AGAPE

ATP CORPORATION

CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

The

accompanying notes are an integral part of these consolidated financial statements.

AGAPE

ATP CORPORATION

CONSOLIDATED

STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

The

accompanying notes are an integral part of these consolidated financial statements.

AGAPE

ATP CORPORATION

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Currency

expressed in United States Dollars (“US$”)

The

accompanying notes are an integral part of these consolidated financial statements.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

1.

ORGANIZATION AND BUSINESS BACKGROUND

Agape

ATP Corporation, a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on June 1, 2016.

Agape

ATP Corporation operates through its subsidiaries, namely, Agape ATP Corporation, a company incorporated in Labuan, Malaysia, and Agape

Superior Living Sdn. Bhd. (“ASL”), a company incorporated in Malaysia. .

Agape

ATP Corporation, incorporated in Labuan, Malaysia, is an investment holding company with 100% equity interest in Agape ATP International

Holding Limited, a company incorporated in Hong Kong.

On

May 8, 2020, the Company entered into a Share Exchange Agreement with Mr. How Kok Choong, CEO and director of the Company to acquire

9,590,596 ordinary shares, no par value, equivalent to approximately 99.99% of the equity interest in Agape Superior Living Sdn. Bhd.,

a network marketing entity incorporated in Malaysia.

Agape

Superior Living Sdn. Bhd. is a limited company incorporated on August 8, 2003, under the laws of Malaysia.

On

September 11, 2020, the Company incorporated Wellness ATP International Holdings Sdn, Bhd. (“WATP”), a wholly owned subsidiary

under the laws of Malaysia, to pursue the business of promoting wellness and wellbeing lifestyle of the community by providing services

that includes online editorials, programs, events and campaigns on how to achieve positive wellness and lifestyle.

On

November 11, 2021, Agape ATP Corporation (Labuan) formed a joint-venture entity, DSY Wellness International Sdn. Bhd. (“DSY Wellness”)

with an independent third party which Agape ATP Corporation (Labuan) owns 60% of the equity interest, to pursue the business of providing

complementary health therapies.

The

Company and its subsidiaries are principally engaged in the Health and Wellness Industry. The principal activity of the Company is to

supply high-quality health and wellness products, including supplements to assist in cell metabolism, detoxification, blood circulation,

anti-aging and products designed to improve the overall health system of the human body and various wellness programs.

The

accompanying consolidated financial statements reflect the activities of the Company, AATP LB, AATP HK, WATP, ASL and its variable interest

entity (“VIE”), Agape S.E.A. Sdn. Bhd. (“SEA”) (See Note 3), and DSY Wellness.

Details

of the Company’s subsidiaries:

SCHEDULE OF SUBSIDIARIES AND ASSOCIATES

| |

|

Subsidiary company name | |

Place and date of incorporation | |

Particulars of issued capital | |

Principal activities | |

Proportional of ownership interest and voting power held | |

| |

|

| |

| |

| |

| |

| |

| 1. |

|

Agape ATP Corporation | |

Labuan,

March 6, 2017 | |

100 shares of ordinary share of US$1 each | |

Investment holding | |

| 100 | % |

| |

|

| |

| |

| |

| |

| | |

| 2. |

|

Agape ATP International Holding Limited | |

Hong Kong,

June 1, 2017 | |

1,000,000 shares of ordinary share of HK$1 each | |

Wholesaling of health and wellness products; and health solution advisory services | |

| 100 | % |

| |

|

| |

| |

| |

| |

| | |

| 3. |

|

Agape Superior Living Sdn. Bhd. | |

Malaysia,

August 8, 2003 | |

9,590,598 shares of ordinary share of RM1 each | |

Health and wellness products and health solution advisory services via network marketing | |

| 99.99 | % |

| |

|

| |

| |

| |

| |

| | |

| 4. |

|

Agape S.E.A. Sdn. Bhd. | |

Malaysia,

March 4, 2004 | |

2 shares of ordinary share of RM1 each | |

VIE of Agape Superior Living Sdn. Bhd. | |

| VIE | |

| |

|

| |

| |

| |

| |

| | |

| 5. |

|

Wellness ATP International Holdings Sdn, Bhd | |

Malaysia,

September 11, 2020 | |

100 shares of ordinary share of RM1 each | |

The promotion of wellness and wellbeing lifestyle of the community by providing services that includes online editorials, programs, events and campaigns | |

| 100 | % |

| |

|

| |

| |

| |

| |

| | |

| 6. |

|

DSY Wellness International Sdn Bhd. | |

Malaysia,

November 11, 2021 | |

1,000 shares of ordinary share of RM1 each | |

Provision of complementary health therapies | |

| 60 | % |

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

1.

ORGANIZATION AND BUSINESS BACKGROUND (CONT’D)

Business

Overview

Agape

ATP Corporation is a company that provides health and wellness products and health solution advisory services to our clients. The Company

primarily focus its efforts on attracting customers in Malaysia. Its advisory services center on the “ATP Zeta Health Program”,

which is a health program designed to effectively prevent diseases caused by polluted environments, unhealthy dietary intake and unhealthy

lifestyles, and promotion of health. The program aims to promote improved health and longevity in our clients through a combination of

modern medicine, proper nutrition and advice from skilled nutritionists and/or dieticians.

In

order to strengthen the Company’s supply chain, on May 8, 2020, the Company has successfully acquired approximately 99.99% of ASL,

with the goal of securing an established network marketing sales channel that has been established in Malaysia for the past 15 years.

ASL has been offering the Company’s ATP Zeta Health Program as part of its product lineup. As such, the acquisition creates synergy

in the Company’s operation by boosting the Company’s retail and marketing capabilities. The newly acquired subsidiary allows

the Company to fulfill its mission of “helping people to create health and wealth” by providing a financially rewarding business

opportunity to distributors and quality products to distributors and customers who seek a healthy lifestyle.

Via

ASL, the Company offers three series of programs which consist of different services and products: ATP Zeta Health Program, ÉNERGÉTIQUE

and BEAUNIQUE.

The

ATP Zeta Health Program is a health program designed to promote health and general wellbeing designed to prevent health diseases caused

by polluted environments, unhealthy dietary intake and unhealthy lifestyles. The program aims to promote improved health and longevity

through a combination of modern health supplements, proper nutrition and advice from skilled dieticians as well as trained members and

distributors.

The

ÉNERGÉTIQUE series aims to provide a total dermal solution for a healthy skin beginning from the cellular level. The series

is comprised of the Energy Mask series, Hyaluronic Acid Serum and Mousse Facial Cleanser.

The

BEAUNIQUE product series focuses on the research of our diet’s impact on modifying gene expressions in order to address genetic

variations and deliver a nutrigenomic solution for every individual.

The

Company deems creating public awareness on wellness and wellbeing lifestyle as essential to enhance the provision of its health solution

advisory services; and therefore, incorporated WATP. Upon its establishment, WATP started collaborating with ASL to carry out various

wellness programs.

To

further its reach in the Health and Wellness Industry, on November 11, 2021, Agape ATP Corporation (Labuan) formed a joint-venture entity,

DSY Wellness International Sdn. Bhd. (“DSY Wellness”) with an independent third party which Agape ATP Corporation (Labuan)

owns 60% of the equity interest, to pursue the business of providing complementary health therapies.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of presentation

The

accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the

United States of America (“U.S. GAAP”) for information pursuant to the rules and regulations of the Securities Exchange Commission

(“SEC”).

The

consolidated financial statements include the financial statements of the Company, its subsidiaries and its VIE over which the Company

exercises control and, where applicable, entities for which the Company has a controlling financial interest or is the primary beneficiary.

All transactions and balances among the Company, its subsidiaries and its VIE have been eliminated upon consolidation.

Principles

of consolidation

Subsidiaries

are those entities in which the Company, directly or indirectly, controls more than one half of the voting power; or has the power to

govern the financial and operating policies, to appoint or remove the majority of the members of the board of directors, or to cast a

majority of votes at the meeting of directors.

A

VIE is an entity that has either a total equity investment that is insufficient to permit the entity to finance its activities without

additional subordinated financial support, or whose equity investors lack the characteristics of a controlling financial interest, such

as through voting rights, right to receive the expected residual returns of the entity or obligation to absorb the expected losses of

the entity. The variable interest holder, if any, that has a controlling financial interest in a VIE is deemed to be the primary beneficiary

and must consolidate the VIE.

Use

of estimates

The

preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the consolidated

financial statements and the reported amounts of revenues and expenses during the periods presented. Significant accounting estimates

reflected in the Company’s consolidated financial statements include allowance for doubtful accounts, allowance for inventories

obsolescence, useful lives of property and equipment, useful lives of intangible assets, impairment of long-lived assets, allowance for

deferred tax assets, operating right-of-use assets, operating lease liabilities and uncertain tax position and impairment of investment

in non-marketable securities. Actual results could differ from these estimates.

Cash

and cash equivalents

Cash

and cash equivalents are carried at cost and represent cash on hand, time deposits placed with banks or other financial institutions

and all highly liquid investments with an original maturity of three months or less.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Accounts

receivable

Accounts

receivable are recorded at the invoiced amount less an allowance for any uncollectible accounts and do not bear interest, which are due

on credit term. Accounts receivable also include money due from a third-party e-commerce platform acting as a collection agent for the

Company on the sales through their platform. Management reviews the adequacy of the allowance for doubtful accounts on an ongoing basis,

using historical collection trends and aging of receivables. Management also periodically evaluates individual customer’s financial

condition, credit history, and the current economic conditions to make adjustments in the allowance when it is considered necessary.

Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery

is considered remote. The Company’s management continues to evaluate the reasonableness of the valuation allowance policy and update

it if necessary. As of December 31, 2021 and 2020, no allowance of doubtful accounts was recorded.

Inventories

Inventories

consist of finished goods and are stated at the lower of cost or net realizable value using the first-in first-out method. Management

reviews inventory on hand for estimated obsolescence or unmarketable items, as compared to future demand requirements and the shelf life

of the various products. Based on the review, the Company records inventory write-downs, when necessary, when costs exceed expected net

realizable value. For the years ended December 31, 2021,

and 2020, the company recorded $36,241 and $0 write-downs for inventory.

Prepaid

taxes

Prepaid

taxes include prepaid income taxes that will either be refunded or utilized to offset future income tax.

Prepayments

and deposits

Prepayments

and deposits are mainly cash deposited or advanced to suppliers for future inventory purchases or service providers for future services.

This amount is refundable and bears no interest. For any prepayments and deposits determined by management that such advances will not

be in receipts of inventories, services, or refundable, the Company will recognize an allowance account to reserve such balances. Management

reviews its prepayments and deposits on a regular basis to determine if the allowance is adequate, and adjusts the allowance when necessary.

Delinquent account balances are written-off against allowance for doubtful accounts after management has determined that the likelihood

of collection is not probable. The Company’s management continues to evaluate the reasonableness of the valuation allowance policy

and update it if necessary. As of December 31, 2021 and 2020, there was $121,514 and $0 allowance for the doubtful accounts recorded.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Property

and equipment, net

Property

and equipment are stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated

useful lives of the assets with no residual value. The estimated useful lives are as follows:

SCHEDULE OF ESTIMATED USEFUL LIVES OF PROPERTY AND EQUIPMENT

| |

|

Useful

Life |

| |

|

|

| Computer

and office equipment |

|

5-7

years |

| Furniture

& fixtures |

|

6-7 years |

| Leasehold

improvements |

|

Lease

Term |

| Vehicle |

|

5

years |

The

cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is

included in the consolidated statements of income and comprehensive income. Expenditures for maintenance and repairs are charged to earnings

as incurred, while additions, renewals and betterments, which are expected to extend the useful life of assets, are capitalized. The

Company also re-evaluates the periods of depreciation to determine whether subsequent events and circumstances warrant revised estimates

of useful lives.

Intangible

assets, net

Intangible

assets, net, are stated at cost, less accumulated amortization. Amortization expense is recognized on the straight-line basis over the

estimated useful lives of the assets as follows:

SCHEDULE OF ESTIMATED USEFUL LIVES OF INTANGIBLE ASSETS, NET

| Classification |

|

Useful

Life |

| |

|

|

| Computer

software |

|

5

years |

Impairment

for long-lived assets

Long-lived

assets, including property and equipment, and intangible assets with finite lives are reviewed for impairment whenever events or changes

in circumstances (such as a significant adverse change to market conditions that will impact the future use of the assets) indicate that

the carrying value of an asset may not be recoverable. The Company assesses the recoverability of the assets based on the undiscounted

future cash flows the assets are expected to generate and recognize an impairment loss when estimated undiscounted future cash flows

expected to result from the use of the asset plus net proceeds expected from disposition of the asset, if any, are less than the carrying

value of the asset. If an impairment is identified, the Company would reduce the carrying amount of the asset to its estimated fair value

based on a discounted cash flows approach or, when available and appropriate, to comparable market values. As of December 31, 2021 and

2020, no impairment of long-lived assets was recognized.

Deferred

offering costs

Deferred

offering costs represents costs associated with the Company’s current offering which will be netted against the proceeds from the

Company’s current offering.

Investment

in marketable equity securities

The

Company follows the provisions of ASU 2016-01, Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement

of Financial Assets and Financial Liabilities. Investments in marketable equity securities (non-current) are reported at fair value

with changes in fair value recognized in the Company’s unaudited condensed consolidated statements of operations and comprehensive

loss in the caption of “unrealized holding gain loss on marketable securities” in each reporting period.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Investment

in non-marketable equity securities

The

Company follows the provisions of ASU 2016-01, Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement

of Financial Assets and Financial Liabilities. Due to the Company’s non-marketable equity securities (non-current) does not

qualify for the practical expedient to estimate fair value in accordance with ASC 820-10-35-59, the Company has selected to record its

investments in non-marketable equity securities (non-current) at cost minus impairment, if any, plus or minus changes resulting from

observable price changes in orderly transactions for the identical or a similar investment of the same issue.

At

each reporting period, the Company will make a qualitative assessment considering impairment indicators to evaluate whether the investment

is impaired. The qualitative assessment indicators include, but are not limited to: (1) A significant deterioration in the earnings performance,

credit rating, asset quality, or business prospects of the investee; (ii) A significant adverse change in the regulatory, economic, or

technological environment of the investee; (iii) A significant adverse change in the general market condition of either the geographical

area or the industry in which the investee operates; (iv) A bona fide offer to purchase, an offer by the investee to sell, or a completed

auction process for the same or similar investment for an amount less than the carrying amount of that investment; and (v) Factors that

raise significant concerns about the investee’s ability to continue as a going concern, such as negative cash flows from operations,

working capital deficiencies, or noncompliance with statutory capital requirements or debt covenants. If the qualitative assessment indicators

indicated that the non-marketable equity securities (non-current) is deemed to be impaired, the Company would recognize the impairment

loss equal to the difference between the fair value of the investment and its carrying amount.

Customer

deposits

Customer

deposits represent amounts advanced by customers on product orders and discounted value of unapplied coupons. Customer deposits are reduced

when the related sale is recognized in accordance with the Company’s revenue recognition policy.

Revenue

recognition

The

Company adopted Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (ASC Topic 606). The core

principle underlying the revenue recognition of this ASU allows the Company to recognize - revenue that represents the transfer of goods

and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in such exchange.

This will require the Company to identify contractual performance obligations and determine whether revenue should be recognized at a

point in time or over time, based on when control of goods and services transfers to a customer. The Company’s revenue streams

are recognized at a point in time for the Company’s sale of health and wellness products.

The

ASU requires the use of a new five-step model to recognize revenue from customer contracts. The five-step model requires that the Company

(i) identify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction

price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate

the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies

the performance obligation.

The

Company accounts for a contract with a customer when the contract is committed in writing, the rights of the parties, including payment

terms, are identified, the contract has commercial substance and consideration is probable of substantially collection.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Sales

of Health and Wellness products

-

Performance obligations satisfied at a point in time

The

Company derives its revenues from sales contracts with its customers with revenues being recognized when control of the health and wellness

products are transferred to its customer at the Company’s office or shipment of the goods. The revenue is recorded net of estimated

discounts and return allowances. Products are given 60 days for returns or exchanges from the date of purchase. Historically, there were

insignificant sales returns.

The

Company also sells coupons to its customers for cash at a discounted price of the value of the coupons. Customers can apply the value

of the coupons for a reduction in the transaction price paid by the customer are recorded as a reduction of sales. The cash proceeds

resulted from the sale of coupons are recognized as customer deposits until the coupons to be applied as a reduction of the health and

wellness products transaction price upon such sales transactions occurred. The Company’s coupons have a validity period of six

months. If the Company’s customers did not utilize the coupons after six months, the Company would recognize the forfeiture of

the originated sales value of the coupons as net revenues. For the years ended December 31, 2021 and 2020, the Company recognized $15,209

and $170,431 as forfeited coupon income.

As

of December 31, 2021, the Company had contracts for the sales of health and wellness products amounting to $183,816 which it is expected

to fulfill within 12 months from December 31, 2021.

Sales

of Health and Wellness services

-

Performance obligations satisfied at a point in time

The

Company carries out its Wellness program, where the Company’s products are bundled with health screening test and a health camp

program. The health screening test and the health camp programs are considered as separate performance obligations. The promises to deliver

the health screening test report and the attendance at the health camp are separately identifiable, which are evidenced by the fact that

the Company provides separate services of delivering the health screening test report and allowing admission of the customers to attend

the health camp. The Company derives its revenues from sales contracts with its customers with revenues being recognized when the test

reports are completed and delivered to its customers during the consultation section in person.

The

Company also separately derives its revenues from sales contracts with its customers with revenues being recognized when the health camp

program was completed in the final day of the health camp.

For the years ended December 31, 2021 and 2020, revenues from health and wellness services are $7,543 and $0, respectively.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Disaggregated

information of revenues by products and services are as follows:

SCHEDULE OF DIS-AGGREGATED INFORMATION OF REVENUES

| | |

2021 | | |

2020 | |

| | |

For

the years ended December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| Survivor Select | |

$ | 83,904 | | |

$ | 149,897 | |

| Energized Mineral Concentrate | |

| 52,047 | | |

| 81,481 | |

| Ionized Cal-Mag | |

| 39,527 | | |

| 908,964 | |

| Omega Blend | |

| 222,718 | | |

| 495,567 | |

| BetaMaxx | |

| 208,043 | | |

| 156,550 | |

| Vege Fruit Fiber | |

| 65,757 | | |

| 1,755 | |

| Iron | |

| 28,114 | | |

| 133,389 | |

| Young Formula | |

| 52,425 | | |

| 653,631 | |

| Organic Youth Care Cleansing Bar | |

| 5,137 | | |

| 43,127 | |

| Mitogize | |

| 183,800 | | |

| 162,801 | |

| No. 1 MED | |

| 15,331 | | |

| 46,713 | |

| Energetique | |

| 25,574 | | |

| 253,396 | |

| Trim+ | |

| 27,042 | | |

| 365,350 | |

| Total revenues – products | |

| 1,009,419 | | |

| 3,452,621 | |

| Health and Wellness

services | |

| 7,543 | | |

| - | |

| Total revenues | |

$ | 1,016,962 | | |

$ | 3,452,621 | |

Cost

of revenue

Cost

of revenue includes freight-in, the purchase cost of manufactured goods for sale to customers, and inventory write-downs. Cost of revenue

amounted to $297,333 (including inventory write-downs of $36,241) and $775,855 for the years ended December 31, 2021 and 2020, respectively.

Shipping

and handling

Shipping

and handling charges amounted to $11,054 and $9,315 for the years ended December 31, 2021 and 2020, respectively. Shipping and handling

charges are expensed as incurred and included in selling expenses.

Advertising

costs

Advertising

costs amounted to $20,218 and $14,339 for the years ended December 31, 2021 and 2020, respectively. Advertising costs are expensed as

incurred and included in selling expenses.

Commission

expenses

Commission

expenses are the Company’s most significant expenses. As with all companies in the network marketing industry, the Company’s

sales channel is external to the Company. The Company’s “external sales force” is stratified into two levels based

on priority recruitment. First, there are sales distributors. Second, all members recruited by a sales distributor, directly or indirectly,

are referred to as “sales network members”. The Company pays commission to every sales distributor based on purchases made

by its sales network members which includes the independent

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

direct

sales members. Top performing distributors with their own physical stores may also become stockists of the Company, whereby they enjoy

benefits such as maintaining a certain amount of the Company’s inventory on their store premises. The stockists shall account to

the Company for all products sales from their store premises as monitored through the Company’s centralized stock tracking system.

The Company pays a separate commission to stockists based on revenue generated from the stockists’ physical stores. Commission

expenses amounted to $316,267 and $830,659 for the years ended December 31, 2021 and 2020, respectively.

Defined

contribution plan

The

full-time employees of the Company are entitled to the government mandated defined contribution plan. The Company is required to accrue

and pay for these benefits based on certain percentages of the employees’ respective salaries, subject to certain ceilings, in

accordance with the relevant government regulations, and make cash contributions to the government mandated defined contribution plan.

Total expenses for the plans were $99,488 and $75,802 for the years ended December 31, 2021 and 2020, respectively.

The

related contribution plans include:

| |

- |

Social

Security Organization (“SOSCO”) – 1.75% based on employee’s monthly salary capped of RM 4,000; |

| |

- |

Employees

Provident Fund (“EPF”) – 12% based on employee’s monthly salary; |

| |

- |

Employment

Insurance System (“EIS”) – 0.2% based on employee’s monthly salary capped of RM 4,000; |

| |

- |

Human

Resource Development Fund (“HRDF”) – 1% based on employee’s monthly salary |

Income

taxes

The

Company accounts for income taxes in accordance with U.S. GAAP for income taxes. The charge for taxation is based on the results for

the fiscal year as adjusted for items, which are non-assessable or disallowed. It is calculated using tax rates that have been enacted

or substantively enacted by the balance sheet date.

Deferred

taxes is accounted for using the asset and liability method in respect of temporary differences arising from differences between the

carrying amount of assets and liabilities in the consolidated financial statements and the corresponding tax basis used in the computation

of assessable tax profit. In principle, deferred tax liabilities are recognized for all taxable temporary differences. Deferred tax assets

are recognized to the extent that it is probable that taxable profit will be available against which deductible temporary differences

can be utilized. Deferred tax is calculated using tax rates that are expected to apply to the period when the asset is realized or the

liability is settled. Deferred tax is charged or credited in the income statement, except when it is related to items credited or charged

directly to equity, in which case the deferred tax is also dealt with in equity. Deferred tax assets are reduced by a valuation allowance

when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

Current income taxes are provided for in accordance with the laws of the relevant taxing authorities.

An

uncertain tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained

in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that

is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test,

no tax benefit is recorded. $395 and $0 penalties and interest incurred related to underpayment of income tax for the years ended December

31, 2021 and 2020, respectively.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

The

Company conducts much of its business activities in Hong Kong and Malaysia and is subject to tax in each of their jurisdictions. As a

result of its business activities, the Company will file separate tax returns that are subject to examination by the foreign tax authorities.

Comprehensive

income (loss)

Comprehensive

income (loss) consists of two components, net income (loss) and other comprehensive income (loss). Other comprehensive income (loss)

refers to revenue, expenses, gains and losses that under GAAP are recorded as an element of stockholders’ equity but are excluded

from net income. Other comprehensive income (loss) consists of a foreign currency translation adjustment resulting from the Company not

using the U.S. dollar as its functional currencies.

Non-controlling

interest

Non-controlling

interest consists of 40% of the equity interests of DSY Wellness held by an individual and approximately 0.01% (2 ordinary shares out

of 9,590,598 shares) of the equity interests of ASL held by two individuals. The non-controlling interests are presented in the consolidated

balance sheets, separately from equity attributable to the shareholders of the Company. Non-controlling interests in the results of the

Company are presented on the face of the consolidated statements of operations as an allocation of the total income or loss for the periods

between non-controlling interest holders and the shareholders of the Company.

Earnings

(loss) per share

The

Company computes earnings (loss) per share (“EPS”) in accordance with ASC 260, “Earnings per Share”. ASC 260

requires companies to present basic and diluted EPS. Basic EPS is measured as net income divided by the weighted average ordinary share

outstanding for the period. Diluted EPS presents the dilutive effect on a per share basis of the potential ordinary shares (e.g., convertible

securities, options and warrants) as if they had been converted at the beginning of the periods presented, or issuance date, if later.

Potential ordinary shares that have an anti-dilutive effect (i.e., those that increase income per share or decrease loss per share) are

excluded from the calculation of diluted EPS. For the

years ended December 31, 2021 and 2020, there were no dilutive shares.

Foreign

currencies translation and transaction

Transactions

denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing

at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated

into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded

in the consolidated statements of operations and comprehensive income (loss).

The

reporting currency of the Company is United States Dollars (“US$”) and the accompanying financial statements have been expressed

in US$. The Company’s subsidiary in Labuan maintains its books and record in United States Dollars (“US$”) albeit its

functional currency being the primary currency of the economic environment in which the entity operates, which is the Malaysian Ringgit

(“MYR” or “RM”). The Company’s subsidiary in Hong Kong maintains its books and record in Hong Kong Dollars

(“HK$”), similar to its functional currency. The Company’s subsidiary and VIE in Malaysia conducts its businesses and

maintains its books and record in the local currency, Malaysian Ringgit (“MYR” or “RM”), as its functional currency.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

In

general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not US$ are translated into

US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance

sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation

of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income within the

statements of stockholders’ equity. Cash flows are also translated at average translation rates for the periods, therefore, amounts

reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance

sheets.

Translation

of foreign currencies into US$1 have been made at the following exchange rates for the respective periods:

SCHEDULE OF FOREIGN CURRENCIES TRANSLATION EXCHANGE RATES

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| Period-end MYR : US$1 exchange

rate | |

| 4.18 | | |

| 4.02 | |

| Period-end HKD : US$1 exchange rate | |

| 7.80 | | |

| 7.75 | |

| | |

For

the years ended December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| Period-average MYR : US$1 exchange

rate | |

| 4.14 | | |

| 4.20 | |

| Period-average HKD : US$1 exchange rate | |

| 7.77 | | |

| 7.76 | |

Related

parties

Parties,

which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control

the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also

considered to be related if they are subject to common control or common significant influence.

Fair

value of financial instruments

The

accounting standard regarding fair value of financial instruments and related fair value measurements defines financial instruments and

requires disclosure of the fair value of financial instruments held by the Company.

The

accounting standards define fair value, establish a three-level valuation hierarchy for disclosures of fair value measurement and enhance

disclosure requirements for fair value measures. The three levels are defined as follow:

| |

● |

Level

1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| |

● |

Level

2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that

are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments. |

| |

● |

Level

3 inputs to the valuation methodology are unobservable and significant to the fair value. |

Financial

instruments included in current assets and current liabilities are reported in the consolidated balance sheets at face value or cost,

which approximate fair value because of the short period of time between the origination of such instruments and their expected realization

and their current market rates of interest.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

Leases

The

Company adopts ASU 2016-02, “Leases” (Topic 842), and elected the practical expedients that does not require the Company

to reassess: (1) whether any expired or existing contracts are, or contain, leases, (2) lease classification for any expired or existing

leases and (3) initial direct costs for any expired or existing leases. For lease terms of twelve months or fewer, a lessee is permitted

to make an accounting policy election not to recognize lease assets and liabilities. The Company also adopts the practical expedient

that allows lessees to treat the lease and non-lease components of a lease as a single lease component. Some of the Company’s leases

include one or more options to renew, which is typically at the Company’s sole discretion. The Company regularly evaluates the

renewal options, and, when it is reasonably certain of exercise, it will include the renewal period in its lease term. New lease modifications

result in re-measurement of the right of use (“ROU”) assets and lease liabilities. Operating ROU assets and lease liabilities

are recognized at the commencement date, based on the present value of lease payments over the lease term. Since the implicit rate for

the Company’s leases is not readily determinable, the Company use its incremental borrowing rate based on the information available

at the commencement date in determining the present value of lease payments. The incremental borrowing rate is the rate of interest that

the Company would have to pay to borrow, on a collateralized basis, an amount equal to the lease payments, in a similar economic environment

and over a similar term.

Lease

terms used to calculate the present value of lease payments generally do not include any options to extend, renew, or terminate the lease,

as the Company does not have reasonable certainty at lease inception that these options will be exercised. The Company generally considers

the economic life of its operating lease ROU assets to be comparable to the useful life of similar owned assets. The Company has elected

the short-term lease exception, therefore operating lease ROU assets and liabilities do not include leases with a lease term of twelve

months or less. Its leases generally do not provide a residual guarantee. The operating lease ROU asset also excludes lease incentives.

Lease expense is recognized on a straight-line basis over the lease term.

The

Company reviews the impairment of its ROU assets consistent with the approach applied for its other long-lived assets. The Company reviews

the recoverability of its long-lived assets when events or changes in circumstances occur that indicate that the carrying value of the

asset may not be recoverable. The assessment of possible impairment is based on its ability to recover the carrying value of the asset

from the expected undiscounted future pre-tax cash flows of the related operations. The Company has elected to include the carrying amount

of operating lease liabilities in any tested asset group and includes the associated operating lease payments in the undiscounted future

pre-tax cash flows.

Recent

accounting pronouncements

The

Company has reviewed all recently issued, but not yet effective, accounting pronouncements and do not believe the future adoption of

such any pronouncements may be expected to cause a material impact on its financial condition or the results of its operations, as follow:

In

May 2019, the FASB issued ASU 2019-05, which is an update to ASU Update No. 2016-13, Financial Instruments—Credit Losses (Topic

326): Measurement of Credit Losses on Financial Instruments, which introduced the expected credit losses methodology for the measurement

of credit losses on financial assets measured at amortized cost basis, replacing the previous incurred loss methodology. The amendments

in Update 2016-13 added Topic 326, Financial Instruments—Credit Losses, and made several consequential amendments to the Codification.

Update 2016-13 also modified the accounting for available-for-sale debt securities, which must be individually assessed for credit losses

when fair value is less than the amortized cost basis, in accordance with Subtopic 326-30, Financial Instruments— Credit Losses—Available-for-Sale

Debt Securities. The amendments in this Update address those stakeholders’ concerns by providing an option to irrevocably elect

the fair value option for certain financial assets previously measured at amortized cost basis. For those entities, the targeted transition

relief will increase comparability of financial statement information by providing an option to align measurement methodologies for similar

financial assets. Furthermore, the targeted transition relief also may reduce the costs for some entities to comply with the amendments

in Update 2016-13 while still providing financial statement users with decision-useful information.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT’D)

In

November 2019, the FASB issued ASU No. 2019-10, which to update the effective date of ASU No. 2016-13 for private companies, not-for-profit

organizations and certain smaller reporting companies applying for credit losses, leases, and hedging standard. The new effective date

for these preparers is for fiscal years beginning after December 15, 2022. ASU 2019-05 is effective for the Company for annual and interim

reporting periods beginning January 1, 2023 as the Company is qualified as a smaller reporting company. The Company is currently evaluating

the impact ASU 2019-05 may have on its consolidated financial statements.

In

January 2020, the FASB issued ASU 2020-01 to clarify the interaction of the accounting for equity securities under ASC 321 and investments

accounted for under the equity method of accounting in ASC 323 and the accounting for certain forward contracts and purchased options

accounted for under ASC 815. With respect to the interactions between ASC 321 and ASC 323, the amendments clarify that an entity should

consider observable transactions that require it to either apply or discontinue the equity method of accounting when applying the measurement

alternative in ASC 321, immediately before applying or upon discontinuing the equity method of accounting. With respect to forward contracts

or purchased options to purchase securities, the amendments clarify that when applying the guidance in ASC 815-10-15-141(a), an entity

should not consider whether upon the settlement of the forward contract or exercise of the purchased option, individually or with existing

investments, the underlying securities would be accounted for under the equity method in ASC 323 or the fair value option in accordance

with ASC 825. The ASU is effective for interim and annual reporting periods beginning after December 15, 2020. Early adoption is permitted,

including adoption in any interim period. The adoption of this standard on January 1, 2021 did not have a material impact on its consolidated

financial statements.

In

October 2020, the FASB issued ASU 2020-08, “Codification Improvements to Subtopic 310-20, Receivables—Nonrefundable Fees

and Other Costs”. The amendments in this Update represent changes to clarify the Codification. The amendments make the Codification

easier to understand and easier to apply by eliminating inconsistencies and providing clarifications. ASU 2020-08 is effective for the

Company for annual and interim reporting periods beginning January 1, 2021. Early application is not permitted. All entities should apply

the amendments in this Update on a prospective basis as of the beginning of the period of adoption for existing or newly purchased callable

debt securities. These amendments do not change the effective dates for Update 2017-08. The adoption of this standard on January 1, 2021

did not have a material impact on its consolidated financial statements.

In

October 2020, the FASB issued ASU 2020-10, “Codification Improvements”. The amendments in this Update represent changes to

clarify the Codification or correct unintended application of guidance that are not expected to have a significant effect on current

accounting practice or create a significant administrative cost to most entities. The amendments in this Update affect a wide variety

of Topics in the Codification and apply to all reporting entities within the scope of the affected accounting guidance. ASU 2020-10 is

effective for annual periods beginning after December 15, 2020 for public business entities. Early application is permitted. The amendments

in this Update should be applied retrospectively. The adoption of this standard on January 1, 2021 did not have a material impact on

its consolidated financial statements.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

3.

VARIABLE INTEREST ENTITY (“VIE”)

SEA

is a trading company incorporated on March 4, 2004, under the laws of Malaysia. SEA provided majority of ASL’s purchases. Its equity

at risk was insufficient to finance its activities and 100% of its business is transacted with ASL. Therefore, it was considered to be

a VIE and ASL is the primary beneficiary since it has both of the following characteristics:

| |

a. |

The

power to direct the activities of the VIE that most significantly impact the VIE’s economic performance; and |

| |

b. |

The

obligation to absorb losses of the VIE that could potentially be significant to the VIE or the right to receive benefits from the

VIE that could potentially be significant to the VIE. |

Accordingly,

the accounts of SEA is consolidated in the accompanying financial statements.

The

carrying amount of the VIE’s assets and liabilities were as follows:

SCHEDULE

OF VARIABLE INTEREST ENTITY

| | |

| | |

| |

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| Current assets | |

$ | 18,850 | | |

$ | 48,717 | |

| Current liabilities | |

| (51,272 | ) | |

| (53,573 | ) |

| Net deficit | |

$ | (32,422 | ) | |

$ | (4,856 | ) |

| | |

| | |

| |

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 17,493 | | |

$ | 37,387 | |

| Prepaid taxes | |

| 1,357 | | |

| 11,330 | |

| Total current assets | |

$ | 18,850 | | |

$ | 48,717 | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable – intercompany | |

$ | 49,724 | | |

$ | 51,669 | |

| Other payables and accrued

liabilities | |

| 1,548 | | |

| 1,904 | |

| Total current liabilities | |

$ | 51,272 | | |

$ | 53,573 | |

| | |

| | | |

| | |

| Net deficit | |

$ | (32,422 | ) | |

$ | (4,856 | ) |

The

summarized operating results of the VIE’s are as follows:

| | |

| | |

| |

| | |

For

the years ended December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| Operating

revenues | |

$ | - | | |

$ | 346,907 | |

| Gross profit | |

$ | - | | |

$ | 4,442 | |

| Loss from operations | |

$ | (21,966 | ) | |

$ | (10,752 | ) |

| Net loss | |

$ | (27,966 | ) | |

$ | (24,014 | ) |

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

4.

BUSINESS COMBINATION

On

May 8, 2020, the Company entered into a Share Exchange Agreement (“SPA”) with Mr. How Kok Choong, CEO and director of the

Company to acquire 9,590,596 ordinary shares, no par value, equivalent to approximately 99.99% of the equity interest in ASL, an entity

incorporated in Malaysia. Pursuant to the SPA, as amended on July 1, 2020, Mr. How will receive an aggregate consideration of $1,804,046,

which was determined based on the net asset carrying value of ASL as at March 31, 2020. The aggregate consideration shall be satisfied

by (i) the offset of the Consideration whereby the Company has a loan receivable of $656,495 as of March 31, 2020 due from Mr. How; and

(ii) allotment and issuance of common stock of the Company. The Company shall allot and issue 176,547 shares of the Company’s common

stock, par value $0.0001, representing approximately 0.0469% of the total issued and outstanding shares in the Company after the issuance

of the Shares, which is valued at $1,147,551 based on the closing price of $6.50 of the Company as quoted on the OTC Market on March

31, 2020. As of December 31, 2020, the Company has issued all 176,547 shares of the Company’s common stock.

The

Company’s acquisition of ASL was accounted for as a business combination in accordance with ASC 805. The Company has allocated

the purchase price of ASL based upon the carrying value of the identifiable assets acquired and liabilities assumed on April 1, 2020

as ASL was under the common control of Mr. How.

The

following table summarizes the carry value of the identifiable assets acquired and liabilities assumed on the acquisition date, which

represents the net purchase price allocation on the date of the acquisition of ASL.

SUMMARY

OF ASSETS ACQUIRED AND LIABILITIES ASSUMED

| | |

Carry

Value | |

| ASSETS | |

| | |

| Current assets | |

| | |

| Cash | |

$ | 1,206,493 | |

| Other receivables | |

| 33,210 | |

| Other receivables - related

parties | |

| 219,121 | |

| Inventories | |

| 616,880 | |

| Prepaid taxes | |

| 1,206,821 | |

| Prepayments

and other assets | |

| 318,267 | |

| Total

current assets | |

| 3,600,792 | |

| | |

| | |

| Other assets | |

| | |

| Property and equipment,

net | |

| 325,648 | |

| Intangible assets, net | |

| 6,686 | |

| Deferred

taxes asset, net | |

| 172,250 | |

| Total

other assets | |

| 504,584 | |

| | |

| | |

| Total

assets | |

$ | 4,105,376 | |

| | |

| | |

| LIABILITIES AND SHAREHOLDERS’

EQUITY | |

| | |

| Current liabilities | |

| | |

| Accounts payable - related

party | |

$ | 491,628 | |

| Customer deposits | |

| 1,600,606 | |

| Other

payables and accrued liabilities | |

| 209,096 | |

| Total

current liabilities | |

| 2,301,330 | |

| | |

| | |

| Total

liabilities | |

$ | 2,301,330 | |

| | |

| | |

| Total

net assets acquired | |

$ | 1,804,046 | |

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

4.

BUSINESS COMBINATION (CONT’D)

The

following unaudited pro forma combined results of operations presents the Company’s financial results as if the acquisition of

ASL had been completed on January 1, 2020. The unaudited pro forma results do not reflect operating efficiencies or potential cost savings

which may result from the consolidation of operations. Accordingly, the unaudited pro forma financial information is not necessarily

indicative of the results of operations that the Company would have recognized had we completed the transaction on January 1, 2020. Future

results may vary significantly from the results in this pro forma information because of future events and transactions, as well as other

factors.

SCHEDULE

OF PRO FORMA BUSINESS COMBINATION

| | |

For

the year ended December 31, 2020 | |

| | |

| |

| Revenue | |

$ | 4,693,873 | |

| Cost of revenue | |

| (875,708 | ) |

| Gross profit | |

| 3,818,165 | |

| Total operating expenses | |

| (3,839,184 | ) |

| Loss from operations | |

| (21,019 | ) |

| Other income (expense),

net | |

| 267,633 | |

| Income before income taxes | |

| 246,614 | |

| Provision for income

taxes | |

| (212,414 | ) |

| Net income | |

$ | 34,200 | |

| Net income per common

share - basic and diluted | |

$ | 0.00 | |

| Weighted average number

of common shares outstanding - basic and diluted | |

| 376,452,047 | |

5.

CASH AND CASH EQUIVALENTS

As

of December 31, 2021 and 2020 the Company had $2,597,848 and $3,517,600, respectively, of cash and cash equivalents, which consists of

$554,864 and $1,112,147, respectively, of cash in banks and $1,975,347

and $2,391,182, respectively, of time deposits placed

with banks or other financial institutions and are all highly liquid investments with an original maturity of three months or less. The

effective interest rate for the time deposits ranges between 1.10% to 1.25% per annum.

6.

ACCOUNTS RECEIVABLE

SCHEDULE

OF ACCOUNTS RECEIVABLES - RELATED PARTY

| | |

| | | |

| | |

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| Accounts receivable | |

$ | - | | |

$ | 172,757 | |

| Allowance for doubtful

accounts | |

| - | | |

| - | |

| Total | |

$ | - | | |

$ | 172,757 | |

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

7.

INVENTORIES

Inventories

consist of the following:

SCHEDULE

OF INVENTORIES

| | |

| | |

| |

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| Finished

goods | |

$ | 375,535 | | |

$ | 589,814 | |

For

the years ended December 31, 2021 and 2020, the Company recognized $36,241 and $0 inventory write-down, respectively.

8.

PREPAYMENTS AND DEPOSITS

SCHEDULE

OF PREPAID EXPENSES AND DEPOSITS

| | |

| | | |

| | |

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| Receivables from sales distributors | |

$ | 115,379 | | |

$ | 35,302 | |

| Deposits to suppliers | |

| 301,233 | | |

| 261,068 | |

| Subtotal | |

| 416,612 | | |

| 296,370 | |

| Less: Provision for

doubtful accounts | |

| (121,095 | ) | |

| - | |

| Total | |

$ | 295,517 | | |

$ | 296,370 | |

Movements

of allowance for doubtful accounts are as follows:

SCHEDULE OF CHANGES IN ALLOWANCE FOR DOUBTFUL ACCOUNTS

| | |

| | |

| |

| | |

For

the years ended December 31, | |

| | |

2021 | | |

2020 | |

| Beginning balance | |

$ | - | | |

$ | - | |

| Addition | |

| 121,514 | | |

| - | |

| Write off | |

| - | | |

| - | |

| Exchange rate effect | |

| (419 | ) | |

| - | |

| Ending balance | |

$ | 121,095 | | |

$ | - | |

9.

PROPERTY AND EQUIPMENT, NET

Property

and equipment, net consist of the following:

SCHEDULE OF PROPERTY AND EQUIPMENT, NET

| | |

2021 | | |

2020 | |

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| Computer and office equipment | |

$ | 82,298 | | |

$ | 81,437 | |

| Furniture & fixtures | |

| 122,185 | | |

| 126,966 | |

| Leasehold improvements | |

| 202,570 | | |

| 210,496 | |

| Vehicle | |

| 98,702 | | |

| 102,564 | |

| Subtotal | |

| 505,755 | | |

| 521,463 | |

| Less: accumulated depreciation | |

| (289,956 | ) | |

| (223,154 | ) |

| Total | |

$ | 215,799 | | |

$ | 298,309 | |

Depreciation

expense for the years ended December 31, 2021 and 2020 amounted to $75,797 and $55,407, respectively.

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

10.

INTANGIBLE ASSETS, NET

Intangible

assets, net, consist of the following:

SCHEDULE OF INTANGIBLE ASSETS, NET

| | |

2021 | | |

2020 | |

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| Computer software | |

$ | 34,453 | | |

$ | 35,801 | |

| Less: accumulated amortization | |

| (30,793 | ) | |

| (29,975 | ) |

| Total | |

$ | 3,660 | | |

$ | 5,826 | |

Amortization

expense for the years ended December 31, 2021 and 2020 amounted to $1,961 and $1,505, respectively.

11.

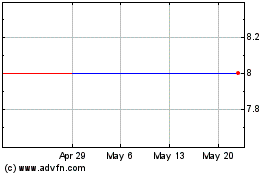

INVESTMENT IN MARKETABLE SECURITIES

| |

(i) |

On

May 17, 2018, the Company purchased 83,333 shares of common stock in Greenpro Capital Corp. for $500,000 at a purchase price of $6

per share. |

| |

|

|

| |

(ii) |

On

July 30, 2018, the Company disposed 20 shares of common stock in Greenpro Capital Corp. for $125 at a purchase price of $6.2613 per

share. |

| |

|

|

| |

(iii) |

On

October 16, 2018, the Company purchased 33,333 shares of common stock in Greenpro Capital Corp. for $1,000 at a purchase price of

$0.03 per share. |

| |

|

|

| |

(iv) |

On

November 3, 2020, the Company received dividend of 6,667 shares of common stock in DSwiss, Inc. for $76,671 at fair value of $11.50

per share from Greenpro Capital Corporation as result of its Spin-off of DSwiss, Inc.’s shares |

| |

|

|

| |

(v) |

On

December 9, 2020, the Company received dividend of 16,663 shares of common stock in DSwiss, Inc. for $83,315 at fair value of $5

per share from Greenpro Capital Corporation as result of its Spin-off of DSwiss, Inc.’s shares. |

| |

|

|

| |

(vi) |

On

September 27, 2021, the Company received dividend of 11,665 shares of common stock in SEATech Ventures Corp. for $18,874 at fair

value of $1.62 per share from Greenpro Capital Corp as a dividend income since Greenpro Capital Corp previously owned these shares. |

SCHEDULE OF INVESTMENT IN MARKETABLE SECURITIES

| | |

2021 | | |

2020 | |

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| Cost of investment | |

$ | 577,035 | | |

$ | 66,484 | |

| Dividend income from Greenpro Capital Corp. | |

| 18,939 | | |

| 160,062 | |

| Unrealized holding (loss) gain | |

| (505,231 | ) | |

| 350,137 | |

| Exchange rate effect | |

| (1,742 | ) | |

| 352 | |

| Investment in marketable

securities | |

$ | 89,001 | | |

$ | 577,035 | |

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

12.

INVESTMENT IN NON-MARKETABLE SECURITIES

The

Company invested in Unreserved Sdn Bhd with the investment amount of $863,592 (RM 3,500,000), which approximated 20% of the equity interest

of Unreserved Sdn Bhd and is accounted for under the equity method of accounting. On March 10, 2019, Unreserved Sdn Bhd issued additional

common stock for working capital. As the Company did not subscribe for the additional common stock, the Company’s equity interest

in investee company was diluted from approximately 20.0% to approximately 17.86%. Effective from March 10, 2019, the Company discontinued

equity accounting on the investee company. The Company also ceased control over the operations of the investee company on the same date.

Accordingly, the investment in investee company was reclassified to investment in non-marketable securities.

Unreserved

Sdn Bhd was incorporated in Malaysia with 2,500,000 ordinary shares authorized, issued and outstanding. Mr. Lim Hun Soon @ David Lim

and Ms. Aniza Helina Akmi Karim are the directors of Unreserved Sdn Bhd. Mr. How Kok Choong was a director of the company from April

30, 2018 to March 27, 2019.

On

March 3, 2020, the Company agreed to sell the 17.86% ownership interest in Unreserved Sdn Bhd at the December 31, 2019 carrying value

of $730,637 to Mr. How Kok Choong, the CEO and director of the Company. The Company received proceeds of $70,173, and had an amount due

from director of $660,464 at March 31, 2020. In May 2020, the entire outstanding balance was settled as part of the consideration in

a transaction which the Company had acquired the CEO’s ownership interest of Agape Superior Living Sdn. Bhd.

On

April 3, 2019, the Company purchased a 5% of stock or 15,000,000 shares of common stock in Phoenix Plus Corp. for $1,500 at purchase

price of $0.0001 per share.

SCHEDULE OF INVESTMENT IN NON MARKETABLE SECURITIES

| | |

As

of December 31, | |

| Unreserved Sdn Bhd | |

2021 | | |

2020 | |

| Investment in non-marketable securities | |

$ | - | | |

$ | 730,637 | |

| Less:

Sale of investment in non-marketable securities | |

| - | | |

| (730,637 | ) |

| Investment in non-marketable

securities | |

| - | | |

| - | |

| Phoenix Plus

Corporation | |

| | | |

| | |

| Cost of investment | |

| 1,500 | | |

| 1,500 | |

| | |

| | | |

| | |

| Total investment in

non-marketable securities | |

$ | 1,500 | | |

$ | 1,500 | |

13.

OTHER PAYABLES AND ACCRUED LIABILITIES

SCHEDULE OF OTHER PAYABLES AND ACCRUED LIABILITIES

| | |

2021 | | |

2020 | |

| | |

As

of December 31, | |

| | |

2021 | | |

2020 | |

| Professional fees | |

$ | 436,541 | | |

$ | 297,636 | |

| Promotion expenses | |

| 36,024 | | |

| 37,433 | |

| Payroll | |

| 22,669 | | |

| 23,976 | |

| Commission | |

| 219,721 | | |

| 224,711 | |

| Others | |

| 143,400 | | |

| 63,921 | |

| | |

| | | |

| | |

| Total | |

$ | 858,355 | | |

$ | 647,677 | |

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

14.

RELATED PARTY BALANCES AND TRANSACTIONS

Related

party balances

Amount

due from related parties

SCHEDULE OF RELATED PARTIES

| Name

of Related | |

| |

| |

As of December

31, | |

| Party | |

Relationship | |

Nature | |

2021 | | |

2020 | |

| | |

| |

| |

| | |

| |

| Agape ATP

(Asia) Limited (“AATP Asia”) | |

Mr. How

Kok Choong, the CEO and director of the Company is also the sole shareholder and director of AATP Asia | |

Expenses

paid for AATP Asia | |

$ | 2,214 | | |

$ | 2,227 | |

Hostastay Sdn. Bhd.

“Hostastay” | |

Mr. How Kok Choong,

the CEO and director of the Company is also the director of Hostastay | |

Sublease rent due from

Hostastay | |

| 4,790 | | |

| 996 | |

TH3 Technology Sdn Bhd

“TH3 Technology” | |

Mr.

How Kok Choong, the CEO and director of the Company is also the director of TH3 Technology | |

Expenses

paid for TH3 Technology | |

| - | | |

| 12 | |

| Total | |

| |

| |

$ | 7,004 | | |

$ | 3,235 | |

Amount

due to a Related Party

| Name of Related | |

| |

| |

As of December

31, | |

| Party | |

Relationship | |

Nature | |

2021 | | |

2020 | |

| | |

| |

| |

| | |

| |

| Agape

Superior Living Pty Ltd “ASLPL” | |

Mr.

How Kok Choong, the CEO and director of the Company is a 51% shareholder and a director of ASLPL | |

ATP

Label Printing Fees | |

$ | - | | |

$ | 455 | |

| Total | |

| |

| |

$ | - | | |

$ | 455 | |

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

14.

RELATED PARTY BALANCES AND TRANSACTIONS (CONT’D)

Related

party transactions

Revenue

| Name of Related | |

| |

| |

For the years

ended December 31, | |

| Party | |

Relationship | |

Nature | |

2021 | | |

2020 | |

| | |

| |

| |

| | |

| |

| Agape Superior

Living Pty Ltd (“ASLPL”) | |

Mr. How

Kok Choong, the CEO and director of the Company is a 51% shareholder and a director of ASLPL | |

Sales of

products | |

$ | - | | |

$ | 18,060 | |

| Vettons

Sdn Bhd* | |

Mr.

How Kok Choong, the CEO and director of the Company is appointed as the non-executive Chairman of Vettons Sdn Bhd on February 1,

2021 | |

Sales

of products made through its platform | |

| 6,625 | | |

| - | |

| Total | |

| |

| |

$ | 6,625 | | |

$ | 18,060 | |

| * |

During the year ended December 31, 2021, the Company had sales

of $6,625 through the online platform owned by Vettons Sdn Bhd (“Vettons”). Vettons is a related party since Mr. How Kok

Choong, the CEO and director of the Company is appointed as the non-executive Chairman of Vettons Sdn Bhd on February 1, 2021. |

Purchase

| | |

| |

| |

For the years ended December 31, | |

| Name of Related Party | |

Relationship | |

Nature | |

2021 | | |

2020 | |

| | |

| |

| |

| | |

| |

| DSY Wellness & Longevity Center Sdn Bhd | |

Dato’ Sri Yap Foo Ching @ Steve Yap,

a director of DSY Wellness International Sdn Bhd, is also a director of DSY Wellness & Longevity Center Sdn Bhd. | |

Purchase | |

$ | 718 | | |

$ | - | |

| Total | |

| |

| |

$ | 718 | | |

$ | - | |

Commission

expense

| |

| |

| |

For the years

ended December 31, | |

| Name

of Related Party | |

Relationship | |

Nature | |

2021 | | |

2020 | |

| | |

| |

| |

| | |

| |

| Mr.

How Kok Choong | |

Mr.

How Kok Choong, the CEO and director of the Company. | |

Commission

expense | |

$ | 12,758 | | |

$ | 10,740 | |

| Total | |

| |

| |

$ | 12,758 | | |

$ | 10,740 | |

Other

income

| Name

of Related Party |

|

|

|

|

|

For

the years ended December 31, |

|

| |

Relationship |

|

Nature |

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Hostastay

Sdn. Bhd. |

|

Mr.

How Kok Choong, the CEO and director of the Company is also the director of Hostastay |

|

Sublease

rental income due from Hostastay |

|

$ |

4,345 |

|

|

$ |

2,881 |

|

| Total |

|

|

|

|

|

$ |

4,345 |

|

|

$ |

2,881 |

|

AGAPE

ATP CORPORATION

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

15.

STOCKHOLDERS’ EQUITY

Preferred

stock

As

of December 31, 2021 and 2020, there were 200,000,000 preferred stocks authorized but none were issued and outstanding.

Common

stock

As

of December 31, 2021 and 2020, there were 1,000,000,000 common stocks authorized, 290,460,047 and 376,452,047 shares issued and outstanding,

respectively.

In

May 2020, the Company issued 162,694 shares of the Company’s common stock in connection with the acquisition of ASL as part of

the acquisition payment.

In

June 2020, ASL made certain adjustments to its March 31, 2020 financial statements. As a result, the net assets carrying value increased

by $90,043, which required the issuance of an additional 13,853 shares of the Company’s common stock to fully satisfy the acquisition

payment for ASL to Mr. How Kok Choong, CEO and director of the Company. The 13,853 additional shares were issued in July 2020.

In

December 2021, there were share forfeiture agreements (the “Share Forfeiture Agreements”) between the Company and

(i) HKC Talent Limited; (ii) various shareholders of the Company (the “Forfeiting Shareholders”), pursuant to which:

(i) HKC Talent Limited had agreed to forfeiture of 41,750,000

shares of common stock of the Company, and (ii)

the Forfeiting Shareholders had agreed to forfeiture, in aggregate, 44,242,000

shares of common stock of the Company. Included

in (ii) is 11,242,000

shares forfeited from HKC Holdings Sdn. Bhd,

a company in which Mr. How Kok Choong, the CEO and director of the Company, is a shareholder.

As a result, the outstanding shares was reduced by 85,992,000

shares of common stock.

There

were no stock options, warrants or other potentially dilutive securities outstanding as of December 31, 2021 and 2020.

16.

NON-CONTROLLING INTEREST

The

Company’s non-controlling interest consists of the following:

SCHEDULE

OF NON CONTROLLING INTEREST

| | |

2021 | | |

2020 | |

| | |

As of December

31, | |

| | |

2021 | | |

2020 | |

| DSY Wellness: | |

| | | |

| | |

| Paid-in capital | |

$ | 97 | | |

$ | - | |

| Accumulated deficit | |

| (436 | ) | |

| - | |

| Accumulated other comprehensive

income | |

| 3 | | |

| - | |

| Non Controlling interest Gross | |