UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

Form 6-K

___________________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2016

Commission File Number: 001-36692

___________________________________

Sears Canada Inc.

(Translation of registrant’s name into English)

290 Yonge Street, Suite 700

Toronto, Ontario, M5B 2C3

Canada

(Address of principal executive office)

___________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in with Rule 12g3-2(b): 82-

EXHIBIT INDEX

EXHIBIT NO. DESCRIPTION

| |

99.1 | Management Proxy Circular |

| |

99.2 | Notice-and-Access Notification |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | | |

| Sears Canada Inc. |

| | |

Date: March 18, 2016 | By: | | /s/ Franco Perugini |

| Name: | | Franco Perugini |

| Title: | | Corporate Secretary |

SEARS CANADA INC.

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN

That the annual and special meeting (the “Meeting”) of holders (the “Shareholders”) of common shares in the capital of Sears Canada Inc. (the "Company") will be held in the Auditorium (Fourth Floor), 290 Yonge Street, Toronto, Ontario, on Wednesday, April 27, 2016 at 8:00 a.m., Eastern time, for the following purposes:

| |

1. | to receive the audited consolidated financial statements of the Company for the financial year ended January 30, 2016 and the auditors' report thereon; |

| |

3. | to appoint auditors and to authorize the directors to fix the auditors’ remuneration; |

| |

4. | to consider and if advisable, approve the Omnibus Equity Incentive Plan; and |

| |

5. | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

Toronto, Ontario

March 17, 2016

By order of the Board of Directors.

|

| |

| |

|

Franco Perugini General Counsel and Corporate Secretary |

Shareholders who are unable to be present at the Meeting are requested to complete the enclosed form of proxy. Completed proxies must be returned to CST Trust Company, the Company’s transfer agent, (i) by mail c/o Proxy Department, P.O. Box 721, Agincourt, Ontario, M1S 0A1; or (ii) by facsimile at (416)368-2502 or 1(866)781-3111 (within Canada and the United States); or (iii) via telephone at 1(888)489-7352 (within Canada and the United States); or (iv) via the Internet at cstvotemyproxy.com; or (v) via email to proxy@canstockta.com, by 5:00 p.m. (Eastern time) on April 25, 2016, or if the Meeting is adjourned or postponed, not later than 5:00 p.m., (Eastern time) on the second last business day prior to the date of the adjourned or postponed Meeting, or delivered to the registration table on the day of the Meeting prior to the commencement of the Meeting.

SEARS CANADA INC.

MANAGEMENT PROXY CIRCULAR

TABLE OF CONTENTS

|

| |

| Page |

1. INFORMATION ON VOTING AND PROXIES | 3 |

| |

1.1 Solicitation of Proxies | 3 |

1.2 Record Date | 3 |

1.3 Notice-and-Access | 3 |

1.4 Appointment of Proxies | 4 |

1.5 Revocation of Proxies | 5 |

1.6 Voting of Proxies | 5 |

1.7 Majority Voting | 5 |

1.8 Share Capital and Principal Shareholders | 6 |

| |

2. BUSINESS OF THE ANNUAL MEETING | 6 |

| |

2.1 Financial Statements | 6 |

2.2 Election of Directors | 6 |

2.2.1 Definition of Independent Director | 7 |

2.2.2 Background Information on Proposed Directors | 7 |

2.2.3 Cease Trade Orders and Bankruptcies | 11 |

2.3 Appointment of Auditors | 12 |

2.4 Omnibus Equity Incentive Plan | 12 |

2.5 Shareholder Proposals | 13 |

| |

3. EXECUTIVE COMPENSATION | 14 |

| |

3.1 Compensation Discussion and Analysis | 14 |

3.1.1 Compensation Philosophy | 14 |

3.1.2 Human Resources and Compensation Committee | 15 |

3.1.3 Composition of HRCC | 16 |

3.1.4 Compensation Structure and Mix | 17 |

3.1.5 Fixed Compensation | 19 |

3.1.6 Variable At-Risk Performance Based Compensation | 20 |

3.1.7 Equity Compensation Plan Information | 27 |

3.1.8 Discretionary Compensation | 28 |

3.1.9 Looking Ahead to 2016 | 28 |

3.2 Report on the Executive Chairman's Compensation | 29 |

3.2.1 Philosophy and Governance | 29 |

3.2.2 Compensation | 29 |

3.3 Compensation of Named Executive Officers | 29 |

3.4 Pension Plans | 31 |

3.4.1 Amendments to the Pension Plans | 31 |

3.4.2 Entitlements Under the SRRP and the SRP | 31 |

|

| |

3.5 Termination and Change of Control Benefits | 33 |

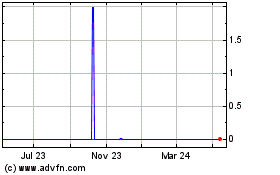

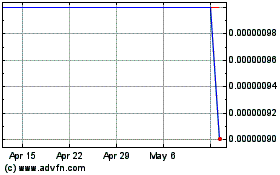

3.6 Performance Graph | 38 |

3.7 Director Compensation | 39 |

3.7.1 Compensation Earned | 39 |

3.7.2 Director Compensation Table | 39 |

3.7.3 Equity-Based Compensation Programs | 40 |

| |

4. INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 41 |

| |

5. CORPORATE GOVERNANCE | 41 |

| |

5.1 Overview | 41 |

5.2 Board of Directors | 41 |

5.2.1 Composition | 41 |

5.2.2 Chairman of the Board and Lead Director | 42 |

5.2.3 Meetings of the Independent Directors | 42 |

5.2.4 Attendance at Board and Committee Meetings | 42 |

5.3 Director Term Limits | 43 |

5.4 Representation of Women on the Board | 43 |

5.5 Representation of Women in Executive Officer Positions | 43 |

5.6 Board Mandate | 43 |

5.7 Position Descriptions | 43 |

5.8 Orientation and Continuing Education | 43 |

5.9 Ethical Business Conduct | 44 |

5.10 Disclosure, Confidentiality and Insider Trading Policy | 45 |

5.11 Board Committees | 45 |

5.11.1 Audit Committee | 45 |

5.11.2 Human Resources and Compensation Committee | 46 |

5.11.3 Governance Committee | 47 |

5.11.4 Investment Committee | 48 |

5.12 Directors' and Officers' Liability Insurance | 48 |

| |

| |

6. ADDITIONAL INFORMATION | 48 |

| |

7. DIRECTORS' APPROVAL | 49 |

| |

Appendix “A” – Omnibus Equity Incentive Plan | 50 |

Appendix "B" - Mandate of the Board of Directors of Sears Canada Inc. | 55 |

| |

| |

| |

1. | INFORMATION ON VOTING AND PROXIES |

| |

1.1 | Solicitation of Proxies |

This management proxy circular (the “Circular”) and the information contained herein are furnished in connection with a solicitation of proxies by or on behalf of the management of Sears Canada Inc. (the “Company” or “Sears Canada”) for use at the annual and special meeting of shareholders (the “Meeting”) called for Wednesday, April 27, 2016 at 8:00 a.m., Eastern time, and any adjournment or postponement thereof. The solicitation of proxies will be primarily by mail. Proxies may also be solicited personally or by telephone by executive officers or employees of the Company. The cost of the solicitation will be paid by the Company.

Unless otherwise stated, the information contained in the Circular is current as of March 17, 2016 and all dollar amounts are in Canadian dollars.

The board of directors of the Company (the “Board”) has fixed March 7, 2016 as the record date (the “Record Date”) for determining the holders (the “Shareholders”) of common shares in the capital of the Company (the “Shares”) who are entitled to receive notice of, and vote at, the Meeting. The failure of any Shareholder to receive notice of the Meeting does not deprive the Shareholder of the right to vote at the Meeting.

The Company has elected to take advantage of the amendments to National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer (“Notice-and-Access”) which came into force on February 11, 2013. Notice-and-Access are a set of rules that reduce the volume of materials that must be physically mailed to shareholders by allowing the Company to post the Circular and additional materials online, for certain Shareholders. All Shareholders that have consented to electronic delivery of shareholder communications will be provided with voting instructions and will receive the Notice-and-Access notification, which outlines relevant dates and matters to be discussed at the Meeting, and the corresponding Proxy-Related Materials (as defined below) for the Meeting through Notice-and-Access. Additionally, pursuant to an exemption received by the Company under the Canada Business Corporations Act (“CBCA”), the Company will deliver paper copies of a proxy form, a Notice-and-Access notification and the Company’s Annual Report (except to any Shareholders that have previously declined), with the Notice of Meeting and Circular being delivered through Notice-and-Access, to all Registered Shareholders (as defined below) that have not consented to electronic delivery of shareholder communications. All other Non-Registered Shareholders (as defined below) will receive a voting instruction form and paper copies of the Notice of Meeting, the Circular, and Annual Report (collectively, the "Proxy-Related Materials"). The Proxy-Related Materials, and the Notice-and-Access notification, have been made available to Shareholders at the website: meetingdocuments.com/cst/scc, and on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at sedar.com, and at the United States Securities and Exchange Commission (“SEC”) website at sec.gov.

The Company will not directly send the Proxy-Related Materials to Non-Objecting Beneficial Owners. Management of the Company does intend to pay for intermediaries to forward the Proxy-Related Materials to Objecting Beneficial Owners.

Should Shareholders wish to receive paper copies of the Proxy-Related Materials, they may contact the Company by calling the following toll-free telephone number: 1(888)433-6443 or by emailing fulfilment@canstockta.com.

| |

1.4 | Appointment of Proxies |

You are a “Registered Shareholder” if your Shares are registered in your name and: (a) you have a share certificate; or (b) you hold your Shares through direct registration in the United States. If a Registered Shareholder does not plan to attend the Meeting, he or she may:

| |

(1) | authorize the persons named in the proxy to vote his or her Shares by completing, signing and dating the enclosed proxy form and returning it in the envelope provided; or |

| |

(2) | appoint some other person to attend and act on the Shareholder’s behalf at the Meeting, including to vote the Shares on his or her behalf, by writing the name of that person in the space provided on the enclosed proxy form, signing and dating the proxy and returning it in the envelope provided. |

Completed proxies, for Registered Shareholders, must be returned to CST Trust Company, the Company’s transfer agent, (i) by mail c/o Proxy Department, P.O. Box 721, Agincourt, Ontario, M1S 0A1; or (ii) by facsimile at (416)368-2502 or 1(866)781-3111 (within Canada and the United States); or (iii) via telephone at 1(888)489-7352 (within Canada and the United States); or (iv) via the Internet at cstvotemyproxy.com; or (v) via email to proxy@canstockta.com, by 5:00 p.m., Eastern time, on April 25, 2016 or, if the Meeting is adjourned or postponed, not later than 5:00 p.m., Eastern time on the second last business day prior to the date of the adjourned or postponed Meeting, or delivered to the registration table on the day of the Meeting prior to the commencement of the Meeting or any adjournment or postponement thereof.

CST Trust Company independently counts and tabulates proxies to preserve the confidentiality of individual votes. Proxies are referred to the Company only in cases where a Shareholder clearly intends to communicate with management, in the event of questions as to the validity of a proxy, or where it is necessary to meet applicable legal requirements.

Registered Shareholders, or the persons they appoint as their proxies, are permitted to vote at the Meeting. However, in many cases, Shares of the Company beneficially owned by a holder (a “Non-Registered Holder”) are registered either:

| |

(a) | in the name of an intermediary (an “Intermediary”), such as a broker, custodian, nominee or fiduciary, that the Non-Registered Holder deals with in respect of the Shares; or |

| |

(b) | in the name of a depository (such as CDS Clearing and Depository Services Inc. or the Depository Trust & Clearing Corporation). |

The Company has distributed the Proxy-Related Materials or the Proxy-Related Materials with the Notice-and-Access notification, to the Intermediaries for onward distribution to Non-Registered Holders, as appropriate. Intermediaries are required to forward the Proxy-Related Materials or the Proxy-Related Materials with the Notice-and-Access notification to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Typically, Intermediaries will use a service company (such as Broadridge Investor Communications Solutions, Canada) to forward the Proxy-Related Materials or the Proxy-Related Materials with the Notice-and-Access notification to Non-Registered Holders.

Generally, Non-Registered Holders who have not waived the right to receive the Proxy-Related Materials will either:

| |

(i) | receive a voting instruction form; or |

| |

(ii) | be given a proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted to the number of Shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. |

Non-Registered Holders should carefully follow the instructions that accompany the voting instruction form or the proxy, including those indicating when and where the voting instruction form or the proxy is to be delivered. Voting instruction forms permit the completion of the voting instruction form online or by telephone. A Non-Registered Holder wishing to attend and vote at the Meeting in person should follow the corresponding instructions on the voting instruction form or, in the case of a proxy, strike out the names of the persons named in the proxy and insert the Non-Registered Holder's name in the space provided.

| |

1.5 | Revocation of Proxies |

A Registered Shareholder who has given a proxy may revoke the proxy at any time by:

| |

(a) | completing and signing a proxy bearing a later date and delivering it to CST Trust Company as described above; or |

| |

(b) | delivering a written statement, signed by the Shareholder or the Shareholder’s attorney, to: |

| |

i. | the Office of the Secretary of the Company at 290 Yonge Street, Suite 700, Toronto, Ontario, M5B 2C3 at any time up to and including 5:00 p.m., Eastern time, on April 25, 2016 or, if the Meeting is adjourned or postponed, not later than 5:00 p.m., Eastern time, on the second last business day preceding the day of the adjourned or postponed Meeting; or |

| |

ii. | the Chair of the Meeting on the day of the Meeting, prior to the commencement of the Meeting or any adjournment or postponement thereof; or |

(c) in any other manner permitted by law.

If you are a Non-Registered Holder, you should contact your Intermediary through which you hold your Shares and obtain instructions regarding the procedure for the revocation of any voting or proxyholder instructions that you have previously provided to your Intermediary.

1.6 Voting of Proxies

All Shares represented by a properly executed proxy will be voted, or withheld from voting, in accordance with the instructions of the Shareholder specified on the proxy and on any ballot that may be called for at the Meeting. If the Shareholder does not specify how he or she wishes the votes cast, the person named on the proxy will vote the Shares for the election of the proposed director nominees listed in this Circular, for the appointment of auditors and the authorization of the directors to fix the auditors’ remuneration and for the Omnibus Equity Incentive Plan. The proxyholder has discretionary authority with respect to amendments or variations to the matters identified in the notice of Meeting and other matters which may properly come before the Meeting or any adjournment or postponement thereof. As at the date of the Circular, the management of the Company is not aware of any such amendments, variations or other matters.

1.7 Majority Voting

The Board has adopted the practice of majority voting. Shareholders have the option of voting for or withholding votes from a director that has been nominated for election. The majority voting practice dictates that if the majority of the votes received by a director are withheld votes, those votes would count as “No” votes and the director would be required to tender his/her resignation to the Board. The Board would then consider the director’s resignation prior to making a decision on accepting or rejecting the resignation.

| |

1.8 | Share Capital and Principal Shareholders |

The authorized share capital of the Company consists of an unlimited number of Shares and an unlimited number of preferred shares, issuable in one or more series (the “Class 1 Preferred Shares”). As at March 17, 2016, there are currently no Class 1 Preferred Shares outstanding. As at March 17, 2016, the issued and outstanding share capital of the Company consists of 101,877,662 Shares, listed for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “SCC” and on the NASDAQ Stock Market ("NASDAQ") under the symbol "SRSC".

Each Share registered is entitled to one vote at the Meeting or any adjournment or postponement thereof. Each matter to be voted on at the Meeting must be approved by a majority of the votes cast.

To the knowledge of the directors and executive officers of the Company, the only persons or companies that beneficially own, or control or direct, directly or indirectly, more than 10% of the Shares, according to the insider reports filed on the System for Electronic Disclosure by Insiders (SEDI) are ESL Investments, Inc. and investment affiliates, including Edward S. Lampert, collectively ("ESL"), the beneficial holder of 46,162,515 Shares representing approximately 45.3% of the Company's total outstanding Shares, Sears Holdings Corporation (“Sears Holdings”), the beneficial owner of 11,962,391 Shares, representing approximately 11.7% of the Company's total outstanding Shares and Fairholme Capital Management, LLC ("Fairholme"), the beneficial owner of 17,969,089 Shares, representing approximately 17.6% of the Company's total outstanding Shares.

2. BUSINESS OF THE ANNUAL MEETING

The audited consolidated financial statements (the “2015 Annual Financial Statements”) of the Company for the 52-week period ended January 30, 2016 (“Fiscal 2015”) and the auditors’ report thereon will be placed before the Meeting. The 2015 Annual Financial Statements are available on SEDAR at sedar.com, the SEC website at sec.gov and the website at meetingdocuments.com/cst/SCC.

2.2 Election of Directors

The Company’s articles of incorporation provide for the Board to consist of a minimum of seven and a maximum of 20 directors, with the number of directors within such limits to be determined by the Board.

The current size of the Board has been fixed at seven directors. Four of the current seven directors, namely Carrie Kirkman, Anand A. Samuel, S. Jeffrey Stollenwerck and Brandon G. Stranzl , are “Non-Independent Directors” (as such term is defined under Section 2.2.1 – “Definition of Independent Director”) and the other three current directors, namely R. Raja Khanna, Deborah E. Rosati and Graham Savage are “Independent Directors” (as such term is defined under Section 2.2.1 – “Definition of Independent Director”). The Nominating and Corporate Governance Committee of the Board (the “Governance Committee”), which is currently comprised of Independent Directors, is responsible for considering and recommending for approval by the Board qualified candidates to be nominated for election or appointment as directors. The Governance Committee bases its review of Board candidates on skill sets as outlined in the Governance Committee charter.

Effective August 28, 2015, Ronald D. Boire resigned as the President and Chief Executive Officer, and as a director of the Company. Brandon G. Stranzl was appointed Executive Chairman effective July 2, 2015. Carrie Kirkman was appointed President and Chief Merchant and director of the Company effective November 1, 2015.

Effective February 4, 2016, Klaudio Leshnajni, who served as a director since July 2014, resigned as a director of the Company.

Having approved the recommendation of the Governance Committee, the Board proposes that the seven persons listed in the table under Section 2.2.2 – “Background Information on Proposed Directors” be nominated for election or re-election to the Board (the “Proposed Directors”). The persons named in the enclosed form of proxy intend to vote for the election of the persons indicated as nominees. The persons proposed for nomination will hold office until the Company’s next annual meeting of shareholders or until their successors are duly elected or appointed. The Proposed Directors are, in the opinion of the Board, well qualified to act as directors. The Board does not contemplate that any of the Proposed Directors will be unable to serve as a director but, if that should occur for any reason prior to the Meeting, the persons named in the enclosed form of proxy reserve the right to vote for another properly qualified nominee at their discretion. The Company’s director retirement policy provides that a director may not stand for election or be appointed to fill a vacancy on the Board after his/her 70th birthday, unless the Board makes an exception to this policy by means of a special resolution.

2.2.1 Definition of Independent Director

The definition of “Independent Director” is derived from National Instrument 52-110 – Audit Committees, as amended, of the Canadian Securities Administrators. For the purpose of determining independence, a director is an “Independent Director” if he or she has no direct or indirect material relationship with the Company or any of its affiliates, including ESL and Sears Holdings. A “material relationship” is a relationship which could, in the view of the Board, be reasonably expected to interfere with the exercise of a member’s independent judgment. A “Non-Independent Director” is a director who is not an Independent Director. For additional information on the Independent and Non-Independent Directors, refer to Section 5.2.1 – “Composition”.

2.2.2 Background Information on Proposed Directors

The following table sets forth the names and background information of the Proposed Directors, including, as applicable, their principal occupations, the election date of the Proposed Director, their current Board committee memberships, their Board and committee attendance record and the number of Shares of Sears Canada which are beneficially owned, or controlled or directed, directly or indirectly, by each of the Proposed Directors.

|

| | | | | | |

| | R. RAJA KHANNA Chief Executive Officer

Blue Ant Media Inc.

(media-related company)

Age: 43

Independent Director

(residing in Ontario, Canada)

Director since: October 2007

Sears Canada Shareholdings

2015: 2,620 Shares

2014: 2,620 Shares

2013: 2,620 Shares

Dollar Amount of Sears Canada Shares1: $16,113

1Dollar amount calculated using the Company’s share price on the TSX as at the close of trading on the last business day of the Company’s financial year end (January 30, 2016), being $6.15 and multiplying that price by the number of Shares held by each individual director. | R. Raja Khanna is currently the Chief Executive Officer of Blue Ant Media Inc. and assumed this position in February 2008. Mr. Khanna co-founded QuickPlay Media Inc., a mobile video company, and served as its Chief Marketing Officer from 2004 until 2007. Previous to that position, Mr. Khanna founded Snap Media Corp., a dot com start-up company, and held the office of Chief Executive Officer from 1995 to 2004. Mr. Khanna is a member of the board of directors of the National Screen Institute and Blue Ant Media Inc. Board and Committee Attendance: |

| |

| |

| |

| |

| | Board Meetings Attended | Committee Meetings Attended |

| | # of Meetings | Attendance Rate (%) | Committee Membership | # of Meetings | Attendance Rate (%) |

| | 11 of 11 | 100% | AUD | 5 of 5 | 100% |

| | | | HRCC | 2 of 2 | 100% |

| | | | GOV (Chair) | 2 of 2 | 100% |

| | AUD: Audit Committee HRCC: Human Resources and Compensation Committee (member since April 2015) GOV: Nominating and Corporate Governance Committee

DIRECTOR EXPERTISE Mr. Khanna’s experience with digital media technologies and his entrepreneurial expertise make him an asset to the Board. Mr. Khanna holds a Bachelor of Laws degree from Osgoode Hall Law School and a Bachelor of Science degree in Philosophy and Genetics from the University of Toronto.

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | CARRIE KIRKMAN President and Chief Merchant Sears Canada Inc. (retail company)

Age: 53

Non-Independent Director (residing in Ontario, Canada)

Director since: November 2015

Sears Canada Shareholdings 2015: Nil

| Carrie Kirkman was appointed President and Chief Merchant of the Company effective November 1, 2015. Prior to her role with Sears Canada, Ms. Kirkman was President of the Jones Group Canada from October 2010 to April 2015. Previous to that position, Ms. Kirkman held several executive level positions with Hudson's Bay Company including General Merchandise Manager, Women's Apparel, Accessories, Jewelry and Footwear from March 2009 to October 2010, General Merchandise Manager, Women's Apparel from June 2006 to March 2009, General Merchandise Manager, Accessories Luggage and Hosiery from February 2005 to June 2006 and General Manager, Brand Management from December 2002 to February 2005. From April 1997 to May 2002, Ms. Kirkman served as the Director of Merchandising for Liz Claiborne Canada.

Board and Committee Attendance: |

| | | |

| | Board* Meetings Attended | Committee Meetings Attended |

| | # of Meetings | Attendance Rate (%) | Committee Membership | # of Meetings | Attendance Rate (%) |

| | 3 of 3 | 100% | N/A | N/A | N/A |

| | Note: Ms. Kirkman is not a member of any of the Committees.

*Ms. Kirkman was appointed to the Board in November 2015.

DIRECTOR EXPERTISE Ms. Kirkman has been in the retail business for over 18 years. Ms. Kirkman's extensive knowledge of the retail industry makes her an asset to the Board and the Company. |

| |

| |

|

| | | | | | |

| | DEBORAH E. ROSATI Corporate Director and Consultant

Age: 54

Independent Director

(residing in Ontario, Canada)

Director since: April 2007

Sears Canada Shareholdings

2015: 2,600 Shares

2014: 2,600 Shares

2013: 2,600 Shares

Dollar Amount of Sears Canada Shares1: $15,990

1Dollar amount calculated using the Company’s share price on the TSX as at the close of trading on the last business day of the Company’s financial year end (January 30, 2016), being $6.15, and multiplying that price by the number of Shares held by each individual director. | Deborah E. Rosati, FCPA, FCA, ICD.D is a Corporate Director and Consultant focused on corporate governance and corporate strategy for emerging companies. Ms. Rosati is the President of her own management consulting firm, Deborah Rosati (formerly RosatiNet). Ms. Rosati has over 25 years experience in financial, operational and strategic management with senior finance roles in both public and private corporations, as well as a general partner with a national venture capital firm. Ms. Rosati is currently on the Board of Directors of NexJ Systems Inc. and is a member of the Department Audit Committee of Correctional Services Canada. Ms. Rosati is also the Co-founder of Women Get on Board Inc. Board and Committee Attendance:

|

| |

| |

| |

| |

| | Board Meetings Attended | Committee Meetings Attended |

| | # of Meetings | Attendance Rate (%) | Committee Membership | # of Meetings | Attendance Rate (%) |

| | 11 of 11 | 100% | AUD (Chair) | 5 of 5 | 100% |

| | | | HRCC | 3 of 3 | 100% |

| | | | GOV | 2 of 2 | 100% |

| | AUD: Audit Committee HRCC: Human Resources and Compensation Committee GOV: Nominating and Corporate Governance Committee

DIRECTOR EXPERTISE Ms. Rosati’s experience in financial, operational and strategic management roles in the Canadian market makes her a valuable member of the Board. Ms. Rosati holds an Honours Bachelor’s degree in Business Administration from Brock University and is a Fellow Chartered Professional Accountant (FCPA, FCA) and certified Director, ICD.D (2008).

|

| |

| |

| |

| |

| |

| |

| |

| |

| | ANAND. A. SAMUEL Analyst ESL Investments, Inc. (investment company) Age: 40

Non-Independent Director (residing in Florida, U.S.A.)

Director since: April 2015

Sears Canada Shareholdings 2015: Nil

| Anand A. Samuel is currently an Analyst at ESL and assumed this position in May 2007. Prior to this, Mr. Samuel was an Associate Attorney in the Tax group at Sullivan & Cromwell LLP from September 2005 to May 2007.

Board and Committee Attendance: |

| |

| |

| |

| |

| | Board* Meetings Attended | Committee Meetings Attended |

| | # of Meetings | Attendance Rate (%) | Committee Membership | # of Meetings | Attendance Rate (%) |

| | 9 of 9 | 100% | INVEST | 3 of 3 | N/A |

| | *Mr. Samuel was appointed to the Board in April 2015 INVEST : Investment Committee

DIRECTOR EXPERTISE Mr. Samuel brings a wealth of legal and business knowledge to the Board. Mr. Samuel graduated magna cum laude with a Juris Doctor degree from Harvard Law School and summa cum laude with a Bachelor of Arts degree, with dual majors in Biophysics and Biology, from the University of Pennsylvania. Mr. Samuel also holds a Bachelor of Science in Economics degree, with a concentration in Finance, from the Wharton School of the University of Pennsylvania. Mr. Samuel is a Chartered Financial Analyst and a member of the New York State Bar.

|

| |

| |

| |

| |

| |

| |

|

| | | | | | |

| | GRAHAM SAVAGE Corporate Director

Age: 67

Independent Director (residing in Ontario, Canada)

Director since: April 2015

Sears Canada Shareholdings 2015: Nil

| Graham Savage is a Corporate Director and currently serves on the boards of Post Media Network Inc., Whistler Blackcomb Holdings Inc. and Cott Corporation. From August 1999 to July 2008, Mr. Savage was Founding Partner of Callisto Capital LP, and its predecessor Savage Walker Capital Inc., both private equity firms. Mr. Savage was Chief Financial Officer and Director of Rogers Communications Inc. from March 1989 to November 1996. Mr. Savage has served as a Director of Canadian Tire Corporation, Alias Corp., FMC Financial Models Limited, Leith Technology Corp., Lions Gate Entertainment Corp., MDC Corp., Microcell Inc., Royal Group Technologies Limited, Sun Media Corp., Sun Times Media Group, Inc. and Vitran Corporation, among others.

Board and Committee Attendance:

|

| |

| |

| |

| |

| | Board* Meetings Attended | Committee Meetings Attended |

| | # of Meetings | Attendance Rate (%) | Committee Membership | # of Meetings | Attendance Rate (%) |

| | 9 of 9 | 100% | AUD | 3 of 3 | 100% |

| | | | HRCC | 1 of 1 | 100% |

| | | | GOV | 2 of 2 | 100% |

| | *Mr. Savage was appointed to the Board in April 2015 AUD: Audit Committee (member since April 2015) HRCC: Human Resources and Compensation Committee (member since August 2015) GOV: Nominating and Corporate Governance Committee

DIRECTOR EXPERTISE Mr. Savage brings a wealth of retail and financial knowledge to the Board having held numerous corporate director roles with many organizations. Mr. Savage holds a Bachelor of Arts degree in Business from Queen's University and an MBA from Queen’s University. Mr. Savage has 40 years of experience in the finance and investment industry, including seven years as Chief Financial Officer of a major public company.

Mr. Savage currently serves on the board of Postmedia Network Inc., Whistler Blackcomb Holdings Inc. and Cott Corporation.

|

| |

| |

| |

| |

| |

| |

| |

| |

| | S. JEFFREY STOLLENWERCK President, Sears Real Estate Business

Sears Holdings Corporation

(retail company)

Age: 46

Non-Independent Director

(residing in Connecticut, U.S.A.)

Director since: April 2014

Sears Canada Shareholdings

2015: 48,733

2014: 2,507

2013: 1,108

Dollar Amount of Sears Canada Shares1: $299,707.95

1Dollar amount calculated using the Company’s share price on the TSX as at the close of trading on the last business day of the Company’s financial year end (January 30, 2016), being $6.15, and multiplying that price by the number of Shares held by each individual director. | S. Jeffrey Stollenwerck is currently the President, Real Estate Business Unit for Sears Holdings and assumed this position in February 2008. Mr. Stollenwerck has also served as the Senior Vice-President, Real Estate for Sears Holdings from March 2005 to February 2008 and the Vice-President, Real Estate for Kmart Corporation from May 2003 to March 2005, prior to the Sears Holdings/Kmart merger in 2005. Prior to joining Sears Holdings, Mr. Stollenwerck was the Vice-President, Research for ESL. Board and Committee Attendance:

|

| |

| |

| |

| |

| | Board Meetings Attended | Committee Meetings Attended |

| | # of Meetings | Attendance Rate (%) | Committee Membership | # of Meetings | Attendance Rate (%) |

| | 11 of 11 | 100% | INVEST | 3 of 3 | 100% |

| | INVEST: Investment Committee

DIRECTOR EXPERTISE Mr. Stollenwerck has been involved in the retail industry for close to 13 years, holding various senior positions relating to the real estate business with both Sears Holdings and Kmart Corporation. Mr. Stollenwerck is a graduate of Stanford University, where he earned a Bachelor of Arts degree with a double major in Economics and Political Science.

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | | | | | |

| | BRANDON G. STRANZL Executive Chairman Sears Canada Inc. (retail company)

Age: 41

Non-Independent Director (residing in Ontario, Canada)

Director since: April 2015

Sears Canada Shareholdings 2015: Nil

| Brandon G. Stranzl is the Executive Chairman of the Company and has held this position since his appointment on July 2, 2015. Previously, Mr. Stranzl served as the Company's Chairman beginning April 23, 2015. Mr. Stranzl is also the General Partner of Beaconfire Capital LP, a position he has held since April 2015. From April 2012 to April 2015, Mr. Stranzl was the Senior Vice-President for First Pacific Advisors LLC, managing value-oriented investments. Prior to this, he was Managing Member of BGS Investments LLC (May 2011 to March 2012), Portfolio Manager and Head of Value Equity and Distressed Credit at C12 Capital Management LLC (May 2010 to April 2011) and Investment Analyst for ESL (May 2008 to April 2010). This was preceded with various positions in the investment industry, including positions with Third Avenue Management LLC, Morgan Stanley Asset Management and Fidelity Investments. Board and Committee Attendance:

|

| |

| |

| |

| |

| | Board* Meetings Attended | Committee Meetings Attended |

| | # of Meetings | Attendance Rate (%) | Committee Membership | # of Meetings | Attendance Rate (%) |

| | 9 of 9 | 100% | HRCC (Chair) | 2 of 2 | 100% |

| | | | INVEST (Chair) | 3 of 3 | 100% |

| | *Mr. Stranzl was appointed to the Board in April 2015

HRCC: Human Resources and Compensation Committee (since April 2015)

INVEST: Investment Committee

DIRECTOR EXPERTISE Mr. Stranzl's vast knowledge of the business, finance and investment sectors makes him an asset to the Board and the Company. Mr. Stranzl holds a BA from Vassar College and is a Chartered Financial Analyst and a member of the New York Society of Security Analysts. |

| |

| |

| |

Ronald D. Boire ceased to be a director of the Board effective August 28, 2015. Mr. Boire attended all Board meetings until August 2015, with an attendance record of 100%.

Klaudio Leshnjani ceased to be a director of the Board effective February 4, 2016. Mr. Leshnjani attended all Board meetings until February 2016, with an attendance record of 100%.

2.2.3 Cease Trade Orders and Bankruptcies

To the knowledge of the Company, except as hereinafter described, no Proposed Director of the Company is, has or has been, within ten years before the date hereof, (a) a director, chief executive officer or chief financial officer of any company, including Sears Canada or any personal holding company, that (i) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, and which was issued while that person was acting in that capacity, or (ii) was subject to an order that was issued after the Proposed Director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or (b) a director or executive officer of any company, including Sears Canada or any personal holding company, that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (c) become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager, or trustee appointed to hold the assets of the Proposed Director.

Graham Savage was a director of Microcell Inc. when it filed for protection under the Companies' Creditors Arrangement Act (Canada) in January 2003. From July 2003 until November 30, 2009, Mr. Savage was a director of Sun-Times Media Group, Inc., a successor entity of Hollinger International Inc. ("Hollinger"). On June 1, 2004, the Ontario Securities Commission issued a permanent management cease trade order (the

"Ontario Cease Trade Order") against the insiders of Hollinger for failing to file its interim financial statements and interim management's discussion and analysis for the three-month period ended March 31, 2004 and its annual financial statements, management's discussion and analysis, and the annual information form for the year ended December 31, 2003. In addition, the British Columbia Securities Commission issued a cease trade order against insiders of Hollinger resident in British Columbia on May 21, 2004, as updated on May 31, 2004 (the "BC Cease Trade Order"). The Ontario Cease Trade Order was allowed to expire on January 9, 2006 and is no longer in effect. The BC Cease Trade Order was revoked on February 10, 2006 and is no longer in effect.

| |

2.3 | Appointment of Auditors |

The persons named in the enclosed form of proxy intend to vote for the appointment of Deloitte LLP, Chartered Accountants, as auditors of the Company, at a remuneration to be fixed by the directors, to hold office until the next annual meeting of Shareholders. Deloitte LLP have served as auditors of the Company since 1984. In accordance with its mandate, the Audit Committee of the Board (the “Audit Committee”) regularly examines the scope of all services provided by the auditors to the Company. In order to enhance such examination and assess the independence of the auditors, the Board has adopted a policy which establishes the scope of the auditors’ services and requires the Audit Committee to pre-approve all services provided by Deloitte LLP. This policy outlines the services which are audit and audit-related, non-audit related and prohibited. Under this policy, the aggregate fees for non-audit related services rendered by the auditors cannot exceed 50% of the total audit and audit-related fees per annum without the pre-approval of the Audit Committee.

Fees paid or accrued, with the approval of the Board, in connection with the services rendered by Deloitte LLP in Fiscal 2015 and Fiscal 2014, (being the 52-week period ended January 31, 2015) were as follows:

|

| | |

External Auditor Service Fees | Fiscal 2015 | Fiscal 2014 |

Audit Fees1 | $2,236,300 | $2,300,500 |

Audit-Related Fees2 | $59,920 | $187,785 |

Tax Fees3 | - | - |

All Other Fees4 | - | $123,756 |

Total | $2,296,220 | $2,612,041 |

| |

1 | Includes fees for professional services provided in conjunction with the audit of the Company’s financial statements, review of the Company’s quarterly financial statements and attestation services normally provided in connection with statutory and regulatory filings and engagements. |

| |

2 | Includes fees for assurance and related professional services primarily related to the rights offering and the audit of associate benefit plans. |

| |

3 | Includes fees for professional services provided related to tax compliance, tax planning, and other tax advice. |

| |

4 | All other fees, if any, consist of permissible work performed by Deloitte LLP which is not included in the categories above. For Fiscal 2014, the other fees were in respect of an assessment of the Company’s logistics network as well as an assessment of the Company's conflict mineral reporting requirements. Management and the Audit Committee concluded that these services provided by Deloitte LLP were not restricted services, and implemented monitoring safeguards to ensure independence was maintained. |

2.4 Omnibus Equity Incentive Plan

Historically, the Company used the Special LTIP and the TIP (see Section 3.1.6 - Variable At-Risk Performance Based Compensation) as equity linked management incentive plans. In order to achieve a better alignment between long-term shareholder value and management incentives, the Company decided to discontinue these programs effective in 2016, and to transfer all remaining participants into a combination of an omnibus equity incentive plan (the “Omnibus Plan”) and/or the LTIP. The Company adopted the Omnibus Plan effective as of September 22, 2015 which permits the grant of options to acquire Common Shares, tandem share appreciation rights, restricted share units and performance share units. The Board has limited the amount of such grants available to the Company, and has imposed holding period requirements on any recipients. Specifically, the Board has determined that the number of Common Shares

issuable pursuant to awards granted under the Omnibus Plan shall be limited to the lesser of 2,000,000 Common Shares each fiscal year or 2% of the then issued and outstanding Common Shares, with any awards granted to be approved by the Board upon recommendation by the Human Resources and Compensation Committee. Further, the terms of the applicable award agreements will provide that, for time-based awards, there is a minimum of a 3-year vesting period, and that the employee must hold any Common Shares issued pursuant to awards granted under the Omnibus Plan (net of any Common Shares sold to cover applicable withholding taxes) for a period of up to five years measured from the date the award is vested (collectively, the "Grant Restrictions"). The material features of the Omnibus Plan are summarized in Appendix "A" to this Management Proxy Circular and the Omnibus Plan would come into force if and when approved by the Shareholders at the Meeting. The Company intends to revise Appendix "A" following the Meeting to include the Grant Restrictions, subject to the approval of the Shareholders at the next annual shareholders meeting.

During Fiscal 2015, the Company made equity based grants of restricted share units (“RSUs”) to Ron Boire, the former President and Chief Executive Officer of the Company, however no RSUs were received by Mr. Boire as he left the Company prior to vesting. In addition, during Fiscal 2015 the Company made a grant of RSUs under the Omnibus Plan to Brandon G. Stranzl, the Executive Chairman of the Company, however none of the awards vested in Fiscal 2015, and vest one-third per year commencing on the first anniversary of the grant date and will be subject to the hold period set out above. See Summary Compensation Table for Fiscal 2015.

As discussed above, during fiscal 2016, the Company intends to discontinue the TIP, which was designed to be an equity linked incentive program. The Company intends to discontinue the TIP in favour of grants under the Omnibus Plan and/or participation in the LTIP, which are programs that the Company believes are better suited to align management incentives with long term shareholder value, than the TIP.

2.5 Shareholder Proposals

Pursuant to the CBCA, proposals by Shareholders to be considered for inclusion in the management proxy circular for the 2017 annual meeting of Shareholders must be received by the Office of the Secretary of the Company by December 12, 2016.

3. EXECUTIVE COMPENSATION

| |

3.1 | Compensation Discussion and Analysis |

The commitment of the Company to making Sears Canada successful through its three key business initiatives of increasing revenue, operating profitably and maintaining a strong balance sheet is contingent upon the ability of the Company to successfully attract, motivate and retain highly talented executive officers who are committed to the Company’s mission, vision and values. The Company firmly believes that its executive compensation strategy is in-line with attracting and retaining executive officers who successfully contribute to the Company’s accomplishments. During Fiscal 2015, the Company sought out or promoted top talent, including the appointment of a new Executive Chairman, a President and Chief Merchant and a Senior Vice-President, Planning and Operations as well as the appointment or promotion of several other senior executives.

This Compensation Discussion and Analysis (“CD&A”) describes and explains the elements of compensation awarded to, earned by, paid to or made payable to the Company’s named executive officers, as defined in Form 51-102F6 under National Instrument 51-102 – Continuous Disclosure Obligations (the “Executive Compensation Rules”) for Fiscal 2015. The Executive Compensation Rules require the Company to provide specific disclosure on the Executive Chairman, the Chief Executive Officer, the Chief Financial Officer and the three other most highly compensated executive officers of the Company who served as executive officers during Fiscal 2015 and whose total compensation, individually, was more than $150,000 and any individual satisfying any of the foregoing criteria but for the fact that the individual was neither an executive officer of the Company or its subsidiaries, nor acting in a similar capacity, at the end of that financial year (“Named Executive Officer” or “NEO”).

This CD&A discusses the Company’s compensation philosophy, plan designs, objectives, and the decisions for the following Named Executive Officers, as approved by the Human Resources and Compensation Committee of the Board (“HRCC”):

Brandon G. Stranzl, Executive Chairman

Ronald D. Boire, Former President and Chief Executive Officer (resignation effective on August 28, 2015)

E.J. Bird, Executive Vice-President and Chief Financial Officer

Gail Galea, Senior Vice-President, Home and Hardlines

Klaudio Leshnjani, Executive Vice-President and Chief Operating Officer (departed the Company effective February 1, 2016)

Becky Penrice, Senior Vice-President, Human Resources and Information Technology (appointed Senior Vice-President and Interim Chief Operating Officer effective February 2, 2016)

3.1.1 Compensation Philosophy

The HRCC’s compensation philosophy is principled on the Company’s executive compensation being:

•Aligned with the goals of the Company;

| |

• | Aligned with the goals and interests of the Shareholders; and |

| |

• | Able to attract, motivate and retain qualified and experienced executives for the Company. |

The Company’s executive compensation programs are established and designed to:

•Provide a competitive total rewards package;

•Reward executives for corporate performance; and

•Support business objectives.

The compensation programs for the executive officers are focused on pay-for-performance, with direct-line-of-sight to corporate and individual performance to drive the achievement of the Company's results.

Executive Peer Group

The Company’s target level of total compensation is a median position in the market of twenty selected Canadian companies that are comparable to the Company in size, revenue, and/or business. This group of comparator companies in retail and general industry, as listed immediately below, was reviewed to ensure that employment positions within both industries are comparable to the positions available at the Company. The Company uses this comparator group to represent the retail and general market, and to benchmark executive compensation against this group in order to attract and retain qualified executives for the achievement of corporate goals. The comparable compensation components are base salary, target annual incentives, target long-term incentives, and target total compensation. During the 2012 fiscal year, a review was conducted of the comparator companies, as well as other companies with which the Company competes for executive talent.

|

| | | |

Executive Peer Group |

Retail Organizations | General Industry Organizations |

Alimentation Couche-Tard Inc. | RONA Inc. | Resolute Forest Products | McDonald's Restaurants of Canada Limited |

Canadian Tire Corporation, Limited | Shoppers Drug Mart Corporation | Canada Post Corporation | Rogers Communications Inc. |

The Home Depot Canada Inc. | Sobeys Inc. | Canadian National Railway Company | TELUS Corporation |

Hudson’s Bay Company | STAPLES Canada Inc. | Finning International Inc. | Tim Hortons Inc. |

Metro Inc. | Walmart Canada | Maple Leaf Foods Inc. | Transcontinental Inc. |

Compensation Consulting Firm

An independent executive compensation consulting firm, Meridian Compensation Partners (“Meridian”), is retained by the Company. Meridian was originally retained during the 2011 fiscal year. The mandate of Meridian is to serve the Company and, at the request of the HRCC, to provide assistance and guidance to the HRCC in its review of executive compensation, including the competitiveness of pay levels, executive compensation design issues, market trends, and technical considerations, as required. Meridian does not perform any non-executive compensation or other related services for the HRCC or the Company. Meridian may perform services for the HRCC, provided that such services are not in conflict with its mandate to serve the Company.

All Other Fees

For Fiscal 2015, Meridian reviewed and commented on the executive compensation report of the Circular. The fees paid to Meridian for services performed during Fiscal 2015 and Fiscal 2014 totaled approximately $7,609 and $6,349, respectively.

3.1.2 Human Resources and Compensation Committee

The HRCC is responsible for overseeing the development of the Company’s overall human resources strategy, policies and practices, for fair and competitive compensation of the executive officers in support of the achievement of the Company’s business strategy, as well as the development of other compensation programs for the benefit of all associates. The HRCC annually reviews executive compensation policies,

programs and practices, as presented by the management of the Company, to assess whether the Company’s compensation programs provide an appropriate balance of risk and reward in relation to the Company’s overall business strategy as well as the application of internal equity. The HRCC also, at least annually, reviews and approves the design and introduction of all associate-related annual and long-term incentive plans, together with performance targets, the level of achievement of performance goals at the end of a performance period and any payments under such plans to the executive officers, as recommended by the management of the Company. The HRCC approves all annual and long-term incentive programs after management of the Company assesses and presents the risks and financial liability of each program, the competitive position in the market and the alignment to the goals and objectives of the Company while also ensuring the program does not encourage executive officers of the Company to undertake undue or inappropriate risk. At the end of Fiscal 2015, no such risks were identified that would likely cause a material adverse effect on the Company. In addition to reviewing and approving executive compensation programs for the Company, the HRCC also oversees and approves:

| |

• | The development of the Executive Chairman’s goals and objectives, and the evaluation of the Executive Chairman’s performance based on the achievement of these goals; |

| |

• | The compensation and performance of the executive officers of the Company, by receiving periodic performance reports and compensation recommendations from the Executive Chairman, as necessary, with respect to the executive officers; and |

| |

• | The development of appropriate succession plans for, and the compensation of, the executive officers. See Section 5.11.2 – “Human Resources and Compensation Committee” for additional details. |

The Executive Chairman’s performance is evaluated by the HRCC on a regular basis and his at-risk compensation is directly tied to the achievement of corporate goals and positive corporate results. The HRCC is kept apprised of the Company’s performance through frequent communication with the Executive Chairman. The Executive Chairman is the Chair of the HRCC, however, he does not participate in conversations and activities related to his compensation or performance.

3.1.3 Composition of HRCC

As at the end of Fiscal 2015, the HRCC was comprised of one Non-Independent Director, being Brandon G. Stranzl, and three Independent Directors, being R. Raja Khanna, Deborah E. Rosati and Graham Savage. None of the Independent Directors on the HRCC are eligible to participate in the Company’s executive compensation programs.

Each of these members brings their own individual expertise to the Committee, including financial, marketing, strategy, investment, and retail knowledge, which is utilized in assessing and approving the implementation of compensation policies and practices for the Company.

The accomplishments of the HRCC in Fiscal 2015 are highlighted below:

| |

• | Reviewed and approved changes to the Annual Incentive Program ("AIP") design; |

| |

• | Reviewed and approved the Long-Term Incentive Plan for designated salaried associates of the Company for the 2015-2017 Long-Term Incentive Plan Performance Period; |

| |

• | Reviewed and approved the Turnaround Incentive Plan ("TIP") for the executive leadership team and designated salaried associates of the Company for the 2015-2017 Performance Period; |

| |

• | Reviewed, recommended and approved the Company’s disclosure of its executive compensation; |

| |

• | Reviewed the retirement plans annual governance report; |

| |

• | Reviewed the executive organizational structure, succession plans, committee charter and 2016 HRCC work plan; and |

| |

• | Approved the appointment and promotion of certain senior level employees. |

| |

3.1.4 | Compensation Structure and Mix |

The Company’s executive compensation programs focus on a total rewards structure, which is inclusive of two components of compensation provided to the executive officers: (i) fixed compensation comprised of base salary, benefits and perquisites, and pension; and (ii) variable at-risk performance based compensation, comprised of an annual incentive program, and long-term incentive plans and, for two NEOs (Messrs. Stranzl and Boire), restricted share units. The fixed elements provide a competitive base of secure compensation necessary to attract and retain qualified executive talent. The variable at-risk performance based elements reward short-term and long-term performance results. The Special Long-Term Incentive Plan will remain effective until the end of 2016. The actual compensation mix varies by executive level, reflecting the impact executive officers have on the Company's results.

The main components of the total rewards structure are:

•Base Salary

•Benefits and Perquisites

•Retirement Benefits and Pension

| |

• | Variable At-Risk Performance Based Compensation: |

| |

• | Annual Incentive Program |

| |

• | Long-Term Incentive Plan ("LTIP") |

| |

• | Special Long-Term Incentive Plan ("Special LTIP") |

| |

• | Turnaround Incentive Plan |

| |

• | Equity Based Compensation: |

| |

• | Restricted Share Units ("RSU") |

The following chart provides a summary of how each element of compensation is intended to reward certain executive officers and salaried associates.

|

| | |

Compensation Element | Objective | Intended Rewards and Why It is Used |

FIXED COMPENSATION |

Base Salary | To provide a portion of compensation as a secure fixed cash amount | • To pay for competence in the role and for scope of responsibilities • To provide a level of secure earnings that is sufficient to meet living standards and discourage undue, high-risk decision making • Market practice |

Benefits and Perquisites | To provide a competitive retention incentive to certain executive officers other than cash compensation, such as health coverage, vehicle or vehicle allowance, and perquisite allowance for club memberships and financial planning | • To ensure access to health services to manage personal wellness • To reinforce individual accountability for personal financial planning • Market practice |

Pension | To provide a retirement savings vehicle | • To provide associates with a pension at retirement. The retirement plans manage associate and employer contributions, while enforcing associate ownership of retirement income • Market practice |

|

| | |

Compensation Element | Objective | Intended Rewards and Why It is Used |

VARIABLE AT-RISK PERFORMANCE BASED COMPENSATION |

AIP | To provide an opportunity for an annual incentive award based on the achievement of near-term corporate objectives | • To focus attention on the achievement of annual Corporate profitability goals • To provide a competitive total compensation package • Market practice |

LTIP | To provide performance and employment retention based compensation designed to encourage long-term sustainable performance results | • To focus attention on the achievement of profitability goals over a three-year period • To provide a competitive total compensation package • Market practice |

Special LTIP | To provide performance and employment retention based compensation for specific designated executives, designed to encourage long-term corporate performance aligned with shareholder interests | • To align executive compensation with shareholder interests and focus attention on the achievement of objectives over a multi-year period • To provide a competitive total compensation package • Participation in the Special LTIP replaces participation in the LTIP for the Performance Period • Market practice |

TIP | To provide performance and employment retention based compensation for specific designated executive leadership team members, designed to encourage long-term corporate performance aligned with shareholder interests

| • To align executive compensation with shareholder interests and focus attention on the achievement of objectives over a multi-year period• To provide a competitive total compensation package• Participation in TIP replaces participation in LTIP and Special LTIP for the Performance Period• Market practice

|

EQUITY BASED COMPENSATION |

RSU | To align shareholder and management interests

| • To align executive compensation with shareholder interests• To provide a competitive total compensation package

|

The Company provides a significant proportion of compensation to its NEOs through variable at-risk performance based programs. A new at-risk TIP was introduced in Fiscal 2015 for designated executive leadership team members of the Company, to further align corporate performance goals with shareholder interests. Participation in the TIP removes the executive from participation in the LTIP and Special LTIP for the Performance Period to ensure at-risk earnings are not too high and to discourage high risk behavior. The Company intends to discontinue the TIP in favour of grants under the Omnibus Plan and/or participation in the LTIP. A Special LTIP was introduced in Fiscal 2013 for specific designated executives and designated salaried associates of the Company to further align corporate performance goals with shareholder interests.

Aggregate Weighting of Compensation Components

for Active Named Executive Officers

The chart above shows the weighting of the various components that the NEOs or executive officers may receive as compensation based on annual base salary, annual target levels of incentive compensation and perquisites, and all other compensation for Fiscal 2015 for all active NEOs. Any base salary amounts in US Dollars were converted to Canadian Dollars using the Bank of Canada exchange rate of 1.4080 on the last trading date of Fiscal 2015 being January 29, 2016. The chart does not include any one-time payments, one-time grants or commuting expenses made to any NEO during Fiscal 2015.

Fixed compensation, which is inclusive of base salary, benefits and perquisites and pension, provides executive officers with earnings that are competitive in the market and consistent with the Company’s compensation philosophy. The Company’s fixed compensation programs are designed to provide a competitive base of secure compensation necessary to attract and retain qualified executive officers while ensuring a level of secure earnings that are sufficient to meet living standards and discourage undue, high-risk decision making.

(a) Base Salaries

Base salary reflects annual compensation received by an associate for the position they hold and the role they perform within the Company. Base salaries are normally set at median market values and balanced with relative roles and responsibilities and equity within the Company. The base salaries reflect accountabilities of the role, the incumbent's performance in the role, as well as experience, individual qualifications and expected future contributions to the Company. Base salaries are normally benchmarked internally against similar roles and externally against comparable roles in peer companies to determine current market competitiveness.

(b) Benefits and Perquisites

The Company provides select executive officers and designated salaried associates with competitive perquisites and benefits that allow them to focus on their daily responsibilities and the achievement of the Company’s objectives. The NEOs are provided with certain perquisites, which may include a company vehicle or vehicle allowance, educational assistance for dependent children, commuting expense reimbursement and/or an annual perquisite allowance to cover club memberships and financial planning. The perquisites are provided to reinforce individual accountability for personal well-being and financial planning. All NEOs are provided with an annual comprehensive executive medical benefit. All executive officers of the Company are provided with reimbursement for premiums and higher plan maximums on optional life insurance and long-term disability insurance.

(c) Retirement Benefits and Pension

The Company provides post-retirement benefits through the Sears Canada Inc. Health and Welfare Plan to all associates who satisfied the eligibility requirements on or before December 31, 2008.

The Sears Registered Retirement Plan (the “SRRP”) has two components: (i) a defined benefit (“DB”) component for service up to and including June 30, 2008, which also includes a Supplementary Retirement Plan (the “SRP”); and (ii) a defined contribution (“DC”) component, effective July 1, 2008, which does not include a supplementary retirement plan.

For further detailed information, refer to Section 3.4 – “Pension Plans”.

3.1.6 Variable At-Risk Performance Based Compensation

The Company's' variable at-risk performance based compensation programs are designed to reinforce the Company’s business strategy, as approved by the Board, by providing executives with the opportunity to earn cash incentives based on the achievement of corporate performance metrics. Award opportunities vary based on a percentage of base salary, position or performance objectives, and are reviewed by the Board/HRCC periodically to ensure ongoing market competitiveness. Performance objectives are based on the Company’s business plan or share price for one or more fiscal years and are intended to be challenging but achievable. All corporate financial measures on all financial statements are stated pursuant to the International Financial Reporting Standards.

For Fiscal 2015, there were four variable at-risk performance based compensation programs for the NEOs:

(a) AIP

The AIP is an important component of the total compensation package. It is designed to provide an annual financial reward based on the achievement of a target corporate financial performance metric, as approved by the HRCC. The AIP design was reviewed and changes were approved by the HRCC in Fiscal 2015. The changes included a reduction to the threshold corporate financial performance metric from 75% to 50% of target and an increase required to achieve the maximum corporate financial performance metric from 125% to 150% of target. There was no change to the payout opportunity. The reduction in the threshold financial metric (from 75% of target to 50% of target) was to encourage motivation to drive results with an achievable goal. The increase in the maximum levels without an increase in the payout opportunity, was to rebalance and create stretch targets while discouraging risky behaviours.

The scorecards continue to be based on team and corporate goals. For the NEOs, the trigger remained based on the financial metric, measured by operating profit (total revenue less total expenses, except for those expenses, which are interest, income tax, depreciation, amortization and other non-recurring, unusual and one-time in nature expenses (the “AIP Adjusted EBITDA”)). Team based measures were financial metrics, such as channel EBITDA, corporate or channel sales, and profitability based metrics that each team was responsible to deliver. This continued to create a focus on key financial targets with AIP Adjusted EBITDA remaining a primary focus in line with shareholder value.

The AIP is designed to achieve three important objectives:

| |

• | Motivate and reward eligible associates who contribute to the Company’s achievement of the corporate financial performance metric; |

| |

• | Provide associates with a competitive total compensation package; and |

| |

• | Attract and retain talented associates. |

For the NEOs, their annual incentive award (target bonus amount as a percentage of base salary) is based on the achievement of the corporate financial performance metric established for each financial year. For Fiscal 2015, the corporate financial performance metric was measured by AIP Adjusted EBITDA and Corporate Sales.

The NEOs had a direct line of sight to the results as they were rewarded completely on corporate financial results with no team or business line specific metrics and were required to achieve at least the AIP Adjusted EBITDA threshold level before a payout could occur.

For the corporate financial performance metric, the threshold goal is set at 50% of target and the maximum goal is set at 150% of target. Compensation awards are determined according to the following criteria:

| |

• | If the threshold level of the corporate financial performance metric is achieved, then 30% of the target award is payable; |

| |

• | If the target level of the corporate financial performance metric is achieved, then 100% of the target award is payable; |

| |

• | If the maximum level of the corporate financial performance metric is achieved, then 150% of the target award is payable to recognize the achievement of superior corporate performance; and |

| |

• | If the actual result of the corporate financial performance metric is between any of the performance levels described above, the award payable is adjusted on a straight-line basis between the threshold and target levels or target and maximum levels. |

Based on the achievement of the threshold level of the corporate financial performance metrics, the final payout is then subject to the individual performance metric to determine the final incentive award payout. The individual performance metric coincides with the Company’s annual performance evaluation program. The final individual performance multiplier rate is subject to approval by the HRCC and will be a percentage up to the maximum for each established rating level.

|

| | | | | |

Individual Performance Metric | Rating = 1 | Rating = 2 |

Rating = 3 (1)

| Rating = 4 | Rating = 5 |

AIP Payment Multiplier | 0% | Up to 35% | Up to 100% | Up to 125% | Up to 150% |

| |

(1) | Represents an associate demonstrating the expected level of performance and being fully competent in the role. |

For the Senior Vice-Presidents and above, the award levels and applicable payout as a percentage of base salary, with an individual performance metric resulting in a payment performance multiplier of 100%, are described below:

|

| | | |

Position | Threshold (30% payout of target award) (1) | Target (100% payout of target award) (1)(2) | Maximum (150% payout of target award) (1) |

Executive Chairman | 52.5% | 175% | 262.5% |

President and Chief Executive Officer (former) | 45% | 150% | 225% |

Executive Vice-Presidents | 22.5% | 75% | 112.5% |

Senior Vice-Presidents | 18% | 60% | 90% |

(1) Payouts are determined based on the percentage of base salary and are pro-rated according to the commencement of program participation.

(2) Represents an associate demonstrating the expected level of performance and being fully competent in the role.

Subject to the terms of the applicable employment agreement, an associate must be actively employed on the date of AIP payment to be eligible to receive the payout (associates who retire or whose employment is terminable, voluntarily or involuntarily, before the date of payout, are not eligible for the payment). As well, associates must be in good performance standing and not undergoing disciplinary action or in a performance improvement program in order to receive their AIP payment. Associates, who are on an approved leave of absence other than long-term disability (“LTD”), will receive their AIP payment upon their return to active employment. In the event an AIP participant dies or sustains an LTD claim during the year, and an AIP payout will occur for that same year, then such participant or his or her estate, as the case may be, is entitled to a pro-rata AIP award payment, based on the date of LTD or death.

For Fiscal 2015, there were no payouts triggered under the AIP for the NEOs, based on the threshold level of the corporate financial performance metric, AIP Adjusted EBITDA, not being met, as described below:

|

| | | | |

Performance Measure | Weighting of the Performance Measure | Threshold | Results | AIP Performance Score |

AIP Adjusted EBITDA | 100% | Adjusted EBITDA of $26 Million | Adjusted EBITDA of ($160.5) Million | 0% |

(b) LTIP

The LTIP provides a cash incentive for eligible executive officers and designated salaried associates who are not participants in the Special LTIP or TIP. The LTIP promotes focused growth of the corporate financial results and return on investment for Shareholders. The plan is a performance and employment retention based incentive, designed to measure and reward long-term corporate performance, as measured by total earnings determined before interest, income taxes, depreciation and amortization, and excluding certain items (the “LTIP Adjusted EBITDA”), over a three-year performance period (the “Performance Period”). The LTIP includes a time-based component with a 25% weighting of the award value.

Upon the HRCC's approval, a new LTIP will continue to be introduced on an annual basis, recognizing three-year corporate performance. This rolling design for LTIP awards allows for annual payouts which began in 2009. The “rolling” design (as demonstrated in the chart below) is intended to serve as a retention tool and to maintain the executive officers’ or designated salaried associates’ focus on achieving long-term sustainable performance results.

|

| | | | | | |

Award Period | Fiscal Years |

2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

Feb 2013 to Jan 2014 | Feb 2014 to Jan 2015 | Feb 2015 to Jan 2016 | Feb 2016 to Jan 2017 | Feb 2017 to Jan 2018 | Feb 2018 to Jan 2019 |

2013-2015 | 3-year Performance Period | Payout | |

2014-2016 | | 3-year Performance Period | Payout | |

2015-2017 | | 3-year Performance Period | Payout |

Certain NEOs, being the Executive Vice-Presidents, were excluded from participating in the 2013-2015 LTIP. Instead, the Executive Vice-Presidents are participants in the 2013-2015 Special LTIP, as described below in Section 3.1.6 (c) - “Special LTIP”. None of the other NEOs were participants in the 2013-2015 LTIP as they were hired after the last day in the Performance Period in which participants could enter the plan.

Beginning in 2014, the Executive Vice-Presidents and other NEOs became participants of the 2014-2016 LTIP.

All NEOs are excluded from participating in the 2015-2017 LTIP. Instead, the NEOs are participants in the 2015-2017 TIP, as described below in section 3.1.6 (d) - "TIP". Beginning in 2016 it is anticipated that the senior executives will remain in a TIP for the 2016-2018 Performance Period.

For the 2014-2016 LTIP, the details of the plan were as follows:

The LTIP was designed to align participants’ financial incentives with the financial goals of the Company and to assist in attracting, retaining, engaging and rewarding executive officers and designated salaried associates. Any such award payouts are paid to the LTIP participant in cash after the end of the three-year Performance Period.

Awards are designed to vary commensurately with the achievement of corporate financial goals for the Performance Period. Under the LTIP, a cash award amount, as a percentage of base salary, is established by the HRCC for participants and correlates with the threshold, target and maximum levels of achievement of the corporate performance metric.

The 2014-2016 LTIP, the three-year Performance Period, which began on February 1, 2014, will mature on January 28, 2017 (the “2014-2016 LTIP”) and will recognize performance results from the 2014 to 2016 fiscal years.

The 2014-2016 LTIP is comprised of two components: (i) a time-based LTIP award component with a 25% weighting of the target incentive award; and (ii) a performance-based LTIP component, based on performance measure achievement with a 75% weighting of the target incentive award.

The time-based LTIP component is measured on time completion, serving as a retention component, and is not linked to the financial performance measure. In order to be eligible for payout, the participant must commence participation in the plan and remain eligible without interruption throughout the entire Performance Period up to and including payment date.