Iberian Minerals Corp. (TSX VENTURE:IZN) today announced financial and operating

results for the three and six month periods ended June 30, 2012, with

comparative figures for the three and six month periods ended June 30, 2011. The

condensed interim consolidated financial statements and related notes, and

Management Discussion and Analysis may be found on www.sedar.com. Unless stated

otherwise, all reported figures are in U.S. dollars. The Company reported net

income of $25.46 million for Q2 2012, representing $0.05 per share.

Financial highlights:

Three months ended June 30, 2012

-- Recorded net income of $25.46 million or $0.05 per registered share

which included:

-- Sales of $124.25 million and gross gain of $31.40 million;

-- A realized gain of $4.75 million on commodity hedges (included in

sales) which contributed to the gross gain;

-- An unrealized non-cash gain of $29.08 million on derivative

financial instruments outstanding, principally as a result of

commodity hedging positions in copper and zinc that were delivered

into during the period and were thus retired.

-- Cash flow provided by operations before changes in working capital items

was $38.7 million.

Six months ended June 30, 2012

-- Recorded net income of $13.17 million or $0.03 per registered share

which included:

-- Sales of $210.78 million and gross gain of $37.87 million;

-- A realized loss of $11.44 million on commodity hedges (included in

sales) which partly net off the gross gain;

-- An unrealized non-cash gain of $13.71 million on derivative

financial instruments outstanding, principally as a result of

commodity hedging positions in copper and zinc that were delivered

into during the period and were thus retired.

-- Cash flow provided by operations before changes in working capital items

was $66.03 million.

Operational highlights - MATSA:

Three months ended June 30, 2012

-- MATSA processed 533,717 tonnes of ores in 2012 versus 466,444 tonnes of

ores in 2011 (increase of 67,273 tonnes or 14.4%).

-- Produced 29,091 DMT of copper concentrate (2011 - 28,300 DMT), 15,200

DMT of zinc concentrate (2011 - 15,236 DMT) and 4,614 DMT of lead

concentrate (2011 - 5,970 DMT). Contained metal production was 6,941 FMT

of copper (2011 - 6,216 FMT), 7,204 FMT of zinc (2011 - 7,307 FMT),

1,037 FMT of lead (2011 - 1,064 FMT) and 256,555 ounces of silver (2011

- 213,806 ounces).

-- The Cash Operating Cost (non-IFRS measure - refer to section 6) was

$1.15 per payable pound of copper (2011 - $1.73 per payable pound of

copper). Cash Operating cost was substantially reduced in 2012 due to

the combined effect of higher payable copper production (6,650 FMT in

2012 versus 5,933 FMT in 2011), lower operating cost realized at Matsa

and higher by-product metal production (US$13,46 million in 2012 versus

US$11,49 in 2011).

-- During the three months ended June 30, 2012, the Company terminated an

agreement with Cadillac Venture Inc. which extinguishes their 90%

interest on 14 of MATSA's properties located in the Iberian Pyrite Belt

of southern Spain. The consideration for the transaction was CAD$2.50

million. The transaction was accepted by TSX Venture Exchange. As of

June 30, 2012, the transaction was paid.

Six months ended June 30, 2012

-- MATSA processed 1,079,530 tonnes of ore in 2012 versus 980,528 tonnes of

ore in 2011 (increase of 99,002 tonnes or 10.1%).

-- Produced 57,196 DMT of copper concentrate (2011 - 55,708 DMT), 35,031

DMT of zinc concentrate (2011 - 32,602 DMT) and 11,321 DMT of lead

concentrate (2011 - 16,245 DMT). Contained metal production was 13,288

FMT of copper (2011 - 12,357 FMT), 16,597 FMT of zinc (2011 - 15,774

FMT), 2,861 FMT of lead (2011 - 2,998 DMT) and 529,445 ounces of silver

(2011 - 486,068 ounces).

-- The Cash Operating Cost was $1.16 per payable pound of copper (2011 -

$1.73 per payable pound of copper). Year-to-date Cash Operating cost was

substantially reduced in 2012 due to the combined effect of higher

payable production and higher by-product metal production. This

improvement has been consistent in the two quarters included in the six

months period ended June 30, 2012.

Operational - CMC:

Three months ended June 30, 2012

-- The average copper ore grade was 0.93% in 2012 versus 1.11% in 2011.

-- CMC processed 626,799 tonnes of ore in 2012 versus 593,290 tonnes of ore

in 2011 (increase of 33,509 tonnes or 5.6%).

-- Copper concentrate production in 2012 was 23,093 DMT versus 24,491 DMT

in 2011 (decrease of 1,398 DMT or 5.7%).

-- Contained copper production in 2012 was 5,313 FMT versus 5,931 FMT

tonnes in the prior year (decrease of 617 FMT or 10.4%).

-- The Cash Operating Cost in 2012 was $1.83 per payable pound of copper

versus prior year of $1.08.

Six months ended June 30, 2012

-- The average copper ore grade was 0.95% in 2012 versus 1.11% in 2011.

-- CMC processed 1,226,102 tonnes of ore in 2012 versus 1,172,028 tonnes of

ore in 2011 (increase of 54,074 tonnes or 4.6%).

-- Copper concentrate production in 2012 was 45,666 DMT versus 47,878 DMT

in 2011 (decrease of 2,212 DMT or 4.6%).

-- Contained copper production in 2012 was 10,526 FMT versus 11,699 FMT in

the prior year (decrease of 1,173 FMT or 10.0%).

-- The Cash Operating Cost in 2012 was $1.77 per payable pound of copper

versus prior year of $1.09.

Summarized Financial Results

The following table presents a summarized Statement of Operations for the three

and six months ended June 30, 2012 with comparatives for the three and six

months ended June 30, 2011.

Three months ended Six months ended

June 30, June 30,

----------------------------------------------------------------------------

(thousands of U.S. Dollars) 2012 2011 2012 2011

----------------------------------------------------------------------------

$ $ $ $

Gross sales 119,502 146,108 222,218 241,976

Realized gains on derivative

financial instruments held for

trading 4,752 (59,965) (11,436) (118,604)

Sales 124,254 86,142 210,782 123,372

Costs and expenses of mining

operations 92,885 93,504 172,912 153,305

----------------------------------------------------------------------------

Gross gain / (loss) 31,369 (7,362) 37,870 (29,933)

Expenses

Administrative expenses and other 13,744 1,625 22,547 3,071

Foreign exchange (gain) loss (1,125) 22 1,385 3,163

Contingent consideration fair value - - - -

Unrealized gain on derivative

instruments (29,079) (65,362) (13,706) (128,440)

----------------------------------------------------------------------------

Total expenses (other income) (16,460) (63,715) 10,226 (122,206)

Operating income 47,829 56,353 27,644 92,273

Net finance costs 867 2,042 1,840 8,273

----------------------------------------------------------------------------

Income before taxation 46,962 54,311 25,804 84,000

Current income tax expense 4,749 238 3,730 1,081

Future income tax expense 16,758 6,277 8,901 4,961

----------------------------------------------------------------------------

Net income 25,455 47,796 13,173 77,958

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings per share ($) 0.05 0.13 0.03 0.21

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Diluted earnings per share ($) 0.05 0.12 0.03 0.20

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Key operating statistics

CMC:

CMC operating statistics

-------------------------- -------------------- ---------------------

Three months Six months

Periods ended June 30, Unit 2012 2011 2012 2011

--------------------------------------------------------------------------

Ore mined t 641,691 591,530 1,273,982 1,179,485

Ore processed t 626,799 593,290 1,226,102 1,172,028

Copper ore grade % 0.93 1.11 0.95 1.11

Concentrate grade % 23 24 23 24

Copper recovery rate % 90 90 90 90

Copper concentrate DMT 23,093 24,491 45,666 47,878

Copper contained in

concentrate FMT 5,313 5,931 10,526 11,699

Gold contained in

concentrate oz 3,251 3,626 6,201 7,031

Silver contained in

concentrate oz 69,822 83,424 146,182 161,264

Payable copper contained

in concentrate FMT 5,057 5,658 10,029 11,164

Payable gold contained in

concentrate oz 2,943 3,283 5,592 6,366

Payable silver contained

in concentrate oz 68,605 74,706 131,125 144,412

--------------------------------------------------------------------------

Cash Operating Cost per

lb of payable copper USD $ 1.83 $ 1.08 $ 1.77 $ 1.09

--------------------------------------------------------------------------

MATSA:

MATSA operating statistics

--------------------------------- ----------------- -----------------

Three months Six months

Periods ended June 30, Unit 2012 2011 2012 2011

--------------------------------------------------------------------------

Copper ore

Ore mined t 269,243 316,274 552,469 620,961

Ore processed t 277,744 287,355 554,994 593,103

Copper ore grade % 1.95 2.23 2.05 2.21

Concentrate grade % 24 22 23 22

Copper recovery rate % 85 85 86 86

Copper concentrate DMT 19,605 24,854 42,297 50,609

Copper contained in concentrate FMT 4,615 5,439 9,710 11,231

Silver contained in concentrate oz 91,876 76,500 178,746 155,200

Payable copper contained in

concentrate FMT 4,419 5,191 9,287 10,725

Payable silver contained in

concentrate oz 72,967 52,505 137,950 106,416

Polymetallic ore

Ore mined t 259,911 200,377 523,707 414,557

Ore processed t 255,973 179,089 524,536 387,424

Zinc ore grade % 4.05 5.86 4.49 5.91

Zinc concentrate grade % 47 48 47 48

Zinc recovery rate % 70 70 71 69

Copper ore grade % 1.35 1.09 1.17 1.05

Copper concentrate grade % 25 23 24 22

Copper recovery rate % 68 40 68 28

Lead ore grade % 1.17 1.73 1.33 2

Lead concentrate grade % 22 18 25 19

Lead recovery rate % 34 34 40 43

Zinc concentrate DMT 15,200 15,236 35,031 32,602

Copper concentrate DMT 9,486 3,446 14,899 5,099

Lead concentrate DMT 4,614 5,970 11,321 16,245

Zinc contained in concentrate FMT 7,204 7,307 16,597 15,774

Copper contained in concentrate FMT 2,327 777 3,578 1,126

Lead contained in concentrate FMT 1,037 1,064 2,861 2,998

Silver contained in concentrate oz 164,679 137,306 350,699 330,868

Payable zinc contained in

concentrate FMT 5,988 6,088 13,795 13,163

Payable copper contained in

concentrate FMT 2,232 743 3,429 1,075

Payable lead contained in

concentrate FMT 899 884 2,521 2,510

Payable silver contained in

concentrate oz 102,902 80,707 211,492 205,362

--------------------------------------------------------------------------

Cash Operating Cost per lb of

payable copper USD 1.15 1.73 1.16 1.73

--------------------------------------------------------------------------

About Iberian Minerals Corp.

Iberian Minerals Corp. is a Canadian listed global base metals company with

interests in Spain and Peru. The Condestable Mine, located in Peru approximately

90 km south of Lima operates at 2.4 million tonnes per year producing copper,

and associated silver and gold in a concentrate. The Aguas Tenidas Mine is in

the Andalucia region of Spain approximately 110 km north-west of Seville and

operates a 2.2 million tonnes per year underground mine and concentrator that

produces copper, zinc and lead concentrates that also contain gold and silver.

Note 1 - The Cash Operating Cost per pound of payable copper is a non-IFRS

performance measure. It includes cash operating costs, including treatment and

refining charges ("TC/RC"), freight and distribution costs, and is net of

by-product metal credits (zinc, gold and silver). The Cash Operating Cost per

pound of payable copper indicator is consistent with the widely accepted

industry standard established by Brook Hunt and is also known as the C1 cash

cost.

FORWARD LOOKING STATEMENTS:

This news release contains certain "forward-looking statements" and

"forward-looking information" under applicable securities laws. Except for

statements of historical fact, certain information contained herein constitutes

forward-looking statements. Forward-looking statements are frequently

characterized by words such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", and other similar words, or statements that certain

events or conditions "may" or "will" occur. Forward looking information may

include, but is not limited to, statements with respect to the future financial

or operating performances of the Corporation, its subsidiaries and their

respective projects, the timing and amount of estimated future production,

estimated costs of future production, capital, operating and exploration

expenditures, the future price of copper, gold and zinc, the estimation of

mineral reserves and resources, the realization of mineral reserve estimates,

the costs and timing of future exploration, requirements for additional capital,

government regulation of exploration, development and mining operations,

environmental risks, reclamation and rehabilitation expenses, title disputes or

claims, and limitations of insurance coverage. Forward-looking statements are

based on the opinions and estimates of management at the date the statements are

made, and are based on a number of assumptions and subject to a variety of risks

and uncertainties and other factors that could cause actual events or results to

differ materially from those projected in the forward-looking statements. Many

of these assumptions are based on factors and events that are not within the

control of the Corporation and there is no assurance they will prove to be

correct. Factors that could cause actual results to vary materially from results

anticipated by such forward-looking statements include changes in market

conditions and other risk factors discussed or referred to in the section

entitled "Risk Factors" in the Corporation's annual information form dated March

29, 2010. Although the Corporation has attempted to identify important factors

that could cause actual actions, events or results to differ materially from

those described in forward-looking statements, there may be other factors that

cause actions, events or results not to be anticipated, estimated or intended.

There can be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ materially from those

anticipated in such statements. The Corporation undertakes no obligation to

update forward-looking statements if circumstances or management's estimates or

opinions should change except as required by applicable securities laws. The

reader is cautioned not to place undue reliance on forward-looking statements.

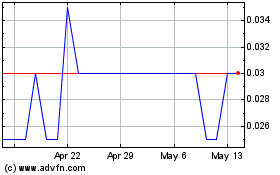

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Apr 2024 to May 2024

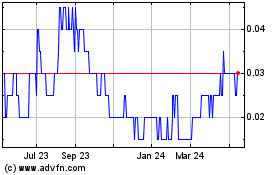

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From May 2023 to May 2024