UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 14, 2014

General Steel Holdings, Inc.

(Exact name of registrant as specified

in its charter)

| Nevada |

|

001-33717 |

|

41-2079252 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

Level 21, Tower B, Jia Ming Center

No. 27 Dong San Huan North Road

Chaoyang District, Beijing, China 100020

(Address of

principal executive offices)

Registrant’s telephone number,

including area code:

+ 86 (10) 57757691

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On August 14, 2014, General Steel Holdings, Inc. (the “Company”)

issued a press release relating to its financial results for its second quarter ended June 30, 2014. The press release contains

statements intended as “forward-looking statements,” all of which are subject to the cautionary statement about forward-looking

statements set forth therein. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated into this Item

2.02 by reference.

In accordance with General Instruction B.2 of Form 8-K, the

information included or incorporated in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes

of Section 18 of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such

information and exhibit be deemed incorporated by reference in any filing under the United States Securities Act of 1933, as amended

(the “Securities Act”), except as shall be expressly set forth by specific reference in such a filing.

ITEM 7.01 REGULATION FD DISCLOSURE.

On August 14, 2014, in connection with its conference call pertaining

to its financial results for its second quarter ended June 30, 2014, the Company posted a slide show presentation on its website

at http://www.gshi-steel.com, which is also furnished as Exhibit 99.2 hereto and incorporated into this Item 7.01 by reference.

In accordance with General Instruction B.2 of Form 8-K, the

information included or incorporated in this Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes

of Section 18 of the Exchange Act, nor shall such information and exhibit be deemed incorporated by reference in any filing under

the Securities Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

Exhibit

No. |

|

Description |

| |

|

| 99.1 |

|

Press Release issued on August 14, 2014. |

| 99.2 |

|

Presentation of General Steel Holdings, Inc. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

General Steel Holdings, Inc. |

| |

|

|

| |

By: |

/s/ John Chen |

| |

Name: |

John Chen |

| |

Title: |

Chief Financial Officer |

Dated: August 14, 2014

Exhibit 99.1

General Steel Reports Second Quarter

2014 Financial Results

Quarterly Gross Margin Improves to a

36-Month High of 4.8%

Quarterly EBITDA Improves by $54.4 million

Year-over-Year to $33.6 million

Quarterly Operating Cash Flows Improve

by $121.4 million Year-over-Year to $56.1 million

Company Reiterates EPS Guidance of $0.08

to $0.12 for Second Half of 2014

BEIJING – August 14, 2014 –

General Steel Holdings, Inc. (“General Steel” or the “Company”) (NYSE: GSI), a leading non-state-controlled

steel producer in China, today announced its financial results for the second quarter ended June 30, 2014.

Henry Yu, Chairman and Chief Executive

Officer of General Steel commented, “We are very proud that our turn-around efforts are now driving measurable improvements

to our financials, as gross margin expanded to a 36-month high and EBITDA substantially improved to a positive $33.6 million. These

highlights reflect the success we have had over the past year in lowering our unit production cost and enhancing our operating

efficiencies.”

“During the second quarter, industry

fundamentals significantly improved, and we were able to hold firm on our pricing. We are seeing a better demand-and-supply balance,

and it is increasingly more evident that the market dynamics and competitive landscape will substantially improve in the coming

months.” Mr. Yu concluded.

John Chen, Chief Financial Officer of General

Steel, commented, “This quarter we saw contributions to profitability from our two major initiatives. Our sourcing strategy

lowered our raw material costs and, our upgraded production lines and technical improvements lowered our unit costs. We also turned

around our operating cash flows to an inflow of $56.1 million, providing us with greater operating flexibility for the quarters

ahead. Given our solid execution and the improved market fundamentals, we anticipate additional margin expansion and are confident

that we will deliver on our target EPS range of 8 to 12 cents for the second half of 2014.”

Second Quarter 2014 Financial Information

| · | Sales volume decreased by 5.7% year-over-year to approximately 1.31 million metric tons, compared

with 1.38 million metric tons in the second quarter of 2013. |

| · | Sales totaled $588.0 million, compared with $653.7 million in the second quarter of 2013. |

| · | Gross profit was $28.1 million on gross margin of 4.8%, compared with a gross loss of $(35.5) million

in the second quarter of 2013. |

| · | Operating income totaled $6.3 million, compared with an operating loss of $(46.9) million in the

second quarter of 2013. |

General Steel Holdings, Inc.

Page 2 of 9 |

| · | Net loss attributable to the Company reduced to approximately $(11.0) million, or $(0.20) per diluted

share, compared with a net loss of $(39.8) million, or $(0.72) per diluted share in the second quarter of 2013. |

| · | As of June 30, 2014, the Company had cash and restricted cash of $492.9 million. |

First Six Months 2014 Financial Information

| · | Sales volume decreased by 2.4% year-over-year to approximately 2.62 million metric tons, compared

with 2.69 million metric tons in the first six months of 2013. |

| · | Sales were $1.2 billion, compared with $1.3 billion in the first six months of 2013. |

| · | Gross profit was $5.5 million on gross margin of 0.5%, compared with a gross loss of $(31.5) million

in the first six months of 2013. |

| · | Operating loss was $(37.3) million, compared with an operating loss of $(15.0) million in the first

six months of 2013. |

| · | Net loss attributable to the Company was $(54.6) million, or $(0.98) per diluted share, compared

with a net loss of $(36.7) million, or $(0.67) per diluted share in the first six months of 2013. |

Second Quarter 2014 Financial and Operating

Results

Total Sales

Total sales for the second quarter of 2014

decreased by 10.0% year-over-year to $588.0 million, compared with $653.7 million in the second quarter of 2013. The year-over-year

sales decreases were due to decreases in both average selling price of rebar and sales volume.

| · | Total sales volume in the second quarter of 2014 was 1.31 million metric tons, a decrease of 5.7%

compared with 1.38 million metric tons in the second quarter of 2013. |

| · | The average selling price of rebar at Longmen Joint Venture in the second quarter of 2014 decreased

to approximately $450.0 per metric ton, down by 6.8% from $482.7 per metric ton in the second quarter of 2013. |

Gross Profit/Loss

Gross profit for the second quarter of

2014 was $28.1 million, or 4.8% of total sales, as compared with a gross loss of $(35.5) million, or (5.4%) of total sales in the

second quarter of 2013. The 1,020 basis points improvement in gross margin during the quarter was mainly attributable to decreased

unit costs of rebar manufactured.

Operating Expenses and Operating Income/Loss

Selling, general and administrative expenses

for the second quarter of 2014 were $18.8 million, a decrease of 9.6% from $20.8 million in the second quarter of 2013. Driven

by effective headcount expense control, general and administrative expenses decreased to $9.1 million in the second quarter of

2014, compared with $11.6 million in the second quarter of 2013. Selling expenses was $9.7 million in the second quarter of 2014,

slighted increased from $9.3 million in the same period of 2013. The increase in selling expenses was mainly due to the increase

in freight expenses as a result of the PRC government’s policy to increase freight train fees in early 2014.

General Steel Holdings, Inc.

Page 3 of 9 |

Other operating loss from change in the

fair value of profit sharing liability during the second quarter of 2014 was $(2.9) million, compared with a gain of $9.5 million

recognized in the same period of last year. The loss recognized from change in the fair value of profit sharing liability was primarily

due to the amortization of the present value discount.

Correspondingly, income from operations

for the second quarter of 2014 was $6.3 million, an improvement of $53.2 million compared with loss from operations of $(46.9)

million for the second quarter of 2013.

Finance Expense

Finance and interest expense in the second

quarter of 2014 was $26.6 million, of which, $5.7 million was the non-cash interest expense on capital lease as compared with $5.1

million in the same period of 2013, and $20.9 million was the interest expense on bank loans and discounted note receivables as

compared with $16.1 million in the same period of 2013. The increase in finance and interest expenses was mainly a result of higher

finance costs charged by banks and more of the early redemption on note receivables.

Net Loss and Net Loss per Share

Net loss attributable to General Steel

for the second quarter of 2014 narrowed $(11.0) million, or $(0.20) per diluted share, based on 55.8 million weighted average shares

outstanding. This compares to a net loss of $(39.8) million, or $(0.72) per diluted share, based on 55.0 million weighted average

shares outstanding in the second quarter of 2013.

First Six Months 2014 Financial and

Operating Results

Total Sales

Total sales for the first six months of

2014 decreased by 9.4% year-over-year to $1.2 billion, compared with $1.3 billion in the first six months of 2013. The year-over-year

sales decreases were due to decreases in both average selling price of rebar and sales volume.

| · | Total sales volume in the first six months of 2014 was 2.62 million metric tons, a decrease of

2.4% compared with 2.69 million metric tons in the first six months of 2013. |

| · | The average selling price of rebar at Longmen Joint Venture in the first six months of 2014 decreased

to approximately $450.4 per metric ton, down by 9.6% from $498.4 per metric ton in the first six months of 2013. |

Gross Profit/Loss

Gross profit for the first six months of

2014 was $5.5 million, or 0.5% of total sales, as compared with a gross loss of $(31.5) million, or (2.4%) of total sales in the

first six months of 2013.

General Steel Holdings, Inc.

Page 4 of 9 |

Operating Expenses and Operating Loss

Selling, general and administrative expenses

for the first six months of 2014 were $39.9 million, slightly increased from $39.8 million in the first six months of 2013. General

and administrative expenses were $21.9 million, compared with $22.5 million in the same period of 2013. Selling expenses increased

by 4.1% to $18.0 million, compared to $17.3 million in the same period of 2013.

Other operating loss from change in the

fair value of profit sharing liability during the first six months of 2014 was $(3.0) million, compared with a gain of $56.3 million

in the same period of last year.

Correspondingly, loss from operations for

the first six months of 2014 was $(37.3) million, compared with loss from operations of $(15.0) million for the first six months

of 2013.

Finance Expense

Finance and interest expense in the first

six months of 2014 was $55.3 million, of which, $10.7 million was the non-cash interest expense on capital lease as compared with

$10.2 million in the same period of 2013, and $44.6 million was the interest expense on bank loans and discounted note receivables

as compared with $35.9 million in the first six months of 2013.

Net Loss and Net Loss per Share

Net loss attributable to General Steel

for the first six months of 2014 was $(54.6) million, or $(0.98) per diluted share, based on 55.8 million weighted average shares

outstanding. This compares to a net loss of $(36.7) million, or $(0.67) per diluted share, based on 54.9 million weighted average

shares outstanding in the first six months of 2013.

Balance Sheet

As of June 30, 2014, the Company had cash

and restricted cash of approximately $492.9 million, compared to $431.3 million as of December 31, 2013. The Company had an inventory

balance of $209.0 million as of June 30, 2014, compared to $212.9 million as of December 31, 2013.

Business Outlook

For the six months ending December 31,

2014, the Company reiterates that it currently projects:

| · | Sales to range from $1.3 billion to $1.4 billion, on sales volume of approximately 3 million metric

tons; |

| · | Net income attributable to the Company to range from $4.5 million to $6.5 million; and |

| · | EPS attributable to the Company to range from $0.08 to $0.12. |

General Steel Holdings, Inc.

Page 5 of 9 |

Conference Call and Webcast:

General Steel will hold a corresponding

conference call and live webcast at 8:00 a.m. EDT on Thursday, August 14, 2014 (which corresponds to 8:00 p.m. Beijing/Hong Kong

Time on Thursday, August 14, 2014) to discuss the results and answer questions from investors. Listeners may access the call by

dialing:

| US Toll Free: |

1-866-250-8117 |

| International Toll: |

1-412-317-6011 |

| China Toll: |

400-120-3170 |

| China Toll Free: |

800-870-0210 |

| Conference ID: |

83542725 |

The call will also be available as a live,

listen-only Webcast under the "Events and Presentations" page on the "Investor Relations" section of the Company's

Website at http://www.corpasia.net/us/GSI/irwebsite/index.php?mod=event. Following the live Webcast, an online archive

of the Webcast will be available for 90 days.

About General Steel Holdings, Inc.

General Steel Holdings, Inc., headquartered

in Beijing, China, produces a variety of steel products including rebar, high-speed wire and spiral-weld pipe. The Company has

operations in China’s Shaanxi and Guangdong provinces, Inner Mongolia Autonomous Region and Tianjin municipality, with seven

million metric tons of crude steel production capacity under management. For more information, please visit www.gshi-steel.com.

To be added to the General Steel email

list to receive Company news, or to request a hard copy of the Company’s Annual Report on Form 10-K, please send your request

to generalsteel@asiabridgegroup.com.

Forward-Looking Statements

This press release may contain certain

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based

on management's current expectations or beliefs about future events and financial, political and social trends and assumptions

it has made based on information currently available to it. The Company cannot assure that any expectations, forecasts or assumptions

made by management in preparing these forward-looking statements will prove accurate, or that any projections will be realized.

Actual results could differ materially from those projected in the forward-looking statements as a result of inaccurate assumptions

or a number of risks and uncertainties. These risks and uncertainties are set forth in the Company's filings under the Securities

Act of 1933 and the Securities Exchange Act of 1934 under “Risk Factors” and elsewhere, and include: (a) those risks

and uncertainties related to general economic conditions in China, including regulatory factors that may affect such economic conditions;

(b) whether the Company is able to manage its planned growth efficiently and operate profitable operations, including whether its

management will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able

to successfully manage and exploit existing and potential market opportunities; (c) whether the Company is able to generate sufficient

revenues or obtain financing to sustain and grow its operations; (d) whether the Company is able to successfully fulfill our primary

requirements for cash; and (e) other risks, including those disclosed in the Company’s Annual Report on Form 10-K, filed

with the United States Securities and Exchange Commission. Forward-looking statements contained herein speak only as of the

date of this release. The Company does not undertake any obligation to update or revise publicly any forward-looking statements,

whether to reflect new information, future events or otherwise.

General Steel Holdings, Inc.

Page 6 of 9 |

Contact Us

General Steel Holdings, Inc.

Joyce Sung

Tel: +1-347-534-1435

Email: joyce.sung@gshi-steel.com

Asia Bridge Capital Limited

Carene Toh

Tel: +1-888-957-3362

Email: generalsteel@asiabridgegroup.com

General Steel Holdings, Inc.

Page 7 of 9 |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(In thousands)

| | |

June 30, | | |

December 31, | |

| | |

2014 | | |

2013 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash | |

$ | 44,749 | | |

$ | 31,967 | |

| Restricted cash | |

| 448,106 | | |

| 399,333 | |

| Notes receivable | |

| 36,948 | | |

| 60,054 | |

| Restricted notes receivable | |

| 106,873 | | |

| 395,589 | |

| Loans receivable - related parties | |

| 4,540 | | |

| 4,540 | |

| Accounts receivable, net | |

| 5,277 | | |

| 4,078 | |

| Accounts receivable - related parties | |

| 5,788 | | |

| 2,942 | |

| Other receivables, net | |

| 54,804 | | |

| 54,716 | |

| Other receivables - related parties | |

| 57,983 | | |

| 54,106 | |

| Inventories | |

| 208,971 | | |

| 212,921 | |

| Advances on inventory purchase | |

| 58,503 | | |

| 44,897 | |

| Advances on inventory purchase - related parties | |

| 119,279 | | |

| 83,003 | |

| Prepaid expense and other | |

| 3,322 | | |

| 1,388 | |

| Prepaid taxes | |

| 12,489 | | |

| 28,407 | |

| Short-term investment | |

| 2,763 | | |

| 2,783 | |

| TOTAL CURRENT ASSETS | |

| 1,170,395 | | |

| 1,380,724 | |

| | |

| | | |

| | |

| PLANT AND EQUIPMENT, net | |

| 1,253,351 | | |

| 1,271,907 | |

| | |

| | | |

| | |

| OTHER ASSETS: | |

| | | |

| | |

| Advances on equipment purchase | |

| 92,133 | | |

| 6,409 | |

| Investment in unconsolidated entities | |

| 16,710 | | |

| 16,943 | |

| Long-term deferred expense | |

| 552 | | |

| 668 | |

| Intangible assets, net of accumulated amortization | |

| 23,333 | | |

| 23,707 | |

| TOTAL OTHER ASSETS | |

| 132,728 | | |

| 47,727 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 2,556,474 | | |

$ | 2,700,358 | |

| | |

| | | |

| | |

| LIABILITIES AND DEFICIENCY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Short term notes payable | |

$ | 875,479 | | |

$ | 1,017,830 | |

| Accounts payable | |

| 418,468 | | |

| 434,979 | |

| Accounts payable - related parties | |

| 262,103 | | |

| 235,692 | |

| Short term loans - bank | |

| 201,673 | | |

| 301,917 | |

| Short term loans - others | |

| 64,395 | | |

| 62,067 | |

| Short term loans - related parties | |

| 153,996 | | |

| 126,693 | |

| Current maturities of long-term loans - related party | |

| 62,374 | | |

| 53,013 | |

| Other payables and accrued liabilities | |

| 48,343 | | |

| 45,653 | |

| Other payable - related parties | |

| 98,209 | | |

| 94,079 | |

| Customer deposits | |

| 136,288 | | |

| 87,860 | |

| Customer deposits - related parties | |

| 142,888 | | |

| 64,881 | |

| Deposit due to sales representatives | |

| 21,435 | | |

| 24,343 | |

| Deposit due to sales representatives - related parties | |

| 1,658 | | |

| 1,997 | |

| Taxes payable | |

| 4,181 | | |

| 4,628 | |

| Deferred lease income, current | |

| 2,171 | | |

| 2,187 | |

| Capital lease obligations, current | |

| 6,443 | | |

| 4,321 | |

| TOTAL CURRENT LIABILITIES | |

| 2,500,104 | | |

| 2,562,140 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES: | |

| | | |

| | |

| Long-term loans - related party | |

| 9,750 | | |

| 19,644 | |

| Deferred lease income, noncurrent | |

| 73,620 | | |

| 75,257 | |

| Capital lease obligations, noncurrent | |

| 384,830 | | |

| 375,019 | |

| Profit sharing liability at fair value | |

| 164,067 | | |

| 162,295 | |

| TOTAL NON-CURRENT LIABILITIES | |

| 632,267 | | |

| 632,215 | |

| TOTAL LIABILITIES | |

| 3,132,371 | | |

| 3,194,355 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| DEFICIENCY: | |

| | | |

| | |

| Preferred stock, $0.001 par value, 50,000,000 shares authorized, 3,092,899 shares issued and outstanding as of June 30, 2014 and December 31, 2013 | |

| 3 | | |

| 3 | |

| Common stock, $0.001 par value, 200,000,000 shares authorized, 58,314,688 and 58,234,688 shares issued, 55,842,382 and 55,762,382 shares outstanding as of June 30, 2014 and December 31, 2013, respectively | |

| 58 | | |

| 58 | |

| Treasury stock, at cost, 2,472,306 shares as of June 30, 2014 and December 31, 2013 | |

| (4,199 | ) | |

| (4,199 | ) |

| Paid-in-capital | |

| 107,097 | | |

| 106,878 | |

| Statutory reserves | |

| 6,408 | | |

| 6,243 | |

| Accumulated deficits | |

| (469,381 | ) | |

| (414,798 | ) |

| Accumulated other comprehensive income | |

| 3,016 | | |

| 729 | |

| TOTAL GENERAL STEEL HOLDINGS, INC. DEFICIENCY | |

| (356,998 | ) | |

| (305,086 | ) |

| | |

| | | |

| | |

| NONCONTROLLING INTERESTS | |

| (218,899 | ) | |

| (188,911 | ) |

| TOTAL DEFICIENCY | |

| (575,897 | ) | |

| (493,997 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND DEFICIENCY | |

$ | 2,556,474 | | |

$ | 2,700,358 | |

General Steel Holdings, Inc.

Page 8 of 9 |

|

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

FOR THE THREE AND SIX MONTHS ENDED JUNE

30, 2014 AND 2013

(UNAUDITED)

(In thousands, except per share

data) |

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| SALES | |

$ | 508,637 | | |

$ | 517,350 | | |

$ | 1,020,642 | | |

$ | 1,019,781 | |

| | |

| | | |

| | | |

| | | |

| | |

| SALES - RELATED PARTIES | |

| 79,376 | | |

| 136,301 | | |

| 161,582 | | |

| 285,161 | |

| TOTAL SALES | |

| 588,013 | | |

| 653,651 | | |

| 1,182,224 | | |

| 1,304,942 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST OF GOODS SOLD | |

| 482,011 | | |

| 540,271 | | |

| 1,012,755 | | |

| 1,038,897 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST OF GOODS SOLD - RELATED PARTIES | |

| 77,908 | | |

| 148,916 | | |

| 163,936 | | |

| 297,514 | |

| TOTAL COST OF GOODS SOLD | |

| 559,919 | | |

| 689,187 | | |

| 1,176,691 | | |

| 1,336,411 | |

| | |

| | | |

| | | |

| | | |

| | |

| GROSS PROFIT (LOSS) | |

| 28,094 | | |

| (35,536 | ) | |

| 5,533 | | |

| (31,469 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | |

| (18,849 | ) | |

| (20,848 | ) | |

| (39,902 | ) | |

| (39,803 | ) |

| CHANGE IN FAIR VALUE OF PROFIT SHARING LIABILITY | |

| (2,920 | ) | |

| 9,494 | | |

| (2,969 | ) | |

| 56,273 | |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME (LOSS) FROM OPERATIONS | |

| 6,325 | | |

| (46,890 | ) | |

| (37,338 | ) | |

| (14,999 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 4,066 | | |

| 3,383 | | |

| 7,258 | | |

| 5,882 | |

| Finance/interest expense | |

| (26,619 | ) | |

| (21,216 | ) | |

| (55,314 | ) | |

| (46,073 | ) |

| Gain (loss) on disposal of equipment and intangible assets | |

| (142 | ) | |

| (235 | ) | |

| (96 | ) | |

| 96 | |

| Income from equity investments | |

| 54 | | |

| 132 | | |

| 67 | | |

| 90 | |

| Foreign currency transaction gain (loss) | |

| (963 | ) | |

| 98 | | |

| (1,817 | ) | |

| 126 | |

| Lease income | |

| 542 | | |

| 539 | | |

| 1,088 | | |

| 1,071 | |

| Other non-operating income (expense), net | |

| 302 | | |

| 521 | | |

| 126 | | |

| 790 | |

| Other expense, net | |

| (22,760 | ) | |

| (16,778 | ) | |

| (48,688 | ) | |

| (38,078 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS BEFORE PROVISION FOR INCOME TAXES AND NONCONTROLLING INTEREST | |

| (16,435 | ) | |

| (63,668 | ) | |

| (86,026 | ) | |

| (53,077 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| PROVISION FOR INCOME TAXES | |

| | | |

| | | |

| | | |

| | |

| Current | |

| 107 | | |

| 105 | | |

| 112 | | |

| 176 | |

| Deferred | |

| - | | |

| - | | |

| - | | |

| - | |

| Provision for income taxes | |

| 107 | | |

| 105 | | |

| 112 | | |

| 176 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

| (16,542 | ) | |

| (63,773 | ) | |

| (86,138 | ) | |

| (53,253 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Less: Net loss attributable to noncontrolling interest | |

| (5,523 | ) | |

| (23,955 | ) | |

| (31,555 | ) | |

| (16,538 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS ATTRIBUTABLE TO GENERAL STEEL HOLDINGS, INC. | |

$ | (11,019 | ) | |

$ | (39,818 | ) | |

$ | (54,583 | ) | |

$ | (36,715 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

$ | (16,542 | ) | |

$ | (63,773 | ) | |

$ | (86,138 | ) | |

$ | (53,253 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER COMPREHENSIVE LOSS | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| (929 | ) | |

| (7,210 | ) | |

| 3,741 | | |

| (9,736 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE LOSS | |

| (17,471 | ) | |

| (70,983 | ) | |

| (82,397 | ) | |

| (62,989 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Less: Comprehensive loss attributable to noncontrolling interest | |

| (5,875 | ) | |

| (26,745 | ) | |

| (30,101 | ) | |

| (20,290 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE LOSS ATTRIBUTABLE TO GENERAL STEEL HOLDINGS, INC. | |

$ | (11,596 | ) | |

$ | (44,238 | ) | |

$ | (52,296 | ) | |

$ | (42,699 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF SHARES | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 55,842 | | |

| 54,980 | | |

| 55,828 | | |

| 54,893 | |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS PER SHARE | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | (0.20 | ) | |

$ | (0.72 | ) | |

$ | (0.98 | ) | |

$ | (0.67 | ) |

General Steel Holdings, Inc.

Page 9 of 9 |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(In thousands)

| | |

For the

Six months ended June 30, | |

| | |

2014 | | |

2013 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net (loss) income | |

$ | (86,138 | ) | |

$ | (53,253 | ) |

| Adjustments to reconcile net loss to cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation, amortization and depletion | |

| 47,788 | | |

| 43,067 | |

| Change in fair value of derivative liabilities - warrants | |

| - | | |

| (1 | ) |

| Change in fair value of profit sharing liability | |

| 2,969 | | |

| (56,273 | ) |

| (Gain) loss on disposal of equipment and intangible assets | |

| 96 | | |

| (96 | ) |

| Provision for doubtful accounts | |

| (250 | ) | |

| (169 | ) |

| Reservation of mine maintenance fee | |

| 278 | | |

| 215 | |

| Stock issued for services and compensation | |

| 219 | | |

| 480 | |

| Amortization of deferred financing cost on capital lease | |

| 9,253 | | |

| 10,217 | |

| Income from equity investments | |

| (67 | ) | |

| (90 | ) |

| Foreign currency transaction (gain) loss | |

| 1,817 | | |

| (126 | ) |

| Deferred lease income | |

| (1,088 | ) | |

| (1,071 | ) |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Notes receivable | |

| 45,931 | | |

| (64,424 | ) |

| Accounts receivable | |

| (1,008 | ) | |

| (33,951 | ) |

| Accounts receivable - related parties | |

| (2,875 | ) | |

| 8,969 | |

| Other receivables | |

| (307 | ) | |

| (857 | ) |

| Other receivables - related parties | |

| (4,275 | ) | |

| 10,275 | |

| Inventories | |

| 1,286 | | |

| 38,014 | |

| Advances on inventory purchases | |

| (13,968 | ) | |

| 23,215 | |

| Advances on inventory purchases - related parties | |

| (36,971 | ) | |

| (48,019 | ) |

| Prepaid expense and other | |

| (1,947 | ) | |

| (1,115 | ) |

| Long-term deferred expense | |

| 111 | | |

| 317 | |

| Prepaid taxes | |

| 15,747 | | |

| 2,742 | |

| Accounts payable | |

| (18,050 | ) | |

| 43,122 | |

| Accounts payable - related parties | |

| 28,204 | | |

| 55,227 | |

| Other payables and accrued liabilities | |

| 2,637 | | |

| 5,002 | |

| Other payables - related parties | |

| 4,824 | | |

| (16,987 | ) |

| Customer deposits | |

| 49,187 | | |

| (6,103 | ) |

| Customer deposits - related parties | |

| 78,667 | | |

| (14,502 | ) |

| Taxes payable | |

| (413 | ) | |

| (6,639 | ) |

| Other noncurrent liabilities | |

| - | | |

| 1,378 | |

| Net cash provided by (used in) operating

activities | |

| 121,657 | | |

| (61,436 | ) |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Restricted cash | |

| (51,820 | ) | |

| (49,988 | ) |

| Cash proceeds from short term investment | |

| - | | |

| 80 | |

| Cash proceeds from sales of equipment and intangible assets | |

| 24 | | |

| 16 | |

| Equipment purchase and intangible assets | |

| (112,713 | ) | |

| (52,350 | ) |

| Net cash used in investing activities | |

| (164,509 | ) | |

| (102,242 | ) |

| | |

| | | |

| | |

| CASH FLOWS FINANCING ACTIVITIES: | |

| | | |

| | |

| Restricted notes receivable | |

| 286,485 | | |

| 244,940 | |

| Borrowings on short term notes payable | |

| 900,202 | | |

| 812,577 | |

| Payments on short term notes payable | |

| (1,035,408 | ) | |

| (1,001,301 | ) |

| Borrowings on short term loans - bank | |

| 185,023 | | |

| 141,484 | |

| Payments on short term loans - bank | |

| (285,100 | ) | |

| (83,433 | ) |

| Borrowings on short term loan - others | |

| 19,949 | | |

| 47,903 | |

| Payments on short term loans - others | |

| (25,417 | ) | |

| (47,055 | ) |

| Borrowings on short term loan - related parties | |

| 32,576 | | |

| 213,576 | |

| Payments on short term loans - related parties | |

| (19,233 | ) | |

| (124,059 | ) |

| Deposits due to sales representatives | |

| (2,736 | ) | |

| (3,734 | ) |

| Deposit due to sales representatives - related parties | |

| (326 | ) | |

| 529 | |

| Payments on long-term loans - related party | |

| - | | |

| (17,544 | ) |

| Net cash provided by financing activities | |

| 56,015 | | |

| 183,883 | |

| EFFECTS OF EXCHANGE RATE CHANGE IN CASH | |

| (381 | ) | |

| 1,199 | |

| INCREASE IN CASH | |

| 12,782 | | |

| 21,404 | |

| CASH, beginning of period | |

| 31,967 | | |

| 46,467 | |

| CASH, end of period | |

$ | 44,749 | | |

$ | 67,871 | |

Exhibit 99.2

1 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. Second Quarter 2014 Earnings Call Presentation August 14, 2014

2 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. Safe Harbor Statement This presentation (including the financial projections and any subsequent questions and answers) contains statements that are forward - looking within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Such forward - looking statements are only predictions and are not guarantees of future performance . Any such forward - looking statements are and will be, as the case may be, subject to many risks, uncertainties, certain assumptions and factors relating to the operations and business environments of General Steel Holdings, Inc . and its subsidiaries that may cause the actual results of the companies to be materially different from any future results expressed or implied in such forward - looking statements . These risk factors, include, but are not limited to, any comments relating to our financial performance, the competitive nature of the marketplace, the condition of the worldwide economy and other factors that have been or will be detailed in the Company’s periodic filings (including Forms 8 - K, 10 - K and 10 - Q) or other documents filed with the Securities and Exchange Commission . For more detailed information on the Company, please refer to the Company filings with the Securities and Exchange Commission, which are readily available at http : //www . sec . gov, or through the Company’s Investor Relations website at http : //www . gshi - steel . com . The Company undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events or otherwise .

3 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. Review of Progress on Key Initiatives Agenda China Steel Industry Dynamics Second Quarter 2014 Highlights Henry Yu, Chief Executive Officer John Chen, Chief Financial Officer Second Half 2014 Guidance Review of Second Quarter 2014 F inancials

4 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. Second Quarter 2014 Highlights Improved Gross Margin 2Q14’s 4.8% was 36 - month high Stabilized ASP* in 2Q 2014 * Average selling price of rebar at Longmen Joint Venture $ / mt Lowered Unit Cost of Rebar $ / mt

5 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. » In July 2014, MIIT announced the first batch of capacity to be closed: • 44 iron - making companies with total capacity of 25.4 million tons • 30 steel - making companies with total capacity of 21.5 million tons • Deadline of closure by September 30, 2014 » 2Q 2014 GDP growth rate of 7.5% and gathering momentum » Manufacturing PMI posted four consecutive monthly rise from March to June » Government launches “mini - stimulus” packages to lift economic growth • China Railway Corp, raise s 2014 railway fixed assets investment budget to RMB 800 billion China Steel Industry Dynamics Potential Catalysts for Steel Demand Steel Capacity Trimming Underway Improving HSBC PMI to new 18 - month High in July 2014 Improving China Steel Mills Profitability in 2Q 2014 Source: Changjiang Securities June PMI: 51.0 July PMI: 51.7 Industry Average Net Margin

6 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. Ramped - Up Continuous Rolling Capacity Yielded Positive Benchmarking Savings Optimized Procurement Channel Continued Progress on Key Initiatives General Steel has made continued progress in optimizing sourcing mechanisms, upgrading production lines and implementing continuous technical improvements. x Partnered with local SOEs to secure high quality and steady supply in local raw materials x Signed direct supply agreement with Rio Tinto in April 2014 for 1,500,000 metric tons of imported iron ore x 2Q 2014, unit cost of iron ore and coke decreased by 9.7% and 17.3%, respectively Statistics in 1H 2014 based on GSI’s internal assessment: x Unit ferrous charges consumption per ton of rebar decreased by 3.2kg/ton YoY to 1,012.6 kg/ton x Comprehensive energy consumption per ton of rebar decreased to 492.3 kgec/ton, down 9.4% YoY x Effective reduction of overall unit production cost x Fully ramped - up utilization x Overall production cost saving of over RMB 68 million in 1H 2014 by internal estimation Unit cost of rebar manufactured Down by 15.9% YoY

7 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. EBITDA and OCF Turned Around EBITDA Operating Cash Flow USD Million Up $54.4 million Y oY USD Million Up $121.4 million Y oY

8 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. Items 2 Q 2014 2 Q 2013 Y - o - Y% Total Sales Volume (Thousands MT) 1,306 1,385 - 5.7% ASP of Rebar** (US$/per MT) 450.0 482.7 - 6 .8% Revenue (US$ million) 588.0 653.7 - 1 0.0% Gross (Loss)/Profit (US$ million) 28.1 - 35.5 N.A. Gross Margin 4.8% - 5.4% +1,020 bps Operating Income (Loss)* (US$ million) 6.3 - 46.9 N.A. Finance Expense (US$ million) - 26.6 - 21.2 + 2 5.5% E B ITDA (US$ million) 33.6 - 20.7 N.A. EPS* (US$) - 0.20 - 0.72 N.A. Second Quarter 2014 Financial Summary Sales Volume Breakdown • Includes $( 2 .9) million change in fair value of profit sharing liability for the second quarter of 2014. • ** ASP of rebar at Longmen Joint Venture Thousands MT Operating Expense Breakdown 9.3 9.7 11.5 9.1 2Q 2013 2Q 2014 Selling Expense G&A Expense USD Million 1,348 1,305 37 1 2Q 2013 2Q 2014 Longmen Joint Venture Other Subsidiaries

9 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. Balance Sheet Summary AS OF (USD 1,000) June 30, 2014 December 31, 2013 Assets: Cash and Restricted Cash $ 492,855 $431,300 Accounts Receivable $11,065 $7,020 Notes Receivable $36,948 $60,054 Inventories $ 208,971 $212,921 Advances on Inventory Purchases $ 177,782 $127,900 Total Current Assets $ 1,170,395 $1,380,724 Property Plant and Equipment $ 1,253,351 $1,271,907 Total Assets $ 2,556,474 $2,700,358 Liabilities: Short Term Notes Payable $875,479 $1,017,830 Accounts Payable $680,571 $670,671 Short Term Loan $420,064 $490,677 Customer Deposits $ 279,176 $152,741 Taxes Payable $4,181 $4,628 Total Current Liabilities $ 2,500,104 $ 2,562,140 Capital Lease Obligations, noncurrent $ 384,830 $ 375,019 Profit Sharing Liability $ 164,067 $ 162,295

10 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. Sales Volume Approx. 3 million mt Approx. 24.4% Total Sales $1.3 ~ $1.4 billion 12.2% ~ 20.8% Net Income * $ 4.5 ~ $6.5 m illion 21.6% ~ 75.7% EPS* $0.08 ~ $0.12 17.6% ~ 76.5% 2H 2014 Y - o - Y Growth Rate Guidance Second Half 2014 Guidance * Net income and EPS attributable to General Steel Holdings, Inc.

11 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. second quarter 2014 earnings call. 11 Q&A Joyce Sung General Steel Holdings, Inc. Tel: +1 - 347 - 534 - 1435 Email: joyce.sung@gshi - steel.com

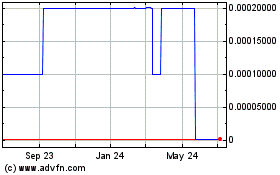

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Jun 2024 to Jul 2024

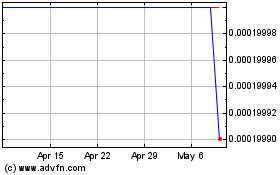

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Jul 2023 to Jul 2024