Iberian Minerals Corp. (TSX VENTURE:IZN) today announced financial and operating

results for the three and nine month periods ended September 30, 2012, with

comparative figures for the three and nine month periods ended September 30,

2011. The condensed interim consolidated financial statements and related notes,

and Management Discussion and Analysis may be found on www.sedar.com. Unless

stated otherwise, all reported figures are in U.S. dollars. The Company reported

net loss of $33.24 million for Q3 2012, representing a loss of $0.07 per share.

Financial highlights:

Three months ended September 30, 2012

-- Recorded net loss of $33.24 million or $(0.07) per registered share

which included:

-- Sales of $115.85 million and gain after cost and expenses of mining

operations of $16.26 million;

-- A realized gain of $2.67 million on commodity hedges (included in

sales) which contributed to the gross gain;

-- An unrealized non-cash loss of $41.92 million on derivative

financial instruments outstanding, principally as a result of

commodity hedging positions in copper and silver.

-- Cash flow provided by operations before changes in working capital items

was $28.47 million.

Nine months ended September 30, 2012

-- Recorded net loss of $20.07 million or $(0.04) per registered share

which included:

-- Sales of $326.63 million and gain after cost and expenses of mining

operations of $54.13 million;

-- A realized loss of $8.76 million on commodity hedges (included in

sales) which partly net off the gross gain;

-- An unrealized non-cash loss of $28.21 million on derivative

financial instruments outstanding, principally as a result of

commodity hedging positions in copper and silver.

-- Cash flow provided by operations before changes in working capital items

was $94.51 million.

Operational highlights - MATSA:

Three months ended September 30, 2012

-- MATSA processed 527,430 tonnes of ores in 2012 versus 518,682 tonnes of

ores in 2011 (increase of 8,748 tonnes or 1.7%).

-- Produced 28,689 DMT of copper concentrate (2011 - 28,707 DMT), 11,885

DMT of zinc concentrate (2011 - 18,260 DMT) and 2,162 DMT of lead

concentrate (2011 - 7,280 DMT). Contained metal production was 6,541 FMT

of copper (2011 - 6,638 FMT), 5,338 FMT of zinc (2011 - 8,632 FMT), 0,38

FMT of lead (2011 - 1,217 FMT) and 177,640 ounces of silver (2011 -

235,549 ounces).

-- The Cash Operating Cost (non-IFRS measure - refer to section 6) was

$1.52 per payable pound of copper (2011 - $1.56 per payable pound of

copper). Reduction in Cash Operating cost in 2012 was due to a reduction

in direct cost (US$23,68 million in 2012 versus US$25,78 in 2011), with

similar copper production levels but significantly net off by lower by-

credits of lead, Zinc and silver (US$9,99 million in 2012 versus

US$11,69 in 2011).

Nine months ended September 30, 2012

-- MATSA processed 1,606,960 tonnes of ore in 2012 versus 1,499,209 tonnes

of ore in 2011 (increase of 107,750 tonnes or 7.2%).

-- Produced 85,885 DMT of copper concentrate (2011 - 84,064 DMT), 46,916

DMT of zinc concentrate (2011 - 50,893 DMT) and 13,483 DMT of lead

concentrate (2011 - 23,525 DMT). Contained metal production was 19,829

FMT of copper (2011 - 18,916 FMT), 21,936 FMT of zinc (2011 - 24,390

FMT), 3,240 FMT of lead (2011 - 4,216 DMT) and 707,085 ounces of silver

(2011 - 725,101 ounces).

-- The Cash Operating Cost was $1.28 per payable pound of copper (2011 -

$1.67 per payable pound of copper). Year-to-date Cash Operating cost was

substantially reduced in 2012. Driver for the reduction is a reduction

on direct cost (US$69,83 million in 2012 versus US$76,94 in 2011) with

higher copper production levels.

-- During the nine months ended September 30, 2012, the Company terminated

an agreement with Cadillac Venture Inc. which extinguishes their 90%

interest on 14 of MATSA's properties located in the Iberian Pyrite Belt

of southern Spain. The consideration for the transaction was CAD$2.50

million. The transaction was accepted by TSX Venture Exchange. As of

September 30, 2012, the transaction was paid.

Operational - CMC:

Three months ended September 30, 2012

-- The average copper ore grade was 0.89% in 2012 versus 1.05% in 2011.

-- CMC processed 627,929 tonnes of ore in 2012 versus 597,139 tonnes of ore

in 2011 (increase of 30,790 tonnes or 5.16%).

-- Copper concentrate production in 2012 was 21,733 DMT versus 24,551 DMT

in 2011 (decrease of 2,818 DMT or 11.47%).

-- Contained copper production in 2012 was 5,061 FMT versus 5,688 FMT

tonnes in the prior year (decrease of 627 FMT or 11.02%).

-- The Cash Operating Cost in 2012 was $2.14 per payable pound of copper

versus prior year of $1,19. Higher Cash Operating Cost in 2012 are

driven by (i) an increase in operating cost mainly due to FX rate of

Nuevos Soles versus USD and higher wages cost and (ii) the impact of

lower head grade levels (from 1.05% in 2011 to 0.89% in 2012).

Nine months ended September 30, 2012

-- The average copper ore grade was 0.93% in 2012 versus 1.09% in 2011.

-- CMC processed 1,854,031 tonnes of ore in 2012 versus 1,769,167 tonnes of

ore in 2011 (increase of 84,864 tonnes or 4.8%).

-- Copper concentrate production in 2012 was 67,399 DMT versus 72,428 DMT

in 2011 (decrease of 5,029 DMT or 6.4%).

-- Contained copper production in 2012 was 15,586 FMT versus 17,387 FMT in

the prior year (decrease of 1,801 FMT or 10.36%).

-- The Cash Operating Cost in 2012 was $1.89 per payable pound of copper

versus prior year of $1.12, driven by decrease in head grades of copper

in 2012 (from 0.93% in 2011 to 1.09% in 2012).

Summarized Financial Results

The following table presents a summarized Statement of Operations for the three

and nine months ended September 30, 2012 with comparatives for the three and

nine months ended September 30, 2011.

Three months ended Nine months ended

September 30, September 30,

----------------------------------------------------------------------------

(thousands of U.S. Dollars) 2012 2011 2012 2011

----------------------------------------------------------------------------

$ $ $ $

Gross sales 113.177 112.533 335.395 354.509

Realized gains on derivative

financial instruments held

for trading 2.673 (52.423) (8.763) (171.027)

Sales 115.850 60.110 326.632 183.482

Costs and expenses of mining

operations 99.589 84.196 272.501 237.499

----------------------------------------------------------------------------

Gross gain / (loss) 16.261 (24.086) 54.131 (54.017)

Expenses

Administrative expenses and

other 2.383 1.876 8.012 4.947

Exploration and evaluation

expenditures 10.055 4.816 26.973 4.816

Foreign exchange (gain) loss 737 (4.770) 2.122 (1.607)

Unrealized gain on

derivative instruments 41.919 (164.216) 28.213 (292.656)

----------------------------------------------------------------------------

Total expenses (other

income) 55.094 (162.294) 65.320 (284.500)

Operating income (38.833) 138.208 (11.189) 230.483

Net finance costs 2.607 (4.490) 4.447 3.783

----------------------------------------------------------------------------

Income before taxation (41.440) 142.698 (15.636) 226.700

Current income tax expense 3.337 (931) 7.067 150

Future income tax expense (11.536) 20.042 (2.635) 25.003

----------------------------------------------------------------------------

Net income (33.241) 123.587 (20.068) 201.547

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings per share ($) (0,07) 0,27 (0,04) 0,51

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Diluted earnings per share

($) (0,06) 0,26 (0,04) 0,49

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Key operating

statistics

CMC:

CMC operating

statistics

------------------- ------------------------ ----------------------

Periods ended Three months Nine months

September 30, Unit 2012 2011 2012 2011

------------------------------------------------------------------------

Ore mined t 629.048 608.008 1.903.030 1.787.493

Ore processed t 627.929 597.139 1.854.031 1.769.167

Copper ore grade % 0,89 1,05 0,93 1,09

Concentrate grade % 23 23 23 24

Copper recovery

rate % 90 91 90 90

Copper concentrate DMT 21.733 24.551 67.399 72.428

Copper contained in

concentrate FMT 5.061 5.688 15.586 17.387

Gold contained in

concentrate oz 3.104 3.543 9.305 10.574

Silver contained in

concentrate oz 74.191 79.404 220.373 240.667

Payable copper

contained in

concentrate FMT 4.819 5.424 14.848 16.588

Payable gold

contained in

concentrate oz 2.788 3.207 8.380 9.574

Payable silver

contained in

concentrate oz 66.408 71.213 197.532 215.625

------------------------------------------------------------------------

Cash Operating Cost

per lb of payable

copper USD $ 2,14 $ 1,19 $ 1,89 $ 1,12

------------------------------------------------------------------------

MATSA:

MATSA operating

statistics

---------------------- ---------------------- ----------------------

Periods ended Three months Nine months

September 30, Unit 2012 2011 2012 2011

------------------------------------------------------------------------

Copper ore

Ore mined t 287.155 257.205 839.624 878.166

Ore processed t 283.965 274.240 838.959 867.343

Copper ore grade % 1,89 2,20 2,00 2,20

Concentrate grade % 23 23 23 22

Copper recovery rate % 85 86 86 86

Copper concentrate DMT 20.074 22.601 62.371 72.859

Copper contained in

concentrate FMT 4.547 5.184 14.256 16.336

Silver contained in

concentrate oz 60.758 61.993 239.504 220.676

Payable copper

contained in

concentrate FMT 4.346 4.958 13.633 15.608

Payable silver

contained in

concentrate oz 41.396 40.193 179.346 163.966

Polymetallic ore

Ore mined t 275.719 230.785 799.426 645.342

Ore processed t 243.465 244.442 768.001 631.866

Zinc ore grade % 3,90 5,39 4,34 5,71

Zinc concentrate grade % 45 47 47 48

Zinc recovery rate % 57 66 68 68

Copper ore grade % 1,19 1,17 1,18 1,10

Copper concentrate

grade % 23 24 24 23

Copper recovery rate % 69 51 69 38

Lead ore grade % 0,98 1,55 1,24 2

Lead concentrate grade % 18 18 23 18

Lead recovery rate % 16 33 34 39

Zinc concentrate DMT 11.885 18.260 46.916 50.893

Copper concentrate DMT 8.615 6.106 23.514 11.205

Lead concentrate DMT 2.162 7.280 13.483 23.525

Zinc contained in

concentrate FMT 5.338 8.632 21.936 24.390

Copper contained in

concentrate FMT 1.994 1.454 5.573 2.580

Lead contained in

concentrate FMT 379 1.217 3.240 4.216

Silver contained in

concentrate oz 116.882 173.556 467.581 504.425

Payable zinc contained

in concentrate FMT 4.387 7.171 18.182 20.321

Payable copper

contained in

concentrate FMT 1.908 1.393 5.338 2.468

Payable lead contained

in concentrate FMT 314 999 2.836 3.510

Payable silver

contained in

concentrate oz 70.128 97.776 281.620 303.121

------------------------------------------------------------------------

Cash Operating Cost

per lb of payable

copper USD 1,52 1,56 1,28 1,67

------------------------------------------------------------------------

About Iberian Minerals Corp.

Iberian Minerals Corp. is a Canadian listed global base metals company with

interests in Spain and Peru. The Condestable Mine, located in Peru approximately

90 km south of Lima operates at 2.4 million tonnes per year producing copper,

and associated silver and gold in a concentrate. The Aguas Tenidas Mine is in

the Andalucia region of Spain approximately 110 km north-west of Seville and

operates a 2.2 million tonnes per year underground mine and concentrator that

produces copper, zinc and lead concentrates that also contain gold and silver.

Note 1 - The Cash Operating Cost per pound of payable copper is a non-IFRS

performance measure. It includes cash operating costs, including treatment and

refining charges ("TC/RC"), freight and distribution costs, and is net of

by-product metal credits (zinc, gold and silver). The Cash Operating Cost per

pound of payable copper indicator is consistent with the widely accepted

industry standard established by Brook Hunt and is also known as the C1 cash

cost.

FORWARD LOOKING STATEMENTS:

This news release contains certain "forward-looking statements" and

"forward-looking information" under applicable securities laws. Except for

statements of historical fact, certain information contained herein constitutes

forward- looking statements. Forward-looking statements are frequently

characterized by words such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", and other similar words, or statements that certain

events or conditions "may" or "will" occur. Forward looking information may

include, but is not limited to, statements with respect to the future financial

or operating performances of the Corporation, its subsidiaries and their

respective projects, the timing and amount of estimated future production,

estimated costs of future production, capital, operating and exploration

expenditures, the future price of copper, gold and zinc, the estimation of

mineral reserves and resources, the realization of mineral reserve estimates,

the costs and timing of future exploration, requirements for additional capital,

government regulation of exploration, development and mining operations,

environmental risks, reclamation and rehabilitation expenses, title disputes or

claims, and limitations of insurance coverage. Forward-looking statements are

based on the opinions and estimates of management at the date the statements are

made, and are based on a number of assumptions and subject to a variety of risks

and uncertainties and other factors that could cause actual events or results to

differ materially from those projected in the forward-looking statements. Many

of these assumptions are based on factors and events that are not within the

control of the Corporation and there is no assurance they will prove to be

correct. Factors that could cause actual results to vary materially from results

anticipated by such forward-looking statements include changes in market

conditions and other risk factors discussed or referred to in the section

entitled "Risk Factors" in the Corporation's annual information form dated March

29, 2010. Although the Corporation has attempted to identify important factors

that could cause actual actions, events or results to differ materially from

those described in forward-looking statements, there may be other factors that

cause actions, events or results not to be anticipated, estimated or intended.

There can be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ materially from those

anticipated in such statements. The Corporation undertakes no obligation to

update forward-looking statements if circumstances or management's estimates or

opinions should change except as required by applicable securities laws. The

reader is cautioned not to place undue reliance on forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Iberian Minerals Corp.

416-815-8558

info@iberianminerals.com

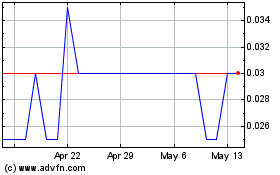

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jun 2024 to Jul 2024

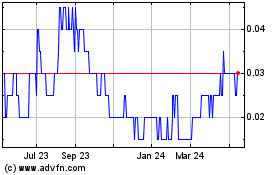

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jul 2023 to Jul 2024