Pacific Energy Resources Ltd.: Part II Onshore California Divestiture, July Production, Exploration Update, and Registration Sta

July 29 2008 - 3:07PM

Marketwired Canada

Pacific Energy Resources Ltd. (TSX:PFE) (the "Company") or ("Pacific Energy") is

pleased to provide a general business update on several areas of strategic

priority.

Onshore California Divestiture

The Company reaffirms that the sale of its second onshore California property

(San Joaquin Basin assets) will close on or before July 31, 2008. The

transaction is expected to bring in approximately $34 million which will be used

for debt reduction, general working capital, and capital projects.

Platform Eureka Production

The Company is currently performing a rig upgrade on platform Eureka to bring

additional wells back on line. The Company expects the additional wells to be

online to meet its 2000 boe/d target from platform Eureka by the end of August.

July 2008 month to date average gross production was approximately 8,450 barrels

of oil equivalent ("boe/d") consisting of 4,596 boe/d from Alaska, 955 boe/d

from onshore California (prior to the divestiture of the LA basin assets), and

2,896 boe/d from the Beta Field. Pacific Energy expects a total company gross

production rate of between 11,000 - 12,000 boe/d by the end of December 2008,

before the expected reduction of approximately 1,000 boe/d of production from

the sale of its onshore California assets.

Exploration Alaska

Cook Inlet - The Company has requested an extension of the July 31, 2008

deadline with the State of Alaska for establishing proof of contract for a heavy

lift vessel to transport a jack up drilling rig to the Cook Inlet. The Company

expects to begin drilling the Corsair prospect during the 2009 drilling season.

The Corsair prospect may contain as much as 500 Bcf of gas and 100 million

barrels of oil. Pacific Energy currently has 100% working interest in the

prospect.

North Slope - Regarding the on-going litigation between ExxonMobil (the Point

Thomson Unit Operator) and the State of Alaska, Department of Natural Resources

("DNR") regarding the DNR's decision earlier this year to terminate the Point

Thomson Unit ("PTU") and all the leases that were included, the DNR rejected

ExxonMobil's Plan of Development ("POD") submitted earlier this year, and

terminated the PTU. ExxonMobil nonetheless plans to proceed, on the part of all

27 PTU working interest owners including Pacific Energy, with the multi-well

drilling program at the Point Thomson field that was part of the rejected Plan

of Development ("POD"). The Alaska State Division of Oil and gas estimates that

Point Thomson holds in-place reserves of 490 million to 600 million barrels of

natural gas liquids and 580 million to 950 million barrels of oil. Pacific

Energy retains a less than 1% working interest in this development.

Registration Statement

The Company has filed its Registration Statement with the US Securities and

Exchange Commission on Form S-1. After several reviews with the SEC, it has

prepared an additional draft to be submitted in August. This updated document

contains additional disclosures required after all of the onshore California

assets are sold.

About Pacific Energy Resources Ltd.

The Corporation is an independent energy company engaged in the acquisition,

development and exploitation of established producing oil and gas properties in

the Western United States and is based in Long Beach, California, U.S.A.

Additional information relating to the Corporation may be found on SEDAR at

www.sedar.com.

ON BEHALF OF THE BOARD OF DIRECTORS

PACIFIC ENERGY RESOURCES LTD.

Mr. Darren Katic, President

This disclosure contains certain forward-looking statements that involve

substantial known and unknown risks and uncertainties, certain of which are

beyond Corporation's control, including: the impact of general economic

conditions, industry conditions, changes in laws and regulations including the

adoption of new environmental laws and regulations and changes in how they are

interpreted and enforced, increased competition, the lack of availability of

qualified personnel or management, fluctuations in commodity prices, foreign

exchange or interest rates, stock market volatility and obtaining required

approvals of regulatory authorities. In addition there are risks and

uncertainties associated with oil and gas operations, therefore Corporation's

actual results, performance or achievement could differ materially from those

expressed in, or implied by, these forward-looking statements will transpire or

occur, or if any of them do so, what benefits, including the amounts of

proceeds, which the Corporation will derive therefrom. All statements included

in this press release that address activities, events or developments that the

Corporation expects, believes or anticipates will or may occur in the future are

forward-looking statements. These statements include future production rates,

completion and production timetables and costs to complete wells, and production

facilities. These statements are based on assumptions made by the Corporation

based on its experience perception of historical trends, current conditions,

expected future developments and other factors it believes are appropriate in

the circumstances.

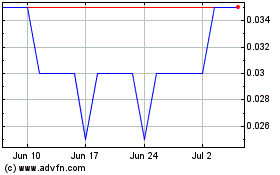

Purepoint Uranium (TSXV:PTU)

Historical Stock Chart

From Jun 2024 to Jul 2024

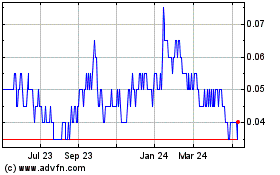

Purepoint Uranium (TSXV:PTU)

Historical Stock Chart

From Jul 2023 to Jul 2024