UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-KSB

(Mark One)

|

|

|

|

|

þ

|

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended February 29, 2008

|

|

|

|

|

o

|

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period

to

Commission file number 000-50107

DAYBREAK OIL AND GAS, INC.

(Name of small business issuer in its charter)

|

|

|

|

|

Washington

|

|

91-0626366

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

601 W. Main Ave., Suite 1012, Spokane, WA

|

|

99201

|

|

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Issuer’s telephone number, including area code: (509) 232-7674

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, par value $0.001 per share

Check whether issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

o

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the

Exchange Act during the past 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

þ

No

o

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B

contained in this form and no disclosure will be contained, to the best of registrant’s knowledge,

in definitive proxy or information statements incorporated by reference in Part III of this Form

10-KSB or any amendment to this Form 10-KSB.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

Non-accelerated filer

þ

|

|

Smaller reporting company

o

|

|

|

|

|

|

(Do not check if a smaller reporting company)

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

o

No

þ

The registrant’s revenues for its most recent fiscal year were $1,017,604.

The aggregate market value of the voting and non-voting stock held by non-affiliates of the

registrant, based on the closing price of $0.45 on May 20, 2008, as reported by the Over the

Counter Bulletin Board was $20,054,834.

At May 20, 2008, the registrant had 44,566,299 outstanding shares of $0.001 par value common stock.

Documents Incorporated by Reference:

Part III of the Form 10-KSB incorporates by reference certain portions of the registrant’s proxy

statement for its 2008 annual meeting of shareholders to be filed with the Commission not later

than 120 days after the end of the fiscal year covered by this report.

Transitional Small Business Disclosure Format (Check one): Yes

o

No

þ

2

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

We believe that some statements contained in this 10-KSB annual report relate to results or

developments that we anticipate will or may occur in the future and are not statements of

historical fact. Words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “predict,” “project,” “will” and similar expressions identify forward-looking

statements. Examples of forward-looking statements include statements about the following:

|

|

•

|

|

Our future operating results,

|

|

|

|

|

•

|

|

Our future capital expenditures,

|

|

|

|

|

•

|

|

Our expansion and growth of operations, and

|

|

|

|

|

•

|

|

Our future investments in and acquisitions of oil and natural gas properties.

|

We have based these forward-looking statements on assumptions and analyses made in light of our

experience and our perception of historical trends, current conditions, and expected future

developments. However, you should be aware that these forward-looking statements are only our

predictions and we cannot guarantee any such outcomes. Future events and actual results may differ

materially from the results set forth in or implied in the forward-looking statements. Factors

that might cause such a difference include:

|

|

•

|

|

General economic and business conditions,

|

|

|

|

|

•

|

|

Exposure to market risks in our financial instruments,

|

|

|

|

|

•

|

|

Fluctuations in worldwide prices and demand for oil and natural gas,

|

|

|

|

|

•

|

|

Fluctuations in the levels of our oil and natural gas exploration and

development activities,

|

|

|

|

|

•

|

|

Risks associated with oil and natural gas exploration and development

activities,

|

|

|

|

|

•

|

|

Competition for raw materials and customers in the oil and natural gas industry,

|

|

|

|

|

•

|

|

Technological changes and developments in the oil and natural gas industry,

|

|

|

|

|

•

|

|

Regulatory uncertainties and potential environmental liabilities,

|

|

|

|

|

•

|

|

Additional matters discussed under “Risk Factors.”

|

4

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Background

Daybreak Oil and Gas, Inc. (referred to herein as “we,” “our,” “Daybreak” or the “Company”) was

originally incorporated in the State of Washington on March 11, 1955 as Daybreak Uranium, Inc. The

Company was established for the purpose of mineral exploration and development on claims or leased

lands throughout the western United States. In August 1955, we acquired the assets of Morning Sun

Uranium, Inc. By the late 1950s, the Company had ceased to be a producing mining company and

thereafter engaged in mineral exploration. In May 1964, to reflect the diversity of its mineral

holdings, the Company changed its name to Daybreak Mines, Inc. The trading symbol for the Company

became DBRM.

Our subsequent efforts in the acquisition, exploration and development of potentially viable

commercial properties were unsuccessful. By February 1967, we had ceased active operations. After

that time, our activities were confined to annual assessment and maintenance work on our Idaho

mineral properties and other general and administrative functions. In November 2004, we sold our

mineral rights in approximately 340 acres in Shoshone County, Idaho.

Oil and Gas Overview

Effective March 1, 2005, we undertook a new business direction for the Company; that of an

exploration and development company in the oil and gas industry. We have become an early stage oil

and gas exploration and development company with projects in Alabama, California Louisiana and

Texas. In October of 2005, to better reflect this new direction of the Company, our shareholders

approved changing our name to Daybreak Oil and Gas, Inc. Our common stock is quoted on the OTC

Bulletin Board (OTC.BB) market under the symbol DBRM.OB.

We are actively pursuing oil and gas opportunities through joint ventures with industry partners as

a means of limiting our drilling risk. Our prospects are generally brought to us by other oil and

gas companies or individuals. We identify and evaluate prospective oil and gas properties to

determine both the degree of risk and the commercial potential of the project. We are currently

developing projects that offer a mix of low risk with a potential of steady reliable revenue as

well as projects with a higher risk, but that may also have a larger return. We strive to use

modern 3-D (three dimensional) seismic technology to help us identify potential drilling targets

and to minimize our risk. We seek to maximize the value of our asset base by exploring and

developing properties that have both production and reserve growth potential. We seek out other

industry partners to maintain a balanced working interest in all of our projects. We also seek

acquisitions that will complement our exploration portfolio.

In many instances, we strive to be operator of our oil and gas properties. As the operator, we are

more directly in control of the costs of drilling, completion and production operations on our

projects. Additionally, operatorship increases the expertise of Daybreak personnel in significant

oil and gas operations including lease negotiations, governmental reporting, permitting, drilling,

completion, production operations and marketing.

5

Historical Business Development

Effective March 1, 2005, we undertook a new business direction for the Company, that of an

exploration and development company in the oil and gas industry. We have become an early stage

exploration and development company with projects in Alabama, California, Louisiana and Texas.

Between March 22, 2005 and August 31, 2005, we borrowed a total of $168,821 from six officers,

directors or shareholders to fund operating capital needs.

In April of 2005, we signed two oil and gas exploration and development agreements for exploration

projects located in Texas (Ginny South and Pearl Projects).

From June through December 2005, we conducted a private placement of our common stock. The proceeds

were used to pay for lease, exploration and drilling expenses of the Company as well as working

capital. Net proceeds to the Company were $1,087,500.

In July 2005, we entered into an exploration agreement with an industry partner and three

Geotechnical professionals to jointly develop an AMI (Area of Mutual Interest) located in the San

Joaquin Basin of California (East Slopes Project).

In September 2005, we entered into an exploration agreement to jointly develop an AMI located in

northeast Louisiana (Tuscaloosa Project).

In November 2005, we agreed to participate in a five well re-entry program in the Saxet Deep Field

in Corpus Christi, Texas.

In December 2005, we borrowed $60,000 to help finance exploration activities as well as increase

operating capital. Additionally, we drilled our first well (Ginny South) in San Patricio County,

Texas. The well was unsuccessful and consequently plugged and abandoned.

In January 2006, we drilled our second well, the Tensas Farms et al “F-1” location on the

Tuscaloosa Project in NE Louisiana. The well was completed and placed into commercial production in

June of 2006. The well was shut-in due to technical issues with water production in November 2006.

Additionally on January 13, 2006, a seventh director was appointed to the Board of Directors. This

individual was Terrence J. Dunne, a shareholder and 10% control person at the time.

Between January 25, 2006 and February 8, 2006, we borrowed a total of $806,700 from seven

shareholders to help finance exploration activities as well as increase operating capital.

Between February 24, 2006 and March 6, 2006, we borrowed $325,001 from four shareholders to meet

operating capital needs.

On March 8, 2006, we and our working interest partners purchased a 50% interest in the mineral

rights for 28,000 acres that were located within the original AMI of the Tuscaloosa Project located

in NE Louisiana.

6

From March through May 2006, we conducted a private placement of our common stock that raised net

proceeds of $5,188,257 for use in acquiring leases, funding our drilling program and meeting our

working capital needs.

On March 30, 2006, we agreed to jointly participate in an exploration project at the Krotz Springs

Field located in St. Landry Parish, Louisiana.

In May 2006, we started the first re-entry of five wells in the Saxet Deep Field near the Corpus

Christi, Texas airport. We also agreed to jointly participate in exploration projects located in

St. Landry Parish, Louisiana (North Shuteston) and in Alberta, Canada (40 Mile Coulee). In an

effort to conserve cash flow, we financed our 40% ownership in the pipeline that is connected to

the “F-1” well on the Tuscaloosa Project in NE Louisiana.

In July 2006, we conducted a private placement of our preferred stock that raised net proceeds of

$3,626,204 for use in acquiring leases, funding our drilling program and meeting working capital

needs.

In August 2006, we finalized an agreement for the refurbishment of a drilling rig. Daybreak had the

right to exclusive use of the drilling rig for a three-year period. From August through November

2006, we advanced $800,000 for the refurbishment of the rig. In May 2007, the drilling rig was

sold and the note receivable plus interest was paid off. Additionally on August 3rd, Eric L. Moe

was appointed as the eighth member of the Board of Directors and to the position of Chief Executive

Officer.

In December 2006, we agreed to jointly participate in an oilfield re-entry project in East

Gilbertown Field located in Choctaw County, Alabama. Additionally, we drilled two more exploratory

wells as part of the Tuscaloosa Project located in Tensas and Franklin Parishes, Louisiana. The

“F-3” well (Tensas Parish) was completed and placed into commercial production in February 2007.

From late July through November 2007 the well was shut-in or produced only sporadically due to

downstream gas sales issues. In November 2007, the F-3 was shut in pending installation of

mechanical lifting equipment and is expected to return to production in the second quarter of 2008.

The “B-1” well (Franklin Parish) was drilled and tested, but was not commercially productive.

Further evaluation of this well is pending.

In January 2007, we commenced drilling the Haas-Hirsch No. 1 well located in the East Krotz Springs

Field, St. Landry Parish, Louisiana. This well was completed and was placed into commercial

production in May 2007. Additionally in January, a ninth director was appointed to the Board of

Directors. This individual was Timothy R. Lindsey, who has over thirty years experience in global

oil and gas exploration, production, technology and business development.

In May 2007, we commenced procedures to attempt to resolve the technical production problems

associated with the Tuscaloosa “F-1” well. Our efforts resulted in the successful re-establishment

of production from this well in mid-July 2007. However, as a result of downstream gas sales issues

covering both the F-1 and F-3 wells in the Tuscaloosa Project, these two wells were shut in

beginning in late July 2007 through November 2007. The wells were allowed to sporadically produce

throughout this time period, but as a result of the well production continually being interrupted,

the wells now require the use of mechanical lifting equipment to continue commercial production.

The “F-1” returned to full-time commercial production in January 2008. It is anticipated the F-3

well will return to production in the second quarter of 2008.

7

In September 2007, we commenced drilling operations on the Tensas Farms et al A-1 well in the

Tuscaloosa project in Louisiana. The well was successfully completed and commenced production in

December 2007. The well achieved “payout” status (recovery of all drilling and completion costs) in

March 2008.

From October 2007 through December 2007, a high resolution 3-D seismic survey program was conducted

on the portion of our California properties that are a part of the Chevron seismic farm-in area.

The seismic will be used to determine four initial drilling prospects in which Daybreak will have a

50% working interest and a 25% revenue interest before royalties to leaseholders.

In December 2007, we drilled and completed the Tensas Farms et al F-2 well, also in the Tuscaloosa

project. Further evaluation of this well is pending.

On December 14, 2007, we underwent a change in the management of Daybreak. Robert N. Martin,

President resigned from that position and was appointed Senior Vice-President, Exploration; Chief

Executive Officer Eric L. Moe resigned from the Company; Timothy R. Lindsey formerly an outside

director was appointed interim President and Chief Executive Officer; Chief Financial Officer

Terrence J. Dunne resigned from the Company; and Controller Thomas C. Kilbourne resigned from that

position but continued as an employee of Daybreak. James F. Westmoreland, formerly a finance and

accounting consultant to Daybreak, was appointed interim Chief Financial Officer.

On December 18, 2007, the Board of Directors voted to reduce the number of Board positions to

three. Subsequently, the following individuals resigned their positions and offices with the Board

of Directors of Daybreak; Robert N. Martin, Eric L. Moe, Terrence J. Dunne, Jeffrey R. Dworkin,

Thomas C. Kilbourne and Michael Curtis. Karol L. Adams, formerly a consultant to Daybreak, was

appointed Corporate Secretary.

On January 18, 2008, we signed a purchase and sale agreement (“PSA”) with an undisclosed buyer for

the sale of our Tuscaloosa project interests for $8 million in cash. The transaction was

originally scheduled to close in two tranches; the first closing for $2 million, representing 25%

of Daybreak’s working interest, closed on January 18, 2008. An intermediate closing in the amount

of $500,000 occurred on April 30, 2008 for 6.25% of the Company’s working interest. The amended

final closing of $5.5 million for the remaining 68.75% of the Company’s working interest is

scheduled to occur during the second calendar quarter of 2008 and is subject to customary closing

adjustments. The sale includes Daybreak’s interests in the Tensas Farms et al F-1, F-3, B-1, A-1

and F-2 wells; and all of its remaining acreage and infrastructure in the project area. Under

terms of the PSA, the effective dates for the respective closings will be January 1, 2008.

On March 24, 2008 James F. Meara was appointed to our Board of Directors, thereby expanding the

Company’s Board to four members.

On April 3, 2008, James F. Westmoreland, formerly interim Chief Financial Officer, was appointed

Executive Vice President and Chief Financial Officer; Karol L. Adams was appointed Chief Compliance

Officer in addition to the Corporate Secretary duties; Thomas C. Kilbourne was appointed Controller

and Assistant Secretary; and Daybreak adopted a series of corporate responsibility statements and

employee guidelines.

8

Competition

We compete with independent oil and gas companies for exploration prospects, property acquisitions

and for the equipment and labor required to operate and develop these properties. Many of our

competitors have substantially greater financial and other resources than we have. These

competitors may be able to pay more for exploratory prospects and may be able to define, evaluate,

bid for and purchase a greater number of properties and prospects than we can. A detailed

discussion of these and other risks and uncertainties that could cause actual results and events to

differ materially from such forward-looking statements is included in “Risk Factors” beginning on

page 10 of this 10-KSB annual report.

Significant Customers

At each of our property locations in Alabama, Louisiana and Texas, we have oil and gas sales

contracts with one dominant purchaser in each respective area. Due to the scarcity of distribution

pipelines or sole distributors, we do not have many options for choosing to whom we will sell our

oil and gas. If these purchasers are unable to resell their products or if they lose a significant

sales contract then we may incur difficulties in selling our oil and gas.

Title to Properties

As is customary in the oil and natural gas industry, we make only a cursory review of title to

undeveloped oil and natural gas leases at the time we acquire them. However, before drilling

commences, we search the title, and remedy most material defects before we actually begin drilling

the well. To the extent title opinions or other investigations reflect title defects, we (rather

than the seller or lessor of the undeveloped property) typically are obligated to cure any such

title defects at our expense. If we are unable to remedy or cure any title defects so that it

would not be prudent for us to commence drilling operations on the property, we could suffer a loss

of our entire investment in the property. We believe that we have good title to our oil and

natural gas properties, some of which are subject to immaterial encumbrances, easements, and

restrictions.

Long Term Success

Our success depends on the successful acquisition, exploration and development of commercial grade

oil and gas properties as well as the prevailing prices for oil and natural gas to generate future

revenues and operating cash flow. Oil and natural gas prices have been extremely volatile in

recent years and are affected by many factors outside our control. This volatile nature of the

energy markets makes it difficult to estimate future prices of oil and natural gas; however, any

prolonged period of depressed prices would have a material adverse effect on our results of

operations and financial condition. Such pricing factors are largely beyond our control, and may

result in fluctuations in our earnings. We believe there are significant opportunities available

to us in the oil and gas exploration and development industry.

Regulation

The exploration and development of oil and gas properties are subject to various types of federal,

state and local laws and regulations. These laws and regulations govern a wide range of matters,

including the drilling and spacing of wells, allowable rates of production, restoration of surface

areas, plugging and abandonment of wells and specific requirements for the operation of wells.

9

Laws and regulations relating to our business frequently change, and future laws and regulations,

including changes to existing laws and regulations, could adversely affect our business.

RISK FACTORS

The following risk factors together with other information set forth in this Form 10-KSB, should be

carefully considered by current and future investors in our securities. An investment in our

securities involves substantial risks. If any of the following risks actually occur, our financial

condition and our results of operations could be materially and adversely affected. Additional

risks and uncertainties not presently known to us may also impair our business operations. In any

such case, the trading price of our common stock could decline, and you could lose all, or a part,

of your investment.

Risks related to investment in our Company

Our independent public accountants have expressed an opinion that our significant operating losses

raise substantial doubt about our ability to continue as a going concern

The Company’s financial statements for the year ended February 29, 2008 and February 28, 2007, have

been audited by our current independent public accountant. Both of these reports include an

explanatory paragraph stating that the financial statements have been prepared assuming the Company

will continue as a going concern. The report also states that the Company has incurred significant

operating losses that raise substantial doubt about its ability to continue as a going concern.

The accompanying financial statements do not include any adjustments that might result from this

uncertainty. If the Company cannot continue as a going concern, your investment in the Company

could become devalued or worthless.

The Company reported a net loss of $4,266,173 for the fiscal year ended February 29, 2008, and a

cumulative net loss from inception through February 29, 2008 of $17,130,244.

We are an early stage oil and gas exploration company with a limited operating history on which to

base an investment decision

We have a limited history of oil and gas production and have minimal proven reserves. To date, we

have had limited revenues and have not yet generated a sustainable positive cash flow or earnings.

The Company cannot provide any assurances that we will ever operate profitability. As a result of

our limited operating history, we are more susceptible to business risks. These risks include

unforeseen capital requirements, failure to establish business relationships, and competitive

disadvantages against larger and more established companies.

The resale of shares offered in private placements could depress the value of the shares

Shares of the Company’s Common Stock have been offered and sold in private placements at

significant discounts to the trading price of the common stock at the time of the offering. Sales

of substantial amounts of common stock eligible for future sale in the public market, or the

availability of shares for sale, including shares issued upon exercise of outstanding warrants,

could adversely

10

affect the prevailing market price of our common stock and our ability to raise capital by an

offering of equity securities.

We have paid our officers and directors significant amounts in the form of salaries, consulting

fees, and stock which could have an adverse affect on our net operating results and earnings per

share

For the fiscal year ended February 29, 2008, we paid our officers and directors a total of $600,000

in cash for services.

For the fiscal year ended February 28, 2007, we paid our officers and directors a total of $553,941

in cash for services. During this same period, we granted these individuals 1,050,000 shares of

unregistered common stock with a fair value of $2,206,500 at the grant date for services.

For the fiscal year ended February 28, 2006, we paid our officers and directors a total of $60,050

in cash for services. During this same period, we granted these individuals 2,783,000 shares of

unregistered common stock with a fair value of $2,010,730 at the grant date for services.

These payments were all approved by the Board of Directors. All compensation payments are

accounted for as administrative expenses. These compensation payments have had, and may continue to

have, an adverse impact on our net results from operations, and earnings (or losses) per share.

We are an exploration stage company implementing a new business plan making it difficult to

evaluate our chance for success

We are an exploration stage company with a limited operating history upon which to base an

evaluation of our current business and future prospects. We started in the oil and gas exploration

and development industry in March 2005. We are in the early stages of the implementation of our

business plan. Based on this limited history, investors do not have a proven basis upon which to

determine the probability of our business success.

The oil and gas business is highly competitive placing us at an operating disadvantage

We expect to be at a competitive disadvantage in (a) seeking to acquire suitable oil and or gas

drilling prospects; (b) undertaking exploration and development; and (c) seeking additional

financing. We base our preliminary decisions regarding the acquisition of oil and or gas prospects

and undertaking of drilling ventures upon general and inferred geology and economic assumptions.

This public information is also available to our competitors.

In addition, we compete with large oil and gas companies with longer operating histories and

greater financial resources than us. These larger competitors, by reason of their size and greater

financial strength, can more easily:

|

•

|

|

access capital markets;

|

|

•

|

|

recruit more qualified personnel;

|

|

•

|

|

absorb the burden of any changes in laws and regulation in applicable jurisdictions;

|

|

•

|

|

handle longer periods of reduced prices of gas and oil;

|

|

•

|

|

acquire and evaluate larger volumes of critical information;

|

|

•

|

|

compete for industry-offered business ventures.

|

11

These disadvantages could create negative results for our business plan and future operations.

We cannot guarantee financial results, making it more difficult to raise additional capital

Since our inception, we have suffered recurring losses from start-up operations and have depended

on external financing to sustain our operations. During the year ended February 29, 2008, we

reported a net loss of $4,266,173. If exploration efforts are unsuccessful in establishing proved

reserves and exploration activities cease, the amounts accumulated as unproved costs will be

charged against earnings as impairments. Potential investors may be dissuaded from investing in

the Company based on historical results.

Our ability to reach and maintain profitable operating results is dependant on our ability to find,

acquire, and develop oil and gas properties

Our future performance depends upon our ability to find, acquire, and develop oil and gas reserves

that are economically recoverable. Without successful exploration and acquisition activities, we

will not be able to develop reserves or generate production revenues to achieve and maintain

profitable operating results. No assurance can be given that we will be able to find, acquire or

develop these reserves on acceptable terms. We also cannot assure that commercial quantities of

oil and gas deposits will be discovered that are sufficient to enable us to recover our exploration

and development costs. Although certain management personnel have significant experience in the

oil and gas industry, we have not yet established a history of locating and developing properties

that have economically feasible oil and gas reserves.

To execute our business plan we will need to develop current projects and expand our operations

requiring significant capital expenditures which we may be unable to fund

We have a history of net losses and expect that our operating expenses will continue over the next

12 months as we continue to implement our business plan. Our business plan contemplates the

development of our current exploration projects and the expansion of our business by identifying,

acquiring, and developing additional oil and gas properties.

We need to rely on external sources of financing to meet the capital requirements associated with

the development of our current properties and the expansion of our oil and gas operations. We plan

to obtain the funding we need through debt and equity markets, as well as property dispositions.

There is no assurance that we will be able to obtain additional funding when it is required or that

it will be available to us on commercially acceptable terms.

We also intend to make offers to acquire oil and gas properties in the ordinary course of our

business. If these offers are accepted, our capital needs will increase substantially. If we fail

to obtain the funding that we need when it is required, we may have to forego or delay potentially

valuable opportunities to acquire new oil and gas properties. In addition, without the necessary

funding, we may default on existing funding commitments to third parties and forfeit or dilute our

rights in existing oil and gas property interests.

12

When we make the determination to invest in oil or gas properties we rely upon geological and

engineering estimates which involve a high level of uncertainty

Geologic and engineering data are used to determine the probability that a reservoir of oil or

natural gas exists at a particular location. This data is also used to determine whether oil and

natural gas are recoverable from a reservoir. Recoverability is ultimately subject to the accuracy

of data including, but not limited to, geological characteristics of the reservoir, structure,

reservoir fluid properties, the size and boundaries of the drainage area, reservoir pressure, and

the anticipated rate of pressure depletion. Also the increasing costs of production operations may

render some deposits uneconomic to extract.

The evaluation of these and other factors is based upon available seismic data, computer modeling,

well tests and information obtained from production of oil and natural gas from adjacent or similar

properties. There is a high degree of risk in proving existence and recoverability of reserves and

actual recoveries of proved reserves can differ materially from original estimates. Accordingly,

reserve estimates may be subject to downward adjustment. Actual production, revenue and

expenditures will likely vary from estimates, and such variances may be material.

Our financial condition will deteriorate if we are unable to retain our interests in our leased oil

and gas properties

All of our properties are held under interests in oil and gas mineral leases. If we fail to meet

the specific requirements of each lease, the lease may be terminated or otherwise expire. We

cannot be assured that we will be able to meet our obligations under each lease. The termination

or expiration of our “working interests” (interests created by the execution of an oil and gas

lease) relating to these leases would impair our financial condition and results of operations.

We will need significant additional funds to meet capital calls, drilling and other production

costs in our effort to explore, produce, develop and sell the natural gas and oil produced by our

leases. We may not be able to obtain any such additional funds on acceptable terms.

Title deficiencies could render our oil and gas leases worthless; thus damaging the financial

condition of our business

The existence of a material title deficiency can render a lease worthless, resulting in a large

expense to our business. We rely upon the judgment of oil and gas lease brokers who perform the

field work and examine records in the appropriate governmental office before attempting to place

under lease a specific mineral interest. This is a customary practice in the oil and gas industry.

We anticipate that we, or the person or company acting as “operator” (the individual or company

responsible for the exploration, exploitation and production of an oil or natural gas well or

lease, usually pursuant to the terms of a joint operating agreement among the various parties

owning the working interest in the well) on the properties that we lease, will examine title prior

to any well being drilled. Even after taking these precautions, deficiencies in the marketability

of the title to the leases may still arise. Such deficiencies may render some leases worthless,

negatively impacting the financial condition of the Company.

13

Reliance on certain third party vendors for outsourced services could be detrimental to our

business plan

To maximize the use of our otherwise limited capital and human resources, we rely on third party

vendors for outsourced drilling, exploration and other operational services. This practice could

allow us to achieve cost savings and operational efficiencies. However, the use of outsourced

resources could expose us to greater risk should we be unable to source critical vendors on a cost

budgeted and timely basis.

Furthermore, the use of outsourced resources could minimize our ability to control the work product

and accountability of such vendors. If any of these relationships with third-party service

providers are terminated or are unavailable on commercially acceptable terms, our business plan

will be adversely affected.

If we as operators, or our operators of our oil and gas projects fail to maintain adequate

insurance, our business could be exposed to significant losses

Our oil and gas projects are subject to risks inherent in the oil and gas industry. These risks

involve explosions, uncontrollable flows of oil, gas or well fluids, pollution, fires, earthquakes

and other environmental issues. These risks could result in substantial losses due to injury and

loss of life, severe damage to and destruction of property and equipment, pollution and other

environmental damage. As protection against these operating hazards we maintain insurance coverage

to include physical damage and comprehensive general liability. However, we are not fully insured

in all aspects of our business. For projects in which we function as the operator, the occurrence

of a significant event against which we are not adequately covered by insurance could have a

material adverse effect on our financial position.

In the projects in which we are not the operator, we require the operator to maintain insurance of

various types to cover our operations with policy limits and retention liability customary in the

industry. The occurrence of a significant adverse event on any of these projects if they are not

fully covered by insurance could result in the loss of all or part of our investment. The loss of

this project investment could have a material adverse effect on our financial condition and results

of operations.

We have limited control over the activities on properties we do not operate, which could reduce or

negate the expected returns on these investments

We currently conduct our oil and gas exploration and development activities in joint ventures with

other industry partners. We have reserved the right to participate in management decisions through

operating agreements with our partners, but do not have ultimate decision-making authority.

In many cases, success in the operation of our properties will be dependent on the expertise and

financial resources of our joint venture partners and third-party operators. Our dependence on the

operator and other working interest owners resulting in our limited ability to control the

operation could adversely affect the realization of our expected returns and lead to unexpected

future costs.

14

We are not in control of our own oil and gas distribution systems and are therefore dependent on

the sales contracts of oil and gas resellers to provide a market for us, which could result in our

not being able to produce from our wells

In each of our producing properties, there is only one market available to purchase our oil and gas

production. If that reseller were to lose a significant sales contract or customer then we might

not be able to produce an otherwise productive well because of a lack of a market in which to sell

oil or gas. Additionally, we are subject to the traditional seasonal energy demands that exist in

the oil and gas industry.

We may lose key management personnel which could endanger the future success of our oil and gas

operations

Our Interim President and Chief Executive Officer, our Chief Financial Officer, our Senior

Vice-President, Exploration and one director have substantial experience in the oil and gas

business. The balance of the management team has limited experience in managing or conducting oil

and gas operations. The loss of any of these individuals, particularly our Interim President and

Chief Executive Officer or our Chief Financial Officer could adversely affect our business. If one

or more members of our management team dies, becomes disabled or voluntarily terminates employment

with us, there is no assurance that a suitable or comparable substitute will be found.

We have disclosed material weakness in our disclosure controls and procedures which could erode

investor confidence, jeopardize our ability to obtain insurance and limit our ability to attract

qualified persons to serve the Company

In our fiscal 2007 and 2008 annual and quarterly SEC filings, we disclosed material weaknesses in

our disclosure controls and procedures. Predicated by the identification of these weaknesses, we

have carried out an evaluation of the effectiveness of the design and operation of our disclosure

controls and procedures.

We have evaluated our internal controls over financial reporting and based upon those evaluations,

concluded that our disclosure controls and procedures were in need of improvement and were not

effective to ensure timely reporting under the Exchange Act. We are working to correct this

situation as quickly and effectively as possible with new processes and controls.

We are required to evaluate our internal controls under Section 404 of the Sarbanes-Oxley Act of

2002 (“SOX”), and any adverse results from such evaluation could result in a loss of investor

confidence in our financial reports and have an adverse effect on the price of our shares of common

stock.

Pursuant to Section 404 of SOX, beginning with this annual report on Form 10-KSB for the fiscal

year ended February 29, 2008, we are required to furnish a report by management on our internal

controls over financial reporting. This report contains among other matters, an assessment of the

effectiveness of our internal control over financial reporting, including a statement as to whether

or not our internal control over financial reporting is effective. This assessment must include

disclosure of any material weaknesses in our internal control over financial reporting identified

by our management.

15

During the evaluation and testing process, we did identify one or more material weaknesses in our

internal control over financial reporting, and are therefore unable to assert that such internal

control is effective. Since we are unable to assert that our internal control over financial

reporting is effective (or if our auditors are unable to attest in the future that our management’s

report is fairly stated or they are unable in the future to express an opinion on the effectiveness

of our internal controls), we could lose investor confidence in the accuracy and completeness of

our financial reports, which could have a material adverse effect on our stock price.

Failure to comply with these rules may make it more difficult for us to obtain certain types of

insurance, including director and officer liability insurance. We may be forced to accept reduced

policy limits and coverage and/or incur substantially higher costs to obtain the same or similar

coverage. The impact of these events could also make it more difficult for us to attract and

retain qualified persons to serve on our Board of Directors, on committees of our Board of

Directors, or as executive officers.

The market price of our common stock could be volatile, which may cause the investment value of our

stock to decline

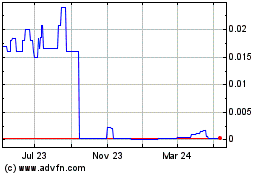

Our common stock is quoted on the OTC Bulletin Board (OTC.BB) market under the symbol DBRM.OB.

From July 2, 2007 to December 13, 2007, our stock was quoted in the OTC pink sheet market, due to

SEC filing delinquencies. Having satisfied financial filing compliance standards, we returned to

being quoted on the OTC Bulletin Board market after the filing of our second fiscal quarter 2008

10-QSB report.

The Bulletin Board market is characterized by low trading volume. Because of this limited

liquidity, shareholders may be unable to sell their shares at or above the cost of their purchase

prices. The trading price of our shares has experienced wide fluctuations and these shares may be

subject to similar fluctuations in the future.

The trading price of our common stock may be affected by a number of factors including events

described in the risk factors set forth in this 10-KSB report, as well as our operating results,

financial condition, announcements of drilling activities, general conditions in the oil and gas

exploration and development industry, and other events or factors.

In recent years, broad stock market indices, in general, and smaller capitalization companies, in

particular, have experienced substantial price fluctuations. In a volatile market, we may

experience wide fluctuations in the market price of our common stock. These fluctuations may have

a negative effect on the market price of our common stock.

Privately placed issuances of our common stock have and may continue to dilute ownership interests

which could have an adverse effect on our stock prices

Our authorized capital stock consists of 200,000,000 shares of common stock and 10,000,000 shares

of preferred stock. As of February 29, 2008, there were 44,293,299 shares of common stock and

1,297,465 shares of Series A Convertible Preferred stock issued and outstanding.

As of February 29, 2008, the Company had sold, in a private placement sale to seven accredited

investors, 605,000 shares at $0.25 per share resulting in gross proceeds of $151,250. Since this

offering began, the price of our common stock has ranged from a low of $0.25 to a high of $0.36.

16

On December 28, 2007, the Company closed on a private placement sale of 2,497,000 shares to

thirteen accredited investors at $0.25 per share resulting in gross proceeds of $624,250. This

private placement sale had been underway since October 19, 2007. At the time of the offering, the

price of our common stock ranged from a low of $0.33 to a high of $0.48.

On July 18, 2006, the Company closed on a private placement sale of 1,399,765 units at $3.00 per

unit resulting in gross proceeds of $4,199,291. Each unit sold was comprised of one share of

Series A Convertible Preferred stock and two common stock purchase warrants. The warrants are

exercisable at a price of $2.00 and expire on July 19, 2011. The 100 investors in this private

placement were issued 1,399,765 shares of Series A Convertible Preferred stock and 2,799,527 common

stock purchase warrants. The placement agent for the offering earned an additional 419,930 common

stock purchase warrants. At the time of the offering, the common stock component prices of the

private placement units were significantly lower than the trading price of our common stock.

On May 19, 2006, the Company closed on a private placement sale of 4,013,602 units at $1.50 per

unit resulting in gross proceeds of $6,020,404. Each unit sold was comprised of two shares of

common stock and one common stock purchase warrant. The warrants are exercisable at a price of

$2.00 and expire on May 20, 2011. The 118 investors in this private placement were issued 8,027,206

shares of common stock and 4,013,602 common stock purchase warrants. The placement agent for the

offering earned an additional 1,204,082 common stock purchase warrants. At the time of the

offering, the common stock component prices of the private placement units were significantly lower

than the trading price of our common stock.

In addition to the completed private placements, we may in the future, issue additional previously

authorized and unissued common stock. These events may result in the further dilution of the

ownership interests of our present shareholders and purchasers of common stock offered in this

prospectus.

Historically we have, and likely will continue to issue additional shares of our common stock in

connection with the compensation of personnel, future acquisitions, private placements, or for

other business purposes. Future issuances of substantial amounts of these equity securities could

have a material adverse effect on the market price of our common stock, and would result in further

dilution of existing stock ownership.

Preferred stock has been issued with greater rights than the common stock issued which may dilute

and depress the investment value of the common stock investments

Our articles of incorporation currently authorize the issuance of 10,000,000 shares of $0.001 par

value preferred stock. In June 2006, the Board of Directors authorized 2,400,000 shares of

preferred stock to be designated as Series A Convertible Preferred stock. The Board of Directors

has the power to issue shares without shareholder approval, and such shares can be issued with such

rights, preferences, and limitations as may be determined by our Board of Directors.

On July 18, 2006, the Company closed on a private placement sale of 1,399,765 units at $3.00 per

unit resulting in gross proceeds of $4,199,291. Each unit sold was comprised of one Series A

Convertible Preferred share and two common stock purchase warrants. Each Series A Convertible

Preferred share can be converted to three common stock shares at any time. The warrants are

17

exercisable at a price of $2.00 and expire on July 18, 2011. The 100 investors in this private

placement were issued a total of 1,399,765 Series A Convertible Preferred shares and 2,799,527

common stock purchase warrants. The placement agent for the offering earned an additional 419,930

common stock purchase warrants.

As of February 29, 2008, 1,297,465 shares of Series A Convertible preferred stock were issued and

outstanding. The rights of the holders of common stock are subject to and may be adversely

affected by the rights and preferences afforded to the holders of these preferred shares. The

rights and preferences of the issued preferred shares include:

|

•

|

|

conversion into common stock of the Company anytime the preferred shareholder may wish;

|

|

•

|

|

automatic convertibility into common stock if after the effective date of the registration

statement the Company’s common stock closes at or above $3.00 per share for twenty (20) out of

thirty trading days (30) days;

|

|

•

|

|

cumulative dividends in the amount of 6% of the original purchase price per annum, payable

upon declaration by the board of directors;

|

|

•

|

|

the ability to vote together with the common stock with a number of votes equal to the

number of shares of common stock to be issued upon conversion of the preferred stock.

|

The issuance of the Series A Convertible Preferred shares could delay, discourage, hinder or

preclude an unsolicited acquisition of our Company. In addition, the issuance of these preferred

shares could make it less likely that shareholders receive a premium for their shares as a result

of any such attempt to acquire the Company. Further, this issuance could adversely affect the

market price of, and the voting and other rights, of the holders of outstanding shares of common

stock.

Although we have no current plans to issue any additional preferred stock, future issuances of

preferred stock may also have more advantageous features than our common stock in terms of

dividends, liquidation and voting rights.

We may seek to raise additional funds in the future through debt financing which may impose

operational restrictions and may further dilute existing ownership interests

We expect to seek to raise additional capital in the future to help fund our acquisition,

development, and production of oil and natural gas reserves. Debt financing, if available, may

require restrictive covenants which may limit our operating flexibility. Future debt financing may

also involve debt instruments that are convertible into or exercisable for common stock. As

mentioned above, the conversion of the debt to equity financing may dilute the equity position of

our shareholders.

Principal shareholders and directors control the Company through substantial voting power

Our two largest principal beneficial shareholders, along with six current directors and officers of

the Company own and control about 25.5% percent of our outstanding common stock.

Our shareholders do not have the right to cumulative voting in the election of our directors.

Cumulative voting could allow a minority group to elect at least one director to our board.

Because there is no provision for cumulative voting, a minority group will not be able to elect any

directors. Conversely, if our principal beneficial shareholders and directors wish to act in

concert, they would be able to vote to appoint directors of their choice, and otherwise directly or

indirectly, control the direction and operation of the Company.

18

We do not anticipate paying dividends on our common stock which could devalue the market value of

these securities

We have not paid any cash dividends on our common stock since our inception. We do not anticipate

paying cash dividends in the foreseeable future. Any dividends paid in the future will be at the

complete discretion of our board of directors. For the foreseeable future, we anticipate that we

will retain any revenues which we may generate from our operations. These retained revenues will

be used to finance and develop the growth of the Company. Prospective investors should be aware

that the absence of dividend payments could negatively affect the market value of our common stock.

Pursuant to SEC Rules our common stock is classified as a “penny stock’ increasing the risk of

investment in these shares

Our common stock is designated as “penny stock” and thus may be more illiquid than shares traded on

an exchange or on NASDAQ. The SEC has adopted rules (Rules 15g-2 through l5g-6 of the Exchange

Act) which define “penny stocks” and regulate broker-dealer practices in connection with

transactions with these stocks. Penny stocks generally are any non-NASDAQ or non-exchange listed

equity securities with a price of less than $5.00, subject to certain exceptions. The “penny stock

rules” require a broker-dealer to:

|

•

|

|

deliver a standardized risk disclosure document prepared by the SEC;

|

|

•

|

|

provide the customer with current bid and offer quotations for the penny stock;

|

|

•

|

|

include the compensation of the broker-dealer and its salesperson in the transaction;

|

|

•

|

|

provide monthly account statements showing the market value of each penny stock held in the

customer’s account;

|

|

•

|

|

make a special written determination that the penny stock is a suitable investment for the

purchaser and receive the purchaser’s written agreement to the transaction.

|

The “penny stock” reporting and disclosure requirements may have the effect of reducing the level

of trading activity in the secondary market for a stock that is subject to these rules. The market

liquidity for the shares could be severely and adversely affected by limiting the ability of

broker-dealers to sell these shares. In addition, the ability of purchasers in this offering to

sell their stock in any secondary market could be adversely restricted.

Due to limited and sporadic trading volume, investors may not be able to resell their shares of

common stock at favorable times and prices

Although our common stock has been quoted on the OTC Bulletin Board for several years, the trading

in our stock has been limited and sporadic. Although trading volume has increased over the past

fiscal year, it has still been sporadic. The trading volume during this period has ranged from

several hundred thousand shares to as few as no shares traded on certain days. A consistently

active trading market for our common stock may never be developed, or sustained if it emerges. In

addition, the price of our common stock on the OTC Bulletin Board has been extremely volatile. Low

volume or lack of demand for these securities may make it more difficult for you to sell such

shares at a price or at a time that would be favorable. We cannot assure you that you will be able

to sell your shares at an attractive price relative to the price you are paying or that you will be

able to sell these securities in a timely fashion.

19

An investment in the common stock of our Company will not provide any federal income tax benefits

for the shareholders

Investors should be aware that they will not receive any of the federal income tax benefits

available to individuals investing as limited partners in oil and gas partnership programs. Any

income tax advantages will inure solely to the benefit of the Company and will not be passed

through to any shareholders.

Risks Related to Our Industry

We are subject to complex laws and regulations that can negatively impact the cost, manner and

feasibility of conducting our business

Our business is governed by numerous laws and regulations at various levels of government. These

laws and regulations govern the operation and maintenance of our facilities, the discharge of

materials into the environment and other environmental protection issues. These laws and

regulations may, among other potential consequences, require that we:

|

•

|

|

acquire permits before the commencement of drilling;

|

|

•

|

|

restrict the substances that can be released into the environment with drilling and

production activities;

|

|

•

|

|

limit or prohibit drilling activities on protected areas;

|

|

•

|

|

require that reclamation measures be taken to prevent pollution from former operations;

|

|

•

|

|

require remedial measures to be taken with respect to contaminated property.

|

The costs of complying with environmental laws and regulations could negatively impact our

financial condition and results of operations. Future changes in environmental laws and

regulations could occur that may result in stricter standards and enforcement which could further

negatively impact our business.

The volatility of oil and natural gas prices could adversely affect our business

Our future revenues, profitability and growth of our investments in oil and gas properties depend

to a large degree on prevailing oil and gas prices. These prices tend to fluctuate significantly

in response to factors beyond our control. These factors include, but are not limited to, the

continued threat of escalating war in the Middle East and actions of the Organization of Petroleum

Exporting Countries and its maintenance of production constraints. Additional factors include, the

U.S. economic environment, weather conditions, the availability of alternate fuel sources,

transportation interruption, the impact of drilling levels on crude oil and natural gas supply, and

environmental issues. The prices for oil and natural gas have varied substantially over time based

on general supply and demand and may in the future decline. These prices have been and are likely

to remain volatile. Significant declines in these prices owing to this volatility will adversely

affect our business and consequently our shareholders.

The success of our business is dependent on our ability to produce sufficient quantities of oil and

gas which may be adversely affected by a number of factors outside of our control

The business of exploring for and producing oil and gas involves a substantial risk of investment

loss. Drilling oil and gas wells involves the risk that the wells may be unproductive or that,

although productive, that the wells may not produce oil and/or gas in economic quantities. Other

20

hazards, such as unusual or unexpected geological formations, pressures, fires, blowouts, loss of

circulation of drilling fluids may substantially delay or prevent completion of any well. Adverse

weather conditions can also hinder drilling operations. In addition, a “productive well” (a well

that is producing oil or gas or that is capable of production) may become uneconomic due to

pressure depletion, water encroachment, mechanical difficulties, etc, which impair or prevent the

production of oil and/or gas from the well; or, due to increased production costs.

There can be no assurance that oil and gas will be produced from the properties in which we have

interests. Governmental permitting requirements and regulations may delay or deter drilling in

some areas. Further, the marketability of any oil or gas that we acquire or discover may be

influenced by numerous factors beyond our control. We cannot predict how these factors may affect

our business.

The unavailability or high cost of drilling rigs and related equipment could adversely affect our

ability to execute our exploration and exploitation plans on a timely and economic basis

Increased oil and natural gas prices have stimulated increased demand and resulted in escalated

prices for drilling rigs, crews, and associated equipment, supplies and services. This demand has

created a shortage of drilling rigs and crews as the number of wells being drilled have vastly

increased. The inability to secure drilling rigs and crews may delay development of properties in

which we acquire an interest, resulting in the untimely and costly expiration of certain leases.

Drilling delays and the loss of leases could have a material negative effect on our business

operations and financial condition.

Employees and Consultants

In December 2007, both the management and the Board of Directors of Daybreak were restructured to

allow for future growth and increased efficiency within the Company. Robert N. Martin, President

resigned from that position and was appointed Senior Vice-President, Exploration; Chief Executive

Officer Eric L. Moe resigned from the Company; Timothy R. Lindsey formerly an outside director was

appointed interim President and Chief Executive Officer; Chief Financial Officer Terrence J. Dunne

resigned from the Company; and Controller Thomas C. Kilbourne resigned from that position but

continued as an employee of Daybreak. James F. Westmoreland, formerly a finance and accounting

consultant to Daybreak, was appointed interim Chief Financial Officer.

On December 18, 2007, the Board of Directors voted to reduce the number of Board positions to

three. Subsequently, the following individuals resigned their positions and offices with the Board

of Directors of Daybreak; Robert N. Martin, Eric L. Moe, Terrence J. Dunne, Jeffrey R. Dworkin,

Thomas C. Kilbourne and Michael Curtis. Karol L. Adams, formerly a consultant to Daybreak, was

appointed Corporate Secretary.

On March 24, 2008 James F. Meara was appointed to our Board of Directors. The addition of Mr.

Meara expanded the Company’s board to four members.

On April 3, 2008, James F. Westmoreland, formerly interim Chief Financial Officer, was appointed

Executive Vice President and Chief Financial Officer; Karol L. Adams was appointed Chief Compliance

Officer in addition to the Corporate Secretary duties; Thomas C. Kilbourne was

21

appointed Controller and Assistant Secretary; and Daybreak adopted a series of corporate

responsibility statements and employee guidelines.

We currently have seven employees located throughout four states. We may hire more employees in

the next fiscal year as needed. All other services are currently contracted for with independent

contractors. The Company has not obtained “key man” life insurance on any of its officers or

directors.

The Daybreak Oil and Gas, Inc. corporate office is located at 601 W. Main Ave., Suite 1012,

Spokane, Washington 99201-0613. Our telephone number is (509) 232-7674.

Our regional operations office is located at 16225 Park Ten Place, Suite 500, Houston, Texas 77084.

The telephone number of our office in Houston is (281) 994-4021.

Availability of SEC Filings

You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 450

Fifth Street, NW, Washington, DC 20549. You can obtain information on the operation of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that

contains reports, proxy and information statements, and other information regarding issuers that

file electronically with the SEC. The address of that site is (http://www.sec.gov).

Website / Available Information

Our website can be found at

www.daybreakoilandgas.com

. Our Annual Reports on Form 10-KSB,

Quarterly Reports on Form 10-QSB, Current Reports on Form 8-K and amendments to those reports filed

or furnished with the U.S. Securities and Exchange Commission, or SEC, pursuant to Section 13(a) or

15(d) of the Securities Exchange Act of 1934, or the Exchange Act, can be accessed free of charge

on our web site at

www.daybreakoilandgas.com

on the “Shareholder Information” section of

our web site under the “SEC Filings” button as soon as reasonably practicable after we

electronically file such material with, or otherwise furnish it to, the Securities and Exchange

Commission (the “SEC”).

We have adopted an Ethical Business Conduct Policy Statement to provide guidance to our directors,

officers and employees on matters of business conduct and ethics, including compliance standards

and procedures. We also have adopted a Code of Ethics for Senior Financial Officers that applies

to our principal executive officer, principal financial officer, principal accounting officer and

controller. Our Ethical Business Conduct Policy Statement and Code of Ethics for Senior Financial

Officers are available on the “Shareholder Information” section of our web site at

www.daybreakoilandgas.com

under the heading “Corporate Governance.” We intend to promptly

disclose via a Current Report on Form 8-K or via an update to our web site information any

amendment to or waiver of these codes with respect to our executive officers and directors. Waiver

information disclosed via the web site will remain on the web site for at least 12 months after the

initial disclosure of a waiver. Our Corporate Governance Guidelines and the charters of our Audit

Committee, Nominating and Corporate Governance Committee, and Compensation Committee are also

available on the “Shareholder Information” section of our web site at

www.daybreakoilandgas.com

under the heading “Corporate Governance.” In addition, copies of

our Ethical Business Conduct Policy Statement, Code of Ethics for Senior Financial Officers,

Corporate Governance Guidelines and the charters of the Committees referenced above are

22

available at no cost to any shareholder who requests them by writing or telephoning us at the

following address or telephone number:

Daybreak Oil and Gas, Inc.

601 W. Main Ave., Suite 1012

Spokane, WA 99201-0613

Attention: Corporate Secretary

Telephone: (509) 232-7674

Information contained on or connected to our web site is not incorporated by reference into this

Annual Report and should not be considered part of this report or any other filing that we make

with the SEC.

23

ITEM 2. DESCRIPTION OF PROPERTIES

We have onshore oil and gas projects underway throughout the United States. We have not filed any

estimates of total, proved net oil or gas reserves with any Federal agency for the fiscal year

ended February 29, 2008. Throughout this 10-KSB annual report oil is shown in barrels (“Bbl”), and

of natural gas is shown in thousands of cubic feet (“Mcf”). The project areas that we are involved

in are as follows:

Alabama (East Gilbertown Field)

Choctaw County.

In December 2006, we acquired a working interest in an existing oil field

project, the East Gilbertown Field (“Gilbertown”) that produces relatively heavy oil (approximately

18º API). This field has nineteen wellbores most of which are capable of production.

From December 2006 through March 2007, we incrementally increased our working interest in this

project from 2.5% to 12.5%. On June 1, 2007, we became the operator of the Gilbertown. Future

plans are to continue to increase production in the field by bringing more non-producing wellbores

back into production. As of February 29, 2008, we had spent $397,229 in leasehold, production and

workover costs associated with this field. We plan to spend approximately $200,000 in capital

repairs and new investments within the field in the upcoming fiscal year.

Reserves

At March 1, 2008 we had net proved reserves of 2,391 Bbls. (“Barrels”) of oil in Gilbertown

according to SEC guidelines as determined by a certified independent engineering firm.

California

East Slopes Project in Kern and Tulare Counties

. In May 2005, we agreed to jointly explore

an Area of Mutual Interest (“AMI”) in the southeastern part of the San Joaquin Basin. For our 50%

interest we initially paid a $12,500 fee to secure the project and the geological concepts. Our

agreement calls for us to also pay another $5,000 fee upon the completion of each sub-regional lead

that is developed from a 3-D seismic survey. Additionally, we agreed to pay another $5,000 fee

upon the spud of the first well in each prospect area.

Four prospect areas have been identified and we are actively leasing lands in the East Slopes

project area. Additionally, we have identified two prospect areas to the north of the East Slopes

AMI. This second AMI is referred to as the “Expanded AMI” project area. We have now jointly leased

about 25,633 undeveloped acres in the two AMI’s. Drilling targets are porous and permeable

sandstone reservoirs at depths of 1,200 feet to 4,000 feet. Daybreak has a 50% of the working

interest in the area that is not in the Chevron partnered East Slopes AMI project area covered by

the recently completed high definition 3-D seismic survey.

As of February 29, 2008 we have spent $778,806 in leasehold and geologic and geophysical costs

associated with this project.

In June 2007, Daybreak and its partners (“Daybreak et al”), entered into a Seismic Option Farmout

Agreement with Chevron U.S.A. Inc. (“Chevron”), for a seismic and drilling program in the East

Slopes (Kern County) project area. By paying the full cost of the seismic program Chevron has

24

earned a 50% interest in the Daybreak et al lands and a 50% working interest for the drilling of

future wells in the project area after the drilling of the first four wells. Daybreak et al will

earn a 50% (Daybreak 25%) interest in the Chevron lands located in the same project area, by paying

100% of the cost of the first four initial test wells to be drilled on the jointly held lands. The

four initial test wells must be drilled within nine months of the seismic data interpretation being

completed. In January 2008, we announced that data processing is underway following the recently

completed field acquisition of the 35 square-mile high resolution 3-D seismic survey. As of the

date of this report, we have currently identified 12 potential drilling locations from ongoing

interpretation of the seismic data. Drilling is expected to commence in the second fiscal quarter

of 2008. We plan to spend approximately $2,000,000 in new capital investments within the AMI

covering the Seismic Option area in the upcoming fiscal year.

Louisiana

Tuscaloosa Project in Tensas and Franklin Parishes

. On January 18, 2008 we signed a

purchase and sale agreement (“PSA”) for the sale of our project interests for $8 million in cash.

The transaction was originally scheduled to close in two tranches; the first closing for $2

million, representing 25% of Daybreak’s working interest, closed on January 18, 2008. An

intermediate closing in the amount of $500,000 occurred on April 30, 2008, for 6.25% of the

Company’s working interest. The amended final closing for $5.5 million is scheduled to occur during

the second calendar quarter of 2008 for the remaining 68.75% of the Company’s working interest and

is subject to customary closing adjustments. The sale includes Daybreak’s interests in the Tensas

Farms et al F-1, F-3, B-1, A-1 and F-2 wells; and all of its remaining acreage and infrastructure

in the project area. Under terms of the PSA, the effective dates for the respective closings will

be January 1, 2008.

Reserves

At March 1, 2008 we had net proved reserves of 31.8 MMcf of gas and 10,567 Bbls. of oil in the

Tuscaloosa Project according to SEC guidelines as determined by a certified independent engineering

firm.

The Krotz Springs Project in

St. Landry Parish

is a deep gas play with current net

production from a Cockfield Sands reservoir. Daybreak was the operator for this project during the

drilling and completion phases of this single well. When production commenced in May of 2007, the

unitized field operator of the Krotz Springs Field became the operator for this well. Total project

drilling and completion costs were approximately $9.2 million. We have a 12.5% working interest in

this project, with a net revenue interest (“NRI”) of 9.125%. As of February 29, 2008, we had spent

$1.16 million in leasehold, drilling, completion and production costs associated with this project.

Current production is being evaluated prior to recompleting another prospective producing zone in

the well in which Daybreak will spend approximately $25,000 in the upcoming fiscal year.

Reserves

At March 1, 2008 we had net proved reserves of 4.6 MMcf (million cubic feet) of gas and 46 Bbls. of

oil in the Krotz Springs Project according to SEC guidelines as determined by a certified

independent engineering firm

The North Shuteston Prospect

, also in St. Landry Parish is a three dimensional (“3-D”)

seismic objective supported by a shallow amplitude anomaly at a depth of 2,300 feet. This anomaly

is

25

related to a Miocene Age Sand. On April 23, 2008, we conveyed our interest in this project to

another party in exchange for a two percent (2.0%) overriding royalty interest (“ORRI”) in the

production revenue from the start of production. Drilling will begin on this project during the

summer of 2008; however, Daybreak no longer has a working interest in this project, and therefore

will not have any more capital investment. As of February 29, 2008, we had spent about $130,000 in

leasehold, geologic and geophysical (“G&G”) and project management costs associated with this

project.

Avoyelles Parish.

This Prospect is a Cretaceous target positioned beneath an existing

oilfield that has produced over 28 million barrels of oil. The project is focused on the broad

northeast flank of the Cretaceous structure, targeting the Massive Sand of the Lower Tuscaloosa

Formation; and, the Fractured Lower (Austin) Chalk. Plans call for a 3-D seismic survey covering

about 36 square miles. This is primarily a deep gas play. Gross project costs are estimated to be