UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended December 31, 2014

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-52375

|

Kingfish Holding Corporation

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware

|

|

20-4838580

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

2641 49th Street, Sarasota, Florida

|

|

34234

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(941) 870-2986

|

|

(Registrant’s Telephone Number, Including Area Code)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer

|

¨

|

Non-Accelerated Filer

|

¨

|

|

Accelerated Filer

|

¨

|

Smaller Reporting Company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes x No ¨

As of February 12, 2015, the number of issued and outstanding shares of common stock of the registrant was 119,180,335.

KINGFISH HOLDING CORPORATION

TABLE OF CONTENTS

|

Item Number in Form 10-Q

|

|

|

Page |

|

|

|

|

|

|

|

PART I – Financial Information

|

|

|

|

| |

|

|

|

|

Item 1.

|

Financial Statements

|

|

|

3 |

|

|

|

|

|

|

|

|

Balance Sheets – December 31, 2014 (Unaudited) and September 30, 2014

|

|

|

3 |

|

|

|

|

|

|

|

|

Statements of Operations (Unaudited) for the Three Months Ended December 31, 2014 and 2013

|

|

|

4 |

|

|

|

|

|

|

|

|

Statements of Cash Flows (Unaudited) for the Three Months Ended December 31, 2014 and 2013

|

|

|

5 |

|

|

|

|

|

|

|

|

Notes to Financial Statements (Unaudited)

|

|

|

6 |

|

|

|

|

|

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

13 |

|

|

|

|

|

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

18 |

|

|

|

|

|

|

|

|

Item 4.

|

Control and Procedures

|

|

|

18 |

|

|

|

|

|

|

|

PART II – Other Information

|

|

|

|

|

|

|

|

|

|

|

Item 1.

|

Legal Proceedings

|

|

|

19 |

|

|

|

|

|

|

|

|

Item 1A.

|

Risk Factors

|

|

|

19 |

|

|

|

|

|

|

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

|

|

19 |

|

|

|

|

|

|

|

|

Item 3

|

Defaults on Securities

|

|

|

19 |

|

|

|

|

|

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

|

19 |

|

|

|

|

|

|

|

|

Item 5.

|

Other Information

|

|

|

19 |

|

|

|

|

|

|

|

|

Item 6.

|

Exhibits

|

|

|

20 |

|

|

|

|

|

|

|

|

Signatures

|

|

|

|

21 |

|

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

|

KINGFISH HOLDING CORPORATION

|

|

BALANCE SHEETS

|

|

DECEMBER 31 AND SEPTEMBER 30, 2014

|

| |

|

12/31/2014 |

|

|

9/30/2014 |

|

| |

|

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

ASSETS

|

| |

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash

|

|

$

|

22,571

|

|

|

$

|

13,377

|

|

|

Prepaid expense

|

|

|

-

|

|

|

|

10,000

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

22,571

|

|

|

$

|

23,377

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

1,634,348

|

|

|

$

|

1,596,886

|

|

|

Accrued expenses

|

|

|

390,034

|

|

|

|

390,034

|

|

|

Total Current Liabilities

|

|

|

2,024,382

|

|

|

|

1,986,920

|

|

|

|

|

|

|

|

|

|

|

|

Long Term Liabilities:

|

|

|

|

|

|

|

|

|

|

Notes payable

|

|

|

247,459

|

|

|

|

271,894

|

|

|

Convertible notes payable to related party

|

|

|

150,000

|

|

|

|

90,000

|

|

|

Rescission liability

|

|

|

20,000

|

|

|

|

20,000

|

|

|

Total Long Term Liabilities

|

|

|

417,459

|

|

|

|

381,894

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

2,441,841

|

|

|

|

2,368,814

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Deficit:

|

|

|

|

|

|

|

|

|

|

Preferred stock, par $0.0001, 20,000,000 shares authorized, 0 shares issued and

|

|

|

|

|

|

|

|

|

|

outstanding at December 31 and September 30, 2014, respectively

|

|

|

- |

|

|

|

- |

|

|

Common stock, par $0.0001, 200,000,000 shares authorized, 116,712,987 shares issued and

|

|

|

|

|

|

|

|

|

|

outstanding at December 31, 2014 and September 30, 2014, respectively

|

|

|

11,672

|

|

|

|

11,672

|

|

|

Paid in capital

|

|

|

4,129,945

|

|

|

|

4,129,945

|

|

|

Retained deficit

|

|

|

(6,540,887

|

)

|

|

|

(6,467,054

|

)

|

|

Rescission liability

|

|

|

(20,000

|

)

|

|

|

(20,000

|

)

|

|

|

|

(2,419,270

|

)

|

|

|

(2,345,437

|

)

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Deficit

|

|

$

|

22,571

|

|

|

$

|

23,377

|

|

The accompanying notes are an integral part of these statements.

|

KINGFISH HOLDING CORPORATION

|

|

STATEMENTS OF OPERATIONS - UNAUDITED

|

|

FOR THE THREE MONTHS ENDED DECEMBER 31, 2014 AND 2013

|

| |

|

12/31/2014 |

|

|

|

12/31/2013 |

|

|

Expenses:

|

|

|

|

|

|

|

|

|

Professional fees

|

|

$

|

97,228

|

|

|

|

$

|

2,692

|

|

|

Insurance

|

|

|

-

|

|

|

|

|

5,000

|

|

|

Postage

|

|

|

42

|

|

|

|

|

-

|

|

|

Taxes and licenses

|

|

|

998

|

|

|

|

|

70

|

|

|

General and Administrative Expenses

|

|

|

98,268

|

|

|

|

|

7,762

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income:

|

|

|

|

|

|

|

|

|

|

|

Gain on extinguishment of debt

|

|

|

24,435

|

|

|

|

|

-

|

|

|

Total Other Income

|

|

|

24,435

|

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Before Income Taxes

|

|

|

(73,833

|

)

|

|

|

|

(7,762

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

(73,833

|

)

|

|

|

$

|

(7,762

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net income (loss) per share

|

|

$

|

0.00

|

|

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average common shares outstanding

|

|

|

116,712,987

|

|

|

|

|

116,712,987

|

|

The accompanying notes are an integral part of these statements.

| KINGFISH HOLDING CORPORATION |

| STATEMENTS OF CASH FLOWS - UNAUDITED |

| FOR THE THREE MONTHS DECEMBER 31, 2014 AND 2013 |

| |

|

12/31/2014 |

|

|

12/31/2013 |

|

| Cash Flows From Operating Activities: |

|

|

|

|

|

|

| Net loss |

|

$ |

(73,833 |

) |

|

$ |

(7,762 |

) |

| Adjustments to reconcile net loss to net cash used by operations: |

|

|

|

|

|

|

|

|

| Gain on extinguishment of debt |

|

|

(24,435 |

) |

|

|

- |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Escrow held by attorney |

|

|

- |

|

|

|

698 |

|

| Prepaid expenses |

|

|

10,000 |

|

|

|

(8,672 |

) |

| Accounts payable and accrued expenses |

|

|

37,462 |

|

|

|

1,994 |

|

| Net Cash flows used by operating activities |

|

|

(50,806 |

) |

|

|

(13,742 |

) |

|

|

|

|

|

|

|

|

|

| Cash Flows From Financing Activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from note payable to related party |

|

|

60,000 |

|

|

|

16,383 |

|

| Net Cash flows from financing activities |

|

|

60,000 |

|

|

|

16,383 |

|

|

|

|

|

|

|

|

|

|

| Net Increase in Cash |

|

|

9,194 |

|

|

|

2,641 |

|

|

|

|

|

|

|

|

|

|

| Cash at the beginning of year |

|

|

13,377 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

| Cash at the end of the year |

|

$ |

22,571 |

|

|

$ |

2,641 |

|

The accompanying notes are an integral part of these statements.

KINGFISH HOLDING CORPORATION

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2014

(unaudited)

Our Business:

Kingfish Holding Corporation (the “Company”) was incorporated in the State of Delaware on April 11, 2006 as Offline Consulting, Inc. It became Kesselring Holding Corporation on June 8, 2007 and on November 25, 2014 it changed its name to Kingfish Holding Corporation. The Company was engaged in (i) restoration services, principally to commercial property owners, (ii) the manufacture and sale of cabinetry and remodeling products, principally to contractors and (iii) multifamily and commercial remodeling and building services on customer owned properties.

The Company discontinued operations in 2009, sold our last subsidiary in May 2010 and effected a change in management and control at the same time. As part of this transition, old management took possession of the majority of the accounting and corporate records. The Company’s last annual report Form 10-KSB for the year ended September 30, 2008 was filed with the Securities and Exchange Commission (SEC) on December 29, 2008 and the Company’s last quarterly report Form 10-Q for the period ended June 30, 2009 was filed with the SEC on August 19, 2009.

On December 17, 2014, the Company reactivated its suspended reporting obligations under Section 15(d) of the Exchange Act by filing a Form 10-K for the fiscal year ended September 30, 2013 and Forms 10-Q for the quarters ended December 31, 2013, March 31, 2014 and June 30, 2014. The Company's activities are subject to significant risks and uncertainties, including failing to secure additional funding to reorganize and finding a suitable candidate to participate in its renewable energy initiatives.

|

2.

|

Summary of Significant Accounting Policies:

|

Basis of presentation:

The accompanying financial statements are unaudited and have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and reflect all adjustments, consisting solely of normal recurring adjustments, needed to fairly present the financial results for these periods. The financial statements and notes are presented as permitted by Form 10-Q. Accordingly, certain information and note disclosures normally included in financial statements prepared in accordance U.S. GAAP have been omitted.

The accompanying financial statements should be read in conjunction with the financial statements for the fiscal years ended September 30, 2014 and 2013 and notes thereto in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2014. Operating results for the three months ended December 31, 2014 and 2013 are not necessarily indicative of the results that may be expected for the entire year. In the opinion of management, all adjustments, consisting only of normal recurring adjustments necessary for a fair statement of (a) the results of operations for the three month periods ended December 31, 2014 and 2013, (b) the financial position at December 31, 2014, and (c) cash flows for the three month periods ended December 31, 2014 and 2013, have been made.

The preparation of financial statements in accordance with Accounting Principles Generally Accepted in the United States of America contemplates that the Company will continue as a going concern, for a reasonable period. As reflected in the Company’s financial statements, the Company has a retained deficit of $6,540,887 on December31, 2014. The Company used cash of ($50,806) and ($13,742) in operating activities during the three months ended December 31, 2014 and 2013, respectively. The Company has a working capital deficiency of ($2,001,811) at December 31, 2014 that is insufficient in management‘s view to sustain current levels of operations for a reasonable period without additional financing. These trends and conditions continue to raise substantial doubt surrounding the Company’s ability to continue as a going concern for a reasonable period. Ultimately, the Company’s ability to continue as a going concern is dependent upon management’s ability to continue to curtail current operating expense and obtain additional financing to augment working capital requirements and support acquisition plans. There can be no assurance that management will be successful in achieving these objectives or obtain financing under terms and conditions that are suitable. The accompanying financial statements do not include any adjustments associated with these uncertainties.

KINGFISH HOLDING CORPORATION

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2014

(unaudited)

|

2.

|

Summary of Significant Accounting Policies (continued):

|

Use of estimates:

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets, if any at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

Cash:

Cash is maintained at a financial institution and, at times, balance may exceed federally insured limits. We have never experienced any losses related to the balance. Currently, the FDIC provides insurance coverage up to $250,000 per depositor at each financial institution and our cash balance did not exceed such coverage on December 31, 2014.

For purpose our statements of cash flows, the Company considers all highly liquid investments with a maturity of three months or less when purchased to be cash.

Prepaid expense:

Prepaid expense consisted of payments to professional for services to be rendered at a later date.

Income Taxes:

Deferred taxes are provided on the asset and liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Future tax benefits for net operating loss carry forwards are recognized to the extent that realization of these benefits is considered more likely than not. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

KINGFISH HOLDING CORPORATION

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2014

(unaudited)

|

2.

|

Summary of Significant Accounting Policies (continued):

|

The Company follows the provisions of FASB ASC 740-10 “Uncertainty in Income Taxes” (ASC 740-10). A reconciliation of the beginning and ending amount of unrecognized tax benefits has not been provided since there are no unrecognized benefits for all periods presented. The Company has not recognized interest expense or penalties as a result of the implementation of ASC 740-10. If there were an unrecognized tax benefit, the Company would recognize interest accrued related to unrecognized tax benefit in interest expense and penalties in operating expenses.

Net income (loss) per share:

Basic income (loss) per share is computed by dividing net income (loss) available to common stockholders by the weighted average number of outstanding common shares during the period of computation. Diluted loss per share gives effect to potentially dilutive common shares outstanding. The Company gives effect to these dilutive securities using the Treasury Stock Method. Potentially dilutive securities include convertible financial instruments. The Company gives effect to these dilutive securities using the If-Converted-Method. At December 31, 2014, convertible notes payable to related party of $150,000 can potentially convert into 27,231,979 shares of common stock. These shares have been excluded from the diluted net loss per share calculations because the effect of including them would be anti-dilutive. For the three months ended December 31, 2013, 66,666,667 shares of common stock have been included in our basic and diluted net income per share calculations as of the commitment date. These shares were issued after December 31, 2013, but the Company was committed to issue the shares at September 30, 2013.

|

3.

|

Accounts Payable and Accrued Expenses:

|

Accounts payable and accrued expenses are comprised of the followings:

| |

|

December 31,

2014 |

|

|

September 30,

2014 |

|

| |

|

|

|

|

|

|

| Accounts Payable |

|

$ |

1,634,348 |

|

|

$ |

1,596,886 |

|

| Accrued expenses |

|

|

390,034 |

|

|

|

390,034 |

|

|

|

$ |

2,024,382 |

|

|

$ |

1,986,920 |

|

As a result of the lack of documentation of payments or settlement agreements for reason described in Note 1, the Company was not able to definitively determine that approximately $1,991,000 and $1,977,000 these liabilities at December 31, 2014 and September 30, 2014, respectively, were settled with our vendors. Therefore, these liabilities will remain on the Company’s books until the statute of limitation expires which the Company estimates to be approximately 2015.

KINGFISH HOLDING CORPORATION

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2014

(unaudited)

Notes payable consisted of the following at December 31 and September 30, 2014:

| |

|

12/31/2014 |

|

|

09/30/2014 |

|

|

4.9% Note payable due August 2010 (a)

|

|

$

|

-

|

|

|

$

|

13,246

|

|

|

Auto Loan (a)

|

|

|

-

|

|

|

|

11,189

|

|

|

Prime Plus 4.5%, 1,000,000 bank credit facility (b)

|

|

|

180,141

|

|

|

|

180,141

|

|

|

Loan on equipment

|

|

|

67,318

|

|

|

|

67,318

|

|

|

|

$

|

247,459

|

|

|

$

|

271,894

|

|

| |

(a)

|

Documentation was obtained substantiating that these notes were satisfied in full. Therefore, the company recorded a gain on extinguishment of debt of $24,435 during the quarter ended December 31, 2014.

|

| |

|

|

| |

(b)

|

On May 14, 2008, the Company entered into an agreement with a financial institution to provide up to $1,000,000 in secured credit, subject to certain limitations. This facility replaced a previous facility with another bank that had a limit of $300,000. Under this new facility, the Company is permitted to draw on an advance of up to 80% of certain eligible accounts receivable arising from our manufactured products segment. The interest rate is prime plus 4.5%. The line is secured by the accounts receivable, inventory, and the unencumbered fixed assets of that segment. As part of the transaction, the lender was granted 150,000 shares of common stock having a fair market value of $15,000.

|

The above notes were entered into with various financial institutions when the Company was an operating company. However, due to the lack of documentation of payments or settlement agreements for reason described in Note 1, the Company was not able to definitively determine that these notes were settled even though it appeared that the financial institutions repossessed the underlying collaterals. Therefore, these notes will remain on our books until the statute of limitation expires which we estimate to be between 2015 and 2017.

|

5.

|

Convertible Notes Payable to Related Party:

|

On February 20, 2013, the Company entered into a convertible note with a director for $5,000. The note bears interest rate at 3% per annum and all unpaid principle and interest were due on demand by the director but no earlier than June 15, 2013. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at the conversion price which is the average of the mean of the bid and ask prices for the ninety consecutive full trading days in which the shares were traded ending at the close of trading on the fifth business day preceding the conversion date. As a result of the variable feature associated with the conversion option, pursuant to ASC Topic 815, the Company bifurcated the conversion option, to determine the fair value of the conversion option. At the issuance date and thereafter, the Company concluded that the derivative liability and the debt discount were not material to the financial statements.

On February 20, 2013, the Company entered into a convertible note with a director for $30,000. The note bears interest rate at 3% per annum and all unpaid principle and interest were due on demand by the director but no earlier than June 15, 2013. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at the conversion price which is the average of the mean of the bid and ask prices for the ninety consecutive full trading days in which the shares were traded ending at the close of trading on the fifth business day preceding the conversion date. As a result of the variable feature associated with the conversion option, pursuant to ASC Topic 815, the Company bifurcated the conversion option, to determine the fair value of the conversion option. At the issuance date and thereafter, the Company concluded that the derivative liability and the debt discount were not material to the financial statements.

KINGFISH HOLDING CORPORATION

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2014

(unaudited)

|

5.

|

Convertible Notes Payable to Related Party (continued):

|

On July 2, 2013, the director elected to convert the above two notes into the Company’s common stock. The conversion price was determined to be $0.0029, resulting in the issuance of 11,999,999 shares of common stock to the director.

On August 22, 2013, the Company entered into a convertible note with a director for $50,000. The note bears interest rate at 4% per annum and all unpaid principle and interest were due on demand by the director but no earlier than August 30, 2013. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at the conversion price which is the average of the closing prices for the ninety consecutive full trading days in which the shares were traded ending at the close of trading on the fifth business day preceding the conversion date. As a result of the variable feature associated with the conversion option, pursuant to ASC Topic 815, the Company bifurcated the conversion option, to determine the fair value of the conversion option. At the issuance date and thereafter , the Company concluded that the derivative liability and the debt discount were not material to the financial statements.

On August 31, 2013, the director elected to convert the above note into the Company’s common stock. The conversion price was determined to be $0.00075, resulting in the conversion into 66,666,667 shares of common stock to the director. These shares were issued to the director subsequent to September 30, 2013, therefore, the Company recorded a common stock payable for $50,000 at September 30, 2013.

On October 21, 2013, the Company entered into a convertible note with a director for $10,000. The note bears interest rate at 3.5% per annum and all unpaid principle and interest were due on demand by the director but no earlier than June 1, 2015 or 30 calendar days after the recommencement of the public company status as defined in the note agreement. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at the conversion price which is the average of the mean of the bid and ask prices for the ninety consecutive full trading days in which the shares were traded ending at the close of trading on the fifth business day preceding the conversion date. As a result of the variable feature associated with the conversion option, pursuant to ASC Topic 815, the Company bifurcated the conversion option, to determine the fair value of the conversion option. At the issuance date and thereafter, the Company concluded that the derivative liability and the debt discount were not material to the financial statements.

On November 13, 2013, the Company entered into a convertible note with a director for $10,000. The note bears interest rate at 3.5% per annum and all unpaid principle and interest were due on demand by the director but no earlier than June 1, 2015 or 30 calendar days after the recommencement of the public company status as defined in the note agreement. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at the conversion price which is the average of the mean of the bid and ask prices for the ninety consecutive full trading days in which the shares were traded ending at the close of trading on the fifth business day preceding the conversion date. As a result of the variable feature associated with the conversion option, pursuant to ASC Topic 815, the Company bifurcated the conversion option, to determine the fair value of the conversion option. At the issuance date and thereafter, the Company concluded that the derivative liability and the debt discount were not material to the financial statements.

KINGFISH HOLDING CORPORATION

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2014

(unaudited)

|

5.

|

Convertible Notes Payable to Related Party (continued):

|

On January 13, 2014, the Company entered into a convertible note with a director for $10,000. The note bears interest rate at 3.5% per annum and all unpaid principle and interest were due on demand by the director but no earlier than June 1, 2015 or 30 calendar days after the recommencement of the public company status as defined in the note agreement. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at the conversion price which is the average of the mean of the bid and ask prices for the ninety consecutive full trading days in which the shares were traded ending at the close of trading on the fifth business day preceding the conversion date. As a result of the variable feature associated with the conversion option, pursuant to ASC Topic 815, the Company bifurcated the conversion option, to determine the fair value of the conversion option. At the issuance date and thereafter, the Company concluded that the derivative liability and the debt discount were not material to the financial statements.

On April 24, 2014, the Company entered into a convertible note with a director for $20,000. The note bears interest rate at 3.5% per annum and all unpaid principle and interest were due on demand by the director but no earlier than June 1, 2015 or 30 calendar days after the recommencement of the public company status as defined in the note agreement. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at the conversion price which is the average of the mean of the bid and ask prices for the ninety consecutive full trading days in which the shares were traded ending at the close of trading on the fifth business day preceding the conversion date. As a result of the variable feature associated with the conversion option, pursuant to ASC Topic 815, the Company bifurcated the conversion option, to determine the fair value of the conversion option. At the issuance date and thereafter, the Company concluded that the derivative liability and the debt discount were not material to the financial statements.

On May 22, 2014, the Company entered into a convertible note with a director for $20,000. The note bears interest rate at 3.5% per annum and all unpaid principle and interest were due on demand by the director but no earlier than June 1, 2015 or 30 calendar days after the recommencement of the public company status as defined in the note agreement. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at the conversion price which is the average of the mean of the bid and ask prices for the ninety consecutive full trading days in which the shares were traded ending at the close of trading on the fifth business day preceding the conversion date. As a result of the variable feature associated with the conversion option, pursuant to ASC Topic 815, the Company bifurcated the conversion option, to determine the fair value of the conversion option. At the issuance date and thereafter, the Company concluded that the derivative liability and the debt discount were not material to the financial statements.

On September 17, 2014, the Company entered into a convertible note with a director for $20,000. The note bears interest rate at 3.5% per annum and all unpaid principle and interest were due on demand by the director but no earlier than June 1, 2015 or 30 calendar days after the recommencement of public company status as defined in the note agreement. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at the conversion price which is the average of the mean of the bid and ask prices for the ninety consecutive full trading days in which the shares were traded ending at the close of trading on the fifth business day preceding the conversion date. As a result of the variable feature associated with the conversion option, pursuant to ASC Topic 815, the Company bifurcated the conversion option, to determine the fair value of the conversion option. At the issuance date and thereafter, the Company concluded that the derivative liability and the debt discount were not material to the financial statements.

KINGFISH HOLDING CORPORATION

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2014

(unaudited)

|

5.

|

Convertible Notes Payable to Related Party (continued):

|

On February 10, 2015, the Company entered into a convertible note with a director for $60,000 advanced during the quarter ended December 31, 2014. The note bears interest rate at 3.5% per annum and all unpaid principle and interest were due on demand by the director but no earlier than June 1, 2015 or 30 calendar days after the recommencement of public company status as defined in the note agreement. The outstanding principle balance of the note is convertible into the Company’s shares of common stock at a fixed conversion price of $.01 per share.

The Company is authorized to issue up to 20,000,000 shares of Preferred Stock with designations, rights and preferences determined from time to time by our Board of Directors. Accordingly, our Board of Directors is empowered, without shareholder approval, to issue Preferred Stock with dividend, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of our Common Stock. The terms of the preferred stock have not been approved. As of December 31, 2014 and September 30, 2014, there was no Preferred Stock issued and outstanding, respectively.

On November 20, 2009, the Company issued 2,000,000 shares of its common stock to pay for services valued at $20,000. The issuance of these shares was declared invalid by the court since they were issued by prior management who did not have the authority to do so since they were validly removed on November 16, 2009. These shares remained outstanding at December 31, 2014 and will be returned to the Company’s transfer agent upon locating the holder of these shares.

|

8.

|

Recent Accounting Pronouncement

|

In August 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-15, “Presentation of Financial Statements-Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern” (“ASU 2014-15”). ASU 2014-15 is intended to define management’s responsibility to evaluate whether there is substantial doubt about an organization’s ability to continue as a going concern and to provide related footnote disclosures. The amendments in this ASU are effective for reporting periods beginning after December 15, 2016, with early adoption permitted. Management is currently assessing the impact the adoption of ASU 2014-15 will have on our financial statements.

On January 12, 2015, the Company’s Board of Directors approved the amendment to the conversion rate of all existing convertible notes with related party dated between October 21, 2013 and September 17, 2014 to a fixed rate of $0.01 per share.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the consolidated financial statements and notes thereto appearing elsewhere in this quarterly report. Historical results and trends which might appear should not be taken as indicative of future operations. Our results of operations and financial condition, as reflected in the accompanying statements and related notes, are subject to management’s evaluation and interpretations of business conditions, changing market conditions and other factors.

A NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (including the exhibits hereto) contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, such as statements relating to our financial condition, results of operations, plans, objectives, future performance or expectations, and business operations. These statements relate to expectations concerning matters that are not historical fact. Accordingly, statements that are based on management’s projections, estimates, assumptions, and judgments constitute forward-looking statements. These forward-looking statements are typically identified by words or phrases such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “approximately,” “intend,” “objective,” “goal,” “project,” and other similar words and expressions, or future or conditional verbs such as “will,” “should,” “would,” “could,” and “may.” These forward-looking statements are based largely on information currently available to our management and on our current expectations, assumptions, plans, estimates, judgments and projections about our business and our industry, and such statements involve inherent risks and uncertainties. Although we believe our expectations are based on reasonable estimates and assumptions, they are not guarantees of performance and there are a number of known and unknown risks, uncertainties, contingencies, and other factors (many of which are outside our control) which may cause actual results, performance, or achievements to differ materially from those expressed or implied by such forward-looking statements. Accordingly, there is no assurance that our expectations will in fact occur or that our estimates or assumptions will be correct, and we caution investors and all others not to place undue reliance on such forward-looking statements.

These potential risks and uncertainties include, but are not limited to, our ability to identify, secure and obtain suitable and sufficient financing to continue as a going concern; our ability to identify, enter into and close an appropriate a merger, acquisition, or other combination transaction with a business prospect; economic, political and market conditions; the general scrutiny and limitations placed on “blank check” and “shell” companies under applicable governmental regulatory oversight; interest rate risk; government and industry regulation that might affect future operations; potential change of control transactions resulting from merger, acquisition, or combination with a business prospect; the potential dilution in our equity (both economically and in voting power) that might result from future financing or from merger, acquisition, or combination activities; and other factors.

All written or oral forward-looking statements that are made or attributable to us are expressly qualified in their entirety by this cautionary notice. The forward-looking statements included herein are only made as of the date of this Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2014 (this “Form 10-Q”). We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Overview

Operations. Historically, we were engaged in the business of homebuilding and restoration operations in central Florida and in the manufacture of building products from operations located in the State of Washington. During the fiscal year ended September 30, 2010, the Company defaulted on its loan agreements with AMI Holdings, Inc. ("AMI") and on May 24, 2010 AMI foreclosed on and took possession of all of the Company’s then-existing operating entities. Following the foreclosure, the Company has not engaged in any business activities and has conducted only minimal operations.

During the fiscal year ended September 30, 2012, our management concluded that it may be feasible to acquire a target company or business seeking the perceived advantages of being a publicly held corporation and, as a result, our management determined that it should explore opportunities to acquire other assets or business operations that will maximize shareholder value. However, it was determined that prior to undertaking a search for any such acquisition opportunities, the Company should take the steps necessary to (a) reconstitute a full board of directors, (b) update and complete its corporate records and corporate governance documents, including the payment of any franchise fees and taxes owed to the State of Delaware, (c) satisfy all its obligations owed to its transfer agent, (e) obtain an audit of its financial statements by independent registered public accountants, and (f) reactivate its suspended reporting obligations under Section 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”)(collectively, “Preparatory Actions”).

Following that determination, as an initial step, the Company made arrangements to take the Preparatory Actions and, as a result, the operations of the Company through December 17, 2014 were focused on preparing the Company for reactivation of its suspended reporting obligations under Section 15(d) of the Exchange Act. On December 17, 2014, the Company re-activated is filing obligations under the Exchange Act by filing a Form 10-K for the fiscal year ended September 30, 2013 and Quarterly Reports on Form 10-Qs for the quarters ended December 31, 2013, March 31, 2014, and June 30, 2014.

Our plan is to seek a business venture in which to participate. The selection of a business opportunity in which to participate is complex and extremely risky and will be made by management in the exercise of its business judgment. No assurance can be given that we will be able to identify a suitable target or, if identified, that we will be able to successfully negotiate and agree upon terms acceptable to the Company or to successfully complete and close the proposed acquisition or business combination. No specific assets or businesses have yet been identified and there is no certainty that any such assets or business will be identified or any transactions will be consummated.

We expect to pursue our search for a business opportunity primarily through our officers and directors, although other sources, such as professional advisors, securities broker-dealers, venture capitalists, members of the financial community, and others, may present unsolicited proposals. Our activities are subject to several significant risks that arise primarily as a result of the fact that we have no specific target company or business and may acquire or participate in a business opportunity based on the decision of management which will, in all probability, act without the consent, vote, or approval of our shareholders. For a more detailed discussion of the manner in which we will pursue the search for and participation in a business venture, please see “Item 1: Business” of our Form 10-K filed for the fiscal year ended September 30, 2014.

Financial Condition. We have not recorded revenues from operations during the fiscal quarter covered by our financial statements included in this Form 10-Q and are not currently engaged in any business activities that provide cash flows. We do not expect to generate any revenues during the current fiscal year. Our principal business objective for the current fiscal year and beyond such time will be to achieve long-term growth potential through a combination with a business. We will not restrict our potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business. During the remainder of this fiscal year and the next fiscal year we anticipate incurring costs related to: (i) investigating and analyzing potential business combination transactions; (ii) the preparation and filing of Exchange Act reports, and (iii) consummating an acquisition, if any. We believe we will be able to meet these costs through use of funds in our treasury and additional amounts, as necessary, to be loaned by or invested in us by our shareholders, management or other investors.

We have no specific plans, understandings or agreements with respect to the raising of such funds, and we may seek to raise the required capital by the issuance of equity or debt securities or by other means. Since we have no such arrangements or plans currently in effect, our inability to raise funds for the consummation of an acquisition may have a severe negative impact on our ability to become a viable company.

We have negative working capital, negative shareholders’ equity and have not earned any revenues from operations. James K. Toomey, the Company’s principal stockholder and a director (“Mr. Toomey”), has loaned the Company monies in the past to cover our operations and Preparatory Actions. However, we have no formal commitment that he will continue to provide the Company with working capital sufficient until we consummate a merger or other business combination with a target company or business operation. We are currently devoting our efforts to locating such targets. Our ability to continue as a going concern is dependent upon our ability to develop additional sources of capital, locate and complete a merger with another company, and ultimately, achieve profitable operations. Our historical operating results disclosed in this Form 10-Q are not meaningful to our future results.

Going Concern Issues

In its report dated December 29, 2014, our auditors, Warren Averett, LLC expressed an opinion that there is substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. We have generated no operating revenues for the fiscal year ended September 30, 2014 or during the three-month period ending December 31, 2014 and we had an accumulated deficit of $2,419,270 as of December 31, 2014. Furthermore, at December 31, 2014, we had a retained deficit of $6,540,887 and a working capital deficit of $2,001,811. As a result of our working capital deficit and anticipated operating costs for the next 12 months, we do not have sufficient funds available to sustain our operations for a reasonable period without additional financing. Our continuation as a going concern is dependent upon future events, including our ability to raise additional capital and to generate positive cash flows.

Results of Operations

Comparison of Three Months Ended December 31, 2014 and 2013

Revenues. Because we currently do not have any business operations, we have not had any revenues during our fiscal quarters ended December 31, 2014 and December 31, 2013.

General and Administrative Expenses. We had operating expenses of $98,268 and $7,762 for the quarters ended December 31, 2014 and December 31, 2013, respectively. These expenses consisted of general and administrative expenses which were primarily comprised of professional fees associated with various corporate and accounting matters. The increase in such expenses for the year ended December 31, 2014 as compared to the same period last year was due to the increased level of activities undertaken to complete the Preparatory Actions and make all of the required filings with the SEC during the quarterly period ended December 31, 2014 to reactivate the Company’s suspended reporting obligations under Section 15(d) of the Exchange Act. Now that we have completed our Preparatory Actions, we anticipate that our general and administrative expenses will be reduced and remain relatively low until such time as we effect a merger or other business combination with an operating business, if at all.

Other Income. During the quarter ended December 31, 2014, we were able to obtain documentations to substantiate that certain notes payable were previously settled in full. Therefore, we recorded a gain on extinguishment of debt in the amount of $24,435 during the period.

Net Income (Loss). We incurred net losses for the quarters ended December 31, 2014 and 2013 of $73,833 and $7,762, respectively. The increase in net loss was directly attributable to an increase in general and administrative expenses incurred in connection with the completion of the Preparatory Actions. .

Liquidity and Capital Resources

At December 31, 2014, we had a working capital deficit of $2,001,811, compared to a working capital deficit of $1,963,543 at September 30, 2014. Current liabilities increased to $2,024,382 at December 31, 2014 from $1,986,920 at September 30, 2014 due to an increase in accounts payable. Total assets decreased from $23,377 at September 30, 2014 to $22,571 at December 31, 2014 primarily due to a decrease in prepaid expenses which was only partially offset by an increase in cash and cash equivalents.

We had no material commitments for capital expenditures as of December 31, 2014. However, if we are able to execute our business plan as anticipated in the future, we would likely incur substantial capital expenditures and require additional financing to fund such expenditures.

During the fiscal year ended September 30, 2014, the Company borrowed $90,000 from Mr. Toomey to pay for the Company’s ongoing business operations and to pay the costs associated with the Preparatory Actions. On October 24, 2014, the Company acknowledged and formalized these loans by entering into the October 2014 Note Agreement, by and between the Company and Mr. Toomey to evidence these loans made by Mr. Toomey to the Company. The October 2014 Note Agreement covers six different advances made by Mr. Toomey from October 2013 through September 2014, each of which is evidenced by a promissory note in favor of Mr. Toomey for the principal amount thereof (the “2014 Convertible Promissory Notes”). Each of the 2014 Convertible Promissory Notes bear fixed interest rates of 3.5% per annum, payable from the date of the actual loan. The outstanding principal and interest on each of these 2014 Convertible Promissory Notes are payable upon demand by Mr. Toomey; provided, however, that no demand for payment shall be made prior to earlier of: (a) June 1, 2015, and (b) thirty (30) calendar days after the Company reactivates its reporting obligations under Section 15(d) of the Exchange Act. The Company reactivated its reporting obligations under the Exchange Act on December 17, 2014. Each of these 2014 Convertible Promissory Notes were convertible into the common stock of the Company by Mr. Toomey at a conversion price equal to the average of the mean of the bid and asked prices of the shares for the ninety consecutive full trading days in which the shares were traded ending at the close of business of the fifth day preceding the conversion date; but only when, and if, sufficient shares of authorized common stock exists under the Company’s certificate of incorporation. However, we did not have a sufficient number of authorized shares to convert the 2014 Convertible Promissory Notes issued pursuant to the October 2014 Note Agreement under those conversion terms and as of the date hereof the underlying promissory notes have not yet been converted into shares of our common stock. Although we agreed in the October 2014 Note Agreement to promptly submit an amendment to the Company’s certificate of incorporation to our stockholders to increase the number of authorized shares, Mr. Toomey agreed to waive that requirement until June 30, 2016.

On December 19, 2014, Mr. Toomey advanced an additional $60,000 to the Company. These funds were used by the Company to pay for the Company’s ongoing business operations and to pay the costs associated with certain of the final Preparatory Actions. On February 10, 2015, the Company acknowledged and formalized this loan by entering into a Convertible Promissory Note Purchase Agreement, effective as of February 10, 2015 (the “February 2015 Note Agreement”), by and between the Company and Mr. Toomey, and issuing a convertible promissory note in favor of Mr. Toomey in aggregate principal amount of $60,000 bearing interest at a fixed rate of 3.5% per annum, payable from December 19, 2014, the date of that the actual loan was provided to the Company (the “February 2015 Promissory Note”). The February 2015 Promissory Note is convertible into shares of our common stock Company by Mr. Toomey at a fixed conversion price equal to $0.01 per share (subject to anti-dilution adjustments).

Because we do not have any revenues from operations, absent a merger or other business combination with an operating company or a public or private sale of our equity or debt securities, the occurrence of either of which cannot be assured, we will continue to be dependent upon future loans or equity investments from our present shareholders or management to fund operating shortfalls and do not foresee a change in this situation in the immediate future. We will attempt to raise capital for our current operational needs through loans from related parties, debt financing, equity financing or a combination of financing options. However, there are no existing understandings, commitments or agreements for extension of outstanding notes or an infusion of capital, and there are no assurances to that effect. Further, our need for capital may change dramatically if unknown claims or debts surface or if we acquire an interest in a business opportunity. There can be no assurances that any additional financings will be available to us on satisfactory terms and conditions, if at all. Unless we can obtain additional financing, our ability to continue as a going concern is doubtful. Although Mr. Toomey has provided the necessary funds for the Company in the past, there is no existing commitment to provide additional capital and he is unlikely to fund the Company to pay for any claims made against the Company for substantial debt claims or other obligations. In such situation, there can be no assurance that we shall be able to receive additional financing, and if we are unable to receive sufficient additional financing upon acceptable terms, it is likely that our business would cease operations or. at the very least, cease to be a reporting company under the Exchange Act.

Subsequent Events

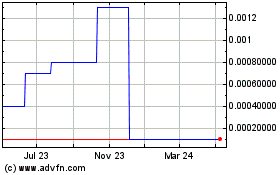

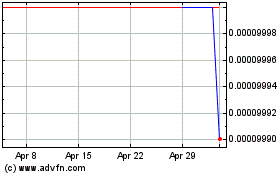

Based on the limited trading in our common stock, it was difficult for the Company to reasonably determine the number of shares that may be issuable under its 2014 Convertible Promissory Notes. However, the conversion rate had ultimately resulted in there being an insufficient number of shares available for issuance to Mr. Toomey upon conversion of the 2014 Convertible Notes. On January 12, 2015, Mr. Toomey and the Company agreed in principle that it would be in the best interests of the Company to eliminate the floating conversion rate set forth in the 2014 Convertible Promissory Notes and to instead use a fixed conversion price of $0.01 per share (subject to certain anti-dilution protections), which price is in excess of the current market price for our common stock. An increase of the conversion rate to $0.01 would benefit the Company by (a) reducing the number of shares issuable upon conversion and, if converted, reducing the effective cost of such financings, and (b) eliminate the need to amend our Certificate of Incorporation to increase the number of authorized shares of Common Stock in order to satisfy the terms of the October 2014 Note Agreement and the 2014 Convertible Notes. On February 10, 2015, the parties entered into a First Amendment to the October 2014 Note Agreement to effectuate this agreement and the Company issued amended 2014 Convertible Notes to reflect the change in the conversion price and to add anti-dilution provisions.

As a result, the Company now has a sufficient number of authorized shares of Common Stock available for issuance to Mr. Toomey upon conversion of the 2014 Convertible Notes and the February 2015 Promissory Note, and such notes currently are convertible. Mr. Toomey has not yet executed his conversion rights and there is no assurance that he will exercise such rights.

Now that the Company has reactivated its suspended reporting obligations under the Exchange Act, former shareholders, officers, employees, creditors, or others may approach the Company and allege that there are outstanding claims for which the Company is responsible. In fact, the Company has been contacted by one shareholder suggesting that the Company may owe certain contractual obligations to that shareholder. However, the Company is unclear as to the nature of any such obligation and, in any event, does not believe that any obligations are owed to that shareholder. In view of the Company’s extremely limited resources, any such claims, if formally made, and/or proceedings commenced with respect thereto by such shareholder or any other third party or parties against the Company, would have a material adverse impact on the Company and may cause the Company to cease as a going concern. In such event, it is unlikely that the Company would be able to obtain any future financings from Mr. Toomey or others in order to maintain its current operations and it also would render unlikely that the Company would be able to pursue its business plan or that it will continue to be a reporting company under the Exchange Act.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a “Smaller Reporting Company”, the Company is not required to provide the information required by this Item.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedure

Our disclosure controls and procedures are designed to provide reasonable assurance that information required to be disclosed in our reports under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

As of the end of the period covered by this report, an evaluation was carried out under the supervision and with the participation of our sole officer and employee of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities and Exchange Act of 1934, as amended). Based on that evaluation, our sole officer and employee concluded that the Company’s disclosure controls and procedures were not effective as of December 31, 2014 as a result of the material weakness in internal control over financial reporting because of inadequate segregation of duties over authorization, review and recording of transactions, as well as the financial reporting of such transactions. Although financial resources are limited, management continues to evaluate opportunities to mitigate the above material weaknesses. Despite the existence of these material weaknesses, we believe the financial information presented herein is materially correct and in accordance with generally accepted accounting principles.

Changes in Internal Control over Financial Reporting

There were no significant changes in our internal controls or in other factors that could significantly affect our disclosure controls and procedures subsequent to the date of the above referenced evaluation. Furthermore, there was no change in our internal control over financial reporting or in other factors during the quarterly period covered by this report that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II

ITEM 1. LEGAL PROCEEDINGS

There are presently no pending legal proceedings to which the Company, any of its subsidiaries, any executive officer, any owner of record or beneficially of more than five percent of any class of voting securities is a party or as to which any of its property is subject, and no such proceedings are known to the Company to be threatened or contemplated against it.

ITEM 1A. RISK FACTORS

As a “Smaller Reporting Company”, the Company is not required to provide the information required by this Item.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

During the quarter ended December 31, 2014, Mr. Toomey advanced the Company an aggregate of $60,000 on December 19, 2014 in exchange for the February 2015 Promissory Note, bearing fixed interest rates of 3.5% per annum, payable from the date of the actual loan. The February 2015 Promissory Note is convertible into the common stock of the Company by Mr. Toomey. As of the date hereof the underlying promissory note has not yet been converted into shares of our common stock. These funds from the amounts advanced by Mr. Toomey during the quarter ended December 31, 2014, were used by the Company to pay for the Company’s ongoing business operations and to pay the costs associated with certain of its the Preparatory Actions.

ITEM 3. DEFAULTS ON SECURITIES

Not Applicable.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. OTHER INFORMATION

Although there are no legal proceedings pending or, to the knowledge of the Company, currently threatened or contemplated against it, now that the Company has reactivated its suspended reporting obligations under the Exchange Act, former shareholders, officers, employees, creditors, or others may allege that there are outstanding claims for which the Company is responsible. In fact, the Company has been contacted by one shareholder suggesting that the Company may owe certain contractual obligations to that shareholder. However, the Company is unclear as to the nature of any such obligation and, in any event, does not believe that any obligations are owed to that shareholder. In the case any such claims are formally made or presented to the Company by any third parties, we will review and analyze such claim on a case by case basis and respond to it as we deem appropriate.

ITEM 6. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

Exhibit

Number

|

|

Description of Exhibits

|

|

4.1

|

|

Convertible Promissory Note No. 10 in favor of James K. Toomey in principal amount of $60,000 for December 19, 2014 loan. *

|

|

|

|

|

|

4.2

|

|

Amended Convertible Promissory Note No. 4, dated February 10, 2015, in favor of James K. Toomey in principal amount of $10,000 for October 21, 2013 loan. *

|

|

|

|

|

|

4.3

|

|

Amended Convertible Promissory Note No. 5, dated February 10, 2015, in favor of James K. Toomey in principal amount of $10,000 for November 13, 2013. *

|

|

|

|

|

|

4.4

|

|

Amended Convertible Promissory Note No. 6, dated February 10, 2015, in favor of James K. Toomey in principal amount of $10,000 for January 13, 2014 loan. *

|

|

|

|

|

|

4.5

|

|

Amended Convertible Promissory Note No. 7, dated February 10, 2015, in favor of James K. Toomey in principal amount of $20,000 for April 24, 2014 loan. *

|

|

|

|

|

|

4.6

|

|

Amended Convertible Promissory Note No. 8, dated February 10, 2015, in favor of James K. Toomey in principal amount of $20,000 for May 22, 2014 loan. *

|

|

|

|

|

|

4.7

|

|

Amended Convertible Promissory Note No. 9, dated February 10, 2015, in favor of James K. Toomey in principal amount of $20,000 for September 17, 2014 loan. *

|

|

|

|

|

|

10.1

|

|

Convertible Promissory Note Purchase Agreement, effective as February 10, 2015, by and between Kingfish Holding Corporation and James K. Toomey. *

|

|

|

|

|

|

10.2

|

|

First Amendment to Convertible Promissory Note Purchase Agreement, effective as October 24, 2014, by and between Kingfish Holding Corporation and James K. Toomey. *

|

|

|

|

|

|

31.1

|

|

Certification of the Company’s Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rule 15d-14(a)), with respect to the registrant’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014. *

|

|

|

|

|

|

31.2

|

|

Certification of the Company’s Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rule 15d-14(a)), with respect to the registrant’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014. *

|

|

|

|

|

|

32.1

|

|

Certificate of Principal Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted under Section 906 of the Sarbanes-Oxley Act of 2002 (Rule 15d-14(b)). *

|

|

|

|

|

|

32.2

|

|

Certificate of Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted under Section 906 of the Sarbanes-Oxley Act of 2002 (Rule 15d-14(b)). *

|

|

|

|

|

|

101.INS

|

|

XBRL Instance Document * |

|

|

|

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document * |

|

|

|

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document * |

|

|

|

|

|

101.DEF

|

|

XBRL Taxonomy Definition Linkbase Document * |

|

|

|

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document * |

|

|

|

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document * |

___________

* Exhibit Filed Herewith

SIGNATURES

In accordance with Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KINGFISH HOLDING CORPORATION |

|

| |

|

|

|

| Date: February 12, 2015 |

By: |

/s/ Ted Sparling |

|

| |

|

Ted Sparling |

|

| |

|

Chief Executive Officer |

|

| |

|

(Principal Executive Officer) |

|

INDEX TO EXHIBITS

|

Exhibit

Number

|

|

Description of Exhibits

|

|

4.1

|

|

Convertible Promissory Note No. 10 in favor of James K. Toomey in principal amount of $60,000 for December 19, 2014 loan.*

|

|

|

|

|

|

4.2

|

|

Amended Convertible Promissory Note No. 4, dated February 10, 2015, in favor of James K. Toomey in principal amount of $10,000 for October 21, 2013 loan. *

|

|

|

|

|

|

4.3

|

|

Amended Convertible Promissory Note No. 5, dated February 10, 2015, in favor of James K. Toomey in principal amount of $10,000 for November 13, 2013. *

|

|

|

|

|

|

4.4

|

|

Amended Convertible Promissory Note No. 6, dated February 10, 2015, in favor of James K. Toomey in principal amount of $10,000 for January 13, 2014 loan. *

|

|

|

|

|

|

4.5

|

|

Amended Convertible Promissory Note No. 7, dated February 10, 2015, in favor of James K. Toomey in principal amount of $20,000 for April 24, 2014 loan. *

|

|

|

|

|

|

4.6

|

|

Amended Convertible Promissory Note No. 8, dated February 10, 2015, in favor of James K. Toomey in principal amount of $20,000 for May 22, 2014 loan. *

|

|

|

|

|

|

4.7

|

|

Amended Convertible Promissory Note No. 9, dated February 10, 2015, in favor of James K. Toomey in principal amount of $20,000 for September 17, 2014 loan. *

|

|

|

|

|

|

10.1

|

|

Convertible Promissory Note Purchase Agreement, effective as February 10, 2015, by and between Kingfish Holding Corporation and James K. Toomey. *

|

|

|

|

|

|

10.2

|

|

First Amendment to Convertible Promissory Note Purchase Agreement, effective as October 24, 2014, by and between Kingfish Holding Corporation and James K. Toomey. *

|

|

|

|

|

|

31.1

|

|

Certification of the Company’s Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rule 15d-14(a)), with respect to the registrant’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014. *

|

|

|

|

|

|

31.2

|

|

Certification of the Company’s Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rule 15d-14(a)), with respect to the registrant’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014. *

|

|

|

|

|

|

32.1

|

|

Certificate of Principal Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted under Section 906 of the Sarbanes-Oxley Act of 2002 (Rule 15d-14(b)). *

|

|

|

|

|

|

32.2

|

|

Certificate of Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted under Section 906 of the Sarbanes-Oxley Act of 2002 (Rule 15d-14(b)). *

|

|

|

|

|

|

101.INS

|

|

XBRL Instance Document *

|

|

|

|

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document *

|

|

|

|

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document *

|

|

|

|

|

|

101.DEF

|

|

XBRL Taxonomy Definition Linkbase Document *

|

|

|

|

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document *

|

|

|

|

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document *

|

____________

* Exhibit Filed Herewith

22

EXHIBIT 4.1

THIS CONVERTIBLE PROMISSORY NOTE HAS NOT BEEN REGISTERED UNDER SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY OTHER JURISDICTION AND MAY NOT BE OFFERED FOR SALE, SOLD, ASSIGNED, PLEDGED, HYPOTHECATED, OR OTHERWISE TRANSFERRED, NOR WILL ANY ASSIGNEE, VENDEE, TRANSFEREE, OR ENDORSEE THEREOF BE RECOGNIZED AS HAVING ACQUIRED ANY SUCH UNITS BY THE ISSUER FOR ANY PURPOSES, EXCEPT (1) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND THE SECURITIES LAWS OF ALL OTHER APPLICABLE JURISDICTIONS OR (2) THE AVAILABILITY OF AN EXEMPTION FROM SUCH REGISTRATION SHALL BE ESTABLISHED TO THE REASONABLE SATISFACTION OF THE ISSUER.

CONVERTIBLE PROMISSORY NOTE

|

Note No. 10

|

February 10, 2015

|

|

U.S. $60,000.00

|

Tampa, Florida

|

FOR VALUE RECEIVED, the undersigned Kingfish Holding Corporation, a Delaware corporation (the “Company”), promises to pay to the order of James K. Toomey (“Payee”, and Payee and any subsequent permitted holder(s) of this Note being referred to collectively as “Holder”), at Holder’s address set forth below (or by wire transfer to Holder’s wire address set forth below) or at such other place as Holder may designate in writing pursuant to the notice provisions below, the principal sum of SIXTY THOUSAND DOLLARS ($60,000.00) (the “Principal Amount”), together with accrued and unpaid interest thereon, said principal and interest to be due and payable as stated below.

This convertible promissory note (the “Note”) is issued pursuant to the terms of that certain Convertible Promissory Note Purchase Agreement (as amended, the “Purchase Agreement”) dated as of February 10, 2015 by and between the Company and the Payee. Capitalized terms used herein without definition shall have the meanings given to such terms in the Purchase Agreement.

1. Interest Rate. The Company promises to pay simple interest on the outstanding principal amount of this Note from December 19, 2014 (the date that the underlying loan was originally made by the Holder to the Company) until paid in full at the fixed rate of three and one-half percent (3.5%) per annum. Interest shall be calculated on a 365-day year basis and shall be due and payable as set forth below.