Royal Bank of Canada Posts Strong 1Q - Analyst Blog

March 01 2013 - 10:05AM

Zacks

Royal Bank of Canada (RY) reported fiscal

first-quarter 2013 net income from continuing operations of C$2.1

billion ($2.1 billion), beating the year-ago earnings of C$1.9

billion ($1.9 billion). This reflects a year-over-year increase of

11%.

Results reflect a rise in revenue, aided by higher net interest and

non-interest income. Yet, the deteriorating credit quality and

elevated non-interest expenses were the headwinds.

Performance in Detail

Total revenues in the quarter reached C$7.9 billion ($7.8 billion),

rising 4% from C$7.6 billion ($7.5 billion) reported in the

comparable prior-year period. Revenue growth was mainly due to

higher interest as well as non-interest income.

Net interest income came in at C$3.3 billion ($3.3 billion), up

6.7% from C$3.0 billion ($3.0 billion) reported in the comparable

prior-year period. Non-interest income stood at C$4.6 billion ($4.6

billion), almost in line with the year-ago quarter’s level.

For the quarter, non-interest expenses were recorded at C$2.1

billion ($2.1 billion), up 11.4% from C$1.9 billion ($1.9 billion)

recorded in the prior-year quarter. The increase was marked mainly

by higher human resources, occupancy and equipment expenses.

Credit Quality

Total provision for credit losses stood at C$349 million ($347

million) in the quarter, up 31% from the year-ago quarter,

primarily due to provisions on a couple of accounts in the

wholesale portfolio, partly offset by lower write-offs related to

the credit card portfolio.

Capital Position

As of Jan 31, 2012, Royal Bank of Canada reported total loans of

C$382.9 billion ($383.7 billion), up 8% from the prior year.

Moreover, deposits climbed to C$514.6 billion ($515.7 billion) up

5% as of Jan 31, 2012. Total assets were C$837.6 billion ($839.5

billion), up 3% as of Jan 31, 2012.

As of Jan 31, 2013, Royal Bank of Canada’s Tier 1 capital ratio

came in at 11.5%, down 70 basis points (bps) from the prior-year

quarter. Total capital ratio was 14.3%, down 2 bps year over

year.

The company’s estimated pro-forma Basel III common equity Tier 1

ratio was about 9.3%, up 90 basis points compared with 8.4% last

quarter, reflecting the delayed regulatory implementation of the

credit valuation adjustment (CVA) capital requirements and strong

internal capital generation.

Dividend Update

Concurrent with the earnings release, the company’s board of

directors approved an increase in quarterly dividend of 5%, to 63

cents per share. The increased dividend will be paid on and after

May 24, 2013, to shareholders of record at the close of business on

Apr 25, 2013.

Our Viewpoint

Going forward, we expect Royal Bank of Canada’s strong business

model, diversified product mix and sturdy capital position to boost

its bottom line. However, a persistent low interest rate

environment, weak economic recovery and stringent regulatory

requirements will remain a drag on its financials.

Royal Bank of Canada currently carries a Zacks Rank #3 (Hold).

Foreign banks that are performing well include Bank of

China Limited (BACHY), Banco do Brasil

S.A. (BDORY) and Credit Suisse Group

(CS). Bank of China carries a Zacks Rank #1 (Strong Buy), while the

other 2 stocks carry a Zacks Rank #2 (Buy).

BANK CHINA LTD (BACHY): Get Free Report

BANCO DO BRASIL (BDORY): Get Free Report

CREDIT SUISSE (CS): Free Stock Analysis Report

ROYAL BANK CDA (RY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

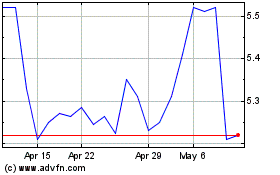

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Jun 2024 to Jul 2024

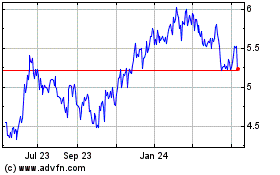

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Jul 2023 to Jul 2024