MedQuist Holdings Inc. (NASDAQ: MEDH):

Fourth Quarter

Highlights

- Total clinical documentation volume

increased 37% to 850 million lines

- Adjusted EBITDA increased 66% to

$27.6 million, or 25% of net revenues

- Adjusted Net Income per diluted

share - adjusted for the IPO and exchange offer up 22% to

$0.28

- Percentage of total clinical

documentation volume produced offshore and edited post speech

recognition reaches 42% and 71%

- Issues performance goals for

2011

Capital Structure and Liquidity

Highlights

- Full year free cash flow exceeded

60% of Adjusted EBITDA

- Improved liquidity with new $200

million term loan, $25 million credit facility and $85 million in

Senior Notes

- Sale of A-Life Medical and Patient

Financial Services generated $32 million in proceeds

- Closed IPO totaling 4.5 million

shares, including 3.0 million primary shares and 1.5 million

secondary shares

- Completed exchange offers that

result in approximately 97% ownership of MedQuist Inc.

The highlights above, as well as the discussion below, contain

certain non-GAAP financial measures that, together with applicable

GAAP financial measures, we utilize to evaluate the results of our

performance. Refer to the section of this release entitled

“Non-GAAP Financial Measures” for further discussion, as well as

the tables attached to this release that reconcile these non-GAAP

financial measures to applicable GAAP financial measures.

MedQuist Holdings Inc. (NASDAQ: MEDH), a leading provider of

integrated clinical documentation solutions for the U.S. healthcare

industry, announced its financial results for the fourth quarter

and full year ended December 31, 2010. The Company’s consolidated

statements of operations contained herein give effect to the

reclassification of the Patient Financial Services business into

discontinued operations.

Fourth Quarter Results

Net revenues increased 29% to $110.5 million for the three

months ended December 31, 2010, compared with $85.8 million for the

three months ended December 31, 2009, including $29.9 million in

net revenues contributed by the acquisition of Spheris in April

2010. Total clinical documentation volume for the fourth quarter of

2010 increased 37% to 850 million lines compared with 620 million

lines in the prior-year period. The revenue trend reflects our

efforts to offer lower pricing to our customers in exchange for

increased offshore production and speech recognition; ensuring

higher customer retention at higher margins.

Adjusted EBITDA for the fourth quarter of 2010 improved to $27.6

million, or 25.0% of net revenues, compared with $16.7 million, or

19.5% of net revenues, for the prior-year period. The increase in

Adjusted EBITDA and margin is the result of higher utilization of

offshore resources and higher percentage of volume edited post

speech recognition. Increased volumes from the acquisition of

Spheris added to the Company’s scalable platform and allowed the

Company to realize $7 million in synergies during the fourth

quarter.

Adjusted net income for the fourth quarter of 2010 was $14.4

million, or $0.28 per diluted share - adjusted for the IPO and

exchange offer, compared with $11.9 million, or $0.23 per diluted

share - adjusted for the IPO and exchange offer, in the prior-year

period. Net income attributable to common shareholders for the

fourth quarter of 2010 was $1.4 million, or $0.04 per diluted

share, compared with $275,000, or $0.01 per diluted share, reported

in the prior-year period.

Free cash flow for the fourth quarter of 2010 was $13.5 million

compared with $13.1 million in the fourth quarter of 2009.

Fourth Quarter Operating Metrics 2010

2009 Total clinical documentation volume: 850 million lines

620 million lines Transcription volumes processed offshore: 42% 39%

Transcription volumes edited post speech recognition: 71% 53%

Robert Aquilina, Chairman of MedQuist Holdings, said, “Through

our industry leading platform, we are giving our customers the

features, customer service capabilities, and cost savings they

desire. Our higher volumes have enabled us to leverage the scale of

our platform while also realizing the benefits of offshore

resources and post speech recognition editing. The acquisition and

turnaround of two companies in the last two years speaks to the

success of our strategy with a five-fold increase in Adjusted

EBITDA during that period and, most recently, the $7 million of

synergies gained in the fourth quarter, or $28 million annualized,

from the integration of Spheris. We will look to continue this

performance in 2011 as well as organic growth derived from a

relentless focus on new business.”

Full Year 2010 Results

Net revenues increased 18% to $417.3 million for the year ended

December 31, 2010 compared with $353.9 million for the year ended

December 31, 2009, including $88 million in net revenues from the

acquisition of Spheris in April 2010. Total clinical documentation

volume in 2010 increased 24% to 3.1 billion lines compared with 2.5

billion lines in 2009. Revenue trends for 2010 are consistent with

the factors cited above for the fourth quarter.

Adjusted EBITDA increased to $85.5 million, or 20.5% of net

revenues, for 2010, compared with $59.7 million, or 16.9% of net

revenues, for 2009. The increase in Adjusted EBITDA and margin

during 2010 is the result of higher utilization of offshore

resources and higher percentage of volume edited post speech

recognition, as well as increased volumes resulting from the

acquisition of Spheris and related synergies. The full year 2010

results only reflect $12 million of Spheris acquisition synergies

due to timing of the acquisition, of which $7 million was realized

in the fourth quarter.

Adjusted net income for 2010 was $52.3 million, or $1.01 per

diluted share - adjusted for the IPO and exchange offer, compared

with $39.9 million, or $0.79 per diluted share - adjusted for the

IPO and exchange offer, for 2009. Net income attributable to common

shareholders for 2010 was $5.8 million, or $0.16 per diluted

share, compared with a net loss attributable to common shareholders

of $(2.0) million, or $(0.06) per diluted share, for 2009.

Free cash flow for 2010 was $54.5 million compared with $44.2

million in 2009.

Full Year Operating Metrics 2010

2009 Total clinical documentation volume: 3.1 billion lines 2.5

billion lines Transcription volumes processed offshore: 41% 35%

Transcription volumes edited post speech recognition: 65% 48%

Liquidity and Capital

Structure

As of December 31, 2010, the Company had $67 million in cash and

$295 million in debt. During the fourth quarter of 2010, the

Company entered into a credit agreement consisting of a $200

million term loan along with a $25 million revolving credit

facility and borrowed an additional $85 million under a Senior

Subordinated Note. Proceeds were used to refinance existing

indebtedness and pay a special cash dividend of $53.9 million to

shareholders. The Company also improved its liquidity with the sale

of two non-strategic businesses during the quarter. In October, the

Company completed the sale of its interest in A-Life Medical for

cash consideration of $23.6 million of which $4.1 million will be

held in escrow until March 2012, resulting in an $8.8 million gain

in the fourth quarter. In December, the Company also divested its

Patient Financial Services business for total consideration of

$14.8 million, resulting in a $525,000 gain in the fourth quarter.

In addition to the $5 million scheduled principal amortization, the

Company also made an optional $20 million prepayment on its term

loan in the first quarter of 2011, thereby satisfying its principal

amortization obligations on its term loan through the first quarter

of 2012.

Our high level of cash generated as compared to our Adjusted

EBITDA reflects our continued ability to utilize our tax attributes

to absorb current period taxes. As of December 31, 2010, we had

federal net operating loss carry forward amounts of approximately

$102 million plus state net operating loss carry forward amounts of

approximately $286 million available to help off-set future period

taxable income amounts. We also had approximately $194 million of

capitalized tax intangibles that will be amortized against

operating income in future periods. Utilization of the net

operating loss carry forwards and intangible amortization amounts

are subject to annual limitations in future years, but are

anticipated to result in low cash tax amounts paid in the near

term.

Mr. Aquilina, noted, “The proceeds from the IPO and the

continued ability to convert Adjusted EBITDA into high levels of

free cash flow will allow us to execute on our growth initiatives.

Our highly efficient operating model is further enhanced by our

significant net operating loss tax carry forwards, the tax

amortization of acquired intangibles, and modest capital

expenditure requirements.”

On January 27, 2011, the Company changed its name from

CBaySystems Holdings Limited to MedQuist Holdings Inc., delisted

its common stock from the Alternative Investment Market of the

London Stock Exchange (AIM) and redomiciled from a British Virgin

Islands company to a Delaware corporation. On February 4, 2011,

MedQuist Holdings Inc. listed its shares on the NASDAQ and began

trading. MedQuist Holdings Inc. closed its initial U.S. public

offering of 3.0 million primary shares of common stock and 1.5

million secondary shares of its common stock on February 9, 2011.

The Company received approximately $22.3 million in proceeds, net

of the underwriting discount, and incurred approximately $7.5

million in additional fees and expenses associated with the

IPO.

On February 15, 2011, MedQuist Holdings Inc. completed a private

exchange through which it exchanged MedQuist Holdings Inc. shares

for MedQuist Inc. shares and increased its ownership of MedQuist

Inc. from 69.5% to 82.2%. The Company initiated a public exchange

offer for all remaining shares of MedQuist Inc. on February 3,

2011, which was subsequently completed on March 11, 2011 and

brought MedQuist Holdings Inc.’s ownership of MedQuist Inc. to

approximately 97%. The Company estimates that it will pay

additional fees and expenses associated with the exchange offers of

approximately $12.0 million. In accordance with the terms of a

memorandum of understanding entered into in connection with the

settlement of MedQuist Inc. shareholder litigation and subject to

final approval of the settlement by the Court, the remaining issued

and outstanding shares of MedQuist Inc. are expected to be

exchanged on the same terms as the public exchange in a short-form

merger by the end of the second quarter of 2011.

Performance Goals for

2011

The Company expects that volume growth, higher percentage of

volume edited using speech recognition technology and produced

offshore, growth in Adjusted EBITDA and Adjusted Net Income per

share will continue to be the primary metrics for assessing the

Company’s performance. With the completion of the recapitalization,

the Company is now in a position to implement the full integration

of MedQuist Inc. and MedQuist Holdings. To achieve this

integration, the Company is evaluating a potential restructuring

plan and believes a potential charge could range from $2.5 million

to $5.0 million. The restructuring plan will be finalized and

implemented throughout 2011 with the full benefit experienced by

early 2012.

The Company’s Performance Goals noted below include the expected

benefit in the second half of 2011 from additional integration

savings and assumes 52.2 million fully diluted common shares

outstanding for the year. The Performance Goals exclude any impact

from potential acquisitions.

Total clinical documentation volume: 3.5

billion to 3.7 billion lines Adjusted EBITDA: $112 million to $116

million Adjusted Net Income: $1.24 to $1.31 per diluted share -

adjusted for the IPO and exchange offer

Commenting on the 2011 outlook, Mr. Aquilina added, “We expect

to achieve volume growth in 2011 through significant, aggressive

sales efforts, and excellent customer service and retention. We

will also continue to benefit from the synergies from our

successful integration of Spheris, the increase in volume processed

offshore and edited post speech recognition, and our plans for

achieving additional synergies from the integration of MedQuist

Inc. later in the year. While we have made no projections for

acquisitions in our outlook, we will continue to explore potential

opportunities that create synergies through our lower cost

structure, add value to our industry leading platform, and/or

extend the range of solutions we provide.”

Investor Conference Call and Web

Simulcast

MedQuist Holdings will host a conference call on March 16, 2011,

at 9:00 a.m. CT to discuss its results of operations for the fourth

quarter of 2010. The number to call for the interactive

teleconference is (212) 231-2905. A replay of the conference call

will be available through Wednesday, March 23, 2011, by dialing

(402) 977-9140 and entering the confirmation number, 21514728.

A live broadcast of MedQuist Holdings quarterly conference call

will be available online at the Company's website,

www.medquistholdings.com, under Investor Relations or

http://www.videonewswire.com/event.asp?id=77420 on March 16, 2011,

beginning at 9:00 a.m. CT. The online replay will follow

shortly after the call and continue for one year.

About MedQuist Holdings

MedQuist Holdings is a leading provider of integrated clinical

documentation solutions for the U.S. healthcare system, and the

largest provider by revenue of clinical documentation based on

physicians’ dictation of patient interaction, or the physician

narrative, in the United States. MedQuist Holdings serves more than

2,400 hospitals, clinics, and physician practices throughout the

United States, including 40% of hospitals with more than 500

licensed beds.

MedQuist Holdings’ solutions convert the physician narrative

into a high quality and customized electronic record, and enable

hospitals, clinics, and physician practices to improve the quality

of clinical data as well as accelerate and automate the

documentation process. We believe our solutions improve physician

productivity and satisfaction, enhance revenue cycle performance,

and facilitate the adoption and use of electronic

health records. For more information, please visit our website

at www.medquistholdings.com.

Forward-Looking

Statements

Information provided and statements contained in this press

release that are not purely historical, such as statements

regarding our 2011 financial and operating performance, are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements only speak as of the date of this

press release and MedQuist Holdings Inc. assumes no obligation to

update the information included in this press release. Statements

made in this press release that are forward-looking in nature may

involve risks and uncertainties. Accordingly, readers are cautioned

that any such forward-looking statements are not guarantees of

future performance and are subject to certain risks, uncertainties

and assumptions that are difficult to predict, including, without

limitation, specific factors discussed herein and in other releases

and public filings made by MedQuist Holdings Inc. (including

filings by MedQuist Holdings Inc. with the SEC). Although MedQuist

Holdings believes that the expectations reflected in such

forward-looking statements are reasonable as of the date made,

expectations may prove to have been materially different from the

results expressed or implied by such forward-looking statements.

Unless otherwise required by law, MedQuist Holdings also disclaims

any obligation to update its view of any such risks or

uncertainties or to announce publicly the result of any revisions

to the forward-looking statements made in this press release.

MedQuist Holdings Inc.

and Subsidiaries Consolidated Statements of Operations

(In thousands, except per share amounts) Unaudited

Three

Months Ended Year Ended December 31, December

31, 2010 2009 2010 2009 Net

revenues $ 110,534 $ 85,812 $ 417,326 $ 353,932 Cost of

revenues 64,308 54,254 259,194

229,701

Gross Profit

46,226 31,558 158,132

124,231

Operating costs and expenses: Selling,

general and administrative 15,398 12,504 61,062 53,089 Research and

development 3,086 2,369 12,030 9,604 Depreciation and amortization

8,872 6,446 32,617 25,366 Cost of legal proceedings and settlements

820 1,403 3,605 14,943 Acquistion and integration related charges

512 1,246 7,407 1,246 Restructuring charges 1,759

2,246 3,672 2,727

Total operating costs and expenses 30,447

26,214 120,393 106,975

Operating income 15,779 5,344 37,739 17,256 Gain on sale of

investment 8,780 8,780 - Equity in income (loss) of affiliated

company 77 (602 ) 693 1,933 Other income (expense) (100 ) 12 460 13

Loss on extinguishment of debt (13,525 ) - (13,525 ) - Interest

expense, net (7,299 ) (2,149 ) (19,268 )

(9,019 )

Income from continuing operations before

income taxes and noncontrolling interests 3,712 2,605 14,879

10,183 Income tax provision (benefit) (2,159 )

(221 ) (2,312 ) 1,012

Net income from continuing

operations

$ 5,871 $ 2,826 $ 17,191 $ 9,171

Discontinued Operations Income (loss) from discontinued

Patient Financial Services business, net of tax 218

(71 ) 556 (1,351 )

Income

(loss) from discontinued operations 218

(71 ) 556 (1,351 )

Net income 6,089

2,755 17,747 7,820 Less: Net income attributable to

noncontrolling interests (4,006 ) (1,793 )

(9,240 ) (7,085 )

Net income attributable to

MedQuist Holdings Inc. $ 2,083 $ 962 $ 8,507

$ 735

Net income (loss) per common share

from continuing operations Basic $ 0.03 $ 0.01 $

0.14 $ (0.02 ) Diluted $ 0.03 $ 0.01 $ 0.14

$ (0.02 )

Net income (loss) per common share from

discontinued operations Basic $ 0.01 $ - $ 0.02

$ (0.04 ) Diluted $ 0.01 $ - $ 0.02 $

(0.04 )

Net income (loss) per common share attributable

to MedQuist Holdings Inc. Basic $ 0.04 $ 0.01 $

0.16 $ (0.06 ) Diluted $ 0.04 $ 0.01 $ 0.16

$ (0.06 ) Weighted average shares outstanding: Basic

35,158 35,013 35,102

34,692 Diluted 36,370 35,013

35,954 34,692

MedQuist Holdings Inc. and

Subsidiaries Consolidated Balance Sheets (In

thousands) Unaudited December 31,

December 31, 2010 2009

Assets Current assets: Cash and cash equivalents $

66,779 $ 29,633 Accounts receivable, net of allowance of $1,466 and

$1,753, respectively 82,038 53,099 Other current assets

23,706 8,739 Total current assets

172,523 91,471 Property and equipment, net 23,018 19,511

Goodwill 90,268 53,187 Other intangible assets, net 107,962 72,838

Deferred income taxes 6,896 2,495 Other assets 14,212

13,566 Total assets $ 414,879 $ 253,068

Liabilities and Equity Current liabilities:

Current portion of long term debt $ 27,817 $ 6,207 Accounts payable

11,358 11,191 Accrued expenses and other current liability 36,917

29,803 Accrued compensation 16,911 16,034 Deferred revenue

10,570 9,924 Total current liabilities 103,574

73,159 Long term debt 266,677 101,133 Deferred income taxes 4,221

2,166 Due to related parties 3,537 2,185 Other non-current

liabilities 2,360 2,124 Total

liabilities 380,368 180,767 Commitments

and contingencies Total equity:

Preferred stock - $0.10 par value;

authorized 25,000 shares; none issued or outstanding

- -

Common stock - $0.10 par value; authorized

300,000 shares; 35,158 and 35,013 shares issued and outstanding,

respectively

3,516 3,501 Additional paid in capital 148,265 149,339 Accumulated

deficit (107,179 ) (115,686 ) Accumulated other comprehensive loss

(663 ) (174 ) Total MedQuist Holdings Inc.

stockholders' equity 43,939 36,980 Noncontrolling interests

(9,428 ) 35,321 Total equity 34,511 72,301

Total liabilities and equity $ 414,880 $ 253,068

MedQuist

Holdings Inc. and Subsidiaries Consolidated Statements of

Cash Flow (In thousands) Unaudited

Years ended December 31,

2010 2009

Operating activities:

Net income $ 17,747 $ 7,820 Adjustments to reconcile net

income to cash provided by operating activities: Depreciation and

amortization 33,454 26,977 Gain on sale of investment (8,780 ) -

Equity in income of affiliated company (693 ) (1,933 ) Deferred

income taxes (3,566 ) 679 Share based compensation 764 856

Provision for doubtful accounts 1,538 2,306 Non-cash interest

expense 4,132 3,272 Loss on extinquishment of debt 13,525 - Other

(963 ) 200 Changes in operating assets and liabilities:

Accounts receivable (9,962 ) 3,816 Other current assets (1,858 )

2,185 Other non-current assets (495 ) (615 ) Accounts payable 981

871 Accrued expenses (5,378 ) (3,634 ) Accrued compensation (4,244

) 1,904 Deferred revenue 569 (2,128 ) Other non-current liabilities

(546 ) 94 Net cash provided by operating

activities $ 36,225 $ 42,670

Investing

activities: Purchase of property and equipment (7,152 ) (6,475

) Proceeds from sale of investments 19,469 - Purchases of

capitalized intangible assets (7,155 ) (2,995 ) Proceeds from sale

of subsidiaries 12,547 - Payments for acquisitions and interests in

affiliates, net of cash acquired (99,793 ) (2,690 )

Net cash used in investing activities (82,084 )

(12,160 )

Financing activities: Proceeds from debt

392,352 659 Repayment of debt (229,727 ) (28,613 ) Dividends paid

to noncontrolling interests (53,913 ) (15,256 ) Debt issuance costs

(21,607 ) (1,201 ) Payments related to initial public offering

(3,745 ) - Net cash provided by (used in)

financing activities 83,360 (44,411 )

Effect of exchange rate changes (355 ) 666

Net increase (decrease) in cash and cash equivalents

37,146 (13,235 ) Cash and cash equivalents -

beginning of period 29,633 42,868

Cash and cash equivalents - end of period $ 66,779 $

29,633

MedQuist Holdings Inc. and Subsidiaries Reconciliation of

Net Income to Adjusted EBITDA (In thousands)

Unaudited

Three Months Ended Year Ended December

31, December 31, 2010 2009

2010 2009 Net income

attributable to MedQuist Holdings Inc. $ 2,083 $ 962 $ 8,507 $ 735

Net income attributable to noncontrolling interest 4,006

1,793 9,240 7,085 (Income) loss from discontinuing operations (218

) 71 (556 ) 1,351 Income tax provision (benefit) (2,159 ) (221 )

(2,312 ) 1,012 Interest expense, net 7,299 2,149 19,268 9,019 Loss

on extinguishment of debt 13,525 - 13,525 - Depreciation and

amortization 8,872 6,446 32,617 25,366 Restructuring charges 1,759

2,246 3,672 2,727 Acquisition and integration related charges 512

1,246 7,407 1,246 Cost of legal proceedings and settlements 820

1,403 3,605 14,943 Accrual reversals - - - (1,864 ) Gain on sale of

investment (8,780 ) - (8,780 ) - Equity in (income) loss of

affiliated company (77 ) 602

(693 ) (1,933 ) Adjusted EBITDA $

27,642 $ 16,697 $ 85,500

$ 59,687 Adjusted EBITDA as a percentage of

net revenues 25.0 % 19.5 % 20.5 % 16.9 %

MedQuist Holdings Inc. and

Subsidiaries Free Cash Flow (In thousands)

Unaudited

Three Months Ended Year Ended December

31, December 31, 2010 2009

2010 2009 Adjusted EBITDA $

27,642 $ 16,697 $ 85,500 $ 59,687

Less:

Interest expense, net

(7,299 ) (2,149 ) (19,268 ) (9,019 )

Non-cash interest expense

803 - 4,132 3,272

Capital expenditures (including

internal-use software)

(4,687 ) (2,331 ) (14,307 ) (9,470 )

Tax (provision) benefit

2,159 221 2,312 (1,012 )

Add:

Deferred tax provision (benefit)

(5,072 ) 693 (3,903 )

695 Free Cash Flow $ 13,546

$ 13,131 $ 54,466 $

44,153

MedQuist

Holdings Inc. and Subsidiaries Adjusted Net Income

(In thousands) Unaudited Adjusted Net Income:

Adjusted EBITDA $ 27,642 $ 16,697 $ 85,500 $ 59,687

Amortization (excluding acquired intangibles) (3,869 ) (3,534 )

(16,482 ) (13,686 )

Cash interest (total expenses less

non-cash)

(6,496 ) (2,149 ) (15,137 ) (5,747 )

Current tax provision (benefit)

(2,913 ) 914 (1,590 )

(333 ) Adjusted Net Income $ 14,364

$ 11,928 $ 52,291 $

39,921 Adjusted Net Income Per Share - Adjusted for

IPO and Exchange Offer: Basic (a) $ 0.28 $ 0.23 $ 1.03 $ 0.79

Diluted (a) $ 0.28 $ 0.23 $ 1.01 $ 0.79 (a) Based on

proforma shares outstanding for the IPO and Exchange Offer. See

Share Calculation below.

MedQuist Holdings Inc. and Subsidiaries Share

Calculation (In thousands) Unaudited

Three

Months Ended Year Ended December 31, December

31, 2010 2009 2010

2009 MedQuist Holdings Shares Basic

outstanding 35,158 35,013 35,012 34,692 Effect of diluted options

1,212 - 942 - Diluted shares 36,370

35,013 35,954 34,692 MedQuist, Inc. Shares Basic outstanding

37,556 37,556 37,556 37,556 Effect of diluted options 34

- - - Diluted shares 37,590 37,556 37,556

37,556 Minority interest - basic (1) 11,455 11,455 11,455

11,455 Minority interest - diluted (1) 11,465 11,455 11,455 11,455

Proforma Shares Outstanding for Exchange Offer Basic 46,613

46,468 46,467 46,147 Diluted 47,835 46,468 47,409 46,147

Proforma Shares Outstanding for IPO and Exchange Offer Basic 50,932

50,787 50,786 50,466 Fully Diluted 52,124 50,787 51,728 50,466

(1) Assumes the issuance of our common stock in exchange for

shares of MedQuist Inc. common stock pursuant to terms of private

and public exchange offers, which will increase our ownership in

MedQuist Inc. from 69.5% to 100%. We have completed our exchange

offers, and we currently own approximately 97% of MedQuist Inc.

Total Clinical Documentation Volume

Management believes that total clinical documentation volume is

an important measure of the Company’s operating results. Total

clinical documentation volume is defined as total lines processed

on our clinical documentation platforms and/or transcribed or

edited by our personnel.

Non-GAAP Financial

Measures

In addition to the United States generally accepted

accounting principles, or GAAP, results provided throughout this

document, MedQuist Holdings Inc. has provided certain

non-GAAP financial measures to help evaluate the results of our

performance. The Company believes that these non-GAAP financial

measures, when presented in conjunction with comparable GAAP

financial measures, are useful to both management and investors in

analyzing the Company’s ongoing business and operating performance.

The Company believes that providing the non-GAAP information to

investors, in addition to the GAAP presentation, allows investors

to view the Company’s financial results in the way that management

views financial results. The tables attached to this press release

include a reconciliation of these historical non-GAAP financial

measures to the most directly comparable GAAP financial

measures.

We also present Adjusted EBITDA and Adjusted Net Income on a

forward-looking basis as part of our Performance Goals for 2011. We

are unable to present a quantitative reconciliation of these

forward-looking non-GAAP financial measures to the most directly

comparable forward-looking GAAP financial measures because

management cannot predict, with sufficient reliability,

contingencies relating to potential changes in tax valuation

allowances, potential changes to customer accommodation accruals,

potential restructuring impacts, contingencies related to past and

future acquisitions, and changes in fair values of our derivative

instruments, all of which are difficult to estimate primarily due

to dependencies on future events.

Adjusted EBITDA

Adjusted EBITDA, a non-GAAP financial measure, is defined by the

Company as Net Income excluding taxes, interest, equity in income

of an affiliated company, depreciation, amortization, cost of legal

proceedings and settlements, acquisition related charges,

restructuring charges and certain non-recurring accrual

reversals.

Management believes Adjusted EBITDA is useful as a supplemental

measures of the Company's financial results because it removes

costs not related to the Company's operating performance.

Management believes that Adjusted EBITDA should be considered in

addition to, but not as a substitute for items presented in

accordance with GAAP that are presented in this press release. A

reconciliation of Net income to Adjusted EBITDA is provided

above.

Free Cash Flow

Free Cash Flow, a non-GAAP financial measure, is defined by the

Company as Adjusted EBITDA less interest expense (net of non-cash

interest), less capital expenditures (including capitalized

software development costs), and less current tax provision.

Management believes that utilization of Free Cash Flow is an

important non-GAAP measure of the Company’s ability to convert

operating results into cash.

Adjusted Net Income

Adjusted Net Income, a non-GAAP financial measure, is defined by

the Company as Adjusted EBITDA less amortization expense (net of

amortization related to acquired intangibles), less interest

expense (net of non-cash interest), and less current tax provision.

We measure Adjusted Net Income based on Proforma Shares Outstanding

(see below). Management believes that utilization of Adjusted Net

Income is an important non-GAAP financial measure of our normalized

operating results.

Proforma Shares Outstanding for Exchange Offer

For purposes of evaluating our results on per-share metrics,

many of our computations utilize proforma share computations. Our

measure of proforma shares includes our Basic and Diluted share

computations utilized for GAAP purposes, plus our estimate of the

impacts of minority interest shares outstanding of 11.5 million

shares.

Proforma Shares Outstanding for Initial Public Offering and

Exchange Offer

For purposes of evaluating our results on per-share metrics,

many of our computations utilize proforma share computations. Our

measure of proforma shares include our Basic and Diluted share

computations utilized for GAAP purposes, plus our estimate of the

impacts of minority interest shares outstanding of 11.5 million

shares and 3.0 million primary shares issued by us in our initial

public offering as well as 1.3 million other shares issued after

December 31, 2010.

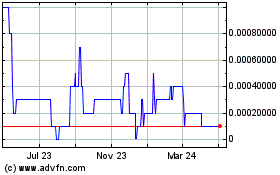

Medx (CE) (USOTC:MEDH)

Historical Stock Chart

From Jun 2024 to Jul 2024

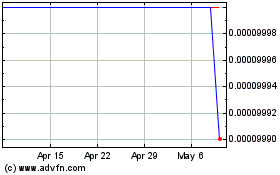

Medx (CE) (USOTC:MEDH)

Historical Stock Chart

From Jul 2023 to Jul 2024