Current Report Filing (8-k)

July 28 2022 - 7:30AM

Edgar (US Regulatory)

0000798941falseFirst Citizens BancShares Inc /DE/00007989412022-07-282022-07-280000798941us-gaap:CommonClassAMember2022-07-282022-07-280000798941us-gaap:SeriesAPreferredStockMember2022-07-282022-07-280000798941us-gaap:SeriesCPreferredStockMember2022-07-282022-07-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 28, 2022

_________________________________________________________________

First Citizens BancShares, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-16715 | 56-1528994 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 4300 Six Forks Road | Raleigh | North Carolina | 27609 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (919) 716-7000

________________________________________________________________________________

(Former name or former address, if changed since last report)

| | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Common Stock, Par Value $1 | FCNCA | Nasdaq Global Select Market |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of 5.375% Non-Cumulative Perpetual Preferred Stock, Series A | FCNCP | Nasdaq Global Select Market |

5.625% Non-Cumulative Perpetual Preferred Stock, Series C | FCNCO | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 28, 2022, First Citizens BancShares, Inc. (“BancShares”) announced its results of operations for the quarter ended June 30, 2022. A copy of BancShares’ press release containing this information is attached as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”) and is incorporated herein by reference. The press release is available on BancShares’ Internet site at http://www.firstcitizens.com.

Item 7.01. Regulation FD Disclosure.

As previously announced, BancShares will host a conference call at 9:00a.m. Eastern time on Thursday, July 28, 2022, to discuss its financial results for the quarter ended June 30, 2022. The slides that will be made available in connection with the presentation are attached as Exhibit 99.2 hereto and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information presented herein pursuant to Item 2.02, “Results of Operations and Financial Condition” and Item 7.01, “Regulation FD Disclosure,” including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall the information be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On July 26, 2022, the Board of Directors (the “Board”) of BancShares authorized a share repurchase program for up to 1,500,000 shares of BancShares’ Class A common stock for the period commencing August 1, 2022 through July 28, 2023. This authority supersedes the authority to repurchase shares approved by the Board in April 2020, which expired on July 31, 2020.

Under the newly authorized share repurchase program, shares of BancShares’ Class A common stock may be repurchased from time to time on the open market or in privately negotiated transactions, including through a Rule 10b5-1 plan, but the Board's action does not obligate BancShares to repurchase any particular number of shares, and repurchases may be suspended or discontinued at any time (subject to the terms of any Rule 10b5-1 plan in effect).

The authorization to repurchase Class A common stock will be utilized at management’s discretion. The actual timing and amount of Class A common stock that may be repurchased under the new authorization will depend on a number of factors, including the terms of any Rule 10b5-1 plan then in effect, price, general business and market conditions, and alternative investment opportunities or capital needs. Information regarding share repurchases will be available in BancShares’ periodic reports on Form 10-Q and Form 10-K filed with the Securities and Exchange Commission as required by the applicable rules of the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibits accompany this Report.

| | | | | | | | |

| Exhibit No. | | Description |

| |

| 99.1 | |

| |

| 99.2 | |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Disclosures About Forward-Looking Statements

This Report may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and future performance of BancShares. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “targets,” “designed,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on BancShares’ current expectations and assumptions regarding BancShares’ business, the economy, and other future conditions.

Because forward-looking statements relate to future results and occurrences, they are subject to inherent risks, uncertainties, changes in circumstances and other factors that are difficult to predict. Many possible events or factors could affect BancShares’ future financial results and performance and could cause the actual results, performance or achievements of

BancShares to differ materially from any anticipated results expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others, general competitive, economic, political, geopolitical events (including the military conflict between Russia and Ukraine) and market conditions, the impacts of the global COVID-19 pandemic on BancShares’ business, and customers, the financial success or changing conditions or strategies of BancShares’ customers or vendors, fluctuations in interest rates, actions of government regulators, including the recent and projected interest rate hikes by the Board of Governors of the Federal Reserve Board (the “Federal Reserve”), the potential impact of decisions by the Federal Reserve on BancShares’ capital plans, adverse developments with respect to U.S. or global economic conditions, the impact of the current inflationary environment, the impact of implementation and compliance with current or proposed laws, regulations and regulatory interpretations, the availability of capital and personnel, and the failure to realize the anticipated benefits of BancShares’ previously announced acquisition transaction(s), including the recently-completed transaction with CIT Group Inc., which acquisition risks include (1) disruption from the transaction, or recently completed mergers, with customer, supplier or employee relationships, (2) the possibility that the amount of the costs, fees, expenses and charges related to the transaction may be greater than anticipated, including as a result of unexpected or unknown factors, events or liabilities, (3) reputational risk and the reaction of the parties’ customers to the transaction, (4) the risk that the cost savings and any revenue synergies from the transaction may not be realized or take longer than anticipated to be realized, and (5) difficulties experienced in the integration of the businesses. Except to the extent required by applicable law or regulation, BancShares disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Additional factors which could affect the forward-looking statements can be found in BancShares’ Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and its other filings with the Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | |

| | | First Citizens BancShares, Inc. | |

| | | (Registrant) | |

| | | | |

| | | | |

Date: | July 28, 2022 | | By: /s/ Craig L. Nix | |

| | | Name: Craig L. Nix | |

| | | Title: Chief Financial Officer | |

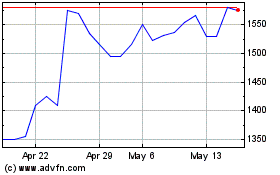

First Citizen Bancshares (PK) (USOTC:FCNCB)

Historical Stock Chart

From Jun 2024 to Jul 2024

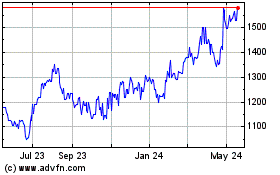

First Citizen Bancshares (PK) (USOTC:FCNCB)

Historical Stock Chart

From Jul 2023 to Jul 2024