false

0001374328

0001374328

2024-05-14

2024-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 14, 2024

Commission File Number: 000-52369

FitLife Brands, Inc.

(Exact name of registrant as specified in its charter.)

|

Nevada

|

20-3464383

|

|

(State or other jurisdiction of incorporation

or organization)

|

(IRS Employer Identification No.)

|

5214 S. 136th Street, Omaha, Nebraska 68137

(Address of principal executive offices)

402-884-1894

(Registrant's Telephone number)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

FTLF

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 14, 2024, FitLife Brands, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter ended March 31, 2024. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure

See Item 2.02.

Disclaimer.

The information furnished pursuant to Item 2.02 and 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by referenced.

Disclaimer.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits Index

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FitLife Brands, Inc.

|

| |

|

|

|

Date: May 14, 2024

|

By:

|

/s/ Dayton Judd

|

| |

|

Dayton Judd

|

| |

|

Chief Executive Officer

|

Exhibit 99.1

FitLife Brands Announces First Quarter 2024 Results

OMAHA, NE – May 14, 2024 – FitLife Brands, Inc. (“FitLife” or the “Company”) (NASDAQ: FTLF), a provider of innovative and proprietary nutritional supplements and wellness products, today announced financial results for the first quarter ended March 31, 2024.

Highlights for the first quarter ended March 31, 2024 include:

| |

●

|

Total revenue was $16.5 million, an increase of 54% compared to the first quarter of 2023.

|

| |

●

|

Online sales were $10.8 million, representing 65% of total revenue and an increase of 116% compared to the first quarter of 2023.

|

| |

●

|

Gross margin was 44.0% compared to 41.1% during the first quarter of 2023.

|

| |

●

|

Net income for the first quarter of 2024 was $2.2 million compared to $0.2 million during the same period last year.

|

| |

●

|

Basic earnings per share and diluted earnings per share were $0.47 and $0.43, respectively, compared to $0.03 during the first quarter of 2023.

|

| |

●

|

Adjusted EBITDA was $3.6 million, a 62% increase compared to the first quarter of 2023.

|

| |

●

|

The Company ended the quarter with $16.5 million outstanding on its term loans and cash of $3.3 million, or total net debt of $13.2 million.

|

For the first quarter ended March 31, 2024, total revenue was $16.5 million, an increase of 54% compared to $10.7 million during the same period last year. Online revenue for the quarter was $10.8 million, an increase of 116% compared to the quarter ended March 31, 2023. Online sales for legacy FitLife increased 3% during the quarter compared to the same period last year. Online revenue accounted for 65% and 47% of the Company’s total revenue during the quarters ended March 31, 2024 and 2023, respectively.

Wholesale revenue for the quarter ended March 31, 2024 was $5.7 million, flat when compared to the same period last year. The Company’s recent acquisitions contributed $1.2 million of wholesale revenue during the first quarter of 2024, while Legacy FitLife wholesale revenue was down $1.2 million, or 21%, compared to the same period last year.

Gross margin for the quarter ended March 31, 2024 was 44.0% compared to 41.1% during the same period in the prior year. Excluding the impact of the inventory step-up resulting from the acquisition of Mimi’s Rock Corp (“MRC”), gross margin during the quarter ended March 31, 2023 would have been 42.1%.

Net income for the first quarter of 2024 was $2.2 million compared to $0.2 million during the quarter ended March 31, 2023. Basic earnings per share and diluted earnings per share were $0.47 and $0.43 respectively, compared to $0.03 during the first quarter of 2023. Net income during the first quarter of 2023 was adversely impacted by a number of acquisition-related items that did not recur in 2024 including transaction expenses of $1.4 million, amortization of the inventory step-up valuation of $0.1 million, and a loss on a currency hedge of $0.1 million.

Adjusted EBITDA for the quarter ended March 31, 2024 was $3.6 million, an increase of 62% compared to the same period in 2023.

The Company ended the quarter with $16.5 million outstanding on its term loans and cash of $3.3 million, or total net debt of $13.2 million. As previously disclosed, the Company made a voluntary paydown on its term loan of $2.5 million during the first quarter of 2024 in addition to the scheduled amortization payment of $1.1 million.

Dayton Judd, the Company’s Chairman and CEO, commented “The Company is off to a solid start in 2024 and there are many bright spots in our business. At MRC, I am encouraged that the Dr. Tobias brand—which represents approximately 90% of the MRC business—returned to growth during the quarter despite advertising spend that was 39% lower than in the first quarter of 2023. And although the skin care brands continue to struggle on the top line, they are more profitable now than they were at the time of the acquisition. In total, MRC is significantly more profitable than when we made the acquisition.

“Our legacy FitLife brands continue to face headwinds in the wholesale channel due to declining foot traffic at our brick-and-mortar retail partners. Although the declines were partially offset by growth in the legacy FitLife online business, the online growth rate we experienced during the first quarter was lower than anticipated. We are encouraged, though, that the growth rate for legacy FitLife online sales was much stronger during April with a 13% year-over-year increase.

“In addition, I am excited about a number of new products that we will be introducing this year across several of our brands. Of note, we recently re-launched the MusclePharm Combat Sport protein bar in April 2024. We believe the MusclePharm brand is our most significant organic growth opportunity. Both online and wholesale revenue for MusclePharm ramped up throughout the quarter, and we hope to continue the momentum. Overall, our first quarter results demonstrate that we are continuing to execute our goal of profitably growing revenue and paying down debt.”

The Company will hold an investor conference call on Tuesday, May 14, 2024 at 4:30 pm ET. Investors interested in participating in the live call can dial (833) 492-0064 from the U.S. and provide the conference identification code of 629005. International participants can dial (973) 528-0163 and provide the same code.

About FitLife Brands

FitLife Brands is a developer and marketer of innovative and proprietary nutritional supplements and wellness products for health-conscious consumers. FitLife markets more than 250 different products primarily online, but also through domestic and international GNC® franchise locations as well as through approximately 16,000 additional domestic retail locations. FitLife is headquartered in Omaha, Nebraska. For more information, please visit our website at www.fitlifebrands.com.

Forward-Looking Statements

Statements in this release that are forward looking involve known and unknown risks and uncertainties, which may cause the Company's actual results in future periods to be materially different from any future performance that may be suggested in this news release. Such factors may include, but are not limited to, the ability of the Company to continue to grow revenue, and the Company's ability to continue to achieve positive cash flow given the Company's existing and anticipated operating and other costs. Many of these risks and uncertainties are beyond the Company's control. Reference is made to the discussion of risk factors detailed in the Company's filings with the Securities and Exchange Commission including its reports on Form 10-K and 10-Q. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

Non-GAAP Financial Measures

The financial presentation below contains certain financial measures defined as “non-GAAP financial measures” by the SEC, including non-GAAP EBITDA and non-GAAP adjusted EBITDA. These measures may be different from non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP.

As presented below, non-GAAP EBITDA excludes interest, income taxes, and depreciation and amortization and foreign currency gain/loss. Adjusted non-GAAP EBITDA excludes—in addition to interest, taxes, depreciation and amortization—equity-based compensation, M&A/integration expense, restatement-related expense and non-recurring gains or losses. The Company believes the non-GAAP measures provide useful information to both management and investors by excluding certain expense and other items that may not be indicative of its core operating results and business outlook. The Company believes that the inclusion of non-GAAP measures in the financial presentation below allows investors to compare the Company’s financial results with the Company’s historical financial results and is an important measure of the Company’s comparative financial performance.

v3.24.1.1.u2

Document And Entity Information

|

May 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

FitLife Brands, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 14, 2024

|

| Entity, File Number |

000-52369

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, Tax Identification Number |

20-3464383

|

| Entity, Address, Address Line One |

5214 S. 136th Street

|

| Entity, Address, City or Town |

Omaha

|

| Entity, Address, State or Province |

NE

|

| Entity, Address, Postal Zip Code |

68137

|

| City Area Code |

402

|

| Local Phone Number |

884-1894

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

FTLF

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001374328

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

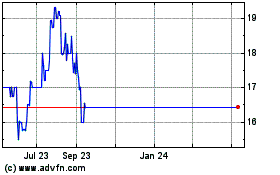

FitLife Brands (PK) (USOTC:FTLF)

Historical Stock Chart

From Jun 2024 to Jul 2024

FitLife Brands (PK) (USOTC:FTLF)

Historical Stock Chart

From Jul 2023 to Jul 2024