Iberian Minerals Corp. (TSX VENTURE:IZN) today announced financial and operating

results for the year ended December 31, 2011, with comparative figures for the

year ended December 31, 2010. The audited consolidated financial statements and

related notes, and Management Discussion and Analysis may be found on

www.sedar.com. Unless stated otherwise, all reported figures are in U.S.

dollars. The Company reported net income of $173.7 million for 2011,

representing $0.42 per share.

Financial:

Year ended December 31, 2011

- Recorded net income of $173.65 million or $0.42 per registered share which

included:

-- Sales of $245.32 million and gross loss of $77.03 million;

-- A realized loss of $206.62 million on commodity hedges (included in

sales) which caused the gross loss;

-- An unrealized non-cash gain of $302.97 million on derivative financial

instruments outstanding, partially as a result of commodity hedging

positions in copper and zinc that were delivered into during the year

and were thus retired and partially due to a decline in metals prices

impacting the fair value of outstanding hedge positions.

- Cash flow provided by operations was $29.04 million.

- In June 2011 the Company completed a CA$76 million equity financing which

allowed for the buy-out of Trafigura's 45.96% net-profit interest ("NPI")

in Condestable (for 2011 to 2014) for $60 million. The buy-out of the NPI

was completed on June 30, 2011.

Three months ended December 31, 2011

- Recorded net loss of $27.90 million or $0.06 per registered share which

included:

-- Sales of $61.84 million and gross loss of $23.01 million;

-- A realized loss of $35.60 million on commodity hedges (included in

sales) which caused the gross loss;

-- An unrealized non-cash gain of $10.32 million on derivative financial

instruments outstanding, partially as a result of commodity hedging

positions in copper and zinc that were delivered into during the

period and were thus retired and partially due to a decline in metals

prices impacting the fair value of outstanding hedge positions.

Operational - CMC:

Year ended December 31, 2011

- The average copper ore grade for Condestable was 1.06% in 2011 versus

1.16% in 2010.

- CMC processed 2,364,034 tonnes of ore in 2011 versus 2,234,498 tonnes of

ore in 2010 (increase of 6%).

- Copper concentrate production in 2011 was 94,412 DMT versus 92,264 DMT in

2010 (increase of 2%).

- Contained copper production in 2011 was 22,572 tonnes versus 23,153 tonnes

in the prior year.

- The Cash Operating Cost (non-IFRS measure; refer to section 5) in 2011 was

$1.21 per payable pound of copper versus prior year of $1.04.

Three months ended December 31, 2011

- Copper ore grade was 0.96% versus 1.16% in the fourth quarter of 2010.

- CMC processed 594,867 tonnes of ore in the period versus 567,566 tonnes

for the same period of the prior year (increase of 5%).

- Copper concentrate production in the period was 21,945 DMT versus 23,383

DMT in the prior year period.

- Contained copper production in the period was 5,176 tonnes versus 5,891

tonnes in the prior year period.

- The Cash Operating Cost for the period was $1.49 per payable pound of

copper versus prior year of $1.08.

Other

- In May 2011 completed an amendment to its senior debt facility and

increased the principal to $60 million and extended the term by six months

(to September 2013).

- Major project works were completed on the previously announced processing

plant expansion. The processing plant capacity reached 7,000 tpd of ore

processed at the end of 2011.

- In December 2011 CMC signed a new collective labour agreement through to

October 2014. Detailed in the new collective agreement are terms and

conditions reflecting current labor norms with some extended benefits and

salary increases in each year of the agreement.

Operational - MATSA:

Year ended December 31, 2011

- MATSA processed 2,031,044 tonnes of ores in 2010; 1,160,978 copper and

870,066 polymetallic. This was an increase of 21% over the 1,681,140

tonnes of ores processed in 2010.

- Produced 114,533 DMT of copper concentrate (2010 - 88,999 DMT), 69,266 DMT

of zinc concentrate (2010 - 36,196 DMT), and 30,669 DMT of lead

concentrate (2010 - 1,179 DMT). Contained metal production was 25,883

tonnes of copper (2010 - 20,351 tonnes), 33,197 tonnes of zinc (2010 -

17,323 tonnes), 5,705 tonnes of lead (2010 - 229 tonnes) and 961,975 oz of

silver (2010 - 655,319 oz).

- The Cash Operating Cost was $1.60 per payable pound of copper (2010 -

$2.22 per payable pound of copper). Cash Operating Cost was substantially

reduced in 2011 due to the combined effect of higher payable copper

production, higher by-product metal production and lower actual operating

costs realized.

Three months ended December 31, 2011

- MATSA processed 531,834 tonnes of ore in the period versus 480,789 during

the fourth quarter of 2010 (increase of 11%).

- Produced 30,118 DMT of copper concentrate (2010 - 22,295 DMT), 18,373 DMT

of zinc concentrate (2010 - 15,105 DMT) and 7,144 DMT of lead concentrate

(2010 - 1,179 DMT). Contained metal production was 6,888 tonnes of copper

(2010 - 4,933 tonnes), 8,796 tonnes of zinc (2010 - 7,209 tonnes), 1,490

tonnes of lead (2010 - 229 tonnes) and 240,328 ounces of silver (2010 -

151,051 ounces).

- The Cash Operating Cost was $1.39 per payable pound of copper (2010 -

$2.11 per payable pound of copper). Cash Operating Cost was substantially

reduced in 2011 due to the combined effect of higher payable copper

production, higher by-product metal production and lower actual operating

costs realized.

Other

- In May 2011 MATSA was awarded the exploration concessions by the local

authorities for the Sotiel property, located approximately 25 km from the

Aguas Tenidas Mine. The Sotiel mine, which forms part of the concessions,

was a past producing mine and is located approximately 30 km from the

Aguas Tenidas operation.

- In February 2012 MATSA signed a new collective labour agreement with its

unionized workers. The new agreement expires in December 2015. The

agreement includes salary increases tied to the Spanish inflationary

index.

Summarized Financial Results

The following table presents a summarized Statement of Operations for the

periods ended December 31, 2011 with comparatives for the periods ended December

31, 2010.

Years ended December Three months ended

31, December 31,

----------------------------------------------------------------------------

(thousands of U.S. Dollars) 2011 2010 2011 2010

----------------------------------------------------------------------------

$ $ $ $

Sales 245,321 226,723 61,839 61,747

Costs and expenses of mining

operations 322,348 303,423 84,849 79,849

----------------------------------------------------------------------------

Gross loss (77,027) (76,700) (23,010) (18,102)

Expenses

Administrative expenses and

other 8,128 3,681 3,181 400

Exploration and evaluation

expenditures 11,796 - 6,980 -

Foreign exchange gain (2,404) (5,560) (797) 834

Contingent consideration fair

value - 5,233 - 0

Unrealized (gain) loss on

derivative instruments (302,973) 40,964 (10,317) 62,057

----------------------------------------------------------------------------

(285,453) 44,318 (953) 63,291

Operating income (loss) 208,426 (121,018) (22,057) (81,393)

Net finance costs 17,800 20,886 14,017 16,100

----------------------------------------------------------------------------

Income (loss) before taxation 190,626 (141,904) (36,074) (97,493)

Current income tax expense 4,095 7,474 3,945 1,863

Deferred income tax expense

(recovery) 12,880 (35,676) (12,123) (39,472)

----------------------------------------------------------------------------

Net income (loss) 173,651 (113,702) (27,896) (59,884)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings (loss) per share

($) 0.42 (0.33) (0.06) (0.18)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Key operating statistics

CMC:

----------------------------------------------------------------------------

Fourth quarter Year

Periods ended December

31, Unit 2011 2010 2011 2010

----------------------------------------------------------------------------

Ore mined t 567,177 563,034 2,354,670 2,217,413

Ore processed t 594,867 567,566 2,364,034 2,234,498

Copper ore grade % 0.96 1.16 1.06 1.16

Concentrate grade % 24 25 24 25

Copper recovery rate % 90 90 90 89

Copper concentrate DMT 21,945 23,383 94,412 92,264

Copper contained in

concentrate FMT 5,176 5,891 22,572 23,153

Gold contained in

concentrate oz 3,269 3,214 13,850 13,881

Silver contained in

concentrate oz 76,291 82,950 317,081 291,000

Payable copper

contained in

concentrate FMT 4,932 5,628 21,520 22,119

Payable gold contained

in concentrate oz 2,960 2,911 12,540 12,249

Payable silver

contained in

concentrate oz 68,318 74,281 283,946 265,617

----------------------------------------------------------------------------

Cash Operating Cost per

lb of payable copper USD $ 1.49 $ 1.08 $ 1.21 $ 1.04

----------------------------------------------------------------------------

MATSA:

----------------------------------------------------------------------------

Three months Year

Periods ended December

31, Unit 2011 2010 2011 2010

----------------------------------------------------------------------------

Copper ore

-----------------------

Ore mined t 303,430 287,588 1,175,613 1,215,224

Ore processed t 293,634 252,597 1,160,977 1,173,152

Copper ore grade % 2.22 1.95 2.21 1.86

Concentrate grade % 23 22 22 22

Copper recovery rate % 86 81 85 83

Copper concentrate DMT 24,337 18,017 97,547 80,539

Copper contained in

concentrate FMT 5,516 3,988 21,931 17,888

Silver contained in

concentrate oz 66,704 53,571 283,926 249,384

Payable copper

contained in

concentrate FMT 5,272 3,808 20,956 17,083

Payable silver

contained in

concentrate oz 43,231 36,193 189,840 171,702

Polymetallic ore

-----------------------

Ore mined t 250,117 223,674 894,008 505,071

Ore processed t 238,200 228,189 870,066 507,988

Zinc ore grade % 5.34 5.09 5.61 5.71

Zinc concentrate grade % 48 48 48 48

Zinc recovery rate % 69 64 68 63

Copper ore grade % 1.06 1.17 1.09 1.23

Copper concentrate

grade % 24 22 23 22

Copper recovery rate % 54 36 42 37

Lead ore grade % 1.57 - 1.66 -

Lead concentrate grade % 21 - 19 -

Lead recovery rate % 40 - 40 -

Zinc concentrate DMT 18,373 15,105 69,266 36,196

Copper concentrate DMT 5,781 4,278 16,986 8,460

Copper/lead concentrate DMT - - - 6,071

Lead concentrate DMT 7,144 1,179 30,669 1,179

Zinc contained in

concentrate FMT 8,796 7,209 33,197 17,323

Copper contained in

concentrate FMT 1,372 945 3,952 2,463

Lead contained in

concentrate FMT 1,490 229 5,705 229

Silver contained in

concentrate oz 173,624 97,480 678,049 405,935

Payable zinc contained

in concentrate FMT 7,327 6,000 27,655 14,427

Payable copper

contained in

concentrate FMT 1,314 903 3,782 2,318

Payable lead contained

in concentrate FMT 1,275 176 4,785 176

Payable silver

contained in

concentrate oz 103,413 67,900 411,484 289,655

----------------------------------------------------------------------------

Cash Operating Cost per

lb of payable copper USD 1.39 2.11 1.60 2.22

----------------------------------------------------------------------------

About Iberian Minerals Corp.

Iberian Minerals Corp. is a Canadian listed global base metals company with

interests in Spain and Peru. The Condestable Mine, located in Peru approximately

90 km south of Lima operates at 2.4 million tonnes per year producing copper,

and associated silver and gold in a concentrate. The Aguas Tenidas Mine is in

the Andalucia region of Spain approximately 110 km north-west of Seville and

operates a 2.2 million tonnes per year underground mine and concentrator that

produces copper, zinc and lead concentrates that also contain gold and silver.

Note 1 - The Cash Operating Cost per pound of payable copper is a non-IFRS

performance measure. It includes cash operating costs, including treatment and

refining charges ("TC/RC"), freight and distribution costs, and is net of

by-product metal credits (zinc, gold and silver). The Cash Operating Cost per

pound of payable copper indicator is consistent with the widely accepted

industry standard established by Brook Hunt and is also known as the C1 cash

cost.

FORWARD LOOKING STATEMENTS:

This news release contains certain "forward-looking statements" and

"forward-looking information" under applicable securities laws. Except for

statements of historical fact, certain information contained herein constitutes

forward-looking statements. Forward-looking statements are frequently

characterized by words such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", and other similar words, or statements that certain

events or conditions "may" or "will" occur. Forward looking information may

include, but is not limited to, statements with respect to the future financial

or operating performances of the Corporation, its subsidiaries and their

respective projects, the timing and amount of estimated future production,

estimated costs of future production, capital, operating and exploration

expenditures, the future price of copper, gold and zinc, the estimation of

mineral reserves and resources, the realization of mineral reserve estimates,

the costs and timing of future exploration, requirements for additional capital,

government regulation of exploration, development and mining operations,

environmental risks, reclamation and rehabilitation expenses, title disputes or

claims, and limitations of insurance coverage. Forward-looking statements are

based on the opinions and estimates of management at the date the statements are

made, and are based on a number of assumptions and subject to a variety of risks

and uncertainties and other factors that could cause actual events or results to

differ materially from those projected in the forward-looking statements. Many

of these assumptions are based on factors and events that are not within the

control of the Corporation and there is no assurance they will prove to be

correct. Factors that could cause actual results to vary materially from results

anticipated by such forward-looking statements include changes in market

conditions and other risk factors discussed or referred to in the section

entitled "Risk Factors" in the Corporation's annual information form dated March

29, 2010. Although the Corporation has attempted to identify important factors

that could cause actual actions, events or results to differ materially from

those described in forward-looking statements, there may be other factors that

cause actions, events or results not to be anticipated, estimated or intended.

There can be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ materially from those

anticipated in such statements. The Corporation undertakes no obligation to

update forward-looking statements if circumstances or management's estimates or

opinions should change except as required by applicable securities laws. The

reader is cautioned not to place undue reliance on forward-looking statements.

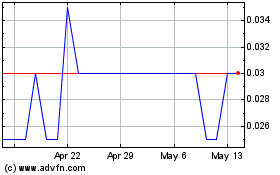

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jun 2024 to Jul 2024

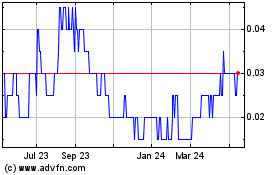

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jul 2023 to Jul 2024