false

0001618835

0001618835

2024-07-14

2024-07-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 14, 2024

EVOFEM

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36754 |

|

20-8527075 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

7770

Regents Road, Suite 113-618

San

Diego, California 92122

(Address

of principal executive offices)

(858)

550-1900

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

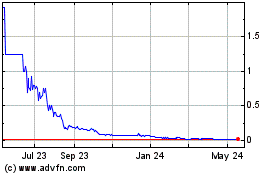

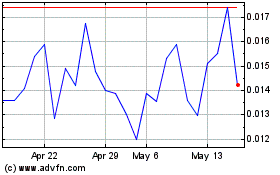

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

EVFM |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

July 14, 2024, Evofem Biosciences, Inc., a Delaware corporation (the “Company”), entered into an asset purchase agreement

(the “Asset Agreement”), with Lupin Inc. (“Lupin”). Pursuant to the Asset Agreement, Lupin sold to the Company

all of its rights and title to Solosec (secnidazole), approved by the Food and Drug Administration (“FDA”)

and currently marketed for sale to consumers as SOLOSEC® (the “Product”). The Company also assumed all of Lupin’s

rights, title and obligations under that certain Omnibus Acquisition Agreement, dated May 1, 2017 by and among Lupin, Saker Merger Sub

LLC, a Delaware limited liability company, Symbiomix Therapeutics, LLC, a Delaware limited liability company, and Shareholder

Representative Services LLC, a Colorado limited liability company (the “OAA”). The transactions contemplated by the

Asset Agreement closed as of July 14, 2024. Capitalized terms used, but not otherwise defined, herein shall have the respective meanings

ascribed to such terms in the Asset Agreement, a copy of which is filed herewith as Exhibit 10.1. As consideration for entering into

the Asset Agreement, the Company will pay to Lupin (i) a one-time upfront payment, plus (ii) sales-based payments, plus

(iii) assumption of the OAA Liabilities, minus (iv) Seller OAA Contributions.

The

Asset Agreement contains customary representations, warranties and indemnities of the Company and Lupin relating to the Product, the

Excluded Assets, Excluded Liabilities of Lupin and the Assumed Liabilities.

The

foregoing description of the Asset Agreement in this Item 1.01 and the transactions contemplated thereunder is not complete and is qualified

in its entirety by reference to the Asset Agreement. A copy of which is hereby filed as Exhibit 10.1 to this Current Report on

Form 8-K and incorporated herein by reference.

Item

8.01 Other Events

On

July 15, 2024, Lupin released a press release announcing its divestiture of the Product through the Asset Agreement. A copy of

the press release is filed as Exhibit 99.1 in this Current Report and is incorporated by reference herein.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

+

Certain schedules, exhibits, annexes and similar attachments have been omitted pursuant to Item 601(b)(10)(iv) of Regulation S-K. A copy

of any omitted schedule or exhibit will be furnished supplementally to the Securities and Exchange Commission upon request; provided,

however, that the Company may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as

amended, for any schedule or exhibit so furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

EVOFEM

BIOSCIENCES, INC. |

| |

|

|

| Dated:

July 18, 2024 |

By: |

/s/

Saundra Pelletier |

| |

|

Saundra

Pelletier |

| |

|

Chief

Executive Officer |

Exhibit

10.1

CERTAIN

INFORMATION CONTAINED IN THIS EXHIBIT, MARKED BY “[*]” HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS BOTH (i) NOT MATERIAL,

AND (ii) IS THE TYPE THAT THE COMPANY TREATS AS PRIVATE OR CONFIDENTIAL.

ASSET

PURCHASE AGREEMENT

BETWEEN

EVOFEM

BIOSCIENCES, INC.

AND

LUPIN

INC.

DATED

AS OF

July

14, 2024

TABLE

OF CONTENTS

| |

Page |

| ARTICLE I DEFINITIONS |

1 |

| Section 1.1. |

Definitions |

1 |

| |

|

|

| ARTICLE II SALE AND PURCHASE OF TRANSFERRED

ASSETS |

11 |

| Section 2.1. |

Purchase and Sale of Assets |

11 |

| Section 2.2. |

Transferred Assets; Excluded Assets |

11 |

| Section 2.3. |

Assumption of Certain Liabilities and Obligations |

14 |

| Section 2.4. |

Assignment of Certain Transferred Assets |

16 |

| Section 2.5. |

Delivery |

17 |

| |

|

|

| ARTICLE III PURCHASE PRICE |

17 |

| Section 3.1. |

Purchase Price |

17 |

| Section 3.2. |

Sales-Based Payments |

17 |

| Section 3.3. |

Seller OAA Contributions |

17 |

| Section 3.4. |

Transition Services |

18 |

| Section 3.5. |

Withholding |

18 |

| |

|

|

| ARTICLE IV THE CLOSING |

18 |

| Section 4.1. |

Closing Date |

18 |

| Section 4.2. |

Closing Deliveries by Seller |

19 |

| Section 4.3. |

Closing Deliveries by Buyer |

19 |

| |

|

|

| ARTICLE V REPRESENTATIONS AND WARRANTIES

OF SELLER |

20 |

| Section 5.1. |

Seller Organization; Good Standing |

20 |

| Section 5.2. |

Authority; Enforceability |

20 |

| Section 5.3. |

No Conflicts |

20 |

| Section 5.4. |

Consents and Approvals |

20 |

| Section 5.5. |

Title to Transferred Assets; Sufficiency of Assets |

21 |

| Section 5.6. |

Litigation |

21 |

| Section 5.7. |

Compliance with Laws |

21 |

| Section 5.8. |

Regulatory Matters |

21 |

| Section 5.9. |

Brokers |

25 |

| Section 5.10. |

Permits |

25 |

| Section 5.11. |

Transferred Contracts |

25 |

| Section 5.12. |

Taxes |

25 |

| Section 5.13. |

Intellectual Property |

26 |

| Section 5.14. |

Undisclosed Liabilities |

28 |

| Section 5.15. |

Conduct in the Ordinary Course of Business |

28 |

| Section 5.16. |

Customers; Sales Practices |

28 |

| Section 5.17. |

Suppliers |

28 |

| Section 5.18. |

The OAA |

28 |

| Section 5.19. |

Books, Records and Documentation |

29 |

| Section 5.20. |

No Other Representations and Warranties |

29 |

| |

|

|

| ARTICLE VI REPRESENTATIONS AND WARRANTIES

OF BUYER |

29 |

| Section 6.1. |

Buyer’s Organization; Good Standing |

29 |

| Section 6.2. |

Authority; Enforceability |

29 |

| Section 6.3. |

No Conflicts |

29 |

| Section 6.4. |

Consents and Approvals |

30 |

| Section 6.5. |

Absence of Restraints; Compliance with Laws |

30 |

| Section 6.6. |

Litigation |

30 |

| Section 6.7. |

Financial Ability |

30 |

| Section 6.8. |

No Brokers |

30 |

| |

|

|

| ARTICLE VII CERTAIN COVENANTS AND AGREEMENTS |

31 |

| Section 7.1. |

Confidentiality |

31 |

| Section 7.2. |

Insurance |

31 |

| Section 7.3. |

Regulatory and Other Authorizations; Consents |

31 |

| Section 7.4. |

Access |

32 |

| Section 7.5. |

Books and Records |

33 |

| Section 7.6. |

Transfer and Assumption of Regulatory Commitments |

33 |

| Section 7.7. |

Certain Tax Matters |

33 |

| Section 7.8. |

Further Assurances |

35 |

| Section 7.9. |

Covenants and Agreements of Buyer |

35 |

| |

|

|

| ARTICLE VIII INDEMNIFICATION |

36 |

| Section 8.1. |

Survival |

36 |

| Section 8.2. |

Indemnification by Seller |

36 |

| Section 8.3. |

Indemnification by Buyer |

36 |

| Section 8.4. |

Limitations |

37 |

| Section 8.5. |

Procedure |

38 |

| Section 8.6. |

Tax Treatment of Indemnification Payments |

40 |

| |

|

|

| ARTICLE IX GENERAL PROVISIONS |

40 |

| Section 9.1. |

Expenses |

40 |

| Section 9.2. |

Notices |

41 |

| Section 9.3. |

Public Announcements |

41 |

| Section 9.4. |

Severability |

42 |

| Section 9.5. |

Counterparts |

42 |

| Section 9.6. |

Entire Agreement |

42 |

| Section 9.7. |

Assignment |

43 |

| Section 9.8. |

Third-Party Beneficiaries |

43 |

| Section 9.9. |

Amendment; Waiver |

43 |

| Section 9.10. |

Schedules |

44 |

| Section 9.11. |

Governing Law; Submission to Jurisdiction |

44 |

| Section 9.12. |

Specific Performance |

44 |

| Section 9.13. |

Limitation on Liability |

45 |

| Section 9.14. |

Rules of Construction |

45 |

| Section 9.15. |

Waiver of Jury Trial |

46 |

| Section 9.16. |

Admissibility into Evidence |

46 |

| Section 9.17. |

No Agency, Joint Venture or Partnership |

46 |

| Section 9.18. |

Waiver of Conflict of Interest; Privilege |

46 |

| Exhibit A |

Assignment and Assumption Agreement |

| Exhibit B |

Bill of Sale |

| Exhibit C |

IP Assignment Agreement |

| Exhibit D |

Transition Services Agreement |

| Exhibit E-1 |

Seller NDA Letter |

| Exhibit E-2 |

Buyer NDA Letter |

| Exhibit F-1 |

Seller IND Letter |

| Exhibit F-2 |

Buyer IND Letter |

| Exhibit G |

Buyer Product Commercialization Plan |

| Exhibit H |

Buyer Budget |

| Exhibit I |

Initial Public Announcement |

ASSET

PURCHASE AGREEMENT

THIS

ASSET PURCHASE AGREEMENT (this “Agreement”), dated as of July 14, 2024, is made by and between Evofem Biosciences,

Inc., a Delaware corporation (“Buyer”), and Lupin Inc., a Delaware corporation (“Seller”). Buyer

and Seller are each referred to herein as a “Party” and collectively referred to herein as the “Parties.”

WHEREAS,

Seller sells the pharmaceutical product that currently is marketed for sale to consumers under the trademark SOLOSEC®, and in connection

therewith, operates the Business (as defined herein); and

WHEREAS,

on the date hereof, Seller wishes to sell to Buyer, and Buyer wishes to (a) purchase from Seller the Transferred Assets (as defined herein)

(for the avoidance of doubt, excluding Excluded Assets (as defined herein), including those Excluded Assets comprising the remaining

portion of the Business (as defined herein)) and (b) assume the Assumed Liabilities (as defined herein), (for the avoidance of doubt,

excluding Excluded Liabilities (as defined herein)), in each case, upon the terms and subject to the conditions set forth in this Agreement.

NOW,

THEREFORE, in consideration of the mutual covenants herein contained and for other good and valuable consideration, the receipt and adequacy

of which are hereby acknowledged, the Parties hereby agree as follows:

ARTICLE

I

DEFINITIONS

Section

1.1. Definitions.

As used in this Agreement, the following terms have the meanings set forth below:

“Accounts

Payable” means all invoices, bills, accounts payable or other trade payables due and owed to any Third Party arising out of

or in connection with the Exploitation of the Product by Seller and any of its respective Affiliates on or prior to the Closing Date

but excluding such invoices, bills, accounts payable or other trade payables for products or services included in the Product or the

Transferred Assets to be delivered after the Closing which, for the avoidance of doubt, shall include the PDUFA program fee invoice from

the Food and Drug Administration due in October, 2024 which Buyer shall timely pay directly to the Food and Drug Administration.

“Affiliate”

means, with respect to any Person, any other Person that controls, is controlled by or is under common control with such Person (and

for this purpose, the term control means the power to direct the management and policies of a Person (directly or indirectly), whether

through ownership of voting securities, by Contract or otherwise (and the terms controlling and controlled have meanings correlative

to the foregoing)).

“Ancillary

Agreements” means the Assignment and Assumption Agreement, the Bill of Sale, the IP Assignment Agreement, the Confidentiality

Agreements, the Transition Services Agreement, and the other documents, instruments, exhibits, annexes, schedules or certificates contemplated

hereby and thereby.

“Anti-Bribery

Laws” shall mean the Foreign Corrupt Practices Act, 15 U.S.C. §§ 78dd-1, et seq., the Anti-Kickback Act of 1986,

applicable legislation implementing the Organization for Economic Cooperation and Development Convention Against Bribery of Foreign Public

Officials in International Business Transactions and all other applicable international anti-bribery laws and all other applicable anti-corruption

or bribery laws, rules and regulations (including any applicable written statements, requirements, directives or policies of any Governmental

Authority) in any jurisdiction in which the applicable Person has conducted business.

“Assignment

and Assumption Agreement” means the Assignment and Assumption Agreement, in the form attached hereto as Exhibit A.

“Bill

of Sale” means the Bill of Sale, in the form attached hereto as Exhibit B.

“Business”

means the Exploitation of the Product as conducted by Seller as of the Closing Date.

“Business

Day” means any day other than a Saturday, Sunday or other day on which banks in Wilmington, Delaware are permitted or required

to close by applicable Law.

“Buyer

Fundamental Representations” means the representations and warranties of Buyer set forth in Section 6.2 (Authority;

Enforceability), and Section 6.3 (No Conflict).

“Calendar

Year” shall mean the twelve (12)-month period commencing on January 1 and ending on December 31 of a given year.

“Code”

means the United States Internal Revenue Code of 1986, as amended.

“Commercialize”

shall mean to promote, market, distribute, sell, offer for sale, have sold and provide product support for the Product pursuant to an

NDA, and “Commercializing” and “Commercialization” shall have correlative meanings.

“Confidentiality

Agreements” has the meaning set forth in Section 7.1.

“Contract”

means any written legally binding contract, subcontract, agreement, instrument, lease, license, commitment, sale and purchase order,

or other instrument, arrangement or understanding of any kind, together with amendments, modifications and supplements thereto.

“Control”

means, with respect to any document, information, material or Intellectual Property right, possession of the right, whether directly

or indirectly, and whether by ownership, license or otherwise, to sell, transfer or assign or grant a license, sublicense or other right

(including the right to reference any regulatory documentation) to or under such document, information, material, or Intellectual Property

right to the extent permitted under applicable Law and as provided for herein without violating the terms of any agreement or other arrangement

with any Third Party.

“Covers”

means, with respect to a Patent Right and a thing or method, such as a referenced product, activity or service, that such Patent Right

would be infringed by the unauthorized making, use, sale, offer for sale, sale, copying, distribution, display, practice, performance,

import, export, lease or other disposition, of such thing or method.

“COVID-19”

means COVID-19 or SARS-COV-2, including any future resurgence or evolutions or mutations thereof and/or any related or associated disease

outbreaks, epidemics and/or pandemics.

“COVID-19

Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing,

shut down, closure, safety or similar Law, directive, guidelines or recommendations promulgated, ordered or made by any Governmental

Authority, including the Centers for Disease Control and Prevention and the World Health Organization, in each case, in connection with

or in response to COVID-19, including any Law passed by any Governmental Authority in response to COVID-19, including the Coronavirus

Aid, Relief, and Economic Security Act of 2020 and the Families First Coronavirus Response Act of 2020 (FFCRA).

“Earnout

Payments” has the meaning set forth in the OAA.

“Earnout

Term” means the period commencing upon the Closing Date and ending upon the fifteenth (15th) anniversary of the

Closing Date.

“Encumbrance”

means, any mortgage, charge, lien, security interest, easement, right of way, pledge or other material encumbrance of any kind.

“Exhibits”

means, collectively, the Exhibits referred to throughout this Agreement.

“Exploitation”,

and related terms such as “Exploit”, shall mean the research, development, investigational use, Manufacture, testing,

storage, import, export, distribution, sale, offering for sale, use, licensing, advertising, marketing and promotion of the Product and

other Commercialization, including the outsourcing of any of the foregoing activities.

“FDA”

means the U.S. Food and Drug Administration.

“FDCA”

shall mean the United States Federal Food, Drug and Cosmetic Act, 21 U.S.C. §301, et seq., as amended, and all related rules, regulations

and guidelines.

“Federal

Health Care Program” shall mean “federal health care program” as such term is defined in 42 U.S.C. § 1320a-7b(f),

including Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), the U.S. Department of Veterans Affairs and U.S.

Department of Defense healthcare and contracting programs, TRICARE and similar or successor programs that are funded, in whole or in

part, by the United States Government.

“Generic

Entry” means the earliest to occur of (a) approval by the FDA under section 505(j) of the FDCA of an application for any product

that identifies the Product as a reference listed drug in the application and (b) the filing of an ANDA with paragraph IV certification

under the Drug Price Competition and Patent Term Restoration Act of 1984 that identifies the Product.

“Good

Clinical Practices” shall have the meaning set forth in the FDCA and its implementing regulations.

“Good

Laboratory Practice” shall mean the applicable then-current standards for laboratory activities for pharmaceutical products,

whether investigational or commercialized, as set forth in the FDCA and any regulations or guidance documents promulgated thereunder,

as amended from time to time, together with any similar standards of good laboratory practice as are required by any Governmental Authority,

as applicable.

“Good

Manufacturing Practices” shall have the meaning set forth in the FDCA and its implementing regulations.

“Governmental

Authority” means any supra-national, federal, foreign, national, state, county, local, municipal or other governmental, legislative,

judicial, regulatory or administrative authority, agency, commission or other instrumentality, any court, tribunal or arbitral body with

competent jurisdiction and any of their respective subdivisions, agencies, instrumentalities, authorities or tribunals, including any

Governmental Authority that is concerned with the safety, efficacy, reliability, Manufacture, Commercialization, Exploitation, investigation,

research, development, sale, distribution or marketing of pharmaceutical products, medical products, biologics or biopharmaceuticals,

including the FDA.

“Governmental

Order” means any order, writ, judgment, injunction, decree, stipulation, determination or award entered by or with any Governmental

Authority.

“IND”

shall mean an investigational new drug application (including any amendment or supplement thereto) submitted to the FDA pursuant to U.S.

21 C.F.R. Part 312, including any amendments thereto.

“Intellectual

Property” shall mean, collectively, all rights of any nature or kind in any of the following in any jurisdiction throughout

the world: (a) Patent Rights, registered trademarks and service marks and applications therefor, Internet domain name registrations and

copyright registrations and applications therefor (collectively, “Registered IP”); (b) unregistered trademarks and

service marks, trade names, domain names, social media names, “tags,” and “handles”, trade dress, product configurations

or other marks, names, logos and slogans embodying business or product goodwill or indications of origin, all translations, adaptations,

derivations and combinations thereof, and all goodwill associated with the businesses in which the foregoing are used; (c) inventions

and discoveries, whether patentable or unpatentable, whether or not memorialized in an invention disclosure, and whether or not reduced

to practice, including articles of manufacture, business methods, compositions of matter, machines, methods, and processes and all improvements

thereto; (d) unregistered copyrights, designs, mask works or other expressions and works of authorship and derivative works and translations

thereof, all moral rights and visual artists’ rights in relation to the foregoing and to registered copyrights and applications

therefor, (e) the right of privacy or publicity, and (f) trade secrets and know-how meeting the definition of a trade secret under the

Uniform Trade Secrets Act (collectively, “Trade Secrets”) and all other Know-How.

“IP

Assignment Agreement” means the IP assignment agreement, in the form attached hereto as Exhibit C.

“IRS”

means the United States Internal Revenue Service.

“Know-How”

shall mean all technical, scientific and other know-how and information, Trade Secrets, knowledge, technology, means, methods, processes,

practices, formulas, instructions, skills, techniques, procedures, experiences, ideas, technical assistance, designs, drawings, assembly

procedures, computer programs, apparatuses, specifications, data, results and other material, including high-throughput screening and

other drug discovery and development technology, pre-clinical and clinical trial results, investigational use information, manufacturing

procedures, test procedures and purification and isolation techniques, (whether or not confidential, proprietary, patented or patentable)

in written, electronic or any other form now known or hereafter developed, and all improvements, whether to the foregoing or otherwise,

and other discoveries, developments, inventions, and other intellectual property (whether or not confidential, proprietary, patented

or patentable).

“Law”

means any applicable law, judgment, order, decree, statute, ordinance, rule, code, regulation, directive or other requirement or rule

of law enacted, issued or promulgated by any Governmental Authority.

“Liability”

means any debt, liability, claim, expense, commitment or obligation of whatever kind, whether direct or indirect, accrued or fixed, absolute

or contingent, matured or not.

“Losses”

means any and all damages, losses, Liabilities, Taxes, judgments, penalties, costs and expenses actually suffered or incurred and paid

(including reasonable legal fees and expenses incurred in investigating and/or prosecuting any claim for indemnification).

“Manufacture”

and “Manufacturing” shall mean all activities related to the production, manufacture, processing, testing, filling,

finishing, packaging, labeling, and shipping and holding (prior to distribution) of the Product or any intermediate thereof, including

quality assurance and quality control.

“Manufacturing

Documentation” shall mean any and all documentation that is necessary, required by applicable Laws and in the possession of

Seller for the Manufacture of the Product (or any component thereof), including, if any, the following: manufacturing process validation

reports; manufacturing instructions; batch record templates; manufacturing standard operating procedures; specifications and test methods

for the Product, raw materials and stability; standard operating procedures and specifications for labeling, packaging, manufacturing

and packaging instructions; master formula; validation reports (analytical, packaging and cleaning); stability data; and approved supplier

lists.

“Material

Adverse Effect” means a material adverse effect on the financial condition or results of operations of Seller; provided,

however, that any adverse effect arising out of, resulting from or attributable to (a) an event or circumstances or series of

events or circumstances affecting (i) the U.S. or any other country or jurisdiction in which Seller or its business operates or the global

economy generally or capital, financial, banking, credit or securities markets generally (whether in the United States or in any other

country or in any international market, and including any disruption thereof, any changes in interest or exchange rates, and any decline

in the price of any security or any market index), (ii) political conditions generally of the U.S. or any other country or jurisdiction

in which Seller or its business operates or globally or (iii) any operating, business, regulatory or other conditions in the industry

generally in which Seller or its business or any customer thereof operates or in which products or services of Seller’s business

are used or distributed, (b) the negotiation, pendency, announcement or consummation of the transactions contemplated by, or the performance

of obligations under, this Agreement or any Ancillary Agreement, including adverse effects related to compliance with the covenants or

agreements contained herein, the failure to take any action as a result of any restrictions or prohibitions set forth herein or the identity

of Buyer, (c) the taking of any action, or refraining from taking any action as contemplated by this Agreement or the Ancillary Agreements,

including the completion of the transactions contemplated hereby or thereby, or the taking of any action, or refraining from taking any

action at the request of Buyer or any of its Affiliates or as expressly required by this Agreement, (d) a breach of this Agreement or

any Ancillary Agreement by Buyer, (e) any adoption, implementation, repeal, modification, reinterpretation or proposal of any applicable

Law or U.S. GAAP, or accounting principles, practices or policies that Seller is required to adopt, or the enforcement or interpretation

thereof, (f) the occurrence of any act of God or other calamity or force majeure events (whether or not declared as such), including

any strike, labor dispute, civil disturbance, embargo, cyber-attack or malware attack, or epidemic, pandemic or outbreak of disease (including

the COVID-19 pandemic, and any future resurgence, or evolutions or mutations, of COVID-19 or related disease outbreaks, epidemics or

pandemics), natural disaster, fire, flood, hurricane, tornado, or other weather event, (g) local, regional, national or international

political or social conditions, including any hostilities, acts of war (whether or not declared), sabotage, terrorism or military actions,

or any escalation or worsening of any such hostilities, act of war, sabotage, terrorism or military actions, and (h) any failure of Seller

to meet any internal or published projections, forecasts or revenue, earning predictions or other measures of financial or operating

performance for any period (it being understood that any events underlying such failure may be taken into account in determining whether

a Material Adverse Effect has occurred), shall not, in any such case, constitute or be deemed to contribute to a Material Adverse Effect,

and otherwise shall not be taken into account in determining whether a Material Adverse Effect has occurred or would be reasonably likely

to occur; provided further, that, in the case of clause (a), the event or circumstance referred to therein shall be taken

into account in determining whether a Material Adverse Effect has occurred or would reasonably be expected to occur only to the extent

that such event or circumstance has a disproportionate effect on Seller, as compared to other participants in the industries in which

Seller operates or conducts its business.

“Milestone

Payments” has the meaning set forth in the OAA.

“NDA”

means a New Drug Application filed with the FDA for approval to market and sell a drug product in the United States.

“NDC

Number” means a national drug code as issued by the FDA.

“OAA”

means that certain Omnibus Acquisition Agreement, dated May 1, 2017, by and among Seller, Saker Merger Sub LLC, a Delaware limited liability

company, Symbiomix Therapeutics, LLC, a Delaware limited liability company, and Shareholder Representative Services LLC, a Colorado limited

liability company.

“OAA

Contingent Consideration Obligations” means those obligations in Section 1.14 (including Exhibits F and G) of the OAA with

respect to the Product, including, without limitation, those with respect to the payment of the applicable Milestone Payments and Earnout

Payments; such obligations to apply, mutatis mutandis, to Buyer.

“Ordinary

Course of Business” means the ordinary course of business through the date hereof consistent with past practice, giving effect

to any adjustments and modifications thereto reasonably necessary or reasonably taken in response to or as a result of the COVID-19 pandemic,

including any COVID-19 Measures. Notwithstanding anything contrary contained herein, the definition of Ordinary Course of Business shall

not include: “channel stuffing”, discounting products beyond what is commercially reasonable and consistent with past practice,

or acting in bad faith or otherwise.

“Participating

Securityholders” has the meaning set forth in the OAA.

“Patent

Rights” shall mean: (a) all patents, patent applications (including provisional applications), statutory invention registrations,

utility models, inventors’ certificates in any country or supranational jurisdiction worldwide; and (b) any substitutions, divisionals,

continuations, continuations-in-part, reissues, renewals, registrations, confirmations, re-examinations, extensions, supplementary protection

certificates, and the like of any such patents or patent applications.

“Payment

Agent” has the meaning set forth in the OAA.

“Permits”

means all consents, approvals, authorizations, certificates, filings, notices, permits, concessions, registrations, franchises, licenses

or rights of or issued by any Governmental Authority, including Product Regulatory Approvals.

“Permitted

Encumbrances” means: (a) Encumbrances for Taxes that are not yet due and payable or which are being contested in good faith;

(b) Encumbrances that do not materially impair the ownership or use of assets to which they relate; (c) Encumbrances imposed by applicable

Law (including materialmen’s, mechanics’, carriers’, workmens’ and repairmen’s liens and transfer restrictions

imposed by national, federal or state securities laws); (d) Encumbrances imposed in the Ordinary Course of Business which are not yet

due and payable, which are being contested in good faith or which are securing Liabilities that are not material to the applicable Transferred

Asset; (e) pledges or deposits to secure obligations under applicable Law to secure public or statutory obligations; (f) liens, title

retention arrangements or deposits to secure the performance of bids, trade contracts (other than for borrowed money), conditional sales

contracts, leases, statutory obligations, surety and appeal bonds, performance bonds and other obligations of a like nature incurred

in the Ordinary Course of Business; (g) other imperfections of title or Encumbrances that do not materially detract from the value of

the applicable asset, right or property or which do not materially interfere with the continued Exploitation or use of the applicable

asset, right or property as currently Exploited or used; (h) Encumbrances imposed or promulgated by Laws with respect to real property

and improvements, including zoning, entitlement, building, environmental and other land use regulations, that do not materially interfere

with the ownership, use or operation of such real property; (i) Encumbrances created by non-exclusive licenses of Intellectual Property

granted in the Ordinary Course of Business; and (j) Encumbrances arising under worker’s compensation, unemployment insurance, social

security, retirement and similar legislation.

“Person”

means any individual, corporation, partnership, limited liability company, joint venture, trust, business association, organization,

Governmental Authority or other entity.

“Personal

Information” means any information relating to an identified or identifiable natural person; an “identifiable natural

person” is one who can be identified, directly or indirectly, in particular by reference to an identifier such as a name, an identification

number, location data, an online identifier, or to one or more factors specific to the physical, physiological, genetic, mental, economic,

cultural or social identity of such natural person.

“Post-Closing

Product” has the meaning set forth in the OAA.

“Pre-Closing

Tax Period” means any taxable period (or portion thereof) ending on or before the Closing Date (including the portion of any

Straddle Period ending on the Closing Date).

“Proceeding”

means any civil, criminal, judicial, administrative or arbitral actions, suits, hearings, litigation, proceedings (public or private),

claims, or investigations by or before a Governmental Authority.

“Product”

means SOLOSEC (secnidazole) approved by FDA under the Product NDA and currently marketed for sale to consumers as SOLOSEC®; such

product, including, for clarity, as marketed and sold throughout the world for any and all indications and under any and all names, and

including any reformulation, improvement, enhancement, refinement, or modification thereof, and any supplement to the Product NDA.

“Product

Labeling” shall mean, with respect to the Product, (a) the full prescribing information for the Product, including any required

patient information and (b) all labels and other written, printed or graphic matter upon a container, wrapper or any package insert utilized

with or for the Product.

“Product

Liabilities” means all claims, Liabilities and Proceedings related to or arising from actual or alleged harm, injury, damage

or death to Persons, defects in the Product or damage to property or businesses, including the Business, irrespective of the legal theory

asserted, and resulting from or alleged to result from the use, sale or Manufacture of the Product.

“Product

NDA” means Application Number [*], as filed with the FDA and approved on September 15, 2017 including all amendments, supplements,

variations, extensions and renewals thereof through the Closing Date.

“Product

Regulatory Approvals” means with respect to the Product in the applicable regulatory jurisdiction, all permits, licenses, certificates,

approvals, clearances, or other authorizations of or recognized by the applicable Governmental Authority necessary to Exploit the Product

in such regulatory jurisdiction in accordance with applicable Law (including NDAs, INDs, 510(k)s, 505(b)(2)s or their foreign equivalents,

all supplements and amendments thereto, and, only to the extent required by applicable Law, pricing and reimbursement approvals).

“Regulatory

Correspondence” shall mean all applications, submissions, filings, reports or other documents, submitted or required to be

submitted to any Governmental Authority, including the FDA, including amendments or supplements to any such documents and correspondence

and other submissions related thereto (including minutes and official contact reports relating to any communications with any Governmental

Authority), annual reports, safety reports, including adverse event reports, other periodic reports, and electronic establishment registration

and drug listing files, as well as all correspondence received from such Governmental Authority and regulatory and clinical files and

data pertaining to the foregoing in possession of Seller, whether in paper or electronic form.

“Regulatory

Documentation” shall mean all regulatory, scientific and technical documents, and any other books and records, owned, maintained

or in the possession of Seller and related solely to the Product, including (a) the Regulatory Correspondence, (b) all applications,

registrations, clearances, authorizations and approvals (including all Product Regulatory Approvals), and non-clinical and clinical study

authorization applications or notifications (including all supporting files, writings, data, studies and reports) prepared for submission

to a Governmental Authority or research ethics committee with a view to the granting of any Product Regulatory Approval, (c) correspondence

and reports with or to Governmental Authorities necessary to Exploit the Product as of or following the Closing Date submitted to or

received from Governmental Authorities (including minutes and official contact reports relating to any communications with any Governmental

Authority) and relevant supporting documents submitted to or received from Governmental Authorities with respect thereto, including regulatory

drug lists, Product Labeling used as of the Closing Date, adverse event files and complaint files, (d) all research and development data

(including all bioequivalence and other clinical trial data) and investigational use information related to the Transferred Assets or

the Product, including those contained in or generated in support of the INDs, and NDAs, together with all applicable books and records,

(e) all development work, formulations, and analytical methods related to the Product or any IND or NDA and any applicable supplements

thereto, and (f) all data (including clinical and pre-clinical data) and investigational use related to the Product contained in any

of the foregoing, in each case, other than any such documents, books or records relating to the advertising, promotion or marketing of

the Product.

“Representatives”

means the directors, officers, employees, agents, or advisors (including attorneys, accountants, investment bankers, financial advisers

and other consultants and advisors) of the specified party hereto.

“Schedules”

means, collectively, the disclosure schedules, dated as of the date hereof, delivered by Seller to Buyer, as supplemented or amended

in accordance with this Agreement, which forms a part of this Agreement.

“SEC”

means the United States Securities and Exchange Commission.

“Seller

Fundamental Representations” means the representations and warranties of Seller set forth in Section 5.1, (Seller

Organization; Good Standing) Section 5.2 (Authority; Enforceability), Sections 5.3(a) and (b) (No Conflicts),

Section 5.5(a) (Title to Transferred Assets), Section 5.9 (Brokers) and Section 5.18 (OAA).

“Seller’s

Knowledge” means, the actual knowledge, after making a reasonable inquiry of such Person’s direct reports under the circumstances,

of each of Fabrice Egros, Thomas Gillespie, Emmanuel Obanu, Abel Rajan and Dawn Brindley.

“Seller

Taxes” means (a) all Taxes arising from or with respect to the Transferred Assets that are incurred in or attributable to any

Pre-Closing Tax Period or to the pre-Closing portion of any Straddle Period; (b) all Taxes of Seller or any Affiliate of Seller for any

period; and (c) the Seller’s share of Transfer Taxes set forth in Section 7.7(c).

“Straddle

Period” means any taxable period beginning on or before the Closing Date and ending after the Closing Date.

“Tax(es)”

means all U.S. federal, state, and local and non-U.S. taxes, assessments, and other governmental charges, duties, impositions, and liabilities

of any kind whatsoever in the nature of taxes, including income, gross receipts, profits, franchise, license, registration, capital stock,

sales, use, value added, ad valorem, real property, personal property, transfer, stamp, payroll, employment, occupation, severance, unemployment,

disability, social security (or similar), excise, recapture, premium, alternative or add-on minimum, estimated, environmental, customs,

escheat, unclaimed property, withholding taxes, or other charge in the nature of tax imposed by a Governmental Authority, whether computed

on a separate or consolidated, unitary, or combined basis or in any other manner, together with all interest, penalties, and additions

with respect thereto, whether disputed or not.

“Tax

Contest” means any Tax audit, claim, dispute, examination, investigation, or other proceeding related to the Transferred Assets

for any Pre-Closing Tax Period (including the pre-Closing portion of any Straddle Period).

“Tax

Return” means any report, return, election, notice, estimate, declaration, information statement, claim for refund, and other

forms and documents (including all schedules, exhibits and other attachments thereto and including all amendments thereof) relating to

Taxes or filed or required to be filed with any Governmental Authority.

“Third

Party” means any Person, other than the Parties and their Affiliates.

“Transition

Services Agreement” means the Transition Services Agreement, in the form attached hereto as Exhibit D.

“Treasury

Regulations” means the regulations promulgated under the Code.

“U.S.”

or “U.S.A.” means the United States of America.

“U.S.

GAAP” means U. S. Generally Accepted Accounting Principles.

ARTICLE

II

SALE AND PURCHASE OF TRANSFERRED ASSETS

Section

2.1. Purchase and Sale of Assets .

Upon the terms and subject to the conditions of this Agreement, and subject to Section

2.4, at the Closing, Seller shall sell, assign, transfer, convey and deliver to Buyer, and Buyer shall purchase, acquire and accept

from Seller all right, title and interest of Seller in, to and under the Transferred Assets, free and clear of all Encumbrances, other

than Permitted Encumbrances.

Section

2.2. Transferred Assets; Excluded Assets .

(a)

The term “Transferred Assets” means the following assets, rights or interests of Seller:

| (i) | the

Contracts listed in Schedule 2.2(a)(i) (the “Transferred Contracts”); |

| (ii) | all

of the following Intellectual Property owned or purported to be owned by Seller (collectively,

the “Transferred Intellectual Property”): |

| (A) | the

Patent Rights that Cover the Product identified on Schedule 2.2(a)(ii)(A) (the “Product

Patent Rights”); |

| (B) | (1)

the Registered IP and (2) all material unregistered trademarks, trade names, service marks,

copyrights and domain names and social media names, “tags,” and “handles”;

including all registrations or applications for registrations thereof with Governmental Authorities,

in each case, other than Patent Rights, used in the Exploitation of the Product but only

as identified on Schedule 2.2(a)(ii)(B) (the “Product Non-Patent IP”); |

| (C) | all

Know-How that is owned or purported to be owned by Seller as of the Closing Date and that

relates solely to the Product except with regard to the advertising, marketing or promotion

of the Product; and |

| (D) | all

goodwill appurtenant to, or associated with, any of the foregoing, any and all rights of

renewal relating to any of the foregoing, and all past, present or existing, and future claims,

causes of action, rights of recovery and rights of set-off of any kind (including the right

to sue and recover for infringements or misappropriations) against any Person related to

or arising from any of the foregoing; |

| (iv) | all

books and records, in whatever form or medium (e.g., audio, electronic, visual or print),

for customers’ and suppliers’ lists as set forth in the Schedules, laboratory

records and preclinical and clinical marketing studies (but expressly excluding any and all

such books and records comprising electronic mail of Seller), regulatory notes and letters,

and manufacturing information and reports, in each case, solely to the extent (and only to

the extent) related to the other Transferred Assets or Assumed Liabilities and in existence

on the Closing Date (the “Transferred Books and Records”), it being agreed

and acknowledged that (A) Seller shall be entitled to redact or otherwise remove or eliminate

from any of the foregoing any data, information or materials that is not related to the Transferred

Assets or Assumed Liabilities and (B) nothing in this Section 2.2(a)(iv) shall be

deemed to require Seller to create any of the foregoing; |

| (v) | all

Regulatory Documentation relating solely to the Product NDA, excluding the Product NDC Number

and all other Product Regulatory Approvals and Permits; |

| (vi) | all

Manufacturing Documentation; |

| (vii) | any

and all (A) causes of action and/or claims of Seller (including remedies thereunder), and

(B) amounts due to Seller in respect of, actions or judgments; in either case relating to

or arising from one or more of the Transferred Assets and arising in respect of, or otherwise

attributable to, the period after the Closing Date, including unliquidated rights under manufacturers’

or vendors’ warranties in respect of Transferred Assets; |

| (viii) | to

the extent transferable, all rights of Seller under or pursuant to all warranties, representations,

indemnities and guarantees made by suppliers, manufacturers, intermediaries, distributors

and contractors in connection with products sold to Seller and comprising or incorporated

in any Transferred Asset, but excluding such rights with respect to any Excluded Asset; |

| (ix) | all

Non-Transferable Assets that are subsequently assigned or transferred to Buyer pursuant to

Section 2.4; and |

| (x) | all

goodwill and other intangible assets associated with the Transferred Assets or the Product. |

(b)

Seller and Buyer expressly agree and acknowledge that the Transferred Assets will not include any assets of any kind, nature, character

or description (whether real, personal or mixed, whether tangible or intangible, whether absolute, accrued, contingent, fixed or otherwise,

and wherever situated) that is not expressly included in the definition of “Transferred Assets” in Section 2.2(a).

For clarity, the “Transferred Assets” do not include the following assets, rights or interests of Seller (collectively, the

“Excluded Assets”):

| (i) | all

personal property or personal productivity equipment (including laptops, personal computers,

tablets, printers and mobile devices) used by any employees of Seller in the conduct of the

Business; |

| (ii) | all

marketing materials, research data, customer and sales information, product literature, advertising

and other promotional materials and data, and training and educational materials, in whatever

form or medium (e.g., audio, electronic, visual or print), except as otherwise expressly

provided in this Agreement or any Ancillary Agreement; |

| (iii) | all

books, records, data, documents and other materials owned by or in possession of Seller other

than the Transferred Books and Records; |

| (iv) | all

organizational documents, qualifications to do business as a foreign corporation, arrangements

with registered agents relating to foreign qualifications, taxpayer and other identification

numbers, seals, minute books, stock transfer books, blank stock certificates and other documents

relating to the organization, maintenance and existence of Seller as a corporation; |

| (v) | all

cash and cash equivalents; |

| (vi) | all

rights of Seller under this Agreement and the Ancillary Agreements; |

| (vii) | all

insurance policies and binders and all claims, refunds and credits from insurance policies

or binders due or to become due with respect to such policies or binders; |

| (viii) | all

electronic email except such email that is encompassed in Transferred Books and Records; |

| (ix) | all

Regulatory Documentation (including the Product NDC Number) other than Regulatory Documentation,

Regulatory Correspondence and Product Regulatory Approvals that relates solely to the Product

NDA and the Product IND, as applicable; |

| (x) | all

Contracts other than the Transferred Contracts; |

| (xi) | (A)

all records and reports prepared or received by Seller in connection with the sale of the

Transferred Assets and the transactions contemplated hereby, including all analyses relating

to the Product or Buyer so prepared or received; (B) all confidentiality agreements with

prospective purchasers of the Product or any portion thereof, and (C) all bids and expressions

of interest received from Third Parties with respect to the Product; |

| (xii) | (A)

all real property and any buildings, improvements and fixtures thereon; and (B) all leasehold

interests, including any prepaid rent, security deposits and options to renew or purchase

in connection therewith, of Seller; |

| (xiii) | all

Intellectual Property other than the Transferred Intellectual Property; |

| (xiv) | all

Permits whether or not relating to the Product; |

| (xv) | Non-Transferable

Assets, subject to Section 2.4; and |

| (xvi) | all

computer hardware and networks owned by Seller. |

Section

2.3. Assumption of Certain Liabilities and Obligations

..

(a)

Upon the terms and subject to the conditions set forth herein and subject to Section 2.4, Buyer agrees, effective at the Closing,

to assume and to timely satisfy and discharge the following Liabilities of Seller relating to the Transferred Assets, in each case other

than the Excluded Liabilities (all of the foregoing Liabilities being collectively referred to hereinafter as the “Assumed Liabilities”):

| (i) | except

for the Seller OAA Contributions under Section 3.3, all Liabilities arising from the

OAA (including, for the avoidance of doubt, the OAA Contingent Consideration Obligations,

but excluding any Liabilities that occurred prior to the Closing Date resulting from a breach,

violation, penalty or similar Liability as a result of an action or omission by Seller) (the

“OAA Liabilities”); |

| (ii) | all

Liabilities arising solely out of or relating to Proceedings commenced after the Closing,

irrespective of the legal theory asserted, arising from the Exploitation of the Product or

the use of the Transferred Assets, in each case, solely to the extent relating to the period

of time after the Closing Date (subject to the terms and provisions of this Agreement and

the Ancillary Agreements); |

| (iii) | all

Product Liabilities relating to the Product sold after the Closing; |

| (iv) | all

Liabilities to third-party customers, third-party suppliers or other Third Parties, solely

to the extent relating to the Product or the Transferred Assets and ordered in the Ordinary

Course of Business (or at the express request of Buyer) either (i) on or prior to the Closing,

but scheduled to be delivered or provided after the Closing, or (ii) after the Closing; |

| (v) | all

Liabilities arising out of or relating to any Transferred Contract after the Closing, to

the extent relating to the period of time after the Closing Date (but not including any Liabilities

that occurred prior to the Closing Date in connection with a breach, violation, penalty or

similar Liability as a result of an action or omission by Seller); |

| (vi) | all

other Liabilities arising out of or relating to the Product or the Transferred Assets, to

the extent relating to the period of time after the Closing, including the use, ownership,

possession, operation, management, business integration, sale or lease of the Transferred

Assets and the Manufacture, Exploitation or Commercialization of any Product by Buyer after

the Closing Date. |

(b)

Except to the extent expressly included in the Assumed Liabilities, Buyer will not assume or be responsible or liable for any Liabilities

of Seller, including the following (collectively, the “Excluded Liabilities”):

| (i) | the

Seller OAA Contributions under Section 3.3 and any Liabilities arising from the OAA

that occurred prior to the Closing Date resulting from a breach, violation, penalty or similar

Liability as a result of an action or omission by Seller; |

| (ii) | all

Liabilities arising out of or relating to Proceedings regardless of when such Proceeding

was commenced or made, that arose from the Exploitation of the Product or the use of the

Transferred Assets, in each case, by Seller prior to Closing; |

| (iii) | all

Product Liabilities relating to Product sold prior to Closing; |

| (iv) | all

Liabilities to third-party customers, third-party suppliers or other Third Parties for the

Product, materials and services, to the extent relating to the Product or the Transferred

Assets, in each case, arising prior to the Closing or relating to the period of time prior

to the Closing; |

| (v) | all

Liabilities arising out of or relating to the return of the Product sold by Seller prior

to the Closing; |

| (vi) | all

Liabilities for any credits or rebates in respect of the Product and all Liabilities arising

out of or relating to any recall or post-sale warning in respect of the Product, in each

case, sold by Seller on or prior to the Closing, regardless of whether such Liabilities arose

prior to or after the Closing; |

| (vii) | except

as expressly provided in this Section 2.3, all Liabilities to the extent related to

the Excluded Assets; |

| (viii) | all

Liabilities arising out of or relating to any Transferred Contract, to the extent relating

to the period of time prior to the Closing; |

| (ix) | all

Liabilities with respect to any current or former employee or contractor of Seller; |

| (xi) | all

Liabilities related to any Accounts Payable; |

| (xii) | all

Liabilities for any indebtedness of Seller; and |

| (xiii) | other

than the Assumed Liabilities, all other Liabilities arising out of or relating to the Transferred

Assets, to the extent such Liabilities relate to the period of time prior to the Closing. |

Section

2.4. Assignment of Certain Transferred Assets

..

(a)

Notwithstanding the foregoing, this Agreement shall not constitute an agreement for Seller to sell, convey, assign, transfer or deliver

to Buyer any Transferred Asset or any claim or right or any benefit arising thereunder or resulting therefrom or to enter into or fulfill

its obligations under this Agreement and the Ancillary Agreements, or for Buyer to purchase, acquire, or receive any Transferred Asset

or to enter into or fulfill its obligations under this Agreement and the Ancillary Agreements if an attempted sale, conveyance, assignment,

transfer or delivery thereof, or an agreement to do any of the foregoing, without the consent, authorization or approval of a Third Party

(including any Governmental Authority), would constitute a breach or other contravention thereof or a violation of Law. For clarity,

if any Contract that would otherwise constitute a Transferred Contract, or other asset that would otherwise constitute a Transferred

Asset, is not assignable or transferable as contemplated in this Section 2.4(a) (each, a “Non-Transferable Asset”),

such asset shall not be deemed a Transferred Asset; provided, however, following Seller’s receipt of the relevant

consent, authorization or approval, as applicable, Seller shall promptly assign or transfer to Buyer the Non-Transferable Asset, and

such asset shall thereafter be deemed a “Transferred Asset” for purposes of this Agreement. Schedule 2.4(a) sets forth

a list of the Non-Transferable Assets as of the date hereof.

(b)

If, on the Closing Date, any such consent, authorization or approval is not obtained, or if an attempted sale, conveyance, assignment,

transfer or delivery thereof would constitute a breach or other contravention or a violation of Law, Seller will, for one hundred and

twenty (120) days following the Closing Date, use commercially reasonable efforts to obtain any such consent, authorization or approval

as promptly as practicable after the date hereof, and Buyer shall, and shall cause each of its applicable Affiliates to, use its commercially

reasonable efforts to cooperate with Seller to obtain any such consent, authorization or approval, necessary for the sale, conveyance,

assignment, transfer or delivery of any such Non-Transferable Asset to Buyer, and upon receipt of such consent, authorization or approval,

Seller shall promptly assign or transfer to Buyer such Non-Transferable Asset. Prior to having the ability to convey a Non-Transferable

Asset as provided in this Section 2.4(b), Seller and Buyer will cooperate and use commercially reasonable efforts to obtain a

mutually acceptable arrangement under which Buyer would, in compliance with Law and the terms of the applicable Non-Transferable Asset,

obtain the benefits of, and assume the obligations and bear the economic burdens associated with, such Non-Transferable Asset, claim,

right or benefit in accordance with this Agreement, including subcontracting, sublicensing or subleasing to Buyer, or under which Seller

would (i) enforce for the benefit of Buyer any and all of its or their rights against a Third Party (including any Governmental Authority)

associated with such Non-Transferable Asset, claim, right or benefit, and (ii) promptly pay to Buyer, when received, all monies received

by it under any such Non-Transferable Asset, claim, right or benefit, and Buyer would assume the obligations and bear the economic burdens

associated therewith (provided that in no event shall Seller be required to take any action that would result in any additional

economic obligations or other requirements applicable to Seller). In the event that Seller remains unable to convey such Non-Transferable

Asset after using such commercially reasonable efforts to do so for one hundred and twenty (120) days following the Closing Date, and

during such period in which Seller attempts to obtain such consent, authorization or approval, Seller, upon Buyer’s prior written

request, will cooperate with Buyer and use commercially reasonable efforts to assist Buyer in entering into a new contract or contracts

with the applicable Third Party on substantially similar terms (provided that such assistance shall not include assistance by

Seller with the negotiation of commercial terms between Buyer and the applicable Third Party related to such new contract or contracts)

(provided further that nothing in this Section 2.4(b) shall require Seller to pay any consideration or make any concession

with respect to any novation or assignment).

Section

2.5. Delivery .

At the Closing, Seller shall deliver, or cause to be delivered, to Buyer, as applicable, all of the Transferred Assets (other than any

Non-Transferrable Assets), which shall be delivered to Buyer in a form and to a location to be mutually agreed between Buyer and Seller

on the Closing Date; provided that, to the extent reasonably practicable, Seller shall deliver, or cause to be delivered, to Buyer all

of the Transferred Assets (other than any Non-Transferrable Assets) through electronic delivery or in another manner reasonably calculated

and legally permitted to minimize or avoid the incurrence of any transfer or sales Taxes if such method of delivery does not adversely

affect the condition, operability, or usefulness of any Transferred Asset. Each of Buyer and Seller shall be responsible for and pay

50% of any and all cost and expense for such delivery of the Transferred Assets (other than any Non-Transferrable Assets).

ARTICLE

III

PURCHASE PRICE

Section

3.1. Purchase Price .

The consideration for the Transferred Assets shall be (i)

an aggregate cash amount equal to the sum of (A) [*] (the “Closing Date Payment”),

plus (B) the Sales-Based Payments, plus

(C) assumption of the OAA Liabilities minus (D) the

Seller OAA Contributions (such aggregate sum, the “Purchase Price”).

Section

3.2. Sales-Based

Payments .

Buyer shall pay to Seller those certain payments pursuant to the terms of, and as set forth on, Schedule 3.2.

Section

3.3. Seller OAA Contributions.

(a)

Seller shall pay or cause to be paid to the Payment Agent directly, on behalf of Buyer, by wire transfer of immediately available funds,

to an account designated by the Payment Agent and for the benefit of the Participating Securityholders the following amounts (the “Seller

OAA Contributions”):

| (i) | on

or before Friday, March 14, 2025, an amount equal to the Milestone Payments due prior to

the first anniversary of the Closing; and |

| (ii) | on

or before Friday, March 13, 2026, an amount equal to the Milestone Payments due prior to

the second anniversary of the Closing. |

(b)

If, after the Closing Date, any Milestone Payment is adjusted, either in amount, timing or other conditions, such adjustment shall apply

to the Seller OAA Contributions set forth in clauses (i) and (ii) of Section 3.3(a), as applicable, mutatis mutandis,

provided that, Seller shall have the right to consent to any increase in any such adjustment in its sole discretion.

(c)

If any Seller OAA Contribution due under Section 3.3 is not paid when due (a “Delinquent Seller OAA Contribution”)

such Delinquent Seller OAA Contribution shall accrue interest from the date due at the rate of prime (as reported in The Wall Street

Journal (Eastern U.S. Edition)) plus two and one half (2.5) percentage points or the maximum rate allowable by applicable Law, whichever

is less. The payment of such interest shall not limit Buyer to receive payment from exercising any other rights it may have as a consequence

of the lateness of any payment. In addition to the foregoing, at any time, Buyer may, in its sole discretion and upon written notice

to Seller, set off all or a portion of any Delinquent Seller OAA Contribution, plus any interest accrued pursuant to this Section

3.3(c), against any amounts then due and payable by Buyer to Seller pursuant to this Agreement.

Section

3.4. Transition

Services . The Parties shall promptly and in good faith implement a transition

services agreement in substantially the form attached hereto as Exhibit D.

Section

3.5. Withholding .

Buyer and any other applicable withholding agent shall be entitled to deduct and withhold from all amounts payable pursuant to this Agreement

all amounts, including Taxes, that Buyer may be required to deduct and withhold under applicable Law. If Buyer or any other applicable

withholding agent determines that withholding from any payment of the Purchase Price payable after the Closing contemplated hereunder

to Seller is required under applicable Law, then Buyer shall provide Seller with advance written notice prior to the withholding so as

to provide Seller with an opportunity to provide any form or documentation or take such other steps in order to eliminate or reduce such

withholding. Any amounts so deducted or withheld shall be timely paid over to the appropriate Governmental Authority or other appropriate

Person. To the extent such amounts are so deducted and withheld and paid over to the appropriate Governmental Authority or other appropriate

Person, such amounts shall be treated as having been paid to the Person to whom such amounts would otherwise have been paid.

ARTICLE

IV

THE CLOSING

Section

4.1. Closing Date .

The closing of the transactions contemplated by this Agreement (the “Closing”)

shall take place remotely via the electronic exchange of documents and signature pages on the date hereof (the “Closing

Date”). For purposes of this Agreement and the transactions contemplated hereby, the Closing

will be deemed to occur and be effective, and title to and risk of loss associated with the Transferred Assets, shall be deemed to occur

at 12:01 a.m., Eastern Standard Time, on the Closing Date.

Section

4.2. Closing Deliveries by Seller.

At the Closing, Seller shall deliver or cause to be delivered to Buyer:

(a)

a counterpart of the Assignment and Assumption Agreement, duly executed by Seller;

(b)

a counterpart of the Bill of Sale, duly executed by Seller;

(c)

a counterpart of the IP Assignment Agreement, duly executed by Seller;

(d)

a counterpart of the Transition Services Agreement, duly executed by Seller;

(e)

a letter to the FDA, substantially in the form attached hereto as Exhibit E-1 (the “Seller NDA Letter”), executed

by Seller, informing the FDA of the transfer of the Product NDA to Buyer, such Seller NDA Letter to be delivered by Seller in accordance

with Section 7.3;

(f)

a letter to the FDA, substantially in the form attached hereto as Exhibit F-1 (the “Seller IND Letter”), executed

by Seller, informing the FDA of the transfer of the IND for the Product to Buyer, such Seller IND Letter to be delivered by Seller in

accordance with Section 7.3; and

(g)

a duly executed IRS Form W-9 of Seller.

Section

4.3. Closing Deliveries

by Buyer . At the Closing, Buyer shall deliver to Seller:

(a)

the Closing Date payment;

(b)

a counterpart of the Assignment and Assumption Agreement, duly executed by Buyer;

(c)

a counterpart of the Bill of Sale, duly executed by Buyer;

(d)

a counterpart of the IP Assignment Agreement, duly executed by Buyer;

(e)

a counterpart of the Transition Services Agreement, duly executed by Buyer;

(f)

a letter to the FDA, substantially in the form attached hereto as Exhibit E-2 (the “Buyer NDA Letter”), executed

by Buyer, accepting the transfer of the Product NDA to Buyer, such Buyer NDA Letter to be delivered by Buyer in accordance with Section

7.3; and

(g)

a letter to the FDA, substantially in the form attached hereto as Exhibit F-2 (the “Buyer IND Letter”), executed

by Buyer, accepting the transfer of the IND for the Product to Buyer, such Buyer IND Letter to be delivered by Buyer in accordance with

Section 7.3.

ARTICLE

V

REPRESENTATIONS AND WARRANTIES OF SELLER

As

of the date of this Agreement, Seller hereby represents and warrants to Buyer that:

Section

5.1. Seller Organization; Good Standing.

Seller is duly incorporated, validly existing and, to the extent legally applicable, in good standing under the laws of Delaware and

has the requisite power and authority to operate its business as now conducted. Seller is duly qualified to conduct business as a foreign

corporation and, to the extent legally applicable, is in good standing in each jurisdiction where the nature of the business conducted

by it makes such qualification necessary, except where the failure to so qualify or be in good standing would not, individually or in

the aggregate, reasonably be expected to materially delay the consummation of the transactions contemplated hereby or have a Material

Adverse Effect.

Section

5.2. Authority; Enforceability.

Seller has the requisite corporate power and authority to enter into this Agreement and to consummate the transactions contemplated hereby.

The execution and delivery of this Agreement and the Ancillary Agreements by Seller and the consummation of the transactions contemplated

hereby and thereby have been duly and validly authorized. This Agreement has been duly executed and delivered by Seller, and upon execution

and delivery thereof, the Ancillary Agreements will have been duly executed and delivered by Seller, and assuming the due authorization,

execution and delivery of this Agreement by Buyer, this Agreement constitutes, and upon the due authorization, execution and delivery

thereof by Buyer, the Ancillary Agreements will constitute the legal, valid and binding obligation of Seller, enforceable against Seller

in accordance with the terms hereof, subject to the effect of any applicable Laws relating to bankruptcy, insolvency, reorganization,

moratorium, fraudulent transfer and other similar applicable Laws relating to or affecting creditors’ rights generally from time

to time in effect and to general principles of equity, regardless of whether considered in a Proceeding in equity or at law (the “Enforceability

Exceptions”).

Section

5.3. No Conflicts. The execution, delivery

and performance by Seller of this Agreement and the Ancillary Agreements and the consummation by Seller of the transactions contemplated

hereby and thereby do not, and will not (a) conflict with or violate any Law or Governmental Order applicable to Seller, (b) conflict

with or violate, in any material respect, any provision of the articles of incorporation or by-laws (or similar organizational document)

of Seller, or (c) result in any breach of, or constitute a default under, or give to any Person any rights of termination, amendment,

acceleration or cancellation of, or result in the creation of any Encumbrance (other than a Permitted Encumbrance) on any of the Transferred

Assets pursuant to any note, bond, mortgage, indenture, contract, agreement, lease, license, permit, franchise or other instrument to

which Seller (with respect to the Transferred Assets) is a party or by which any Transferred Asset is bound, except for any consents,

approvals, authorizations and other actions set forth in Schedule 5.3 or described in Section 5.4.

Section

5.4. Consents and Approvals .

The execution, delivery and performance by Seller of this Agreement and the Ancillary Agreements and the consummation by Seller of the

transactions contemplated hereby and thereby do not and will not require any material consent, approval, authorization or other similar

action by, or any material filing with or notification to, any Governmental Authority by Seller, except (a) to notify the FDA of the

transfer of the Product NDA and IND to Buyer or (b) where the failure to obtain such consent, approval, authorization, or action or to

make such filing or notification would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect

or would not prevent or materially impede, interfere with, hinder or delay the ability of Seller to consummate the transactions contemplated

by, or perform its obligations under this Agreement or any of the Ancillary Agreements. No filing, waiting period or approval pursuant

to any U.S. or non-U.S. antitrust or competition Laws is required with respect to the transactions contemplated by this Agreement.

Section

5.5. Title to Transferred Assets; Sufficiency

of Assets .

(a)

Seller has good, valid and marketable title to all of the Transferred Assets, free and clear of all Encumbrances, other than Permitted

Encumbrances. The Transferred Assets include all assets and rights of Seller that were exclusively used or held for use by Seller relating

to the Product.

(b)

Except for (i) the assets, properties and rights used to perform the services that are the subject of the Transition Services Agreement

and (ii) the assets set forth on Schedule 5.5, the Transferred Assets constitute all of the material assets, properties and rights

owned, leased or held by Seller for the operation of the Business as of immediately prior to the Closing.

Section

5.6. Litigation. As of the date hereof,

there is no (a) Proceeding pending or, to Seller’s Knowledge, threatened in writing against Seller, or (b) injunctive, declaratory,

or other equitable relief or remedy affecting the ownership right of or in any Transferred Asset or involving an investigation or suit

by any Governmental Authority, in each of (a) and (b) relating to the Product.

Section

5.7. Compliance with Laws.

Seller is not in material violation of any Laws or Governmental Orders applicable to the conduct of the Business or the Product. Seller

is in compliance with all applicable Anti-Bribery Laws. Without limiting the foregoing, neither Seller, nor any of its Representatives

acting on its behalf, has, with respect to the Product, the Transferred Assets or the transactions contemplated by this Agreement or

any of the Ancillary Agreements, (i) used any funds for unlawful contributions, gifts, entertainment or other unlawful expenses related

to political activity, (ii) made any unlawful payment or offered anything of value to foreign or domestic government officials or employees

or to foreign or domestic political parties or campaigns, or (iii) violated any applicable money laundering or anti-terrorism law or

regulation.

Section

5.8. Regulatory Matters .

(a)