SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 12, 2015

INTERNATIONAL STEM CELL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-51891 |

|

20-4494098 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

5950 Priestly Drive, Carlsbad, California 92008

(Address of principal executive offices, including zip code)

(760) 940-6383

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CAR 240.13e-4(c)) |

| ITEM 1.01 |

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT |

On May 12, 2015, to obtain funding for working capital

purposes and to refinance the indebtedness incurred on May 6, 2015, International Stem Cell Corporation (the “Company”) issued an unsecured, non-convertible promissory note in the principal amount of $2,262,000 (the “Note”)

to Dr. Andrey Semechkin in return for Dr. Semechkin (i) surrendering the note issued to him by the Company on May 6, 2015 in the principal amount of $262,000, and (ii) providing an additional $2 million of funds to the

Company. Dr. Semechkin is the Company’s Co-Chairman and Chief Executive Officer.

The principal amount under the Note accrues interest at a rate

of One Half of One Percent (0.50%) per annum. The Note is due and payable August 10, 2015, but may be pre-paid by the Company without penalty at any time.

The foregoing summary of the Note is qualified in its entirety by reference to the full text of the form of Note filed as Exhibit 10.1 to this Current Report

on Form 8-K.

| ITEM 2.03 |

CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT |

The description of the Note set forth under Item 1.01 is incorporated herein by reference.

(d) Exhibits

|

|

|

| Exhibit

No. |

|

Exhibit Description |

|

|

| 10.1 |

|

Note issued on May 12, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| International Stem Cell Corporation |

|

|

| By: |

|

/s/ Sofya Bakalova |

|

|

Sofya Bakalova |

|

|

VP, Legal Affairs and Operations |

Dated: May 14, 2015

Exhibit 10.1

INTERNATIONAL STEM CELL CORPORATION

PROMISSORY NOTE

FOR

VALUE RECEIVED, and subject to the terms and conditions set forth herein, on this 12th day of May, 2015 (the “Issuance Date”), International Stem Cell Corporation, a Delaware corporation (the “Borrower”), hereby

unconditionally promises to pay to the order of Andrey Semechkin or his assigns (the “Noteholder”), the principal amount of two million two-hundred and sixty-two thousand Dollars ($2,262,000) (the “Loan”), together

with all accrued interest thereon, as provided in this Promissory Note (the “Note”).

1. Previous Loan. On May 6, 2015

Noteholder was issued a Promissory Note in the principal amount of $262,000 by the Borrower (the “Original Note”). On May 12, 2015 Noteholder provided additional $2,000,000 of funds to the Borrower and surrendered the Original

Note, in return for which the Noteholder was issued this Note.

2. Final Payment Date; Optional Prepayments.

2.1 Final Payment Date. The aggregate unpaid principal amount of the Loan and all accrued and unpaid interest shall be due and payable

August 10, 2015 (the “Maturity Date”).

2.2 Optional Prepayment. The Borrower may prepay the Loan in whole or

in part at any time or from time to time without penalty or premium by paying the principal amount to be prepaid together with accrued interest thereon to the date of prepayment. No prepaid amount may be reborrowed.

3. Interest.

3.1 Interest Rate.

The outstanding principal amount of the Loan made hereunder shall bear interest at the annual rate of One-Half of One Percent (0.50%) from the date the Loan was made until the Loan is paid in full, whether at maturity, by prepayment or otherwise.

3.2 Interest Payment Dates. Interest shall be payable on maturity, or earlier with respect to any prepayment.

3.3 Computation of Interest. All computations of interest shall be made on the basis of a year of 360 days and the actual number of

days elapsed. Interest shall accrue on the Loan on the day on which such Loan is made, and shall not accrue on the Loan (or any portion thereof) for the day on which it is paid.

3.4 Interest Rate Limitation. If at any time and for any reason whatsoever, the interest rate payable on the Loan shall exceed the

maximum rate of interest permitted to be charged by the Noteholder to the Borrower under applicable law, such interest rate shall be reduced automatically to the maximum rate of interest permitted to be charged under applicable law, and that portion

of any sum paid attributable to that portion of such interest rate that exceeds the

maximum rate of interest permitted by applicable law shall be deemed a voluntary prepayment of principal.

4. Payment Mechanics. All payments of principal and interest shall be made in lawful money of the United States of America by check or by wire transfer

of immediately available funds to the Noteholder’s account at a bank specified by the Noteholder in writing to the Borrower from time to time.

5.

Governing Law. This Note and any claim, controversy, dispute or cause of action based upon, arising out of or relating to this Note, and the transactions contemplated hereby, shall be governed by the laws of the State of California.

IN WITNESS WHEREOF, the Borrower has executed this Note as of the Issuance Date written above.

|

|

|

|

|

|

|

|

|

| NOTEHOLDER |

|

|

|

INTERNATIONAL STEM CELL CORPORATION |

|

|

|

|

|

| By |

|

/s/ ANDREY SEMECHKIN |

|

|

|

By: |

|

/s/ SOFYA BAKALOVA |

|

|

Andrey Semechkin |

|

|

|

Name: |

|

Sofya Bakalova |

|

|

|

|

|

|

Title: |

|

VP, Legal Affairs and Operations |

2

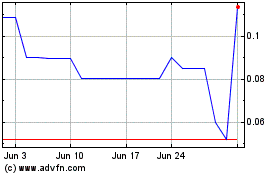

International Stem Cell (QB) (USOTC:ISCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

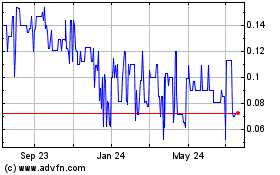

International Stem Cell (QB) (USOTC:ISCO)

Historical Stock Chart

From Jul 2023 to Jul 2024