IMF: Spain Needs To Continue, Deepen Financial Sector Reform

April 25 2012 - 1:27PM

Dow Jones News

The International Monetary Fund said Wednesday that although

Spain's largest banks appear sufficiently capitalized and have

strong profitability to withstand a further deterioration of

economic conditions, vulnerabilities remain in other banks that are

reliant on state support.

The IMF said in a statement--following a visit to Spain by a

delegation of its Monetary and Capital Markets Department--that

although a major restructuring of the savings bank sector is taking

place, "the capacity to cope with the needed adjustments differs

significantly across the system."

The IMF said in its Financial Sector Assessment for Spain that

the "sector as a whole remains vulnerable to sustained disruptions

in funding markets."

"The assessment confirms the need to continue with and further

deepen the financial sector reform strategy to address remaining

vulnerabilities and build strong capital buffers in the sector,"

the IMF added.

"A carefully designed strategy to clean up the weak institutions

quickly and adequately is essential to avoid any adverse impact on

the sound banks. Furthermore, dealing effectively and

comprehensively with banks' legacy problem assets should be the

priority of the next stage of the financial reform strategy," the

IMF said.

-By Santiago Perez, Dow Jones Newswires; (34) 91 395 8119;

santiago.perez@dowjones.com

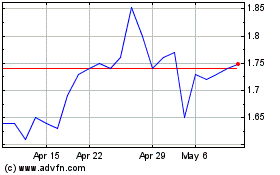

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Jul 2023 to Jul 2024