Purepoint Uranium Group Closes Second Tranche of Non-Brokered Private Placement and Further Raises Ceiling for Financing

December 24 2013 - 9:51AM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES

Purepoint Uranium Group Inc. (TSX VENTURE:PTU) (the "Company"), is pleased to

announce the closing of the second tranche of the non-brokered private placement

announced on December 3, 2013, for gross proceeds of $441,949. The Company

issued 8,035,436 flow-through units at a price of $0.055 per unit. Each

flow-through unit consists of one common share in the capital of the Company

issued on a "flow through" basis pursuant to the Income Tax Act (Canada) and one

common share purchase warrant. Each warrant entitles its holder to purchase one

common share in the capital of the Company at an exercise price of $0.10 per

share for a period of 24 months from the date of issuance. The closing is

subject to final acceptance by the TSX Venture Exchange of the private

placement.

In connection with the closing of the second tranche of the private placement,

the Company paid finders' fees consisting of $35,355.92 (plus applicable taxes)

in cash and issued 642,834 non-transferable compensation options to certain

finders. Each compensation option entitles its holder to purchase one common

share in the capital of the Company at an exercise price of $0.10 per share for

a period of 24 months after the closing date.

Together with the first tranche closing of the private placement announced on

December 6, 2013, the Company issued a total of 13,554,254 flow-through units

under the private placement for aggregate gross proceeds of $745,484, paid

finders' commission in an aggregate amount of $57,958.72 and issued 1,053,794

compensation options to certain finders.

Mr. James B.C. Doak, a director of the Company, participated in the private

placement by subscribing 181,818 flow through units for $10,000. By virtue of

such participation by the insider, the private placement constitutes a related

party transaction under applicable securities laws. Neither independent

valuation nor minority shareholder approval was required to complete the related

party transaction because the Company relied on exemptions from both

requirements under applicable securities laws.

The Company also announces its intention to further raise the ceiling for the

private placement from $750,000 to $850,000. Up to 15,454,545 flow-through units

at a price of $0.055 per unit are issuable pursuant to the private placement.

The Company expects to close the last tranche of the private placement on or

before December 31, 2013.

All securities issued in connection with the second tranche of the private

placement are subject to a four-month hold period pursuant to the applicable

securities laws with an expiry date of April 24, 2014. The net proceeds of the

private placement will be used for the exploration program of the Company to be

conducted to advance the Company's eleven uranium projects located in the

Province of Saskatchewan.

About Purepoint Uranium Group Inc.

Purepoint Uranium Group Inc. is focused on the precision exploration of its

eleven projects in the Canadian Athabasca Basin. Purepoint proudly maintains

project ventures in the Basin with the three largest uranium producers in the

world, Cameco Corporation, AREVA and Rio Tinto. Established in the Athabasca

Basin well before the initial resurgence in uranium earlier last decade,

Purepoint is actively advancing a large portfolio of multiple drill targets in

the world's richest uranium region.

Disclosure regarding forward-looking statements

This press release contains projections and forward-looking information that

involve various risks and uncertainties regarding future events. Such

forward-looking information can include without limitation statements based on

current expectations involving a number of risks and uncertainties and are not

guarantees of future performance of the Company. These risks and uncertainties

could cause actual results and the Company's plans and objectives to differ

materially from those expressed in the forward-looking information. Actual

results and future events could differ materially from those anticipated in such

information. These and all subsequent written and oral forward-looking

information are based on estimates and opinions of management on the dates they

are made and expressly qualified in their entirety by this notice.

FOR FURTHER INFORMATION PLEASE CONTACT:

Purepoint Uranium Group Inc.

Chris Frostad

President & CEO

(416) 603-8368, Ext. 200

cfrostad@purepoint.ca

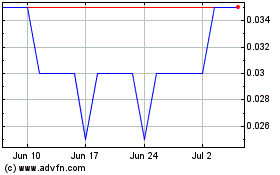

Purepoint Uranium (TSXV:PTU)

Historical Stock Chart

From Jun 2024 to Jul 2024

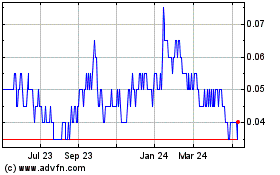

Purepoint Uranium (TSXV:PTU)

Historical Stock Chart

From Jul 2023 to Jul 2024