Purepoint Uranium Group Inc. Completes Flow-Through Financing With MineralFields Group and Others

June 03 2011 - 5:14PM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES

Purepoint Uranium Group Inc. (TSX VENTURE:PTU) is pleased to announce that it

has completed a private placement of 2,272,727 units ("Units") at a price of

$0.22 per Unit for gross proceeds of $500,000 to a group of investors including

MineralFields Group. Each Unit will consist of one flow-through common share of

Purepoint and one-half of a warrant ("Warrant"). Each whole Warrant will entitle

its holder to acquire one non-flow-through common share of Purepoint for a

period of 24 months from the date of issuance, at a price of $0.30 per share

during the first 12 months and $0.35 per share during the second 12 months. All

securities issued under this private placement are subject to resale

restrictions until October 4, 2011.

The net proceeds of this private placement will be used to further advance

Purepoint's uranium exploration projects in Saskatchewan. Canadian exploration

expenses incurred using the proceeds of the private placement will be renounced

to the purchasers of the flow-through common shares in accordance with

applicable law.

The private placement was brokered by First Canadian Securities(R), a division

of Limited Market Dealer Inc. For its services, First Canadian received a cash

fee of 5% of the gross proceeds of the offering, as well as broker's options to

acquire a number of units ("Broker's Units") equal to 5% of the number of Units

sold under the offering. Each Broker's Unit will entitle its holder to acquire

one non-flow-through common share of Purepoint and one-half of a Warrant for a

period of 24 months from the date of issuance, at a price of $0.22 per Broker's

Unit.

About Purepoint

Purepoint Uranium Group Inc. is focused on the precision exploration of its

thirteen projects in the Canadian Athabasca Basin. Purepoint proudly maintains

project ventures in the Basin with the three largest uranium producers in the

world, Cameco Corporation, AREVA and Rio Tinto. Established in the Athabasca

Basin well before the initial resurgence in uranium earlier last decade,

Purepoint is actively advancing a large portfolio of multiple drill targets in

the world's richest uranium region.

About MineralFields, Pathway and First Canadian Securities(R)

MineralFields Group (a division of Pathway Asset Management), based in Toronto,

Montreal, Vancouver and Calgary, is a mining fund with significant assets under

administration that offers its tax-advantaged super flow-through limited

partnerships to investors throughout Canada as well as hard-dollar resource

limited partnerships to investors throughout the world. The sector focus is on

gold and precious metals, base metals, rare earths and lithium, potash, uranium,

oil, coal and gas. Pathway Asset Management also specializes in the

manufacturing and distribution of structured products and mutual funds

(including the Pathway Multi Series Funds Inc. corporate-class mutual fund

series). Information about MineralFields Group is available at

www.mineralfields.com. First Canadian Securities(R) (a division of Limited

Market Dealer Inc.) is active in leading resource financings (both flow-through

and hard dollar PIPE financings) on competitive, effective and service-friendly

terms, and offers investment banking, mergers and acquisitions, and mining

industry consulting, services to resource companies. MineralFields and Pathway

have financed several hundred mining and oil and gas exploration companies to

date through First Canadian Securities(R), and have raised over $1 billion in

their 10 year history.

Disclosure regarding forward-looking statements

Note: This press release contains projections and forward-looking information

that involve various risks and uncertainties regarding future events. Such

forward-looking information can include without limitation statements based on

current expectations involving a number of risks and uncertainties and are not

guarantees of future performance of the Corporation. These risks and

uncertainties could cause actual results and the Corporation's plans and

objectives to differ materially from those expressed in the forward-looking

information. Actual results and future events could differ materially from those

anticipated in such information. These and all subsequent written and oral

forward-looking information are based on estimates and opinions of management on

the dates they are made and expressly qualified in their entirety by this

notice. The Corporation assumes no obligation to update forward-looking

information should circumstances or management's estimates or opinions change.

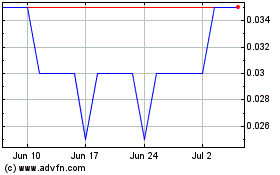

Purepoint Uranium (TSXV:PTU)

Historical Stock Chart

From Jun 2024 to Jul 2024

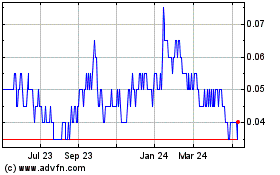

Purepoint Uranium (TSXV:PTU)

Historical Stock Chart

From Jul 2023 to Jul 2024