KaloBios Takes Measures to Limit Shkreli's Shareholder Rights

July 07 2016 - 10:00AM

Dow Jones News

KaloBios Pharmaceuticals on Thursday said it had reached an

agreement with ousted Chief Executive Martin Shkreli to limit his

shareholder rights, a week after the rare disease drugmaker said it

had emerged from bankruptcy.

Mr. Shkreli, who holds 50.3% of the South San Francisco-based

biotech firm's shares according to FactSet data, was arrested in

December on securities-fraud charges unrelated to KaloBios. Soon

after, the company filed for bankruptcy protection, fearing the

turmoil surrounding Mr. Shkreli created an "imminent threat" to its

liquidity.

On Thursday, the company said it signed a governance agreement

with Mr. Shkreli, including an option for the company to repurchase

his shares as well as provisions significantly restricting his

actions as a shareholder.

"This agreement is another step in the company's pursuit of

revitalizing its reputation," said Chief Executive Cameron Durrant.

"KaloBios is building a company committed to transformational

ideas, like transparent and responsible pricing, to drive change.

This agreement, combined with our recent emergence from bankruptcy,

helps to hit the reset button and move forward."

Mr. Shkreli, also formerly the CEO of Turing Pharmaceuticals,

was widely criticized for increasing the price of anti-parasite

drug Daraprim by fiftyfold. Before the criminal charges, which he

denies, he alarmed advocates for rare-disease treatments when he

told investors he intended to price Chagas disease treatment

benznidazole in line with hepatitis C treatments that can cost as

much as $94,000 per course. In Latin America, where most cases of

Chagas disease are found, benznidazole costs $60 to $100, according

to the Drugs for Neglected Diseases Initiative.

In the agreement with KaloBios, for 180 days following June

30—the company's effective emergence from its chapter 11 bankruptcy

proceedings—Mr. Shkreli may not sell his shares to any third party

for less than $2.50 a share or a 10% discount to the prior two-week

volume-weighted average price, whichever is greater. Additionally,

KaloBios has right to buy any or all of Mr. Shkreli's shares at the

market discount price for 180 days after Aug. 30.

For "a limited time," the company can also refuse to purchase

shares that Mr. Shkreli proposes selling. The agreement bars him

from transferring any shares to his affiliates or associates unless

they agree to be subject to the same terms.

Mr. Shkreli can't nominate directors to the board and has agreed

to vote his shares in proportion to the votes of the company's

public stockholders.

The agreement also prohibits, for the next two years, Mr.

Shkreli or his affiliates from purchasing any stock or assets of

the company; participating in any proposal for any merger, tender

offer or other business combination; seeking to control or

influence the management, board or policies of the company; or

submitting any proposal to be considered by stockholders.

Mr. Shkreli paid $3.2 million in November 2015 for a controlling

stake in the struggling biotech firm, became its CEO and saw the

value of that holding grow to more than $48 million before his

arrest a month later. The criminal charges involve allegations he

hid losses in hedge funds he managed with the help of money from a

public company.

Mr. Shkreli couldn't immediately be reached for comment.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 07, 2016 09:45 ET (13:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

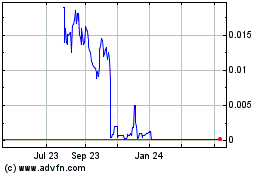

Humanigen (CE) (USOTC:HGEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Humanigen (CE) (USOTC:HGEN)

Historical Stock Chart

From Jul 2023 to Jul 2024