UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

____________________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of

Report (Date of Earliest Event Reported): April 9, 2009 (April 6,

2009)

DAYBREAK

OIL AND GAS, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Washington

|

000-50107

|

91-0626366

|

|

(State

or Other Jurisdiction

|

(Commission

|

(IRS

Employer

|

|

of

Incorporation)

|

File

Number)

|

Identification

No.)

|

601 W.

Main Ave., Suite 1012

Spokane,

WA 99201

(Address

of Principal Executive Offices, Zip Code)

(509)

232-7674

(Registrant’s

Telephone Number, Including Area Code)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

|

[

]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

[

]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Item

5.02

|

Departure

of Directors or Certain Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangements of Certain

Officers.

|

Named

Executive Officer Compensation

In order

to reduce general and administrative expenses, on April 6, 2009, the Board, with

the assistance of the Compensation Committee, approved an arrangement reducing

the base salaries of certain of the Company’s named executive

officers. Effective April 1, 2009, the salary of James F.

Westmoreland, President and Chief Executive Officer, will be reduced by 25% to

$150,000. The salary of Robert Martin, Senior Vice President –

Exploration, and Bennett W. Anderson, Chief Operating Officer, will be reduced

by 50% to $87,000 and $63,000, respectively. Additionally, if Mr.

Anderson works more than 11 days per month, he will earn an additional amount

equal to $200 per day, with such additional amount being capped at $2,200 per

month. Each of Mssrs. Westmoreland, Martin and Anderson has accepted

the new salary arrangement.

Approval

of Restricted Stock and Restricted Stock Unit Plan

On

April

6, 2009, the

Board of Directors

(the “

Board

”) of

Daybreak Oil and Gas, Inc. (the “

Company

”)

approved the 2009 Restricted Stock and Restricted Stock Unit Plan (the “

Plan

”). The

Company’s

Board

delegated the

administration of the Plan to the Compensation Committee (the “

Administrator

”). The

Administrator will have the power and authority to select Participants (as

defined below) and grant Awards (as defined below) to such Participants pursuant

to the terms of the Plan. In addition, the Administrator will have

the authority to (i) determine the number of shares of the Company’s common

stock, par value $0.001 (the “

Common

Stock

”), to be covered by, or with respect to which payments, rights, or

other matters are to be calculated in connection with, Awards;

(ii) determine the terms and conditions of any Award; (iii) determine

whether, to what extent, and under what circumstances Awards may be settled in

cash, shares of Common Stock, other securities, other Awards or other property,

or canceled, forfeited, or suspended and the method or methods by which Awards

may be settled, canceled, forfeited, or suspended; (iv) determine whether,

to what extent, and under what circumstances the delivery of cash, Common Stock,

other securities, other Awards or other property and other amounts payable with

respect to an Award shall be deferred either automatically or at the election of

the Participant or of the Administrator; (v) interpret, administer,

reconcile any inconsistency in, correct any defect in and/or supply any omission

in the Plan and any instrument or agreement relating to, or Award granted under,

the Plan; (vi) establish, amend, suspend, or waive any rules and

regulations and appoint such agents as the Administrator shall deem appropriate

for the proper administration of the Plan; (vii) accelerate the vesting of,

payment for or lapse of restrictions on, Awards; and (viii) make any other

determination and take any other action that the Administrator deems necessary

or desirable for the administration of the Plan. All decisions made

by the Administrator pursuant to the provisions of the Plan shall be final and

binding on the Company and the Participants.

Subject

to adjustment, the total number of shares of the Company’s Common Stock that

will be available for the grant of Awards under the Plan may not exceed

4,000,000 shares; provided, that, for purposes of this limitation, any stock

subject to an Award that is forfeited in accordance with the provisions of the

Plan will again become available for issuance under the Plan.

Stock

available for distribution under the Plan will be authorized and unissued shares

or shares reacquired by the Company in any manner.

Restricted

Stock and Restricted Stock Unit Awards

Awards

may be granted to officers, other employees, consultants and directors of the

Company and its affiliates (“

Participants

”),

and may be in the form of actual shares of Common Stock (“

Restricted

Stock

”) or hypothetical Common Stock units having a value equal to the

fair market value of an identical number of shares of Common Stock (“

Restricted Stock

Units

”). The Restricted Stock and Restricted Stock Units that

may be granted pursuant to the Plan are herein referred to individually as an

“

Award

” and

collectively as “

Awards

”. Unless

otherwise provided by the Administrator in an individual Award agreement, Awards

under the Plan will vest 25% on each of the first four anniversaries of the date

of grant and the unvested portion of any Award will terminate and be forfeited

upon termination of the Participant’s employment or service.

Subject

to the terms of the Plan and the applicable Award agreement, the recipients of

restricted stock generally will have the rights and privileges of a stockholder

with respect to the Restricted Stock, including the right to vote the shares and

to receive dividends, if applicable. The recipients of restricted

stock units will not have the rights and privileges of a stockholder with

respect to the shares underlying the Restricted Stock Unit award until the award

vests and the shares are received. The Administrator may, at its

discretion, withhold dividends attributed to any particular share of Restricted

Stock, and any dividends so withheld will be distributed to the Participant upon

the release of restrictions on such shares in cash, or at the sole discretion of

the Administrator, in shares of Common Stock having a fair market value equal to

the amount of such dividends. Awards under the Plan may not be

assigned, alienated, pledged, attached, sold or otherwise transferred or

encumbered by a Participant other than by will or by the laws of descent and

distribution.

Change in

Control

Unless

otherwise provided in an Award agreement, in the event of a change in control

(as defined in the Plan) of the Company the Administrator may provide that the

restrictions pertaining to all or any portion of a particular outstanding Award

will expire at a time prior to the change in control. To the extent

practicable, any actions taken by the Administrator to accelerate vesting will

occur in a manner and at a time which will allow affected Participants to

participate in the change in control transaction with respect to the Common

Stock subject to their Awards.

Amendment and

Termination

The Board

at any time, and from time to time, may amend or terminate the Plan; provided,

however, that such amendment or termination shall not be effective unless

approved by the Company’s shareholders to the extent shareholder approval is

necessary to comply with any applicable tax or regulatory

requirements. In addition, any such amendment or termination that

would materially and adversely affect the rights of any Participant shall not to

that extent be effective without the consent of the affected

Participant. The Administrator at any time, and from time to time,

may amend the terms of any one or more Awards; provided, however, that the

Administrator may not effect any amendment which would materially and adversely

affect the rights of any Participant under any Award without the consent of such

Participant.

The

foregoing summary description of the Plan is qualified in its entirety by

reference to the actual terms of the Plan, the Form of Restricted Stock Award

Agreement and the Form of Restricted Stock Unit Award Agreement, which are filed

as Exhibits 4.5, 4.6 and 4.7, respectively, to the Company’s Form S-8 dated

April 7, 2009 and incorporated herein by reference.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

(d) Exhibits

|

Exhibit No.

|

Description

|

|

|

|

|

10.1

|

Daybreak Oil and Gas, Inc. 2009 Restricted Stock

and Restricted Stock Unit Plan

(1)

|

|

10.2

|

Form of Restricted Stock Award

Agreement

(2)

|

|

10.3

|

Form of Restricted Stock Unit Award

Agreement

(3)

|

(1) Previously

filed as Exhibit 4.5 to Form S-8 on April 7, 2009, and incorporated herein by

reference.

(2) Previously

filed as Exhibit 4.6 to Form S-8 on April 7, 2009, and incorporated herein by

reference.

(3) Previously

filed as Exhibit 4.7 to Form S-8 on April 7, 2009, and incorporated herein by

reference.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended,

Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

April

9, 2009

|

DAYBREAK

OIL AND GAS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/

James F. Westmoreland

|

|

|

|

James

F. Westmoreland

|

|

|

|

President

and Chief Executive Officer

|

|

Exhibit No.

|

Description

|

|

|

|

|

10.1

|

Daybreak Oil and Gas, Inc. 2009 Restricted Stock

and Restricted Stock Unit Plan

(1)

|

|

10.2

|

Form of Restricted Stock Award

Agreement

(2)

|

|

10.3

|

Form of Restricted Stock Unit Award

Agreement

(3)

|

(1) Previously

filed as Exhibit 4.5 to Form S-8 on April 7, 2009, and incorporated herein by

reference.

(2) Previously

filed as Exhibit 4.6 to Form S-8 on April 7, 2009, and incorporated herein by

reference.

(3) Previously

filed as Exhibit 4.7 to Form S-8 on April 7, 2009, and incorporated herein by

reference.

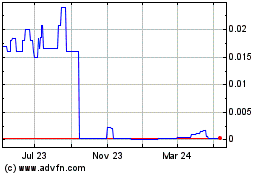

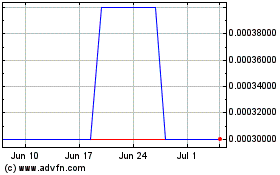

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From May 2024 to Jun 2024

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From Jun 2023 to Jun 2024