Filed Pursuant to Rule 253(g)(2)

File No. 024-10997

Supplement No. 2 to Offering Circular

dated May 27, 2020

Manufactured Housing Properties Inc.

136 Main Street

Pineville, NC 28134

(980) 273-1702; www.mhproperties.com

This Offering Circular Supplement No. 2

(the “Supplement”) relates to the Offering Circular of Manufactured Housing Properties Inc. (the “Company”),

dated May 27, 2020 (the “Offering Circular”), relating to the Company’s public offering under Regulation

A of Section 3(6) of the Securities Act of 1933, as amended, for Tier 2 offerings, pursuant to which the Company is offering up

to 1,000,000 shares of Series B Cumulative Redeemable Preferred Stock (the “Series B Preferred Stock”) at an

offering price of $10.00 per share, for a maximum offering amount of $10,000,000. In addition, the Company is offering bonus shares

to early investors in this offering. The first 400 investors will receive, in addition to Series B Preferred Stock, 100 shares

of Common Stock, regardless of the amount invested, for a total of 40,000 shares of Common Stock. This Supplement should be read

in conjunction with the Offering Circular and Offering Circular Supplement No. 1 filed with the Securities and Exchange Commission

(the “SEC”) on May 28, 2020 (the “Prior Supplement”) and is qualified by reference to the

Offering Circular and the Prior Supplement except to the extent that the information contained herein supplements or supersedes

the information contained in the Offering Circular and the Prior Supplement, and may not be delivered without the Offering Circular

and the Prior Supplement.

On November 29, 2019, the Company completed

an initial closing of the offering, pursuant to which the Company sold an aggregate of 335,512 shares of Series B Preferred Stock

to 103 investors for total gross proceeds of $3,355,120. After deducting the placement fee, the Company received net proceeds of

approximately $3,120,262. The Company also issued 10,300 shares of Common Stock to these early investors.

On December 31, 2019, the Company completed

an additional closing of the offering, pursuant to which the Company sold an aggregate of 74,210 shares of Series B Preferred Stock

to 54 investors for total gross proceeds of $742,100. After deducting the placement fee, the Company received net proceeds of approximately

$690,153. The Company also issued 5,100 shares of Common Stock to additional investors.

On January 29, 2020, the Company completed

an additional closing of the offering, pursuant to which the Company sold an aggregate of 52,500 shares of Series B Preferred Stock

to 21 investors for total gross proceeds of $525,000. After deducting the placement fee, the Company received net proceeds of approximately

$488,250. The Company also issued 2,100 shares of Common Stock to additional early investors.

On January 31, 2020, the Company completed

an additional closing of the offering, pursuant to which the Company sold an aggregate of 11,000 shares of Series B Preferred Stock

to 4 investors for total gross proceeds of $110,000. After deducting the placement fee, the Company received net proceeds of approximately

$102,300. The Company also issued 400 shares of Common Stock to additional early investors.

On February 28, 2020, the Company completed

an additional closing of the offering, pursuant to which the Company sold an aggregate of 19,595 shares of Series B Preferred Stock

to 21 investors for total gross proceeds of $195,950. After deducting the placement fee, the Company received net proceeds of approximately

$182,234. The Company also issued 2,100 shares of Common Stock to additional early investors.

On March 30, 2020, the Company completed

an additional closing of the offering, pursuant to which the Company sold an aggregate of 32,140 shares of Series B Preferred Stock

to 14 investors for total gross proceeds of $321,400. After deducting the placement fee, the Company received net proceeds of approximately

$298,902. The Company also issued 1,400 shares of Common Stock to additional early investors.

On June 2, 2020, the Company completed

an additional closing of the offering, pursuant to which the Company sold an aggregate of 16,160 shares of Series B Preferred Stock

to 8 investors for total gross proceeds of $161,600. After deducting the placement fee, the Company received net proceeds of approximately

$150,288. The Company also issued 800 shares of Common Stock to additional early investors.

This Supplement includes the attached Current

Report on Form 8-K filed with the Securities and Exchange Commission on June 2, 2020. The exhibits to such Form 8-K are not included

with this Supplement and are not incorporated by reference herein.

INVESTING IN OUR SECURITIES INVOLVES

A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ AND CONSIDER THE “RISK FACTORS” BEGINNING ON PAGE 10 OF THE OFFERING

CIRCULAR.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this Offering Circular

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Supplement No. 2 to

Offering Circular is June 5, 2020

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment

No. 1)

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 2, 2020 (March 12, 2020)

|

Manufactured

Housing Properties Inc.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Nevada

|

|

000-51229

|

|

51-0482104

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

|

136

Main Street, Pineville, North Carolina

|

|

28134

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

|

(980)

273-1702

|

|

(Registrant’s

telephone number, including area code)

|

|

|

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2 of the Securities Exchange Act of 1934.

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act: None

EXPLANATORY

NOTE

As

previously disclosed MHP Pursuits LLC, a wholly-owned subsidiary of Manufactured Housing Properties Inc., a Nevada corporation

(the “Company”), entered into a purchase and sale agreement (the “Purchase Agreement”) with

J & A Real Estate, LLC (“J&A”) on January 7, 2020 for the purchase of a manufactured housing community

known as Countryside Estates Mobile Home Park (the “Property”), which is located in Lancaster, South Carolina

and totals 110 sites, for a total purchase price of $3.7 million. As previously reported, closing of the Purchase Agreement was

completed on March 12, 2020 and the Company’s newly formed wholly owned subsidiary Countryside MHP LLC purchased the Property.

This

Current Report on Form 8-K/A amends the original Form 8-K that the Company filed on March 27, 2020 to include J&A’s

statement of revenues and certain expenses for the year ended December 31, 2019 and the unaudited pro forma combined financial

information related to the acquisition required by Items 9.01(a) and 9.01(b) of Form 8-K.

|

|

Item

9.01

|

Financial

Statements and Exhibits.

|

(a)

Financial Statements of Business Acquired

The

statement of revenues and certain expenses for J&A for the year ended December 31, 2019 and the accompanying notes thereto

is filed as Exhibit 99.1 attached hereto and is incorporated by reference herein.

(b)

Pro forma financial information

The

unaudited pro forma combined financial statements giving effect to the acquisition is filed as Exhibit 99.2 attached hereto

and is incorporated herein by reference.

(d)

Exhibits

|

Exhibit

No.

|

|

Description

of Exhibit

|

|

10.1

|

|

Purchase and Sale Agreement, dated January 7, 2020, between MHP Pursuits LLC and J & A Real Estate, LLC (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed on January 13, 2020)

|

|

10.2

|

|

Promissory Note issued by Countryside MHP LLC to J & A Real Estate, LLC on March 12, 2020 (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed on March 27, 2020)

|

|

10.3

|

|

Mortgage, Assignment of Rents and Leases, Security Agreement and Fixture Filing, dated March 12, 2020, between Countryside MHP LLC and J & A Real Estate, LLC (incorporated by reference to Exhibit 10.3 to the Current Report on Form 8-K filed on March 27, 2020)

|

|

99.1

|

|

Statement of Revenues and Certain Expenses

|

|

99.2

|

|

Unaudited Pro Forma Combined Financial Statements

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this current report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

Date:

June 2, 2020

|

MANUFACTURED

HOUSING PROPERTIES INC.

|

|

|

|

|

|

|

By:

|

/s/

Raymond M. Gee

|

|

|

|

Raymond

M. Gee

|

|

|

|

Chief

Executive Officer

|

Exhibit 99.1

J

& A REAL ESTATE, LLC

STATEMENT

OF REVENUES AND CERTAIN EXPENSES

FOR

THE YEAR ENDED DECEMBER 31, 2019

INDEPENDENT

AUDITOR’S REPORT

To

the Members of:

J

& A Real Estates, LLC

We

have audited the accompanying statement of revenue and certain expenses of J & A Real Estate, LLC (the “Company”)

for the year ended December 31, 2019 and the related notes to the statement of revenue and certain expenses.

Management’s

responsibility for Statement of Revenue and Certain Expenses

Management

is responsible for the preparation and fair presentation of the statement of revenue and certain expenses in conformity with U.S.

generally accepted accounting principles. This includes the design, implementation, and maintenance of internal control relevant

to the preparation and fair presentation of the statement of revenue and certain expenses that are free from material misstatement,

whether due to fraud or error.

Auditor’s

Responsibility

Our

responsibility is to express an opinion on the statement of revenue and certain expenses based on our audit. We conducted our

audit in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and

perform the audit to obtain reasonable assurance about whether the statement of revenue and certain expenses is free from material

misstatement.

An

audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the statement of revenue and

certain expenses. The procedures selected depend on the auditor’s judgement, including the assessment of the risks of material

misstatement of the statement of revenue and certain expenses, whether due to fraud or error. In making those risk assessments,

the auditor considers internal control relevant to the entity’s preparation and fair presentation of the statement of revenue

and certain expenses in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An

audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluating the overall presentation of the statement of revenue and certain expenses.

We

believe that our audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In

our opinion, the statement of revenue and certain expenses referred to above presents fairly, in all material respects, the statement

of revenue and certain expenses described on Note 1 of the Company’s statement of revenue and certain expenses for the year

ended December 31, 2019 in conformity with generally accepted accounting principles.

Emphasis

of Matter

We

draw attention to Note 1 to the statement of revenue and certain expenses, which describes that the accompanying statement of

revenue and certain expenses was prepared for the purposes of complying with the rules and regulations of the Securities and Exchange

Commission and is not intended to be a complete presentation of the Company’s revenue and expenses. Our opinion is not modified

with respect to this matter.

/s/

Liggett & Webb, P.A.

LIGGETT

& WEBB, P.A.

Certified

Public Accountants

Boynton

Beach, Florida

June

2, 2020

J

& A REAL ESTATE, LLC

STATEMENT

OF REVENUES AND CERTAIN EXPENSES

FOR

THE YEAR ENDED DECEMBER 31, 2019

|

|

|

For the

Year Ended December 31,

2019

|

|

|

|

|

|

|

|

REVENUE:

|

|

|

|

|

Rental and Related Income

|

|

|

485,445

|

|

|

Total Revenues

|

|

|

485,445

|

|

|

|

|

|

|

|

|

CERTAIN EXPENSES:

|

|

|

|

|

|

Repairs and Maintenance

|

|

|

40,199

|

|

|

Insurance

|

|

|

1,973

|

|

|

Utilities

|

|

|

4,116

|

|

|

Real Estate Taxes

|

|

|

29,018

|

|

|

Salaries and Wages

|

|

|

57,622

|

|

|

Bad Debt

|

|

|

18,317

|

|

|

Total Certain Expenses

|

|

|

151,245

|

|

|

|

|

|

|

|

|

REVENUE IN EXCESS OF CERTAIN EXPENSES

|

|

$

|

334,200

|

|

See

accompanying notes to statement of revenue and certain expenses

J

& A REAL ESTATE, LLC

NOTES

TO STATEMENT OF REVENUES AND CERTAIN EXPENSES

FOR

THE YEAR ENDED DECEMBER 31, 2019

NOTE

1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND ORGANIZATION

(A)

Organization and Basis of Presentation

J

& A REAL ESTATE, LLC (the “Company”) was formed as a limited liability company under the laws of the State of

South Carolina.

The

accompanying statement of revenues and certain expenses has been prepared for the purpose of complying with Rule 3-14 of

Regulation S-X promulgated under the Securities Act of 1933, as amended, and accordingly, is not representative

of the actual results of operations of the properties for the periods presented, due to the exclusion of the following revenues

and expenses which may not be comparable to the proposed future operations:

|

|

●

|

Depreciation

and amortization

|

|

|

●

|

Interest

income and expense

|

Except

as noted above, management is not aware of any material factors relating to the properties that would cause the reported financial

information not to be indicative of future operating results. In the opinion of management, all adjustments (consisting solely

of normal recurring adjustments) necessary for the fair presentation of this statement of revenues and certain expenses have been

included.

(B)

Use of Estimates

In

preparing financial statements in conformity with generally accepted accounting principles, management is required to make estimates

and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities

at the date of the financial statements and revenues and expenses during the reported period. Actual results could differ from

those estimates.

(C)

Business Segments

The

Company operates in one segment and therefore segment information is not presented.

(D)

Operating Expenses

Operating

expenses represent the direct expenses of operating the properties and consist primarily of real estate taxes, payroll, repairs

and maintenance, utilities, insurance and other operating expenses that are expected to continue in the proposed future operations

of the properties.

(E)

Revenue Recognition

The

Company follows Topic 606 of the Financial Accounting Standards Board (the “FASB”) Accounting Standards Codification

for revenue recognition and Accounting Standards Update (“ASU”) 2014-09. On January 1, 2019, the Company adopted ASU

2014-09, which is a comprehensive new revenue recognition model that requires revenue to be recognized in a manner to depict the

transfer of goods or services to a customer at an amount that reflects the consideration expected to be received in exchange for

those goods or services. The Company considers revenue realized or realizable and earned when all the five following criteria

are met: (1) identify the contract with a customer, (2) identify the performance obligations in the contract, (3) determine the

transaction price, (4) allocate the transaction price to the performance obligations in the contract, and (5) recognize revenue

when (or as) the entity satisfies a performance obligation. Results for reporting periods beginning after January 1, 2019 are

presented under ASU 2014-09, while prior period amounts are not adjusted and continue to be reported under the previous accounting

standards. There was no impact to revenues as a result of applying ASU 2014-09 for the year ended December 31, 2019, and there

have not been any significant changes to the Company’s business processes, systems, or internal controls as a result of

implementing the standard. The Company recognizes rental income revenues on a monthly basis based on the terms of the lease agreement

which are for either the land or a combination of both, the mobile home and land. Home sales revenues are recognized upon the

sale of a home with an executed sales agreement. The Company has deferred revenues from home lease purchase options and records

those option fees as deferred revenues and then records them as revenues when (1) the lease purchase option term is completed

and title has been transferred, or (2) the leaseholder defaults on the lease terms resulting in a termination of the agreement

which allows us to keep any payments as liquidated damages.

(F)

Recent Accounting Pronouncements

In

June 2016, the FASB issued ASU No. 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit

Losses on Financial Instruments.” ASU 2016-13 requires that entities use a new forward looking “expected loss”

model that generally will result in the earlier recognition of allowance for credit losses. The measurement of expected credit

losses is based upon historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability

of the reported amount. ASU No. 2016-13 is effective for annual reporting periods, including interim reporting periods within

those periods, beginning after December 15, 2020. The Company is currently evaluating the potential impact this standard may have

on the financial statements.

In

February 2016, the FASB issued ASU 2016-02, “Leases.” ASU 2016-02 amends the existing accounting standards for lease

accounting, including requiring lessees to recognize most leases on their balance sheets and making targeted changes to lessor

accounting. The standard requires a modified retrospective transition approach for all leases existing at, or entered into after,

the date of initial application, with an option to use certain transition relief. ASU 2016-02 will be effective for annual reporting

periods beginning after December 15, 2020. Early adoption is permitted. The Company has evaluated the potential impact this standard

may have on the financial statements and determined that it has no impact on the financial statements.

In

June 2018, the FASB issued ASU 2018-07 “Compensation – Stock Compensation (Topic 718): Improvements to Nonemployee

Share-Based Payment Accounting.” This ASU relates to the accounting for non-employee share-based payments. The amendment

in this Update expands the scope of Topic 718 to include all share-based payment transactions in which a grantor acquired goods

or services to be used or consumed in a grantor’s own operations by issuing share-based payment awards. The ASU excludes

share-based payment awards that relate to (1) financing to the issuer or (2) awards granted in conjunction with selling goods

or services to customers as part of a contract accounted for under Topic 606, “Revenue from Contracts from Customers.”

The share-based payments are to be measured at grant-date fair value of the equity instruments that the entity is obligated to

issue when the good or service has been delivered or rendered and all other conditions necessary to earn the right to benefit

from the equity instruments have been satisfied. This standard will be effective for public business entities for fiscal years

beginning after December 15, 2018, including interim periods within that fiscal year. For all other entities, the amendments are

effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December

15, 2020. Early adoption is permitted, but no earlier than an entity’s adoption of Topic 606. The Company is currently reviewing

the provisions of this ASU to determine if there will be any impact on its results of operations, cash flows or financial condition.

Management

does not believe that any other recently issued, but not yet effective accounting pronouncements, if adopted, would have a material

effect on the accompanying financial statements.

NOTE

2 – COMMITMENTS AND CONTINGENCIES

From

time to time, the Company may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of

business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise

that may harm its business. The Company is currently not aware of any such legal proceedings or claims that it believes will have,

individually or in the aggregate, a material adverse effect on its business, financial condition or operating results.

NOTE

3 – CONCENTRATION OF RISK

The

Company’s manufactured housing community is located in South Carolina. These concentrations of assets are subject to the

risks of real property ownership and local and national economic growth trends.

NOTE

4 – SUBSEQUENT EVENTS

On

January 7, 2020, the Company entered into a purchase and sale agreement (the “Purchase Agreement”) with MHP Pursuits

LLC, pursuant to which MHP Pursuits LLC agreed to purchase all of the assets of the Company for $3.7 million comprised of $1.1

million in home buildings and $2.6 million in land and land improvements.

In

December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China. The virus has since spread to

over 150 countries and every state in the United States. On March 11, 2020, the World Health Organization declared the outbreak

a pandemic, and on March 13, 2020, the United States declared a national emergency. Most states and cities, including where

the Company’s property is located, have reacted by instituting quarantines, restrictions on travel, “stay at home”

rules and restrictions on the types of businesses that may continue to operate, as well as guidance in response to the pandemic

and the need to contain it. The rules and restrictions put in place have had a negative impact on the economy and business activity

and may adversely impact the ability of the Company’s tenants, many of whom may be restricted in their ability to work,

to pay their rent as and when due. The impact of the pandemic on the Company’s business cannot be reasonably estimated at

this time but may materially affect its business.

In

preparing these financial statements, the Company has evaluated events and transactions for potential recognition or disclosure

through June 2, 2020, the date the financial statements were issued.

Exhibit

99.2

UNAUDITED

PRO FORMA COMBINED FINANCIAL STATEMENTS

The

following unaudited pro forma combined financial statements have been prepared in accordance with US GAAP and S-X Article

11 to provide pro forma information with regards to certain real estate acquisitions and financing transactions, as applicable.

On

January 7, 2020, MHP Pursuits LLC, a wholly-owned subsidiary of Manufactured Housing Properties Inc., a Nevada corporation (the

“Company”), entered into a purchase and sale agreement (the “Purchase Agreement”) with J & A Real

Estate, LLC (“J&A”) for the purchase of a manufactured housing community known as Countryside Estates Mobile

Home Park, which is located in Lancaster, South Carolina and totals 110 sites, for a total purchase price of $3.7 million, of

which approximately $2.6 million will be attributed to the value of land and land improvements, and $1.1 million will be attributed

to the mobile homes. Closing of the Purchase Agreement was completed on March 12, 2020 and the Company’s newly formed wholly

owned subsidiary, Countryside MHP LLC, purchased the assets. The transaction will be accounted for as an asset acquisition.

The

accompanying unaudited pro forma combined statements of operations of the Company are presented for the year ended December

31, 2019 and include pro forma adjustments to illustrate the estimated effect of the Company’s acquisition described above.

This

unaudited pro forma combined financial information is presented for informational purposes only and does not purport to be

indicative of the Company’s financial results as if the transactions reflected herein had occurred on the date or been in

effect during the period indicated. This pro forma combined financial information should not be viewed as indicative of the

Company’s financial results in the future and should be read in conjunction with the Company’s financial statements.

MANUFACTURED

HOUSING PROPERTIES INC.

UNAUDITED

PRO FORMA COMBINED STATEMENTS OF OPERATIONS

FOR

THE YEAR ENDED DECEMBER 31, 2019

|

|

|

Historical

|

|

|

Acquisition

|

|

|

Adjustment

|

|

|

Pro Forma

|

|

|

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental and related income

|

|

$

|

2,968,472

|

|

|

$

|

485,445

|

|

|

|

|

|

|

$

|

3,453,917

|

|

|

Management fees, related party

|

|

|

48,319

|

|

|

|

-

|

|

|

|

|

|

|

|

48,319

|

|

|

Home sales

|

|

|

4,900

|

|

|

|

-

|

|

|

|

|

|

|

|

4,900

|

|

|

Total revenues

|

|

|

3,021,691

|

|

|

|

485,445

|

|

|

|

|

|

|

|

3,507,136

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repair and maintenance

|

|

|

234,770

|

|

|

|

40,199

|

|

|

|

|

|

|

|

274,969

|

|

|

Real estate taxes

|

|

|

142,187

|

|

|

|

29,018

|

|

|

|

|

|

|

|

171,205

|

|

|

Utilities

|

|

|

212,719

|

|

|

|

4,116

|

|

|

|

|

|

|

|

216,835

|

|

|

Insurance

|

|

|

83,975

|

|

|

|

-

|

|

|

|

|

|

|

|

83,975

|

|

|

General and administrative expense

|

|

|

476,137

|

|

|

|

77,912

|

|

|

|

|

|

|

|

554,049

|

|

|

Total community operating expenses

|

|

|

1,149,788

|

|

|

|

111,046

|

|

|

|

|

|

|

|

1,260,834

|

|

|

Corporate payroll and overhead

|

|

|

1,253,383

|

|

|

|

-

|

|

|

|

|

|

|

|

1,253,383

|

|

|

Depreciation and amortization expense

|

|

|

786,179

|

|

|

|

-

|

|

|

|

174,621

|

(a)

|

|

|

960,800

|

|

|

Interest expense

|

|

|

1,312,469

|

|

|

|

-

|

|

|

|

165,000

|

(b)

|

|

|

1,477,469

|

|

|

Refinancing costs

|

|

|

552,272

|

|

|

|

-

|

|

|

|

|

|

|

|

552,272

|

|

|

Total expenses

|

|

|

5,054,091

|

|

|

|

151,245

|

|

|

|

|

|

|

|

5,544,957

|

|

|

Net income (loss) before provision for income taxes

|

|

|

(2,032,400

|

)

|

|

|

334,200

|

|

|

|

|

|

|

|

(2,037,821

|

)

|

|

Provision for income taxes

|

|

|

6,347

|

|

|

|

-

|

|

|

|

|

|

|

|

6,347

|

|

|

Net income (loss) attributable to the Company

|

|

|

(2,038,747

|

)

|

|

|

334,200

|

|

|

|

|

|

|

|

(2,044,168

|

)

|

|

Total preferred stock dividends

|

|

|

360,937

|

|

|

|

-

|

|

|

|

|

|

|

|

360,937

|

|

|

Net income (loss) attributable to common shareholders

|

|

$

|

(2,399,684

|

)

|

|

$

|

334,200

|

|

|

|

|

|

|

$

|

(2,405,105

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average loss per share - basic and fully diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

(0.19

|

)

|

|

Weighted averages shares - basic and fully diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,624,171

|

|

|

(a)

|

Adjustment

to recognize depreciation expense on the investment property and amortization expense

on the acquisition costs.

|

|

(b)

|

Adjustment

to recognize the interest expense on the outstanding debt issued for the purchase of

investment property.

|

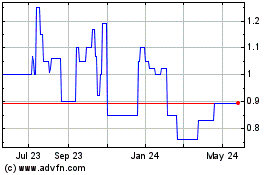

Manufactured Housing Pro... (CE) (USOTC:MHPC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Manufactured Housing Pro... (CE) (USOTC:MHPC)

Historical Stock Chart

From Jul 2023 to Jul 2024