of 2022, operating results for the second quarter of 2022

will remain unchanged from such results reported in the Company’s quarterly report on Form 10-Q filed on August 22, 2022.

We have discussed the matters disclosed in this

filing with Gries & Associates, LLC, the Company’s independent accountants who concur with our conclusions.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

Tingo, Inc. |

| | |

|

| Date: August 24, 2022 | By: |

/s/

Kenneth Denos |

| | |

Name: Kenneth Denos |

| | |

Title: Secretary |

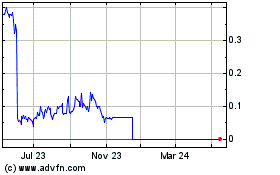

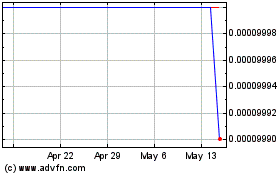

Tingo (CE) (USOTC:TMNA)

Historical Stock Chart

From May 2024 to Jun 2024

Tingo (CE) (USOTC:TMNA)

Historical Stock Chart

From Jun 2023 to Jun 2024