NasdaqFALSE000165194400016519442024-06-122024-06-1200016519442024-04-182024-04-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 12, 2024

DERMTECH, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38118 | 84-2870849 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

12340 El Camino Real

San Diego, CA 92130

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code (858) 450-4222

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.0001 per share | DMTK | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.03. Bankruptcy or Receivership.

On June 18, 2024, after considering various strategic alternatives, DermTech, Inc. and its subsidiary, DermTech Operations, Inc. (together, the “Company” or “DermTech”) filed voluntary petition for relief under Chapter 11 of Title 11 (“Chapter 11”) of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”), thereby commencing a Chapter 11 case for the Company - In re DermTech, Inc., et. al. (Bankr. D. Del.). The Company continues to operate its business as a “debtor-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code. The Company is seeking approval of a variety of “first day” motions containing customary relief intended to enable the Company to continue its ordinary course operations and run value maximizing Chapter 11 cases. The Company intends to sell substantially all of its assets during the Chapter 11 cases.

Additional information about the Chapter 11 case, including access to court documents, is available online at https://cases.stretto.com/DermTech, a website administered by Stretto, Inc., a third-party bankruptcy claims and noticing agent. The information on this website is not incorporated by reference into, and does not constitute part of, this Current Report on Form 8-K.

Item 2.05. Costs Associated with Exit or Disposal Activities.

On June 12, 2024, the Board of Directors (the “Board”) of the Company approved a reduction in force (the “Reduction in Force”) of approximately 15 employees (approximately 20% of the Company’s workforce), with potential additional reductions of DermTech’s workforce in the future, in order to reduce the Company’s operating expenses and in an effort to preserve value for stakeholders.

The Company estimates that it will incur aggregate pre-tax charges of approximately $0.6 million in connection with the Reduction in Force, primarily consisting of severance payments, employee benefits and related costs. The Company’s Reduction in Force is now complete and this one-time charge will be incurred in the second quarter of 2024. The costs related to the Reduction in Force are subject to a number of assumptions, and actual results may differ materially. The Company may also incur other charges or cash expenditures not currently contemplated due to events that may occur as a result of, or associated with, the Reduction in Force.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 12, 2024, the Company entered into retention and release agreements (collectively, the “Retention Agreements”) with each of Bret Christensen, the Company’s Chief Executive Officer, Kevin Sun, the Company’s Chief Financial Officer, Mark Aguillard, the Company’s Chief Commercial Officer, and Ray Akhavan, the Company’s General Counsel (collectively, the “Recipients”), pursuant to which each Recipient will receive a one-time cash retention award (collectively, the “Retention Awards”) in the amounts of $510,000, $349,350, $200,000 and $330,650 (each less applicable withholdings), respectively, subject to certain pro rata repayment requirements if such Recipient’s employment with the Company terminates under certain circumstances before December 31, 2024, as described below. Each Retention Agreement also contained a release by the Participant of the Company as settlement in full of all outstanding obligations owed to the Recipient by the Company as of the date of the Retention Agreement, including, but not limited to, any prior bonus, severance, or change of control arrangements. The Retention Awards will be paid in full within 10 business days after the effective date of the applicable Retention Agreement. If the Recipient’s employment is terminated for “cause” (as defined in the applicable Retention Agreement) or for any reason other than due to the Recipient’s death or disability (as defined in the applicable Retention Agreement) during the “retention period” (as defined in the applicable Retention Agreement), the Recipient will be required to repay to the Company a pro rata portion of the Retention Award in accordance with the terms of the applicable Retention Agreement; provided, however that such “repayment requirement” (as defined in the applicable Retention Agreement) shall be waived if, prior to December 31, 2024, (i) the Company consummates a restructuring, liquidation or wind-down of the Company that occurs on or after the “effective date” (as defined in the applicable Retention Agreement) of the applicable Retention Agreement, or (ii) a Recipient’s employment transfers to a buyer of Company assets in connection with, and at or promptly following, such buyer’s purchase of such assets. In addition, each of the Recipients received notice pursuant to the Worker Adjustment and Retraining Notification Act of 1988.

Item 8.01. Other Events.

On June 18, 2024, the Company issued a press release in connection with the filing of the Chapter 11 case. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Cautionary Note Regarding the Company’s Securities

The Company cautions that trading in its securities during the pendency of the Chapter 11 case is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Chapter 11 case. In particular, the Company expects that its equity holders will likely experience a complete loss on their investment, depending on the outcome of the Chapter 11 case.

Cautionary Statement Regarding Forward Looking Statements

This Current Report on Form 8-K, and certain materials DermTech files with the U.S. Securities and Exchange Commission (the “SEC”), as well as information included in oral statements or other written statements made or to be made by DermTech, other than statements of historical fact, contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including but not limited to statements regarding the Chapter 11 case, including the expected timing of implementing and completing the Bankruptcy Petition and the potential for and timing of the consummation of sales of the Company’s assets or other strategic alternatives. These forward-looking statements are based on current expectations, estimates, assumptions, projections and management’s beliefs that are subject to change. There can be no assurance that these forward-looking statements will be achieved; these statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond DermTech’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Factors that could cause actual outcomes and results to differ materially from such forward-looking statements include, but are not limited to, the following: risks attendant to the Chapter 11 bankruptcy process, including the Company’s ability to obtain court approval from the Bankruptcy Court with respect to motions or other requests made to the Bankruptcy Court throughout the course of the Chapter 11 process; the effects of Chapter 11, including increased legal and other professional costs necessary to execute the Chapter 11 process and on the Company’s liquidity and results of operations (including the availability of operating capital during the pendency of Chapter 11); the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of Chapter 11; the Company’s ability to continue funding operations through the Chapter 11 bankruptcy process, and the possibility that it may be unable to obtain any additional funding as needed; the Company’s ability to meet its financial obligations during the Chapter 11 process and to maintain contracts that are critical to its operations; the effect of the Chapter 11 filings on the Company’s relationships with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in connection with the Chapter 11 process and risks associated with third-party motions in Chapter 11; employee attrition and the Company’s ability to retain senior management and other key personnel due to the distractions and uncertainties; the impact and timing of any cost-savings measures and related local law requirements in various jurisdictions; and the impact of litigation and regulatory proceedings. The Company’s business is subject to a number of risks, which are described more fully in DermTech’s Annual Report on Form 10-K for the year ended December 31, 2023, as amended, its Quarterly Reports on Form 10-Q and in its other filings with the SEC. DermTech undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date hereof.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| DERMTECH, INC. |

| | |

| Date: June 18, 2024 | By: | /s/ Kevin Sun |

| Name: | Kevin Sun |

| Title: | Chief Financial Officer |

DERMTECH FILES FOR VOLUNTARY CHAPTER 11 PROTECTION

SAN DIEGO – June 18, 2024 – DermTech, Inc. (NASDAQ: DMTK) (DermTech or the Company), a leader in precision dermatology enabled by a non-invasive skin genomics technology, today filed for voluntary chapter 11 protection in the U.S. Bankruptcy Court for the District of Delaware. The chapter 11 filing is a continuation of the Company’s strategic alternatives review process. Currently, the Company intends to continue its laboratory operations and processing orders for the DermTech Melanoma Test (DMT), while simultaneously conducting a process to sell substantially all of its assets. Through the bankruptcy process, the Company intends to safeguard the interest of stakeholders and maximize the value of its assets.

DermTech is advised in this matter by Wilson, Sonsini, Goodrich & Rosati, PC, AlixPartners, Inc., and TD Cowen, a division of TD Securities.

Alongside the chapter 11 filings, the Company also implemented a reduction in force (RIF) to significantly reduce expenses associated with its current operations to preserve cash. This RIF resulted in an immediate workforce reduction of approximately 15 employees (approximately 20% of the Company’s workforce), with potential additional reductions of DermTech’s workforce in the future.

About DermTech

DermTech is a leading genomics company in dermatology and is creating a new category of medicine, precision dermatology, enabled by its non-invasive skin genomics technology. DermTech’s mission is to improve the lives of millions by providing non-invasive precision dermatology solutions that enable individualized care. DermTech provides genomic analysis of skin samples collected using its Smart StickersTM. DermTech develops and markets products that facilitate the assessment of melanoma. For additional information, please visit www.dermtech.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The expectations, estimates, and projections of DermTech may differ from its actual results and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “explore,” “estimate,” “project,” “budget,” “forecast,” ”aim,” “runway,” "outlook," “anticipate,” “intend,” “plan,” “strive," “may,” “will,” “sustain,” “remain," “continue,” “could,” “should,” “believe,” “predict,” “potential,” and similar expressions are intended to identify such forward‑looking statements. These forward-looking statements include, without limitation, expectations, evaluations and other statements with respect to: the performance, patient benefits, cost-effectiveness, commercialization and adoption of DermTech’s products and the market opportunity for these products; expectations regarding DermTech’s financial outlook, including its cash runway, future financial performance and ability to reduce cost, expenses and cash burn, including as a result of DermTech’s restructuring plan; and the prospects for DermTech’s review and evaluation of potential strategic alternatives; and the terms, timing, structure, benefits and costs of any strategic transaction and whether one will be consummated at all; and statements regarding the chapter 11 proceeding. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside of the control of DermTech and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the outcome of any legal proceedings that may be instituted against DermTech; (2) DermTech’s ability to obtain additional capital when and as needed or on acceptable terms or its ability to complete a strategic transaction, the failure of which may result in DermTech having to further curtail its operations, liquidate or otherwise dispose of assets, wind-down or cease operations entirely, any of which may result in stockholders receiving limited or no value for their investment; (3) the existence of favorable or unfavorable clinical guidelines for DermTech’s tests; (4) the reimbursement of DermTech’s tests by government payers (including Medicare) and commercial payers; (5) the ability of patients or healthcare providers to obtain coverage of or sufficient reimbursement for DermTech’s products; (6) DermTech’s ability to manage its existing and potential future operations (including with respect to processing test orders), retain its key employees, maintain or improve its operating efficiency and reduce operating expenses, including, in each case, after the restructuring actions are complete; (7) changes in applicable laws or regulations; (8) the market adoption and demand for DermTech’s products and services together with the possibility that DermTech may be adversely affected by other economic, business, and/or competitive factors; (9) the potential outcome and timing of DermTech’s announced process to explore strategic alternatives, including the potential that no such transaction will be completed in a timely manner or at all or that such a transaction will result in any value to stockholders; (10) DermTech’s ability to continue as a going concern, (11) DermTech’s ability to continue operating in the ordinary course while the chapter 11 proceeding is pending, and (12) other risks and uncertainties included in the “Risk Factors” section of the most recent Annual Report on Form 10-K filed by DermTech with the Securities and Exchange Commission (the “SEC”), and other documents filed or to be filed by DermTech with the SEC, including subsequently filed reports. DermTech cautions that the foregoing list of factors is not exclusive. You should not place undue reliance upon any forward- looking statements, which speak only as of the date made. DermTech does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based. Contact

Investor Relations

DermTech

investorrelations@dermtech.com

v3.24.1.1.u2

Cover Page

|

Jun. 12, 2024 |

Apr. 18, 2024 |

| Cover [Abstract] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Jun. 12, 2024

|

|

| Entity Registrant Name |

DERMTECH, INC.

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity File Number |

001-38118

|

|

| Entity Tax Identification Number |

|

84-2870849

|

| Entity Address, Address Line One |

12340 El Camino Real

|

|

| Entity Address, City or Town |

San Diego

|

|

| Entity Address, State or Province |

CA

|

|

| Entity Address, Postal Zip Code |

92130

|

|

| City Area Code |

858

|

|

| Local Phone Number |

450-4222

|

|

| Written Communications |

false

|

|

| Soliciting Material |

false

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Title of 12(b) Security |

Common Stock,par value $0.0001 per share

|

|

| Trading Symbol |

DMTK

|

|

| Entity Emerging Growth Company |

false

|

|

| Amendment Flag |

false

|

|

| Entity Central Index Key |

0001651944

|

|

| Security Exchange Name |

NASDAQ

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

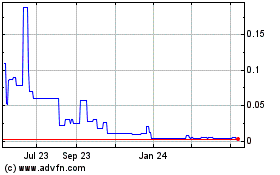

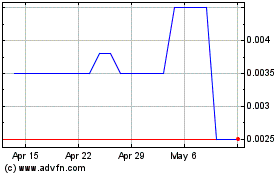

DermTech (PK) (USOTC:DMTKW)

Historical Stock Chart

From May 2024 to Jun 2024

DermTech (PK) (USOTC:DMTKW)

Historical Stock Chart

From Jun 2023 to Jun 2024