|

OMB APPROVAL

|

|

OMB Number:

|

3235-0420

|

|

Expires:

|

April 30, 2009

|

|

Estimated average burden

hours per response:

|

1646

|

|

|

|

|

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

, D.C.

20549

FORM

10-KSB/A- 2

|

[X]

|

ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year

ended:

June 30

, 2008

|

|

|

|

[ ]

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

|

|

For the transition

period from _____________ to ______________

|

|

|

|

Commission file

number:

000-50156

|

|

|

|

|

|

|

|

Molecular

Pharmacology (USA) Limited

|

|

|

|

|

|

(Name of small

business issuer in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada

|

|

|

71-0900799

|

|

|

|

(State of other

jurisdiction of incorporation or organization)

|

|

|

(I.R.S. Employer

I.D. No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

Drug

Discovery Centre

28 Oxford Street, Leederville 6007 Perth, Western Australia

|

|

00000

|

|

|

|

(Address of

principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuer's

telephone number

011-61-8-9443-3011

|

|

|

|

|

|

|

|

N/A

|

|

|

|

(Former names,

former address and former fiscal year, if changed since last report)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered under section 12(b) of the Exchange Act:

|

|

|

Title of each Class

|

|

Name of each exchange on which registered

|

|

|

|

None

|

|

Not Applicable

|

|

|

|

|

Securities registered under Section 12(g) of the Exchange Act:

|

|

|

Common

Shares with a par value of $0.001 per share

|

|

|

|

(Title of Class)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i

|

Check whether

the issuer (1) has filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the past 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days.

|

|

|

Yes

|

X

|

|

No

|

|

|

|

|

Check if there is no disclosure of delinquent filers in response to Item 405

of Regulation S-B contained in this form, and no disclosure will be

contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form

10-KSB or any amendment to this Form 10-KSB.

|

|

|

Yes

|

|

|

No

|

X

|

|

|

|

Indicate by

check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

|

|

|

Yes

|

|

|

No

|

|

|

|

|

State issuer's

revenues for its most recent fiscal year:

$0.00

|

|

|

|

State the

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity

was sold, or the average bid and asked price of such common equity, as of a

specified date within the past 60 days. (See definition of affiliate in Rule

12b-2 of the Exchange Act.)

|

|

As

of September 29, 2008, the aggregate market value of equity shares held by

non-affiliates was

|

$

942,150

|

|

(1) Last close price on September 29, 2008

|

|

|

|

|

|

|

|

|

|

(APPLICABLE

ONLY TO CORPORATE REGISTRANTS)

|

|

State the number

of shares outstanding of each of the issuer's classes of common equity, as of

the latest practicable date.

|

|

|

111,553,740

common shares issued and

outstanding as of September 29, 2008

|

|

|

|

|

|

|

|

|

|

DOCUMENTS INCORPORATED BY

REFERENCE

|

|

None

|

|

|

|

Transitional Small Business Disclosure Format (Check

one):

|

Yes

|

|

|

No

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ii

TABLE OF CONTENTS

iii

iv

REASON FOR AMENDMENT

This Amended Form 10-KSB is being filed to: (1) revise

management's conclusions regarding the effectiveness of our disclosure controls and

procedures; (2) to include a separate conclusion on the effectiveness of

our disclosure controls and procedures over financial reporting; and

provide new Exhibit 31.1 and 31.2 certificates.

Other than the foregoing changes the Form 10-KSB/A as dated June

8, 2009 remains the same in its entirety and does not reflect events occurring

after the original filing of the Form 10-K with the SEC on October 10, 2008.

FORWARD LOOKING INFORMATION

This annual report contains forward-looking

statements as that term is defined in the Private Securities Litigation Reform

Act of 1995. These statements

relate to future events or our future financial performance. In some cases, you can identify

forward-looking statements by terminology such as "may",

"will", "should", "expects", "plans",

"anticipates", "believes", "estimates",

"predicts", "potential" or "continue" or the negative

of these terms or other comparable terminology. These statements are only predictions

and involve known and unknown risks, uncertainties and other factors, including

the risks in the section entitled "Risk Factors", that may cause our

or our industry's actual results, levels of activity, performance or

achievements to be materially different from any future results, levels of

activity, performance or achievements expressed or implied by these

forward-looking statements.

Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements. Except as required by applicable law,

including the securities laws of the United States, we do not intend to update

any of the forward-looking statements to conform these statements to actual

results.

Our financial statements are stated in United

States Dollars (US$) and are prepared in accordance with United States

Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts

are expressed in United States Dollars.

All references to CDN$

refer to Canadian Dollars.

As used in this annual report, the terms "

we

", "

us

",

"

our

", "

Corporation

"

and "

Molecular USA

" mean Molecular

Pharmacology (USA) Limited unless otherwise indicated.

PART I

Item

1. Description of Business

Business Development - Formation and Reorganization

Molecular USA was incorporated in the state of Nevada on

May 1, 2002 under the name "

Blue Hawk Ventures,

Inc

."

Molecular USA changed its name to "Molecular Pharmacology (USA) Limited"

on August 29, 2005. At this

same time Molecular USA completed a four for one forward split of its issued

and outstanding share capital and altered its share capital to 300,000,000

shares of common stock with a par value of $0.001 per share.

Molecular USA has not been involved in any

bankruptcy, receivership or similar proceeding nor has there been any material

reclassification or merger, consolidation or purchase or sale of a significant

amount of assets not in the ordinary course of business other than as disclosed

herein.

Up until the fall of 2005, Molecular USA was in

the business of mineral exploration and development of a mineral property.

On October 13, 2005, Molecular USA entered into a

distribution and supply agreement with Molecular Pharmacology Limited ("

MPLA

"). MPLA is incorporated under the laws of

Australia and at the time was a wholly owned subsidiary company of PharmaNet

Group Limited ("PharmaNet"), an Australian company listed on the

Australian Stock Exchange.

Under the terms of the distribution and supply agreement, Molecular USA received

the exclusive distribution rights to distribute, market, promote, detail,

advertise and sell certain "

Licensed Products

",

as defined in the agreement, with metallo-polypeptide analgesic as an active

ingredient, in the United States (excluding its territories and

possessions).

On May 9, 2006, Molecular USA announced that

it has acquired 100% of the issued and outstanding share capital of MPLA. The transaction was originally announced

by Molecular USA in a press release dated November 29, 2005, and was

subsequently approved by a majority of the stockholders of the Company at a

stockholders meeting held on April 21, 2005. As a result of the transaction,

PharmaNet, the former parent company of MPLA, now

1

controls approximately 79% of Molecular USA

's issued and outstanding share capital. The transaction between the parties

closed in escrow with an effective closing date of May 8, 2006. The business of

MPLA is now the business of Molecular USA.

Our Current Business

The acquisition of MPLA provided Molecular

USA an immediate and solid

international foundation which management believes will allow it to grow its

business into all major geographical markets. The assets and resources of the

Australian company and its existing teams and development programs has

augmented Molecular USA's

plan to develop safe and effective pain and inflammation management products.

Molecular USA through its wholly owned

subsidiary MPLA is in the business of developing and commercializing a new

analgesic and anti-inflammatory molecule known as Tripeptofen. Tripeptofen is

likely to appear in a new group of products suitable for the treatment of

common every-day pain. As an analgesic and anti-inflammatory drug, Tripeptofen

is unusual due to its rapid speed of action and its topical or rub-on

application.

The majority of over-the-counter anti-pain and anti-inflammatory

products sold for the treatment of acute localised pain are based on

non-steroidal anti-inflammatory drugs or NSAIDs. The majority of such products

are slow acting and provide only mild pain relief.

The NSAID group has come under additional pressure and increasing

medical alarm, as many drugs in this class have been found to set-back the

recovery of certain conditions and treatments for which they were marketed.

Moreover, NSAIDs are associated with severe gastro-intestinal side-effects.

This has left a niche in an industry under-served by new products and

ingredients.

MPLA's business strategy is to exploit the fast and locally acting, low

side effects, and recovery-enhancing properties of its new drug group and to

market this as a new ingredient, enabling pharmaceutical companies to develop

and market effective and safer products suited to a broad range of common

everyday pain.

Licensed Products

Molecular USA has exclusive distribution

rights to distribute, market, promote, detail, advertise and sell certain

"Licensed Products", with metallo-polypeptide analgesic and

anti-inflammatory activity as an active ingredient, in the United States

(excluding its territories and possessions) from its wholly owned subsidiary

company MPLA.

The Licensed Products include all products in

all dosage forms, formulations, line extensions and package configurations

using or otherwise incorporating any aspect or production method of

metallo-polypeptide analgesic and anti-inflammatory activity as an active

ingredient marketed by MPLA or its affiliates under the tradename Tripeptafen

or any other trade names or trademarks used by MPLA relating to the product and

any improvements to such formulations or dosages as may hereafter be

distributed by MPLA or its affiliates in the territory during the term of the

distribution and supply agreement between Molecular USA and MPLA for the

topical application for human use only, and specifically excludes:

-

dermatological

or cosmetic use, or tissue repair or tissue regeneration effect;

-

any use or application of the

Licensed Product in non-human groups or species; and

-

Thermalife

cream, presently owned by PharmaNet, the holding company of MPLA.

All Licensed Products must first obtain

regulatory clearance in the United

States before they may be marketed and sold

by Molecular USA in that territory. Clinical programs are currently planned by

MPLA for Europe, USA and Australia.

The clinical trial program is expected to be expanded with follow-up trials.

Regulatory approval, commencement of the Master Drug File (MDF) and market

approval are the focus of an ongoing program expected to continue over the next

18 to 24 months.

2

MPLA has an exclusive license from Cambridge

Scientific Pty Ltd of Australia. This license is restricted to a "field of

use" defined in the license documentation. Cambridge Scientific Pty Ltd

may grant other licenses to third parties outside the "field of use"

the subject of the licenses granted to MPLA.

Patents & Trademarks

Molecular USA and its subsidiary MPLA, regard

their intellectual property rights, such as copyrights, trademarks, trade

secrets, practices and tools, as important to the success of their company. To

protect their intellectual property rights, Molecular USA relies on a

combination of patent, trademark and copyright law, trade secret protection,

confidentiality agreements and other contractual arrangements with their

employees, affiliates, clients, strategic partners, acquisition targets and

others. Effective patent, trademark, copyright and trade secret protection may

not be available in every country in which the combined company intends to

offer its products. The steps taken by Molecular USA and MPLA to protect their

intellectual property rights may not be adequate. Third parties may infringe or

misappropriate the combined company's intellectual property rights or the

combined company may not be able to detect unauthorized use and take

appropriate steps to enforce its rights. In addition, other parties may assert

infringement claims against the combined company. Such claims, regardless of

merit, could result in the expenditure of significant financial and managerial

resources. Further, an increasing number of patents are being issued to third

parties regarding these processes. Future patents may limit the combined

company's ability to use processes covered by such patents or expose the

combined company to claims of patent infringement or otherwise require the

combined company to seek to obtain related licenses. Such licenses may not be

available on acceptable terms. The failure to obtain such licenses on

acceptable terms could have a negative effect on the combined company's

business.

To protect their intellectual property

rights, MPLA relies on a combination of license and patent applications held by

Cambridge Scientific Pty Ltd, namely "Analgesic and Anti-Inflammatory

Composition" comprising USA

patent application in completion plus PCT Provisional Specification having the

same name designated as Serial No. 11/059580. These patent applications embody

all the current Analgesic and Anti-inflammatory assets. MPLA will also rely on

the exclusive nature of its license, trademark and copyright law, trade secret

protection, confidentiality agreements and other contractual arrangements as it

may execute from time to time.

Management of Molecular USA and MPLA believes

that MPLA's products, trademarks, and other proprietary rights do not infringe

on the proprietary rights of third parties.

Marketing

Molecular USA

plans to market its Licensed Products, when approved, through existing

pharmaceutical distributors and by collaborative dealings with major companies

active in the United States

and Europe.

In addition, Molecular USA plans to explore

opportunities for direct sales, out-licensing and the integration of the

company's proprietary anti-inflammatory and analgesic components in

products already distributed through various international markets.

Molecular USA

expects that these activities may even help fund the development costs of the

Licensed Products in the United

States.

Manufacturing & Supply

Molecular USA and MPLA have no manufacturing

facilities. MPLA is required to supply Molecular USA with all Licensed Products

under the distribution and supply agreement entered into by the parties in

October 2005. It is likely MPLA will enter into arrangements with various Good

Manufacturing Practice ("GMP") certified formulation and

manufacturers of the Licensed Products for clinical trial and sales purposes.

These formulations and the manufacturing facilities must comply with

regulations and current good laboratory practices or cGLPs,

3

and current good manufacturing practices or cGMPs,

enforced by the Food and Drug Administration ("FDA"). Molecular USA

plans to continue MPLA's practice to outsource formulation and

manufacturing for its clinical trials and potential commercialization after the

acquisition of MPLA by Molecular USA.

Molecular USA has not entered into any supply

agreements.

Competition

Molecular USA

and MPLA compete in the segment of the pharmaceutical market that treats pain

and inflammation, which is highly competitive. We face significant competition

from most pharmaceutical companies as well as biotechnology companies that are

also researching and selling products designed to treat pain and inflammation.

Many of our competitors have significantly greater financial, manufacturing,

marketing and product development resources than we do. Large pharmaceutical

companies in particular have extensive experience in clinical testing and in

obtaining regulatory approvals for drugs. These companies also have

significantly greater research capabilities than we do. In addition, many

universities and private and public research institutes are active in

neurological research, some in direct competition with us. These companies, as

well as academic institutions, governmental agencies and other public and

private organizations conducting research, also compete with Molecular USA and

MPLA in recruiting and retaining highly qualified scientific personnel and

consultants and may establish collaborative arrangements with competitors of

Molecular USA.

Molecular USA's

competition will be determined in part by the potential indications for which

the MPLA's products are developed and ultimately approved by regulatory

authorities.

Molecular USA

knows of other companies and institutions dedicated to the development of

anti-pain and anti-inflammatory pharmaceuticals similar to those being

developed by MPLA and licensed to Molecular USA. Many of Molecular USA's

competitors, existing or potential, have substantially greater financial and

technical resources and therefore may be in a better position to develop,

manufacture and market pharmaceutical products. Many of these competitors are

also more experienced with regard to preclinical testing, human clinical trials

and obtaining regulatory approvals. The current or future existence of

competitive products may also adversely affect the marketability of Molecular

USA's products.

Governmental

Regulation

FDA Regulation

. Pharmaceutical products are subject to

extensive pre- and post-marketing regulation by the FDA, including regulations

that govern the testing, manufacturing, safety, efficacy, labeling, storage,

record-keeping, advertising and promotion of the products under the Federal

Food, Drug and Cosmetic Act and the Public Health Services Act, and by

comparable agencies in most foreign countries. The process required by the FDA

before a new drug may be marketed in the U.S. generally involves the following:

completion of pre-clinical laboratory and animal testing; submission of an

investigational new drug application, or IND, which must become effective

before clinical trials may begin; performance of adequate and well controlled

human clinical trials to establish the safety and efficacy of the proposed

drug's intended use; and approval by the FDA of a New Drug Application,

or NDA.

The activities required before a pharmaceutical agent may be marketed in

the United States

begin with pre-clinical testing.

Pre-clinical tests include laboratory evaluation of potential products

and animal studies to assess the potential safety and efficacy of the product

and its formulations. The results of these studies and other information must

be submitted to the FDA as part of an IND

application, which must be reviewed and approved by the FDA before proposed

clinical testing can begin. Clinical trials involve the administration of the

investigational new drug to healthy volunteers or to patients under the

supervision of a qualified principal investigator. Clinical trials are

conducted in accordance with Good Clinical Practices under protocols that

detail the objectives of the study, the parameters to be used to monitor safety

and the efficacy criteria to be evaluated. Each protocol must be submitted to

the FDA as part of the IND

application. Further, each clinical study must be conducted under the auspices

of an independent institutional review board. The institutional review board

will consider, among other things, ethical factors and the safety of human

subjects.

4

Typically, human clinical trials are conducted in three phases that may

overlap. In Phase 1, clinical trials are conducted with a small number of

subjects to determine the early safety profile and pharmacology of the new

therapy. In Phase 2, clinical trials are conducted with groups of patients

afflicted with a specific disease in order to determine preliminary efficacy,

optimal dosages and expanded evidence of safety. In Phase 3, large scale,

multicenter, comparative clinical trials are conducted with patients afflicted

with a target disease in order to provide enough data for the statistical proof

of efficacy and safety required by the FDA and others.

The results of the pre-clinical and clinical testing, together with

chemistry and manufacturing information, are submitted to the FDA in the form

of an NDA for a pharmaceutical product in order to obtain approval to commence

commercial sales. In responding to an NDA, the FDA may grant marketing

approvals, request additional information or further research, or deny the

application if it determines that the application does not satisfy its

regulatory approval criteria. Patient-specific therapies may be subject to

additional risk with respect to the regulatory review process. FDA approval for

a pharmaceutical product may not be granted on a timely basis, if at all, or if

granted may not cover all the clinical indications for which approval is sought

or may contain significant limitations in the form of warnings, precautions or

contraindications with respect to conditions of use.

Satisfaction of FDA premarket approval requirements for new drugs

typically takes several years, and the actual time required may vary

substantially based upon the type, complexity and novelty of the product or

targeted disease. Government regulation may delay or prevent marketing of

potential products for a considerable period of time and impose costly

procedures upon our activities. Success in early stage clinical trials or with

prior versions of products does not assure success in later stage clinical

trials. Data obtained from clinical activities are not always conclusive and

may be susceptible to varying interpretations that could delay, limit or

prevent regulatory approval.

Once approved, the FDA may withdraw the product approval if compliance

with pre- and post-marketing regulatory standards is not maintained or if

problems occur after the product reaches the marketplace. In addition, the FDA

may require post-marketing studies, referred to as Phase 4 studies, to monitor

the effect of an approved product, and may limit further marketing of the

product based on the results of these post-market studies. The FDA has broad

post-market regulatory and enforcement powers, including the ability to levy

fines and civil penalties, suspend or delay issuance of approvals, seize or

recall products, or withdraw approvals.

Facilities used to manufacture drugs are subject to periodic inspection

by the FDA, Drug Enforcement Agency and other authorities where applicable, and

must comply with the FDA's Current Good Manufacturing regulations.

Failure to comply with the statutory and regulatory requirements subjects the

manufacturer to possible legal or regulatory action, such as suspension of

manufacturing, seizure of product or voluntary recall of a product. Adverse

experiences with the product must be reported to the FDA and could result in

the imposition of market restriction through labeling changes or in product

removal. Product approvals may be withdrawn if compliance with regulatory

requirements is not maintained or if problems concerning safety or efficacy of

the product occur following approval.

With respect to post-market product advertising and promotion, the FDA

imposes a number of complex regulations on entities that advertise and promote

pharmaceuticals, which include, among other things, standards and regulations

relating to direct-to-consumer advertising, off-label promotion, industry sponsored

scientific and educational activities, and promotional activities involving the

Internet. The FDA has very broad enforcement authority under the

Federal Food, Drug and Cosmetic Act

, and failure to abide by

these regulations can result in penalties including the issuance of a warning

letter directing the entity to correct deviations from FDA standards, a

requirement that future advertising and promotional materials be pre-cleared by

the FDA, and state and federal civil and criminal investigations and

prosecutions.

Research facilities are subject to various laws and regulations

regarding laboratory practices, the experimental use of animals, and the use

and disposal of hazardous or potentially hazardous substances in connection

with the research in question. In

each of these areas, as above, the government has broad regulatory and

enforcement powers, including the ability to levy fines and civil penalties,

suspend or delay issuance of approvals, seize or recall products, and withdraw

approvals, any one or more of which could have a material adverse effect upon

us.

5

Other Government Regulations

. In addition to laws and regulations enforced

by the FDA, research of Molecular USA's products in the United States are

subject to regulation under National Institutes of Health guidelines, as well

as under the Controlled Substances Act, the Occupational Safety and Health Act,

the Environmental Protection Act, the Toxic Substances Control Act, the

Resource Conservation and Recovery Act and other present and potential future

federal, state or local laws and regulations, as research and development of

its products involves the controlled use of hazardous materials, chemicals,

viruses and various radioactive compounds.

In addition to regulations in the United States, Molecular

USA's products are subject to a variety of foreign regulations governing

clinical trials and commercial sales and distribution of its Licensed Products.

Whether or not Molecular USA obtains FDA approval for a product, Molecular USA

or its subsidiaries must obtain approval of a product by the comparable

regulatory authorities of foreign countries before it can commence clinical

trials or marketing of the product in those countries. The approval process

varies from country to country, and the time may be longer or shorter than that

required for FDA approval. The requirements governing the conduct of clinical

trials, product licensing, pricing and reimbursement vary greatly from country

to country.

Sarbanes-Oxley Act of 2002

. On July 30, 2002, President Bush signed into law the

Sarbanes-Oxley Act of 2002, or the SOA. SOA imposes a wide variety of new

requirements on both U.S.

and non-U.S. companies, that file or are required to file periodic reports with

the Securities and Exchange Commission (the "

SEC

") under the Securities Exchange

Act of 1934. Many of these new requirements will affect Molecular USA and its

board of directors. For instance, under SOA Molecular USA is required to:

-

form an audit committees in compliance with SOA;

-

have Molecular USA's chief executive officer and chief financial

officer certify its financial statements;

-

ensure Molecular USA's directors and senior officers are required

to forfeit all bonuses or other incentive-based compensation and profits

received from the sale of Molecular USA's securities in the twelve month

period following initial publication of any of Molecular USA's financial

statements that later require restatement;

-

disclose any off-balance sheet transactions as required by SOA;

-

prohibit all personal loans to directors and officers;

-

insure directors, officers and 10% holders file their Forms 4's within

two days of a transaction;

-

adopt a code of ethics and file a Form 8-K whenever there is a change

or waiver of this code; and

-

insure Molecular USA's auditor is independent as defined by SOA.

SOA has required us to review our current

procedures and policies to determine whether they comply with the SOA and the

new regulations promulgated thereunder. We will continue to monitor our compliance

with all future regulations that are adopted under the SOA and will take

whatever actions are necessary to ensure that we are in compliance.

Environmental Compliance

The

nature of Molecular USA's and MPLA's business does not require

special environmental or local government approval. Molecular USA and MPLA are compliant with all

environmental laws. The cost of such compliance is minimal for the company.

6

Employees

In the year ended June 30, 2008, Molecular

USA did not have any employees and do not intend to hire any employees in the

upcoming year. We rely heavily on

outside contractors to conduct our business.

Immediate

Business Plans

Over the next 12 to 24 months, Molecular USA, through its subsidiary

MPLA, plans to continue to pursue the various levels of the international

regulatory approval processes. Applications and product opportunities for

Tripeptofen are believed to be broad and cover a range of commercial fields,

each with distinct pre-market requirements. The international drug development

team, global resources and local know-how will allow MPLA to seek the most time

and cost effective regulatory pathways for each product and market sector.

On commercial development, MPLA will continue to focus on consolidating

the regulatory pathway work in order to prioritize the path to market. Jeff

Edwards will work to set-out the strategies designed to maximize the

multi-jurisdictional capabilities of MPLA's development teams.

Reports to Securities

Holders

We are required to file annual reports on Form

10-KSB and quarterly reports on Form 10-QSB with the Securities Exchange

Commission on a regular basis, and will be required to timely disclose certain

material events (e.g., changes in corporate control; acquisitions or

dispositions of a significant amount of assets other than in the ordinary

course of business; and bankruptcy) in a current report on Form 8-K.

Although our Internet site www.mpl-usa.com does

not contain our reports, you may read and copy any materials we file with the

Securities and Exchange Commission at their Public Reference Room at 450 Fifth Street, N.W., Washington, D.C. 20549. You may obtain information on

the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Additionally, the SEC maintains an

Internet site (http://www.sec.gov) that contains reports, proxy and information

statements and other information regarding issuers that file electronically

with the SEC.

Item

2. Description of Property

Molecular USA's office space is located

at Drug Discovery Centre, 28 Oxford Street, Leederville 6007 Perth, Western

Australia. This office space was

provided free of charge during the year ended June 30, 3008, from a company

controlled by an officer of PharmaNet.

Item

3. Legal Proceedings

We know of no material, active or pending legal

proceedings against our company, nor are we involved as a plaintiff in any material

proceeding or pending litigation.

There are no proceedings in which any of our directors, officers or

affiliates, or any registered or beneficial shareholder, is an adverse party or

has a material interest adverse to our interest.

Item

4. Submissions of Matters to a Vote of Security Holders

No matters were submitted to our stockholders

during this period.

7

PART II

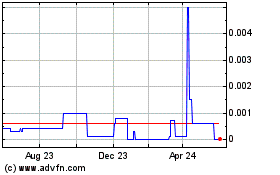

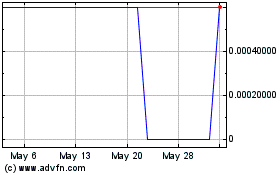

Item 5. Market for Common Equity and Related

Stockholder Matters Market Information

.

Our common shares are quoted on the PinkSheets

under the symbol "

MLPH

".

The following quotations reflect the high and low bids for our common stock

based on inter-dealer prices, without retail mark-up, mark-down or commission

and may not represent actual transactions. The high and low bid prices for our

common shares (obtained from www.otcbb.com) for each full financial quarter for

the two most recent full fiscal years were as follows:

|

Quarter Ended

(1) (2)

|

High

|

Low

|

|

June 30, 2008

|

$0.04

|

$0.03

|

|

March 31, 2008

|

$0.05

|

$0.03

|

|

December 31, 2007

|

$0.09

|

$0.03

|

|

September 30, 2007

|

$0.11

|

$0.06

|

|

June 30, 2007

|

$0.17

|

$0.13

|

|

March 31, 2007

|

$0.06

|

$0.04

|

|

December 31, 2006

|

$0.08

|

$0.03

|

|

September 30, 2006

|

$0.16

|

$0.06

|

|

June 30, 2006

|

$0.60

|

$0.12

|

|

|

|

|

|

|

|

|

|

Note

s:

|

|

|

(1)

|

The quotations above reflect inter-dealer prices,

without retail mark-up, mark-down or commission and may not represent actual

transactions.

|

|

|

(2)

|

Molecular USA was originally first quoted on the

OTCBB on May 13, 2005 under the symbol "BHWV". Its symbol was changed to

"MLPH" on August 29, 2005. On November 26, 2007, the stock was

moved to the PinkSheet quotation system for failure to comply with NASD 6530. The shares of Molecular USA will be

eligible to be quoted once again on the OTCBB on November 26, 2008 on

application request by a market maker of the common stock of Molecular USA.

|

Holders

of Common Stock

As of September 29, 2008, there were 16 registered

shareholders of Molecular USA's common stock.

Dividends

Molecular

USA

has never declared nor paid any cash dividends on its capital stock and does

not anticipate paying cash dividends in the foreseeable future. Molecular USA's

current policy is to retain any earnings in order to finance the expansion of

its operations. Molecular USA's board of directors will determine future

declaration and payment of dividends, if any, in light of the then-current

conditions they deem relevant and in accordance with the

Nevada

Revised Statutes

.

Recent Sales of Unregistered Securities

Not Applicable

Item

6. Management Discussion and Analysis

THE FOLLOWING ANALYSIS OF THE RESULTS OF

OPERATIONS AND FINANCIAL CONDITION

OF

THE COMPANY FOR THE YEAR ENDED

JUNE 30, 2008,

SHOULD BE READ IN CONJUNCTION WITH

THE

COMPANY

'S

CONSOLIDATED FINANCIAL STATEMENTS, INCLUDING THE NOTES THERETO CONTAINED

ELSEWHERE IN THE FORM 10-KSB

8

Our consolidated financial statements

are stated in United States Dollars and are prepared in accordance with United

States Generally Accepted Accounting Principles.

Overview

We

were incorporated in the state of Nevada on May 1, 2002. Up until the fall of

2005, Molecular USA was in the business of mineral exploration and development

of a mineral property.

On

October 13, 2005, Molecular USA entered into a distribution and supply

agreement with Molecular Pharmacology Limited ("

MPLA

").

MPLA is incorporated under the laws of Australia and is a wholly owned

subsidiary company of PharmaNet, an Australian company listed on the Australian

Stock Exchange. Under the terms of the distribution and supply agreement,

Molecular USA has the exclusive distribution rights to distribute, market,

promote, detail, advertise and sell certain "Licensed Products", as

defined in the agreement, with metallo-polypeptide analgesic as an active

ingredient, in the United States (excluding its territories and possessions).

Molecular

USA entered into a share purchase agreement dated November 25, 2005, to acquire

all of the shares of MPLA from PharmaNet (the "

Purchase

Agreement

").

The transaction between the parties closed in escrow with an effective

closing date of May 8, 2006. Molecular USA, in exchange for 100% of the

issued and outstanding shares of MPLA, issued PharmaNet an aggregate total of

88,000,000 shares of its common stock of Molecular USA on closing of the

transaction. PharmaNet now holds approximately 79% of Molecular USA's issued

and outstanding common shares. The

business of MPLA is now the business of Molecular USA.

On

March 29, 2007, we changed our year end from October 31

st

of each

calendar year to June 30

th

of each calendar year. This action was taken to harmonize our

year end with PharmaNet which holds 79% of issued and outstanding shares.

2008 Activities

and Developments

For the year ended June 30, 2008, our net income was $62,296 ($0.001

per share). The earnings per share was based on a weighted average of

111,553,740

common

shares outstanding. For the eight month period ended June 30, 2007, our net loss was $377,131 ($0.003 per share)

based on a weighted average of 131,553,740 common shares outstanding. For

the year ended October 31, 2006, our net loss was $509,018 ($0.005 per share)

based on a weighted average of 99,357,420 common shares outstanding. For the period from inception on July 14, 2004 to June 30, 2008 Molecular USA

has an accumulated net loss of $1,339,250.

Molecular has working capital of $4,620 at June 30, 2008 (June 30, 2007

- working capital deficit of $23,913). As a result our auditors have qualified

their opinion as having substantial doubt about our ability to continue as a

going concern unless we are able to generate sufficient cash flows to meet our

obligations and sustain our operations.

To achieve our goals and objectives for the

next 12 months, we plan to raise additional capital through private placements

of our equity securities, proceeds received from the exercise of outstanding

options, future financing from our new majority shareholder PharmaNet and, if

available on satisfactory terms, debt financing.

If we are unsuccessful in obtaining new

capital, our ability to seek and consummate strategic acquisitions to build our

company internationally and to expand of our business development and marketing

programs could be adversely affected.

Results of

Operation

For

the year ended June 30, 2008,

eight month period ended June 30, 2007 and the period from July

14, 2004

(inception)

to

June 30, 2008

:

9

REVENUES

REVENUE - Molecular USA has net income of $62,296 for the year ended June 30,

2008 (eight month period ended June 30, 2007 - loss of $377,131; year

ended October 31, 2006 - loss $509,018) and a loss of

$1,339,250 for the period from inception to June

30, 2008

.

To date, we have generated limited revenues from our business operations.

LOANS

- As of June 30, 2008, PharmaNet

has loaned Molecular USA a total of $1,411,131 for working capital (eight month

period ended June 30, 2007 - $1,138,943; year ended October 31, 2006 - $725,817). The advance does not carry an

interest rate, is unsecured and has no fixed terms of repayment.

COMMON STOCK

- Net cash provided

by financing activities during the year ended June 30, 2008 was $0.00 (eight month period ended

June 30, 2007 - $0.00; year ended October 31, 2006 - $0.00).

EXPENSES

SUMMARY

- Total

expenses were $198,311 for the year ended June 30, 2008. Expenses have decreased in the year ended

June 30, 2008 by $178,820 from $377,131 in the previous eight month period

ended

June 30, 2007

. A total of $1,600,615

in expenses has been incurred by Molecular USA since inception on

July

14, 2004

through to June 30, 2008. The decrease

in costs over the past year has occurred as the result of Molecular USA's

wholly owned subsidiary reducing its involvement in research projects resulting

in a decrease in consulting fees and expenses. The costs can be subdivided into the

following categories.

-

Office Expenses

: $33,079 in office expenses (includes rent

and administrative costs) were incurred for the year ended

June 30, 2008

as compared to $43,120 for the eight

month period ended

June

30, 2008

and $37,329 for the year ended October 31, 2006, while a

total of $151,412 was incurred in the period from inception on

July 14, 2004

to

June 30, 200

8. All contributed expenses are reported

as contributed costs with a corresponding credit to additional paid-in

capital.

-

Consulting and Analysis Costs

: Molecular USA relies on consultants and

other third parties to conduct the majority of its research. For the year ended June 30, 2008, $88,322

in consulting and analysis expenses were incurred as compared to $227,844 for

the eight month period ended

June 30, 2007 and $361,696

for the year ended October 31, 2006.

We have incurred a total of $1,059,693 in the period from inception

on

July 14, 2004

to

June 30, 2008

.

-

Advertising, Public Relations and Promotion

Fees

: Molecular

USA has spent a nominal amount in this area. During the year ended

June

30, 2008

and eight month period ended June 30, 2007 we spent $0.00

on advertising and public relations while for the year ended

October 31, 2006 we spent $3,381 in this area. We have incurred a total of

$27,739 in the period from inception on

July 14, 2004

to

June 30, 2008.

-

Professional Fees

: Molecular USA incurred $64,236 in

professional fees for the year ended on

June 30, 2008

as compared to $55,989 for the eight

month period ended June 30, 2007 and $51,457 for the year ended October 31,

2006. From inception to

June 30, 2008

, we have incurred a total of $171,682

in professional fees mainly spent on legal and accounting matters.

-

Travel Costs

: Molecular USA incurred $8,968 in

travel costs for the year ended on

June 30, 2008

as compared to $31,615 for the eight

month period ended

June 30, 2007 and $45,204 for the year

ended October 31, 2006

.

This decrease can largely be attributed to our attendance at a

limited number of pharmacology trade shows and restricting the expense of

visiting various research facilities.

-

Salaries and Benefit Costs

: Molecular USA and its subsidiary relies

primarily on outside consultants and not salaried employees. As a result, Molecular USA incurred

$0.00 in salaries and benefits for the year ended June 30, 2008 and $16,008

was incurred for the eight month period ended

June 30, 2007

and $2,652 for the year ended October 31, 2006

. For the period

July

14, 2004

(inception) through

June 30, 2008

, Molecular USA has spent a total of $44,464

on salaries and benefits.

Molecular USA continues to carefully control

its expenses and overall costs as it moves forward with the development of its

new business plan. Molecular USA does not have any employees and engages

personnel through outside consulting

contracts

or agreements or other such

arrangements.

INCOME TAX PROVISION

: We have losses carried forward for income tax purpose to June 30,

2008. There are no current or deferred tax expenses for the year ended

June 30, 2008, due to our loss position. We have

10

fully reserved for any benefits of these losses. The deferred

tax consequences of temporary differences in reporting items for financial

statement and income tax purposes are recognized as appropriate.

Off-Balance Sheet

Arrangement

As of June 30, 2008, we have had no off-balance

sheet arrangements.

Research and

Development

Since the acquisition of MPLA, Molecular USA

has adopted MPLA's research and development program to:

-

Refine and prove-up its proprietary active ingredients and to

commence the processes that will lead to the issue of a Master Drug File

registration of its products;

-

Define the mode of action and potential of Tripeptofen in both in

vitro, animal and human studies;

-

Gain Australian regulatory and marketing approval;

-

Gain European regulatory approval; and

-

Commence application for American regulatory approval.

MPLA is in the business of developing and

commercializing a new analgesic and anti-inflammatory molecule known as

Tripeptofen. Tripeptofen is likely to appear in a new group of products

suitable for the treatment of common every-day pain. As an analgesic and

anti-inflammatory drug, Tripeptofen is unusual due to its rapid speed of action

and its topical or rub-on application.

On April 19, 2006, Molecular USA, announced the filing of a

new patent, Tissue Disruption Treatment and Composition for Use (US Patent

number 11218382). The patent

describes a proprietary process for the manufacture of topical biological

secondary injury mediators (B-SIMs) that should have local, rather than

systemic, effects and may be significantly less expensive to manufacture than

conventional B-SIMs. MPLA is

developing its B-SIMs to stop the tissue disruption that occurs after injury by

suppressing the body's reactions, such as inflammation and damage/death

of otherwise uninjured cells that are triggered in response to primary injury.

The first conditions targeted by MPLA will be

the musculoskeletal injuries. The

use of a B-SIM in these markets

represents a new approach to one of the world's largest over the counter

drug markets and includes indications such as joint inflammation,

musculoskeletal pain, overuse and strain injuries, burns and even surgical and

cosmetic procedures. MPLA's

proprietary, industrially scalable peptide-ligand bond exchange (PLBE) B-SIM manufacturing process involves the

disassociation of proteins, rather than the far more costly process of

assembling B-SIMs one sequence at a time. The patent was lodged in the name of

Cambridge Scientific Pty Ltd; however, Molecular USA holds the worldwide

exclusive license to manufacture, commercialize, market and distribute topical

anti-inflammatory and analgesic products based on the proprietary MPL-TL

compound.

Molecular USA is still working on the

projections regarding the necessary expenditure and time frame involved in

pursuing this research and development program. Any such program will also be subject to

Molecular USA raising the necessary funds to advance such a program.

Capital Expenditure

Commitments

Capital

expenditures for the year ended June 30, 2008 amounted to

$0.00 ($0.00 for the eight month period ended June 30, 2007 and $0.00 for the year ended

October 31, 2006). Molecular

USA does not anticipate any significant purchase or sale of equipment over the

next 12 months.

11

Strategic Acquisitions

On November 25,

2005, Molecular USA entered into a share purchase

agreement dated November 25, 2005 with PharmaNet to acquire 100% of the issued

and outstanding shares of MPLA. Molecular

USA issued a total of 88,000,000 shares of its common stock to PharmaNet the

parent company of MPLA.

Accordingly, PharmaNet

controls approximately 79% of Molecular USA's issued and outstanding

shares of common stock.

Recent

Accounting Pronouncements

In May 2008, the Financial Accounting

Standards Board (the "FASB") issued Statements of Financial Accounting Standards

("SFAS") No. 163, Accounting for Financial Guarantee Insurance Contracts - an

interpretation of FASB Statement No. 60 ("SFAS No. 163"). SFAS

No. 163 provides enhanced guidance on the recognition and measurement to be

used to account for premium revenue and claim liabilities and related

disclosures and is limited to financial guarantee insurance (and reinsurance)

contracts, issued by enterprises included within the scope of FASB Statement

No. 60, Accounting and Reporting by Insurance Enterprises. SFAS No. 163 also requires that an

insurance enterprise recognize a claim liability prior to an event of default

when there is evidence that credit deterioration has occurred in an insured

financial obligation. SFAS No. 163

is effective for financial statements issued for fiscal years and interim

periods beginning after 15 December 2008, with early application not

permitted. Molecular USA does not

expect SFAS No. 163 to have an impact on its consolidated financial statements.

In May 2008, the FASB issued SFAS No. 162, The

Hierarchy of Generally Accepted Accounting Principles ("SFAS No.

162"). SFAS No. 162 is intended to improve financial reporting by

identifying a consistent framework, or hierarchy, for selecting accounting

principles to be used in preparing financial statements that are presented in

conformity with U.S. Generally Accepted Accounting Principles ("GAAP") for nongovernmental entities. Prior to the issuance of SFAS No. 162,

GAAP hierarchy was defined in the American Institute of Certified Public

Accountants ("AICPA") Statement on Auditing Standards No. 69, The

Meaning of Present Fairly in Conformity with Generally Accepted Accounting

Principles ("SAS No. 69").

SAS No. 69 has been criticized because it is directed to the auditor

rather than the entity. SFAS No.

162 addresses these issues by establishing that the GAAP hierarchy should be

directed to entities because it is the entity, not its auditor, that is

responsible for selecting accounting principles for financial statements that

are presented in conformity with GAAP.

SFAS No. 162 is effective 60 days following the SEC's approval of

the Public Company Accounting Oversight Board Auditing amendments to AU Section

411, The Meaning of Present Fairly in Conformity with Generally Accepted

Accounting Principles. Molecular USA

does not expect SFAS No. 162 to have a material effect on its consolidated

financial statements.

In March 2008, the FASB issued SFAS No. 161,

Disclosures about Derivative Instruments and Hedging Activities - an amendment

of FASB Statement No. 133 ("SFAS No. 161"). SFAS No. 161 is intended to improve transparency

in financial reporting by requiring enhanced disclosures of an entity's

derivative instruments and hedging activities and their effects on the

entity's financial position, financial performance, and cash flows. SFAS No. 161 applies to all derivate instruments

within the scope of SFAS No. 133, Accounting for Derivative Instruments and

Hedging Activities ("SFAS No. 133"). It also applies to non-derivative

hedging instruments and all hedged items designated and qualifying as hedges

under SFAS No. 133. SFAS No. 161 is

effective prospectively for financial statements issued for fiscal years

beginning after 15 November 2008, with early application encouraged. Molecular USA is currently evaluating

the new disclosure requirements of SFAS No. 161 and the potential impact on

Molecular USA's consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141

(revised 2007), Business Combinations ("SFAS No. 141(R)"). SFAS

No. 141(R) establishes principles and requirements for how an acquirer

recognizes and measures in its financial statements the identifiable assets

acquired, the liabilities assumed, any noncontrolling interest in the acquiree

and the goodwill acquired. SFAS No. 141(R) also establishes disclosure

requirements to enable the evaluation of the nature and financial effects of

the business combination. SFAS No. 141(R) is effective for fiscal

12

years beginning after 15 December 2008. Molecular USA is currently evaluating

the potential impact, if any, of the adoption of SFAS No. 141(R) on its

consolidated results of operation and financial condition.

In December 2007, the FASB issued SFAS No.

160, Noncontrolling Interests in Consolidated Financial Statements - an

amendment of Accounting Research Bulletin No. 51 ("SFAS No.

160"). SFAS No. 160

establishes accounting and reporting standards for ownership interests in

subsidiaries held by parties other than the parent, the amount of consolidated

net income attributable and to the noncontrolling interest, changes in a

parent's ownership interest, and the valuation of retained noncontrolling

equity investments when a subsidiary is deconsolidated. SFAS No. 160 also establishes disclosure

requirements that clearly identify and distinguish between the interests of the

parent and the interests of the noncontrolling owners. SFAS No. 160 is effective for fiscal

years beginning after 15 December 2008.

Molecular USA is currently evaluating the potential impact, if any, of

the adoption of SFAS No. 160 on its consolidated results of operation and

financial condition.

In February 2007, the FASB issued SFAS No.

159, "The Fair Value Option for Financial Assets and Financial Liabilities" ("SFAS No. 159"). SFAS 159 allows a company to choose to

measure many financial assets and financial liabilities at fair value. Unrealized gains and losses on items for

which the fair value option has been elected are reported in earnings. SFAS 159 is effective for fiscal years

beginning after November 15, 2007.

Molecular USA is currently evaluating the requirements of SFAS No. 159

and the potential impact on Molecular USA's consolidated financial

statements.

In September 2006, the FASB issued SFAS No.

158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement

Plans - an amendment of FASB Statements No. 87, 88, 106 and 132(R)" ("SFAS 158"). SFAS 158 requires an employer that

sponsors one or more single-employer defined benefit plans to (a) recognize the

overfunded or underfunded status of a benefit plan in its statement of

financial position, (b) recognize as a component of other comprehensive income,

net of tax, the gains or losses and prior service costs or credits that arise

during the period but are not recognized as components of net periodic benefit

cost pursuant to SFAS 87, "Employers' Accounting for

Pensions", or SFAS 106, "Employers' Accounting for

Postretirement Benefits Other Than Pensions", (c) measure defined benefit

plan assets and obligations as of the date of the employer's fiscal

year-end, and (d) disclose in the notes to financial statements additional

information about certain effects on net periodic benefit cost for the next

fiscal year that arise from delayed recognition of the gains or losses, prior

service costs or credits, and transition asset or obligation. SFAS 158 is

effective for Molecular USA's fiscal year ending June 30, 2008. The adoption of SFAS

No. 158 is not expected to have a material impact on Molecular USA's financial position,

results of operations or cash flows.

In September 2006, the FASB issued SFAS No. 157,

"Fair Value Measurement" ("SFAS No. 157"). The Statement

provides guidance for using fair value to measure assets and liabilities. The

Statement also expands disclosures about the extent to which companies measure

assets and liabilities at fair value, the information used to measure fair

value, and the effect of fair value measurement on earnings. This Statement

applies under other accounting pronouncements that require or permit fair value

measurements. This Statement does not expand the use of fair value measurements

in any new circumstances. Under this Statement, fair value refers to the price

that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants in the market in which the

entity transacts. SFAS No. 157 is effective for Molecular USA for fair value

measurements and disclosures made by Molecular USA in its fiscal year beginning

on July 1, 2008. Molecular USA is currently reviewing the impact of this

statement.

Critical Accounting Policies and Estimates

Our audited consolidated financial

statements and accompanying notes are prepared in accordance with generally

accepted accounting principles used in the United States. Preparing financial statements requires

management to make estimates and assumptions that affect the reported amounts

of assets, liabilities, revenue, and expenses. These estimates and assumptions

are affected by management's application of accounting policies. We believe that understanding the basis

and nature of the estimates and assumptions involved with the following aspects

of our consolidated financial statements is critical to an understanding of our

financials.

13

Stock-based

compensation

On February 1, 2006, we adopted the

provisions of SFAS No. 123(R), "

Share-Based Payment

",

which establishes accounting for equity instruments exchanged for employee

services. Under the provisions of SFAS No. 123(R), stock-based compensation cost is measured at the grant date,

based on the calculated fair value of the award, and is recognized as an

expense over the employees' requisite service period (generally the vesting

period of the equity grant). Before February 1, 2006, we accounted for

stock-based compensation to employees in accordance with Accounting Principles

Board Opinion No. 25, "

Accounting for Stock

Issued to Employees

", and complied with the disclosure

requirements of SFAS No. 123, "

Accounting for Stock-Based

Compensation

". We adopted SFAS No. 123(R) using the

modified prospective method, which requires us to record compensation expense

over the vesting period for all awards granted after the date of adoption, and

for the unvested portion of previously granted awards that remain outstanding

at the date of adoption.

Accordingly, financial statements for the periods prior to February 1,

2006 have not been restated to reflect the fair value method of expensing

share-based compensation. Adoption

of SFAS No. 123(R) does not change the way we account for share-based

payments to non-employees, with guidance provided by SFAS No. 123 (as originally

issued) and Emerging Issues Task Force Issue No. 96-18, "

Accounting for Equity Instruments That Are Issued to Other Than

Employees for Acquiring, or in Conjunction with Selling, Goods or Services

".

Item 7. Financial Statements

Auditors' Report dated August 20, 2008

Consolidated Balance Sheets

Consolidated Statements of Operations

Consolidated Statement of Changes in Stockholders'

Deficiency

Consolidated Statements of Cash Flows

Notes to Consolidated Financial Statements

14

|

James Stafford

|

|

|

|

James

Stafford

Chartered Accountants

Suite 350 - 1111 Melville Street

Vancouver, British Columbia

Canada V6E 3V6

Telephone +1 604 669 0711

Facsimile +1 604 669 0754

*Incorporated professional, James Stafford Inc.

|

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of

Molecular Pharmacology (USA) Limited

(A Development Stage Company)

We have audited the consolidated balance sheets of Molecular Pharmacology (USA)

Limited (the "Company") as at 30 June 2008 and 2007 and the related consolidated

statements of operations, cash flows and changes in stockholders' deficiency for

the year ended 30 June 2008, the eight month period ended 30 June 2007 and the

year ended 31 October 2006. These consolidated financial statements are the

responsibility of the Company's management. Our responsibility is to express an

opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States of America). Those standards require

that we plan and perform the audits to obtain reasonable assurance about whether

the consolidated financial statements are free of material misstatement. An

audit includes examining, on a test basis, evidence supporting the amounts and

disclosures in the consolidated financial statements. An audit also includes

assessing the accounting principles used and significant estimates made by

management, as well as evaluating the overall consolidated financial statement

presentation. We believe that our audits provide a reasonable basis for our

opinion.

In our opinion, the consolidated financial statements referred to above present

fairly, in all material respects, the financial position of the Company as of 30

June 2008 and 2007 and the results of its operations, its cash flows and its

changes in stockholders' deficiency for the year ended 30 June 2008, the eight

month period ended 30 June 2007 and the year ended 31 October 2006 in conformity

with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming

that the Company will continue as a going concern. As discussed in Note 1 to the

consolidated financial statements, conditions exist which raise substantial

doubt about the Company's ability to continue as a going concern unless it is

able to generate sufficient cash flows to meet its obligations and sustain its

operations. Management's plans in regard to these matters are also described in

Note 1. The consolidated financial statements do not include any adjustments

that might result from the outcome of this uncertainty.

|

|

/s/

"James Stafford"

|

|

Vancouver, Canada

|

Chartered Accountants

|

|

|

|

|

20 August 2008

|

15

Molecular Pharmacology (USA) Limited

(A Development Stage Company)

Consolidated Financial Statements

(Expressed in U.S. Dollars)

30 June 2008

16

Molecular Pharmacology (USA) Limited

(A Development Stage Company)

Consolidated Balance Sheets

(Expressed in U.S. Dollars)

|

|

|

As at

30 June

2008

|

|

As at

30 June

2007

|

|

|

|

$

|

|

$

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

Cash and cash equivalents (Note 3)

|

|

21,490

|

|

20,994

|

|

Amounts receivable

|

|

9,396

|

|

|

|

|

|

|

|

|

|

|

|

30,886

|

|

42,296

|

|

|

|

|

|

|

|

Property, plant and equipment

(Note 4)

|

|

3,712

|

|

|

|

|

|

|

|

|

|

|

|

34,598

|

|

47,465

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

Accounts payable and accrued liabilities (Note

5)

|

|

26,266

|

|

66,209

|

|

|

|

|

|

|

|

Due to related parties

(Note 6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' deficiency

|

|

|

|

|

|

Capital stock

(Note 7)

|

|

|

|

|

|

Authorized

|

|

|

|

|

|

300,000,000 of common shares, par value $0.001

|

|

|

|

|

|

Issued and outstanding

|

|

|

|

|

|

30 June 2008 - 111,553,740 common shares, par

value $0.001

|

|

|

|

|

|

30 June 2007 - 111,553,740 common shares, par

value $0.001

|

|

111,554

|

|

111,554

|

|

Additional paid-in capital

|

|

106,707

|

|

106,707

|

|

Cumulative translation adjustment

|

|

(294,838)

|

|

(128,355)

|

|

Deficit, accumulated during the development

stage

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,598

|

|

|

Nature and Continuance of Operations

(Note 1) and

Commitments

(Note 9)

On behalf of the Board:

/s/ Jeffrey Edwards

_____________________________________

Director

Jeffrey Edwards

The accompanying notes are an integral part of

these consolidated financial statements

17

Molecular Pharmacology (USA) Limited

(A Development Stage Company)

Consolidated Statements of Operations

(Expressed in U.S. Dollars)

|

|

For the

period from

the date of

inception on

14 July 2004

to 30 June

2008

(Unaudited)

|

For the

year

ended

30 June

2008

|

For the

eight month

period

ended

30 June

2007

|

For the

year

ended

31 October

2006

|

|

|

|

$

|

|

$

|

|

$

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

Advertising and promotion

|

|

23,739

|

|

-

|

|

-

|

|

3,881

|

|

Analysis

|

|

33,947

|

|

-

|

|

-

|

|

-

|

|

Consulting (Note 6)

|

|

1,059,693

|

|

88,332

|

|

227,844

|

|

361,696

|

|

Depreciation

|

|

4,024

|

|

1,457

|

|

1,025

|

|

1,480

|

|

Office and miscellaneous

(Note 6)

|

|

123,653

|

|

33,079

|

|

29,788

|

|

29,309

|

|

Professional fees

|

|

171,682

|

|

64,236

|

|

55,989

|

|

51,457

|

|

Public relations

|

|

3,656

|

|

-

|

|

1,430

|

|

2,226

|

|

Rent (Note 6)

|

|

27,759

|

|

-

|

|

13,332

|

|

8,020

|

|

Salaries and benefits

|

|

44,464

|

|

-

|

|

16,008

|

|

2,652

|

|

Transfer agent and filing

fees

|

|

5,432

|

|

2,239

|

|

100

|

|

3,093

|

|

Travel

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss before other

items

|

|

(1,600,615)

|

|

(198,311)

|

|

(377,131)

|

|

(509,018)

|

|

|

|

|

|

|

|

|

|

|

|

Other items

|

|

|

|

|

|

|

|

|

|

Export market development

grants

|

|

63,174

|

|

63,174

|

|

-

|

|

-

|

|

Interest income

|

|

2,322

|

|

1,564

|

|

-

|

|

758

|

|

Research and development tax

refund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) for the

period

|

|

(1,339,250)

|

|

62,296

|

|

(377,131)

|

|

(508,260)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted income

(loss) per common share

|

|

(0.012)

|

|

0.001

|

|

(0.003)

|

|

(0.005)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of

common shares used in per share calculations

|

|

111,553,740

|

|

111,553,740

|

|

131,553,740

|

|

99,357,420

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss

|

|

|

|

|

|

|

|

|

|

Net income (loss) for the

period

|

|

(1,339,250)

|

|

62,296

|

|

(377,131)

|

|

(508,260)

|

|

Foreign currency translation

adjustment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss

for the period

|

|

(1,634,088)

|

|

(104,187)

|

|

(482,567)

|

|

(524,482)

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss per

common share

|

|

(0.015)

|

|

(0.001)

|

|

(0.004)

|

|

(0.005)

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these

consolidated financial statements

18

Molecular Pharmacology (USA) Limited

(A Development Stage Company)

Consolidated Statements of Cash Flows

(Expressed in U.S. Dollars)

|

|

For the

period from

the date of

inception on

14 July 2004

to 30 June

2008

(Unaudited)

|

For the

year

ended

30 June

2008

|

For the

eight month

period

ended

30 June

2007

|

For the

year

ended

31 October

2006

|

|

|

|

$

|

|

$