Current Report Filing (8-k)

November 18 2022 - 5:16PM

Edgar (US Regulatory)

0001596062

false

--11-30

0001596062

2022-11-16

2022-11-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

November 16, 2022

Date of Report (Date of earliest event reported)

Q BioMed Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55535 |

46-4013793 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

c/o Ortoli Rosenstadt LLP

366

Madison Avenue, 3rd

Floor

New York, NY |

10017 |

| (Address of principal executive offices) |

(Zip Code) |

(212) 588-0022

Registrant’s telephone number, including

area code

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered: |

| None |

|

None |

|

None |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item

3.02 | Unregistered

Sales of Equity Securities |

On November 18, 2022, we issued 1,000,000 Series

C Preferred Shares (as defined below) in exchange for the settlement of $50,000 in amounts due to our directors and/or officers.

The securities mentioned above were issued, or

will be issued, in reliance on exemptions from registration under Section 4(2) of the Securities Act of 1933, as amended (the “Act”),

and Rule 506 of Regulation D promulgated under the Act. This transaction qualified for exemption from registration because among other

things, the transaction did not involve a public offering, the investor was an accredited investor and/or qualified institutional buyer,

the investor had access to information about our company and its investment, the investor took the securities for investment and not resale,

and we took appropriate measures to restrict the transfer of the securities.

| Item

3.03 | Material

Modification to Rights of Security Holders. |

The information set forth in Item 1.01 hereof is incorporated by reference

into this Item 3.03.

| Item

5.03 | Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

Our Articles of Incorporation,

as amended, authorize us to issue up to 100,000,000 million shares of preferred stock with the consent of our Board of Directors and without

any further consent from our holders of capital stock. On November 16, 2022:

| |

· |

our Board of Directors authorized the creation of up to 1,000,000 shares of Series C Convertible Preferred Stock (the “Series C Preferred Shares”) |

| |

· |

we filed a Certificate of Designations with the Secretary of Nevada creating such Series C Preferred Shares |

The foregoing is only

a summary of the Certificate of Designations, which is filed as an exhibit hereto, so that you may more fully understand the terms the

Series C Preferred Shares.

Liquidation. The

Series C Preferred Shares have a liquidation preference that is junior to our Series A convertible preferred stock, Series B preferred

stock and our common stock. The holders of the Series A Preferred Shares shall be entitled to receive a payment in an amount that is equal

to $0.05 per share plus any dividends that are due on such share (the “Liquidation Value”).

Dividends. The

holders of the Series C Preferred Shares shall be entitled to receive, when, if and as declared by our board of directors, out of funds

legally available therefor, any dividends or other distributions that we declare on the common stock, $0.001 par value per share, of the

Corporation (the “Common Stock”) (other than dividends payable solely in additional shares of Common Stock).

Voting. The Series C Preferred Shares shall

vote together with the Common Stock, and each Series C Preferred Share shall have two hundred (200) votes for each vote held by a share

of Common Stock.

Forced conversion. The Series C Preferred

Shares shall convert into shares of Common Stock on the earlier of:

| · | the five-year anniversary of the filing of this Certificate of Designations; |

| · | the date on which any of the Company’s securities is listed on a National Securities Exchange; and |

| · | a date agreed upon by the majority of the Series C Preferred Share voting together as a class (including

by written consent). |

The number of shares of Common Stock to be issued

upon conversion shall equal the aggregate amount of the Liquidation Value being converted divided by the higher of (a) $0.0209 (110% of

the volume weighted average price of the Common Stock on the trading day immediately prior to the filing of the certificate of designations

for the Series C Preferred Shares) or (b) 110% of (i) the initial public offering price if such conversion occurs in connection with a

listing on a national securities exchange, (ii) the volume weighted average price of the common stock on the trading day immediately prior

to such conversion as reported by Bloomberg, (iii) in the event Bloomberg does not report such information, the closing bid price of the

Common Stock on the national securities exchange or, if none, over the counter bulletin board containing such information or (iv) if the

data in (i), (ii) and (iii) are not available, a good-faith estimate by the majority of the board of directors of the market value of

the Common Stock.

| Item

9.01 | Financial

Statements and Exhibits. |

Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Q BioMed Inc. |

| |

|

|

| Date: November 18, 2022 |

By: |

/s/ Denis Corin |

| |

Name: |

Denis Corin |

| |

Title: |

President and Chief Executive Officer |

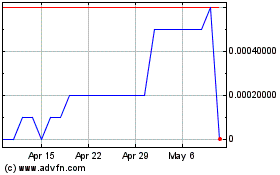

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

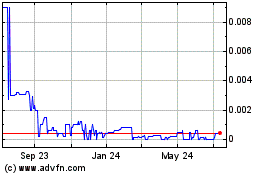

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Jul 2023 to Jul 2024