true

0001162896

0001162896

2024-03-19

2024-03-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

Amendment

No. 2

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 19, 2024

Prairie

Operating Co.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41895 |

|

98-0357690 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

602

Sawyer Street, Suite 710

Houston,

TX |

|

77007 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (713) 424-4247

N/A

(Former

Name or Former Address, If Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 per share |

|

PROP |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory

Note

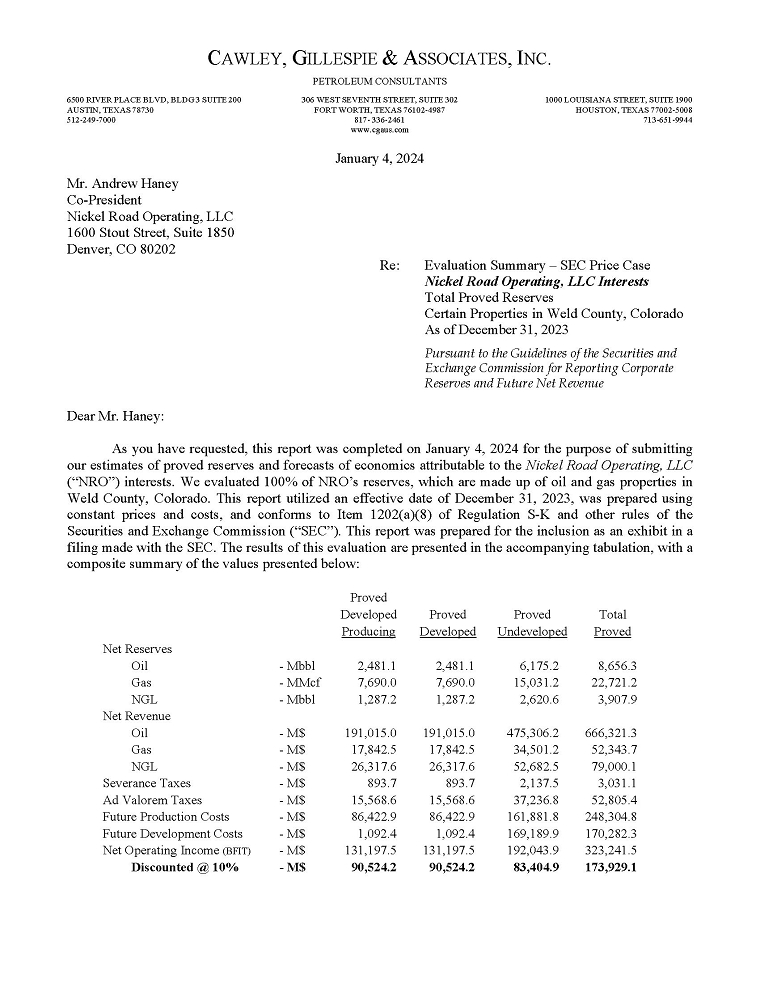

On

January 12, 2024, Prairie Operating Co. (the “Company”) filed a Current Report on Form 8-K to announce the Company’s

entry into an asset purchase agreement to acquire the assets of Nickel Road Operating LLC (“NRO”), which the Company subsequently

amended by filing Amendment No. 1 to the Current Report on Form 8-K/A on February 9, 2024 (as so amended, the “Original 8-K”).

This Amendment No. 2 to the Original 8-K (this “Amendment No. 2”), is being filed with the Securities and Exchange Commission

solely to amend and supplement Item 9.01 of the Original 8-K, as described in Item 9.01 below. This Amendment No. 2 makes no other amendments

to the Original 8-K.

Item

9.01 Financial Statements and Exhibits.

(a)

Financial Statements of Businesses Acquired

The

report prepared by Cawley, Gillespie & Associates, Inc., independent petroleum engineers, relating to the reserves of NRO as of December 31, 2023, is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

The

audited financial statements of NRO as of and for the years ended December 31, 2023 and December 31, 2022 are filed as Exhibit 99.2 hereto

and are incorporated herein by reference.

(b)

Pro Forma Financial Information

The

unaudited pro forma condensed combined financial information of the Company as of and for the year ended December 31, 2023 is filed as

Exhibit 99.3 hereto and incorporated herein by reference.

(d)

Exhibits

| Exhibit

Number |

|

Description |

| 23.1 |

|

Consent of Moss Adams LLP. |

| 23.2 |

|

Consent of Cawley Gillespie & Associates Inc. |

| 99.1 |

|

Report of Cawley, Gillespie & Associates, Inc., dated January 4, 2024, as to the reserves of Nickel Road Operating LLC as of December 31, 2023. |

| 99.2 |

|

Audited financial statements of Nickel Road Operating LLC, as of and for the years ended December 31, 2023 and December 31, 2022. |

| 99.3 |

|

Unaudited Pro Forma Condensed Combined Financial Information as of and for the year ended December 31, 2023. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Prairie

Operating Co. |

| Date:

March 19, 2024 |

|

|

| |

By:

|

/s/

Daniel T. Sweeney |

| |

|

Daniel

T. Sweeney |

| |

|

General

Counsel & Corporate Secretary |

Exhibit

23.1

Consent

of Independent Auditors

We

consent to the incorporation by reference in the Registration Statements on Form S-1 (Nos. 333-272743 and 333-276998) of Prairie Operating

Co. of our report dated March 14, 2024, relating to the consolidated financial statements of Nickel Road Operating LLC and Subsidiaries

as of and for the years ended December 31, 2023 and 2022, appearing in this Amendment No. 2 to the Current Report on Form 8-K of Prairie

Operating Co.

/s/ Moss Adams LLP

Denver,

Colorado

March 19, 2024

Exhibit

23.2

CONSENT

OF INDEPENDENT PETROLEUM RESERVE EXPERTS

We

hereby consent to the references to our firm in the form and context in which they appear, and the inclusion of our

report dated January 4, 2024 with respect to the estimates of reserves and future net revenues of Nickel Road Operating LLC, as of December

31, 2023, in this Amendment No. 2 to the Current Report on Form 8-K/A of the Company, and to the

incorporation by reference of such reports in the Registration Statements (Nos. 333-272743 and 333-276998) on Form S-1 of the Company,

filed with the U.S. Securities and Exchange Commission.

/s/

W. Todd Brooker

President

Cawley, Gillespie & Associates, Inc.

Fort

Worth, Texas

March 19, 2024

Exhibit

99.1

Exhibit

99.2

Report

of Independent Auditors

and Consolidated Financial Statements

Nickel

Road Operating LLC and Subsidiaries

December

31, 2023 and 2022

Table

of Contents

Report

of Independent Auditors

The

Management Committee

Nickel

Road Operating LLC and Subsidiaries

Report

on the Audit of the Financial Statements

Opinion

We

have audited the consolidated financial statements of Nickel Road Operating LLC and Subsidiaries, which comprise the consolidated balance

sheets as of December 31, 2023 and 2022, and the related consolidated statements of income, changes in members’ capital, and cash

flows for the years then ended, and the related notes to the consolidated financial statements.

In

our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of Nickel

Road Operating LLC and Subsidiaries as of December 31, 2023 and 2022, and the results of their operations and their cash flows for the

years then ended in accordance with accounting principles generally accepted in the United States of America.

Basis

for Opinion

We

conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities

under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section

of our report. We are required to be independent of Nickel Road Operating LLC and Subsidiaries and to meet our other ethical responsibilities,

in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient

and appropriate to provide a basis for our audit opinion.

Responsibilities

of Management for the Financial Statements

Management

is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles

generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant

to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In

preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate,

that raise substantial doubt about Nickel Road Operating LLC and Subsidiaries’ ability to continue as a going concern within one

year after the date that the financial statements are available to be issued.

Auditor’s

Responsibilities for the Audit of the Financial Statements

Our

objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement,

whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level

of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always

detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than

for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of

internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate,

they would influence the judgment made by a reasonable user based on the consolidated financial statements.

In

performing an audit in accordance with GAAS, we:

| ● | Exercise

professional judgment and maintain professional skepticism throughout the audit. |

| | |

| ● | Identify

and assess the risks of material misstatement of the consolidated financial statements, whether

due to fraud or error, and design and perform audit procedures responsive to those risks.

Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures

in the consolidated financial statements. |

| | |

| ● | Obtain

an understanding of internal control relevant to the audit in order to design audit procedures

that are appropriate in the circumstances, but not for the purpose of expressing an opinion

on the effectiveness of Nickel Road Operating LLC and Subsidiaries’ internal control.

Accordingly, no such opinion is expressed. |

| | |

| ● | Evaluate

the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluate the overall presentation of the consolidated

financial statements. |

| | |

| ● | Conclude

whether, in our judgment, there are conditions or events, considered in the aggregate, that

raise substantial doubt about Nickel Road Operating LLC and Subsidiaries’ ability to

continue as a going concern for a reasonable period of time. |

We

are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit,

significant audit findings, and certain internal control–related matters that we identified during the audit.

Other

Supplementary Information

Our

audit was conducted for the purpose of forming an opinion on the consolidated financial statements as a whole. The accompanying supplemental

schedules concerning oil and gas producing properties in Notes 10 and 11 are presented for purposes of additional analysis and is not

a required part of the consolidated financial statements. Because of the significance of the matter described above, it is inappropriate

to, and we do not, express an opinion on this supplementary information.

Denver,

Colorado

March

14, 2024

Consolidated

Financial Statements

Nickel

Road Operating LLC and Subsidiaries

Consolidated

Balance Sheets

December

31, 2023 and 2022

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| ASSETS |

|

|

|

|

|

|

|

|

| | |

| | |

| |

| CURRENT

ASSETS | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 336,115 | | |

$ | 276,039 | |

| Restricted

cash | |

| - | | |

| 3,200,000 | |

| Joint

interest receivable | |

| 897,804 | | |

| 197,655 | |

| Accrued

oil and gas sales | |

| 5,658,034 | | |

| 3,861,311 | |

| Derivative

asset, current | |

| 270,925 | | |

| - | |

| Prepaid

expenses | |

| 426,404 | | |

| 693,325 | |

| | |

| | | |

| | |

| Total

current assets | |

| 7,589,282 | | |

| 8,228,330 | |

| | |

| | | |

| | |

| OIL

AND GAS PROPERTIES, at cost (successful efforts method) | |

| | | |

| | |

| Proved

properties | |

| 137,855,719 | | |

| 113,415,744 | |

| Unproved

properties | |

| 1,690,690 | | |

| 1,068,954 | |

| Accumulated

depletion | |

| (41,010,449 | ) | |

| (25,691,574 | ) |

| | |

| | | |

| | |

| Total

oil and gas properties, net | |

| 98,535,960 | | |

| 88,793,124 | |

| | |

| | | |

| | |

| OTHER

NONCURRENT ASSETS | |

| | | |

| | |

| Right-of-use

asset, net | |

| 325,933 | | |

| - | |

| | |

| | | |

| | |

| TOTAL

ASSETS | |

$ | 106,451,175 | | |

$ | 97,021,454 | |

See

accompanying notes.

Nickel

Road Operating LLC and Subsidiaries

Consolidated

Balance Sheets

December

31, 2023 and 2022

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| LIABILITIES AND MEMBERS’ CAPITAL | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 1,801,926 | | |

$ | 1,921,542 | |

| Accrued liabilities | |

| 12,178,821 | | |

| 9,150,627 | |

| Due to related party | |

| 114,346 | | |

| 255,743 | |

| Current maturities of long-term debt, net of deferred financing costs | |

| 3,800,000 | | |

| - | |

| Short-term lease liability | |

| 192,384 | | |

| - | |

| Derivative liability, current | |

| - | | |

| 2,727,867 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 18,087,477 | | |

| 14,055,779 | |

| | |

| | | |

| | |

| NONCURRENT LIABILITIES | |

| | | |

| | |

| Long-term debt, net of current portion and deferred financing costs | |

| 16,660,116 | | |

| 25,036,040 | |

| Long-term lease liability | |

| 133,550 | | |

| - | |

| Asset retirement obligations | |

| 1,347,493 | | |

| 1,167,701 | |

| | |

| | | |

| | |

| Total noncurrent liabilities | |

| 18,141,159 | | |

| 26,203,741 | |

| | |

| | | |

| | |

| Total liabilities | |

| 36,228,636 | | |

| 40,259,520 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES (Note 7) | |

| | | |

| | |

| | |

| | | |

| | |

| MEMBERS’ CAPITAL | |

| | | |

| | |

| Contributed capital | |

| 64,025,830 | | |

| 64,025,830 | |

| Distributed capital | |

| (64,300,000 | ) | |

| (58,000,000 | ) |

| Retained earnings | |

| 70,496,709 | | |

| 50,736,104 | |

| | |

| | | |

| | |

| Total members’ capital | |

| 70,222,539 | | |

| 56,761,934 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND MEMBERS’ CAPITAL | |

$ | 106,451,175 | | |

$ | 97,021,454 | |

See

accompanying notes.

Nickel

Road Operating LLC and Subsidiaries

Consolidated

Statements of Income

Years

Ended December 31, 2023 and 2022

| | |

2023 | | |

2022 | |

| REVENUES | |

| | | |

| | |

| Oil and gas sales | |

$ | 48,169,114 | | |

$ | 66,059,962 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| Production taxes | |

| 4,408,520 | | |

| 4,975,383 | |

| Lease operating | |

| 4,616,425 | | |

| 3,942,294 | |

| Depreciation, depletion, and amortization | |

| 16,115,889 | | |

| 17,760,179 | |

| General and administrative | |

| 4,068,463 | | |

| 4,259,939 | |

| Impairment | |

| 5,077,697 | | |

| - | |

| Lease expirations | |

| - | | |

| 329,911 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 34,286,994 | | |

| 31,267,706 | |

| | |

| | | |

| | |

| INCOME FROM OPERATIONS | |

| 13,882,120 | | |

| 34,792,256 | |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | |

| Interest expense | |

| (2,025,960 | ) | |

| (936,453 | ) |

| Gain on sale of oil and gas properties | |

| 5,925,755 | | |

| 25,331,465 | |

| Realized loss on derivative instruments | |

| (1,021,596 | ) | |

| (21,751,084 | ) |

| Unrealized gain on derivative instruments | |

| 2,998,792 | | |

| 3,286,777 | |

| Other income | |

| 4,227 | | |

| 20,029 | |

| Income tax expense | |

| (18,000 | ) | |

| (4,748 | ) |

| Interest income | |

| 15,267 | | |

| 41,152 | |

| | |

| | | |

| | |

| Total other income | |

| 5,878,485 | | |

| 5,987,138 | |

| | |

| | | |

| | |

| NET INCOME | |

$ | 19,760,605 | | |

$ | 40,779,394 | |

See

accompanying notes.

Nickel

Road Operating LLC and Subsidiaries

Consolidated

Statements of Changes in Members’ Capital

Years

Ended December 31, 2023 and 2022

| | |

Class A | | |

Class B | | |

Retained Earnings | | |

Total Members’ | |

| | |

Capital | | |

Capital | | |

(Deficit) | | |

Equity | |

| | |

| | |

| | |

| | |

| |

| BALANCE, January 1, 2022 | |

$ | 64,025,830 | | |

$ | - | | |

$ | 9,956,710 | | |

$ | 73,982,540 | |

| | |

| | | |

| | | |

| | | |

| | |

| Capital distributions | |

| (58,000,000 | ) | |

| - | | |

| - | | |

| (58,000,000 | ) |

| Net income | |

| - | | |

| - | | |

| 40,779,394 | | |

| 40,779,394 | |

| | |

| | | |

| | | |

| | | |

| | |

| BALANCE, December 31, 2022 | |

| 6,025,830 | | |

| - | | |

| 50,736,104 | | |

| 56,761,934 | |

| | |

| | | |

| | | |

| | | |

| | |

| Capital distributions | |

| (6,300,000 | ) | |

| - | | |

| - | | |

| (6,300,000 | ) |

| Net income | |

| - | | |

| - | | |

| 19,760,605 | | |

| 19,760,605 | |

| | |

| | | |

| | | |

| | | |

| | |

| BALANCE, December 31, 2023 | |

$ | (274,170 | ) | |

$ | - | | |

$ | 70,496,709 | | |

$ | 70,222,539 | |

See

accompanying notes.

Nickel

Road Operating LLC and Subsidiaries

Consolidated

Statements of Cash Flows

Years

Ended December 31, 2023 and 2022

| | |

2023 | | |

2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net income | |

$ | 19,760,605 | | |

$ | 40,779,394 | |

| Adjustments to reconcile net income to net cash from operating activities | |

| | | |

| | |

| Depreciation, depletion, and amortization | |

| 16,115,889 | | |

| 17,760,179 | |

| Impairment | |

| 5,077,697 | | |

| - | |

| Amortization of debt issuance costs | |

| 104,395 | | |

| 140,941 | |

| Gain on sale of oil and gas properties | |

| (5,925,755 | ) | |

| (25,331,465 | ) |

| Lease expirations | |

| - | | |

| 329,911 | |

| Unrealized gain on derivative instruments | |

| (2,998,792 | ) | |

| (3,286,777 | ) |

| Change in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (2,496,872 | ) | |

| 4,505,745 | |

| Prepaid expenses | |

| 266,921 | | |

| (42,120 | ) |

| Accounts payables | |

| (119,616 | ) | |

| 105,677 | |

| Due to related party | |

| (141,397 | ) | |

| 167,993 | |

| Accrued liabilities | |

| 4,472,384 | | |

| 24,449 | |

| | |

| | | |

| | |

| Net cash from operating activities | |

| 34,115,459 | | |

| 35,153,927 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Purchases of oil and gas properties | |

| (32,429,078 | ) | |

| (37,025,536 | ) |

| Proceeds from the sale of oil and gas properties | |

| 6,154,013 | | |

| 58,693,653 | |

| | |

| | | |

| | |

| Net cash (used in) from investing activities | |

| (26,275,065 | ) | |

| 21,668,117 | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Proceeds from debt | |

| 68,116,667 | | |

| 29,700,000 | |

| Repayment of debt | |

| (72,633,333 | ) | |

| (25,175,000 | ) |

| Debt issuance costs | |

| (163,652 | ) | |

| (19,377 | ) |

| Capital distributions | |

| (6,300,000 | ) | |

| (58,000,000 | ) |

| | |

| | | |

| | |

| Net cash used in financing activities | |

| (10,980,318 | ) | |

| (53,494,377 | ) |

| | |

| | | |

| | |

| NET CHANGE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | |

| (3,139,924 | ) | |

| 3,327,667 | |

| | |

| | | |

| | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, beginning of year | |

| 3,476,039 | | |

| 148,372 | |

| | |

| | | |

| | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, end of year | |

$ | 336,115 | | |

$ | 3,476,039 | |

| | |

| | | |

| | |

| RECONCILIATION OF CASH, CASH EQUIVALENTS, AND RESTRICTED | |

| | | |

| | |

| CASH, end of year | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 336,115 | | |

$ | 276,039 | |

| Restricted cash | |

| - | | |

| 3,200,000 | |

| | |

| | | |

| | |

| Cash, cash equivalents, and restricted cash, end of year | |

$ | 336,115 | | |

$ | 3,476,039 | |

| | |

| | | |

| | |

| SUPPLEMENTAL CASH FLOW INFORMATION | |

| | | |

| | |

| Capital expenditures in accounts payable and accrued liabilities | |

$ | 316,880 | | |

$ | - | |

| | |

| | | |

| | |

| Asset retirement obligations incurred, net | |

$ | 126,707 | | |

$ | 209,652 | |

| | |

| | | |

| | |

| Asset retirement obligations settled | |

$ | - | | |

$ | 185,440 | |

| | |

| | | |

| | |

| Right-of-use asset obtained in exchange for lease obligations | |

$ | 388,011 | | |

$ | - | |

| | |

| | | |

| | |

| Cash paid for interest | |

$ | 1,821,998 | | |

$ | 853,027 | |

See

accompanying notes.

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Note

1 – Organization and Summary of Significant Accounting Policies

Organization

– Nickel Road Operating LLC , a Delaware limited liability company (the Company), was formed on July 25, 2017, for the purpose

of engaging in the evaluation, acquisition, exploration, drilling, development, and production of oil and gas in the United States of

America. The Company shall continue in existence until it is liquidated or dissolved under the terms of the Amended Limited Liability

Company Agreement (the LLC Agreement).

As

a Limited Liability Company (LLC), the amount of loss at risk for each individual member is limited to the amount of capital contributed

to the LLC, and unless otherwise noted, the individual member’s liability for indebtedness of an LLC is limited to the member’s

capital contributions.

Basis

of presentation – The Company follows accounting standards established by the Financial Accounting Standards Board (FASB).

The FASB sets accounting principles generally accepted in the United States of America (GAAP) to ensure consistent reporting of the Company’s

financial condition, results of operations, and cash flows. References to GAAP issued by the FASB in these footnotes are to the FASB

Accounting Standards Codification (ASC) or “Codification.”

Use

of estimates in the preparation of financial statements – The preparation of financial statements in conformity with generally

accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities

and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of

revenues and expenses during the reporting period. Actual results could differ from those estimates.

Depreciation,

depletion, and amortization of oil and gas properties and the impairment of proved oil and gas properties are determined using estimates

of oil and gas reserves. There are numerous uncertainties in estimating the quantity of reserves and in projecting the future rates of

production and timing of development expenditures, including future costs to dismantle, dispose, and restore the Company’s properties.

Oil and gas reserve engineering must be recognized as a subjective process of estimating underground accumulations of oil and gas that

cannot be measured in an exact way.

Fair

value of financial instruments – The Company’s financial instruments consist of cash and cash equivalents, restricted

cash, trade receivables, trade payables, accrued liabilities, and derivative financial instruments. The carrying value of cash and cash

equivalents, restricted cash, trade payables, accrued liabilities, and derivative financial instruments are considered to be representative

of their fair market value due to the short maturity of these instruments. The carrying amount of debt reflected on the consolidated

balance sheets approximates fair value as this debt has a variable interest rate that approximates a market interest rate.

Principles

of consolidation – The accompanying consolidated financial statements are consolidated and include the accounts of the Company

and its wholly owned subsidiaries, Source Rock Royalty LLC, Nickel Road Development LLC, and Peak Stone Properties LLC. All significant

intercompany amounts have been eliminated in consolidation.

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Cash

and cash equivalents – The Company considers all highly liquid investments with a maturity of three months or less, when purchased,

to be cash equivalents. Cash and cash equivalents are maintained at financial institutions, and, at times, balances may exceed federally

insured limits. The Company has not experienced any losses related to such balances, and management believes that the Company is not

exposed to any significant risks on the balances.

Restricted

cash – As of December 31, 2022, the Company held restricted cash of approximately $3,200,000 for accounts held in escrow related

to the Company’s sale of Oil and Gas Properties. Per the terms of the Asset Purchase Agreement, see oil and gas properties within

Note 1, entered on June 1, 2022, the escrow period is defined as one year from the closing date. The restricted cash balance was released

during the period ended December 31, 2023. The Company did not hold any restricted cash as of December 31, 2023.

Accounts

receivable – In June of 2016, the FASB issued ASC Topic 326, Financial Instruments - Credit Losses. This new guidance

replaces the current incurred loss impairment model with a requirement to recognize lifetime expected credit losses immediately when

a financial asset is originated or purchased. This new Current Expected Credit Losses (CECL) model applies to (1) loans, accounts receivable,

trade receivables, and other financial assets measured at amortized cost, (2) loan commitments and certain other off-balance- sheet credit

exposures, (3) debt securities and financial assets measured at fair value, and (4) beneficial interests in securitized financial assets.

The Company adopted this ASU effective January 1, 2023. As originally provided for in the CECL standard, the Company applied the new

guidance through a cumulative-effect adjustment to retained earnings as of the beginning of the year of adoption, which, for the Company

was January 1, 2023, with future adjustment to credit loss expectations recorded through the income statement as charges or credits to

earnings. The Company’s adoption of this guidance resulted in no cumulative effect adjustment to retained earnings upon adoption

and there was no significant impact to the Company’s operating results during 2023.

Accounts

receivable consist of uncollateralized joint interest owner obligations due within 30 days of the invoice date, uncollateralized accrued

revenues due under normal trade terms, generally requiring payment within 30 days of production, and other miscellaneous receivables.

Management estimates the allowance balance using the relevant available information, from internal and external sources, related to past

events, current conditions, and reasonable and supportable forecasts of economic conditions. No allowance for bad debts has been recorded

during the years ended December 31, 2023 and 2022.

Significant

customers – As of and for the year ended December 31, 2023, the Company’s largest customer generated approximately 90%

of sales, and one customer accounted for approximately 95% of accrued oil and gas sales.

As

of and for the year ended December 31, 2022, the Company’s two largest customers generated approximately 82% and 15% of sales,

and one customer accounted for approximately 88% of accrued oil and gas sales.

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Oil

and gas properties – The Company accounts for its oil and gas operations using the successful efforts method of accounting.

Under this method, all costs associated with property acquisitions, successful exploratory wells, and development wells are capitalized.

Items charged to expense generally include geological and geophysical costs, costs of unsuccessful exploratory wells, delay rentals,

and oil and gas production costs. Capitalized costs of proved leasehold costs are depleted on a well-by-well basis using the units-of-production

method based on total proved developed producing oil and gas reserves. Other capitalized costs of producing properties are also depleted

based on total proved developed producing reserves. Depletion expense for the years ended December 31, 2023 and 2022 was approximately

$16,063,000 and $17,712,000, respectively.

The

Company assesses its proved oil and gas properties for impairment whenever events or circumstances indicate that the carrying value of

the assets may not be recoverable, but at least annually. The impairment test compares undiscounted future net cash flows to the assets’

net book value. If the net capitalized costs exceed future net cash flows, then the cost of the property is written down to the estimated

fair value. Fair value for oil and natural gas properties is generally determined based on an analysis of discounted future net cash

flows adjusted for certain risk factors. General rules for asset impairment described in ASC Topic 360 also apply. Impairment of proved

properties as of December 31, 2023 and 2022 was approximately $4,991,000 and $0, respectively.

Unproved

properties are assessed periodically on a project-by-project basis to determine whether an impairment has occurred. Management’s

assessment includes consideration of the results of exploration activities, commodity price predictions or forecasts, planned future

sales, or expiration of all or a portion of such projects. Impairment of unproved properties as of December 31, 2023 and 2022 was approximately

$87,000 and $0, respectively.

Gains

and losses arising from sales of oil and gas properties are included in other income. However, a partial sale of proved properties within

an existing field that does not significantly affect the unit-of-production depletion rate will be accounted for as a normal retirement

with no gain or loss recognized. The sale of a partial interest within a proved property is accounted for as a recovery of cost. The

partial sale of unproved property is accounted for as a recovery of cost when there is uncertainty of the ultimate recovery of the cost

applicable to the interest retained.

On

June 1, 2022, the Company entered into an Asset Purchase Agreement with a third party to sell a portion of the Company’s proved

and unproved oil and gas properties. The Company sold various oil and gas properties held in the DJ Basin to a third party for $64,000,000;

after purchase price adjustments total proceeds were approximately $58,694,000. The oil and gas properties sold by the Company had a

carrying value of approximately $33,363,000, resulting in a gain of approximately $25,331,000.

On

March 1, 2023, and closed on August 31, 2023, the Company entered into an Asset Purchase Agreement with a third party to sell the Company’s

royalty assets owned by the subsidiary, Source Rock Royalty LLC. The Company sold for $7,000,000; after purchase price adjustments total

proceeds were approximately $6,405,000. The oil and gas properties sold by the Company had a carrying value of approximately $2,017,000,

resulting in a gain of approximately $4,388,000.

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Derivative

financial instruments – The Company enters into derivative contracts, primarily swaps, and collars to hedge future crude oil

and natural gas production in order to mitigate the risk of market price fluctuations. All derivative instruments are recorded on the

balance sheet at fair value. The Company has elected not to apply hedge accounting to any of its derivative transactions; consequently,

the Company recognizes mark-to-market gains and losses in earnings currently, rather than deferring such amounts in other comprehensive

income for those commodity derivatives that qualify as cash flow hedges.

Asset

retirement obligations – An asset retirement obligation associated with the retirement of a tangible long-lived asset is recognized

as a liability in the period incurred, with an associated increase in the carrying amount of the related long-lived asset and oil and

natural gas properties. The cost of the tangible asset, including the asset retirement cost, is depleted over the useful life of the

asset. The asset retirement obligation is recorded at its estimated fair value, measured by reference to the expected future cash outflows

required to satisfy the retirement obligation discounted at the credit-adjusted, risk-free interest rate. Accretion expense is recognized

over time, as the discounted liability is accreted to its expected settlement value. Accretion expense is recorded within “Depletion,

depreciation, and amortization” in the consolidated statements of operations. If the estimated future cost of the asset retirement

obligation changes, an adjustment is recorded to both the asset retirement obligation and the long-lived asset. Revisions to estimated

asset retirement obligations can result from changes in retirement cost estimates, revisions to estimated inflation rates, and changes

in the estimated timing of abandonment.

Deferred

financing costs – Deferred financing costs are capitalized and amortized over the contractual term of the related obligations.

Debt issuance costs of approximately $444,000 were recognized within long-term debt as a reduction of the current outstanding balance

in 2023, net of approximately $104,000 of amortization expense which is recorded as interest expense. See Note 8 for further details.

Revenue

recognition – The Company recognizes revenue in accordance with Accounting Standards Codification (ASC) 606, Revenue from

Contracts with Customers. Revenue from the sale of oil, natural gas liquids (NGLs), and natural gas is recognized as the product

is delivered to the customers’ custody transfer points, and collectability is reasonably assured. The Company fulfills the performance

obligations under the customer contracts through daily delivery of oil, NGLs, and natural gas to the customers’ custody transfer

points, and revenues are recorded on a monthly basis. The prices received for oil, NGLs, and natural gas sales under the Company’s

contracts are generally derived from stated market prices, which are then adjusted to reflect deductions, including transportation, fractionation,

and processing. As a result, the revenues from the sale of oil, NGLs, and natural gas will decrease if market prices decline. The sales

of oil, NGLs, and natural gas, as presented on the condensed consolidated statements of operations, represent the Company’s share

of revenues, net of royalties and excluding revenue interests owned by others. When selling oil, NGLs, and natural gas on behalf of royalty

owners or working interest owners, the Company is acting as an agent and, thus, reports the revenue on a net basis. To the extent actual

volumes and prices of oil, NGLs, and natural gas sales are unavailable for a given reporting period because of timing or information

not received from third parties, the expected sales volumes and prices for those properties are estimated and recorded.

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Income

taxes – The Company is an LLC, which is not subject to U.S. federal income taxes. Rather, the Company’s taxable income

flows through to the owners, who are responsible for paying the applicable income taxes on the income allocated to them. For tax years

beginning on or after January 1, 2018, the Company is subject to audit rules enacted as part of the Bipartisan Budget Act of 2015 (the

Centralized Partnership Audit Regime). Under the Centralized Partnership Audit Regime, any IRS audit of the Company would be conducted

at the Company level, and if the IRS determines an adjustment, the default rule is that the Company would pay an “imputed underpayment,”

including interest and penalties, if applicable. The Company may, instead, elect to make a “push-out” election, in which

case the partners for the year that is under audit would be required to take into account the adjustments on their own personal income

tax returns.

The

LLC Agreement does not stipulate how the Company will address imputed underpayments. If the Company receives an imputed underpayment,

a determination will be made based on the relevant facts and circumstances that exist at that time. Any payments that the Company ultimately

makes on behalf of its current partners will be reflected as a dividend, rather than as a tax expense, at the time that such dividend

is declared.

The

Company has not recorded any liabilities as of December 31, 2023 or 2022 related to uncertain tax provisions. As of December 31, 2023

or 2022, the Company made no provision for interest or penalties related to uncertain tax positions. The Company files income tax returns

in the U.S. federal jurisdiction and in various states. There are currently no federal or state income tax examinations underway for

these jurisdictions.

Leases

– In February 2016, the Financial Accounting Standards Board (the FASB) issued Accounting Standards Update (ASU) No. 2016-02,

Leases (Topic 842) which amended the existing lease accounting guidance to require lessees to recognize a right-of-use (ROU) asset

and lease liability on the consolidated balance sheets for all leases with terms greater than 12 months. The Company adopted the new

lease standard and all related amendments on January 1, 2022. The Company applied a modified retrospective transition approach when adopting

this new guidance which resulted in no cumulative-effect adjustments to the opening balance of retained earnings. The Company also elected

the package of practical expedients permitted under the transition guidance that retain the lease classification and initial direct costs

for any leases that existed prior to adoption of the standard. In addition, the Company has not reassessed the accounting treatment of

contracts entered into prior to adoption of the new lease guidance. The Company evaluated whether its contractual arrangements entered

into on or after January 1, 2022, contain leases. Specifically, the Company considered whether it can control the underlying asset and

have the right to obtain substantially all of the economic benefits or outputs from the asset. The Company evaluated the contractual

arrangements, including the agreements governing the operation of both the Company and the Company’s ownership interests in oil

and natural gas properties. At adoption, the Company concluded it did not have leases that represented a lessee or lessor as defined

in Topic 842. The Company entered into a new lease under Topic 842 during 2023.

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Note

2 – Members’ Capital

The

Company is a limited liability company with membership interests issued and held by various members. The LLC Agreement authorizes Class

A units and Class B units. Class A members are eligible to receive distributions. Upon formation, the Company issued a total of approximately

19,000 Class A units to members in proportion to their initial contributions. As of December 31, 2023 and 2022, $64,025,830 in cumulative

capital contributions had been received.

Upon

formation, 100 Class B units were granted to certain executives. Class B units are intended to provide compensation to the Class B member

upon a liquidation event, subject to returns as described in the LLC Agreement. The requirements to provide compensation to the Class

B members had not been met under the arrangement, nor was it considered probable the requirements would be met as of December 31, 2023

and 2022. Therefore, the grant-date fair values were inconsequential, and no amounts were recorded as of December 31, 2023 and 2022 in

the accompanying consolidated financial statements.

By

the terms of the LLC Agreement, distributions occur according to their respective equity interests, as defined. For the years ending

December 31, 2023 and 2022 the Company made distributions to members of approximately $6,300,000 and $58,000,000, respectively.

Note

3 – Asset Retirement Obligations

Asset

retirement obligations represent the estimated present value of the amount to plug, abandon, and remediate producing properties at the

end of their productive lives in accordance with applicable laws. The following table summarizes the Company’s asset retirement

obligation transactions for the years ending December 31, 2023 and 2022:

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Asset retirement obligations, beginning of year | |

$ | 1,167,701 | | |

$ | 1,201,468 | |

| | |

| | | |

| | |

| Liabilities incurred during the year | |

| 208,832 | | |

| 209,652 | |

| Change in estimated plugging costs | |

| (82,125 | ) | |

| (106,690 | ) |

| Liabilities settled during the year | |

| - | | |

| (185,440 | ) |

| Accretion of discount | |

| 53,085 | | |

| 48,711 | |

| | |

| | | |

| | |

| Asset retirement obligation, end of year | |

$ | 1,347,493 | | |

$ | 1,167,701 | |

Note

4 – Hedging and Derivative Financial Instruments

Commodity

derivative agreements – The Company utilizes swap and collar contracts to hedge the effect of price changes on a portion of

its future oil and natural gas production. The objective of the Company’s hedging activities and the use of derivative financial

instruments is to achieve more predictable cash flows. The use of derivatives involves the risk that the counterparties to such instruments

will be unable to meet the financial terms of such contracts. The derivative contracts may be terminated by a nondefaulting party in

the event of default by one of the parties to the agreement.

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

The

Company has elected not to apply hedge accounting to any of its derivative transactions, and, consequently, the Company recognizes mark-to-market

gains and losses in earnings currently, rather than deferring such amounts in accumulated other comprehensive income for those commodity

derivatives that would otherwise qualify as cash flow hedges. All derivative instruments are recorded on the balance sheet at fair value.

As

of December 31, 2023, the Company had the following commodity derivative instruments outstanding through 2023, as summarized in the table

below:

| | |

Collars | |

| | |

| | |

| |

Weighted Average Contract Price | |

| Commodity/Index/Maturity Period | |

Quantity | | |

Units | |

Floor | | |

Ceiling | |

| | |

| | |

| |

| | |

| |

| Crude Oil | |

| | | |

| |

| | | |

| | |

| NYMEX | |

| | | |

| |

| | | |

| | |

| 2024 | |

| 247,100 | | |

BBL | |

$ | 66.55 | | |

$ | 79.15 | |

Derivative

assets and liabilities fair value – The fair value of the derivative commodity contracts was a net asset of approximately $271,000

and a net liability of approximately $2,728,000 at December 31, 2023 and 2022, respectively. The following table details the fair value

of derivatives recorded in the accompanying consolidated balance sheets, by category:

| | |

Fair Value | | |

Fair Value | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

| | |

| |

| Derivative asset - current | |

$ | 270,925 | | |

$ | - | |

| Derivative liability - current | |

$ | - | | |

$ | 2,727,867 | |

Derivative

gain (loss) – The following table summarizes the components of the net derivative gain (loss) line item presented in the accompanying

consolidated statements of operations during the years ended December 31:

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Unrealized gain on derivatives | |

$ | 2,998,792 | | |

$ | 3,286,777 | |

| Realized loss on derivatives | |

| (1,021,596 | ) | |

| (21,751,084 | ) |

| | |

| | | |

| | |

| Total gain (loss) on derivatives | |

$ | 1,977,196 | | |

$ | (18,464,307 | ) |

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Note

5 – Fair Value Measurements

The

Company follows ASC 820, Fair Value Measurements and Disclosures, which establishes a hierarchy for the inputs utilized in measuring

fair value. The hierarchy maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most

observable inputs be used when available. The hierarchy is broken down into three levels based on the reliability of the inputs as follows:

Level

1 – Quoted prices for identical assets or liabilities in active markets;

Level

2 – Quoted prices for similar assets or liabilities in active markets; and

Level

3 – Unobservable inputs for the asset or liability, such as discounted cash models.

The

following tables present the Company’s assets and liabilities that are measured at fair value on a recurring basis as of December

31, 2023 and 2022:

| | |

Fair Value Measurement at December 31, 2023 |

|

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

| | |

| | |

| | |

| |

| Derivative instruments | |

$ | - | | |

$ | 270,925 | | |

$ | - | | |

$ | 270,925 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total investments | |

$ | - | | |

$ | 270,925 | | |

$ | - | | |

$ | 270,925 | |

| | |

Fair Value Measurement at December 31, 2022 |

|

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

| | |

| | |

| | |

| |

| Derivative instruments | |

$ | - | | |

$ | 2,727,867 | | |

$ | - | | |

$ | 2,727,867 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total investments | |

$ | - | | |

$ | 2,727,867 | | |

$ | - | | |

$ | 2,727,867 | |

The

inputs used to determine such fair value are primarily based upon observable market data for similar instruments, including the forward

curve for commodity prices based on quoted market prices and would be classified within Level 2.

Note

6 – Leases

The

Company leases a compressor under a noncancellable operating lease agreement. It has been determined that the lease does not constitute

a finance lease. Operating lease ROU assets and liabilities are recognized based on the present value of the future minimum lease payments

over the lease term at commencement date. The Company believes any option to terminate is not reasonably certain for the operating lease

agreement.

For

the year ended December 31, 2023, components of lease expense were as follows:

| Operating lease cost | |

$ | 68,000 | |

| Short-term lease cost | |

$ | 1,270,763 | |

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

All

components of lease costs are expensed within lease operating expenses on the consolidated statement of income.

There

was not any lease expense under ASC 842 during the year ended December 31, 2022.

For

the year ended December 31, 2023, supplemental cash flow information related to leases was as follows:

| Cash paid for amounts included in measurement of lease liabilities | |

| | |

| Operating cash flows used for operating leases (including short-term) | |

$ | 68,000 | |

| | |

| | |

| Right-of-use assets obtained in exchange for lease obligations (noncash) | |

| | |

| Operating leases | |

$ | 388,011 | |

| | |

| | |

| Weighted-average remaining lease term (years) | |

| | |

| Operating leases | |

| 1.7 | |

| | |

| | |

| Weighted-average discount rate | |

| | |

| Operating leases | |

| 4.9 | % |

The

following is the future maturities of the annual undiscounted cash flows of the operating lease liability as of December 31, 2023:

| Years Ending | |

| |

| December 31, | |

| |

| | |

| |

| 2024 | |

$ | 204,000 | |

| 2025 | |

| 136,000 | |

| | |

| | |

| Total minimum lease payments | |

| 340,000 | |

| | |

| | |

| Less imputed interest | |

| (14,067 | ) |

| | |

| | |

| Present value of lease liability | |

$ | 325,933 | |

Note

7 – Commitments and Contingencies

Government

regulation – Many aspects of the oil and gas industry are extensively regulated by federal, state, and local governments in

all areas in which the Company has operations. Regulations govern such things as drilling permits, environmental protection and pollution

control, spacing of wells, the unitization and pooling of properties, reports concerning operations, royalty rates, and various other

matters, including taxation. Oil and gas industry legislation and administrative regulations are periodically changed for a variety of

political, economic, and other reasons. As of December 31, 2023 or 2022, the Company has not been fined or cited for any violations of

governmental regulations that would have a material adverse effect upon the financial condition, capital expenditures, earnings, or competitive

position of the Company in the oil and gas industry.

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Litigation

– From time to time, the Company may be involved in litigation related to claims arising out of its operations in the normal

course of business. As of the date of this report, no legal proceedings are ongoing or pending that management believes could have a

materially adverse effect upon the Company’s financial condition or results of operations.

Note

8 – Long-Term Debt

Revolving

Loan – On February 22, 2021, the Company entered into a revolving loan agreement (the Loan Agreement) with a maturity of February

22, 2024. The Loan Agreement provides for a maximum revolving loan (the Revolving Loan) of $35,000,000 with an initial borrowing base

of $10,000,000. In October 2022, the Loan Agreement was amended. The total borrowing base and sublimit increased to $30,000,000 for the

revolving loan.

All

sums advanced under the Revolving Loan, together with all accrued but unpaid interest thereon, are due in full at maturity. The Loan

Agreement requires the Company to maintain certain affirmative and negative covenants, including certain financial ratios defined in

the Loan Agreement and second amendment, and provides the lender with a first security interest in substantially all of the Company assets.

The interest rate of the Revolving Loan is the lesser of the (1) Wall Street Journal prime rate, plus the applicable margin, or (2) the

Maximum Rate as defined per the Loan Agreement. The interest rate as of December 31, 2023, was 9.50%. Commitment fees equal to 0.5% of

the undrawn amount are payable quarterly under this agreement. The outstanding balance on the Revolving Loan as of December 31, 2023,

was $16,783,333, due in full on the maturity date of February 22, 2024. Debt issuance cost was approximately $123,000.

On

March 30, 2023, the Company amended its Loan Agreement to provide for a maximum Revolving Loan of $50,000,000 which matures on February

22, 2026. As of the date of the amendment the borrowing base was increased to $35,000,000, with a sublimit of $25,000,000, and continues

to be subject to regular redeterminations by the lender. Permitted distributions are subject to limitations defined within the amendment

and required hedge transactions are amended such that as of December 31, 2023, and thereafter, so long as the borrowing base utilization

exceeds 60%, the Company is required to maintain crude oil hedges of at least 60% of the Company’s anticipated crude oil production

for a period of no less than 12 months, to be complied with on a quarterly basis.

On

August 31, 2023, the Company amended its Loan Agreement to decrease the borrowing base to $33,000,000.

March

2023 Term Loan – The March 2023 amended Loan Agreement also allows for a new Term Loan (March 2023 Term Loan) in the amount

of $10,000,000 which commences on the date of the amendment and continues through July 31, 2023, after which the Lender shall have no

further commitment to make an advance on the March 2023 Term Loan, so long as the aggregate advances do not exceed $10,000,000. The March

2023 Term Loan shall be payable in monthly principal installments commencing on August 1, 2023, plus all accrued interest, and matures

on July 1, 2024. The March 2023 Term Loan bears interest at a rate equal to the sum of the Prime Rate, plus the Applicable Margin (as

defined in the Loan Agreement); provided, however, that the interest rate on the March 2023 Term Loan shall never fall below 3.75%. The

outstanding balance on the March 2023 Term Loan as of December 31, 2023, was $3,800,000. The full outstanding balance is due in full

on the maturity date of July 1, 2024.

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

September

2021 Term Loan – On September 1, 2021, the Loan Agreement was amended to establish a term loan (September 2021 Term Loan) in

the amount of $12,000,000 that matured on August 31, 2022. The September 2021 Term Loan was payable in monthly principal installments

commencing January 31, 2022, plus all accrued interest. Interest for the September 2021 Term Loan was fixed at 5.25%. The September 2021

Term Loan also provides the lender with a first security interest in substantially all of the Company assets. As of December 31, 2023,

this loan matured and was paid off in full.

Interest

expense related to the Revolving Loan and the Term Loan for the years ended December 31, 2023 and 2022, was approximately $1,922,000

and $795,000, respectively.

Note

9 – Related Parties

Management

fees – The Company receives management services from Nickel Road Management LLC under the Management Services Agreement dated

March 30, 2018 (the Services Agreement). In accordance with the Service Agreement, Nickel Road Management LLC provides management services,

including office space and employment of all employees. The Company pays Nickel Road Management LLC a monthly amount equal to the allocated

costs for monthly general and administrative expenses approved by the managers (the Development Plan and Budget). The Services Agreement

will remain in effect for three years and will automatically extend for successive one-year terms coinciding with the period covered

by the Development Plan and Budget unless terminated under the terms of the Services Agreement. For the years ended December 31, 2023

and 2022, the Company incurred service agreement reimbursement costs of approximately $3,781,000 and $4,122,000, respectively. For the

years ending December 31, 2023 and 2022, the Company had approximately $114,000 and $256,000 in management fees due to Nickel Road Management

LLC, respectively.

Note

10 – Estimated Quantities of Oil and Gas Reserves (unaudited)

Costs

Incurred

The

following table sets forth the costs incurred for property acquisitions, exploration, and development activities:

| | |

Years Ended December 31, | |

| | |

2023 | | |

2022 | |

| Acquisition costs | |

| | | |

| | |

| Proved | |

$ | 134,895 | | |

$ | 1,028,411 | |

| Unproved | |

| 720,003 | | |

| 1,213,079 | |

| Exploration costs | |

| | | |

| | |

| Geological and geophysical | |

| - | | |

| - | |

| Development costs | |

| 31,918,742 | | |

| 34,719,791 | |

| Total costs incurred | |

$ | 32,773,640 | | |

$ | 36,961,281 | |

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Oil

and Natural Gas Reserves

The

following table sets forth the Company’s net proved oil and gas reserves and the changes in net proved oil and gas reserves for

the years ended December 31, 2021, 2022, and 2023. All of the Company’s proved reserves are located in the state of Colorado in

the United States of America.

| | |

Oil (Bbl) | | |

Gas (Mcf) | | |

Liquids (Bbl) | | |

BOE | |

| Proved reserves at December 31, 2021 | |

| 9,150,124 | | |

| 16,386,179 | | |

| 4,126,059 | | |

| 16,007,213 | |

| Revisions | |

| (1,806,746 | ) | |

| 875,476 | | |

| (850,846 | ) | |

| (2,511,680 | ) |

| Extensions | |

| 2,238,184 | | |

| 5,752,187 | | |

| 1,031,821 | | |

| 4,228,703 | |

| Divestiture of reserves | |

| (1,705,171 | ) | |

| (3,197,920 | ) | |

| (785,350 | ) | |

| (3,023,508 | ) |

| Acquisition of reserves | |

| - | | |

| - | | |

| - | | |

| - | |

| Production | |

| (618,787 | ) | |

| (919,804 | ) | |

| (161,585 | ) | |

| (933,673 | ) |

| Proved reserves at December 31, 2022 | |

| 7,257,604 | | |

| 18,896,118 | | |

| 3,360,099 | | |

| 13,767,056 | |

| Revisions | |

| 177,709 | | |

| 485,626 | | |

| (40,027 | ) | |

| 218,620 | |

| Extensions | |

| 1,992,949 | | |

| 4,513,455 | | |

| 786,530 | | |

| 3,531,722 | |

| Divestiture of reserves | |

| (155,373 | ) | |

| (286,151 | ) | |

| (49,733 | ) | |

| (252,798 | ) |

| Acquisition of reserves | |

| - | | |

| - | | |

| - | | |

| - | |

| Production | |

| (616,616 | ) | |

| (887,881 | ) | |

| (149,000 | ) | |

| (913,596 | ) |

| Proved reserves at December 31, 2023 | |

| 8,656,273 | | |

| 22,721,167 | | |

| 3,907,869 | | |

| 16,351,003 | |

| | |

| | | |

| | | |

| | | |

| | |

| Proved developed reserves at | |

| | | |

| | | |

| | | |

| | |

| December 31, 2021 | |

| 3,731,662 | | |

| 6,669,807 | | |

| 1,182,570 | | |

| 6,025,867 | |

| December 31, 2022 | |

| 2,599,724 | | |

| 6,452,542 | | |

| 1,103,821 | | |

| 4,778,969 | |

| December 31, 2023 | |

| 2,481,059 | | |

| 7,689,981 | | |

| 1,287,231 | | |

| 5,049,954 | |

| | |

| | | |

| | | |

| | | |

| | |

| Proved undeveloped reserves at | |

| | | |

| | | |

| | | |

| | |

| December 31, 2021 | |

| 5,418,462 | | |

| 9,716,372 | | |

| 2,943,489 | | |

| 9,981,346 | |

| December 31, 2022 | |

| 4,657,880 | | |

| 12,443,576 | | |

| 2,256,278 | | |

| 8,988,087 | |

| December 31, 2023 | |

| 6,175,214 | | |

| 15,031,186 | | |

| 2,620,638 | | |

| 11,301,050 | |

Nickel

Road Operating LLC and Subsidiaries

Notes

to Consolidated Financial Statements

Note

11 – Standardized Measure of Discounted Future Net Cash Flows (unaudited)

The

standardized measure of discounted future net cash flows from the Company’s proved oil and gas reserves is presented in the following

table:

| | |

Years Ended December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Future cash inflows | |

$ | 797,665,069 | | |

$ | 883,016,626 | |

| Future production costs and taxes | |

| (304,141,326 | ) | |

| (293,548,055 | ) |

| Future development costs | |

| (170,282,285 | ) | |

| (147,621,778 | ) |

| Future income tax expense | |

| - | | |

| - | |

| | |

| | | |

| | |

| Future net cash flows | |

| 323,241,458 | | |

| 441,846,793 | |

| 10% annual discount for estimated timing of cash flows | |

| (149,312,372 | ) | |

| (197,175,725 | ) |

| Standardized measure of discounted future net cash flows | |

$ | 173,929,086 | | |

$ | 244,671,068 | |

The

following are the principal sources of change in standardized measure of discounted future net cash flows from the Company’s proved

oil and gas reserves:

| | |

Years Ended December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Balance, beginning of year | |

$ | 244,671,068 | | |

$ | 259,924,928 | |

| Net change in prices and production costs | |

| (98,531,959 | ) | |

| 66,158,782 | |

| Net change in future development costs | |

| 3,286,634 | | |

| (18,682,942 | ) |

| Oil and gas net revenue | |

| (39,144,165 | ) | |

| (57,149,450 | ) |

| Extensions | |

| 31,061,825 | | |

| 52,216,906 | |

| Acquisition of reserves | |

| - | | |

| - | |

| Divestiture of reserves | |

| (8,286,790 | ) | |

| (48,657,637 | ) |

| Revisions of previous quantity estimates | |

| 3,822,640 | | |

| (49,945,233 | ) |

| Previously estimated development costs incurred | |

| 21,453,129 | | |

| 15,239,276 | |

| Net change in taxes | |

| - | | |

| - | |

| Accretion of discount | |

| 24,467,107 | | |

| 25,992,493 | |

| Changes in timing and other | |

| (8,870,403 | ) | |

| (426,055 | ) |

| Balance, end of year | |

$ | 173,929,086 | | |

$ | 244,671,068 | |

Estimated

net future cash flows represent an estimate on future net revenues from the production of proved reserves using average sales prices

along with estimates of the operating costs, production taxes, and future development and abandonment costs necessary to produce such

reserves. The Company’s proved reserves as of December 31, 2023 and 2022, were measured using commodity prices based on the twelve-month

unweighted arithmetic mean of the first day of the month price for the period of January through December. No deduction has been reflected

for depreciation, depletion, or any direct cost, such as general and administrative costs.

Note

12 – Subsequent Events

On

January 11, 2024, the Company entered into an Asset Purchase Agreement (the Transaction) with Prairie Operating Co., LLC (Prairie) to

sell all of the Company’s interests in its oil and gas properties effective February 1, 2024, for cash proceeds of $83.0 million,

subject to customary closing adjustments, and additional cash consideration of $11.5 million for existing permitted locations drilled

by Prairie. The Transaction has not closed as of the date the financial statements were available to be issued.

In

conjunction with the Transaction, the Company liquidated its open hedge positions in January 2024 resulting in net cash proceeds of approximately

$223,000. On January 31, 2024, the Company received a waiver of the minimum hedge transaction requirement from the lender through July

1, 2024. The Revolving Loan is reflected as a long-term debt on the Company’s balance sheet as of December 31, 2023. However, should

the Company fail to repay the loan in full, reapply required hedges, or receive another such waiver from the lender, the Revolving Loan

could become due on July 1, 2024.

The

Company has reviewed all subsequent events through March 14, 2024, the date the consolidated financial statements were available to be

issued.

Exhibit

99.3

UNAUDITED

PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

As

previously disclosed, Prairie Operating Co. (the “Company”) entered into an asset purchase agreement, dated January 11, 2024

(the “NRO Agreement”), by and among the Company, Nickel Road Development LLC, Nickel Road Operating LLC (“NRO”)

and Prairie Operating Co., LLC (“Prairie LLC”), to acquire certain assets of NRO for total consideration of $94.5 million

(the “Purchase Price”), subject to certain closing price adjustments and other customary closing conditions (the “NRO

Acquisition”). The Purchase Price consists of $83.0 million in cash and $11.5 million in deferred cash payments. The Company deposited

$9 million of the Purchase Price into an escrow account on January 11, 2024 (the “Deposit”), which will be released to NRO

upon the earlier of the date of the closing of the NRO Acquisition pursuant to the NRO Agreement (the “Closing”) and August

15, 2024. Portions of the Deposit are subject to earlier release under certain circumstances if the Closing has not occurred on or prior

to June 17, 2024.

The

Company is providing the following unaudited pro forma condensed combined financial information to aid in the analysis of the financial

aspects of the following:

| (i) | the

proposed issuance and sale of shares of common stock of the Company, par value $0.01 per

share (“Common Stock”), in an underwritten public offering (the “Offering”); |

| (iii) | the

sale of all of the Company’s cryptocurrency miners (the “Mining Equipment”)

and the assignment of all of the Company’s rights and obligations under the Master

Services Agreement, dated February 16, 2023, by and between Atlas Power Hosting, LLC and

the Company, to a private purchaser pursuant to an asset purchase agreement, dated January

23, 2024 (the “Crypto Sale”); and |

| (iv) | the

merger of Creek Road Merger Sub, LLC, a Delaware limited liability company and a wholly owned

subsidiary of the Company (“Merger Sub”), with and into Prairie LLC, with Prairie

LLC surviving and continuing to exist as a Delaware limited liability company and a wholly

owned subsidiary of the Company pursuant to that certain Amended and Restated Agreement and

Plan of Merger, dated as of May 3, 2023, by and among the Company, Merger Sub and Prairie

LLC (the “Merger” and collectively, with the Offering, the NRO Acquisition and

the Crypto Sale, the “Transactions”). |

The

following unaudited pro forma condensed combined financial information has been prepared in accordance with Article 11 of Regulation

S-X as amended by the final rule, Release No. 33-10786 “Amendments to Financial Disclosures about Acquired and Disposed Businesses”

and presents the combination of historical financial information of the Company and Prairie LLC, adjusted to give effect to the Transactions

and subsequent events thereto (the “Subsequent Events”) as described in Note 3 below.

The

unaudited pro forma condensed combined balance sheet as of December 31, 2023 combines the historical balance sheet of the Company as

of December 31, 2023 on a pro forma basis as if the Transactions and the Subsequent Events, described in Note 3 below, had been consummated

on December 31, 2023.

The

unaudited pro forma condensed combined statements of operations for the year ended December 31, 2023 combine the historical statements

of operations of the Company, the historical statements of operations of Creek Road Miners, Inc. and the historical consolidated

statements of operations of NRO, as applicable, for such periods on a pro forma as if the Transactions and Subsequent Events, described

in Note 3 below, had been consummated on January 1, 2023.

The

unaudited pro forma condensed combined financial information is based on, and should be read in conjunction with:

| (a) | the

Company’s audited historical consolidated financial statements and related notes included

in its Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities

and Exchange Commission (the “SEC”) on March 19, 2024; |

| (b) | the

Company’s unaudited historical condensed consolidated financial statements and related

notes for the three months ended March 31, 2023 included in its Quarterly Report on Form

10-Q/A for the period ended March 31, 2023, filed with the SEC on June 16, 2023; |

| (c) | the

section entitled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations of Prairie Operating Co.” included in the Company’s

Annual Report on Form 10-K for the year ended 2023, filed with the SEC on March 19,

2024; |

| (d) | NRO’s

audited consolidated financial statements for the year ended December 31, 2023, included

in the Company’s Amendment to its Current Report on Form 8-K/A, filed with the SEC

on March 19, 2024; and |

| (e) | the

section in this prospectus entitled “Management’s Discussion and Analysis

of Financial Condition and Results of Operations of Nickel Road Operating LLC”. |

The

unaudited pro forma condensed combined financial information has been presented for illustrative purposes only and does not necessarily

reflect what the Company’s financial condition or results of operations would have been had the Transactions or Subsequent Events,

described in Note 3 below, occurred on the dates indicated. Further, the unaudited pro forma condensed combined financial information

do not project the Company’s future financial condition and results of operations. The actual financial position and results of

operations may differ significantly from the pro forma amounts reflected herein due to a variety of factors. The unaudited pro forma

adjustments represent management’s estimates based on information available as of the date of this filing and certain assumptions

that management believes are factually supportable and are expected to have a continuing impact on the Company’s results of operations,

and are subject to change as additional information becomes available and analyses are performed.

Description

of the Merger and Related Transactions

On

May 3, 2023 (the “Merger Closing Date”), the Company completed the Merger, and upon consummation thereof, the Company changed

its name from “Creek Road Miners, Inc.” to “Prairie Operating Co.” (the “Merger Closing”). Prior

to the consummation of the Merger, the Company effectuated certain restructuring transactions in the following order and issued an aggregate

of 3,375,288 shares of Common Stock (excluding shares reserved for issuance and unissued subject to certain beneficial ownership limitations)

and 4,423 shares of Series D preferred stock, par value $0.01 per share (“Series D Preferred Stock”):

| (i) | the

Company’s Series A preferred stock, par value $0.0001 per share (“Series A Preferred

Stock”), Series B preferred stock, par value $0.0001 per share (“Series B Preferred

Stock”), and Series C preferred stock, par value $0.0001 per share (“Series C

Preferred Stock”), plus accrued dividends, were converted, in the aggregate, into shares

of Common Stock; |

| (ii) | the

Company’s 12% senior secured convertible debentures (the “Original Debentures”),

plus accrued but unpaid interest and a 30% premium, were exchanged, in the aggregate, for