Current Report Filing (8-k)

June 14 2019 - 9:24AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 12, 2019

JRSIS

HEALTH CARE CORPORATION

(Exact

name of registrant as specified in its charter)

|

Florida

|

|

1-36758

|

|

46-4562047

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

1st

- 7th Floor, Industrial and Commercial Bank Building

Xingfu

Street, Hulan Town, Hulan District, Harbin City

Heilongjiang

Province, P.R. China 150025

(Address

of Principal Executive Office) (Zip Code)

86-451-56888933

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

|

|

|

|

|

|

|

Item

3.02

|

Unregistered

Sale of Equity Securities

|

On

June 12, 2019 the Registrant and Labrys Fund, LP entered into a Securities Purchase Agreement dated May 30, 2019. The Securities

Purchase Agreement provided that, for a purchase price of $253,800, the Registrant issued to Labrys Fund, LP:

|

|

●

|

a

Convertible Promissory Note in the principal amount of $282,000;

|

|

|

|

|

|

|

●

|

a

Common Stock Purchase Warrant (the “Warrant”) to purchase 28,200 shares of

the Registrant’s common stock; and

|

|

|

|

|

|

|

●

|

40,000

shares of common stock (the “Returnable Shares”).

|

The

sale of the securities was exempt from registration pursuant to Section 4(2) of the Securities Act of 1933, as not involving a

public offering. There was no underwriter involved in the transaction.

The

Securities Purchase Agreement provided for the issuance of the Returnable Shares as a commitment fee. The Convertible Promissory

Note provides that the Returnable Shares will be returned to the Registrant’s treasury if the Registrant satisfies the Convertible

Promissory Note in full on or prior to November 30, 2019. The Securities Purchase Agreement also provides that the Registrant

will reimburse Labrys Fund, LP for its expenses incurred in connection with the negotiation and performance of the agreement,

and for any legal fees incurred in securing legal opinions in connection with conversions of the Note.

The

Convertible Promissory Note bears interest at 10% per annum from May 30, 2019 until the Maturity Date; in the event of a default

by the Registrant, the interest rate will increase to 24% per annum. The Maturity Date for payment of the principal amount of

$282,000 plus accrued interest will be November 30, 2019. The principal amount of the Note and, at the holder’s option, accrued

interest will be convertible by the holder into common stock at a conversion price per share equal to the lesser of 60% multiplied

by the lowest trading price during the twenty trading days preceding conversion. The note-holder will be entitled to deduct $850

from each conversion amount to reimburse its expenses in connection with the conversion.

The

Warrant may be exercised at any time or times prior to May 30, 2024. The initial exercise price is $10 per share. In the event

that the Registrant issues any securities with an effective price per common share equivalent of less than the Warrant exercise

price, the Warrant exercise price will be reduced to that effective price, and the number of common shares issuable upon exercise

of the Warrant will be increased so as to maintain the aggregate exercise price.

|

|

Item

9.01

|

Financial

Statements and Exhibits

|

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

|

|

JRSIS Health Care Corporation

|

|

|

|

|

|

Date: June 14, 2019

|

By:

|

/s/ Lihua Sun

|

|

|

|

Lihua

Sun, Chief Executive Officer

|

2

JRSIS Health Care (PK) (USOTC:JRSS)

Historical Stock Chart

From Jun 2024 to Jul 2024

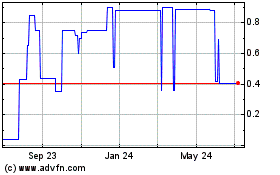

JRSIS Health Care (PK) (USOTC:JRSS)

Historical Stock Chart

From Jul 2023 to Jul 2024