Global Casinos, Inc. (OTCBB: GBCS) today announced financial

results for its third quarter and nine-month period ended March 31,

2010.

Third quarter net revenue was $1,493,000 compared with

$1,584,000 in the third quarter last year. The decline was

attributable to continued weak consumer spending and generally poor

weather conditions, which hindered access to Colorado's mountain

gaming communities from Global's core target markets located along

the state's Front Range.

Global reduced third quarter casino operating expenses by 8%, or

$119,000, and cut operating, general and administrative expenses by

26%, or $11,000, versus the third quarter last year. The Company

also recorded an $890,000 non-cash impairment adjustment to the

carrying value of goodwill associated with its Doc Holliday Casino,

which was acquired in March 2008. Prior to the impairment

adjustment, operating income would have been $66,000 versus

operating income of $26,000 in the third quarter last year.

Inclusive of the adjustment, the Company reported a loss from

operations of $824,000. Details on the methodology of the

impairment test are available in the Company's Form 10-Q filed with

the Securities and Exchange Commission on May 21, 2010.

Third quarter net loss attributable to common shareholders was

$866,000, or $0.14 per diluted share, versus a net loss

attributable to common shareholders of $25,000, or less than $0.01

per diluted share, in the third quarter a year ago.

Cliff Neuman, president and CEO, "We have maintained tight

control of our operating expenses and more than doubled our

operating cash flow from that reported at the end of this year's

six-month mark. Moreover, were it not for the non-recurring,

non-cash charge associated with the impairment to goodwill, we

would have achieved a profitable third quarter."

"We continue to make aesthetic upgrades to our Doc Holliday

Casino in Central City and are working on cross marketing programs

in conjunction with our successful Bull Durham Casino in nearby

Blackhawk," Neuman added. "We continue to believe Global is well

positioned to benefit from the onset of the summer season, as well

as future improvements in the broader economy."

Year-to-date results

Through the first nine months of 2010, net revenue was

$4,507,000 versus $4,764,000 in the same period last year. Prior to

the impairment adjustment, Global would have reported an operating

loss of $17,000 versus an operating loss of $49,000 at the

nine-month mark of fiscal 2009. Including the adjustment, loss from

operations was $907,000. Net loss attributable to common

shareholders was $1,032,000, or $0.18 per diluted share, versus a

net loss attributable to common shareholders of $175,000, or $0.04

per diluted share, in the same period last year.

About Global Casinos, Inc.

Global Casinos, Inc. owns and operates the Bull Durham Saloon

and Casino and Doc Holliday Casino, located in Colorado's limited

stakes gaming districts of Black Hawk and Central City,

respectively.

Safe Harbor Statement

Certain statements in this news release that are not historical

facts are forward-looking statements, such as statements relating

to anticipated enhancements in the Company's financial performance,

and future development or expansion activities. Such

forward-looking statements involve a number of risks and

uncertainties that may significantly affect performance and

financial results in the future and, accordingly, actual results

may differ materially from those expressed in any forward-looking

statements. Such risks and uncertainties include, but are not

limited to, those related to effects of competition, leverage and

debt service financing and refinancing efforts, general economic

conditions, changes in gaming laws or regulations (including the

legalization of gaming in various jurisdictions), risks related to

development and construction activities, as well as the other risks

detailed from time to time in the Company's SEC reports, including

the report on Form 10-KSB for the year ended June 30, 2009.

GLOBAL CASINOS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

for the three months ended March 31, 2010 and 2009

2010 2009

----------- -----------

Revenues:

Casino $ 1,535,909 $ 1,627,142

Promotional allowances (42,861) (43,246)

----------- -----------

Net Revenues 1,493,048 1,583,896

Expenses:

Casino operations 1,395,044 1,514,393

Operating, general, and administrative 31,914 43,301

Impairment 890,000 -

----------- -----------

2,316,958 1,557,694

Income (loss) from operations (823,910) 26,202

Other income (expense):

Interest (28,498) (37,355)

Equity in earnings of Global Gaming

Technologies - (60)

----------- -----------

Income (loss) before provision for income taxes (852,408) (11,213)

Provision for income taxes - -

----------- -----------

Net income (loss) (852,408) (11,213)

Series D Preferred dividends (14,000) (14,000)

----------- -----------

Net income (loss) attributible to common

shareholders $ (866,408) $ (25,213)

=========== ===========

Earnings (loss) per common share:

Basic $ (0.14) $ (0.00)

=========== ===========

Diluted $ (0.14) $ (0.00)

=========== ===========

Weighted average shares outstanding:

Basic 6,344,655 5,955,215

=========== ===========

Diluted 6,344,655 5,955,215

=========== ===========

GLOBAL CASINOS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

for the nine months ended March 31, 2010 and 2009

2010 2009

------------ ------------

Revenues:

Casino $ 4,625,980 $ 4,884,500

Promotional allowances (119,071) (120,155)

------------ ------------

Net Revenues 4,506,909 4,764,345

Expenses:

Casino operations 4,291,959 4,588,744

Operating, general, and administrative 232,204 221,440

Loss on asset disposals - 2,743

Impairment 890,000 -

------------ ------------

5,414,163 4,812,927

Income (loss) from operations (907,254) (48,582)

Other income (expense):

Interest (125,041) (120,009)

Equity in earnings of Global Gaming

Technologies - (6,743)

------------ ------------

Income (loss) before provision for income taxes (1,032,295) (175,334)

Provision for income taxes - -

------------ ------------

Net income (loss) (1,032,295) (175,334)

Series D Preferred dividends (42,622) (42,622)

------------ ------------

Net income (loss) attributible to common

shareholders $ (1,074,917) $ (217,956)

============ ============

Earnings (loss) per common share:

Basic $ (0.18) $ (0.04)

============ ============

Diluted $ (0.18) $ (0.04)

============ ============

Weighted average shares outstanding:

Basic 6,131,041 5,935,507

============ ============

Diluted 6,131,041 5,935,507

============ ============

GLOBAL CASINOS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

March 31, June 30,

2010 2009

----------- -----------

ASSETS

Current Assets

Cash and cash equivalents $ 903,906 $ 1,378,074

Accrued gaming income 167,752 190,516

Inventory 21,464 19,309

Prepaid expenses and other current assets 112,431 100,791

----------- -----------

Total current assets 1,205,553 1,688,690

Land, building and improvements, and equipment:

Land 517,950 517,950

Building and improvements 4,128,021 4,121,308

Equipment 3,184,971 3,192,703

----------- -----------

Total land, building and improvements, and

equipment 7,830,942 7,831,961

Accumulated depreciation (4,696,045) (4,393,514)

----------- -----------

Land, building and improvements, and equipment,

net 3,134,897 3,438,447

Goodwill 1,008,496 1,898,496

----------- -----------

Total assets $ 5,348,946 $ 7,025,633

=========== ===========

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable, trade $ 140,511 $ 140,541

Accounts payable, related parties 8,889 18,507

Accrued expenses 245,082 360,774

Accrued interest 4,309 6,720

Joint venture obligation 25,750 25,850

Current portion of long-term debt 966,568 2,038,068

Current portion of loan participation

obligations 26,531 -

Other 335,125 252,578

----------- -----------

Total current liabilities 1,752,765 2,843,038

Long-term debt, less current portion 167,403 -

Loan participation obligations, less current

portion 232,430 -

Commitments and contingencies

Stockholders' equity:

Preferred stock: 10,000,000 shares authorized

Series A - no dividends, $2.00 stated value,

non-voting, 2,000,000 shares authorized,

200,500 shares issued and outstanding 401,000 401,000

Series B - 8% cumulative, convertible, $10.00

stated value, non-voting, 400,000 shares

authorized, no shares issued and

outstanding - -

Series C - 7% cumulative, convertible, $1.20

stated value, voting 600,000 shares

authorized, no shares issued and outstanding - -

Series D - 8% cumulative, convertible, $1.00

stated value, non-voting 1,000,000 shares

authorized, 700,000 shares issued and

outstanding 700,000 700,000

Common stock - $0.05 par value; 50,000,000

shares authorized; 6,420,488 and 5,955,215

shares issued and outstanding 321,025 297,761

Additional paid-in capital 14,150,855 14,085,449

Accumulated deficit (12,376,532) (11,301,615)

----------- -----------

Total equity 3,196,348 4,182,595

----------- -----------

Total liabilities and stockholders' equity $ 5,348,946 $ 7,025,633

=========== ===========

CONTACTS: Clifford L. Neuman President and CEO Global Casinos,

Inc. 303-449-2100 Geoff High Principal Pfeiffer High Investor

Relations, Inc. 303-393-7044

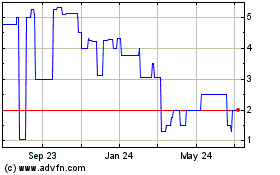

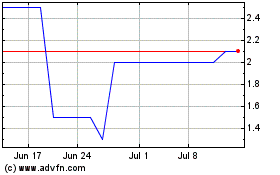

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Jul 2023 to Jul 2024