Current Report Filing (8-k)

October 07 2021 - 12:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

October 7, 2021

Date of Report

Q BioMed Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-55535

|

46-4013793

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

c/o Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY

|

10017

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(212) 588-0022

Registrant’s telephone number, including

area code

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered:

|

|

None

|

|

None

|

|

None

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the

Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement.

On September 29, 2021, Q BioMed Inc. (the “Company”

or we) entered into a securities purchase agreement with an accredited investor (“Lender”), pursuant to which we sold a convertible

debenture (the “Debenture”) with a maturity date of 12 months after the issuance thereof for an aggregate purchase price of

$2,000,000. The closing date of the sale was on October 5, 2021.

The Debenture in the aggregate principal amount

of $2,200,000 (the “Transaction”) which includes an original issue discount of $185,000 and $15,000 for the payment of the

Lender’s legal fees and carries an interest rate of 6% per annum.

We may prepay the Debenture at 105% of the outstanding

aggregate principal amount plus accrued interest within the first 60 days of issuance, at 112% of the outstanding aggregate principal

amount plus accrued interest from 61-120 days after issuance and at 124% of the outstanding aggregate principal amount plus accrued interest

from 121-180 days after issuance. The Debenture may not be prepaid after 180 days.

The Lender has the right to convert all or any

amount of the outstanding aggregate principal amount at any time at a fixed conversion price of $1.00 per share. The conversion price

after six months shall be fixed to $0.50 per share.

However, in the event the Company's Common Stock

trades below $0.50 per share for more than ten (10) consecutive trading days, the Lender is entitled to convert all or any amount of the

outstanding aggregate principal amount into shares of the Company's Common Stock at a Conversion Price for each share of Common Stock

equal to 85% of the average of the 4 lowest VWAP's in the prior 20 trading days.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 hereof

is incorporated by reference into this Item 3.02.

The securities mentioned above were issued, or

will be issued, in reliance on exemptions from registration under Section 4(2) of the Securities Act of 1933, as amended (the “Act”),

and Rule 506 of Regulation D promulgated under the Act. This transaction qualified for exemption from registration because among other

things, the transaction did not involve a public offering, the investor was an accredited investor and/or qualified institutional buyer,

the investor had access to information about our company and its investment, the investor took the securities for investment and not resale,

and we took appropriate measures to restrict the transfer of the securities.

Item 9.01 Financial Statements and Exhibits

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Q BioMed Inc.

|

|

|

|

|

|

Date: October 7, 2021

|

By:

|

/s/ Denis Corin

|

|

|

Name:

|

Denis Corin

|

|

|

Title:

|

President and Chief Executive Officer

|

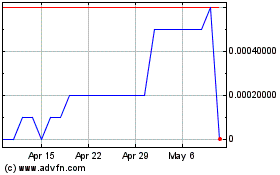

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

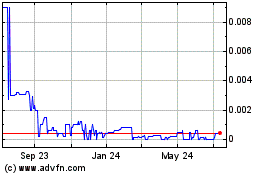

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Jul 2023 to Jul 2024