Current Report Filing (8-k)

August 10 2018 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

July 23, 2018

NanoFlex Power Corporation

(Exact name of registrant as specified in

its charter)

|

Florida

|

|

333-187308

|

|

46-1904002

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

17207 N. Perimeter Dr., Suite 210

Scottsdale, AZ 85255

(Address of Principal Executive Offices)

480-585-4200

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

Item

1.01

|

Entry into a Material Definitive Agreement.

|

On July 23, 2018, NanoFlex Power Corporation, a Florida corporation

(the “Company”) entered into a Securities Purchase Agreement (the “SPA”) with EMA Financial, LLC (“EMA”)

pursuant to which EMA agreed to purchase a convertible note (the “Note”) in the aggregate principal amount of $50,000.00.

On July 23, 2018, the Company issued the Note, which EMA purchased for a purchase price, net of fees, of $45,000.00. The Note

has an interest rate of 10% per annum, a default interest rate of 24% per annum and matures on April 23, 2019. Additionally, if

at any time while the Note is outstanding the Company’s common stock trades below $0.01, the principal amount of the Note

shall automatically increase by $25,000.00, and at the sole option of EMA, the Company shall within 15 calendar days from EMA’s

instruction to do so, effectuate a reverse split.

Under the Note, EMA may convert the Note into shares of the

Company’s common stock beginning from the date of issuance of the Note through the date which is 180 days from the issuance

date of the Note, at a conversion price of $0.25 per share. Starting on the 181

st

date after the issuance date of the

Note, EMA may convert the Note into shares of the Company’s common stock at a conversion price equal to the lower of (i)

the closing price of the Company’s common stock on the principal market on the trading day immediately preceding the issue

date, and (ii) 60% of either the lowest sale price for the Company’s common stock on the principal market during the 20 consecutive

trading days including and immediately preceding the conversion date, or the closing bid price, whichever is lower. The conversion

price under the Note is further subject to additional adjustments as set forth in the full text of the Note, which is filed herewith

as Exhibit 4.1.

If the Company prepays the Note within six months of its issuance,

the Company must pay all of the principal at a cash redemption premium of either (i) 150% if such prepayment is made after 90 days

after the issuance date of the Note or (ii) 135% if such prepayment is made prior to or on the 90

th

day after the issuance

of the Note. After the expiration of six months following the issuance of the Note, there shall be no further right of pre-payment.

In connection with the Note, the Company agreed to cause its transfer

agent to reserve 3,250,000 shares of the Company’s common stock, in the event that the Note is converted. The Note was funded

on August 1, 2018.

The foregoing summaries of the terms of the Note and the SPA

are subject to, and qualified in their entirety by, the agreements and instruments attached hereto as Exhibits 4.1 and 10.1, respectively,

which are incorporated by reference herein.

|

Item

2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 above with respect

to the Note, the SPA and the related agreements is incorporated herein by reference.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The information set forth under Item 1.01 above with respect

to the issuance of the Note is incorporated herein by reference. The issuance of the Note was made in reliance upon the exemption

from the registration requirements of the Act, pursuant to Section 4(a)(2) of the Act.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NanoFlex Power Corporation

|

|

|

|

|

|

Dated: August 9, 2018

|

By:

|

/s/ Dean L. Ledger

|

|

|

Name:

|

Dean

L. Ledger

|

|

|

Title:

|

Chief Executive Officer

|

EXHIBIT INDEX

3

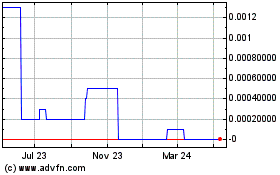

NanoFlex Power (CE) (USOTC:OPVS)

Historical Stock Chart

From Nov 2024 to Dec 2024

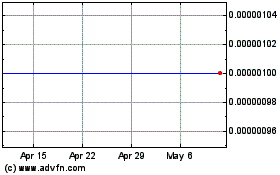

NanoFlex Power (CE) (USOTC:OPVS)

Historical Stock Chart

From Dec 2023 to Dec 2024