UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-KSB

(Mark One)

[X] Annual report under section 13 or 15(d) of the Securities Exchange Act

of 1934

For the fiscal year ended December 31, 2007

[ ] Transition report under section 13 or 15(d) of the Securities Exchange

act of 1934

For the transition period from _____________ to ______________

Commission file number 33-13674-LA

CIRTRAN CORPORATION

(Name of small business issuer in its charter)

Nevada 68-0121636

------------------------------- -------------------

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

4125 South 6000 West, West Valley City, Utah 84128

--------------------------------------------- ------------

(Address of principal executive offices) (Zip Code)

(801) 963-5112

--------------

(Issuer's telephone number)

|

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, Par

Value $0.001

Check whether the issuer is not required to file reports pursuant to Section 13

or 15(d) of the Exchange Act. [ ]

Check whether the issuer (1) filed all reports required to be filed by Section

13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Check if there is no disclosure of delinquent filers in response to Item 405 of

Regulation S-B contained in this form, and no disclosure will be contained, to

the best of registrant's knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-KSB or any

amendment to this Form 10-KSB. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The issuer's revenues for its most recent fiscal year: $12,399,793

The aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

sold as of April 11, 2008, was $9,877,401. As of April 11, 2008, the issuer had

outstanding 1,126,108,010 shares of Common Stock, par value $0.001.

Transitional Small Business Disclosure Format (check one) Yes [ ] No [X]

Documents incorporated by reference: The registrant incorporates information

required by Part III of this report by reference to the registrant's definitive

proxy statement to be filed pursuant to Regulation 14A for the annual meeting of

the shareholders of the issuer scheduled to be held on June 18, 2008.

TABLE OF CONTENTS

ITEM NUMBER AND CAPTION Page

----------------------- ----

Part I

Item 1. Description of Business 2

Item 2. Description of Property 22

Item 3 Legal Proceedings 23

Item 4. Submission of Matters to a Vote of Security Holders 25

Part II

Item 5. Market for Common Equity, Related Stockholder

Matters and Small Business Issuer Purchases of

Equity Securities 25

Item 6. Management's Discussion and Analysis or Plan of

Operation 26

Item 7. Financial Statements 38

Item 8. Changes in and Disagreements with Accountants on 38

Accounting and Financial Disclosure

Item 8A(T) Controls and Procedures 38

Part III

Item 9 Directors, Executive Officers, Promoters, Control

Persons and Corporate Governance; Compliance with

Section 16(a) of the Exchange Act 40

Item 10. Executive Compensation 40

Item 11. Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters 40

Item 12. Certain Relationships and Related Transactions,

and Director Independence 41

Item 13. Exhibits 41

Item 14. Principal Accountant Fees and Services 44

Signatures 45

|

1

PART I

ITEM 1. DESCRIPTION OF BUSINESS

THIS ANNUAL REPORT ON FORM 10-KSB CONTAINS, IN ADDITION TO HISTORICAL

INFORMATION, FORWARD-LOOKING STATEMENTS THAT INVOLVE SUBSTANTIAL RISKS AND

UNCERTAINTIES. OUR ACTUAL RESULTS COULD DIFFER MATERIALLY FROM THE RESULTS

ANTICIPATED BY CIRTRAN AND DISCUSSED IN THE FORWARD-LOOKING STATEMENTS. FACTORS

THAT COULD CAUSE OR CONTRIBUTE TO SUCH DIFFERENCES ARE DISCUSSED BELOW IN THE

SECTION ENTITLED "FORWARD-LOOKING STATEMENTS" AND ELSEWHERE IN THIS ANNUAL

REPORT. WE DISCLAIM ANY INTENTION OR OBLIGATION TO UPDATE OR REVISE ANY

FORWARD-LOOKING STATEMENT, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE

EVENTS, OR OTHERWISE. THE FOLLOWING DISCUSSION SHOULD BE READ TOGETHER WITH OUR

FINANCIAL STATEMENTS AND RELATED NOTES THERETO INCLUDED ELSEWHERE IN THIS

DOCUMENT.

CORPORATE BACKGROUND AND OVERVIEW

In 1987, we were incorporated in Nevada under the name Vermillion Ventures,

Inc., for the purpose of acquiring other operating corporate entities. We were

largely inactive until July 1, 2000, when our wholly-owned subsidiary, CirTran

Corporation (Utah) acquired substantially all of the assets and certain

liabilities of Circuit Technology, Inc. ("Circuit").

Our predecessor business in Circuit was commenced in 1993 by our president,

Iehab Hawatmeh. In 2001, we effected a 1:15 forward split and stock distribution

which increased the number of our issued and outstanding shares of common stock.

We also increased our authorized capital from 500,000,000 to 750,000,000 shares.

In 2007, our shareholders approved a 1:1.2 forward split and an amendment to our

Articles of Incorporation that increased the authorized capital of the Company

to 1,500,000,000 shares of common stock.

Corporate Overview - We provide a mix of high and medium volume turnkey

manufacturing services using surface mount technology ("SMT"), ball-grid array

assembly, pin-through-hole and custom injection molded cabling for leading

electronics original equipment manufacturers ("OEMs") in the communications,

networking, peripherals, gaming, law enforcement, consumer products,

telecommunications, automotive, medical, and semiconductor industries. Our

services include pre-manufacturing, manufacturing and post-manufacturing

services. Our goal is to offer customers the significant competitive advantages

that can be obtained from manufacture outsourcing, such as access to advanced

manufacturing technologies, shortened product time-to-market, reduced cost of

production, more effective asset utilization, improved inventory management, and

increased purchasing power.

We conduct our business principally through six wholly-owned subsidiaries or

divisions: CirTran Corporation ("CirTran USA"), CirTran - Asia, Inc. ("CirTran

Asia"), CirTran Products Corp. ("CirTran Products"), CirTran Media Corp.

("CirTran Media"), CirTran Online Corp. ("CirTran Online"), and CirTran Beverage

Corp. ("CirTran Beverage").

CirTran USA

As of December 31, 2007 and 2006, approximately 25 percent and 29 percent of our

revenues were generated by low-volume electronics assembly activities, which

consist primarily of the placement and attachment of electronic and mechanical

components on printed circuit boards and flexible (i.e., bendable) cables. We

also assemble higher-level subsystems and systems incorporating printed circuit

boards and complex electromechanical components that convert electrical energy

to mechanical energy, in some cases manufacturing and packaging products for

shipment directly to our customers' distributors. In addition, we provide other

manufacturing services, including refurbishment and remanufacturing. We

manufacture on a turnkey basis, directly procuring any of the components

necessary for production where the OEM customer does not supply all of the

components that are required for assembly. We also provide design and new

product introduction services, just-in-time delivery on low to medium volume

turnkey and consignment projects and projects that require more value-added

2

services, and price-sensitive, high-volume production. Our goal is to offer our

customers significant competitive advantages that can be obtained from

manufacturing outsourcing, such as access to advanced manufacturing

technologies, shortened product time-to-market, reduced cost of production, more

effective asset utilization, improved inventory management and increased

purchasing power.

Through our subsidiary, Racore Technology Corporation ("Racore"), we provide

engineering design services to customers of some of our other subsidiaries, and

continue to distribute a small number of Ethernet cards.

CirTran Asia

Through CirTran Asia, we design, engineer, manufacture and supply products in

the international electronics, consumer products and general merchandise

industries for various marketers, distributors and retailers selling overseas.

This subsidiary provides manufacturing services to the direct response and

retail consumer markets. Our experience and expertise in manufacturing enables

CirTran Asia to enter a project at various phases: engineering and design;

product development and prototyping; tooling; and high-volume manufacturing.

This presence with Asian suppliers helps us maintain an international contract

manufacturer status for multiple products in a wide variety of industries, and

has allowed us to target larger-scale contracts.

CirTran Asia maintains an office in Shenzhen, China and has retained dedicated

Chinese personnel to oversee Asian operations. We intend to pursue manufacturing

relationships beyond printed circuit board assemblies, cables, harnesses and

injection molding systems by establishing complete "box-build" or "turn-key"

relationships in the electronics, retail, and direct consumer markets.

During 2006, the Company developed several fitness and exercise products, and

products in the household and kitchen appliance and health and beauty aids

markets that are being manufactured in China. Sales of these products comprised

approximately 34 percent and 32 percent of revenues reported in 2007 and 2006,

respectively. We anticipate that offshore contract manufacturing will continue

to be an emphasis of the Company.

CirTran Products

CirTran Products pursues contract manufacturing relationships in the U.S.

consumer products markets, including products in areas such as: home/garden,

kitchen, health/beauty, toys, licensed merchandise and apparel for film,

television, sports and other entertainment properties. Licensed merchandise and

apparel is defined as any item that bears the image, likeness, or logo of a

product, or a person such as a well-known celebrity, that is sold or advertised

to the public. Licensed merchandise and apparel are sold and marketed in the

entertainment and sports franchise industries. Sales of these products comprised

1 percent and 23 percent of total revenues for 2007 and 2006, respectively. We

have concentrated our product development efforts into three areas, home and

kitchen appliances, beauty products and licensed merchandise. We anticipate that

these products will be introduced into the market either under one uniform brand

name or under separate trademarked names owned by CirTran Products. We are

presently preparing to launch various programs where CirTran Media will operate

as the marketer, campaign manager and distributor in various product categories

including beauty products, entertainment products, software products, and

fitness and consumer products.

CirTran Media

In 2006, we formed Diverse Media Group, now known as CirTran Media, to provide

end-to-end services to the direct response and entertainment industries. We are

developing marketing production services, and preparing programs in which

CirTran Media will operate as the marketer, campaign manager and/or distributor

for beauty, entertainment, software, and fitness consumer products. In 2006, we

entered into an agreement with Diverse Talent Group, Inc., a California

corporation ("DT"), whereby DT agreed to provide outsourced talent agency

services in exchange for growth financing. In March 2007, we mutually agreed

with DT to terminate the agreement, and assigned to DT the name "Diverse Media

Group." Revenues earned by this subsidiary were 6 percent and 16 percent of

total revenues during 2007 and 2006, respectively.

Despite the termination of the DT agreement, we anticipate continuing to produce

infomercials for the direct marketing industry and for product marketing

3

campaigns. We also plan to provide product marketing, production, media funding,

and merchandising services to the direct response and entertainment industries

in concert with the original objectives of this subsidiary.

In 2006, CirTran Media leased a sales office in Bentonville, Arkansas, in close

proximity to Wal-Mart's world headquarters. The office is located there to help

create and manage an ongoing relationship with Wal-Mart and Sam's Club stores in

order to facilitate the distribution of products through Wal-Mart stores.

CirTran Online

During the first quarter of 2007, we started CirTran Online to sell products via

the internet, to offer training, software, marketing tools, web design and

support, and other e-commerce related services to entrepreneurs, and to

telemarket directly to customers. As part of CirTran Online's business plan, we

entered into an agreement with Global Marketing Alliance ("GMA"), a Utah limited

liability company specializing in providing services to E-bay sellers,

conducting internet marketing seminars, and developing and hosting web sites.

Revenues derived from the arrangement with GMA comprised 20 percent of total

revenue in 2007.

CirTran Beverage

In May 2007, we incorporated CirTran Beverage to arrange for the manufacture,

marketing and distribution of Playboy-licensed energy drinks, flavored water

beverages, and related merchandise through various distribution channels. We

also entered into an agreement with Play Beverages, LLC ("PlayBev"), a related

Delaware limited liability company and the licensee under a product licensing

agreement with Playboy Enterprises International, Inc. ("Playboy"). Under the

terms of the PlayBev agreement, we are to provide the initial development and

promotional services to PlayBev, who will collect from us a royalty based on

product sales and manufacturing costs once licensed product distribution

commences. As part of efforts to finance the initial development and marketing

of the Playboy energy drink, the Company, along with other investors, formed

After Bev Group LLC ("AfterBev"), a majority-owned subsidiary organized in

California.

Two versions of the Playboy energy drink, regular and sugar-free, have been

developed. During 2007, PlayBev and the Company conducted focus group taste

tests to determine the best flavor and ingredients; publicized the new drink via

promotional bus tours, celebrity-attended activities, and magazine ads; and

negotiated with production facilities and distribution groups. During the first

part of 2008, the Company secured distribution contracts and the drink began

selling in New England, Florida, and California. Another promotional bus tour

began in Las Vegas at the end of February 2008, and the following month

continued into Florida. Limited energy drink sales at the end of 2007 accounted

for 2 percent of total 2007 sales, and billings to PlayBev for development and

marketing services accounted for 12 percent of our total sales for 2007.

PRIMARY PRODUCTS AND SERVICES

We have five primary product and service areas: fitness and exercise products;

household and kitchen appliances / health and beauty aids; electronics products

and manufacturing; media/online marketing services; and beverages.

Fitness and Exercise Products

The Company began manufacturing fitness products in 2004. To date, we have

manufactured and sold over 12 different fitness products. We manufacture all of

our fitness products through our CirTran Asia subsidiary, originally via an

exclusive, three-year manufacturing agreement with certain developers and their

affiliates that expired by its terms during mid-2007, but which continues on a

month-to-month basis. We are currently in the process of negotiating a renewal

agreement with one of these developers.

In 2004, we began manufacturing the AbRoller, a type of an abdominal fitness

machine, under an exclusive manufacturing agreement. From inception, we have

shipped approximately $3.2 million of this product and will be shipping

additional units of this product throughout 2008 and possibly thereafter.

In 2005, we entered into an exclusive manufacturing contract with Guthy - Renker

Corporation ("GRC") for a new fitness machine. Later, a dispute arose concerning

4

the terms of the contract, and we engaged in litigation against GRC which was

settled subsequent to December 31, 2007. No product was produced under this

contract during 2007. See Part I, Item 3, "Legal Proceedings."

In 2006, we entered into an exclusive, five-year manufacturing agreement for the

CorEvolution(TM) product. The customer has committed to minimum orders,

amounting to $1.2 million in revenues during the first year, $1.8 million during

the second year, and $2.4 million during the third year. This product is

uniquely designed to strengthen and rehabilitate the lower back and adjacent

areas of human body. Since inception through the end of 2007, shipments of this

product have exceeded the agreed-upon minimum orders.

In June 2007, we entered into a five-year, exclusive agreement with Full Moon

Enterprises of Nevada to license a new product for the sold-on-TV market. A

patent application for The Ball Blaster(TM) was filed by the inventor, who

granted the Company the worldwide marketing and distribution rights to this

product. We will pay a royalty to the licensor for each unit sold. During 2007,

we continued our marketing efforts for this product by meeting with potential

celebrity spokespersons intended to appear in related infomercials, however as

of the date of this report no products have been sold.

Household and Kitchen Appliances, and Health and Beauty Aids

We began manufacturing household and kitchen appliance products in January 2005.

To date, we have manufactured and sold five different household and kitchen

appliance products. We manufacture the majority of our household and kitchen

appliance products through our CirTran Asia operation.

In 2005, we entered into an exclusive contract to manufacture the Hot Dog

Express, intended to be marketed nationally, primarily through infomercials. The

contract ran through 2007, and over the life of the contract we shipped

approximately $1.9 million of product. We are currently attempting to market the

product through large retail channels.

In 2005, we signed an exclusive manufacturing agreement with Advanced Beauty

Solutions L.L.C. ("ABS"), regarding the True Ceramic Pro(TM) ("TCP") flat iron

hair product. Later in 2005, we were notified that ABS had defaulted on certain

obligations to a financing company. We stopped shipping under credit, and

exercised rights permitted by the agreement. Following efforts to resolve

disputes, we filed a lawsuit against ABS, citing various claims, and sought

damages. By then we had shipped approximately $4.7 million worth of TCP units,

and were owed approximately $4.0 million. We repossessed from ABS approximately

$2.3 million worth of TCP units, and have since been selling TCP units directly

to ABS customers as permitted under the bankruptcy proceedings, which also

required us to pay royalties to various ABS creditors (see "Legal Proceedings"

for more information regarding ABS-related litigation).

Subsequently, we entered into a contract with another direct marketing company

to sell TCP units internationally, along with other ancillary hair products, and

have generated an additional $2.3 million in sales. During 2007, we also began a

direct TV test marketing program, and by the end of 2007 were evaluating the

roll-out test phase. During this test and evaluation period we decided to devote

additional resources to the TV marketing program, and that TCP shipments would

renew during 2008.

In 2006, we signed a three-year, exclusive agreement with Arrowhead Industries,

Inc. to manufacture the Hinge Helper, a unique, do-it-yourself home utility hand

tool. We produced an initial batch of 1,500 units in conjunction with an

anticipated infomercial, but were disappointed at the results of media testing.

We signed another four-year licensing agreement in February 2007 to market the

product over the internet, through direct marketing, and through retailers;

however, significant sales of this product have not yet been achieved as of the

date of this report.

Also in 2006, we entered into a distribution agreement with Wines and Wines, and

a contract to distribute a line of solar chargers. During 2007, we continued

preliminary marketing efforts in connection with these products. However we

later determined the products would not meet our earlier expectations, and

further development efforts on these products were discontinued by the end of

2007.

In November 2006, we entered into an exclusive agreement with Beautiful Eyes(R),

Inc. for a new "hot lashes" product to be sold via infomercials and through

5

retailers. Through the end of 2007, we worked with the customer, developing the

product and submitting samples for approval. By early 2008, the infomercial was

completed, and we plan to finish media testing by mid-2008.

In February 2007, we announced completion of an infomercial featuring former

heavyweight boxing champion Evander Holyfield and The Real Deal Grill(TM), an

indoor/outdoor cooking appliance. Media testing took place in the fall of 2007.

Sales of approximately $10,000 resulted, and certain changes were made to the

infomercial. We have contracted with another media company for infomercial

airings and distribution, and during early 2008 decided to make additional

changes to the infomercial to determine if a roll-out was justified. We also

completed retail packaging design for this product so we can present it

effectively to major retailers.

Also in February 2007, we signed an agreement to manufacture and market a

patent-pending, hand-held luggage handle and scale, convenient for travelers to

weigh suitcases or packages. During 2007, we worked to develop a final version

of the product, and by early 2008 we finished packaging design. We anticipate

the product being on retailers' shelves by mid-2008.

In March 2007, we entered into a contract with Easy Life Products Corporation to

manufacture and market a new beauty product involving a pencil compact and

related accessories. We plan to continue working with the inventor in order to

complete the final version of the product.

Electronics Products

Since 1993, we have devoted resources to our traditional electronics business

and product lines. We manufacture all of our electronics products through

CirTran USA, and provide some engineering services through Racore.

In 2004 we entered into a three-year agreement with Broadata Communications,

Inc. ("Broadata"). Under this agreement we have been performing "turn-key"

manufacturing services for Broadata, from material procurement to complete

finished box-build. The agreement expired in 2007, but has continued on a

month-to-month basis.

Media/Online Marketing Services

In October 2005, we opened a satellite office in Los Angeles in accordance with

a planned internal expansion program. During 2006, we opened another small

office in New York City. In June 2007, the executive in charge of the Los

Angeles office was terminated and the office was later closed. A new office has

been leased in Los Angeles to house personnel involving CirTran Asia-related

product transportation, along with activities connected with our beverage

business. In July 2007, we relinquished the executive office space in New York

City.

In early 2007, we signed a three-year, Assignment and Exclusive Services

Agreement with GMA, founded by Mr. Sovatphone Ouk, and its affiliate companies,

Online Profit Academy, LLC, and Online 2 Income, LLC, including Webprostore.com

and Myitseasy.com. Based in the Salt Lake area, these companies offer a wide

range of services for E-commerce, including eBay sellers. We plan to work

closely with the GMA companies to sell products via the internet, and to offer

training, software, marketing tools, web design and support, as well as other

e-commerce related services to internet entrepreneurs. Through the GMA

companies, we also intend to telemarket directly to buyers of our products and

services. We also signed a three-year employment agreement with Mr. Ouk to serve

as Senior Vice President of our new CirTran Online subsidiary. GMA and its

affiliate companies offer a range of complementary capabilities and products for

E-commerce, including seminars on how to buy and sell on the World Wide Web. GMA

is experienced in building E-commerce websites, and currently hosts sites for

internet entrepreneurs.

Beverages

During 2007, we developed two versions of the Playboy-labeled energy drink:

regular and sugar-free. Other products considered under the PlayBev agreement

are flavored water beverages and related merchandise. During 2007, we also

initiated a promotional marketing program, whereby contacts were made with

several celebrities who helped publicize the new energy drinks. Additionally, we

ran a college-town bus tour throughout the Southwest United States, and the

geographic area of the Southeast Football Conference. Ads were placed in

college-oriented editions of magazines, and we developed collateral materials

6

used to support the product in the college marketplace. A focus group taste test

was conducted by Alder-Weiner Research, and the results proved favorable with

regards to flavor and ingredients. Approximately $205,000 in preliminary

beverage sales was collected during the fall of 2007.

During the fourth quarter of 2007 and first part of 2008, the Company secured

distribution contracts for the Playboy energy drink and began selling the

product in New England, Florida, and California. Another promotional bus tour

began in Las Vegas at the end of February 2008, and the following month

continued into Florida.

INDUSTRY BACKGROUND

Contract Manufacturing. The contract manufacturing industry specializes in

providing the program management, technical and administrative support and

manufacturing expertise required to take products from the early design and

prototype stages through volume production and distribution. The goal is to

provide the customer with a quality product, delivered on time and at the lowest

cost. This full range of services gives the customer an opportunity to avoid

large capital investments in plant, inventory, equipment and staffing, and to

concentrate instead on innovation, design and marketing. By using our contract

manufacturing services, customers have the ability to improve the return on

their investment with greater flexibility in responding to market demands and

exploiting new market opportunities.

In previous years we identified an important trend in the manufacturing

industry. We found that customers increasingly required contract manufacturers

to provide complete turnkey manufacturing and material handling services, rather

than working on a consignment basis where the customer supplies all materials

and the contract manufacturer supplies only labor. Turnkey contracts involve

design, manufacturing and engineering support, the procurement of all materials,

and sophisticated in-circuit and functional testing and distribution. The

manufacturing partnership between customers and contract manufacturers involves

an increased use of "just-in-time" inventory management techniques that minimize

the customer's investment in component inventories, personnel and related

facilities, thereby reducing their costs.

New Age Beverages. The Playboy energy drink and other products we are developing

are part of a growing market segment of the beverage industry known as the "new

age" or alternative beverage industry. The alternative beverage category

combines non-carbonated ready-to-drink iced teas, lemonades, juice cocktails,

single serve juices and fruit beverages, ready-to-drink dairy and coffee drinks,

energy drinks, sports drinks, and single-serve still water (flavored, unflavored

and enhanced) with "new age" beverages, including sodas that are considered

natural, sparkling juices and flavored sparkling beverages. The alternative

beverage category is the fastest growing segment of the beverage marketplace,

according to Beverage Marketing Corporation. According to Beverage Marketing

Corporation, wholesale sales in 2007 for the alternative beverage category of

the market are estimated at $25.5 billion representing a growth rate of

approximately 11.4% over the estimated wholesale sales in 2006 of approximately

$22.9 billion.

As we launch our Playboy energy drink and other licensed products, we will

compete with other beverage companies not only for consumer acceptance but also

for shelf space in retail outlets and for marketing focus by our distributors,

all of whom also distribute other beverage brands. Our energy drink products

compete with all non-alcoholic beverages; most of the competing products are

marketed by companies with substantially greater financial resources than ours.

We also compete with regional beverage producers and "private label" soft drink

suppliers. We believe that the leading energy drinks are Red Bull and Monster.

MARKET AND BUSINESS STRATEGY

We maintain capabilities domestically and internationally through multiple

channels in product manufacturing, marketing, and distribution. More

specifically, we can provide solutions in areas such as campaign management,

direct-response media, retail and wholesale distribution, web-based marketing,

along with print/catalog and live shopping marketing channels.

We have concentrated our focus on promoting our three operating business

segments, i.e., Contract Manufacturing, Electronics Assembly, and Marketing and

Media. We have currently classified operations relating to our beverage

development, marketing, and distribution business within the Marketing and Media

segment, but anticipate the beverage-related business becoming its own segment

as it becomes more significant in relation to overall operations.

7

Contract Manufacturing

Based on the trends observed in the contract manufacturing industry, one of our

goals is to benefit from the increased market acceptance of, and reliance upon,

the use of manufacturing specialists by many OEMs, marketing firms,

distributors, and national retailers. We believe the trend towards outsourcing

manufacturing will continue. OEMs utilize manufacturing specialists for many

reasons, including reducing the time it takes to bring new products to market,

reducing the initial investment required and to access leading manufacturing

technology, the ability to better focus resources in other value-added areas,

and to improve inventory management and purchasing power. An important element

of our strategy is to establish partnerships with major and emerging OEM leaders

in diverse segments across the electronics industry. Due to the costs inherent

in supporting customer relationships, we focus our efforts on customers with

which the opportunity exists to develop long-term business partnerships. Our

goal is to provide our customers with total manufacturing solutions for both new

and more mature products, as well as across product generations - an idea we

call "Concept to Consumer."

We have hired qualified personnel to support new ventures, and in 2006 we opened

a dedicated office in Bentonville, Arkansas to directly service the Wal-Mart

market. As additional product lines are added, we plan to increase our marketing

staff.

Electronics Assembly

Our strategy is to provide a complete range of manufacturing management and

value-added services, including materials management, board design, concurrent

engineering, assembly of complex printed circuit boards and other electronic

assemblies, test engineering, software manufacturing, accessory packaging and

post-manufacturing services. In our high-volume electronics, we believe we add

value by providing turn-key solutions in design, engineering, manufacturing and

supply of products to our customers.

Marketing and Media

We currently provide product marketing services to the direct response and

retail markets for both proprietary and non-proprietary products. This segment

provides campaign management and marketing services for both the Direct Response

and Retail markets. We provide media services to support our own product

marketing efforts, and will begin offering to customers marketing service in

channels involving television, radio, print media, and the internet. We have

identified a qualified boutique media firm to subcontract this work to in order

to better focus resources, and to conserve on potential set up and staffing

costs.

We feel that our beverage business, currently classified in the Marketing and

Media segment, could have a substantial impact on our business moving forward.

The New Age Beverage industry is still on the move. According to Beverage

Digest, caffeinated energy drinks have become the fastest-growing sector of the

$93 billion domestic beverage industry. Sales of energy drinks grew 700 percent

over the past five years, and continue to grow at an annual rate of 72 percent,

according to beverage industry consultants. This industry is growing due to

current attention to new brands, non-coffee drinkers, and people interested in

health and fitness. By directing products to specific groups such as extreme

sports enthusiasts, energy drinks target consumers made up primarily of male

teenagers and young people in the 20's age bracket.

SUPPLIERS, SUBCONTRACTORS, AND RAW MATERIALS

Our sources of components for our electronics assembly business are either

manufacturers or distributors of electronic components. These components include

passive components, such as resistors, capacitors and diodes, and active

components, such as integrated circuits and semi-conductors. Our suppliers

include Texas Instruments, Fairchild, Harris and Motorola. Distributors from

whom we obtain materials include Avnet, Future Electronics, Digi-key and Force

Electronics. Although from time to time we have experienced shortages of various

components used in our assembly and manufacturing processes, we typically hedge

against such shortages by using a variety of sources and, to the extent

possible, by projecting our customer's needs.

8

We also utilize subcontractors, particularly in China, to manufacture products

that we choose not to produce ourselves in the U.S. due to expertise or economic

issues. This strategy has proved effective and allows us to earn better profit

margins. In addition, we have arrangements with co-packing bottling companies,

along with can manufacturers to provide us with products for energy drink

beverage distribution.

RESEARCH AND DEVELOPMENT

During 2007 and 2006, we spent approximately $179,000 and $271,000,

respectively, on research and development of new products and services. The

costs of that research and development were billed to specific customers. In

addition, our wholly-owned subsidiary, Racore, spent approximately $60,000 and

$45,000 during each of those respective years developing technologies intended

to eventually be used in new products sold through other CirTran subsidiaries.

We will continue to provide Racore's technical expertise to develop and enhance

our product line when, and if future demand may arise.

We possess advanced design and engineering capabilities with experienced

professional staff at both our Salt Lake City and ShenZhen offices for

electrical, software, mechanical and industrial design. This provides our

customers a total solution for original design, re-design and final design of

products.

SALES AND MARKETING

The Company continues to pursue product development and business development

professionals with concentrated efforts on the direct response, product and

retail distribution businesses, as well as sales executives for the electronics

manufacturing division. In 2006, we opened our office in Bentonville, Arkansas,

in close proximity to Wal-Mart's world headquarters. The office is managed by an

employee who is responsible for developing and managing an ongoing relationship

with Wal-Mart / Sam's Club stores.

It is our intention to continue pursuing sales representative relationships as

well as internal salaried sales executives. In 2006, the Company opened a

dedicated satellite sales/engineering office in Los Angeles to headquarter all

business development activities companywide. Among other things, we use that

office to produce infomercials for the direct marketing industry, and for

product marketing campaigns. From the Los Angeles office we also provide product

marketing, production, media funding, and merchandising services to the direct

response and entertainment industries.

We are working aggressively to market existing products through current sales

channels. We will also seek to add new conduits to deliver products and services

directly to end users, as well as motivate our distributors, partners, and other

third party sales mechanisms. We continue to simplify and improve the sales,

order, and delivery process. We are also pursuing strategic relationships with

retail distribution firms to engage with us in a reciprocal relationship where

they would act as our retail distribution arm and we would act as their

manufacturing arm with both parties giving the other priority and first

opportunity to work on the other's products.

Historically, we have had substantial recurring sales from existing customers,

though we continue to seek out new customers to generate increased sales. We

treat sales and marketing as an integrated process involving direct salespersons

and project managers, as well as senior executives. We also use independent

sales representatives in certain geographic areas. We have also engaged

strategic consulting groups to make strategic introductions to generate new

business. This strategy has proven successful, and has already generated

multiple manufacturing contracts.

During a typical contract manufacturing sales process, a customer provides us

with specifications for the product it wants, and we develop a bid price for

manufacturing a minimum quantity that includes manufacture engineering, parts,

labor, testing, and shipping. If the bid is accepted, the customer is required

to purchase the minimum quantity and additional product is sold through purchase

orders issued under the original contract. Special engineering services are

provided at either an hourly rate or at a fixed contract price for a specified

task.

In 2007, 54 percent of our net sales were derived from pre-existing customers,

whereas during 2006, 64 percent of our net sales were derived from customers

that were also customers during the previous year. In 2007, 46 percent of our

sales were derived from new business, with the majority of those sales stemming

9

from sales to PlayBev, revenue derived via the GMA contract, and sales of the

CorEvolution product. In 2007, our largest pre-existing customer, Dynojet,

accounted for about 14 percent of our net sales. Our second largest customer in

2007 was Worldwide Excellence, which also accounted for approximately 14 percent

of net sales. Sales of the CorEvolution product, along with beverage marketing

and development services billed to PlayBev by CirTran Beverage, accounted for 13

and 12 percent, respectively, of total net sales in 2007. Throughout 2008, we

anticipate these sources to continue providing the majority of our net sales.

Our expansion into China manufacturing has allowed us to increase our sales,

manufacturing capacity and output with minimal capital investment required. By

using various subcontractors among which are Zhejiang Cuiori Electrical

Appliances Co., Ltd., which manufactures the Real Deal Grill, and Wuyi Leisure

Products, which manufactures the CorEvolution and AbRoller, we leverage our

upfront payments for inventories and tooling to control costs and receive

benefits from economics of scale in Asian manufacturing facilities. These

expenses can be upwards of $100,000 per product. The Company will, depending on

the contract, prepay some factories anywhere from 10 percent to 50 percent of

the purchase orders for materials. In exchange for theses financial commitments,

the Company receives dedicated manufacturing responsiveness and eliminates the

costly expense associated with capitalizing completely proprietary facilities.

Backlog consists of contracts or purchase orders with delivery dates scheduled

within the next twelve months. As of March 28, 2008, our backlog was

approximately $2,350,000. The Company also has contracts that require minimum

quantity purchase orders over periods terminating between 2009 and 2011; if the

full minimum quantity orders are purchased under these current agreements, they

would generate approximately $20,000,000 in revenues to the Company. The

majority of these blanket quantities orders are contracts from Williams

WorldWide Television and CorEvolution. Each contract contains a buy-out clause

that varies, depending on the product and amounts of product agreed upon.

However, revenue under these contracts are never recognized until ordered

products have been shipped. There is no assurance that the parties to these

agreements will meet their obligations for the minimum quantity or any level of

purchases required under their respective agreements.

Our efforts to enter high-volume manufacturing in the electronics, consumer

products and general merchandise industries affected our sales and backlog. In

March 2005, the Company received ISO9001:2000 certification from the

International Organization for Standardization. Participation in this program is

voluntary, although many countries and customers require adherence to the ISO

standards. The ISO 9001:2000 designation indicates that the enterprise has

established and applies a set standard of policies on quality and manufacturing.

MATERIAL CONTRACTS AND RELATIONSHIPS

We generally use form agreements with standard industry terms as the basis for

our contracts with our customers. The form agreements typically specify the

general terms of our economic arrangement with the customer (number of units to

be manufactured, price per unit and delivery schedule) and contain additional

provisions that are generally accepted in the industry regarding payment terms,

risk of loss and other matters. We also use a form agreement with our

independent marketing representatives that features standard terms typically

found in such agreements.

Broadata Agreement

In 2004, we entered into a stock purchase agreement with Broadata

Communications, Inc., a California corporation ("Broadata") under which we

purchased 400,000 shares of Broadata Series B Preferred Stock (the "Broadata

Preferred Shares") for an aggregate purchase price of $300,000. The Broadata

Preferred Shares are convertible, at our option, into an equivalent number of

shares of Broadata common stock, subject to adjustment. The Broadata Preferred

Shares are not redeemable by Broadata. As a holder of the Broadata Preferred

Shares, we have the right to vote the number of shares of Broadata common stock

into which the Broadata Preferred Shares are convertible at the time of the

vote. Separate from the acquisition of the Broadata Preferred Shares, we also

entered into a Preferred Manufacturing Agreement with Broadata. Under this

agreement, we manufacture Broadata's product at an agreed-upon price per

component, thus providing "turn-key" manufacturing services from material

procurement to complete finished box-build of all of Broadata's products. The

initial term of the agreement was for three years, and following the end of this

initial term, both parties agreed to continue the relationship on a

month-to-month basis.

10

Evolve Agreement

In 2006, we entered into an Exclusive Manufacturing and Supply Agreement (the

"Evolve Agreement") with Evolve Projects, LLC ("Evolve"), an Ohio-based limited

liability company.

The term of the Evolve Agreement (the "Term") is for five years from execution,

and may be continued on a month-to-month basis thereafter. The Evolve Agreement

relates to the manufacturing and production of the CorEvolution. Under the

Evolve Agreement, Evolve committed to minimum orders of at least 20,000 units

during the first year, 30,000 units during the second year, and 40,000 units

during the third year. During both the first and second year, Evolve ordered

units in excess of their committed minimum amounts. There is no minimum order

commitment during years four and five. During the Term, Evolve agreed to

purchase all of its requirements for the Product on an exclusive basis from us.

The CorEvolution is designed to strengthen and rehabilitate the lower back and

adjacent areas of the body. Under the terms of the Evolve Agreement, Evolve owns

all right, title, and interest in and to the product, and markets the

CorEvolution under its own trademarks, service marks, symbols or trade names.

PlayBev Agreement

In May 2007, we entered into an exclusive, three-year manufacturing, marketing,

and distribution agreement (the "PlayBev Agreement") with PlayBev, a related

party. In August 2007, we extended the agreement's term to ten years. PlayBev is

the licensee under a product licensing agreement with Playboy. The PlayBev

Agreement allows us to arrange for the manufacture, marketing and distribution

of Playboy-licensed energy drinks, flavored water beverages, and related

merchandise through various distribution channels. Under the terms of this

agreement, we are to provide the initial development and promotional services to

PlayBev and are required to pay a royalty to PlayBev on our product sales and

manufacturing costs once licensed product distribution commences.

PlayBev has no operations, so under the terms of the PlayBev Agreement, the

Company was appointed the master manufacturer and distributor of the beverages

and other products that PlayBev licensed from Playboy. As a result, we have

assumed all the risk of collecting amounts owed from customers, and contracting

with vendors for manufacturing and marketing activities. The royalty payable to

PlayBev is an amount equal to the Company's gross profits from collected

beverage sales, less 20 percent of the Company's related cost of goods sold, and

6 percent of the Company's collected gross sales.

The Company also agreed to provide services to PlayBev for initial development,

marketing, and promotion of the new beverages. These services are billed to

PlayBev and recorded as an account receivable from PlayBev. The Company agreed

to carry up to a maximum of $1,000,000 as a receivable due from PlayBev in

connection with these billed services; PlayBev will repay the receivable out of

the royalties payable to PlayBev by the Company under the PlayBev Agreement. On

March 19, 2008, the Company and PlayBev agreed to increase the maximum amount of

the receivable from $1,000,000 to $3,000,000, and to begin charging interest at

a rate of 7 percent per annum on the unpaid balance.

COMPETITION

The electronic manufacturing services industry is large and diverse and is

serviced by many companies, including several that have achieved significant

market share. Because of our market's size and diversity, we do not typically

compete for contracts with a discreet group of competitors. We compete with

different companies depending on the type of service or geographic area. Certain

of our competitors have greater manufacturing, financial, research and

development and marketing resources. We also face competition from current and

prospective customers that evaluate our capabilities against the merits of

manufacturing products internally.

We believe that the primary basis of competition in our targeted markets is

manufacturing technology, quality, responsiveness, the provision of value-added

services and price. To remain competitive, we must continue to provide

11

technologically advanced manufacturing services, maintain quality levels, offer

flexible delivery schedules, deliver finished products on a reliable basis and

compete favorably on the basis of price.

Furthermore, the Asian manufacturing market is growing at a rapid pace.

Particularly in China, therefore, management feels that the Company is

strategically positioned to hedge against unforeseen obstacles and continues its

efforts to increase establishing additional relationships with manufacturing

partners, facilities and personnel.

The beverage industry is highly competitive. Our energy drinks compete with

others in the marketplace in terms of pricing, packaging, development of new

products and flavors and marketing campaigns. These products compete with a wide

range of drinks produced by a relatively large number of manufacturers, most of

which have substantially greater financial, marketing and distribution resources

than we do.

We believe that factors affecting our ability to compete successfully in the

beverage industry include taste and flavor of products, strong recognition of

the Playboy brand and related branded product advertising, industry and consumer

promotions, attractive and different packaging, and pricing. We also compete for

distributors; most of our distributors also sell products manufactured by our

competitors and we will compete for the attention of these distributors to

endeavor to sell our products ahead of those of our competitors, provide stable

and reliable distribution and secure adequate shelf space in retail outlets.

These and other competitive pressures in the energy beverage category could

cause our products to be unable to gain or to lose market share or we could

experience price erosion, which could have a material adverse affect on our

business and results.

We compete not only for consumer acceptance, but also for maximum marketing

efforts by multi-brand licensed bottlers, brokers and distributors, many of

which have a principal affiliation with competing companies and brands. Our

products compete with all liquid refreshments and with products of much larger

and substantially better financed competitors, including the products of

numerous nationally and internationally known producers and include products

such as Hansen's energy, Diet Red, Monster Energy, Lost Energy, Joker Mad

Energy, Ace Energy, Unbound Energy, Rumba energy juice, Red Bull, Rockstar, Full

Throttle, No Fear, Amp, Adrenaline Rush, 180, Extreme Energy Shot, Red Devil,

Rip It, NOS, Boo Koo, Vitaminenergy, and many other brands. We also compete with

companies that are smaller or primarily local in operation. Our products also

compete with private label brands such as those carried by grocery store chains,

convenience store chains and club stores.

REGULATION

We are subject to typical federal, state and local regulations and laws

governing the operations of manufacturing concerns, including environmental

disposal, storage and discharge regulations and laws, employee safety laws and

regulations and labor practices laws and regulations. We are not required under

current laws and regulations to obtain or maintain any specialized or

agency-specific licenses, permits, or authorizations to conduct our

manufacturing services. We believe we are in substantial compliance with all

relevant regulations applicable to our business and operations.

EMPLOYEES

As of April 9, 2008, we employed a total staff of 113 persons in the United

States and seven in China. In our Salt Lake headquarters, we employed 108

persons: five in administrative positions, five in engineering and design, 93 in

clerical and manufacturing, two in sales, and three in project management. In

our Los Angeles sales office, we employed three persons: two in administration

and sales, and one clerical assistant. In our Bentonville sales office, we

employed two persons: one in administration and sales, and one clerical

assistant. In our ShenZhen, China office, we employed two persons in

administration and five in engineering. We believe that our relationship with

our employees is good.

RECENT DEVELOPMENTS

In February 2008, we signed an exclusive, three-year agreement with Shaka Shoes,

Inc. ("Shaka"), of Kailua Kona, Hawaii, to manufacture and distribute Shaka

Gear(TM) shoes and accessories. The agreement gives us the exclusive right to

12

manufacture globally, and distribute in the United States. We will pay Shaka a

royalty based on sales volume as determined under the terms of the agreement.

The agreement also contains provisions for us to provide Shaka with marketing

services and media (primarily infomercial) placements.

In February 2008, we extended the maturity dates and registration filing dates

in connection with three debenture agreements involving two of our convertible

debentures issued in 2005 to YA Global Investments, LP ("YA Global," formerly

known as Cornell Capital Partners, LP), and Highgate House Funds, LTD

("Highgate"). The maturity dates for both debentures were extended to August 31,

2008. YA Global also agreed to extend the deadline for registering the resale of

shares of common stock issuable upon conversion of its debentures until January

1, 2009, and similarly agreed to extend the registration deadline in connection

with another debenture we issued in 2006.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of

Section 21E of the Securities Exchange Act of 1934, and Section 27A of the

Securities Act of 1933 that reflect our current expectations about our future

results, performance, prospects and opportunities. These forward-looking

statements are subject to significant risks, uncertainties, and other factors,

including those identified in "Risk Factors" below, which may cause actual

results to differ materially from those expressed in, or implied by, any

forward-looking statements. The forward-looking statements within this Form

10-KSB may be identified by words such as "believes," "anticipates," "expects,"

"intends," "may," "would," "will" and other similar expressions. However, these

words are not the exclusive means of identifying these statements. In addition,

any statements that refer to expectations, projections or other

characterizations of future events or circumstances are forward-looking

statements. Except as expressly required by the federal securities laws, we

undertake no obligation to publicly update or revise any forward-looking

statements to reflect events or circumstances occurring subsequent to the filing

of this Form 10-KSB with the SEC or for any other reason. You should carefully

review and consider the various disclosures we make in this Report and our other

reports filed with the SEC that attempt to advise interested parties of the

risks, uncertainties and other factors that may affect our business.

RISK FACTORS

Our business, financial condition, and results of operations could be harmed by

any of the following risks, or other risks that have not been identified or

which we believe are immaterial or unlikely. Shareholders should carefully

consider the risks described below in conjunction with the other information in

this report on Form 10-KSB and the information incorporated by reference in this

report, including our consolidated financial statements and related notes.

Risks Related to Our Operations

We have a history of operating losses which could have a material adverse impact

on our ability to continue operations.

Our net loss for the year ended December 31, 2007, was $7,232,524, which

included a gain on forgiveness of debt of $67,637, compared to a net loss for

the year ending December 31, 2006 totaling $2,854,369, which was partially

offset by a gain on forgiveness of debt in the amount of $6,930. Our ability to

operate profitably depends on our ability to increase our sales and achieve

sufficient gross profit margins for sustained growth. We can give no assurance

that we will be able to increase our sales sufficiently to enable us to operate

profitably, which would have a material adverse impact on our business. Our

ability to obtain funding has had a material effect on our operations.

Additionally, there is no guarantee that the fluctuations in the volume of our

sales will stabilize or that we will be able to continue to increase our

revenues to exceed our expenses.

Our current liabilities exceeded our current assets, which raises doubts that we

may continue as a going concern.

At December 31, 2007, our current liabilities exceeded our current assets by

$5,986,817, compared to a deficit of $4,863,641 at December 31, 2006. For the

years ended December 31, 2007 and 2006, we had negative cash flows from

operations of $4,260,618 and $1,729,901, respectively. There can be no guarantee

that our current assets will ever exceed our current liabilities. As such, and

in light of our recent history, there remains a doubt we will be able to meet

13

our obligations as they come due and will be able to execute our long-term

business plans. If we are unable to meet our obligations as they come due or are

unable to execute our long-term business plans, we may be forced to curtail our

operations, sell part or all of our assets, or seek protection under bankruptcy

laws.

The "going concern" paragraph in the report of our independent registered public

accounting firm for the years ended December 31, 2007 and 2006 raises doubts

about our ability to continue as a going concern.

The independent registered public accounting firm's report for our financial

statements for the years ended December 31, 2007 and 2006 include an explanatory

paragraph regarding substantial doubt about our ability to continue as a going

concern. This may have an adverse effect on our ability to obtain financing for

our operations and to further develop and market our products.

Our volume of sales has fluctuated significantly over the last four years, and

there is no guarantee that we will be able to increase sales. These fluctuations

in sales volume could have a material adverse impact on our ability to operate

our business profitably.

Our sales volume increased in the year of 2007 as compared to 2006. Our sales

volumes for the previous four years have changed as indicated by the following

levels of net sales for the periods indicated: $8,862,715 for the year ended

December 31, 2004; $12,992,512 for the year ended December 31, 2005; and

$8,739,208 for the year ended December 31, 2006. For the year ended December 31,

2007 our sales increased to $12,399,793, or by 42 percent from the year ended

December 31, 2006. There is no guarantee that the fluctuations in the volume of

our sales will stabilize or that we will be able to continue to increase our

sales volume.

We are involved in legal proceedings that may give rise to liabilities, and

which increase our costs of doing business and could impair our ability to

continue as a going concern.

We are involved in legal proceedings which involve lawsuits filed against us. As

discussed in "Legal Proceedings," we are currently attempting to negotiate with

these claimants to settle claims against the Company, although in some cases, we

have not yet reached final settlements. There can be no assurance that we will

be successful in those negotiations or that, if successful, we will be able to

service any payment obligations which may result from such settlements.

There is a risk, therefore, that the existence and extent of these liabilities

could adversely affect our business, operations and financial condition. The

liabilities and claims could also result in a reduction in our revenues to the

extent that claims relate to specific products or licenses. As a result, we may

be forced to curtail our operations, sell part or all of our assets, or seek

protection under bankruptcy laws. Additionally, there is a risk that our vendors

could expand their collection efforts against us. If they undertake significant

collection efforts, and if we are unable to negotiate settlements or satisfy our

obligations, we could be forced into bankruptcy.

Our assets are encumbered by security interests granted to certain holders of

our convertible debt; if we fail to meet our obligations under the terms of the

instruments creating those security interests, those debt holders may take

control of our assets and our business.

In connection with the sale of our convertible debt, we granted a security

interest in all of our assets to secure our payment obligations under those

securities. If we are unable to meet these obligations, the holders of those

securities could execute on the security interest and seize control of our

assets.

We are dependent on the continued services of our president and other officers,

and the untimely death or disability of Iehab Hawatmeh could have a serious

adverse effect upon our Company.

We view the continued services of our president, Iehab Hawatmeh, and our other

officers as critical to our success. Though we have an employment agreement with

Mr. Hawatmeh, and a key-man life insurance policy for Mr. Hawatmeh, the untimely

death or disability of Mr. Hawatmeh could have a serious adverse affect on our

operations.

Our international business activities generally subject us to risks that could

adversely affect our business.

14

For the year ended December 31, 2007, sales of products manufactured in the

United States accounted for 39 percent of our total net sales, and sales of

products manufactured in China accounted for 41 percent of our total net sales.

Because of the increasing portion of our products that is manufactured outside

the United States, and more particularly, at facilities in close proximity to

our CirTran-Asia production facilities in ShenZhen, China, our business is

increasingly subject to the risks inherent in doing business internationally.

Our international business activities could be affected, limited, or disrupted

by a variety of factors, including:

o The imposition of or changes in governmental controls, taxes,

tariffs, trade restrictions and regulatory requirements;

o The costs and risks of localizing products for foreign countries;

o Longer accounts receivable payment cycles;

o Changes in the value of local currencies relative to our

functional currency;

o Import and export restrictions;

o Loss of tax benefits due to international production;

o General economic and social conditions within foreign countries;

o Differences in international telecommunications standards and

regulatory agencies;

o Product requirements different from those of our current

customers;

o Fluctuations in the value of foreign currencies and the U.S.

dollar;

o Taxation in multiple jurisdictions; and/or;

o Political instability, war or terrorism.

All of these factors could adversely affect future sales of our products to

international customers or future production outside of the United States of our

products, and have a material adverse effect on our business, results of

operations and financial condition.

We may continue to expand our operations in international markets. Our failure

to effectively manage our international operations could harm our business.

Entering new international markets may require significant management attention

and expenditures and could adversely affect our operating margins and earnings.

To date, we have only recently begun to penetrate international markets. To the

extent that we are unable to expand our foreign business ventures in these and

other markets, our growth in international markets would be limited, and our

business could be harmed.

Risks Associated with Operations in the People's Republic of China ("China" or

the "PRC")

The Company's business will be affected by PRC government regulation and the

country's economic environment because a significant portion of our products

will be produced inChina.

It is anticipated that our products manufactured in China will continue to

represent a significant portion of sales in the near future. As a result of our

reliance on the China markets, our operating results and financial performance

could be affected by any adverse changes in economic, political and social

conditions in China.

Economic, political, social and other factors in China may adversely affect our

ability to achieve our business objectives of increasing our manufacturing and

sourcing activities in China.

15

Our ability to achieve our business objectives in China may be adversely

affected by economic, political, social and religious factors, changes in

Chinese law or regulations and the status of China's relations with other

countries. In addition, the economy of China may differ favorably or unfavorably

from the U.S. economy in such respects as the growth rate of its gross domestic

product, the rate of inflation, capital reinvestment, resource self-sufficiency

and balance of payments position. The Chinese economy differs from the economies

of most developed countries in many respects, including:

o the amount of governmental involvement;

o the level of development;

o the growth rate;

o the control of foreign exchange; and

o the allocation of resources.

These differences may adversely affect our ability to manufacture and source

products and materials at favorable costs and to otherwise conduct our

subsidiary's business or contract with business and trading partners with

operations primarily in China. Also, while the Chinese economy has experienced

significant growth in the past 20 years, growth has been uneven, both

geographically and among various sectors of the economy. The Chinese government

has implemented various measures to encourage economic growth and guide the

allocation of resources. Some of these measures benefit the overall Chinese

economy, but may also have a negative effect on our business as a foreign entity

operating a business or businesses in China. For example, our financial

condition and results of operations may be adversely affected by government

control over capital investments or changes in tax regulations that are

applicable to us or our Chinese subsidiary.

The Chinese government's control over the national economy and economic growth

in China could adversely affect our business.

The Chinese economy has been transitioning from a planned economy to a more

market-oriented economy. Although in recent years the Chinese government has

implemented measures emphasizing the utilization of market forces for economic

reform, the reduction of state ownership of productive assets and the

establishment of sound corporate governance in business enterprises, a

substantial portion of the productive assets in China is still owned by the

Chinese government. The continued control of these assets and other aspects of

the national economy by the Chinese government could materially and adversely

affect our business. The Chinese government also exercises significant control

over Chinese economic growth through the allocation of resources, controlling

payment of foreign currency-denominated obligations, setting monetary policy and

providing preferential treatment to particular industries or companies. Efforts

by the Chinese government to slow the pace of growth of the Chinese economy

could result in decreased capital expenditures by the public which in turn could

reduce demand for goods and services.

Any adverse change in the economic conditions or government policies in China

could have a material adverse effect on overall economic growth and the level of

investments and expenditures in China, including in those related to healthcare,

which in turn could lead to a reduction in demand for our products and

consequently have a materially adverse effect on our business.

Because the Chinese judiciary, which is relatively inexperienced in enforcing

corporate and commercial law, will determine the scope and enforcement under

Chinese law of our agreements in China, we may be unable to enforce our rights

under those agreements inside and outside of China.

Chinese law will govern some or all of our agreements with Chinese trade or

business partners, some of which may be with Chinese governmental agencies. We

cannot assure you that we will be able to enforce any of our material agreements

or that remedies will be available under those agreements outside of the

16

People's Republic of China. The Chinese judiciary is relatively inexperienced in

enforcing corporate and commercial law, leading to a higher than usual degree of

uncertainty as to the outcome of any litigation. The inability to enforce or

obtain a remedy under any of our existing or future agreements may have a

material adverse impact on our operations.

Exchange controls that exist in the PRC may limit our ability to utilize our

cash flow generated in China effectively.

Our subsidiary's business is subject to the PRC's rules and regulations on

currency conversion. In the PRC, the State Administration for Foreign Exchange

(SAFE) regulates the conversion of Renminbi into foreign currencies. Currently,

foreign investment enterprises (FIEs) are required to apply to the SAFE for

"Foreign Exchange Registration Certificates for FIEs." FIEs holding such

registration certificates, which must be renewed annually, are allowed to open

foreign currency accounts, including a "basic account" and "capital account."

Currency translation within the scope of the "basic account," such as remittance

of foreign currencies for payment of dividends, can be effected without

requiring the approval of the SAFE. However, conversion of currency in the

"capital account" including capital items such as direct investment, loans and

securities, still require approval of the SAFE. We cannot assure you that the

PRC regulatory authorities will not impose further restrictions on the

convertibility of Chinese currency. Any future restrictions on currency

exchanges may limit our ability to use our cash flow for the distribution of

dividends to our shareholders or to fund operations we may have outside of the

PRC.

Foreign investment policy changes may affect the profitability of our Chinese

operations.

On March 16, 2007, China's parliament, the National People's Congress, adopted

the Enterprise Income Tax Law, which took effect on January 1, 2008. The new

income tax law sets a unified income tax rate for domestic and foreign companies

at 25 percent and abolishes the favorable policy for foreign invested

enterprises. Under this new law, newly established foreign invested enterprises

will not enjoy favorable tax treatment as previously in effect. Our China

subsidiary will be subject to the new tax rate, which may adversely affect our

results of operations.

Failure to comply with the US Foreign Corrupt Practices Act could subject us to

penalties and other adverse consequences.

Since we are a domestic corporation required to file reports under the Exchange

Act, we are subject to the US Foreign Corrupt Practices Act ("FCPA"), which

generally prohibits US companies from engaging in bribery or other prohibited

payments to foreign officials for the purpose of obtaining or retaining

business. Non-US companies, including some that may compete with our company,

are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs,

theft and other fraudulent practices may occur in the PRC. We can make no

assurance, however, that our employees or other agents will not engage in such

conduct for which we might be held responsible. We are also required to maintain

financial controls that will adequately disclose any payments that might violate

the FCPA. If our employees or other agents are found to have engaged in such

practices, we could suffer severe penalties and other consequences that may have

a material adverse effect on our business, financial condition and results of

operations.

Risks Related to Our Industry

The variability of customer requirements in the electronics industry could

adversely affect our results of operations.

Electronic manufacturing service providers must provide increasingly rapid

turnaround time for their OEM customers. We do not obtain firm, long-term

purchase commitments from our customers and have experienced a demand for

reduced lead-times in customer orders. Our customers may cancel their orders,

change production quantities or delay design and production for several factors.

Cancellations, reductions or delays by a customer or group of customers could

adversely affect our results of operations. Additional factors that affect the

electronics industry and that could have a material adverse effect on our

business include the inability of our customers to adapt to rapidly changing

technology and evolving industry standards and the inability of our customers to

develop and market their products. If our customers' products become obsolete or

fail to gain commercial acceptance, our results of operations may be materially

and adversely affected, which could make it difficult for us to continue as a

going concern.

17

Our customer mix and base fluctuates significantly, and responding to these

fluctuations could cause us to lose business or have delayed revenues, which

could have a material adverse impact on our business.

A percentage of our revenue is generated from our electronics assembly and

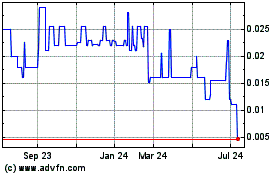

manufacturing services. Of this amount our three largest customers generate